CHFJPY: Intraday Bullish Signal?! 🇨🇭🇯🇵

It looks like CHFJPY has completed a local correctional movement

after a formation of a strong bullish wave.

I see a violation of a resistance line of a falling wedge pattern as a confirmation.

Next goal - 175.72

❤️Please, support my work with like, thank you!❤️

Priceaction

2025-04-10 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Big bear trend line is holding up and market printed a lower high. I expect lower highs and higher lows for much more time. By now you should know that I don’t make up stuff about trading ranges and a triangle is a form of a trading range. You buy low, sell high and scalp. Mark the 30% of the upper and lower bound of the range, trend lines and trade if market turns. It’s not rocket science. It’s about you against you and not letting emotions mess up your trading success.

current market cycle: bear trend valid until bear trend line broken but trading range a bit more likely right now. At least on lower time frames.

key levels: 16000 - 20000

bull case: Bulls want to keep this higher low much higher than 17200 and are trying above the breakout price 18360. Tomorrow we will see if they can get a second leg up and retest 19000. I have no opinion on that and will wait what the market will give me. Shorting below 18800 is bad, no matter what. Is 18450 a good buy for the bulls? Far from it. Where would you put your stop? 17900? Risk of that getting hit is very high.

Invalidation is below 16400.

bear case: Bears did good at keeping this a lower high and casually selling down for 1469 points. In the grand scheme of things it’s around a 50% retracement of yesterday, so currently a “normal” move if you just look at this week. Markets are broken and someone bigger will fail soon. They always do. Swing shorts are ok at 18400 if you can add higher again. Risk of a retest 19000 is too big for a trade with a tight stop. If I had to guess, I think we will retest 17500 tomorrow and close somewhere around 18000.

short term: Neutral around 17900-18700 and only interested in fading the extremes in given range.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. W3 overshot it by 1000 points. Now my bearish bias is gone and I will wait how this unfolds. Big uncertainty for this year but I think this selling is overdone and big bois are buying with both hands below 17000.

trade of the day: Shorting yesterday’s high was the obvious trade of the day since market only made lower highs since Globex open. Tough day in any case because the swings are so wild that the risk is gigantic on any given trade. Not the best environment for beginners or people with small accounts. Trade small and be humble.

Bitcoin -Weekly, Daily, H4, H1 Forecasts, Trading IdeasMidterm forecast, Weekly Timeframe:

While the price is above the support 70550.04, resumption of uptrend is expected.

We make sure when the resistance at 91037.20 breaks.

If the support at 70550.04 is broken, the short-term forecast -resumption of uptrend- will be invalid.

BITSTAMP:BTCUSD MARKETSCOM:BITCOIN

Daily Timeframe:

A trough is formed in daily chart at 74545.70 on 04/09/2025, so more gains to resistance(s) 86499.57 and maximum to Major Resistance (91037.20) is expected.

Take Profits:

86499.57

91037.20

94505.46

98675.19

101430.12

105431.17

109932.89

115000.00

120000.00

125000.00

130000.00

140000.00

H4 Timeframe:

H1 Timeframe:

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

SPY Analysis & Tariff TurmoilLast Friday, the market pressure was intense, and my bullish call option, targeting $537.64 on SPY, seemed overly ambitious as tariffs and political uncertainties peaked. I stated, " AMEX:SPY Trump went all in thinking he had the cards. We were getting sent back to the McKinley era," wondering when or if Trump would fold under international pressure and market realities.

Fast-forward to Wednesday, April 8—Trump didn't just blink; he folded utterly, reversing the harsh tariff policies he initially defended aggressively. Prompted by China's aggressively dumping of U.S. Treasuries and stark recession warnings from Goldman Sachs, BlackRock, and JPMorgan, Trump pivoted significantly:

• Base tariffs: 10%

• Tariffs on China: Increased to 125%

• Tariffs on U.S. goods entering China: Increased to 84% starting April 10

While temporarily bullish, these sudden, dramatic policy swings underline ongoing instability and volatility. However, with big bank earnings on deck this Friday, short-term momentum looks positive.

