XTIUSD Price ActionHello traders!

As you can see, I've highlighted two valid Supply and Demand zones on the chart. Notice that the previous trendline liquidity has already been swept, and the market grabbed liquidity at the top before forming the supply zone.

This presents a good opportunity to enter a trade targeting the next valid demand zone below. Remember, always pay close attention to risk management—protect your balance first, then aim for profits. If you can manage risk effectively, you'll thrive in the market.

Wishing you all successful trades—happy trading!

Priceaction

EUR/JPY – Double Bottom Breakout & Trendline Retest, Trade Setup📊 Chart Type: 1-Hour (H1)

💹 Asset: EUR/JPY

📈 Technical Patterns: Double Bottom, Trendline Breakout, Retest

📌 Overview of the Chart

The EUR/JPY chart showcases a bullish reversal setup, characterized by a Double Bottom pattern, a trendline breakout, and a successful retest. This combination suggests a potential continuation towards higher price levels, making it an ideal setup for traders looking for breakout entries.

The price action initially followed a downtrend, but buyers stepped in at key support zones, leading to the formation of a strong reversal pattern. Now, the price is testing a key resistance level, and if it breaks out, we could see a significant upward move.

🟢 Key Technical Analysis Breakdown

1️⃣ Double Bottom Formation – A Bullish Reversal Signal

🔹 The Double Bottom is a classic reversal pattern that forms after an extended downtrend.

🔹 In this case, price found strong support at 160.139, forming two lows (Bottom 1 & Bottom 2), indicating buyer dominance.

🔹 The confirmation of the pattern comes with a break above the neckline at around 162.000, suggesting a shift from bearish to bullish momentum.

2️⃣ Trendline Breakout & Retest

🔹 A descending trendline had been acting as dynamic resistance, pushing prices lower.

🔹 Recently, the price broke above the trendline, signaling a potential trend shift.

🔹 Now, price is retesting the trendline, which is a key factor in confirming whether the breakout is valid.

🔹 If the retest holds, it could trigger a strong bullish move towards the next resistance zone.

📍 Support & Resistance Zones

🔹 Support Level (160.139):

The lowest point in the chart, where price tested twice and formed the Double Bottom.

Buyers stepped in aggressively at this level, preventing further decline.

Stop Loss Placement: Below this support zone for long trades.

🔹 Resistance Zone (163.725 - Target Level):

The previous swing high and a major supply zone.

A breakout above this area could lead to further bullish momentum.

📈 Trading Strategy – How to Trade This Setup?

✅ Bullish Trade Setup (Breakout & Retest Confirmation)

This setup is ideal for traders looking to capitalize on breakout and retest strategies.

📌 Entry:

Wait for a strong bullish candle to confirm the retest of the trendline.

A break above the 162.500 level could be a good entry confirmation.

📌 Target:

First target: 163.725 (Resistance Zone).

If momentum continues, the next upside target could be around 164.500.

📌 Stop Loss:

Below 160.139 (previous support level) to minimize risk.

Alternatively, place it below the trendline retest zone if entering aggressively.

📌 Risk-to-Reward Ratio (RRR):

This trade offers a strong RRR, as the downside risk is limited, while the upside potential is higher.

🔴 Bearish Scenario – What if the Retest Fails?

While the bias is bullish, traders must be prepared for a fake breakout scenario. If price fails to hold above the trendline and neckline, the structure might break down.

📌 Bearish Entry:

If price rejects the retest zone and closes back below 161.500, it could indicate a false breakout.

📌 Target:

160.139 (Support Level).

📌 Stop Loss:

Above the trendline retest zone to protect against unexpected bullish moves.

🔎 Key Takeaways & Final Thoughts

✅ The Double Bottom pattern signals a potential trend reversal.

✅ The trendline breakout & retest adds further confirmation to the bullish bias.

✅ A breakout above 162.500 could accelerate buying pressure toward 163.725.

✅ Risk management is essential: A well-placed stop loss below the support level ensures minimal downside risk.

✅ If price rejects the retest zone, traders should be prepared for a possible bearish reversal.

📌 Overall Bias: Bullish ✅

📌 Trade Confirmation: Needs trendline retest hold + bullish breakout 📈

📌 Key Level to Watch: 162.500 (Breakout Confirmation Zone) 🔥

💡 Pro Tip : Always wait for confirmation before entering a trade. A strong bullish candlestick pattern (e.g., engulfing candle) on the H1 or H4 timeframe could provide extra confidence in the setup! 🚀

EUR/GBP Chart Analysis – Inverse Head & Shoulders Bullish SetupThis EUR/GBP 1-hour chart showcases a classic Inverse Head & Shoulders (H&S) pattern, signaling a potential trend reversal from bearish to bullish. This pattern is considered one of the most reliable technical formations for spotting upcoming upward momentum, particularly after a prolonged downtrend.

🔎 Market Overview

Currency Pair: EUR/GBP

Timeframe: 1-Hour (H1)

Current Price: 0.83720

Trend: Transitioning from a downtrend to a potential bullish breakout

Key Pattern: Inverse Head & Shoulders

Trading Bias: Bullish (Pending breakout confirmation)

📊 Chart Breakdown & Technical Analysis

1️⃣ Market Structure & Trend Analysis

Before the formation of the Inverse Head & Shoulders, the market was in a strong downtrend, making lower highs and lower lows. However, buyers started stepping in near the 0.8350 level, preventing further decline. This rejection at key support has set the stage for a potential trend reversal.

Left Shoulder: Price formed a minor low around 0.8370, followed by a small bounce.

Head: Price made a deeper low around 0.8351, confirming strong support and buyer interest.

Right Shoulder: Price attempted another dip but failed to break below the previous low, forming a higher low near 0.8370, signaling increasing bullish pressure.

Neckline Resistance: 0.8385 - 0.8390 zone – a crucial level that price needs to break for confirmation of an uptrend.

2️⃣ Key Support & Resistance Levels

Support Level: 0.83513 (Major demand zone)

Resistance Levels:

Neckline: 0.8385 - 0.8390 (Breakout confirmation zone)

Major Resistance: 0.84308 (Target level)

Curve Zone: A dynamic resistance trendline that has been containing price action. A breakout above this curve signals a potential shift in trend.

📈 Trading Strategy – Bullish Breakout Plan

✅ Entry Strategy:

A long trade should be considered only after a confirmed breakout above the neckline (0.8385 - 0.8390). The confirmation comes when:

A strong bullish candle closes above the neckline.

Increased trading volume supports the breakout.

A possible retest of the neckline as new support (0.8385) before continuation.

🎯 Target Price & Stop Loss:

Take Profit (TP): 0.84308 (Projected move based on pattern size).

Stop Loss (SL): Below 0.83513 (Right Shoulder low).

Risk-to-Reward Ratio (RRR): 1:2 or higher, making this a high-probability trade setup.

🛑 Risk Management & Trade Confirmation:

Volume Confirmation: A breakout should be accompanied by a volume spike, confirming strong buyer interest.

Fakeout Warning: If price briefly breaks above the neckline but then falls back below, it could be a false breakout. In this case, waiting for a retest would be a safer approach.

Trailing Stop: Once price moves toward 0.8410, a trailing stop can help secure profits in case of market reversals.

🧐 Summary – Key Takeaways

✅ Inverse Head & Shoulders Identified – A reliable bullish reversal pattern.

✅ Breakout Zone: 0.8385 - 0.8390 (Watch for confirmation).

✅ Target Price: 0.84308 (Potential profit zone).

✅ Stop Loss: Below 0.83513 (Protect against downside risk).

✅ Risk-to-Reward Ratio: Favorable (1:2 or better).

✅ Trading Plan: Buy above the neckline, aim for 0.8430, and manage risk properly.

📌 Final Thought: If the neckline is broken with strong momentum, expect a bullish move toward 0.8430+. However, traders should remain cautious of potential fakeouts and manage risk accordingly.

