Priceactionanalysis

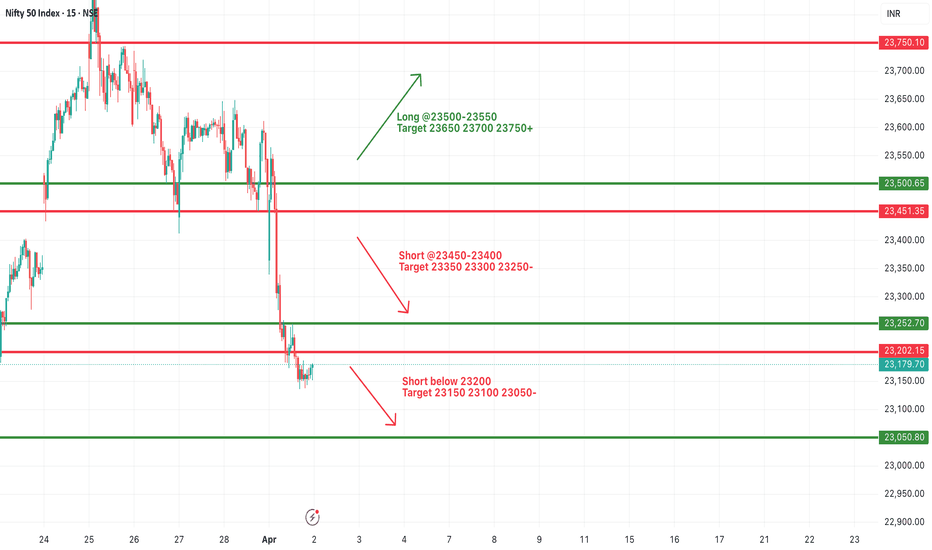

#NIFTY Intraday Support and Resistance Levels - 02/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty starts trading below 23200 level then expected sharp downside upto 23050 level in opening session. Upside 23450 level will act as a strong resistance for today's session. Any bullish side rally can reversal from this level.

[INTRADAY] #BANKNIFTY PE & CE Levels(02/04/2025)Today will be slightly gap up opening expected in index near 51000 level. After opening it will face strong resistance at this level and expected reversal direction towards the 50550 level. This downside rally can extend for further 400-500+ points in case banknifty starts trading below 50450 level. Any bullish side rally only expected if banknifty starts trading and sustain above 51050 level.

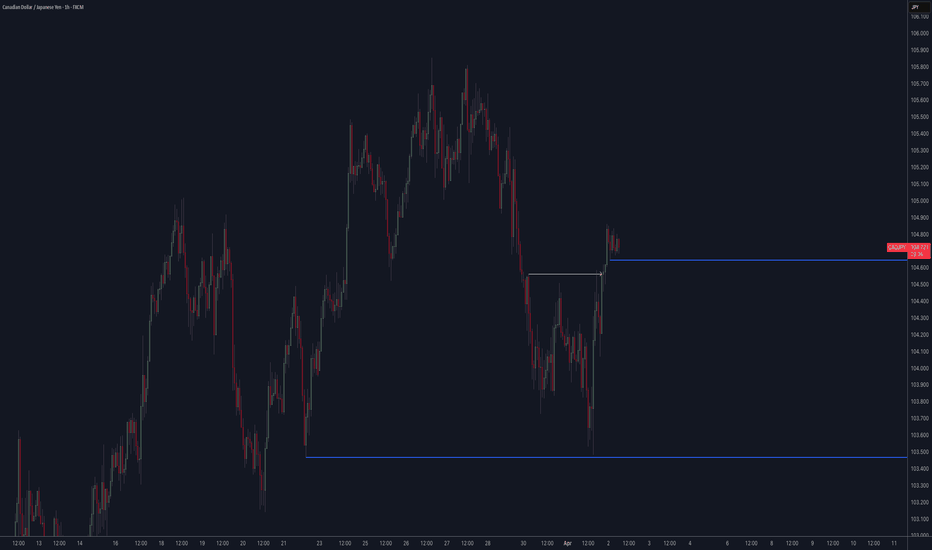

USDJPY Price ActionHello Traders,

As you can see, the price dropped from the previous supply zone and has formed a new one. Along the way, it created both internal and external liquidity, which helps strengthen the newly formed zone — a common pattern we see repeatedly.

