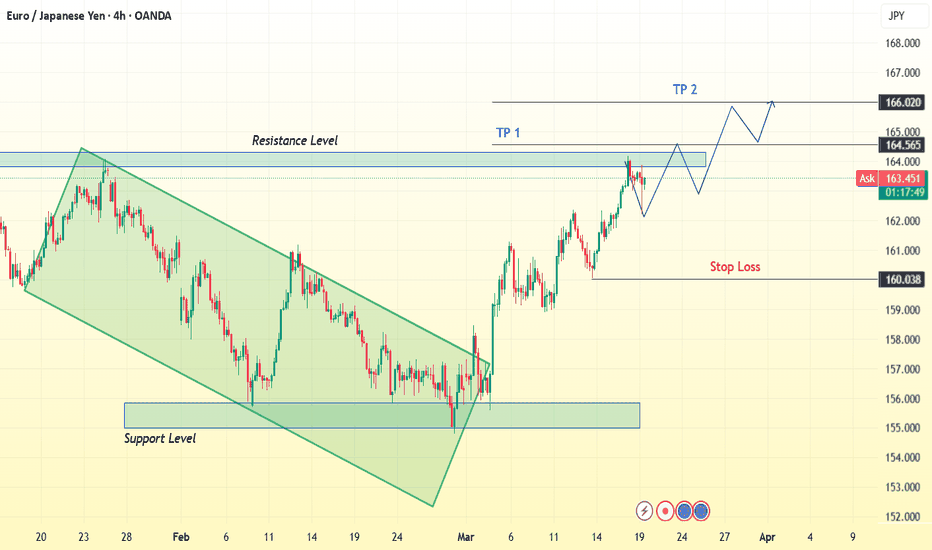

EURJPY 4H | Bullish Breakout & Retest – Next Big Move?The EUR/JPY 4-hour chart presents a compelling bullish breakout setup following a structured downtrend. The market recently broke through a significant resistance zone, indicating potential further upside movement. This analysis outlines key price levels, market structure, and an actionable trading plan.

📊 Market Structure Overview

🔸 Downtrend Reversal: The price was previously trading within a descending channel (highlighted in green), forming lower highs and lower lows.

🔸 Support Confirmation : The price bounced from a strong support zone around 158.500 - 160.000, confirming buyers' interest in this region.

🔸 Breakout & Retest : A strong bullish impulse broke through the 164.500 - 165.000 resistance zone, suggesting a shift in market sentiment.

📌 Key Trading Levels

🔹 Support Zone: 158.500 - 160.000

This area previously acted as a demand zone where buyers aggressively pushed the price higher.

It now serves as a safety net for long positions.

🔹 Resistance Zone (Now Potential Support): 164.500 - 165.000

Price has broken above this level, but a retest could provide an ideal entry for confirmation.

🔹 Next Major Resistance (Target Levels):

TP1: 165.000 → A psychological level and previous resistance.

TP2: 166.020 → A higher resistance zone where price may struggle to break through.

📈 Trading Plan – Long Setup

✅ Entry Confirmation:

Wait for price to pull back to the 164.500 - 165.000 zone.

Look for bullish candlestick patterns (e.g., pin bars, engulfing candles) to confirm buyers stepping in.

🎯 Take Profit Targets:

TP1: 165.000 (Initial resistance level)

TP2: 166.020 (Potential extended bullish move)

🛑 Stop Loss Strategy:

Below 160.038 (Previous structure low & key support level)

Ensures protection against potential fakeouts or trend reversals.

📢 Risk-Reward Ratio:

Aiming for 2:1 or better risk-reward ratio for an optimal trade setup.

📝 Market Outlook & Conclusion

📌 The recent breakout above resistance suggests bullish momentum is strong. However, traders should be patient and wait for a pullback to enter at a better risk-reward level. If price successfully retests and holds above 164.500, there is a high probability of continuation towards 166.020.

🚀 Trading Bias: Bullish – Until market structure shifts or a major rejection occurs at resistance.

📢 Final Trading Tip

🔹 Patience is key! Don’t rush into a trade immediately after a breakout. Wait for confirmation, as false breakouts are common in volatile markets. A successful retest of the broken resistance will provide a low-risk, high-reward entry opportunity.

Profittarget

EURUSD Momentum Break: Trade Setup and Alternative ScenarioBased on this morning’s analysis, we’ve seen a break above the momentum high, signalling that buyers remain confident the EURUSD isn’t too overvalued.

As a straightforward principle, we trade what we observe. Buy above the momentum high, aiming for the next decision point at 1.1140 (H4 Structural Point).

Stop Loss:

What gets you in, gets you out!

Technically, if the price drops back below the momentum high (1.10899), it will be a negative signal for buyers. Therefore, we’ll set a conservative stop at 1.1085.

Profit Target:

1.1134 (Fibonacci Target)

1.1140 (Structural Target)

Alternative Scenario:

If the price breaks below 1.1085, buying is no longer advised. We will reverse the position for a trend reset trade towards the Fibonacci buy zone range of .

