2025-03-10 - priceactiontds - daily update - nasdaq e-mini

Good Evening and I hope you are well.

comment: Strongest bear bar after a 11 bar bear micro channel on the daily chart, that broke below the big bull trend line. I will never see this as even more bearish. Much more likely is that we are very close to an intermediate bottom and squeeze shorts big time. Only looking to long this. After a decent bounce we can talk lower targets again.

current market cycle: trading range - only daily closes below 20000 mark the end of this bull trend

key levels: 19000 - 21000

bull case: Bulls have to trap bears here or we will go for 19000 or even 18867 (2024-09 low) tomorrow. Bulls do not have many arguments until they produce better buying pressure. Every small rip is sold and market stayed below the 15m 20ema the whole day after it broke below it early in EU session. Bulls must claim 19600 for further upside and next would be weekly open at 19668. If bulls get above 19700, I think most bears will give up and wait for 20000 and either of the bear trend lines to be hit before shorting again.

Invalidation is below 19250.

bear case: Below 19250 we most likely go for 19000 or even 19668. Bears are still in full control but the selling is so overdone and climactic and any bigger bounce will likely do for this to completely melt much higher before bears join again. What are the odds of bears just falling through the multi-year bull trend line and keep going? Very. Very. Low. Not impossible but certainly nothing I would bet money on. For now it’s likely best to wait an see if bulls get make higher highs. If I had to guess I’d say we could have seen the lows today but it’s pure guesswork. Shorts make no sense down here and I will only look for longs for at least 19800.

Invalidation is above 20200.

short term: Can only be neutral for now. Having a bullish bias but bulls are not doing enough for now. I wait. 20k is my first target.

medium-long term - Update from 2024-02-23: Neutral since we are in a 4-5 month trading range. Still leaning heavily bearish for this year but for now it’s sideways until we get consecutive daily closes below 20000.

trade of the day: Shorts once market broke below 20000 and failed to get above it again.

Priceaction

EURNZD -Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

While the price is above the support 1.82059, resumption of uptrend is expected.

We make sure when the resistance at 1.85400 breaks.

If the support at 1.82059 is broken, the short-term forecast -resumption of uptrend- will be invalid.

Technical analysis:

The ascending flag taking shape suggests we will soon see another leg higher.

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

A peak is formed in daily chart at 1.85400 on 12/27/2024, so more losses minimum to Major Support (1.82059) is expected.

Relative strength index (RSI) is 43.

Supports and Resistances:

1.87650

1.85400

1.82059

1.78251

1.76500

1.74929

1.73804

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

EURNZD - Weekly forecast, Technical Analysis & Trading IdeasMidterm forecast:

1.84895 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

A trough is formed in daily chart at 1.81705 on 02/21/2025, so more gains to resistance(s) 1.89340, 1.90550, 1.91400 and more heights is expected.

Supports and Resistances:

