GBPUSD FORECASTIn this analysis we're focusing on 4H time frame for GBPUSD. As we know that market trend was bullish and today I'm looking for a buy side opportunity. According to my analysis, if the market price wants to continue its move to the upside, it will need to first retest the key levels drawn on the chart before it can continue its upward movement. Let's see what happens and which opportunity market will give us. Always remember when price reaches our key levels wait for confirmation. After confirmation execute your trades.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis or prediction.

#GBPUSD 4H Technical Analyze Expected Move.

Priceaction

GBPJPY TODAY FORECASTIn this forecast we're analyzing 2H time frame for GBPJPY. Today I'm looking for a potential buy trade setup. According to my analysis and strategy when price enters in my key levels as shown in the chart and give any bullish confirmation like candlestick pattern or price action. After taking confirmation we'll trigger our trade. Confirmation is most important part of this analysis.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

This is just my analysis. Further updates related this analysis will posted soon once price reach our levels.

#GBPJPY 2H Technical Analysis Expected Move.

#BTC/USD ANALYSIS. (BULLISH)Bitcoin Price Action Analysis. The Next Big Move?

Bitcoin is moving within an ascending channel, showing strong bullish momentum! However, a key decision point is approaching as the price nears a critical support zone (highlighted in blue). If BTC holds above this level, we could see a strong push towards the $91,500 resistance and potentially break into the $94,700 range.

A well structured risk-to-reward setup is in play, with a potential bullish breakout targeting new highs. Will BTC sustain its momentum, or will we see a retracement before the next leg up? Stay sharp and trade wisely! We will execute our trades only after receiving bullish confirmation.

Use proper stoploss and proper money management.

This is just my analysis. Observe the behavior of price how it will react.

#BTCUSD 2H Technical Analysis Expected Move.

EUR/JPY Falling Wedge Breakout | Bullish Potential Ahead🔍 Chart Overview: EUR/JPY – Daily Timeframe

This chart illustrates the price action of the Euro against the Japanese Yen and highlights a Falling Wedge Pattern developing over several months. This is a classic bullish continuation/reversal setup, supported by key technical levels.

📐 1. Chart Pattern: Falling Wedge

A falling wedge is a bullish chart pattern that occurs when the market consolidates between two downward-sloping trendlines.

Characteristics Seen in the Chart:

Converging Trendlines: The upper (resistance) and lower (support) boundaries are both sloping downward, indicating a narrowing price range.

Volume (not shown) usually decreases during the formation, followed by a surge on breakout.

Multiple Touch Points: The price action respects both boundaries multiple times, confirming the pattern's validity.

🏛️ 2. Key Levels

✅ Support Level (Demand Zone):

Marked around 156.000 – 158.000

Multiple bounces from this area, indicating strong buying interest.

Aligned with the lower wedge trendline and historical price reaction zones.

🚫 Resistance Level (Supply Zone / Breakout Zone):

Around 164.500 – 166.000

Price repeatedly failed to break this level, confirming it as a strong supply area.

Confluence of horizontal resistance and the upper wedge boundary.

📊 3. Trade Setup

💼 Entry Strategy:

Confirmation Buy: Enter a long position upon a daily candle close above the wedge resistance (around 166.000).

Aggressive traders may consider an earlier entry near the wedge’s support with a tight stop.

🎯 Target:

The projected target is 172.962, calculated based on the height of the wedge pattern added to the breakout point.

This aligns with a previous swing high area, serving as a logical profit-taking zone.

🛑 Stop Loss:

Positioned at 155.576, just below the key support zone.

This allows the trade room to breathe while protecting against a full pattern failure.

⚖️ 4. Risk Management

Risk-to-Reward Ratio (RRR): Target around 172.962 and Stop Loss at 155.576 offer a favorable RRR of approximately 2.5:1 or more, depending on entry.

Position Sizing: Use appropriate lot size based on your account risk tolerance (e.g., 1-2% of equity per trade).

📅 5. Timeframe Outlook

Medium to Long-Term Setup: Since this is a daily chart, the trade may take weeks to months to fully play out.

Patience and proper trade management are essential.

🔎 6. Additional Notes

Retest Opportunity: If price breaks out, look for a retest of the resistance zone as new support before continuation to the upside.

Fundamental Factors: Keep an eye on EUR and JPY economic data, ECB and BoJ policy announcements, and global risk sentiment, which can influence the pair.

🧭 Professional Takeaway

This is a textbook bullish falling wedge pattern within a well-defined technical structure. The chart provides:

A clear pattern breakout level,

Strong historical support/resistance zones,

A defined risk management plan,

And a realistic price target based on technical projection.

If you are a swing trader or position trader, this setup offers a high-probability opportunity with favorable risk-reward dynamics—provided a breakout is confirmed.

EUR/GBP Analysis Double Bottom Breakout Toward TargetOverview of the Chart

This chart displays a EUR/GBP daily timeframe setup, highlighting a Double Bottom Pattern, a well-known bullish reversal formation. The pattern consists of two consecutive lows at a similar price level, followed by a breakout above a key resistance zone. This setup suggests a potential trend reversal from bearish to bullish.

Technical Analysis Breakdown

1. Double Bottom Formation (Reversal Signal)

Bottom 1: The first low was established after a prolonged downtrend, where the price found support and bounced higher.

Bottom 2: Price revisited the same support area but failed to break lower, indicating that sellers are losing strength and buyers are stepping in.

A double bottom pattern signals that the asset is forming a strong base and is likely to move higher after breaking the neckline (resistance level).

2. Support and Resistance Levels

Support Level (~0.8322):

This level acted as a demand zone, preventing further downside.

It marks the price area where buyers accumulated positions, leading to a reversal.

Resistance Level (~0.8500):

This level previously acted as a supply zone, where sellers controlled the price.

A breakout above this level is crucial to confirm the bullish trend continuation.

3. Breakout Confirmation & Retest Expectation

The price successfully broke above the resistance zone, confirming a bullish reversal.

A potential retest of the broken resistance (now turned support) could occur before further upside movement.

Traders often wait for this retest to confirm that the breakout is genuine before entering a position.

4. Price Target Projection

Based on the measured move strategy, the expected target is calculated by measuring the height of the double bottom pattern and projecting it above the breakout zone.

Target Price: 0.8742, aligning with historical resistance levels.

5. Stop Loss Placement

Stop loss at ~0.8322 (below the double bottom support).

This ensures risk is managed in case of an invalid breakout or a false move.

Trading Plan & Execution Strategy

📌 Entry Strategy:

✅ Breakout Entry: Buy after the breakout above resistance.

✅ Retest Entry: Wait for a pullback to the previous resistance (now support) before entering.

📌 Risk Management:

🔹 Stop Loss: Placed below the recent support at 0.8322 to limit downside risk.

🔹 Take Profit: First target at 0.8742 based on the double bottom structure.

📌 Market Outlook:

A successful breakout and bullish momentum could push prices toward the target.

If the price fails to hold above the breakout zone, a deeper retracement could occur before continuing higher.

Conclusion

The EUR/GBP pair has formed a bullish double bottom reversal pattern, signaling a potential uptrend continuation. The key levels to watch include 0.8500 (resistance turned support) and 0.8742 (target projection). Traders should monitor price action around the breakout zone for confirmation and consider risk management strategies before entering a position.

