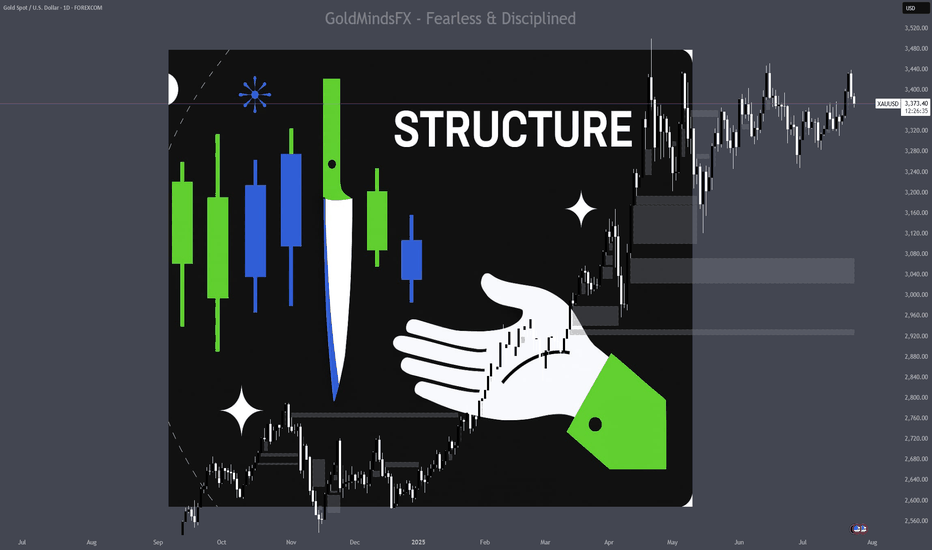

The Myth of Gold Reversals – Why Traders Keep Catching the KnifeGold is a master of deception.

It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there.

The reversal looked real and the candles seemed perfect.

But the move? It was never meant for them.

This isn’t bad luck, but traders who survive aren’t trying to guess, they are the ones reading the reaction after the trap.

Let’s break down how these traps happen — and how Smart Money actually operates when XAUUSD is loading a real move.

🟥 Sell Trap – The "Instant Short" Mistake

Price pushes up into a clear reaction zone — maybe an OB, maybe an imbalance, a FVG, or a gap.

Structure looks stretched. Traders recognize a premium zone and decide it’s time to short.

The trap? Jumping in immediately on the touch, with no confirmation.

This is where Gold loves to trap sellers.

No M15 CHoCH/ BOS on M5 or real liquidity swept. Just a blind move and hope.

Price often pulls slightly higher — sweeping internal liquidity, triggering SLs — then shows a real rejection.

📌 Here’s what needs to happen before selling:

• First: look for a liquidity sweep (equal highs or engineered inducement)

• Then: price must shift — CHoCH or BOS on M15 or M5

• Finally: confirmation via bearish engulf, imbalance fill, or break + retest

• For experts: M1 can offer refined sniper triggers with minimal drawdown

💡 If none of this appears, it’s not a setup — it’s a trap.

🟩 Buy Trap – The "Wick Bounce" Illusion

Price taps a demand zone — again, a refined OB or imbalance, liquidity zone.

A long bullish wick forms. Some candles pause. It looks like a reversal.

But there’s no shift.Just hovering.

Many jump in long the second they see the wick. And then price breaks straight through.

📌 Here’s how to flip this trap into a real buy:

• Let price sweep liquidity below the zone — signs of a purge - true wick bounce

• Watch for a CHoCH or BOS on M15, M5, or even M1

• Look for a strong bullish engulf from the reactive level

• Confirm via imbalance fill or price reclaiming broken structure

📍 If all that happens — the trap becomes your entry.

If not? Stand down.

📊 What Smart Traders Actually Do Differently

They don’t chase wicks.

And never enter just because price tapped a line.

IT IS ALL ABOUT READING STRUCTURE AND PRICE ACTION.

Here’s how:

• Mark the highest probability reaction zones — above and below current price;

• Set alerts, not blind entries;

• Wait for price to come into their zone and then watch what it does there;

• Look for confirmation: CHoCHs, BOS, engulfing candles, FVG fills, clean rejections;

• And always keep one eye on the news — because Gold reacts fast and violently when volatility hits.