Technical Levels & Trade Ideas

Hourly Chart

The hourly chart reveals a critical zone—dubbed "Liberation Day Trapped Longs"—between $544.37 (H. Vol Sell Target 1b) and $560.54 (L. Vol ST 2b). Bulls trapped here from recent highs may now look to exit on a relief rally.

• Bullish Scenario:

• Entry: SPY reclaiming and holding above $544.37.

• Target 1: $560.54 (top of trapped longs)

• Target 2: $566.54 (next resistance area)

• Stop Loss: Below recent lows near $535 to limit downside.

• Bearish Scenario (if tariffs intensify again or earnings disappoint):

• Entry: Breakdown confirmation below $535.

• Target 1: $522.20 (Weeks Low Long)

• Target 2: $510.00, potential further support

• Stop Loss: Above $544.50 to manage risk effectively.

Daily Chart Perspective

The broader daily chart shows SPY stabilizing around key lower supports after significant volatility. Recent price action suggests cautious optimism for an upward bounce, but considerable headwinds remain if tariff escalations resume.

Final Thoughts

The rapid tariff reversals and heightened volatility are unsettling. The short-term bullish move offers potential quick upside trades into earnings, but caution remains paramount. You can continue managing risks prudently and watch closely for political or economic headlines that could quickly shift market sentiment again.

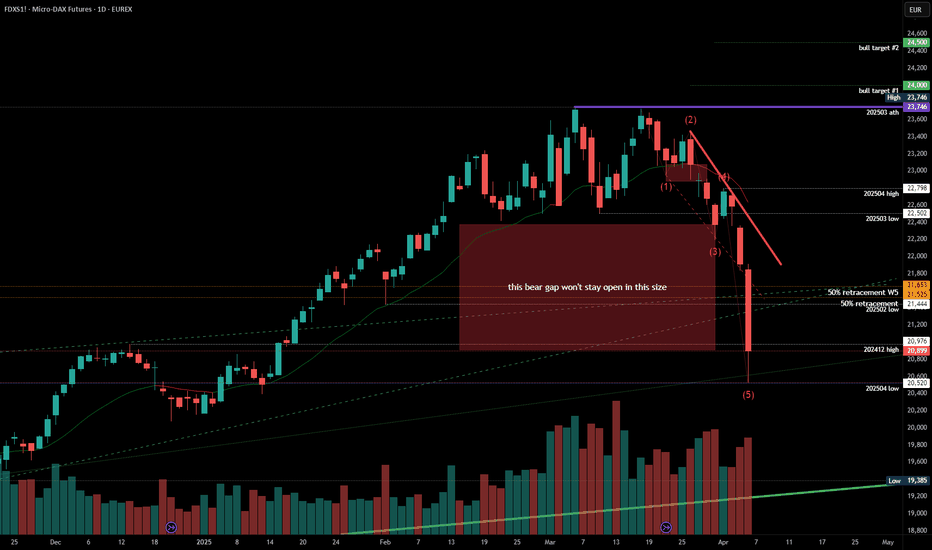

2025-04-09 - priceactiontds - daily update - daxGood Evening and I hope you are well.

comment: Cleanest breakout retest of the big bull trend line from 2024-08 one could ask for. I highly doubt bulls want to buy this above 21000 tomorrow but these moves are so unlikely that anything can happen. Only rough guesses from me here. I will only look for shorts.

current market cycle: trading range more likely than continuation of the bear trend

key levels: 19000 - 22000 yeah. no typo.

bull case: Bulls wettest dreams came true today but this week the market took those profits away quickly afterwards and right now I have no reason to believe that it’s more likely we will continue higher than down again. Ask yourself, if you are a bull and made 10%+ today, will you bet on making 15 or locking in those sweet profits?

Invalidation is below 21000.

bear case: Bear trend line is valid until broken and I doubt bears will let that happen. Too much uncertainty and risk for the markets right now. Bears need to quickly trade down below 21000 tomorrow and by then I think bulls will be in give up mode again. We could range some first but currently the markets are moved by tweets from orange face and they move 10%+ up and down. Wildest of times and you just have to take the momentum trades. Above 22000 I am absolutely wrong about this and market is completely neutral again. Best for bears would be to keep it below 21900.