BTC/USD Weekly Analysis – Cup and Handle Breakout Toward Target🔍 Overview

The chart displays a classic Cup and Handle pattern on the weekly timeframe, a well-established bullish continuation formation often found in long-term uptrends. This pattern, combined with major technical confluences such as trendline support and strong horizontal levels, provides a high-conviction long setup with defined risk and reward.

☕ 1. The Cup Formation

Timeframe: Mid-2021 to early 2024

Shape: Rounded bottom, a hallmark of slow accumulation.

After reaching an all-time high in late 2021, BTC entered a bear market, dropping sharply and eventually bottoming out between $15,000–$20,000.

A gradual recovery followed, forming a wide and symmetrical base—indicating accumulation by institutional and long-term holders.

This phase represents a shift in market sentiment, from bearish to neutral, and eventually bullish, as buyers stepped in around key demand zones.

🔧 2. The Handle Formation

Timeframe: Early 2024 to late 2024

After reclaiming its previous high resistance area near $69,000–$75,000, BTC formed a short-term consolidation or pullback, creating the "handle" portion of the pattern.

The handle appeared as a descending channel, a healthy correction that typically precedes a breakout in this pattern.

This correction also aligned with a trendline retest, offering dynamic support and further strengthening the pattern's reliability.

💥 3. Breakout Confirmation

The breakout from the handle occurred above the descending resistance of the handle pattern.

Weekly candles showed strong bullish momentum, backed by rising volume and rejection from lower trendline levels.

BTC is now trading near $83,000, just above the trendline, confirming both pattern validation and support holding.

🎯 4. Target & Projection

The measured move of the Cup and Handle pattern is calculated by measuring the depth of the cup and projecting that from the breakout point.

Cup Depth: Approximately $60,000

Breakout Point: ~$75,000–$80,000

Target Price: ~$123,000–$125,000

This target aligns with historical Fibonacci extensions and psychological round-number resistance.

🔐 5. Key Levels

Support Zone: $20,000–$30,000 (multi-year accumulation base)

Trendline Support: Drawn from 2022 lows, holding well through handle correction

Resistance Zone: $100,000 psychological barrier

Stop Loss: Placed just below trendline and swing low at $76,340 to protect against downside volatility

🧠 Why This Setup is Strong

Multi-year Base Formation (2.5+ years of consolidation)

Pattern Reliability: Cup and Handle is a well-tested bullish continuation pattern

Confluence of Support: Both horizontal and dynamic trendline support levels

Momentum Structure: BTC has resumed higher highs and higher lows

Volume: Breakout occurred with a noticeable spike in volume, a key validation point

🏁 Conclusion

Bitcoin is displaying strong bullish potential through a large-scale Cup and Handle pattern. This technical setup is supported by:

Long-term accumulation

Structural breakout

Strong support levels

A clear roadmap toward $120K+ targets

As long as BTC maintains above the trendline and doesn't invalidate the handle's structure, the bulls remain firmly in control.

XAU/USD Bullish Pennant Breakout - Trade Setup Toward Target📊 Overview:

This 4-hour chart of Gold Spot (XAU/USD) presents a clean bullish pennant breakout followed by a corrective pullback to key support, offering a high-probability trading setup for bullish continuation traders.

Gold recently surged above the psychological $3,000 level, but after testing the previous resistance zone / ATH, it retraced back into a critical confluence of support. From a technical perspective, the structure remains bullish, supported by strong trendline dynamics, clean price action, and a well-defined pennant formation.

🔍 Step-by-Step Breakdown:

1. Bullish Pennant Formation

A bullish pennant is a continuation pattern that typically occurs after a strong upside rally (the "flagpole"). In this chart:

The flagpole began around March 13, with gold moving vertically from ~$2,630 to ~$2,950.

This was followed by consolidation between March 19–27, forming a symmetrical triangle pattern with converging trendlines (the pennant body).

Volume (if added) would typically decrease during this consolidation phase.

On March 27–28, price broke above the pennant, confirming the bullish bias.

📌 This breakout signals that buyers are ready to resume control after taking a breather.

2. Rally & Retest Phase

Following the breakout:

Price surged to challenge the resistance zone and all-time high (ATH) area, marked between $3,150 – $3,160.

A natural pullback occurred due to profit-taking and overbought conditions.

This retracement brought price back into the support zone at ~$3,000, intersecting perfectly with:

The rising trendline from the pennant breakout

A horizontal demand zone (former resistance turned support)

A key psychological level ($3,000)

💡 This zone acted as a confluence area, attracting buyers and creating a strong bounce — visible as a bullish engulfing candle.

3. Support & Resistance Analysis

✅ Support Level:

$2,990 – $3,010

Marked by previous highs before the breakout

Validated by the trendline and price reaction

🚫 Resistance / ATH Level:

$3,150 – $3,160

Historic resistance zone that capped the recent rally

Price must break this level for further continuation toward the target

4. Trendline Dynamics

The dotted trendline acts as a rising support structure.

Trendlines in bullish continuations are crucial as they confirm upward momentum.

As seen on the chart, price respected the trendline during the recent dip and bounced with strong momentum — a bullish signal.

5. Trade Setup & Risk Management

A trade based on this structure should follow strict risk-to-reward discipline.

🛒 Entry Zone:

Ideal re-entry lies between $3,030 – $3,040, after confirming the bounce from support.

❌ Stop Loss:

Below $2,976, which is under the support zone and trendline. If price breaches this level, the pattern is invalidated.

🎯 Target:

Measured move (height of the flagpole) projected from breakout zone gives us a target of around $3,221.

The chart also marks this clearly as the "Target" zone.

📈 Risk-to-Reward Ratio: Approximately 1:3, which is attractive for swing trades.

6. Market Psychology & Trader Sentiment

The bullish pennant represents temporary indecision, but ultimately market confidence remains strong.

The pullback to support reflects healthy profit-taking, not bearish reversal.

The bounce from support shows buy-the-dip mentality, a sign that bulls remain in control.

7. Macro & Fundamental Backdrop

While the chart is technical, it's wise to factor in macro catalysts:

🏦 Federal Reserve policy: If the Fed holds or cuts rates, gold typically rallies due to lower opportunity cost.

📉 Inflation Data: Rising inflation or expectations can push gold higher as a hedge.

🌍 Geopolitical tensions: Conflicts or economic instability drive safe-haven flows into gold.

Staying updated on these events can help validate or hedge your technical outlook.

✅ Conclusion:

This chart presents a technically sound bullish continuation setup backed by:

A breakout from a bullish pennant

A retest and bounce from a confluence support zone

A clearly defined risk (stop loss) and reward (target)

Traders looking for medium-term opportunities in XAU/USD can consider this as a high-probability setup with logical structure and strong momentum potential.

🔔 TradingView Tag Suggestions:

#XAUUSD #Gold #TechnicalAnalysis #BullishPennant #PriceAction #SwingTrade #Forex #TradingSetup #Commodities #GoldBreakout

Mastering Market Trends: Your Guide to Clearer Trading DecisionsTrends shape every decision you make in the markets, even if you’re unaware of it. Understanding how to identify and adapt to these market phases is your foundational skill - one that separates successful traders from the rest.