• Repeat this work daily until they learn how to recognize signs faster and more secure.

That’s the difference between chasing the reversal… and trading the move after the trap.

Because in this game, patience isn’t just a virtue — it’s survival.

And Gold? Well, XAUUSD has no mercy for those in a hurry and not studying its moves day by day, month after month and so on. Learn structure and price action even if you join any channel for help if you are serious about trading this amazing metal.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

Psychologicallevel

Gold at 100 Times its Price - A Psychological LevelGold has now risen to 100 times its previously fixed price of $35 per ounce.

Is this a psychological milestone signaling a correction ahead, or is there still more upside potential?

Under the Gold Reserve Act of 1934, gold was officially priced at $35, a rate maintained until 1971, when President Nixon suspended the dollar’s convertibility into gold, effectively ending the gold standard. This historic move, known as the “Nixon Shock,” allowed gold to trade freely in the market. By December the same year, the market price had already climbed to around $43–44 per ounce.

So why has gold risen from $35 to $3,500?

Micro Gold Futures & Options

Ticker: MGC

Minimum fluctuation:

0.10 per troy ounce = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

ATOM- BULLISH MOMENTUMEyeing Altcoins Near Their March 2024 Highs

BINANCE:ATOMUSDT

I focus on setups where altcoins are approaching their potential March 2024 peaks. These trades are straightforward in strategy but challenging emotionally, as we can expect turbulence and liquidation cascades along the way.

Bullish Arguments

PMH being disrespected

PML being disrespected

PWH being disrespected

PWL being disrespected

PDL being disrespected

PDH being disrespected

Bearish Arguments:

4H swing high being respected

4H swing low being respected

Trade Management

I keep a tight SL to protect capital in case the market hunts liquidity. If stopped out, I’ll reassess and re-enter if price action confirms. TP is around the March 2024 zone, but partial profits may be taken earlier.

A Word of Caution

As futures trading intensifies, we’ll encounter frequent liquidation cascades and stop hunts. This is where discipline and resilience truly matter. The hardest phase starts now.

Trade wisely, stay focused, and take care.

Bear and bull scenario for today (MONDAY)We recovered the wick from Sunday with the move lower just before the close of the weekly candle. I could see some mean reversion here on the table and a possible break or rejection near the daily open (offset) at $58.4k. Like always $58k region is key. A possible rejection can happen at the psychological low at $58.2k. Right now we are still in the range of $58k - $61k. London Session starts in 8 min and will start the day. Let's go. Trade safe!

Psychological Levels and Round Numbers in Technical Analysis

When traders analyze the key levels, quite often then neglect the psychological levels in trading.

In this article, we will discuss what are the psychological levels and how to identify them .

What is Psychological Level?

Let's start with the definition.

Psychological level is a price level on a chart that has a strong significance for the market participants due to the round numbers.

By the round numbers, I imply the whole numbers that are multiples of 5, 10, 100, etc.

These levels act as strong supports and resistances and the points of interest of the market participants.

Take a look at 2 important psychological levels on EURGBP: 0.95 and 0.82. As the market approached these levels, we saw a strong reaction of the price to them.

Why Psychological Levels Work?

And here is why the psychological levels work:

Research in behavioral finance has shown that individuals exhibit a tendency to anchor their judgments and decisions to round numbers.

Such a decision-making can be attributed to the cognitive biases.

Quite often, these levels act as reference points for the market participants for setting entry, exit points and placing stop-loss orders.

Bad Psychological Levels?

However, one should remember that not all price levels based on round numbers are significant.

When one is looking for an important psychological level, he should take into consideration the historical price action.

Here are the round number based levels that I identified on AUDUSD on a weekly time frame.

After all such levels are underlined, check the historical price action and make sure that the market reacted to that at least one time in the recent past.

With the circles, I highlighted the recent reaction to the underlined levels. Such ones we will keep on the chart, while others should be removed.

Here are the psychological levels and proved their significance with a recent historical price action.

From these levels, we will look for trading opportunities.

Market Reaction to Psychological Levels

Please, note that psychological levels may trigger various reactions of the market participants.