Invalidation is above 22000.

short term: Neutral.

medium-long term from 2024-03-16: Will update this over the weekend. Bear targets are met. I can most likely see this going sideways for months or years now.

current swing trade: None

trade of the day: Not writing anything about this. You either got lucky having longs when the tweet came or not. Otherwise selling 20000 before US open was a decent trade.

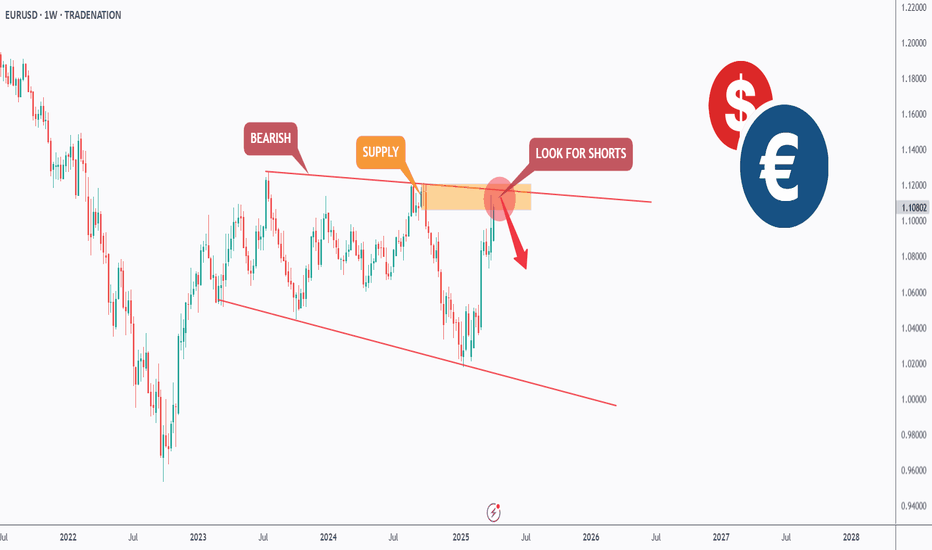

EURUSD - Trade The Impulse!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURUSD has been bearish trading within the falling wedge pattern marked in red.

Currently, EURUSD is retesting the upper bound of the wedge.

Moreover, the $1.12 is a strong weekly supply zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and supply.

📚 As per my trading style:

As #EURUSD is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

2025-04-08 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: W3 was climactic and there could be a possible W5. Right now we are in W4 and the given range will likely be respected and not broken. I will most likely mean reverse to 20000 over the next days.

current market cycle: strong bear - W3 concluded - W5 possibly down to 16000 if we get one but W3 could have been the end of it since it was so climactic and extreme.

key levels: 16000 - 18400 (but I doubt we get below 16400 for the next days/weeks)

bull case: Both sides make good money currently and we have a big range to trade. 17500 is my neutral price where I expect market to spend most of it’s time for the next days/weeks. We should see at least 10 session sideways to up movement.

Invalidation is below 16400.

bear case: Bears can not expect this to continue down for now and they have to continue to keep the market below 19000 and leave a big gap open up to 19350. Earnings start on Friday and I have no idea how that will go. So no bearish bias since my targets are all met.

short term: Neutral around 17500 and only interested in fading the extremes in given range.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. W3 overshot it by 1000 points. Now my bearish bias is gone and I will wait how this unfolds. Big uncertainty for this year but I think this selling is overdone and big bois are buying with both hands below 17000.

trade of the day: Selling the double top above 18300 for a casual 14000 point drop. Congratulations if you took it and held through it. I did not.

Gold (XAU/USD) 4H Analysis – Bullish Momentum Building Up?**Gold (XAU/USD) | 4H Chart | Bullish Bias**

Gold continues to shine as it builds a solid bullish structure on the 4H timeframe. After a healthy pullback, price has bounced back strongly, holding above key support zones and aiming higher.

**What's happening now?**

- Price is forming *higher highs and higher lows*, respecting the bullish trendline.

- Strong demand kicked in around the *$2,950* zone — a key level to watch for potential pullbacks.

- The next resistance lies near *$3,050*, a psychological and technical level that could act as the next target for buyers.