Today, let’s simplify and clarify the three essential types of market trends. By mastering this, you’ll approach trading decisions with more confidence and clarity.

⸻

📈 1. Uptrend – Riding the Bull

• What is it?

An uptrend is like climbing stairs upward. Each step (low) is higher than the previous one, and every leap (high) sets a new peak.

• What drives it?

Buyers dominate, optimism rules, and demand pushes prices upward.

• Trading tip:

Identify support levels and look for retracements as potential entry points. Be cautious about chasing prices that have moved too far without a pullback.

⸻

📉 2. Downtrend – Navigating the Bearish Territory

• What is it?

Visualize going down a staircase. Each step down (low) surpasses the previous one, and every upward bounce (high) falls short of the prior peak.

• What drives it?

Sellers control the market, bearish sentiment takes over, and supply outweighs demand.

• Trading tip:

Look for resistance areas to identify potential short entries or wait patiently for signs of a reversal if you’re bullish.

⸻

➡️ 3. Sideways Market – The Calm Before the Storm

• What is it?

Imagine a tug-of-war with evenly matched teams. The price moves back and forth in a narrow range without breaking decisively higher or lower.

• What drives it?

Uncertainty, indecision, or equilibrium between buyers and sellers.

• Trading tip:

Stay patient! Either look to trade range extremes (buying support and selling resistance) or wait for clear breakout signals to catch the next big move.

⸻

🔍 Pro Tip for Trend Analysis:

• Multi-timeframe analysis is key: Always check higher timeframes (weekly, daily, or hourly) to confirm the primary trend. Don’t let short-term noise mislead your trading decisions.

⸻

🚀 Why It Matters:

Aligning your strategies with the correct market trend significantly improves your odds. It’s like sailing with the wind at your back instead of battling against it.

Now, tell us in the comments: Which trend type do you find most challenging to trade?

Trade smarter. Trade clearer.

Mastering RSI Divergence: A Complete Guide to Trend ReversalsWhat Are Divergences?

In this guide, we will explore the concept of divergence and how it can be effectively utilized alongside the Relative Strength Index (RSI), one of the most popular momentum indicators in technical analysis. Divergence occurs when the price of an asset moves in the opposite direction of an indicator, such as the RSI. Understanding RSI divergence can be a powerful tool for identifying potential trend reversals or continuations. In this guide, we'll delve into the various types of divergence that can occur with the RSI and how to incorporate them into your trading strategy.

Types of Divergences?

There are three primary types of divergence: bullish, bearish, and hidden divergence. Each signals a distinct market condition and potential outcome, and understanding these nuances is key to using divergence effectively in your trading.

1. Bullish Divergence Bullish divergence happens when the price of an asset makes a lower low, while the RSI forms a higher low. This indicates that although the price is declining, momentum is weakening. The failure of the RSI to confirm the new low in price suggests that selling pressure is diminishing, potentially signaling that a reversal to the upside could occur. Essentially, the market is losing its downward momentum, setting the stage for a potential bullish move.

2. Bearish Divergence Bearish divergence occurs when the price forms a higher high, but the RSI forms a lower high. This indicates that although the price is rising, momentum is weakening. It suggests that the uptrend may be losing steam, signaling that a potential reversal to the downside could be on the horizon. As the price continues higher, but the RSI fails to confirm the new highs, it may indicate that the market is becoming overextended and ready for a correction.

3. Hidden Divergence Hidden divergence differs from regular divergence in that it signals a continuation of the existing trend, rather than a reversal. It typically occurs during pullbacks or retracements in a strong trend. Hidden divergence can appear in both uptrends and downtrends, providing traders with an indication that the prevailing trend is likely to continue after the short-term retracement is over. This type of divergence serves as a confirmation of trend strength and helps traders stay in profitable positions during market pullbacks.

Why Are RSI Divergences a Powerful Tool?

RSI divergence is a powerful tool in trading because it offers early insights into potential trend reversals or shifts in momentum before these changes are fully reflected in price movements. By recognizing divergence, traders can anticipate shifts in market sentiment and make timely decisions. One of the main reasons RSI divergence is so effective is that it serves as an early warning system. It signals when the momentum behind a price trend, whether up or down, is starting to weaken.

For example, in a strong uptrend, if prices continue to make new highs, but the RSI fails to reach new highs, this could signal that the buying momentum is losing strength, even though the price is still rising. This divergence indicates that a reversal or pullback might be imminent, allowing traders to exit their positions or prepare for a potential shift in market direction. Understanding this early warning can provide traders with an edge, helping them avoid being caught in the late stages of a trend and positioning themselves ahead of a change.

How to Trade RSI Divergences?

When the price makes a higher high but the RSI fails to confirm with a higher high, this is known as bearish divergence. While this situation suggests weakening momentum, it doesn’t necessarily mean a correction is imminent. The price may continue to rise for some time, and eventually, the RSI could catch up and make a higher high in line with the price action. Essentially, the market could remain in an uptrend, and the RSI could still align with the price over time.

This highlights the importance of not jumping to conclusions solely based on RSI divergence. Divergence can act as a useful warning, but it should not be relied upon as a definitive signal of a trend reversal. To increase the reliability of the signal, traders should wait for additional confirmation, such as a candlestick pattern indicating a potential trend reversal. Candlestick patterns like engulfing patterns, doji candles, or shooting stars at key support or resistance levels can provide stronger evidence that the trend may be about to change.

Therefore, it’s wise to wait for a more comprehensive confirmation from price action before making a move, rather than acting on divergence alone. Combining RSI divergence with other technical tools, such as candlestick patterns or chart patterns, can help increase the accuracy of your trade decisions.

Conclusion:

Divergence is a powerful tool that provides valuable insights into potential trend reversals or continuations. By understanding the different types of divergence and knowing how to identify them, traders can make more informed decisions. However, divergence should always be used in conjunction with other technical analysis tools to enhance the accuracy of your strategy. With practice, patience, and proper risk management, divergence trading can become a profitable strategy for identifying key market turning points. Whether you are seeking trend reversals or confirming ongoing trends, RSI divergence can be an essential component of your trading toolkit.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

EUR/GBP (1H) – Rising Wedge Breakdown & Short Trade Setup1. Overview of Market Structure

The EUR/GBP pair is forming a Rising Wedge Pattern, a well-known bearish reversal formation, which suggests that the current uptrend may soon reverse into a downtrend. The price has been moving within a tightening range, making higher highs and higher lows, but the upward momentum appears to be weakening.

A breakdown from this wedge is a strong bearish signal, indicating that sellers are gaining control, and a significant price drop is expected.

2. Chart Pattern: Rising Wedge – Bearish Reversal

A Rising Wedge is a pattern that occurs when price moves upward within a contracting range. This pattern typically forms after an uptrend and suggests that bullish momentum is slowing down.

Characteristics of the Rising Wedge in This Chart:

The price has tested the upper resistance zone multiple times, but each attempt has resulted in a rejection.

The lower support trendline has been tested frequently, showing that buyers are losing strength.

The breakdown of the wedge signals a strong bearish move, with price expected to drop toward key support levels.

This pattern becomes valid once the price breaks below the lower trendline, confirming the bearish outlook.