📢 Share your thoughts in the comments! Are you bullish on EUR/GBP? 🚀📊

#EURGBP #ForexTrading #TechnicalAnalysis #TradingSetup #InverseHeadAndShoulders

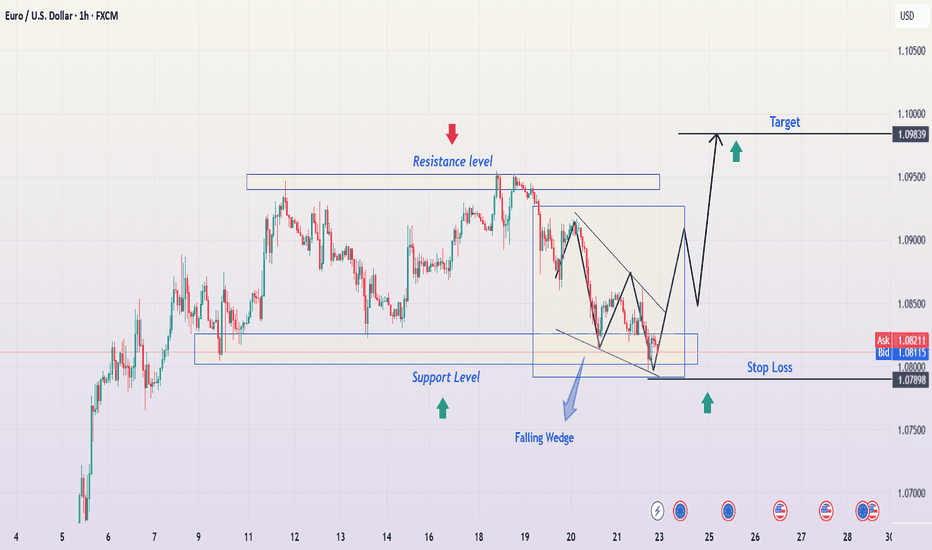

EUR/USD Falling Wedge Breakout – Professional Chart AnalysisOverview of the Chart

The EUR/USD 1-hour chart presents a bullish trading setup, featuring a well-defined falling wedge pattern, a trendline breakout, and a retest phase, signaling a potential upward move. The chart is marked with key technical elements such as support and resistance zones, breakout confirmation, and risk management parameters.

This analysis will break down each component of the chart, explaining the logic behind the setup and how traders can approach this opportunity.

1. Identified Chart Patterns

Falling Wedge Formation (Bullish Reversal Signal)

The price action formed a falling wedge, characterized by lower highs and lower lows, creating a narrowing price channel.

This pattern is typically a bullish reversal structure, as it indicates weakening selling pressure before an expected breakout.

The wedge’s downward movement ended with a strong breakout to the upside, signaling buyers regaining control.

2. Key Technical Levels

Support & Resistance Zones

Support Level (Buyers’ Stronghold)

The horizontal support level is a price area where buyers have previously stepped in, preventing further declines.

This level has been tested multiple times, reinforcing its strength as a key demand zone.

Resistance Zone (Profit Target Area)

The highlighted resistance zone represents a supply area where the price has struggled to move past in previous sessions.

The target price level aligns with this resistance, making it a realistic profit target for the long position.

3. Trendline Breakout Confirmation

Before forming the wedge, the chart shows an uptrend with a breakout above a trendline.

This trendline breakout was an early signal of bullish strength, aligning with the later wedge breakout.

After the breakout, the price came back for a retest, which is a key confirmation before further upward movement.

4. Retesting Phase Before the Upward Move

After breaking out of the wedge, the price returned to the breakout level to confirm support.

Retesting is a crucial validation step—if the price holds above this level, it increases the probability of a continued bullish move.

This retesting action provides a potential entry point for traders looking to go long.

5. Trade Setup & Risk Management Strategy

Trade Entry:

A buy entry is considered after the retest is confirmed (price holding above the breakout level).

Stop Loss Placement (Risk Control):

The stop loss is placed below the previous low at 1.07790, ensuring protection against fake breakouts or unexpected reversals.

Take Profit Target (Projected Price Move):

The target price is set at 1.09698, which aligns with previous resistance levels and the measured move from the wedge breakout.

This provides a strong risk-to-reward ratio, making the setup favorable for bullish traders.

6. Risk-Reward Ratio & Trade Viability

Risk: The distance between the entry point and the stop loss is relatively small, making it a low-risk trade.

Reward: The potential upside move is significantly higher than the risk, creating a high reward-to-risk ratio trade.

This type of technical confluence increases the probability of a successful trade, making it an attractive opportunity.

7. Conclusion & Trading Strategy

📌 Key Takeaways:

✅ The falling wedge breakout signals a bullish reversal.

✅ The trendline breakout and retest add further confirmation to the trade setup.

✅ The support and resistance zones provide a clear risk management strategy.

✅ The risk-reward ratio makes this an attractive long trade setup.

💡 Trading Plan:

🔹 Enter Long after retest confirmation above the breakout level.

🔹 Stop Loss: 1.07790 (below previous low).

🔹 Take Profit: 1.09698 (previous resistance zone).

Final Thoughts

This EUR/USD setup is a textbook example of a bullish reversal following a falling wedge breakout. Traders who patiently wait for a confirmed retest can capitalize on this high-probability trade setup, aiming for a strong bullish continuation.

🔹 Tags: #EURUSD #ForexTrading #TechnicalAnalysis #Breakout #PriceAction #TradingSetup #SupportResistance

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📊 Overview of the Chart

This 4-hour chart of Silver (XAG/USD) provides a classic example of a Rising Wedge Breakdown, a bearish reversal pattern. The price initially followed a strong uptrend, forming a series of higher highs and higher lows, but failed to sustain momentum at the key resistance zone (~$34.00 - $34.50). This led to a breakout to the downside, which has now confirmed a shift in market sentiment from bullish to bearish.

This analysis will break down each key level, the technical indicators supporting this trade setup, and how traders can approach it effectively.

🛠️ Breakdown of the Chart Components

1️⃣ Rising Wedge Formation (Bearish Pattern Identified)

The price action created a Rising Wedge, which is a bearish pattern characterized by an uptrend where the higher highs and higher lows start converging into a narrowing range.

This shows that while buyers were pushing prices higher, their strength was gradually fading.

The breakdown of this structure signaled a loss of bullish momentum, leading to a shift in trend.

2️⃣ Resistance Level & Sell Zone Identified

The resistance level at $34.00 - $34.50 has acted as a supply zone where sellers stepped in, preventing further upside.

A bearish rejection at this zone confirms that sellers are still dominant.

3️⃣ Retest of the Broken Support (Key Confirmation)

After the breakout from the wedge, the price made a retest of the broken trendline, a classic move before further downside.

Retesting this area confirms that it is now acting as resistance rather than support, further strengthening the bearish case.

4️⃣ Trendline Breakout – Shift in Market Structure

The dashed trendline was previously supportive, but now that the price has broken below it, it has turned into a resistance level.

This shift in market structure is a strong bearish signal.

5️⃣ Key Support Levels & Target Projection

The next major support level is at $32.00, a level where price previously found demand.

The ultimate target price is around $31.18, which aligns with historical support and Fibonacci retracement levels.

📉 Trading Strategy – How to Trade This Setup?

✅ Entry Point (Short/Sell Setup)

A good shorting opportunity arises if the price retests the resistance at $33.50 - $34.00 and shows bearish confirmation (like a rejection candlestick or a bearish engulfing pattern).

📍 Stop Loss (SL) Placement

SL should be above $34.20 to avoid getting stopped out by potential fakeouts.

🎯 Take Profit (TP) Levels

TP1: $32.00 (First support level)

TP2: $31.18 (Final bearish target)

📊 Risk-Reward Ratio

Entry at $33.50 - $34.00 with SL at $34.20 and TP at $31.18 provides an excellent risk-to-reward ratio (~1:4).

📌 Market Sentiment & Conclusion

🔴 Bearish signals are dominant, suggesting further downside potential.

📉 A strong bearish move is expected if the price fails to reclaim $34.00.

🎯 Targeting $31.18 in the upcoming sessions.

📢 Final Advice: Traders should watch for confirmation before entering trades. A successful retest and rejection at $33.50 - $34.00 will be a high-probability short setup. 🚀

🔥 Follow price action and risk management principles for a successful trade! 🔥

GBPUSD Week 13 Swing Zone/LevelsYour next trade could be the beginning of your success in Forex.

We’ve been performing exceptionally well so far, identifying key swing levels as always.

- Stop Loss (SL): Set between 10-15 pips from the 5-minute candle entry.