Remember, just because price didn’t move as expected and hit your stop loss, it doesn’t mean your analysis was wrong. That’s exactly why we use stop losses — to protect our capital before chasing profit.

I’ve marked the internal and external liquidity, along with the new supply and demand zones on the chart. As always, without liquidity, there’s no valid zone confirmation. Risk management is key — that’s all you really need.

Wishing you all the best and happy trading.

Thank you!

#NIFTY Intraday Support and Resistance Levels - 01/04/2025Flat or slightly gap down opening expected in nifty. After opening if nifty starts trading below 23450 level then possible strong downside rally upto 23250 level. Any upside movement only expected if nifty sustain above 23500 after opening session. Upside 23750 will act as strong resistance for today's session.

[INTRADAY] #BANKNIFTY PE & CE Levels(01/04/2025)Today will be flat or slightly gap down opening expected in index. After opening important level for banknifty is around 51500. If banknifty starts trading below 51450 level then expected downside movement upto 51050 level in today's session. Similarly if banknifty starts trading and sustain above 51550 level then there will be upside bullish rally upto 51950+ level possible.

Gold Price Analysis March 31Fundamental Analysis

Gold price attracts safe-haven flows for the third straight day amid rising trade tensions.

Fed rate cut bets weigh on the USD and also lend support to the non-yielding yellow metal.

Overbought conditions on the daily chart now warrant some caution for bullish traders.

Technical Analysis

Gold continues to hit ATH levels and is very difficult to trade with a large amount of Fomo BUY. The important point to retest the BUY signal today is at 3100-3098. And 3145 is the target level for the ATH peak of Gold today.

What do you think of the above analysis? Please leave your comments.

AUDUSD Price ActionHello Traders,

Liquidity is what makes supply and demand zones truly powerful. As you can see, I've marked both the supply and demand areas—each supported by clear liquidity levels on both sides.

With that structure in place, we can now look for long opportunities, but always with proper risk management in mind.

Just remember: No Liquidity = No Zone Confirmation.

Keep it simple, stick to the rules.

Good luck and happy trading!

US500 Price ActionHello Trader,

As you can see, the market is currently moving to the downside, approaching a clearly identified Demand Zone. Remember, as I always emphasize: no liquidity, no valid zone. Therefore, I've also marked liquidity levels located just above this Demand Zone, along with a suggested safe Stop Loss (SL) placement. However, please keep in mind that no level is truly "safe" in trading, which is precisely why we always use stop losses and actively manage risk on every trade.

Additionally, I've highlighted two potential Take Profit (TP) areas: one where you might consider closing your trade early for safety, and another where you could hold your position if price action continues to move favorably.

As always, avoid greed, prioritize risk management, and trade responsibly.

Wishing you all the best and happy trading!

Thank you.

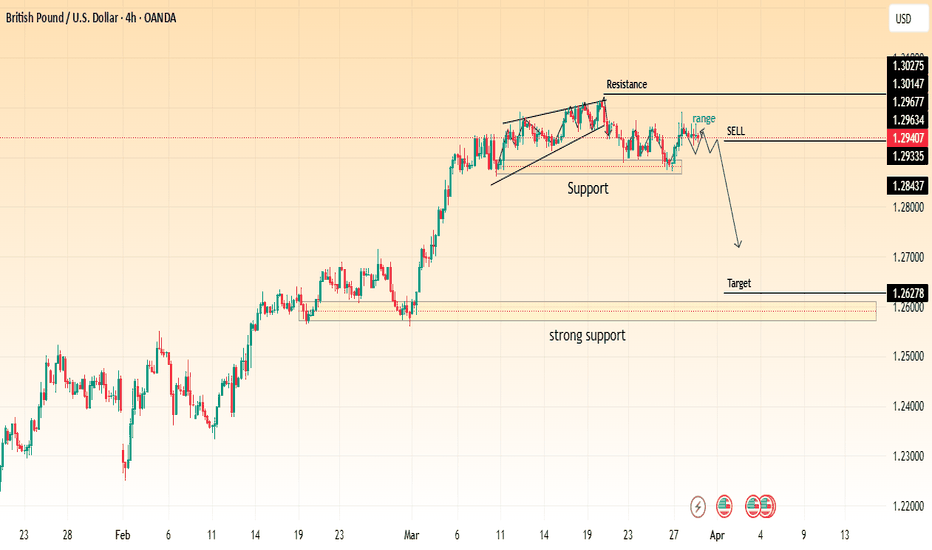

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

"Bitcoin Breakout Setup: Potential Rally Towards $94K!"Key Observations:

Support Zone: A crucial support level is marked below the broken channel, indicating a potential area for a price reversal.