3. Key Technical Levels & Zones

A. Resistance Zone (0.84853) – Strong Supply Area

Marked as a Resistance Zone, where price has struggled to break through.

Sellers have stepped in around this level multiple times, preventing any further bullish movement.

Acts as a major stop-loss level for bearish trades, as a breakout above this zone could invalidate the setup.

B. Support Zones (Potential Take-Profit Targets)

1st Support Level (TP1) – 0.82539

This level has previously acted as strong support, where buyers have entered the market before.

A short-term pullback or consolidation may occur here.

2nd Support Level (TP2) – 0.81332

This is the final bearish target, marking a key demand zone from where price has bounced in the past.

If bearish momentum continues, price could reach this level, making it an ideal take-profit zone for swing traders.

4. Trading Strategy & Execution

A. Entry Strategy

A short trade is ideal after the price breaks below the rising wedge pattern. There are two possible entries:

Aggressive Entry:

Enter immediately after the breakout of the lower trendline, anticipating strong downside momentum.

Higher risk as price might retest the trendline before moving down.

Conservative Entry:

Wait for a retest of the broken trendline before entering short.

This confirms the breakdown, reducing false breakout risks.

B. Stop-Loss Placement

Stop-loss should be placed just above the resistance zone (0.84853).

This prevents being stopped out by minor pullbacks before the actual move happens.

C. Take-Profit Targets

TP1: 0.82539 (First major support level – potential profit booking area)

TP2: 0.81332 (Final bearish target – strong demand zone)

5. Risk Management & Trade Management

Risk-to-Reward Ratio (RRR)

This trade offers a high RRR, making it an attractive setup.

The stop-loss is small compared to the potential downside move.

Trailing Stop Strategy

A trailing stop can be used to lock in profits as price moves lower.

If price reaches TP1, move stop-loss to breakeven to secure capital.

If price reaches TP2, close the trade for maximum profit.

Exit Strategy

Exit early if price fails to break key support zones.

Monitor price action around TP1 & TP2 for signs of reversal.

6. Sentiment Analysis & Market Context

Bearish Confirmation:

Breakdown from the wedge signals bearish sentiment in the market.

If price fails to sustain above support zones, further downside is likely.

News & Fundamentals:

Major economic events or interest rate decisions could impact EUR/GBP volatility.

Traders should check for UK & Eurozone news before entering the trade.

7. Conclusion – Bearish Outlook

The Rising Wedge breakdown is a strong short-selling opportunity.

Confirmation is key: Enter short after the breakdown, use proper risk management, and aim for TP1 & TP2.

If price invalidates the pattern by breaking above 0.84853, the trade setup should be reconsidered.

This setup provides a high-probability bearish trade with a well-defined stop-loss and risk-to-reward ratio.

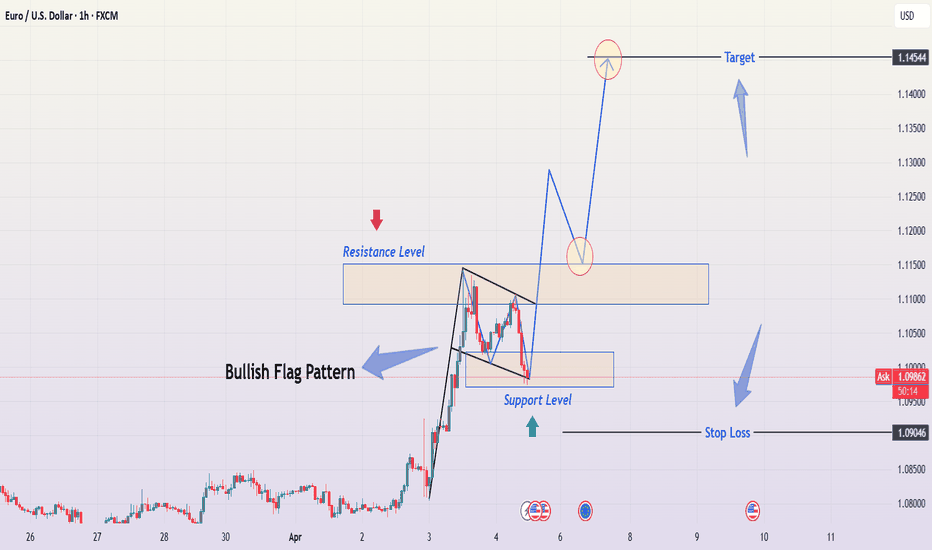

EUR/USD – Bullish Flag Pattern & Trade SetupTechnical Analysis & Trade Plan for TradingView Idea

This chart illustrates a Bullish Flag Pattern on the EUR/USD 1-hour timeframe, suggesting a potential continuation of the prevailing uptrend. Below is a detailed breakdown of the market structure, key levels, and a professional trading strategy.

📌 Chart Pattern: Bullish Flag Formation

The Bullish Flag is a continuation pattern that forms after a strong upward price movement, followed by a short period of consolidation within a downward-sloping channel. It signals a brief pause before the trend resumes.

Flagpole: The sharp price increase before the consolidation.

Flag: The corrective downward movement forming a small parallel channel.

Breakout Potential: A confirmed breakout above resistance could lead to a further bullish rally.

🔍 Key Technical Levels & Market Structure

🔵 Resistance Level (Supply Zone)

The upper boundary of the flag pattern acts as resistance.

A breakout above this level could trigger a strong buying opportunity.

🟢 Support Level (Demand Zone)

The lower boundary of the flag provides support.

Price is currently testing this zone, which is a critical decision point.

🎯 Target Price: 1.14544 (Projected Move)

The price target is calculated based on the height of the flagpole added to the breakout point.

This aligns with a previous significant resistance area.

📈 Trading Strategy & Execution Plan

✅ Entry Criteria:

A confirmed breakout above the flag's resistance level with a strong bullish candlestick.

Increased trading volume supporting the breakout.

🚨 Risk Management:

Stop Loss: Placed below the support zone of the flag to manage risk in case of a false breakout.

Take Profit Target: At 1.14544, aligning with the measured move of the flag pattern.

📊 Trade Confirmation Indicators:

RSI (Relative Strength Index): A reading above 50 confirms bullish momentum.

Moving Averages (50 EMA/200 EMA): A bullish crossover would strengthen the buying signal.

Volume Analysis: A breakout should be accompanied by high trading volume for confirmation.

⚠️ Potential Risks & Alternative Scenarios

Fake Breakout: If the price breaks out but lacks volume, it could be a false signal.

Bearish Reversal: If price breaks below the support zone, the bullish flag setup becomes invalid.

Market Sentiment Shift: Unexpected news events can impact price movement.

📝 Summary

The EUR/USD pair has formed a Bullish Flag Pattern, signaling a possible continuation of the uptrend.

A breakout above the resistance level would confirm the pattern and provide a strong buying opportunity.

Risk management is essential, with a stop loss placed below the support level.

Final Target: 1.14544, based on the flagpole’s measured move.

💡 Conclusion: A well-structured breakout above resistance could lead to a bullish rally toward 1.14544. However, patience and confirmation are key before entering the trade.