- Dynamic Take Profit (DTP): Adjusted based on price reaction to swing levels.

Let’s capitalize on the momentum!

Trading Setup for CHF/USD – Triple Bottom Breakout Strategy📌 Chart Pattern: Triple Bottom with Trendline Breakout

This CHF/USD chart showcases a triple bottom formation, a bullish reversal pattern that signals a potential uptrend after three consecutive lows at a strong support level. The price action respects this support zone and attempts a trendline breakout, suggesting a shift in momentum from bearish to bullish.

📊 Full Chart Breakdown & Professional Analysis

1️⃣ Key Levels & Structure:

✅ Support Level (1.1300 - 1.1270):

The price has tested this region three times, indicating strong buying interest.

This forms a triple bottom, a reliable reversal pattern in technical analysis.

✅ Resistance Zone (1.1400 - 1.1420):

The price previously reversed from this zone, making it a key short-term resistance level.

✅ Target Level (1.1457):

A breakout above resistance could drive the price toward this measured move target, representing a 1% potential gain.

✅ Stop Loss (1.1269):

Placed below the support zone to minimize risk in case of a breakdown.

2️⃣ Price Action & Trendline Breakout:

📌 Triple Bottom Formation:

Price hits the same support level three times, signaling strong demand.

Each bounce from support indicates a gradual weakening of bearish momentum.

📌 Trendline Breakout:

The price broke a downward-sloping trendline, suggesting a potential bullish move.

A successful retest of the trendline could confirm further upside.

📌 Expected Move:

Scenario 1: Price confirms the breakout, retests, and moves toward resistance.

Scenario 2: If resistance is broken, price targets the next major level at 1.1457.

3️⃣ Trading Strategy – How to Trade This Setup?

🎯 Buy Entry:

Enter long after a confirmed breakout and retest of the trendline.

📉 Stop Loss:

Below 1.1269 (beneath triple bottom support) to limit downside risk.

🎯 Take Profit Targets:

Target 1: 1.1400 (Resistance Area)

Target 2: 1.1457 (Measured Move Projection)

💡 Risk-Reward Ratio:

Favorable risk-reward ratio of 1:3, making it an attractive setup for traders.

4️⃣ Market Psychology Behind This Move:

Bears losing strength: Multiple failed attempts to break support indicate sellers are exhausted.

Bulls gaining momentum: Trendline breakout shows buyers are stepping in with confidence.

Breakout confirmation: If resistance breaks, a strong rally toward 1.1457 is likely.

📌 Summary: Bullish CHF/USD Trade Idea

🔹 Pattern: Triple Bottom + Trendline Breakout

🔹 Entry: Buy on retest confirmation

🔹 Stop Loss: 1.1269

🔹 Target: 1.1400 & 1.1457

🔹 Risk-Reward: Favorable 1:3 setup

🚀 This is a high-probability trade setup with strong technical confirmation, making it a great opportunity for breakout traders! 🚀

JPY/USD Head & Shoulders Breakdown – Full Professional Analysis1. Introduction to the Chart Pattern

The JPY/USD chart on the 1-hour (H1) timeframe displays a well-defined Head & Shoulders (H&S) pattern, which is a well-known bearish reversal pattern in technical analysis. This pattern signals the potential end of the previous uptrend and the beginning of a downward move.

A Head & Shoulders pattern consists of three main components:

Left Shoulder: The price rallies to a peak, then retraces.

Head: The price rises higher than the left shoulder, marking the highest point before declining.

Right Shoulder: A lower peak compared to the head, indicating weakening bullish strength.

Neckline: The horizontal support level that, once broken, confirms the bearish trend.

2. Key Levels & Market Structure

🔹 Resistance Level (Supply Zone)

The blue box at the top represents the resistance area, where price action was repeatedly rejected.

This indicates strong selling pressure at this level, preventing further bullish momentum.

🔹 Support Level (Neckline)

The horizontal blue line acts as the support level or neckline of the H&S pattern.

Price has tested this area multiple times, confirming it as a crucial level for trend continuation or reversal.

🔹 Trend Line (Dynamic Support)

The black dashed trend line represents the previous uptrend, which provided support before being violated.

The break of this trend line suggests a weakening bullish structure and increased chances of a bearish move.

3. Breakdown of the Head & Shoulders Pattern

Initial Uptrend:

The market was in a strong uptrend before forming the Head & Shoulders pattern.

Buyers pushed the price higher, making higher highs and higher lows.

Formation of Left Shoulder:

Price reached a peak and then retraced, forming the left shoulder as sellers entered the market.

Formation of the Head:

A strong rally followed, breaking the left shoulder’s peak and reaching a new high, forming the head.

However, buyers started losing momentum, leading to another retracement.

Formation of Right Shoulder:

The price made another attempt to move upward but failed to surpass the head’s high, forming the right shoulder.

This signaled a reduction in bullish strength and potential trend exhaustion.

Neckline Breakdown (Bearish Confirmation):

The price dropped below the neckline (support level), confirming a bearish reversal.

This is the official entry signal for traders looking for a short setup.

4. Expected Market Behavior & Trading Setup

📉 Bearish Confirmation Steps:

Neckline Retest: The price might retest the broken neckline before continuing downward.

Bearish Candlestick Patterns: Look for rejection signals like bearish engulfing or shooting star formations.

Volume Increase on Breakdown: Strong selling pressure confirms the trend continuation.

🎯 Potential Take Profit Levels:

1️⃣ Target 1 (TP1): 0.006492 – This is a short-term support level, where the price might pause before further decline.

2️⃣ Target 2 (TP2): 0.006430 – A stronger support zone, where sellers may take profits.

🚨 Stop Loss Placement:

A stop-loss should be placed above the right shoulder to protect against false breakouts.

This ensures a favorable risk-to-reward ratio.

5. Risk Management & Market Conditions

✅ Entry Strategy: Wait for a retest of the neckline for a higher probability short trade.

✅ Risk-to-Reward Ratio: Ideally, aim for 1:2 or 1:3 to ensure profitability.

✅ Market Catalysts: Be cautious of fundamental news events, as they can cause unexpected volatility.

6. Conclusion: Bearish Outlook for JPY/USD

🔸 The Head & Shoulders pattern breakdown suggests a strong bearish trend reversal.

🔸 If the neckline holds as resistance, a short trade offers a high-probability setup.

🔸 Price may reach TP1 first, then potentially extend to TP2 if selling pressure persists.

📢 Final Verdict: Bearish trend confirmed; watch for short opportunities on retest.

📊 TradingView Tags:

#JPYUSD #HeadAndShoulders #ForexTrading #TechnicalAnalysis #BearishBreakout #ShortTrade

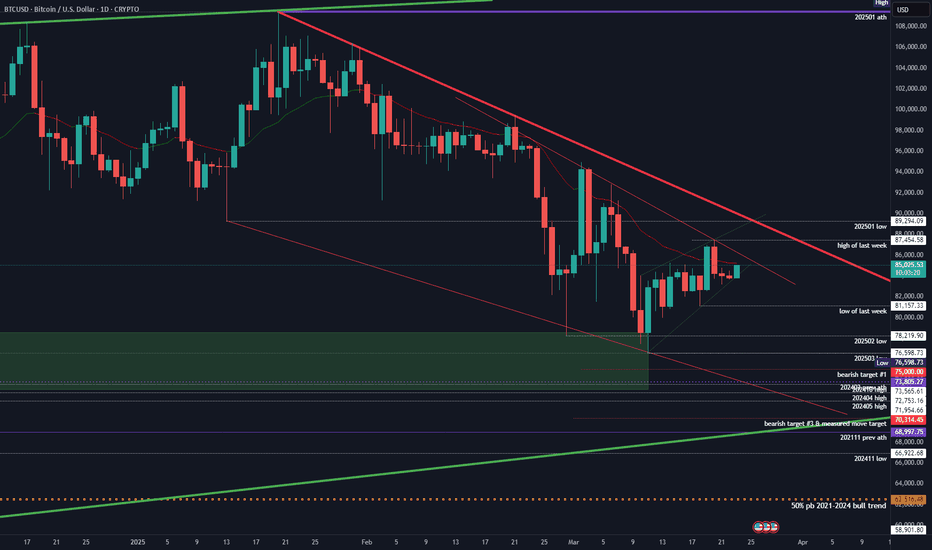

Bitcoin (BTCUSD) Falling Wedge Breakout – Bullish Setup! 📌 Overview of the Chart Setup

This daily Bitcoin (BTC/USD) chart presents a technical breakout from a falling wedge pattern, a well-known bullish reversal signal. The price has been forming lower highs and lower lows over the past months, consolidating within a tightening structure. However, the current price action suggests an early breakout attempt, which could lead to significant upside movement in the coming weeks.