For instance, a price approaching a round number may trigger feelings of greed, leading to increased selling pressure as traders seek to lock in profits.

Alternatively, a breakout above/below a psychological level can trigger buying/selling activity as traders anticipate further price momentum.

For that reason, it is very important to monitor the price action around such levels and look for confirmations .

Learn to identify psychological levels. They are very powerful and for you, they can become a source of tremendous profits.

❤️Please, support my work with like, thank you!❤️

AUDUSD SHORT PROJECTIONLooking to short AUDUSD as it rejected a trendline and 38.20% FIB Level. We will also be monitoring the DXY(Dollar Index) for correlation and more confluence. A break and retest below 0.65200 psychological level support will give us a proper confirmation to go short.

I will be shorting this pair now but with extreme caution and add more orders upon the break and retest of the support.

CHFJPY Short ideaJPY goes bullish, that's why its good idea to sell every currency pair against JPY. All currency pair against JPY is overbought.

Conditions:

1. Daily RSI divergence

2. 4h RSI divergence

3. Break under 170.000

4. Retest 170.000 psychological level

Now just waiting for the entry formation 👀

Or just play stop sell order under the Higher Low

Power of Psychology TradingIn the dynamic world of trading, it is widely acknowledged that strategy and market knowledge are essential for success. However, there is a critical aspect that often goes unnoticed but holds immense power in shaping trading outcomes: the psychological dimension. The psychological aspect of trading encompasses understanding and effectively managing emotions, biases, and mental states that can significantly impact trading decisions. Neglecting this facet can lead to costly mistakes driven by emotional decision-making, such as panic selling during market dips or clinging onto losing trades fueled by hope or fear. Thus, it is crucial to cultivate a clear and disciplined mindset to achieve more profitable and consistent trading outcomes. This tutorial aims to delve into the psychological landscape of trading, offering invaluable insights and practical tips to help you master your mind and, consequently, conquer the market.

Common Psychological Traps in Trading

Traders frequently fall into various psychological traps that can severely undermine their trading performance. One such trap is overconfidence. After experiencing a string of successful trades, it becomes easy to develop an invincible mindset, leading to riskier behaviors and impulsive decisions.

Fear and greed are two emotions that often dictate trading decisions. They serve as key drivers behind market trends but, if not managed properly, can result in significant financial losses. The fear of missing out (FOMO) can drive traders into hasty, poorly thought-out trades, while greed can create a reluctance to sell even when all signs point to a market downturn.

Another common psychological pitfall is anchoring. This occurs when traders become fixated on specific price points or values, distorting their perception of a security's true worth and hindering rational decision-making.

Understanding Your Trading Emotions

To effectively manage your trading emotions, it is essential to first understand them. One practical approach is to maintain a trading journal. In addition to recording your trades and their outcomes, this journal should document your emotions and thoughts at the time of each trade. Over time, patterns may emerge, revealing how your emotions influence your trading decisions.

Another crucial factor is knowing your risk tolerance. Each trader possesses a unique level of comfort when it comes to taking risks, and comprehending this can significantly shape your trading strategy. A risk-averse trader might prefer more stable assets, while a risk-tolerant trader may be comfortable with higher volatility.

Strategies for Managing Trading Emotions

Being in the right mental state before engaging in trading is paramount. Developing a pre-trade routine that helps you calm down and focus can prepare you for the trading day ahead. This routine could include activities such as meditation, exercise, or reviewing the latest market news and your trading plan for the day.

Having a clear trading plan also provides a solid foundation for managing your emotions. This plan should outline your strategy, encompassing risk management tactics, potential entry and exit points, and your objectives for each trade. It serves as a roadmap, grounding you when market volatility triggers emotional responses.

Additionally, learning stress management techniques can be invaluable in the trading arena, often laden with stress. Taking regular breaks, practicing deep breathing exercises, and maintaining a balanced lifestyle outside of trading can help maintain your mental equilibrium.

Conclusion and Further Reading

Trading psychology is a vast and intricate field, but understanding its fundamental principles can profoundly enhance your trading performance. By familiarizing yourself with common psychological traps, comprehending your own emotions and risk tolerance, and employing effective strategies to manage your trading emotions, you can make more informed and profitable trading decisions.