JPY/USD – Rising Wedge Breakdown & Bearish Trading Setup1. Market Structure & Technical Pattern:

The Japanese Yen (JPY) against the U.S. Dollar (USD) has been exhibiting a clear Rising Wedge Pattern over the past few months. This is a classic bearish reversal pattern, indicating that buying momentum is gradually weakening, and a strong decline is likely to follow.

Formation of the Rising Wedge:

The price has been making higher highs and higher lows, confined within two converging trendlines (black lines).

The lower boundary (support trendline) has been consistently acting as a dynamic support level.

The upper boundary (resistance trendline) has been limiting further upward movement, indicating exhaustion of buying pressure.

Breakout Confirmation:

The price action tested the resistance zone multiple times but failed to sustain bullish momentum.

A strong rejection from the upper resistance level led to a sharp sell-off, causing a breakdown of the support trendline.

Once the price broke below the wedge, selling pressure intensified, confirming the trend reversal.

2. Key Technical Levels & Zones:

Resistance Level (0.006895):

The price previously struggled to break above this resistance zone, forming a strong supply area where sellers dominated.

This level aligns with the upper boundary of the rising wedge, making it a significant turning point.

The rejection from this zone initiated the bearish breakdown.

Support Level (Broken – 0.006650):

This level acted as a strong demand zone, preventing further downside movement during the wedge formation.

However, once the price broke below this level, it confirmed the end of the uptrend and the beginning of a downtrend.

This level may now act as a new resistance (role reversal principle).

Stop Loss Placement (Above 0.006895):

A logical stop-loss is placed just above the resistance level to protect against a potential invalidation of the bearish setup.

If the price closes above this level, the bearish thesis would be invalidated.

3. Trading Execution & Risk Management:

Sell Entry Strategy:

Traders looking for short positions should enter after a confirmed break below the wedge’s support.

A potential pullback (retest) to the broken trendline could offer an additional shorting opportunity.

The retest would confirm the previous support turning into resistance before a continuation of the downtrend.

Take Profit Targets (TP1 & TP2):

TP1 (0.006481):

This level represents a strong demand zone where short-term buyers may step in.

Traders may choose to book partial profits here.

TP2 (0.006251):

This is a deeper support level and the final target for this trade setup.

If the price sustains bearish momentum, it is likely to reach this level before stabilizing.

Risk-to-Reward Ratio Consideration:

This setup offers a high probability short trade with an attractive risk-to-reward ratio.

The stop-loss is well-defined, minimizing potential losses while maximizing profit potential.

4. Expected Price Movement & Projection:

Short-term Outlook:

A possible pullback to the broken wedge (previous support now acting as resistance) before continuation lower.

If the price retests and rejects the 0.006650 level, expect acceleration in the downtrend.

Medium-term Outlook:

If the price reaches TP1 (0.006481) and breaks below, it increases the probability of hitting TP2 (0.006251).

A bearish trend continuation could form, potentially leading to further downside levels.

Invalidation Scenario:

If the price closes above the stop-loss level (0.006895), the bearish setup is invalidated, and a bullish breakout could follow instead.

5. Conclusion & Trading Plan:

The rising wedge breakdown signals a shift from bullish to bearish market sentiment.

Traders should look for short entries after a confirmed breakdown or wait for a pullback before executing trades.

The risk-to-reward ratio makes this a strong high-probability trade setup.

Following the plan with strict stop-loss placement ensures risk is controlled while maximizing profit potential.

6. Summary & Key Takeaways:

✅ Pattern: Rising Wedge (Bearish Reversal)

✅ Breakout Direction: Downside

✅ Resistance Level: 0.006895

✅ Support Levels: 0.006650 (broken), 0.006481 (TP1), 0.006251 (TP2)

✅ Stop-Loss Placement: Above 0.006895

✅ Profit Targets: TP1 – 0.006481, TP2 – 0.006251

✅ Trade Bias: Bearish

Detailed Analysis of Silver (XAG/USD) – Double Top BreakoutThe chart represents a technical analysis of Silver (XAG/USD) on the daily timeframe (1D). A Double Top pattern, one of the most reliable bearish reversal formations, is developing. This signals a potential downtrend, with key price levels and trendlines confirming weakness in bullish momentum. Below is a full breakdown of the pattern, price action, and trading setup.

1️⃣ Pattern Formation: Double Top – Bearish Reversal

A Double Top pattern occurs when the price reaches a resistance level twice, failing to break higher. It indicates a shift from a bullish trend to a bearish one.

🔹 Characteristics of the Double Top in This Chart:

First Peak (Top 1 - Resistance at ~$34.57):

The price made a strong move upward, reaching a high near $34.57.

Selling pressure at this level pushed the price downward, forming a support level near $30 (Neckline).

Pullback & Temporary Support (~$30 Neckline):

Buyers stepped in at the support zone, causing a bounce back towards resistance.

This level acted as strong demand, preventing further decline temporarily.

Second Peak (Top 2 - Rejection at Resistance Again):

Price attempted to break above the previous peak but failed.

This failure to form a higher high confirms the presence of strong sellers.

The second rejection strengthens the resistance level at $34.57, signaling exhaustion in buying momentum.

Break of the Trendline Support (Bearish Shift):

A previously ascending trendline (black dashed line) was providing support for the uptrend.

Price broke below this trendline, indicating a possible trend reversal from bullish to bearish.

2️⃣ Key Technical Levels & Trading Setup

🔸 Resistance Zone (~$34.57 - Stop Loss Area)

This is the major resistance level, tested twice and confirmed as a supply zone.

A move above $34.57 would invalidate the bearish pattern, making this an ideal stop-loss level.

🔹 Support Level / Neckline (~$30 - Breakdown Confirmation)

The neckline acts as a critical level. If the price breaks below $30, the Double Top formation is confirmed.

If the price retests this level from below and rejects (fails to reclaim it as support), it becomes a strong short entry signal.

🔻 Target Price (Projected Move - $23.01)

The target is based on the measured move rule of a Double Top:

Distance from resistance ($34.57) to neckline ($30) ≈ $4.57.

Projecting this same distance downward gives a target of ~$23.01.

This aligns with historical demand zones, increasing the probability of price reaching this level.

3️⃣ Trading Plan: Short Setup Execution

🔽 Short Entry (Breakdown Confirmation Below $30)

Ideal entry point is after the neckline breaks and confirms resistance upon a retest.

A breakdown with strong volume enhances the validity of the setup.

🚨 Stop Loss Placement (Above $34.57 Resistance Level)

Placing a stop above the second peak ($34.57) ensures protection against invalidation.

If price moves back above this level, the pattern fails, indicating a potential return to bullish momentum.

🎯 Target Price ($23.01) – Measured Move Projection

The price target aligns with the pattern structure and historical support levels.

Traders can take partial profits at intermediary levels ($27–$26) before full target realization.

4️⃣ Additional Confirmation Factors – Confluence for Bearish Bias

1️⃣ Momentum Indicators: RSI & MACD Bearish Signals

If RSI (Relative Strength Index) drops below 50, it confirms weakening bullish momentum.

A MACD bearish crossover (signal line crossing below the MACD line) would further validate the downtrend.

2️⃣ Volume Analysis – Breakout Confirmation

A high volume breakout below $30 confirms selling pressure.