**Technical Confluence:**

- *Fibonacci retracement* aligns with recent pullbacks around $2,950 – offering strong support.

- *RSI* is hovering above 50, confirming ongoing bullish momentum.

- Price remains above the *50-period EMA*, supporting the uptrend.

---

**Bullish Scenario:**

If gold holds above $2,950 and breaks above $3,010 with volume, we could see a push toward *$3,050–$3,070* in the short term.

**Invalidation:**

A confirmed break below *$2,940* could weaken the bullish outlook and shift momentum.

---

**Educational Insight:**

In trending markets, pullbacks to key zones like Fibonacci levels or prior support often offer higher-probability trades. Instead of chasing breakouts, look for *retests* with confirmation.

---

What’s your take on gold right now? Are we headed toward new highs or due for a pause?

Bitcoin Signal for Short Lets Make Some Real GameThis is an educational trading setup for Bitcoin (BTC/USD), focusing on a short position opportunity between the $82,000 and $80,000 price levels. The analysis is based on technical indicators, price action strategies, and current market sentiment. Please note: this is not financial advice, strictly for learning purposes!

📉 Trade Concept:

Entry Zone: $82,000

Target Zone: $80,000

Setup Type: Short / Sell

Timeframe: Short-term / Intraday

Market Context: After an extended bullish rally, BTC/USD is showing signs of exhaustion near key resistance. High probability retracement expected towards the $80,000 support area.

🔍 Educational Insights:

Technical Indicators: Overbought RSI levels, bearish divergence, and candlestick reversal patterns around $82,000 zone.

Psychological Levels: $80,000 is a major psychological number where buyers may step in.

Risk Management: Always use stop-losses and proper risk-reward ratios in live trades.

💡 Purpose of Sharing:

This setup is shared purely for educational purposes to help traders understand how to spot potential short opportunities in volatile markets like Bitcoin. Learn how to analyze resistance zones, manage risk, and read price action effectively.

📢 Disclaimer:

This is not financial advice. For educational purposes only. Always do your own research and consult with a professional before making financial decisions.

#Bitcoin #BTCUSD #CryptoAnalysis #ShortTrade #BitcoinSignal #PriceAction #Educational #TradingStrategy #TechnicalAnalysis #CryptoEducation #LearnTrading #RiskManagement

BTC/USD Forming Bullish Falling Wedge – Potential Target📐 2. Technical Pattern – Falling Wedge

A falling wedge forms when the price consolidates between two converging downward-sloping trendlines. It suggests diminishing selling pressure and a likely reversal.

Key Characteristics in This Chart:

Upper Resistance Trendline: Formed by connecting the series of lower highs.

Lower Support Trendline: Formed by connecting the lower lows.

The price respects both boundaries, confirming wedge structure.

Volume generally decreases during the wedge (implied but not shown).

✅ Bullish Implication: Once price breaks above the upper resistance, it often triggers a sharp upward move due to the squeeze of supply and the build-up of demand.

🧱 3. Support and Resistance Zones

🔻 Resistance Zone:

Area: ~100,000 to ~108,000 USD

Marked as a wide horizontal band (beige-shaded area).

Previous price peaks and consolidations suggest this zone is strong supply.

Breakout above this zone could trigger momentum towards the higher target.

🔹 Support Zone:

Area: ~72,000 to ~75,000 USD

Historical reaction level where buyers previously stepped in.

Coincides with the lower wedge boundary and recent bounce points.

Repeated tests strengthen this as a reliable accumulation zone.

🎯 4. Trade Setup Strategy

💼 Entry Strategy:

Trigger: A confirmed breakout above the wedge’s upper trendline (black diagonal line).

Confirmation: A strong bullish daily close above the trendline, ideally with volume spike.

The current price (~77,130) is near the lower boundary—offering a potential early entry or low-risk setup with a tight stop.

📌 Stop-Loss Placement:

Level: 70,916 USD

Below the wedge’s lower support and beneath the broader support zone.

Ensures exit if the pattern fails or bears regain control.

🧭 Target Projection:

Target Price: 114,562 USD

Based on the height of the wedge projected from the breakout point, a standard wedge breakout measurement.

Aligns with historical highs and psychological resistance.