Continuous learning and emotional self-awareness are key to successful trading. There are numerous resources available for those who wish to delve deeper into trading psychology, risk management, and market analysis. While the journey to master your trading psychology may present challenges, the potential rewards - improved trading outcomes and personal growth - far outweigh the effort invested.

EURAUD I What to consider before shorting key resistanceWelcome back! Let me know your thoughts in the comments!

** EURAUD Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

Downgraded From BB+ To BBIt's a personal opinion of mine that psychological levels, whole number resistance and support, should have this much control over price action.

Psychological levels have the most effect when there's extremes of emotions. I feel it's rather self-explanatory.

It's either going towards zero or it's getting bought to prevent it from hitting the pavement.

The variance in price alone is a clear indicator its in deep trouble while it was just downgraded to BB.

Previous low on charts of $17.60 is notable, while $20 pertains to psychological significance.

Below this, I see little more than psychological levels.

$10, double digits. $5, where select exchanges consider a stock a penny stock. $1, where the rest consider it a penny stock.

You can label a ton of this chart a deadcat bounce here or there.

Please add thoughts. I didn't see a Fibonacci ladder helping much because the price action was too chaotic.

DYOR/DYOC.

📍 The 5 Step Process1️⃣ MARKET STRUCTURE

The market structure has a significant impact on the formation of prices, dissemination of information, and execution of transactions. In the context of stock trading, market structure can also refer to the pattern of price movements in a downtrend, characterized by lower highs and lower lows. This pattern indicates that prices are consistently decreasing over time and that selling pressure is outweighing buying pressure. The market structure in a downtrend can provide important information to traders and investors about the overall sentiment in the market and can inform their decision-making process.

2️⃣ PSYCHOLOGICAL LEVEL

A psychological price level in trading refers to a price point that is believed to have a significant impact on market participants' behavior and decision making. These price levels are usually round numbers, such as $50 or $100, or important milestones, such as all-time highs or lows, and are often used as reference points in trading. Market participants often view psychological price levels as significant barriers that need to be breached or defended in order to signal a change in market sentiment.

3️⃣ FIBONACCI

Fibonacci retracement is a technical analysis tool used in stock trading to identify potential levels of support and resistance. It is based on the idea that prices will tend to retrace a predictable portion of a move, after which they will continue to move in the original direction. The tool is used by drawing a trendline between two extreme points and then dividing the vertical distance by the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8% and 100%.

4️⃣ TRENDLINE

A trendline in trading is a straight line drawn on a price chart to identify a current trend in the market. The trendline is drawn by connecting two or more price points and is used to identify the direction of the trend, either up, down, or sideways. If the trendline is sloping upwards, it is considered an uptrend, and if it is sloping downwards, it is considered a downtrend.

5️⃣ CANDLESTICK

A twizzer bottom is formed when a long green candle is followed by a red candle that closes below the midpoint of the first candle. This pattern indicates that the buying pressure that was present in the first candle is being replaced by selling pressure, and suggests a potential reversal from an uptrend to a downtrend. It's important to note that a twizzer candlestick pattern is just one piece of information and should not be relied upon solely when making trading decisions. It is often used in conjunction with other technical analysis tools and indicators to form a more comprehensive view of market conditions.

👤 @AlgoBuddy

📅 Daily Ideas about market update, psychology & indicators

❤️ If you appreciate our work, please like, comment and follow ❤️

EURCHF Short Term Buy IdeaD1 - Price respected a psychological level and is bouncing higher.

Bullish divergence.

H1 - Bullish divergence.

Higher highs.

Until the strong support zone holds my short term view remains bullish here.

If we get a valid breakout above the high at 0.98050 we may then consider it as a validation for this bullish view.

CADJPY Sell IdeaD1 - Price is bouncing lower from a psychological level.

Multiple false breaks with bearish divergences.

Expecting short term bearish moves to happen here.

H1 - Bearish trend pattern.

Currently it looks like a correction is happening.

Bearish hidden divergence followed by bearish regular divergence.

Until the two strong resistance zones hold my view remains bearish here.

GBPCAD Short Term Buy IdeaD1 - Price respected the psychological level 1.55 and bounced higher.

Bullish divergence.