1.95650

1.90550

1.87650

1.85400

1.81700

1.78251

1.76500

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

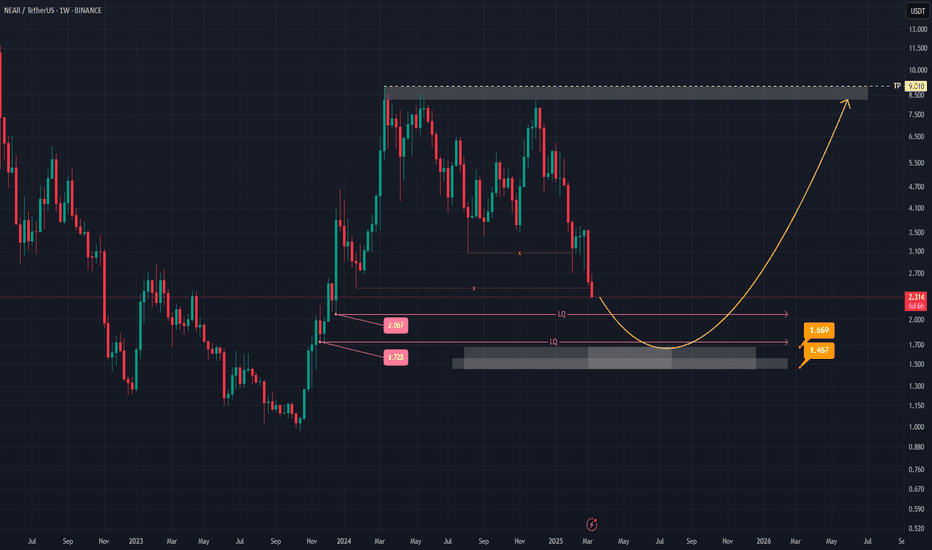

NEAR (NEARUSDT) Weekly Analysis: Potential Reversal in SightHey everyone! Let’s take a look at NEAR (NEARUSDT) on the weekly chart. There’s a chance the price might move into the 1.728–2.067 range, possibly sweeping up some liquidity before heading toward the 1.467–1.669 zone. This area seems like it could act as a launchpad for a potential bounce, aiming for higher targets afterward.

Watch for a spike in trading volume around that zone—if volume picks up, it could indicate stronger buying interest. Another key signal to look out for is a bullish candlestick pattern (like a hammer or a bullish engulfing), which might confirm a reversal if it appears near the 1.467–1.669 level.

Of course, if the price drops below 1.467, it might change this outlook and suggest a different path forward. Since the market can be unpredictable, it’s always important to keep an eye on these levels and stay prepared.

Above all, remember to do your own research and stay informed—this space can move fast, and it’s best to approach it with a curious mind. Keep learning, stay positive, and good luck out there! 📈

BTC HALVING APRIL 2024! 479497$As we approach the impending halving event in 2024, slated to commence in a month, speculation arises regarding its potential outcomes. Historical data provides insights into recurring patterns, yet uncertainty looms regarding whether past scenarios will manifest once again.

We invite your insights:

Do you foresee growth or a departure from traditional trends towards decline?

Your perspectives are welcomed and valued.

Soybean Futures Surge: ZS, ZL, and ZM Align for a Bullish MoveI. Introduction

Soybean futures are showing a potentially strong upcoming bullish momentum, with ZS (Soybean Futures), ZL (Soybean Oil Futures), and ZM (Soybean Meal Futures) aligning in favor of an upward move. The recent introduction of Micro Ag Futures by CME Group has further enhanced trading opportunities by allowing traders to manage risk more effectively while engaging with longer-term setups such as weekly timeframes.

Currently, all three soybean-related markets are displaying bullish candlestick patterns, accompanied by strengthening demand indicators. With RSI confirming upward momentum without entering overbought territory, traders are eyeing potential opportunities. Among the three, ZM appears to be the one which will potentially provide the greatest strength, showing resilience in price action and a favorable technical setup for a high reward-to-risk trade.

II. Technical Analysis of Soybean Markets

A closer look at the price action in ZS, ZL, and ZM reveals a confluence of bullish factors:

o Candlestick Patterns:

All three markets have printed bullish weekly candlestick formations, signaling increased buying interest.

o RSI Trends:

RSI is in an uptrend across all three contracts, reinforcing the bullish outlook.

Importantly, none of them are currently in overbought conditions, suggesting further upside potential.

o Volume Considerations:

Higher volume on up moves and decreasing volume on down-moves adds credibility to the bullish bias.

III. Comparative Price Action Analysis

While all three soybean-related markets are trending higher, their relative strength varies. By comparing recent weekly price action:

o ZM (Soybean Meal Futures) stands out as the one which will potentially become the strongest performer.

Last week, ZM closed above its prior weekly open, marking a +1.40% weekly gain.

RSI is not only trending higher but is also above its average, a sign of potential continued strength.

o ZS and ZL confirm bullishness but lag slightly in relative strength when compared to ZM.

This comparative analysis suggests that while all three markets are bullish, ZM presents the most compelling trade setup in terms of technical confirmation and momentum.