Bullish Projection: A breakout above this support level could push BTC higher towards the target price of 94,101.24 USD.

Technical Patterns: The price initially showed a strong downtrend, followed by a recovery forming an ascending channel, and now a potential bullish breakout is expected.

Trading Plan:

Bullish Scenario: If BTC holds above the support level, a strong move upwards toward 94,101.24 USD could be expected.

Bearish Scenario: A failure to hold support could result in further downside toward lower key levels.

Conclusion:

Traders might look for buying opportunities near the support zone with a potential upside target of 94,101.24 USD while managing risk in case of further breakdown.

Would you like to refine this further or add specific indicators? 🚀

"Gold (XAU/USD) Approaching 3,110 – Sell Setup in Play?"The price is in an uptrend, making higher highs and higher lows.

A potential reversal zone is identified around $3,110, marked as a possible sell entry.

The chart suggests that after reaching $3,110, the price may decline towards the support zone at $3,010 - $2,999.

Confirmation of the sell trade can be considered if price action forms a bearish structure around resistance.

Key support levels are at $3,010, $2,999, and $2,981, which could act as potential take profit targets for short positions.

Trading Strategy:

Sell Entry: Around $3,110, if resistance holds.

Target: $3,010 - $2,999 zone.

Stop Loss: Above $3,120 to manage risk.

This idea follows technical price action, making it crucial to watch for confirmation signals before executing a trade. 🚀📉

USDJPY analysis week 14🌐Fundamental Analysis

The Federal Reserve (Fed) kept interest rates unchanged in the 4.25% - 4.50% range and forecast core PCE inflation to average 2.8% by year-end. The higher-than-expected inflation data reinforced expectations that the Fed will maintain current interest rates for an extended period. Investors are concerned that these tariffs could add to global inflationary pressures and trigger a recession.

In Japan, the Tokyo CPI rose sharply in March, boosting expectations that the Bank of Japan (BoJ) will continue to raise interest rates this year. The hot inflation data also supported the Yen's appreciation against other currencies.

🕯Technical Analysis

USDJPY is still in a bullish recovery. The pair is facing support at 149.200, preventing further declines. The weekly high around 151.100 is still acting as key resistance before the pair breaks out to 152.000. Conversely, if the trend breaks at 149.200, weekly support is seen at 148.300.

📈📉Trading Signals

SELL USDJPY 151.300-151.100 SL 150.500

SELL USDJPY 152.000-152.200 SL 152.400

BUY USDJPY 149.300-149.100 SL 148.900

Gold Price Analysis March 28Fundamental Analysis

Gold (XAU/USD) continued its upward trend, hitting a record high of $3,086 during the European session on Friday. Global risk sentiment weakened due to concerns over US President Donald Trump's auto tariffs and uncertainty over upcoming tariffs, boosting safe-haven demand for gold.

In addition, expectations of an early Fed rate cut due to concerns over Trump's trade policies affecting US economic growth also supported gold's gains. Although the USD recovered slightly ahead of the US personal consumption expenditure (PCE) price index report, this did not reduce the appeal of XAU/USD.

Technical Analysis

Gold is quite difficult to trade around the ATH zone today. Note that the lower boundary zone of 3060 is converging with the EMA 34 zone and the SELL zone around the 3100 round-trip barrier. The basic trading strategy requires your patience as the market is not easy to trade at the moment.

BTC/USDT - The moment of truthThe BTC/USDT chart highlights a crucial moment as the price breaks out of a bearish trendline and tests a Fair Value Gap (FVG) zone. Key scenarios include:

- A potential continuation of the bullish trend if the price successfully holds above the FVG zone and confirms support.

