GBP/JPY- Trend Changing PatternMy focus this morning is on the GBPJPY, we have seen a strong reaction to the breakdown low that happened on 03 May 2024. The reaction gave us a bullish wave structure on the H1 timeframe, the concluding factor is that wave structure 4 failed to make an HH 5 (200.652). Instead of an HH 5, the price made an LH 5 in an uptrend. The price then proceeded to break structure 4, known as a trend-changing pattern.

Knowing this information determined our directional bias for the GBPJPY.

So far, we have seen a retracement to the LH 5 (200.652), which has now become a structural point because it made a LL.

Yesterday the price formation indicated that the Sellers are slowly coming into the market above the 200.652, we saw sharp rejections twice yesterday and a trade below the 200.65 and 200.50 today will be a sell indication for us.

The invalidation point is a break above the 200.95, above here selling is no longer an option for us.

Think in Probability:

As traders, you must be careful to align your behavior and expectations with the following principles:

- Anything can happen

- An EDGE is only an indication of one thing happening over another

- There is a random distribution between wins and losses

- You don't need to know what will happen in order to make money in trading.

Pricebehaviour

USDCAD Buyers are still in controlThe USDCAD has been discounted nicely, price violated the sellers on Tuesday by breaking above Monday's high.

This was a buy signal, we have seen a correction, consolidation, and a strong reversal (manipulation/stops hunt) without breaking below the previous Daily low.

We are buying above: 1.2607

Stop: below 1.2580

Target above Momentum High 1.2653

GBPUSD More upside after correctionThe pound is still bullish and the trend is still up, knowing this fact we want to buy the dips and stand aside when price is at the high.

look for a correction to the key fibonacci levels and buy in to the impulse to the upside.

1.3484 is the key Level we want to see price above before we can become bearish.

Trade with care.

Remember the market will not take away anything from you if you dont give it. Mark douglas

Weekly Trade Analysis Currency PairsThis week analysis is the continuation of the last week analysis because the pairing in the idexes did not change.

CURRENCY PAIRINGS

BUY PAIRS

EURUSD

GBPUSD

NZDUSD

AUDUSD

EURJPY

GBPJPY

AUDJPY

CADJPY

SELL PAIRS

USDCHF

USDCAD

Note: Trading is execution, in order to trade successfully, you must learn to execute your trades flawlessly and do it over and over again.

How to read the price successfullyIn this short video, I explained how you can read the price using structural points to determine whether you want to be a buyer or a seller.

Key Points:

---------PRICE BEHAVIOUR----------

S-STR = Short Structure / A sell decision-making point

L-STR = Long Structure / A buy decision-making point

Downtrend: Series of LH & LL

Uptrend: Series of HL & HH

GBPUSD Uptrend continues above 1.3150The PoundDollar is resuming its uptrend after a correction.

The price has behaved as expected stopping at the 50% retracement.

15 Mins Price Behaviour: Consolidation and Breakout at 50% retracement level.

We have seen the first impulse and a pause. This pause is an opportunity to Buy into the uptrend.

Stop Loss is still recommended to be the Low of Yesterday. We need to see another impulse before we can use this morning correction low 15Mins as a stop.

I encourage you to count the waves.

Always count 4 Impulse and 3 Correctives.

Trade with care.

GBPUSD more upside expected above 1.3153Market Phase: The current situation in the cable is still Up-Trend

Last Action: The last significant move in the gbpusd is a Higher High created above the previous Higher high .

The truth about the trending market:

- A trend will continue in the same direction for as long as possible

- A trend will not change easily

- A move in the opposite direction of the trend is an opportunity to trade in the direction of the trend

- A trend will only change after a STRUCTURAL FAILURE.

Trade Approach & Execution:

Price has retraced to the 37.5% of the last action , We have now seen participation at this level.

Buy GBPUSD; When 1hr Candle Closes above 1.3153

Stop Loss: 1.3120

Target1: 1.34210 Fibonacci Target1{23.6%}

Target2: 1.35970 Fibonacci Target2{61.8%}

....................................

Trade with care.

EURJPY WAVES OF SUCCESS ANALYSISEducation Post:

This is a Price Behaviour Methodology.

You have to learn to interprete the waves/swings that price makes at any given time and location on the chart.

Attach a true meaning to it and react according to the information you have been presented.

As you may be aware, predicting is not going to make you money, but following the footsteps of those that are making money will make you money.

Trading is EXECUTION!!!

AUDJPY SHORT UPDATEThis is a quick update on the Short Position we had on AUDJPY.

Price took long to break out of the trading range below the Momentum low of 73.79. We finally had this break this morning.

In order for further decline to be seen in the AUDJPY, price must remain below the momentum low and break 73.42 Low.

Alternatively a break back above the 73.79 will trigger a rally back towards the 74.50.

This is a continuation trade and more room is seen towards 72.40.

***We Are still Targetting 72.30***

USDJPY LONG 108.495

Price made a low of 108.428 on the 4th Dec. and then rallied making 3 consecutive HH's before retracing back to the current low of 108.43 . 108.495 is the Low of Friday, this stands as our preferred Buying price in the USDJPY.