IV. Trade Setup & Forward-Looking Trade Idea

Given the strong technical signals, the trade idea focuses on ZM (Soybean Meal Futures) as the primary candidate.

Proposed Trade Plan:

Direction: Long (Buy)

Entry: Buy above last week’s high at 307.6

Target: UFO resistance at 352.0

Stop Loss: Below entry at approximately 292.8 (for a 3:1 reward-to-risk ratio)

Reward-to-Risk Ratio: 3:1

Additionally, with the introduction of Micro Ag Futures, traders can now fine-tune position sizing, making it easier to manage risk effectively on longer-term charts like the weekly timeframe. Given the novelty of such micro contracts, here is a CME resource that could be useful to understand their characteristics such as contracts specs .

V. Risk Management & Trade Discipline

Executing a trade plan is just one part of the equation—risk management is equally critical, especially when trading larger timeframes like the weekly chart. Here are key considerations for managing risk effectively:

1. Importance of Precise Entry and Exit Levels

Entering above last week’s high (307.6) ensures confirmation of bullish momentum before taking a position.

The target at 352.0 (UFO resistance) provides a well-defined profit objective, avoiding speculation.

A stop-loss at 292.8 is strategically placed to maintain a 3:1 reward-to-risk ratio, ensuring that potential losses remain controlled.

2. The Role of Stop Loss Orders & Hedging

A stop-loss prevents excessive drawdowns in case the market moves against the position.

Traders can also hedge using Micro Ag Futures to offset exposure while maintaining a bullish bias on the broader trend.

3. Avoiding Undefined Risk Exposure

The Micro Ag Futures contracts enable traders to scale into or out of positions without significantly increasing risk.

Position sizing should be adjusted based on account risk tolerance, ensuring no single trade overly impacts capital.

4. Adjusting for Market Volatility

Monitoring volatility using ATR (Average True Range) or other risk-adjusted indicators helps in adjusting stop-loss placement.

If volatility increases, a wider stop may be needed, but it should still align with a strong reward-to-risk structure.

Proper risk management ensures that trades are executed with discipline, preventing emotional decision-making and maximizing long-term trading consistency.

VI. Conclusion & Disclaimers

Soybean futures are showing bullishness, with ZS, ZL, and ZM aligning in favor of further upside. However, among them, ZM (Soybean Meal Futures) potentially exhibits the most reliable momentum, making it the prime candidate for a high-probability trade setup.

With bullish candlestick patterns, RSI trends confirming momentum, and volume supporting the move, traders have an opportunity to capitalize on this momentum while managing risk effectively using Micro Ag Futures.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

#202510 - priceactiontds - weekly update - dax futuresGood Evening and I hope you are well.

comment: Market had big swings up and down last week but went nowhere after Monday’s gap up. Can’t be anything but neutral. The bull channel is valid until broken so bulls remain in control.

current market cycle: Bull trend until consecutive daily closes below 22000

key levels: 22000 - 24000

bull case: Above 23500 we could go for 24000 next week. Market is still euphoric given the probable spending spree the new government wants to do. It’s still being front-run since there are still couple of hurdles before that bill is approved, so bulls better be cautious buying new highs on the hopes of higher ones. New highs were immediately sold lately so I guess we continue with the deeper pullbacks for bulls to buy. I’d be very surprised if we see an acceleration of this trend and a break above the channel. More likely is some more sideways to down until we hit the lower trend line again.

Invalidation is below 21900.

bear case: Bears selling new highs and making decent money but that’s about it. Bull channel is alive and well and we have not closed a daily bar below the daily 20ema since first trading day of 2025. Bears had a really strong bear day on Tuesday but the follow-through was even better, so they are burned again if they did not take profits the same day. Bears can start yapping again once we have a daily close below 23k, until they I will mainly look for long scalps.