Low-volume breakdowns can lead to false breakouts, making volume a crucial factor to watch.

3️⃣ Fundamental Factors – Macro Outlook on Silver (XAG/USD)

Silver prices are influenced by interest rates, inflation, and USD strength.

If USD strengthens, silver could face more selling pressure, aligning with this bearish technical setup.

Any hawkish monetary policy statements could accelerate the downside movement.

5️⃣ Risk Management & Alternative Scenarios

✔️ Ideal Risk-Reward Ratio

Risk: Stop loss at $34.57 (~4.5% above entry)

Reward: Target at $23.01 (~23% move)

Risk-Reward Ratio: ~1:5 (highly favorable for short trades)

⚠️ Bullish Invalidations – When to Avoid the Trade?

If Silver reclaims $34.57 and holds above, the pattern fails.

A false breakout scenario could occur if price breaks below $30 but quickly moves back above.

Watching for bullish divergence on indicators like RSI before entering a short position is recommended.

Final Conclusion: Bearish Bias with Strong Downside Potential

📉 Summary of the Bearish Case:

✔️ Double Top pattern confirms a bearish reversal if the neckline breaks.

✔️ Break of ascending trendline signals increasing seller control.

✔️ Key levels: Stop-loss above $34.57 | Entry below $30 | Target $23.01.

✔️ Additional confluence: RSI, MACD, and volume confirmation strengthen the trade setup.

🚀 If price action aligns with this analysis, this setup presents a high-probability short opportunity.

Would you like any refinements or additional insights? 🔥

XAU/USD Analysis – Wedge Breakdown & Bearish Trade Setup1. Chart Overview

The 15-minute XAU/USD chart shows a descending wedge pattern forming after a price rally. The wedge is characterized by a series of lower highs and lower lows, signaling a gradual weakening of bullish momentum. After consolidating within this wedge, the price has broken down, suggesting a bearish continuation.

This setup provides a high-probability short trade with clear entry, stop-loss, and multiple take-profit levels.

2. Key Technical Elements

A) Chart Pattern – Descending Wedge Breakdown

A descending wedge is typically a bullish reversal pattern when forming at the bottom of a downtrend. However, in this case, it appears at the end of a corrective move, making it a bearish continuation setup.

The upper trendline (black dashed line) acts as resistance, preventing price from breaking higher.

The lower trendline (solid blue line) represents temporary support.

The wedge narrows as price action contracts, leading to an eventual breakdown.

👉 Breakout Confirmation:

The price has broken below the wedge’s support trendline.

A minor pullback to retest the broken trendline suggests validation of the breakdown.

B) Resistance & Support Levels

1️⃣ Resistance Level (Sell Zone) – $3,100 to $3,135

This area previously acted as a supply zone, rejecting bullish attempts.

Price was unable to sustain above this level, leading to further downside pressure.

Stop-loss should be placed above this level ($3,135.57) to protect against invalidation.

2️⃣ Support Level (Buy Zone) – $3,050 to $3,056

This was a previous reaction zone where price briefly bounced before continuing lower.

Now acting as Take Profit 1 (TP1) at $3,056.58.

3️⃣ Breakout & Retest

After breaking the wedge, price retested the trendline but failed to reclaim it, confirming the bearish trend.

3. Trade Setup & Execution

🔵 Entry Point:

Short trade activation upon the breakdown and retest of the wedge structure.

Price rejection at the trendline confirms seller strength.

🔴 Stop-Loss:

Placed at $3,135.57, slightly above recent swing highs.

This protects against false breakouts or sudden reversals.

🎯 Take Profit Levels:

TP1 ($3,056.58): First target where buyers might step in.

TP2 ($3,022.39): Midway target, acting as another strong support.

TP3 ($2,985.44): Final target where price may stabilize or reverse.

4. Market Context & Confirmation Indicators

📉 Bearish Confirmation:

Strong downward momentum suggests continued selling pressure.

Price action is failing to make new highs, confirming lower highs and lower lows.

📊 Risk-to-Reward Ratio (RRR):

The trade offers a favorable RRR, as the downside potential is significantly larger than the stop-loss range.

⚡ Additional Confirmation:

A strong bearish candle confirmed the breakout, rejecting higher levels.

Potential support breakouts suggest that price could reach TP3 if bearish momentum continues.

5. Conclusion – Trading Strategy Summary

✅ Pattern Identified: Descending Wedge Breakdown (Bearish)

✅ Trade Direction: Short (Sell)

✅ Entry Trigger: Breakout & Retest of the Trendline

✅ Stop-Loss: Above $3,135.57 (Wedge Resistance Zone)

✅ Take Profit Targets:

TP1: $3,056.58

TP2: $3,022.39

TP3: $2,985.44

📌 Final Thoughts:

This setup provides a high-probability trade with a clear breakdown structure and downside potential. If the price continues to respect the bearish trend, reaching all TP levels is likely. However, traders should monitor for reversal signals and manage risk accordingly.

🔔 Risk Warning: Always use proper risk management and adjust positions according to market conditions! 🚀

2025-04-03 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: 18200 is the next huge support and it’s likely that we get there tomorrow and there I would conclude my W3 thesis. Doing another red day into the weekend seems most reasonable because who the duck wants to hold on to longs in the current environment?

current market cycle: strong bear - W3 ongoing - target is 18200ish and W5 should get us to 17500ish

key levels: 18000 - 20100

bull case: Bulls can make money buying new lows on days like today but bears made sure to only print lower highs. For tomorrow bulls can’t expect something different to happen. Best they can hope for is to stay closer to 20000 but I highly doubt that.

Invalidation is below 18100.

bear case: Bears have the 2024-04 and 2024-08 lows in sight and could get there tomorrow. They are in full control if they continue to print lower lows and lower highs. Right now the 1h 20ema is holding like a champ but my drawn bear trend line will most likely have to be adjusted tomorrow before EU open. Every bear who sold the spike down yesterday is betting on a measured move down which is around 17600. Can we get there tomorrow? Very unlikely. This is most likely a spike & channel pattern that started Wednesday and given that tomorrow is the end of the week, I expect market to now go above 19000.

short term: Bearish for 18400 or even 18200. Lower highs have to hold, so no prices above 19000 or market turns a tad more neutral at least on lower time frames. Bulls can only hope for long scalps on new lows and going sideways.

medium-long term - Update from 2024-03-16: My most bearish target for 2025 was 17500ish, given in my year-end special. W3 underway, W5 should get us to my target. If we get there, no matter how dire, you just have to buy some very long term investments there. Odds that Nasdaq will stay below 20000 for the next 5 years are so abysmally low.

trade of the day: Sell anywhere and hold or look which bigger 20ema holds and look for shorts near it. Today it was once again the 1h 20ema.