A trade back above the 108.495 will trigger our long entry position, and the stop loss will be below 108.40.

Our Target is 109.35.

USDJPY MORE DOWNSIDEThis pair has the potential to capitulate again, it all depend on the Yen Strenght that is currently obvious in all the Yen crosses.

Technically, price has rejected the 61.8% retracement of the Lower High created on 8th Nov. We will go short from 109.04, stop is at 109.30.

Intraday Target is 108.54.

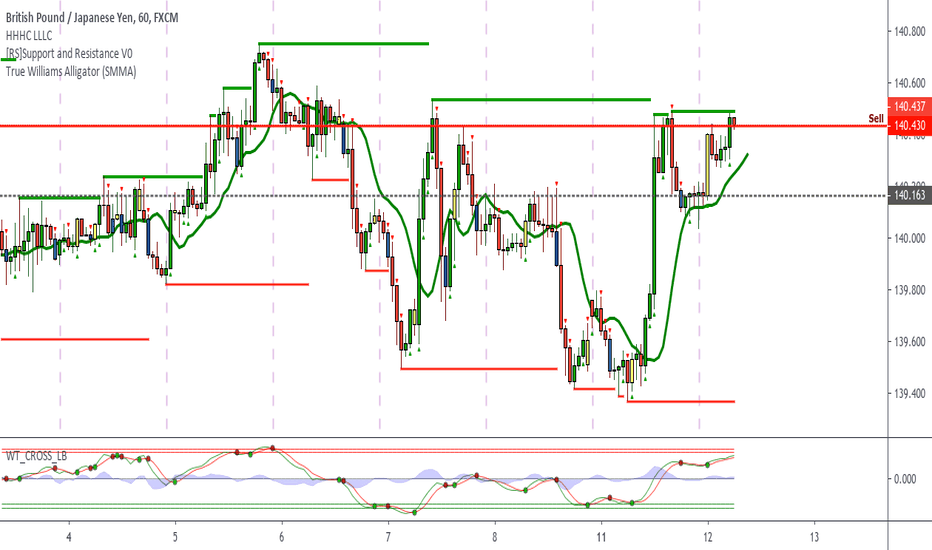

GBPJPY SELL 140.43GBPJPY is currently printing another lower High, price on the daily chart has been in range for several days and we have seen a breakdown from smaller time-frames. Yesterday rally can be considered as a discount in price. First indication is 140.43 is an area of interest, this price level was sold yesterday and another failure to advance beyond this point with momentum will further increase the likelihood of a strong selloff.

ENTRY SHORT: 140.43

SL: 140.80

Target1: 138.63

Target2: 135.49

USDCAD READY FOR STRONG RECOVERY

We have been watching this one very closely, Canadian Dollar has been very strong in recent days even with the strong Dollar on Friday, price continued to trade lower below the Momentum low. On Friday, some positive news for USD but bad reaction in USDCAD which suggests the pattern hasn't been completed.

The way to look at this is very simple, Think like a Fundamentalist, Trade like a Technician. The fundamentals are Positive towards USD, but technically we must wait for failure to make a lower low.

We have seen a failure from a lower time frame, and the invitation is accepted to go long from current level.

BUY @ 1.3095

SL: @1.3080

Target@ 1.3374

NZDUSD STRONG REVERSAL BELOW 0.6883The weakness in USD is clear for all to see after FOMC release on Wednesday, however, we have to spot opportunities when the market presents it.

NZDUSD broke above the daily resistance 0.6883, the price action we have seen so far suggests that price is likely to reverse if it breaks below the resistance. Word of caution, Reversal does not mean a change in trend so we will break even at the earliest possible opportunity.

SHORT: 0.6902

STOP LOSS: 0.6925

TARGET: 0.6827

Break even as soon as price trade below 0.6883.

USDJPY UPSIDE MORE LIKELY

This pair is still in a strong upside trend at least short term. There hasn't been any violation of the current trend. Even the lower High did not make a valid Lower Low that might contribute to the downside momentum.

Lot of key economic actions today and we have to bear that in mind.

We are going Long the USDJPY above structure 109.39. Target is 109.99.

Anything can happen above the 110.00 number.

Stop Loss = 109.11

USDJPY LAST CHANCE FOR THE BEARSThis pair we have been trading short term the previous 2 dontrend structure triggers, Price made a Higher low of 107.88 which in theory should propel the buyers beyond current level of 108.70. However, the behaviour we can see here is typical strong reversal for the continuation of downtrend. This completed wave is the last chance for Sellers, if price breaks above 108.98 we can fully expect more higher prices. The Downtrend Trigger is still intact, and we have not seen a Higher High that suggests the downtrend is invalidated. If that is the case the only option is to short USDJPY from 108.70.

This price point represent to us the last opportunity for a valid short.

SHORT: 108.70

STOP LOSS: 109.00

TARGET 1: 107.80

The outcome of Target 1 will determine the future price.