Invalidation is above 23500.

short term: Neutral around 23000/223400 and only interested in strong momentum trades. Longs above 500 or around 23k. Shorts only on another strong rejection above 400 or very strong selling below 23k.

medium-long term from 2024-02-16: As much as I would love to see this 30% lower, it’s not happening anytime soon. Market will probably has to move sideways for some weeks before this could go down.

current swing trade: None

chart update: Removed last weeks guess of a contracting range. Market is still too bullish for that. Added new bull channel.

#202510 - priceactiontds - weekly update - nasdaq e-mini futuresGood Evening and I hope you are well.

comment: Bear rejections around 20000 are getting stronger and we could have seen the intermediate lows on Friday. I lean heavily bullish since we have touched the big bull trend line and market reacted there as expected. Bounce up could easily go for 21k again, which is the 50% retracement. Again. Bears need to form a proper wider channel down if they want lower prices. The past 3 weeks of selling were getting climactic and unsustainable.

current market cycle: trading range

key levels: 19500 - 21400

bull case: Very bullish daily bar on Friday and bulls need follow-through to trigger a short squeeze. They want at least 21k again and if bears are not strong enough there, this selling could already be over again. 50% retracement is 21k and two big magnets are enough for me to have this as my main target next week. Bulls have to stay above 20k or they risk more poking at the bull trend line that started 2 years ago. On the monthly chart we are in a perfect bull wedge that has room to the upside and a bounce would fit the structure much more than a break below 19700.

Invalidation is below 20400.

bear case: Bears have shown strength for 3 consecutive weeks but are they really gonna fight the big trend line before we had a bounce? Selling around 20k is bad, no matter how you look at it. My measured move target for the bears was 19600 and the low was 19766. I really don’t have much for the bears at these lows. Sure we can continue down but it’s very unlikely. Best bears could get is probably sideways movement and if they are really strong, we stay below 20400.

Invalidation is above 20400.

short term: Neutral until bulls continue. Heavy bullish bias going into next week. I doubt we go much lower than 19766. 21k is my target.

medium-long term - Update from 2024-02-23: Neutral since we are in a 4-5 month trading range. Still leaning heavily bearish for this year but for now it’s sideways until we get consecutive daily closes below 20000.

current swing trade: None

chart update: Updated possible bigger wave thesis for the next months. Until we have a W2 and new lows afterwards, it’s a rough guess.

#202510 - priceactiontds - weekly update - bitcoinGood Evening and I hope you are well.

comment: Every bounce is sold. Target 75k remains but I hope for 70k. The big bear trend line is valid until broken, so bulls need to claim 94k again for higher prices. Not the white house summit nor the crypto reserve could break the bear trend line, why would it break now? People are running for the exits and are desperate for exit liquidity. Hence the explosion in "btfd posts”.

current market cycle: bear trend

key levels: 70k - 94k

bull case: Bulls need anything above 94k to break above the bear trend line. If they can claim it, no reason not to go for 100k again but for now that’s a pipe dream. This is going down and bulls would need to stop the daily big bear bars for more days to turn this neutral again.

Invalidation is below 70k.

bear case: Bears showing strength and are in full control. They want to retest the previous ath 73805 and the cluster of previous highs in that area. For now it’s tough to have a better looking structure than this ABC move. The weekly chart could be seen as W3 we are currently in but it’s ugly af. If bears are really strong, we go directly down to 70k and then we could very well test the bull trend line around 67k. There is no reason why it should break on the next touch but it would be amazing for the bears to get there because it would be a 40% crash in roughly 2 months. I am enjoying this down move a lot, given the attention these people get, that tell everyone they should sell their grandmother and a kidney to buy btc above 100k.

Invalidation is above 94k.

short term: Max bearish. Any pullback is a good short with a stop 97k.

medium-long term - Update from 2025-02-23: 75000 is still my biggest target for 2025. It’s happening. 70k/75k and then I expect a bigger bounce first. Then we will see if we can go lower or not. For now it’s very low probability that the big bull trend line from 2023-10 breaks anytime soon.

current swing trade: None

chart update: Removed 5-wave thesis for now.