Happy Trading!

USD/JPY - Bullish Trend ContinuationThis morning, the focus is on the Dollar-Yen pair. The bullish trend is evident across all timeframes. Yesterday, we observed a strong break of the reversal structure at 161.269 after reaching a momentum high of 161.95. This break is crucial for the continuation of the bullish trend. Following the break, a bullish pattern has formed, and the price has moved into the Fibonacci buy zones of the initial move. Given this setup, the high probability action is to buy or do nothing above 161.57.

Stop Loss: 161.14

Target 1: 162.35

Always think in probabilities.

📈 Tata Steel: Bouncing Off Support and Eyeing New Highs! 🚀Hello traders!

Today, let's dive into $NSE:TATASTEEL. Here's the breakdown:

📉 Support Bounce: Tata Steel has recently touched its support at Rs.132 and is now making a move upward.

📈 Targeting ₹140: The current trajectory suggests a push towards the near-term profit target of ₹140.

💹 Derivative Opportunity: For derivative traders, considering the 130 call option could be a strategic move.

✨ Potential Upside: With good support, there's a chance for Tata Steel to soar higher. Keep a close watch for further developments.

🔄 Dynamic Market: Always remember, the market is dynamic, and these are observations. Conduct your analysis before making any trading decisions.

🤔 Your Take: How do you interpret Tata Steel's movement? Share your insights in the comments!

📌 Stay Updated: Let's navigate these markets together. Stay tuned for more posts and updates!

Best regards,

Alpha Trading Station

CADJPY Successful Live tradeI am providing an update on the ongoing CADJPY sell trade. All the confirmation levels have aligned in favour of the short position, validating our initial analysis.

As anticipated, the price swiftly broke below the 1dh (one-day high) and continued its downward movement, breaching the structure (4). This development confirms the bearish momentum in the market.

The trade was eventually closed out at the trail stop, coming just 5 pips short of reaching the initial target. While the trade did not fully achieve our desired outcome, it still resulted in a profitable exit.

Additionally, I have conducted analyses on the GBPUSD, AUDUSD, and USDJPY currency pairs. These analyses provide valuable insights into their respective market conditions and potential trading opportunities.

Wishing you continued success!

Short Selling Opportunity Ahead: AUDCAD Analysis | 4h chartHello traders,

As you can see in my previous post the resistance level reached and profit target hit.

Now again short selling opportunity on the horizon. Wait for the OANDA:AUDCAD to close below stable support (0.91200-0.91500) and test resistance before opening short position.

Avoid long position due to downward trend and high supply.

Thanks & regards,

Alpha Trading Station

Disclaimer: This view is for educational purpose only & any stock mentioned here should not be taken as a trading/investing advice. We may or may not have position in the stocks mentioned here. Please consult your financial advisor before investing. Because Price is the "King of Market".

+200 pips bagged then a clean bounce from our Fib zoneOn friday which was on the 5th of this month August, i called in a signal for a sell, hours before the NFP data release which in truth was a pullback to a Fib zone (0.618) in M15.

Price reacted to the Fib zone by bouncing off of it which signals a continuation of the uptrend regardless of the NFP impulsive sells.

This is my own opinion of what the price of Nasdaq intends doing.

Market Structure Alignment DOGECOIN USING BAR CHART H4**************************************

Market Structure Alignment

DOGECOIN

M =

W =

D =

H4 = br

H1 = br

M15 =

M5 =

M1 =

**************************************

BIASES:

BB = Bullish BIAS

BRB = Bearish BIAS

****************************************

CODES:

b = Bullish

bg = Bullish Range

br = Bearish

brg = Bearish Range

****************************************

Bimb = Buyers IMBalance

Simb = Sellers IMBalance

****************************************

Boms = Break of Market Structure

Bboms = Bullish Break of Market Structure

Brboms = Bearish Break of Market Structure

****************************************

DZ = DemandZONE

SZ =SupplyZONE

************************************

H = High

HH = HigherHIGH

HL = HigherLOW

L = Lower

LL = Lowbrow

LH = LowerHIGH

*************************************

POI = Point Of Interest

IMB = Imbalance

IC = Institutional Candle

MIT = Mitigation

*************************************

Black = Monthly

Red = Weekly

Green = Daily

Yellow = H4

SkyBlue = H1

NavyBlue = M15

Pink = M5

Purple = M1

Orange = Alerts

************************************

READY FOR LIFTOFF?Lookin at a decending wedge, you have price touching the bottom trendline of a rising channel.If price falls below this zone your looking at the next zone below between $1.85-$1.61. Coming closer to the bottom of this wedge I don't see price retesting the lower trendline of the wedge, but anything is possible. 1st target looking at $9.75, if we get past that I'm projecting a 2nd tarjay @ $19.00, where we have the next major monthly supply zone and some resistance. Let me know your thoughts.