Let’s break down the key levels, technical insights, and trading opportunities visible in this chart.

📉 Chart Pattern: Falling Wedge (Bullish Reversal)

🔹 What is a Falling Wedge?

A falling wedge is a bullish continuation or reversal pattern characterized by converging downward-sloping trendlines. It typically signals a loss of bearish momentum, leading to a breakout to the upside.

🔹 Key Observations in the Chart

The price has been moving inside the falling wedge structure, with clear lower highs and lower lows.

The support level around $75,000-$80,000 has been repeatedly tested, forming a strong demand zone.

A trendline breakout has occurred, suggesting that bulls are regaining control over the price action.

Volume is expected to increase upon a confirmed breakout, reinforcing the bullish momentum.

📊 Important Technical Levels

1️⃣ Support & Resistance Zones

📌 Support Level: The $75,000-$80,000 zone has acted as a strong base, preventing further downside. Buyers have stepped in multiple times here.

📌 Resistance Level: The $95,000-$100,000 range represents a historical resistance where price has struggled to break through.

2️⃣ Trendline Breakout

The chart clearly shows a breakout above the falling wedge’s upper boundary, indicating a potential trend reversal from bearish to bullish.

If this breakout holds, Bitcoin could see strong buying pressure pushing it toward its next major resistance level.

📈 Trading Strategy & Setup

🔹 Entry Confirmation

To enter a long position, traders should wait for:

✅ A daily close above the wedge resistance (confirmed breakout).

✅ A successful retest of the breakout zone, which strengthens the bullish case.

A breakout retest is ideal because it provides a lower-risk entry point, ensuring the breakout is legitimate rather than a false move.

🔹 Target Price Projection

Using the height of the falling wedge as a projection, the potential price target is set at $118,000.

This level aligns with a 35%+ upside from the breakout zone.

Bitcoin must clear the $95,000-$100,000 resistance before reaching the final target.

🔹 Stop Loss Placement

A stop loss is positioned at $59,896, slightly below the previous major support zone.

This ensures that if the breakout fails, losses are minimized while still allowing price fluctuations within expected volatility.

🔹 Risk-to-Reward Ratio

Entry around breakout level (~$87,000)

Target: $118,000 (35% upside)

Stop Loss: $59,896 (~30% downside)

Risk-to-reward ratio: ~1:3, making this an attractive trade setup.

📢 Market Psychology & Sentiment

Why This Pattern Matters?

A falling wedge represents seller exhaustion. Over time, the bearish pressure weakens, leading to a bullish breakout.

If Bitcoin can maintain this breakout, momentum traders and institutional investors may step in, accelerating the rally.

Breaking above the resistance at $95K-$100K would confirm bullish dominance, potentially leading to new all-time highs.

Potential Risks

❌ Fake Breakout: If Bitcoin fails to hold above the wedge resistance, we may see a pullback to support before another breakout attempt.

❌ Macro Factors: External factors like regulatory news, interest rate decisions, and market-wide sentiment could impact price action.

❌ Bitcoin Dominance: If altcoins start rallying, some capital may rotate out of Bitcoin, slowing the upside move.

🚀 Final Thoughts: A High-Probability Bullish Setup

✅ The falling wedge breakout suggests a strong bullish shift, with a 35%+ potential upside.

✅ A confirmed breakout above $95K-$100K will act as a final confirmation before the next leg up.

✅ Risk is managed with a stop loss at $59,896, ensuring downside protection.

🔹 Best trading approach? Wait for confirmation, manage risk, and let the trend develop.

Would you like additional insights on entry techniques, volume confirmation, or potential invalidation points? 😊

XAU/USD – Triple Top Formation & Bearish Breakdown Potential📌 Overview of the Chart

This chart presents the XAU/USD (Gold Spot vs. USD) price action on a 15-minute timeframe, highlighting a classic Triple Top pattern. The Triple Top is a well-known bearish reversal pattern that forms after an extended uptrend. It signals that buyers have attempted to push the price higher multiple times but failed, indicating weakening bullish momentum.

This pattern is crucial for traders as it often precedes a trend reversal. The breakdown below the neckline (support level) confirms that selling pressure is taking over, leading to a potential decline.

📊 Identifying the Triple Top Formation

A Triple Top pattern consists of three peaks (Top 1, Top 2, and Top 3) at nearly the same resistance level. Here’s a detailed breakdown of its formation:

🔹 Step 1: Price Uptrend Leading to Resistance

Before the pattern develops, the price follows a strong uptrend with buyers dominating.

The price reaches a key resistance level and faces rejection (Top 1), signaling initial weakness.

🔹 Step 2: Repeated Attempts to Break Resistance

After pulling back slightly, buyers make another attempt to break through resistance (Top 2), but fail again.

This signals that sellers are actively defending this price zone.

🔹 Step 3: Final Rejection & Breakdown Setup

The third attempt (Top 3) fails to break resistance once more.

This repeated rejection confirms a Triple Top formation.

The price then moves toward the neckline (support level), which is a critical area for the bearish breakdown.

📉 Trading Setup & Execution Strategy

✅ Entry Point – When to Open a Short Position?

A short position is confirmed when the price breaks below the neckline with a strong bearish candlestick.

A breakdown with high volume strengthens the bearish confirmation.

Conservative traders may wait for a retest of the broken neckline before entering.

❌ Stop Loss Placement – Managing Risk

The stop loss should be placed above the highest peak ($3,039.076), ensuring protection against false breakouts.

If the price moves above this level, the Triple Top pattern fails, and the bearish setup is invalidated.

🎯 Profit Targets – Where to Exit?

After the breakdown, price action usually follows a measured move based on the height of the pattern. The following target levels are identified:

1️⃣ First Target: $3,000.962 → A key support level where price may pause.

2️⃣ Second Target: $2,991.766 → A deeper support area that aligns with the price projection from the pattern.

Risk-Reward Ratio: The trade setup offers a favorable risk-to-reward ratio, making it an attractive opportunity for short sellers.

📈 Confirmation Signals to Strengthen the Setup

To increase the probability of a successful trade, look for additional confirmations:

🔸 Volume Analysis:

A spike in selling volume at the neckline breakdown suggests strong bearish conviction.

Low volume breakdowns may indicate a false move, requiring extra caution.

🔸 Retest of the Neckline:

Sometimes, after breaking below the neckline, the price retests the level before continuing downward.

This provides a secondary entry opportunity for traders who missed the initial breakdown.

🔸 RSI & Momentum Indicators:

If RSI (Relative Strength Index) shows bearish divergence, it adds confidence to the downside move.

Momentum indicators like MACD crossing bearish further confirm selling pressure.

📍 Key Considerations & Risk Management

🔹 False Breakout Risk: If price bounces back above the neckline after the breakdown, it could be a false move. Waiting for confirmation reduces this risk.

🔹 Macro Fundamentals: Gold prices are sensitive to economic news, interest rates, and geopolitical events. Unexpected fundamental shifts can impact the pattern’s reliability.

🔹 Trailing Stop Strategy: To protect profits, traders can use a trailing stop-loss, adjusting as the price moves toward targets.

🔍 Summary & Trading Plan

📊 Pattern: Triple Top (Bearish Reversal)

📉 Bias: Bearish (Short Setup)

🛠️ Entry: Sell below neckline confirmation

🎯 Targets:

Target 1: $3,000.96

Target 2: $2,991.76

🚨 Stop Loss: Above $3,039

💡 Final Thoughts

The Triple Top pattern on XAU/USD suggests a high-probability bearish setup. A confirmed neckline breakdown signals selling pressure, with price targets well-aligned with historical support zones. Patience and confirmation are key—watch for a clean breakdown or a potential retest before entering.

