Priceprojection

Week ending 7-12-19Lot's of strength - new records have been made

The daily close is almost 2x the average trade range, so I anticipate a stall at some point this coming week to allow the averages to catch up.

Price projections from July 10 indicate a strong push to 8295 - 8305

Range for the coming week: 8138-8522.

Week ending 7-12-19Lot's of strength - new records have been made

Friday daily generated a price projection of 3054.

There is a projection open from July 10 taking aim at 3017.

The daily close is 2x the average trade range, so I anticipate a stall at some point this coming week to allow the averages to catch up.

Range for the coming week: 2982 - 3096.

Bear Consolidation. Bullish strength extinguished.Price Projection indicators show that all the bearish strength has been extinguished.

All bullish price targets have been reached in while trading in a bearish environment.

There is a bearish projection that still is holding projecting to ~137

The coming week range appears to be 219.23/248.40

Strength for the coming weekThe weekly consolidation range was broken Friday.

Like the other indexes, we may see a return to the this consolidation range in the coming week.

Projections from the daily chart that are still available: 8194 - 8211.

Expecting the trade range next week to be 8055 - 8306.24

Walking the range?A lot of strength is being displayed in the SP500.

Both the weekly and the daily are showing very strong bull markets.

Weekly chart consolidation is broken.

Daily consolidation is reset to: 2967.97 - 2995.84

Price Projections still exist for 3055.66 on the daily and 3084 on the weekly.

SP500 traditionally walks the upper bands of the ATR range. The close is currently above that level.

We can see a return to consolidation the coming week or extension of the strength.

Expecting a trade range of 2958.41 - 3074.76 for the coming week.

Strength with possible consolidationWe have strength, but we are far beyond the mean.

The Daily charts indicate Strong Bull while the weekly indicate Very Strong Bull.

The consolidation has been broken to the upside.

The broken consolidation range is: 26049/26907

The Friday close was 10 points beyond the upper ATR Band.

Next week we could see a retreat back into the prior consolidation range or a continuation of the long. However, the prices do need to return to the mean.

Expecting to range between: 26618 - 27722.92 for the next week.

Is a little exhaustion entering?Wednesday was amazing!

However, one indicator trigger a projection to 8228.99

While a bearish indicator is saying 8211.13

The bearish indicator triggering and nearly matching the other indicator in projection is hinting at a little exhaustion entering into the prices.

We could end up generating a consolidation range around 8200 to catch our breath before pushing out. Let's see what the weekly says on Saturday.

Record breaking birthday present.Happy Birthday America!

26966!

Closing above all the HMAs indicates a change in attitude into a very strong bull.

Repaint on a RENKO box date, changing to July 3rd (From July 2nd).

July 2nd had suggested 26892.57 (Reached!) July 3rd is looking toward 27093.34

This is also paired with a BSI crossing (same projection) and the Bear RSI returning into Bull territory (same projection).

Three indicators calling out for the same price. Friday is looking positive.

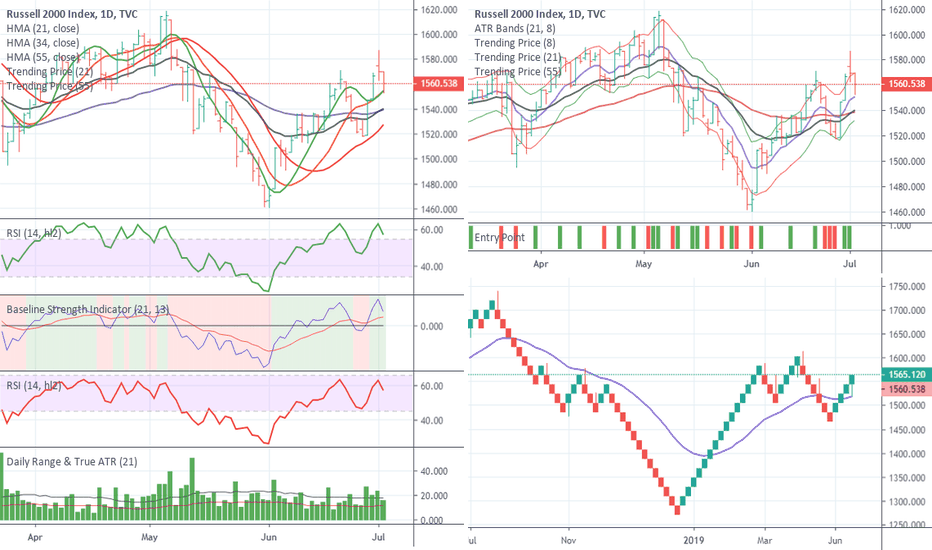

Monitor with cautionConsolidation has been established with a range of 1548.12 - 1586.77