🧮 Risk-Reward Ratio: Assuming entry around 77,130:

Risk (Stop-Loss): ~6,200 points

Reward (Target): ~37,432 points

R:R Ratio ≈ 1:6 – Highly favorable

⚙️ 5. Market Psychology & Price Action Insight

The falling wedge pattern suggests exhaustion of sellers.

Buyers are defending the support zone aggressively—creating higher lows within the wedge.

Each bounce is slightly more aggressive, indicating growing bullish sentiment.

A breakout from the wedge could act as a catalyst for rapid price acceleration as sidelined bulls enter and shorts cover.

📊 6. Summary of the Setup

Component Detail

Pattern Falling Wedge (Bullish)

Timeframe 1-Day Chart

Entry Point Breakout above upper trendline

Stop Loss 70,916 USD

Target 114,562 USD

Support Zone 72,000–75,000 USD

Resistance Zone 100,000–108,000 USD

Risk/Reward Approx. 1:6

Bias Bullish

📌 Final Thoughts

This setup provides a technically sound opportunity with clear invalidation (stop loss) and a well-defined profit target. The risk-to-reward ratio is attractive, and the price structure suggests a bullish reversal is likely, pending a confirmed breakout.

BTC/USD Long Setup – Bullish Reversal PlayAfter a sharp drop, BTC is testing a key liquidity zone around 78.2k. The market structure suggests a potential bullish reversal, with a fakeout and recovery in sight.

📌 Trade Idea:

Entry: After confirmation of a reclaim and bullish structure break (above ~79.3k)

SL: Below recent low ~77.6k

TP: 82.8k zone

RRR: ~3.2

📅 Timeframe: 30min

📈 Bias: Counter-trend long

🔁 Watch for: Price reaction at current support and market structure shift

🚨 Wait for confirmation – patience is key in volatile conditions!

#202514 - priceactiontds - weekly update - wti crude oil futures

Good Evening and I hope you are well.

#mcl1 - wti crude oil futures

comment: Strong momentum for the bears but I have zero interest in selling where all bears for the past 2 years lost money. Not much more to say about this. Wait for strong buying and join but market will likely do some more testing of 60 first and then sideways before we can go higher. Anything above 63 is a bull surprise and could lead to a squeeze.

current market cycle: trading range on the monthly chart

key levels: 59 - 63

bull case: Bulls are at prior big support but right now we are still in the spike down phase. Market likely needs some time sideways before we can try a bounce. Bulls would do good if they stay above the 2023-12 low and keep it a higher low. Targets for bulls are the bull trend line break retest around 63.7 and the next breakout retest 2025-03 low at 65.

Invalidation is below 59.

bear case: Bears had the news crash down and now what? Are they strong enough to make lower lows below 60? I highly doubt it until it happens. Only pattern is an ugly expanding triangle and we are at the very bottom of it. Bears don’t have much reasons to sell down here but technicals only go so far for commodities. I will sit on hands for this.

Invalidation is above 63.

short term: Neutral for now but I will never sell down here since we have not traded this low for 2 years and every time we went below 65 bears lost.

medium-long term - Update from 2025-02-23: Down at support again around 60. Market has not traded below 59 since 2023 and until it happens it’s a bad trade betting on it. It’s a multi-year trading range and below 64 bulls made money, not bears.

current swing trade: None

chart update: Highlighted broken shallow bull trend line and just removed things

#202514 - priceactiontds - weekly update - nasdaq e-mini futures

Good Evening and I hope you are well.

comment: W3 has likely concluded and I expect the same price action as for W2. Market is respecting technicals precisely. Look at the chart and the obvious numbers and lines. We can always do an over- or undershoot but for now I don’t think looking for shorts after two days of crashing make any sense.

current market cycle: strong bear trend

key levels: 16000 - 19600

bull case: Bulls still running for the exits but we have fallen too much too fast and we are getting into value territory for bigger players to buy the dip. Almost nothing is ever as bad as these extreme market reactions want to trap you into. Not to the downside and certainly not to the upside but to the upside everyone is busy pounding their chest because they are such a genius for making money in a bull market. Bulls want a squeeze up to 19000, that’s about it. Bear trend line around 18800-19000 will most likely get hit over the next 2 weeks.