Would you like any modifications or additional insights? 🚀

Levels in LINK: Breakdown or Breakout?If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment!

### **Technical Overview**

- **Current Price**: $14.35 (approx.)

- **Trend Structure**: Elliott Wave count suggests Wave 3 has wrapped up. Wave 4 and 5 are likely next.

---

### **Key Observations**

- **Impulse Invalidation Level**: $19.190

→ A break above this invalidates the current bearish impulse.

- **Bullish Barriers**:

- *Minor Resistance*: $15.002

- *Major Resistance*: $17.677

These are the key spots bulls need to reclaim to regain control.

- **Crucial Support**: $12.426

→ If this breaks, expect more downside—likely toward the final Wave 5 zone.

- **Bearish Target**: $9.283

→ Probable landing spot for Wave 5 (of C). Could shape up as a longer-term accumulation zone.

---

### **Elliott Wave Context**

- A possible running or expanded flat scenario is in play, with Wave (B) topping around the 1.382 extension.

- Wave 3 appears to have completed near the 1.618 extension, a textbook zone for this kind of move.

---

### **Potential Scenarios**

1. **Bullish Reversal Case**:

- Price reclaims $15.00 and ideally $17.677.

- The bearish count falls apart.

2. **Bearish Continuation Case**:

- Price stalls under resistance.

- A break of $12.426 sets the stage for continuation down to $9.283.

3. **Neutral Scenario**:

- Choppy consolidation between $12.5–$15 while the market sorts itself out.

---

### **Strategic Considerations**

- **Short-term Bulls**: Watch $15–$17.6. Any strong reclaim could offer clean long setups.

- **Bears & Shorts**: Prime fade zone if price gets rejected near resistance.

- **Long-term Investors**: If we hit $9.283, that’s a potential loading zone for the next cycle.

Trade safe, trade smart, trade clarity.

#202512 - priceactiontds - weekly update - dax futuresGood Day and I hope you are well.

comment: Neutral week. Bulls retested the ath and could not print a new one and bears failed at 23k. Do not make these range bound markets harder than they are. You have no edge on predicting where the breakout will happen. So trade the range and if the breakout happens, wait for confirmation and join along.

current market cycle: Bull trend until consecutive daily closes below 23000 (changed upwards to 23k since we are staying above it now too long)

key levels: 22000 - 24000

bull case: As long as bulls keep it above the bull trend line and inside the channel, they are fine. 23k is the big support to hold for them. If it fails, we test 22500. Only question right now is, how high are the odds of another bull leg up to 24k or higher? I have no idea and every time I feel that way, I am neutral. The bull channel is still the dominant feature so bulls remain in control but they have to close green on Monday or the channel is most likely broken. Targets above are 24k and maybe 24500.

Invalidation is below 23000.

bear case: Double top is their only legit argument for now until we see consecutive daily closes below 23k. The Thu/Fr bear bars do not look all that bearish, so selling below 23200 is bad no matter how you look at it. If anything I’d look for longs 23126 for 23400+. I won’t make stuff up for bears. Once we close below 23k. Bears next target is previous support at 22500 and below that would be the gap close to 22270ish.

Invalidation is above 23500.

short term: Neutral/leaning very slightly bullish since we are near big support. If bulls come around, I want to be long for 23400+. Shorts only closer to 23746 (keep in mind we had contract switch) or on a strong move below 23k.

medium-long term from 2024-03-16: Germany takes on huge amount of new debt. Dax is rallying hard and broke above multi-year bull trends. This buying is as real as it gets, as unlikely as it is. Market is as expensive as it was during the .com bubble but here we are and marking is pointing up. Clear bull channel and until it’s broken, I can not pound my chest and scream for lower prices. Price is truth. Is the selling around 23000 strong enough that we could form a top? Yes. We have wild 1000 point swings in both directions. Look at the weekly chart. Last time we had this volatility was 2024-07 and volume then was still much lower. We are seeing a shift from US equities to European ones and until market closes consecutive daily bars below 22000, we can’t expecting anything but sideways to up movement.

current swing trade: None

chart update: Nothing big, just new targets

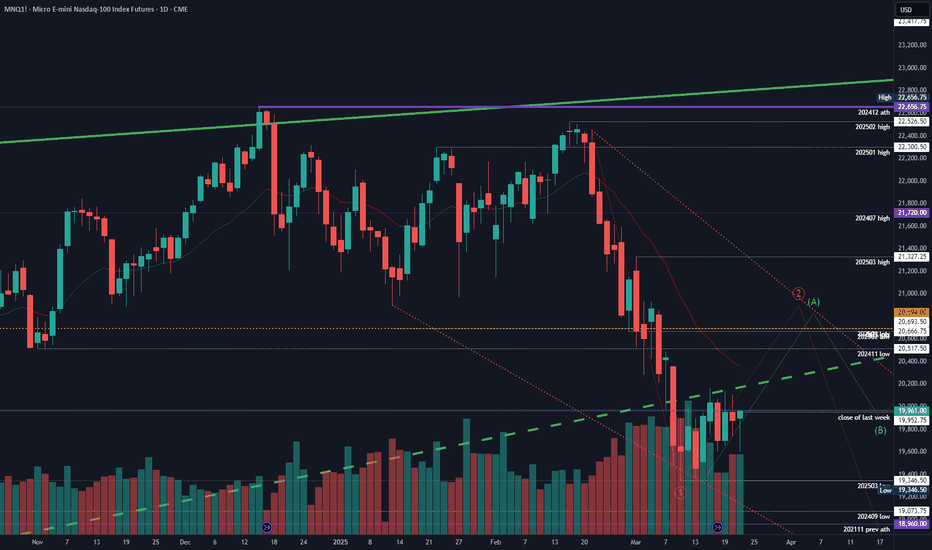

#202512 - priceactiontds - weekly update - nasdaq e-mini futuresGood Day and I hope you are well.

comment: Bulls were not strong enough to trap late bears and every bear selling below 19700 had multiple chances of exiting break-even or even with a profit. I still think we need to see a bigger bounce but for now market is in balance at 19800, which is bad for the bulls. We need to form a proper channel down and going sideways to do so would be amazing for the bears and a show of big strength by them. 23 days earlier we were trading couple points below ath. Volume last week was low but I can’t see this breaking down again this early after that much selling. I still expect 20400/20700 to be hit next week. Anything above would be bad for bears.

current market cycle: strong bear trend but pullback expected

key levels: 19300 - 20700

bull case: Bulls stopped the selling and printed a green week, which was only due to a 100 point rally in the final 10min of Friday. They are expect to bounce this higher but for now it’s not happening. Their first target is a daily close above 20k and next would be the daily 20ema around 20300. Market has now touched the bull trend line from 2023-01, 3 times and it also touched the monthly 20ema 3 times with it. I can not see this just breaking down below it, without a bigger bounce.

Invalidation is below 19100.

bear case: Bears showing incredible strength by keeping the market mostly below 20k. They even printed a couple ticks below the previous low on Friday, which means lower lows and higher highs and that’s always something that happens in trading ranges, not in trends. Bears are fine with going sideways because they can hold on to longer term positions comfortably. As long as any bounce stays below the 50% retracement to 20700, bears are good and expect more selling after we have formed a proper channel. You can never expect a -14% move to just get more follow-through selling after a couple of days. If any market does it, it’s a parabolic climax which can go on for long but are unsustainable. My best guess on how the next weeks could play out is in my chart since last week and is valid until market does something very different.

Invalidation is above 21100.

short term: Still… Heavy bullish bias for 20000 and likely 20400. Above 20500 air would get real thin again, if this was the start of a bear market. For now I think the pattern from 2024-07 is more likely to repeat than the bear trend as drawn on the chart. No updates since we moved sideways. Important to note, again, is that the longer the market stays at these lows, the more accepted the prices are and the higher the odds of another strong leg down.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. We don’t know if we have printed the W1 of the new bear trend or repeat the pattern from 2024, where we sold of very strong to reverse even more strongly and make new all time highs. Market needs a bounce and around 20000/20500 we will see the real battle for the next weeks.

current swing trade: None

chart update: Updated the possible bear trend and added a bullish alternative to show what we did in 2024. For now the bullish path is more likely.