GOLD UPDATE ROUTE MAPI am currently analyzing the 4-hour timeframe of gold. As we know, there has been strong bearish pressure in the gold market over the past few days. Therefore, my focus will remain on bearish opportunities. On the higher timeframe, gold has broken its bullish trendline, and my selling area will be around this level, as seen on the chart. I will wait for the price to reach my key levels and either show bearish confirmation or any reversal signal so that I can plan my sell entry at my ideal level. Confirmation is very important. Let's see what happens.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis or prediction. Let's analyze more deeply in smaller time frame.

#XAUUSD 4H Technical Analysis Expected Move.

GOLD(XAUUSD) -Weekly forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

If resistance at 2955 can prevent further price increases, a price drop to 2833 and ultimately the buying zone of 2790 is expected.

If gold can break the resistance at 2955, the price could reach $3,000 or even $350.

Take Profits:

2833.00

2879.11

2955.00

3000.00

3050.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

Russel 2000 Compared to General MarketTVC:RUT has continued to sell off since my last couple posts and I believe we could see a huge market correction this year if price doesn't look to stop selling.

The next play on RUT I would like to see price pullback to the last breakout zone ($2,200) to confirm a continuation in trend

This play also looks very familiar to the 2022 selloff with equal highs to our current price structure. Seeing that AMEX:SPY is at a higher high tells me there is market-wide divergence and a topping pattern could be in play.

Now when we add CRYPTOCAP:BTC and $OTHER to the mix we can see bitcoin actually tops out first while Alts and SPX look to make one more leg up before crashing out.

The Trend Reader at the lower tab has topped out and has a bearish crossing in the overbought zone indicating we can see a long term play to the downside.

Channel**SAND/USDT – 15-Minute Chart Analysis**

The price has formed a **double bottom** near the **0.3040 - 0.3027** support zone and is showing signs of bullish reversal. A breakout from the short-term downtrend structure has occurred, and a **higher low** is forming.

Entry has been taken at the breakout with a target around **0.3206**, which aligns with a previous resistance level. The stop-loss is set below the recent support zone.

🟢 **Trade Management**: Close **half of the position** at **TP1** to secure profits and let the rest run.

Gold (XAUUSD) - Liquidity Grab & Potential ReversalGold has been showing interesting price action around key levels, forming a potential double top structure. The market tested the 2,930.19 resistance level, rejecting it sharply and showing signs of exhaustion.

Possible Scenario:

- Point A : Price is currently reacting from a key resistance level where liquidity is stacked.

- Point B : A potential sweep of liquidity around 2,874.04 , where price could create a demand zone before reversing.

- Point C : If buyers step in after the liquidity grab at B, we could see a rally back into the resistance zone, targeting a break of 2,930.19 .

However, if the structure breaks lower without a strong buyer reaction, further downside could come into play, possibly targeting 2,820 as the next liquidity zone.

Key Considerations:

- Monitoring fundamental catalysts such as economic data and interest rate decisions. With NFP and Fed updates this week, volatility is expected!

- Watching for confirmation of bullish intent after the liquidity grab.

- Tracking volume to gauge potential momentum.

🚀 Do you think gold will hold above 2,874.04 , or will bears take over? Drop your thoughts below! 🚀

#Tradingview

FOREXCOM:XAUUSD

EURJPY - Follow the Bears!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉EURJPY has been overall bearish trading within the falling wedge pattern marked in red.

Since it is retesting the upper bound of the wedge, I will be looking for trend-following sell setups on lower timeframes.

For now, we wait!⏱️

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY: Bearish Continuation 🇳🇿🇯🇵

NZDJPY formed a huge head & shoulders pattern after a test

of a key daily resistance.

Its neckline violation is a strong bearish trend-following signal.

I think that the market will continue falling.

Next support - 84.0

❤️Please, support my work with like, thank you!❤️

BTCUSD – Head & Shoulders Confirmed?In my previous analysis ( ), I outlined a potential Head & Shoulders formation that could lead to a bearish move. So far, price action has followed this structure accurately.

Key Developments:

✅ The right shoulder seems to be forming as expected.