Expecting short term bullish moves to happen here.

H4 - Bullish convergence.

Currently it looks like a pullback is happening.

Until both the strong support zones hold my short term view remains bullish here.

Trader comfort zone journey 🥴➡️😊Let's end the week on a thoughtful note.

On the chart is a visual I see the other day that I feel relates to trading massively.

It's called the comfort zone map.

This can be applied to many situations in a person's life as a generic visual map.

But I really do think it represents the journey every trader must take in order to become successful.

COMFORT ZONE

It's where we all start any journey

Sat in the comfort zone not wanting to leave as we dont want to fail or get hurt.

Some will stay in this zone forever but will never progress.

If you are on TradingView looking at this idea then chances are leaving this zone is already being explored.

We all like this zone put you have to take the leap of faith in order to progress.

As traders we all have to leave our comfort zone in order to start our trading journey.

FEAR ZONE

This is the worse zone for any human on any sort of journey but more so for traders.

Things are really uncomfortable in this zone and pain will be felt.

Mistakes will made, as traders money well be lost but key bit is learn from those mistakes.

Plenty of people will turn their backs at this point and jump back into the comfort zone.

Those who carry on trying to achieve will have other people questioning what are they doing.

Don't let opinions sway you and find a way to find your feet in this zone.

You will lack knowledge, You will lack skills at the start but traction comes with hard work and persistence.

LEARNING ZONE

The traction gained and hurdles overcome in the fear zone leads you to this zone.

Once in this zone it's now all in the eye of the beholder.

This is now the new comfort zone but don't drop the ball you can end up dropping back in this zone.

Now's the time in this zone to really kick on but it can take time.

You are now laying the foundations of an exciting future.

Take the base knowledge gained and gain even more in this zone.

Problems are no longer holding you back as you are able to overcome.

You enjoy the challenges and tackle them head on while still learning.

Putting the time in here takes you to the next step but also stands you in good stead for rest of lives hurdles.

GROWTH ZONE

This where the fruits of your labour are felt but not just in trading profits.

Mindset and contentment are on point.

Due to the above continued learning never stops.

Objectives are now smashed.

Purpose and fresh identic is now found within yourself.

Continued Personal growth as well as financial growth is now a element of life.

In this zone the end game is infinite but shouldn't be taken for granted.

Hard work has got you here but don't get complacent.

Treat everyday as an opportunity to fulfil your life even more in many ways not just money.

You earnt the right to be in this zone so enjoy.

But be grateful in this zone and take nothing for granted.

Stay level headed and with the right mindset this becomes your new comfort zone to enjoy forever.

Enjoy the weekend folks and see you next week 👍

Darren✌️

GBPUSD Projection After studying GU for quite a while, I know what to expect, a fakeout is possible at this point, to make the 3rd touch of the Trendline of the new downtrend that started last Friday, looking to go short at that level with rejection, or a candle closure in my direction. This is not a financial advice, practice proper Risk management

Strong fundamentals + 1.13500 + price AStrong fundamentals and the action of price both support the sell from the psychological level at 1.13500.

Price action + technical indicator (preferably one of the oscillators) = Divergence

Price made a high broke it and made a Higher high on the chart and on the RSI. Iit made a high and a lower high, price couldn't break that high on the RSI and viola, Divergence was handed to us on a platter !.

EURUSD is going to sell but it needs to consolidate a bit to gather enough volume to do just that !.

Parameters

Sell EURUSD to the next psychological level or like 10 pips before 1.13000 which is exactly 1.13100

Set your stop 🛑 loss @15 pips above entry which gives us 1.13650.

If price hits our stops, we sell again, maintaining our stop level at another 15 pips and that will be all for the day if fundamentals fail us during NYSE.

WE ARE SELLING JUST TWICE. KEEP THAT IN MIND !.

GBPAUD - To Revisit the November HighSimple set up on GBPAUD.

Anticipating GBPAUD to continue its bullish direction into around the 1.88 level. As we can see price appears to have found a new support at the 1.86 prior resistance, it is also supported by the H1 EMA. Psychological levels are super accurate with this pair a lot of the time i find.

I expect a rise now to meet yesterday's high. Decent R:R on this one, let's see how it plays out.