#202512 - priceactiontds - weekly update - wti crude oil futuresGood Day and I hope you are well.

comment: 4h chart tells the story the best. No acceptance below 66.5 and above 68. Bulls managed to get the second weekly bull bar but they have gained almost nothing. It could continue up and keep the multi-year contraction alive, since the double bottom at 65 looks good.

current market cycle: trading range

key levels: 65 - 70

bull case: Bulls need to print 70. That’s about it. The double bottom at 65 is decent enough to buy pull-backs with that stop. Bulls also managed to close above the daily 20ema on Friday and above 68. They now need to break above the last bear trend line around 68.5 and are then free to test 70. They do need to prevent another lower low below 65 if they want to have a major trend reversal.

Invalidation is below 65.

bear case: Bears look like they are exhausted and not pushing for new lows. If we close green next week and above 70, clear major trend reversal. Bears could surprise again and push below 65, which would open up targets below 64 and 63. Issue for bears is that below are so many support prices, that it’s hard to argue for more selling but since this is a commodity, could surprise to the downside as well. Technically, bears do not have much below 68. They need to keep the bear trend line around 68.5 alive or give up until market hits 70 again.

Invalidation is above 71.

short term: Neutral but if bulls continue above 68.5, leaning bullish for 70. Odds favor continuation of sideways movement 65-68.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Removed bear trend lines that were broken or likely not relevant anymore.

#202512 - priceactiontds - weekly update - bitcoinGood Day and I hope you are well.

comment: Bulls are still too weak to close strongly above 84k but they kept the market above 80k. Another neutral week which is good for the bears. We are getting close to the big bear trend line, where I expect market to create another strong bear leg down to 75k or lower. Plan did not change for the past 2 weeks. Above 87k we could test 90k and maybe higher, which would damage the bear case big time. Below 80k we likely do the next leg to 75k or even 70k. Clean bear flag but remember, they can also break to the upside. I just don’t think it’s likely given the current structure.

current market cycle: bear trend

key levels: 70k - 94k

bull case: Bulls need anything above 90k/91k to break above the bear trend line but giving this some room, even 94k could still not be enough for them to stop this bear trend. They are doing good at keeping the market above 80k and if they prevent the bears from testing the previous ath at 73.8k, that would be the third try and likely the last before many bears give up and bulls could test higher again.

Did not change much to last week since market has not invalidated anything of it.

Invalidation is below 70k.

bear case: Bears need to close the bull gap down to 73800, no ifs or buts. If they do not create better selling pressure next week and close a daily bar below 80k, market has likely turned more neutral again and both sides have equal odds of the next impulse.

Invalidation is above 94k.

short term: Neutral. Need strong selling momentum again for me to join this.

medium-long term - Update from 2025-02-23: 75000 is still my biggest target for 2025. It’s happening. 70k/75k and then I expect a bigger bounce first. Then we will see if we can go lower or not. For now it’s very low probability that the big bull trend line from 2023-10 breaks anytime soon.

current swing trade: None

chart update: Nothing

Bullish Reversal with Inverse Head & Shoulder + QuasimodoEthereum is currently showing strong bullish potential on the 1-hour chart, forming a powerful confluence of reversal patterns—Inverse Head & Shoulders and the Quasimodo Pattern. These patterns often indicate trend exhaustion and signal a shift in momentum.

📊 Pattern Analysis

1. Inverse Head & Shoulders Pattern

This pattern is a classic bullish reversal setup.

The structure is well-defined:

Left Shoulder: Forms after a local downtrend.

Head: Makes a deeper low.

Right Shoulder: Higher low indicating reduced selling pressure.

The neckline has just been breached, suggesting the breakout has begun.

2. Quasimodo Pattern (QM)

Often forms at key reversal points.

Characterized by a head and shoulders structure with a lower low (head) and a higher low (right shoulder).

Acts as additional confirmation of a reversal with tight invalidation zones.

The Quasimodo zone also aligns with strong demand just below $1,970.

🎯 Target Projection

The projected minimum target is measured from the bottom of the head to the neckline, then added to the breakout point.

Target: ~$2,121.41

This implies a 5.38% potential move from the breakout zone.

The yellow highlighted area marks a potential supply zone, where price could face resistance.

🧠 Trade Considerations

Entry: On breakout above neckline (already triggered).

Confirmation : Look for bullish candles + volume spike.

Retest Entry: If price revisits the neckline (~$2,000 zone) and holds as support, it provides a second chance entry.

Invalidation: A break below the right shoulder (~$1,965) would invalidate the pattern setup.

Stop Loss Idea : Below the head or right shoulder depending on risk tolerance.

📌 Confluence Factors

Dual bullish reversal patterns (H&S + QM)

Breakout in progress with bullish momentum

Strong price reaction from the higher low confirms buyer interest

Room to run into previous supply zone around $2,120–2,140

EUR/JPY Chart Analysis - Falling Wedge Target with Bullish SetupThis EUR/JPY 1-hour chart reveals a well-defined falling wedge pattern, which is a bullish reversal formation. Additionally, we see key support and resistance levels, a double bottom, and a breakout potential that traders can use to plan an entry. Let’s dissect this chart in a professional and detailed manner to understand the trade setup and market psychology.

🔹 Market Trend & Structure Analysis

The market was previously in an uptrend, making higher highs and higher lows, until it faced strong resistance at the 163.500 level. Upon reaching this zone, the price reversed downward, forming a series of lower highs and lower lows, which resulted in a falling wedge pattern.

This downward movement was accompanied by a trendline break, signaling a shift in momentum. The price has since reached a strong support level and is showing signs of potential bullish reversal.

🔹 Key Technical Patterns & Indicators

1️⃣ Falling Wedge Pattern (Bullish Reversal Signal)

A falling wedge is a pattern characterized by two downward-sloping trendlines that converge, indicating that selling pressure is weakening. This pattern is considered a bullish signal because:

✔️ The declining price movement shows exhaustion of sellers.

✔️ Volume typically decreases as the wedge forms, indicating a breakout is coming.

✔️ Once price breaks out of the wedge, a strong bullish move often follows.

The key here is to wait for a breakout above the upper trendline, which will confirm the bullish momentum.

2️⃣ Double Bottom Formation at Support (Reversal Confirmation)

The price tested the 160.500 support level twice, forming a double bottom pattern. This is another bullish sign, as it indicates:

✔️ Buyers are actively defending this level.

✔️ There’s strong demand around this price zone.

✔️ If price breaks above the wedge resistance, it could trigger a significant rally.

🔹 Key Support & Resistance Levels

Identifying support and resistance is crucial for defining entry and exit points.

✅ Support Levels:

160.500 – Strong horizontal support (Price tested this twice).

158.982 – Stop-loss level (Below this, the bullish setup is invalid).

✅ Resistance Levels:

163.500 – Major resistance (Previous high and supply zone).

165.090 – Final target (Key breakout level).

If the price successfully breaks out of the wedge, it has room to rise significantly, with 163.500 as the first target and 165.090 as the ultimate goal.

🔹 Trade Setup & Execution Plan

🎯 Bullish Breakout Trade Strategy

Since this setup signals a potential reversal, here’s how traders can execute a high-probability trade:

🔹 Entry Points:

✅ Aggressive Entry: Enter as soon as price breaks above the wedge resistance.

✅ Conservative Entry: Wait for a breakout and a retest of the resistance-turned-support before entering.

🔹 Target Levels:

🎯 First target: 163.500 (Previous resistance level).

🎯 Final target: 165.090 (Major resistance zone).

🔹 Stop-Loss Placement:

❌ Place the stop loss below 158.982, as a break below this level would invalidate the bullish setup.

🔹 Risk-Reward Ratio & Trade Justification

📈 Why This Trade Has a High Potential Reward?

Low-risk, high-reward: The stop loss is tight, while the upside potential is large.

Confluence of bullish signals: Falling wedge + Double bottom + Strong support.

Institutional interest likely: Buyers are stepping in at key levels.

A proper risk-to-reward ratio (RRR) for this trade would be at least 1:3, meaning for every 1% risk, there’s a 3% profit potential. This makes it a great swing trading setup.

🔹 Market Psychology Behind the Setup

The falling wedge represents a market correction after a strong bullish trend.

The double bottom shows that sellers are exhausted and buyers are gaining control.