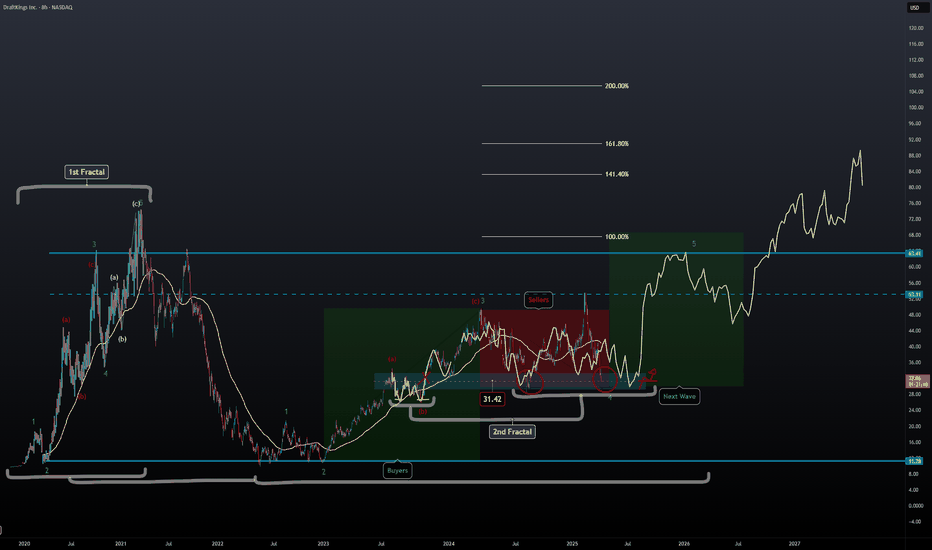

DKNG Update | Second Fractal | Extended TargetsPrice action looks very similar to the '23 Q3 play where we saw a double bottom move taking off from $26 - $49 which is also the ABC move that carried the 3rd impulse wave of the original fractal.

We're still in correction wave 4 and are about to start wave 5 shortly from now to July.

It's possible we could see price action higher than $74 based on the new fractal overlay and with the help of the fib extension.

Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

Is gold going to be eclipsed?

-------------------------

Timeframe: 240 Min

-------------------------

The price action suggests a completed impulse structure originating from the 2833 low, with gold now trading at an all-time high. Based on cluster zones and Fibonacci extensions, wave (5) still has the potential to extend toward the 3150-3200 range. This zone represents a key resistance level where buying momentum may slow down, signaling an impending shift in market dynamics.

Once wave (5) completes, it will mark the end of wave ((3)) of a higher degree, setting the stage for a corrective move. A retracement toward the previous wave (4) level is expected as wave ((4)) develops, aligning with historical corrective behavior after extended rallies. This phase will provide crucial insights into the market’s next major move. Stay tuned for further updates.

EUR/GBP Triangle Pattern - Bearish Breakdown SetupProfessional Analysis of the EUR/GBP Chart

This EUR/GBP (Euro/British Pound) daily chart from OANDA, published on April 3, 2025, highlights a key technical setup based on price action analysis, chart patterns, and support/resistance levels.

1. Market Context: Accumulation & Transition to a Triangle Pattern

Curve Zone Formation (Rounded Bottom):

The market initially exhibited a rounded bottom structure (curve zone) from July 2024 to February 2025, indicating a gradual accumulation phase.

This phase often signals a shift in market sentiment, where sellers lose dominance, and buyers start stepping in.

Breakout from Accumulation:

After reaching the support zone (~0.8250 - 0.8300), price rebounded sharply in March 2025, confirming strong buyer interest.

However, it failed to sustain upward momentum near the resistance zone (~0.8470 - 0.8500), leading to consolidation.

2. Formation of a Symmetrical Triangle Pattern

Lower Highs & Higher Lows:

Price action began forming a symmetrical triangle, a classic consolidation pattern that typically precedes a strong breakout.

The market is currently trading near the apex of the triangle, indicating that a breakout is imminent.

Potential Breakout Direction:

Symmetrical triangles are neutral patterns, meaning they can break either upward or downward.

However, the price structure and resistance rejection suggest a higher probability of a bearish breakdown.

3. Key Levels & Trading Setup

Resistance & Support Zones:

🔴 Resistance Zone (~0.8470 - 0.8500):

This area has repeatedly acted as strong resistance, where sellers have consistently pushed prices lower.

A breakout above this zone would indicate a bullish invalidation of the current bearish bias.

🟢 Support Zone (~0.8250 - 0.8300):

This level has held price multiple times, acting as key support.

A break below this zone would confirm bearish momentum, targeting lower price levels.

4. Bearish Trade Setup

📉 Entry Strategy (Short Position):

Wait for a confirmed breakout below the triangle’s lower trendline (~0.8320 - 0.8350).

A retest of the broken support turning into resistance would provide the best short entry.

📌 Stop-Loss Placement (~0.84764):

Positioned above recent highs and the resistance zone to minimize risk.

This ensures the trade is protected against potential false breakouts.

🎯 Profit Target (~0.81190 - 0.81134):

The projected move aligns with historical support levels, making it a logical target.

This level represents a previous market structure where buyers stepped in.

5. Conclusion & Trade Considerations

✅ Bearish Bias: The price action and pattern suggest a higher probability of a downside breakout.

✅ Defined Risk & Reward: A well-structured stop-loss and target level ensures a solid risk management strategy.

✅ Watch for Confirmation: Traders should wait for a confirmed breakout before entering a trade to avoid false moves.

📊 Overall Verdict: A high-probability short setup is forming, with a clear entry, stop-loss, and take-profit strategy. If the market respects the triangle breakdown scenario, this could lead to a significant bearish move toward the 0.81190 target.

EUR/USD Analysis Ascending Triangle Breakout – Bullish TargetOverview of the Chart:

The chart represents the EUR/USD (Euro to U.S. Dollar) pair on a 1-hour timeframe, showcasing a bullish ascending triangle breakout. The pattern indicates an upward continuation in the trend after a period of consolidation. This analysis will break down the key elements of the chart, the technical structure, and the potential trading strategy.

1. Market Structure & Key Zones

A. Market Curve Area (Early Trend Development)

The price started with a strong bullish trend leading up to the formation of the triangle.

The curved trendline suggests a gradual increase in buying pressure, indicating that the market was preparing for a larger breakout.

B. Resistance and Support Levels

Resistance Level (Red Arrow & Blue Box):

This level acted as a price ceiling where sellers previously dominated.

The market attempted multiple times to break this resistance before successfully breaching it.

Support Level (Green Arrow & Yellow Zone):

The price consistently found buyers at this level, reinforcing a higher low structure.

The rising support line within the triangle indicated strong accumulation by buyers.

2. Chart Pattern: Ascending Triangle Formation

The price action formed an ascending triangle, which is a well-known bullish continuation pattern.

The higher lows (trendline support) indicated buyers were gaining control, gradually pushing the price toward the resistance.

Eventually, the resistance was broken with strong bullish momentum, confirming a valid breakout.

3. Breakout Confirmation & Retest

The breakout above the resistance level came with high volume, indicating strong market participation.

After the breakout, a minor pullback (retest) occurred, confirming previous resistance as new support.

The price surged upward after the retest, validating the bullish trade setup.

4. Trade Setup & Risk Management

A. Entry Strategy

A trader would enter a buy (long) position after confirming the breakout.

Entry Trigger:

Either at breakout (high-risk, early entry)

Or after a successful retest (safer entry)

B. Stop Loss Placement

A stop loss is placed below the previous support level at 1.07276, ensuring risk is limited in case of a false breakout.

C. Target Projection

The target price is measured using the height of the triangle added to the breakout level.

