Who wants to $PRTY for Halloween Earnings ? Spooky season is coming up & with it approaching rapidly also comes the opening of those Spirit Halloween stores that seemingly pop up out of nowhere. $PRTY is a seasonal stock because they earn most of their money during the halloween season. With the stock trading at near 2020 lows again we could potentially realize some serious upside after the company reports their Halloween (November) earnings. I put some ghost bars on the chart to resemble the past aug-nov 2020 price action, if the pattern follows the exact same price action then we should settle at about $1.40 right before the November earnings. I am going to be patient with this play and if it fits the 2020 h&s pattern pre-earnings then it's game on! Happy Trading!

PRTY

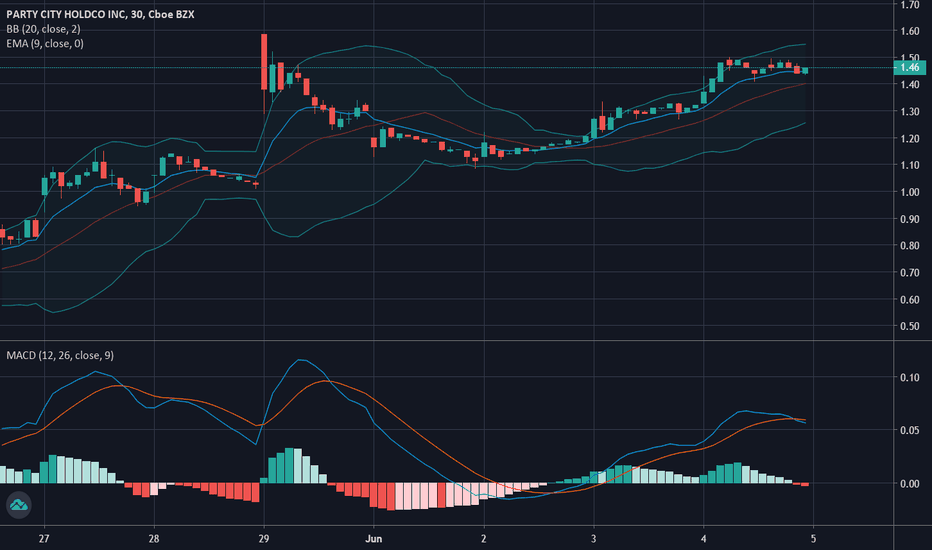

PRTY Earnings Breakout LONGNYSE:PRTY

PRTY had a double or triple bottom after the earnings

miss in May but has reversed after

PRTY had great reported earnings last week and now

has breakout price action. A Target of %3.00 based

on the volume profile and the EMA 200 seems

reasonable. A stop loss of 1.69 based on the

EMA20 and the volume profile makes for a

good reward for the risk. The low volume

area ( a bit of a gap ) could allow for quick

upwards price action into the upper high volume

as the price fell through the same area quickly

back in May with the earnings miss.

All in all, this makes for an excellent swing trade

setup.

PRTY : There will be a PARTY @ PARTY CITYLOOKS like the PARTY is just GETTING STARTED ... @ PARTY CITY.

Adding a few graphic embellishments to this CHART seemed appropriate.

RESISTANCE BECOMES SUPPORT ZONE

Who knows if nobody sells PRTY may not take a dip ???

SHORT/MID-TERM = LONG.

WHATCH for the across the board US-MARKET correction... THEN

LONG-TERM = VERY LONG.

PRTY : Don't Miss The Party @ PARTY CITY LOOKS like the PARTY is just GETTING STARTED ... @ PARTY CITY.

Adding a few graphic embellishments to this CHART seemed appropriate.

SHORT/MID-TERM = LONG.

WHATCH for the across the board US-MARKET correction... THEN

LONG-TERM = VERY LONG.

Long | PRTYNYSE:PRTY

Possible Scenario: LONG

Evidence: Price Action

This is my idea and could be wrong 100%

PARTY CITY - potential H&S reversal patternThese are my thoughts on PRTY. They are meant to give you an idea, not trading advice.

Party City is very low at these levels.

It looks like this stock is about to start building the right shoulder, to form an inverted Head and Shoulders pattern, which according to the textbooks is bullish.

If this is so, a buy at the lows of the forming shoulder would be a very good buy to enter a long position.

There's a gap at the end of 2019 that could get filled, what should take the price to about 5$.

PRTY - Actual Party City Baby!!Excited for the market to open. Current position: 500 shares at $1.46.

Short term support and resistance levels at $0.54 and $2.79

Exit target - 1.75, already trading at 1.60 pre-market hours, if things go south, exiting at 1.40.

The valuable lesson I learned:

The most important times for buying and selling shares are market open and market close. Market open allows you to sell with the algorithms, and before the market close, you can establish your position to ride the wave the next day, ON TIME.

Anyone else trading this stock that would like to share any thoughts? I appreciate learning from more experienced traders.