Cypher Pattern Profit Target Reached in Stocks!! 😎Stocks have broken down from our butterfly cypher pattern. This has been a long time in the making, and our analysis with harmonic patterns has foretold this correction weeks prior. We have actually broken down a bit past the target, to the 0.618 Fibonacci retracement level at 4144, which is also a technical level. If anything is going to slow the bleeding for stocks, it would be a level like this. That appears to be the case, as we have seen a bounce back to 4193. The Kovach OBV has definitely taken on a negative trajectory, but could be rounding off perhaps suggesting more momentum may come through. Momentum at the open will likely foretell where the price action is going today.

Eur/Gbp Profit target achieved 56 Pipsthis was a wonderful setup which we took the trade last week. and fortunate enough we saw a wonderful gap to dowside hitting our 56 pip profit target. have a look at the perspective on this week i broke down another setup . i will link it below watch it

Thank you for the support. and dont forget to follow me!!!

XBTUSDBitcoin has come down and tested the low from 2019-07-02, between it and the weekly were a nice entry zone. We only just tapped the range, only giving me a partial fill. Continuing higher, I'd look for some profit-taking around 10245.

You could use the profit target as a short entry but I would keep my stop tight.

Short term FUN trading idea for nice profitHello, guys as descirbed we might reach 1 st target soon and 2nd possible too in next also depending on how btc price will go

Intermediate Trading Strategy - Part 3In the previous post we discussed risk:reward, profit taking and trailing stop losses. If you have not read part 1 and part 2 then you are highly recommended to start there.

Taking Profit

Always taking partial profits, never making decisions for the full position. This is true when entering and this is true when exiting. It minimizes anxiety and emotional decision making.

In Trending Markets: Stop loss is trailed once new highs/lows are established. If long then move it up to be slightly under the recent low and if short move it slightly above the most recent high. This can generally be illustrated with Bill Williams Fractals on the weekly and daily charts. Full profit can be taken on the third test of a trendline.

In Parabolic Markets: I like to gamble on house money, it makes me feel much more comfortable about the draw downs. Here is an example for how to take profits in a parabolic market: If +100% then take 10%-20% off the table. If +100% again then take another 15%-25% off the table. Keep doing this as long as price is making all time highs.

Take full profit if phase 4 or phase 3 of hyperwave is violated

If weekly and daily RSI (with 30 setting) are > 80 then take full profit. If Welles Wilder’s ADX is > 50 on the weekly and/or > 60 on the daily then time to take full profit.

For Bitcoin' watch for NVT to reach overbought zones and consider how this metric will be affected by Lightning Network and batching transactions.

If Trading a Pattern: A chart pattern will indicate a profit target. If your reason for entering the trade was the chart pattern then do not get greedy with the profit target! Relying on a trailing stop will often cause a trader to miss out on a large part of the profit when trading a pattern.

Be very specific about what you are investing in long term/hodling and what you are using to trade.

If investing/hodling then put into cold storage and don’t do anything for a minimum of 10 years.

In the final post we will delve into the best indicators and provide guidelines for when they are most effective.

aELF - Target 1 reached ... can we go to Target 2??Hello All,

Here's an update on aELF.

So those who followed my call last night would have woken up to a 15% profit this morning. BTC is expected to make a pullback and could very well be doing that now (this appears to be wave b of an abc correction up). Once wave b is complete, BTC could start moving up in wave c and that could propel ELF through resistance. IF wave a of the ELF correction is over (it might not be), that would make wave a $0.25 long ... and assuming wave c does the same ... this could bring us to the next target level of 1.55.

For those who bought low, perhaps take partial profit, but it may be worth the gamble to see if we can get to 1.55.

Personally I'm holding, as I don't see a huge BTC drop coming in yet. I have raised my stops though so I do protect some profit. I'm willing to give it a shot, given generally most believe BTC will continue to 8600 - 8800 level ... there could be some good profits to be made on ELF!

Remember only a fool relies on one potential outcome.

Do not make financial decisions using this info. For educational purposes only.

If you wish to make a donation, based on profit you made on my ideas ... it would be greatly appreciated.

BTC address 14i2Xit5pH7Sz5TMegDn8vDT6VcoN85f42

ETH address

0x8a62eE1B2628297EA51aD08dadFFCed3F73e6eed

LTC address

LXoyzmL85HvED1LyHkJtGygUPbBUZd

ARCH on the Move!!!!Hey Guys, here with a quick idea, but does not mean this idea is meaningless.

ARCH has amazing fundamentals. Do your own DD but I promise they're fantastic

Huge uptrend, 0.5 retractment, rising 5-Day MA, and positive ichimoku are looking good for this stock. Profit target of 114. Likely route is that it hits the top, retracts a little, then continues on to 114. My drawing does not represent the time-frame I think it will take, just the route that's probably likely. Could just blow by 100 or never get past it, that's why you set stop losses. If it gets past 100 though, that huge psychological barrier break will cause some major movement.

Keep this one in mind, I'm doing an April option on it, $100 Call.

If it hits 114 two months from now, 200% Profit.

Do your own DD, I'm not licensed and am not responsible for losses.

Any questions,

Leave them down below