If price breaks out, many traders will enter, triggering a strong upward rally.

This bullish breakout setup aligns with the smart money concept, where institutions accumulate positions before a big move.

🔹 Final Thoughts & Trade Outlook

This EUR/JPY setup presents a high-probability trade opportunity with a bullish breakout scenario. The combination of:

✅ Falling Wedge Pattern (Bullish reversal)

✅ Double Bottom at Support (Buyers stepping in)

✅ Key Resistance Targets (Clear trade exit points)

…creates a great trading setup.

📌 Trading Plan Summary:

✔️ Buy on breakout above the falling wedge.

✔️ Target 163.500 & 165.090 for profits.

✔️ Stop-loss below 158.982 for risk management.

🚀 If executed correctly, this trade has the potential for strong bullish momentum. Would you like a real-time update once the price confirms the breakout? Let’s keep an eye on this trade! 📊🔥

CHF/USD Trading Setup – Triple Bottom Reversal & Breakout Setup🔍 Overview of the Chart Setup

The CHF/USD (Swiss Franc vs. U.S. Dollar) 1-hour timeframe chart reveals a classic Triple Bottom pattern, which is a well-known bullish reversal signal. This pattern indicates that sellers have attempted to break the support level three times but failed, suggesting a potential shift in momentum from bearish to bullish.

Traders closely watch this structure as it often leads to a strong upward breakout once key resistance levels are breached. The current setup provides an excellent risk-to-reward trading opportunity, especially for those looking to capitalize on the breakout.

📊 Key Levels in the CHF/USD Chart

1️⃣ Support and Resistance Zones

🟢 Support Level (~1.1300 - 1.1280 Zone)

This zone has been tested three times, confirming strong buying interest at this price level.

The formation of long wicks on candlesticks signals strong demand and buyer dominance.

A breakdown below this level would invalidate the bullish setup and may indicate a continuation of the bearish trend.

🔴 Resistance Level (~1.1415 - 1.1430 Zone)

This level acts as a price ceiling, where previous bullish attempts were rejected.

A break and retest above this zone would confirm the Triple Bottom breakout.

🎯 Target Level (~1.1457 Zone)

The projected target is based on the height of the pattern, which is measured and added to the breakout point.

This level aligns with previous price action zones and acts as a natural take-profit area for traders.

🚨 Stop-Loss Level (~1.1243 Zone)

A stop-loss is placed below the support zone to protect against false breakouts or an invalidation of the pattern.

📉 Understanding the Triple Bottom Pattern

The Triple Bottom is a strong bullish reversal formation that occurs at the end of a downtrend. It signals that sellers are exhausted, and buyers are gradually taking control.

🔹 Breakdown of the Triple Bottom Formation

✅ Bottom 1 (First Low)

The first bottom forms when the price hits the support level and bounces back.

Sellers are still active, so price declines again to test the same support zone.

✅ Bottom 2 (Second Low - Confirmation of Support)

The second test of the support zone validates the demand area.

Buyers step in again, pushing the price upward.

The market still lacks enough momentum for a breakout, leading to a third retest.

✅ Bottom 3 (Final Low and Strong Rejection)

The third bottom is crucial because it signals the last test of support before a breakout.

The failure to break lower creates a higher probability of an upside move.

📌 Breakout Confirmation & Price Action Signals

🔵 The breakout is confirmed when:

The price closes above the resistance zone (1.1415 - 1.1430) with strong momentum.

Volume spikes during the breakout, indicating institutional buying interest.

A successful retest of the resistance zone as new support further validates the trend reversal.

If the breakout lacks volume or gets rejected, traders should be cautious of a fakeout or potential retracement.

📈 Trading Strategy & Execution Plan

🔹 Conservative Entry (Safe Approach)

Enter after a confirmed breakout above 1.1415, ensuring a strong candle close above resistance.

Look for a retest of the breakout level before entering the trade.

🔹 Aggressive Entry (Early Positioning)

Enter near the third bottom (~1.1300 - 1.1320) with a tight stop-loss.

Higher risk but better reward if the price moves upward without retesting.

🔹 Stop-Loss Placement

Conservative traders: Place the stop-loss below the support zone (~1.1243).

Aggressive traders: Place a tight stop below the recent swing low for better risk management.

📌 Profit Target Projection

Take Profit Target: 1.1457, based on the height of the pattern.

📌 Risk-to-Reward Ratio

Risk: ~60 pips (from entry to stop-loss).

Reward: ~150 pips (from entry to target).

Risk-to-Reward Ratio: 1:3, making it a high-probability trade.

📡 Additional Confirmation Indicators for Stronger Trade Setup

📊 1. Volume Analysis

A spike in volume at the breakout level suggests strong buyer interest.

Low volume on the breakout may indicate a potential fakeout.

📈 2. RSI (Relative Strength Index) Confirmation

RSI should be above 50 and trending upward to confirm bullish momentum.

If RSI is overbought (>70), watch for a pullback before entering the trade.

📉 3. Moving Averages Support

If the 50-period or 200-period moving average supports the breakout level, it adds extra confirmation.

A moving average crossover may further validate the trend reversal.

🔍 4. Beware of Fake Breakouts

If the price briefly moves above resistance but fails to hold, it may be a bull trap.

Always wait for a candle close above resistance and a potential retest before confirming the entry.

🛠️ Alternative Scenarios & Market Risks

🔺 Bullish Scenario (Breakout & Rally to Target)

Price breaks above 1.1415, confirming a trend reversal.

A retest of resistance as support gives additional buying confidence.

Price reaches 1.1457 target before facing new resistance.

🔻 Bearish Scenario (Fakeout & Breakdown Below Support)

Price fails to hold above resistance and falls back below support.

A breakdown below 1.1243 invalidates the pattern, triggering a bearish continuation.

Traders should cut losses quickly if the setup is invalidated.

⚠️ Fundamental Risks to Watch

U.S. Dollar news events (FOMC, NFP, CPI reports) can increase volatility.

Swiss economic data may impact CHF strength.

Unexpected geopolitical events can influence currency movements.

🔎 Summary of the Trading Plan

📌 Trading Strategy Checklist

✅ Pattern: Triple Bottom (Bullish Reversal).

✅ Entry Strategy: Buy after breakout confirmation above 1.1415.

✅ Take Profit Target: 1.1457.

✅ Stop-Loss Level: Below 1.1243.

✅ Risk-to-Reward Ratio: 1:3 (High-Profit Potential with Proper Risk Management).

💡 Final Thought:

This setup provides a high-probability bullish trade with strong technical confluence. However, always remain cautious of market news, economic reports, and sudden volatility that could influence price action.

🚀 Patience & discipline are key—wait for confirmation before entering! 📊

XAUUSD - Bearish Quasimodo Pattern Triggered Gold (XAU/USD) has formed a classic Quasimodo pattern on the 1H timeframe, signaling a potential bearish reversal after a strong uptrend.

🔍 Pattern Breakdown:

The structure resembles a Head & Shoulders, with a more complex formation known as the Quasimodo Pattern.

We see a clear Left Shoulder, Head, and Right Shoulder, followed by a breakdown below the neckline.

A successful retest of the neckline as resistance confirms the bearish momentum.

🎯 Target Zone:

Based on the height of the pattern, the projected target lies in the 2960–2970 region, aligning with a previous demand zone.

The expected drop is approximately -2.10%, matching the prior rally before the reversal pattern.

📌 Key Levels:

Breakdown Level: ~3030

Current Price: ~3024

Target: ~2960–2970

⚠️ Watch for:

Bearish follow-through after the retest.

Potential reaction in the highlighted target zone (yellow box).

This setup provides a great opportunity for short sellers if momentum continues to the downside. Risk management is key as always!

EUR/USD Trading Analysis – Falling Wedge Breakout StrategyChart Overview

The EUR/USD 1-hour chart presents a classic falling wedge pattern, which is a bullish reversal setup indicating that selling momentum is weakening and a breakout to the upside is imminent. This chart provides a structured trading plan, highlighting support and resistance levels, entry points, stop-loss placement, and a target price.

Traders can use this setup to capitalize on the potential bullish move while effectively managing risk. Let’s break it down step by step.