For the technicians out there who like patterns. A Pivot High was just completed. So, look at the bottom of the consolidation range for your breakout signals.

Anchor bar on the consolidation is a positive bar which suggests a 70% chance of breakout to the top.

Coupled with the pivot high - I would decrease that down to 30%.

This is a mixed bag of directional signals, suggesting the market hasn't decided yet.

Strength is still currently visible.SP500 is still demonstrating strength.

While Tuesday has placed the index in consolidation between 2952.22 - 2977.93

Weekly charts are caught in consolidation 2887.30 - 2964.15

A indicator triggered that SP500 has a desire to attempt to reach 3035.18 which would break both consolidations

While prices to HMA relationship is saying that a strong bull exists. The consolidation anchor bar is a negative bar and this projection might be the SP500 just calling out a future objective. Should the bull wane along with the DJI loss of strength, then the beginning would be to return to previous consolidation range 2912.99 - 2946.52. The negative anchor bar on the consolidation indicates the possibility of 2948.44 if the bar were to be examined all by its lonesome.

Weakening tides?2 July provided a slow day in the DJIA. However, the close managed to secure a new Renko box.

DJI is currently in consolidation. Both at the weekly and the daily levels.

The daily level has a resistance of 26907.64 and support off 26465.32

The Prices to HMA suggest "cover the longs" or "lock in gains".

The projection triggered from the new Renko box suggests the DJI will move to 26892.57

Still in consolidation. Not promising. Not strong at all.

OPEC Failed to impress and the prices reflectFriday the price chart generated an engulfing bearish bar.

Monday the prices closed between Fridays prices suggesting either consolidation/turning.

Tuesday it broke through the floor of Fridays price, crossed the 21 MA and 55 MA and closed under the 34 HMA in "cover the long" territory.

Also, with the prices below the two trend lines - it suggests that the attitude has gone bearish.

A second close below the 21 & 55 MA will give a strong indication of what the attitude truly is.

HOWEVER.

Price projection was triggered on the bullish RSI indicator projecting a fall in prices between 54.11 - 53.89

Bitcoin Fibonacci Price Cluster Setup!55EMA below 34EMA

Price below the 2 EMA’s

Price projection -

1.0 - 9984.23 low to 10655.84 high projected to 9714.70 low

1.0 - 11630.15 low to 12243.79 high projected to 9714 low

1.0 - 10624.96 low to 11194.84 high projected to 9714

1.0 - 10838.55 low to 11429.36 high projected to 9174

Fibonacci retracement -

0.382 - 11429.36 high to 9714.00 low

0.236 - 12243.79 high to 9714.70 low

Consolidation range is HUGE!**Disclaimer**

I don't trade BTC. I am apply the Price Projection Theories against it to see how well it stands against the massive swings of BTC.

Weekly and Daily trade zones are caught in consolidation.

Weekly Consolidation: 10300 - 13880

Daily Consolidation: 10300 - 13355.61

Weekly projected a signal for 15,441.11 before locking into consolidation.

The Daily HMAs have suggested "cover the longs" (June 30)

The BSI has projected for - 10097.15

The Bear RSI has projected for - 9806.66

So, in summary. Cover longs and give it a wait. Enter back in between 9806 - 10097.

** This is just a test **

Enjoy!

Strong Week AheadPersonally endured an internet brown out this weekend. This is getting released late.

Noticed immediate change in strength of the Russell after reorganization.

No new projections this last week.

Bullish going into the weekend.

G20 announcements are exciting for the market.

Expecting a range this week of between 1542.80 - 1629.23