✅ Price grabbed liquidity above $92,500 before reacting downward.

✅ A double top has formed, adding further bearish confluence.

What’s Next?

If the market respects this pattern, a break below the neckline could confirm a continuation lower, with a potential target at $59,117 , aligning with the full Head & Shoulders projection.

Conclusion:

So far, this setup is playing out perfectly. If bearish pressure continues, we could see a deeper decline. However, a sustained move above $95,150 would invalidate this scenario.

🔔 Do you see BTC following this path, or do you expect a bullish surprise? Drop your thoughts below!

2025-03-06 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Another ath but two rejections for 300+ points. I give bulls one more try at this and if we pull back below 23300 again, this likely sells off into the weekend. Past 3 Friday’s we chopped into the weekend after a gap down. Right now is not the time to have bigger positions over the weekend when orange face is at work.

current market cycle: bull trend until trend line is broken (daily close below 22300)

key levels: 22000 - 24000

bull case: Bulls want 24k now. They are high enough that they could get there but the upper bull trend line is still resistance and every time we touched it in the past days, we sold off for couple hundred points. Bulls know that and since we closed high, I doubt many want to buy above 23200 and hold those over the weekend. Weekly close above 23000 would be very good for the bulls though.

Invalidation is below 22900.

bear case: Bears need the week to close below 23k, no ifs or buts. A head & shoulders breakdown would be my preferred structure tomorrow, with a measured move down could get us to 22500 but we would need a news bomb I guess. Technically chop between 23000 - 23500 is most likely after a wild week. Weekly close couple ticks below 23k. Anything below 22900 tomorrow is a bear surprise and could go much lower then. Again, my bullish targets were all met with 23k and this channel can’t go on forever but until it’s broken, bulls are in control.

Invalidation is above 23600.

short term: Neutral around 23200/300. Bearish only below 22900 or around 23500. I’d like to see a lower high tomorrow and then some really big bear bars and a bear surprise. More likely is chop though. Next days we could get some news that the current government might not be able to get enough votes to get the gigantic special budget approved. If so, could trigger a mini-crash. This market is up here on the hopes and dreams of German stimulus. Not saying it won’t happen but front-running goes horribly wrong sometimes.

medium-long term from 2024-02-26: As much as I would love to see this 30% lower, it’s not happening anytime soon. Market will probably has to move sideways for some weeks before this could go down. Daily close below 22000 is needed to turn this neutral and end the bull trend-.

current swing trade: None

trade of the day: Buying from 23130 was insanely strong on US open but so was the rejection. Both trades were good if you are comfortable with reversing positions. You could have bought at previous support and sold at previous resistance. So both were amazing trades and not the hardest to take.

GBP/USD - Institutional Backed Long Setup📌 Trade Execution & Technicals

Pair: GBP/USD

Timeframe: 15M

Trade Type: Long Position

Entry: 1.2816 – Price rejected key Fibonacci retracement level (0.62 Fib) after a liquidity sweep

Stop Loss: Below 1.2800

Take Profit Levels:

TP1: 1.2862 (-0.27 Fib extension) ✅ Target

TP2: 1.2883 (-0.62 Fib extension) ✅ Target

Technical Confluence:

Fibonacci Retracement Levels: Price bounced off the 0.62 retracement (1.2816)

Market Structure: Higher low formation confirmed bullish continuation

Institutional Liquidity Grab: Price swept sell-side liquidity before reversing bullish

📊 Trade Outcome

✅ High-Probability Long Setup

Both TP1 & TP2 levels hit with strong bullish momentum

Risk-to-Reward Ratio (RRR) > 1:3

Price action confirmed bullish institutional positioning

🌍 High-Impact News That Influenced GBP/USD

UK S&P Global Services PMI (Actual: 51.0 vs Forecast: 51.1) – Slightly weaker, but still expansionary

US ADP National Employment (77K vs Forecast: 140K) – Weaker than expected, USD pressured

BoE Treasury Select Hearing (Hawkish Bias) – Supporting GBP strength

US ISM Manufacturing Prices & Business Activity Upcoming – Expected to increase USD volatility