1. Understanding the Falling Wedge Pattern

A falling wedge is formed when price action moves within two downward-sloping trendlines that converge. It signals decreasing bearish pressure, as the price forms lower highs and lower lows within a narrowing range. The decreasing range indicates that sellers are losing control, and an upside breakout is likely.

In this chart, we observe the following key characteristics of a falling wedge:

✅ Two converging downward trendlines that contain price movement.

✅ Lower highs and lower lows showing seller exhaustion.

✅ Decreasing volume as the price approaches the breakout zone.

✅ Support near 1.08000, which has held price several times before.

A breakout above the wedge signals a shift from bearish to bullish sentiment, making this a strong trade setup.

2. Key Support & Resistance Levels

🔹 Support Level (Demand Zone)

The horizontal blue zone at 1.07898 – 1.08000 is a critical support level.

This level has been tested multiple times, making it a strong demand zone where buyers step in.

The falling wedge bottom aligns with this area, reinforcing its importance.

If price stays above this zone, it confirms the potential for a bullish breakout.

🔹 Resistance Level (Supply Zone)

The resistance zone at 1.09300 - 1.09839 has acted as a barrier to upward movement.

Price previously reversed from this zone, making it a logical take-profit area.

If the breakout happens, this level will be tested again.

A break above 1.09839 would signal further bullish momentum.

3. Trading Strategy – Step-by-Step Execution

📌 Entry Confirmation

To enter this trade with confidence, traders should wait for a confirmed breakout above the wedge.

A strong bullish candle breaking above the wedge’s upper trendline signals entry.

Ideally, a pullback and retest of the breakout level would provide additional confirmation before entering long.

📌 Stop-Loss Placement

Risk management is key, and stop-loss placement should be strategic to avoid unnecessary losses.

A stop-loss is set just below 1.07898, slightly under the recent low.

This placement ensures protection against false breakouts.

📌 Take-Profit Target

The take-profit target is set at 1.09839, aligning with key resistance and the projected wedge breakout distance.

This level has historically acted as resistance, making it an ideal zone to exit profits.

Partial profit-taking can be considered near 1.09300, before the final target.

📌 Risk-to-Reward Ratio

With a tight stop-loss and a higher profit target, this trade offers a favorable risk-reward ratio (RRR).

A minimum RRR of 1:3 is recommended, meaning potential reward is three times the risk taken.

4. Expected Market Behavior & Possible Scenarios

📊 Scenario 1: Bullish Breakout Confirmation 🚀

If price breaks and closes above the wedge, we expect a rally towards 1.09300 - 1.09839.

Pullback to retest the breakout zone would further confirm bullish strength.

Strong volume would validate the breakout, leading to a high-probability move.

📉 Scenario 2: Bearish Breakdown (Invalidation) ❌

If price breaks below 1.07898, the bullish setup is invalidated.

A downside move could push the price lower, possibly towards 1.07500 or below.

Traders should exit long positions if this scenario unfolds.

5. Additional Technical Indicators for Confirmation

To strengthen this trade setup, traders can use:

✅ RSI (Relative Strength Index) – Look for RSI divergence or a move above 50, confirming bullish strength.

✅ MACD (Moving Average Convergence Divergence) – A bullish crossover on MACD would reinforce the breakout.

✅ Volume Analysis – A spike in volume at the breakout level adds confidence in the move.

6. Conclusion & Trading Plan

This falling wedge setup suggests a high-probability bullish breakout if the price confirms above the resistance zone.

🔹 Trading Plan Summary:

✅ Wait for a breakout above the wedge before entering.

✅ Confirm breakout with a retest or strong bullish candle.

✅ Set stop-loss below 1.07898 to limit downside risk.

✅ Take profit at 1.09839, securing profits at resistance.

This strategy offers an excellent risk-to-reward ratio, making it a well-structured trade setup. Always manage risk and avoid premature entries without confirmation.

📌 TradingView Tags for Maximum Visibility

#EURUSD #Forex #TechnicalAnalysis #FallingWedge #Breakout #PriceAction #ForexSignals #SupportResistance #TradingSetup #DayTrading #SwingTrading

EUR/GBP - Double Bottom Reversal Setup | Trendline BreakoutThis EUR/GBP (Euro to British Pound) daily chart presents a textbook double bottom reversal pattern, signaling a potential trend reversal after a prolonged downtrend. Additionally, a trendline breakout further strengthens the bullish outlook.

The market structure suggests that buyers are regaining control, and a breakout above the neckline resistance zone (0.84500 - 0.85000) could trigger a significant upward move. Let's break down this setup in detail.

📊 Technical Breakdown of the Chart

1️⃣ Double Bottom Formation – A Strong Reversal Signal

🔹 The double bottom is a powerful bullish reversal pattern that forms after an extended downtrend, indicating that selling pressure is fading and buyers are stepping in.

🔹 First Bottom: Established in December 2024, where the price reached a key support level (~0.82453) before bouncing back.

🔹 Second Bottom: Formed in March 2025, confirming the validity of the support level and creating a solid demand zone.

🔹 The neckline resistance (0.84500 - 0.85000) is the key level that price must break to confirm the reversal.

2️⃣ Trendline Breakout – Shift in Market Sentiment

🔹 The market has been in a downtrend, as shown by the descending trendline acting as resistance for several months.

🔹 Recently, the price broke above this trendline, indicating that bearish momentum is weakening and a potential trend reversal is underway.

🔹 This breakout adds confluence to the double bottom pattern, reinforcing the bullish bias.

3️⃣ Key Support & Resistance Levels to Watch

📌 Support Zone (Bottom Area) – 0.82453:

✅ This level has been tested twice (December & March), confirming it as a strong demand zone.

✅ Price consistently rebounded from this level, showing buyers’ dominance.

✅ This is the ideal stop-loss level to protect against downside risks.

📌 Resistance Zone (Neckline) – 0.84500 - 0.85000:

✅ A breakout above this neckline resistance is necessary for a bullish continuation.

✅ If price breaks and retests this level as support, it will confirm a high-probability buy setup.

📌 Target Level – 0.87394 (Projected Move)

✅ This is calculated using the measured move technique, where the distance from the bottom to the neckline is projected upwards.

✅ This level coincides with a previous resistance zone, making it a realistic target.

📈 Trading Strategy – How to Trade This Setup

🎯 Entry Plan for Long Position (Buy Setup)

1️⃣ Breakout Entry:

Enter a long position after a confirmed breakout above 0.85000.

Watch for strong bullish candles with volume confirmation.

2️⃣ Retest Entry (Safer Option):

If price breaks above resistance, wait for a pullback and retest of the 0.84500 - 0.85000 level.

If price holds this zone as new support, it strengthens the bullish confirmation.

📉 Stop-Loss Placement (Risk Management)

✅ Place a stop-loss just below the support zone (0.82453) to protect capital.

✅ This level is strong because price has bounced off it twice, confirming buyer strength.

🎯 Profit Target (Take Profit)

✅ The projected target is 0.87394, aligning with previous resistance.

✅ This offers a high reward-to-risk ratio (RRR), making the trade worth taking.

⚠️ Risk Management & Market Outlook

✅ Bullish Bias – Price action suggests uptrend continuation after breaking out of the trendline.

✅ Confirmation is Crucial! – Enter only after a clear breakout and retest.

✅ Watch for Fakeouts – If price fails to hold above the neckline, it could be a false breakout.

✅ Fundamental Factors – Keep an eye on economic data and central bank policies (ECB & BoE) that may impact the GBP & EUR.

📢 Final Thoughts – Why This Trade is High-Probability

🚀 Double Bottom + Trendline Breakout = Strong Bullish Signal

🚀 Neckline Breakout Above 0.85000 = Confirmation of Trend Reversal

🚀 Targeting 0.87394 with a Favorable Risk-Reward Setup

If price successfully breaks and holds above resistance, we could see a strong rally toward 0.87394 in the coming weeks.

📌 Monitor price action carefully and wait for confirmation before entering the trade.

🔔 Like & Follow for More Trading Setups! 🚀📈

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.

🔻 Bearish Targets: The price is expected to fall toward 31.96 in the coming sessions.

🔻 High-Probability Trade: Strong technical reasons support a bearish outlook.

🚨 Watch for further confirmations and manage risk effectively! 📊💰