- Alternatively, a rejection at this level could signal a return to bearish momentum.

Keep an eye on price action within the FVG zone for confirmation of the next move. Which way do you see BTC heading?

Gold Analysis March 27Yesterday's D1 candle is still a contested candle with no clear winner. If it maintains this, there may be a strong sell-off on Friday.

The wave structure is expanding in an upward direction after a push into the Asian session. The price is reacting around the 3028 area. If gold cannot break 3028, it is possible to BUY back to the peak of the Asian session in the morning around 3038. If this peak is broken, DCA will add an order towards the target of 3044. On the contrary, if the European session cannot break the peak of 3038, SELL to 3020 and if the US breaks 3020, DCA SELL to 3006. On the contrary, if it does not break, Buy back around 3020 and the gold margin will fluctuate around 3020-3028 until the end of the day.

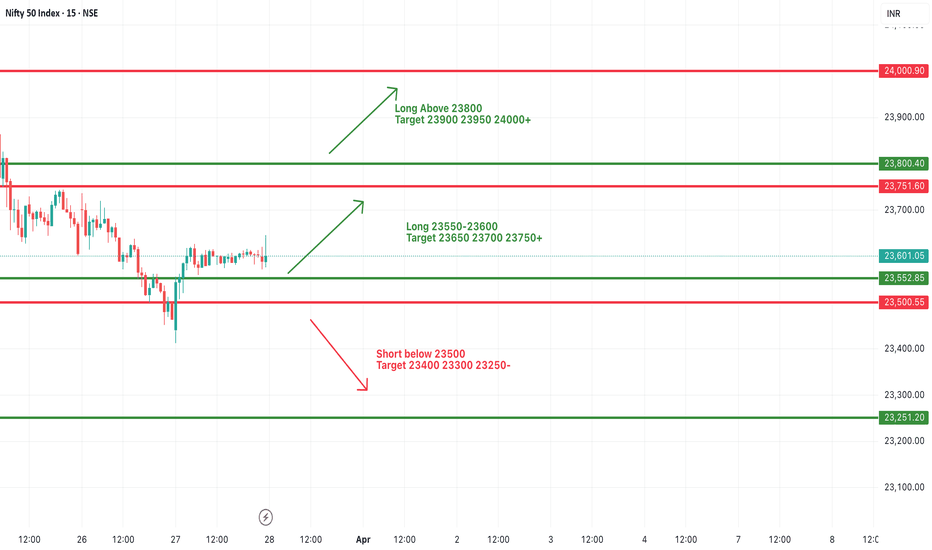

#NIFTY Intraday Support and Resistance Levels - 28/03/2025Gap up opening expected in nifty. After opening if nifty starts trading and sustain above 23800 level then possible upside rally continue upto 24000+ level. 23550-23750 zone is the consolidation zone for nifty. Any major downside expected below 23450 level.

WhiteBIT Coin $WBT: Getting Ready for a New ATHMarkets often react to major events, whether political statements or high-profile initiatives in the crypto industry. For instance, the impact of Donald Trump’s economic policies and regulatory decisions on asset prices and the market capitalization of crypto exchanges has been widely discussed - coinmarketcap.com

In particular, market volatility following such developments has led to a decline in the market value of leading crypto exchanges. However, beyond global factors, internal ecosystem growth drivers also play a crucial role.

One such trigger could be the International Crypto Trading Championship (ICTC)—WhiteBIT’s trading tournament, which will be the first-ever global live-streamed trading competition.

What does this mean for WhiteBIT Coin?

Increased platform activity → higher demand for internal assets.

Greater trader engagement → potential impact on trading volumes and liquidity.

Media exposure of the event → attracting global attention to the WhiteBIT ecosystem.

Currently, WBT is trading at $29.20 (-0.26% over the past 24 hours), down 6.29% from its ATH of $31.16. However, given the growing interest in the platform and the impact of market supply dynamics, this tournament could act as a catalyst for reassessing current price levels. If exchange activity intensifies, it’s reasonable to expect that WBT could retest its ATH zone or even break through it.

Whether this scenario plays out remains to be seen. But one thing is certain—ICTC will be a key indicator of WBT’s momentum and overall market sentiment. 🔥

What are your thoughts? Will this tournament give WBT a new boost?