💡 News Summary:

Weaker-than-expected US jobs data pressured the USD, providing momentum for GBP/USD upside

GBP remained resilient despite mixed PMI data, benefiting from USD weakness

📈 Volatility & Liquidity Insights

🔍 Prime Market Terminal Key Data:

GBP/USD Average True Range (ATR):

1-week ATR: 0.81%

1-month ATR: 0.86%

Institutional Liquidity Insights:

High liquidity buildup in the 1.2800-1.2820 range, acting as support

Strong order flow pushing GBP/USD higher post-US employment data release

🏦 Institutional Positioning & Market Flow

📊 Commitment of Traders (COT) Data & Smart Money Insights:

Dealer Positioning:

GBP Net Positioning: +56,707 contracts (Bullish institutional sentiment)

USD Net Positioning: -11,542 contracts (Bearish outlook on USD)

Open Interest & Retail Sentiment:

Retail Short Bias: 72% Short, 28% Long – Potential short squeeze

Smart Money Accumulation Zone: 1.2800-1.2820

📌 Conclusion

🔹 Why This Trade Worked:

✔ Liquidity Grab Below 1.2816 Before Reversal

✔ Institutional Positioning Confirmed Bullish Momentum

✔ Weaker US Jobs Data Weighed on USD, Pushing GBP/USD Higher

🚀 Next Steps:

Monitoring 1.2860 for continuation towards 1.2900 key level

Watching upcoming US ISM data for potential volatility spike

🔥 What’s your outlook on GBP/USD? Comment your thoughts below!

1/2/3**PI/USDT – 30-Minute Chart Analysis**

The price is moving within an ascending channel and has recently reached the **1.9730 - 2.0445** resistance zone. A rising wedge pattern has formed at the top of this trend, which could indicate weakening bullish momentum.

If the price reacts negatively to this level, a correction towards the **1.8500 - 1.8200** range is possible. Conversely, if the resistance is broken, the price could move towards **2.1000**.

Avoid Market Maker Traps: Liquidity Sweeps & FVG ExplainedUnderstanding Market Maker's Perspective: Liquidity Sweeps and Fair Value Gaps (FVG)

In this educational post, I'll dive into the smart money concepts (SMC) that help traders understand market behavior from a broker or market maker's perspective. This analysis will focus on liquidity sweeps, Fair Value Gaps (FVG), and how market makers use these strategies to manipulate price movements.

What is a Liquidity Sweep?

A liquidity sweep occurs when the market pushes through a known level of liquidity, such as stop losses or pending orders. This action often creates sharp wicks or sudden moves, typically engineered by smart money to gather liquidity for their positions.

Fair Value Gap (FVG) Explained

An FVG is a price gap between a consecutive bullish and bearish candle (or vice versa), leaving a void in the market. These gaps often act as magnets for price, as market makers seek to "fill" these gaps, using them as traps for retail traders.

The Retail Trader's Perspective

Many new traders view the FVG as a signal to enter the market, expecting price to move in their favor immediately. They often set stop losses below recent lows, providing market makers with a clear liquidity target.

How Market Makers Exploit Liquidity

Market makers often execute a classic trap strategy:

Push the price up slightly to create a false sense of security for retail buyers.

Execute a sharp move down to trigger stop losses and capture liquidity below key levels.

Finally, reverse the price direction sharply to the upside, aligning with their true market intent.

Practical Trading Strategy

For new traders, understanding this concept can help avoid common traps:

Avoid entering trades at the FVG without confirmation.

Look for signs of a liquidity sweep, such as long wicks or strong rejections.

Enter trades only after seeing a market structure shift (MSS) that confirms the true direction.

Conclusion

By thinking like a market maker, traders can align their strategies with smart money concepts, improving their chances of success. Always remain patient, seek confirmation, and avoid the traps set by market manipulation.

This post aims to educate traders on avoiding common pitfalls and developing a more strategic approach to trading using smart money concepts.