Based on this calculation, the projected target is around 1.12838.

5. Conclusion & Trading Plan

The EUR/USD pair has executed a clean ascending triangle breakout, signaling further bullish movement.

The trading plan suggests:

✅ Entry: Buy after breakout confirmation or retest.

✅ Stop Loss: Placed below 1.07276 for risk management.

✅ Take Profit: Targeting 1.12838, based on the pattern’s height projection.

This setup presents a high-probability long opportunity in a trending market, with proper risk management to protect against potential reversals.

PY/USD Analysis: Rising Wedge Bearish Reversal & Short SetupThis chart represents the JPY/USD (Japanese Yen vs. US Dollar) on a daily timeframe (1D), published on April 3, 2025, via TradingView. The price action and technical indicators suggest a bearish outlook based on the formation of a Rising Wedge Pattern, a classic reversal structure signaling potential price depreciation.

1. Chart Structure & Identified Patterns

A. Rising Wedge Formation (Bearish Reversal Pattern)

The price has been moving in an uptrend, forming higher highs (HH) and higher lows (HL).

The two converging black trendlines indicate a rising wedge, a pattern that typically precedes a downside breakout.

A rising wedge is considered a bearish signal, especially when formed after a strong rally.

B. Support and Resistance Levels

Resistance Zone (Highlighted in Beige, Upper Range)

This level represents a historically significant supply area where selling pressure is expected.

Price action shows multiple rejections at this level, indicating the presence of strong resistance.

The red downward arrow further confirms that this level is acting as a cap on price movement.

Support Zone (Highlighted in Beige, Lower Range)

This area previously served as a strong demand level, where buyers stepped in, reversing the price.

The green upward arrow suggests that it played a critical role in the prior bullish move.

C. Key Price Levels

All-Time High (ATH) Marked at ~0.007155

This represents the historical peak price, which serves as a potential long-term resistance.

Stop-Loss Placement (~0.006959)

This is placed above the resistance level to manage risk in case of a false breakout.

Target Level (~0.006178)

Based on the wedge height, this level is calculated as the measured move after a breakdown.

2. Price Action & Market Sentiment

A. Recent Bullish Move

The market has been in a strong uptrend since hitting the support zone.

This move was characterized by higher lows and higher highs, reinforcing bullish momentum.

However, momentum appears to be weakening as the price struggles to break through the resistance.

B. Confirmation of a Bearish Reversal

The price has touched the upper resistance zone multiple times but failed to break through.

The trendline breakdown (expected move) suggests sellers are stepping in.

A lower high formation is seen as an early warning of a reversal.

3. Trade Setup: Short Position Strategy

This setup aligns with the principles of technical analysis, utilizing the Rising Wedge as a bearish reversal pattern.

A. Entry Strategy

Sell Entry Trigger: Enter a short trade upon a confirmed breakdown below the lower trendline.

Retest Confirmation: Ideally, wait for a pullback to the broken trendline before shorting to avoid false signals.

B. Risk Management

Stop-Loss Placement: Above the resistance zone at 0.006959, to protect against an invalidation.

Take-Profit Target: Set at 0.006178, calculated based on the wedge’s height projection.

C. Reward-to-Risk Ratio (RRR)

RRR = 2:1 or higher

The target level offers a risk-reward ratio that justifies the trade setup.

4. Summary & Final Outlook

Bearish Signals:

✅ Rising Wedge Pattern – A strong reversal indicator.

✅ Lower Highs and Weak Momentum – Suggests selling pressure.

✅ Failure to Break Resistance – Indicates bullish exhaustion.

✅ Projected Target Based on Wedge – Price expected to reach 0.006178.

Neutral Considerations:

If price does not break the lower trendline, the pattern is not validated.

If a false breakdown occurs, prices may briefly recover before falling.

Bullish Invalidation:

If the price breaks above 0.006959 and sustains above resistance, the bearish setup is invalidated.

Final Verdict:

📉 Bearish Bias – The market setup favors a downside move upon a confirmed breakdown.

🎯 Target: 0.006178 (Key support level).

⚠️ Risk: If the price does not break lower, consolidation may occur before a clearer move.

Silver Breakdown: Rising Wedge Bearish Move Towards Target1. Chart Overview

This 4-hour (H4) chart of Silver (XAG/USD) shows a clear Rising Wedge Pattern, a bearish technical formation. The price action recently broke below the lower support trendline, confirming a downside move. Several key levels, indicators, and trading strategies can be derived from this setup.

2. Identified Chart Pattern: Rising Wedge (Bearish Reversal)

A Rising Wedge is a pattern that forms when price consolidates between two upward-sloping trendlines, with the support line rising at a steeper angle than the resistance line. This pattern is considered bearish because it signals weakening buying pressure and an impending breakdown.

Uptrend Formation: The price had been moving within a wedge, forming higher highs and higher lows.

Volume Considerations: A wedge breakout is often accompanied by increasing volume, further confirming the trend shift.

Breakout Confirmation: The price has decisively broken below the lower boundary of the wedge, indicating that sellers are taking control.

3. Key Technical Levels & Trading Strategy

Resistance Level (Rejection Zone) – $34.00 - $34.50

The upper boundary of the rising wedge acted as strong resistance.

Multiple price rejections confirm sellers' dominance in this area.

Any future retest of this level may provide a new opportunity for short entries.

Support Level (Broken & Retested) – $32.50 - $32.80

This zone previously acted as strong support, preventing price from falling lower.

Now that price has broken this support level, it could act as resistance if a retest occurs.

A confirmed rejection here will further validate the bearish outlook.

Stop Loss Placement – $34.16

A logical stop-loss placement is slightly above the previous swing high and resistance area.

If price moves above this level, it would indicate that the breakdown has failed, invalidating the bearish setup.

Bearish Target – $30.76 (Measured Move Projection)

This level is derived from the height of the rising wedge pattern projected downward.

The area around $30.76 aligns with a previous support zone, making it a reasonable target for the current breakdown.

4. Price Action & Future Expectations

Current Market Sentiment: Bearish

The break below the wedge confirms a bearish sentiment.

A slight retracement to the previous support (now resistance) around $32.80 - $33.00 is possible before further downside.

If selling pressure remains strong, Silver is likely to reach the $30.76 target in the coming sessions.

Alternative Scenario: Bullish Recovery

If the price moves back above $34.16, the bearish outlook is invalidated.

A sustained move above this level could indicate a false breakdown and may push Silver toward new highs.

5. Trading Plan Based on This Setup

🔹 Entry Strategy:

Look for a retest of the broken support zone ($32.80 - $33.00) to enter short positions.

A rejection from this level with bearish confirmation (e.g., a bearish engulfing candle) strengthens the trade setup.

🔹 Stop Loss:

Placed above the wedge resistance at $34.16 to protect against false breakouts.

🔹 Take Profit Targets:

First Target: $31.50 (intermediate support level)

Final Target: $30.76 (measured move projection of the wedge)

6. Conclusion

This Rising Wedge Breakdown on Silver’s H4 chart presents a strong bearish trading opportunity with a well-defined risk-reward ratio. The break below key support signals continued downside, with $30.76 as the next major target. However, traders should monitor any retest of the broken support zone to confirm further selling momentum before entering new positions.