Invalidation is below 17000.

bear case: Same reasoning as for dax. Bears want the big bull trend line around 16500 but they won’t get there in a straight line. W4 is likely around the corner. If we stay below 18800, that would once again leave another gap open and be another show of big strength by the bears.

Invalidation is above 19100.

short term: W3 has likely concluded, shorting below 18000 is really really not a good trade unless it’s a momentum scalp. Looking to scalp some longs on the squeeze up.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. Clear W1 of this bear trend. Market now has to close below 19000 to confirm W3. Depending on how deep W3 goes, W5 will either reach only around 17500 or the bull trend line around 16000.

current swing trade: None

chart update: Made the bear trend clear and my expectation for W4 and W5. As always, it’s a guess.

#202514 - priceactiontds - weekly update - dax futures

Good Evening and I hope you are well.

comment: By now you could likely be crash-news-fatigued and I get it. I keep it short and technical. My base assumption is that all markets are heading for their 50% retracements from the covid lows. If no bigger positive news will stop it, we will get there with the next leg down. For now market is tough since 20500 is close enough to expect 20000 but we could very well squeeze to 21500 before more down. Do not try to catch the knife here and wait for market to clearly stop the falling. Chart is clear, mark the levels and trade small.

current market cycle: bear trend

key levels: 20000 - 21500

bull case: Bulls are at big support with 20000 and the bull trend line from 2023-10. That bull trend line can be drawn many different ways and I just presented one possibility and you never know which algos respect what version the most until market has turned. I do think the selling is overdone very much and the short squeeze is around the corner. Targets above are the obvious ones. 21000 and then maybe 21500 but not much more for now.

Invalidation is below 19900.

bear case: Bears need to reduce risk and lock in some profits I think. I highly doubt market can go to 22000 but it’s not impossible and bears don’t want to see their windfall profits disappear again. The odds of continuing straight down after -10% are low. Very very low. Market could likely do some sideways first. Bears want 20000 and there I expect most to take big profits and a bigger bounce. My wave count is most likely off since I can not see this selling ending here above 20000. The covid low bull trend line is around 19500 and too obvious to not get hit over the next weeks.

Invalidation is above 21600.

short term: Neutral but I expect a big short squeeze next week. 21500 is my target for the bulls but most likely outcome for next days is chop between 20000 and 21000

medium-long term from 2024-03-16: Clear new bear trend and targets were given end of 2024. If this hits 19500, you buy with both hands stocks and etfs and do not look at them for months or years. Generational buying opportunity.

current swing trade: Out of most shorts. Next swing will be for W5 but I want an entry closer to 21500 or 22000 but 22000 is likely too much and we could not get there.

chart update: Big bear gap won’t stay open in that size. Big bear trend line above is the most important line on this chart besides the bull trend line from the covid low.

#202514 - priceactiontds - weekly update - bitcoinGood Evening and I hope you are well.

#btcusd - bitcoin

comment: The move I was writing and have been expecting for multiple weeks started today and 75k is the target. I won’t repeat all of it. Chart is clear and now it’s on bears to make meaningful lower lows. Below 70k you will likely see some panic.

current market cycle: bear trend

key levels: 70k - 90k

bull case: Bulls tried and failed under 90000. Now their last hope is to keep it above 75000 or risk going down to 70000 or below. I absolutely have nothing for them besides praying that 75000 holds.

Invalidation is below 70k.

bear case: Bears have all the arguments now and the chart is clear as day. Would not be the first time a market would do the opposite of what’s expected but you will not make money in the long run if you only bet on the low probability things happen. Maybe you can but you have to be S-Tier trader amongst traders. Much easier to follow the trend here. 75000 was my big target and I hope we crash to 69000.

Invalidation is above 90k.

short term: Full bear for 75000 or lower.

medium-long term - Update from 2025-02-23: 75000 is still my biggest target for 2025. It’s happening. 70k/75k and then I expect a bigger bounce first. Then we will see if we can go lower or not. For now it’s very low probability that the big bull trend line from 2023-10 breaks anytime soon.

current swing trade: Short since 85000. Stop is 89000 no matter where you go short.

chart update: Removed one minor broken bear trend line.