Psychology

The Myth of Gold Reversals – Why Traders Keep Catching the KnifeGold is a master of deception.

It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there.

The reversal looked real and the candles seemed perfect.

But the move? It was never meant for them.

This isn’t bad luck, but traders who survive aren’t trying to guess, they are the ones reading the reaction after the trap.

Let’s break down how these traps happen — and how Smart Money actually operates when XAUUSD is loading a real move.

🟥 Sell Trap – The "Instant Short" Mistake

Price pushes up into a clear reaction zone — maybe an OB, maybe an imbalance, a FVG, or a gap.

Structure looks stretched. Traders recognize a premium zone and decide it’s time to short.

The trap? Jumping in immediately on the touch, with no confirmation.

This is where Gold loves to trap sellers.

No M15 CHoCH/ BOS on M5 or real liquidity swept. Just a blind move and hope.

Price often pulls slightly higher — sweeping internal liquidity, triggering SLs — then shows a real rejection.

📌 Here’s what needs to happen before selling:

• First: look for a liquidity sweep (equal highs or engineered inducement)

• Then: price must shift — CHoCH or BOS on M15 or M5

• Finally: confirmation via bearish engulf, imbalance fill, or break + retest

• For experts: M1 can offer refined sniper triggers with minimal drawdown

💡 If none of this appears, it’s not a setup — it’s a trap.

🟩 Buy Trap – The "Wick Bounce" Illusion

Price taps a demand zone — again, a refined OB or imbalance, liquidity zone.

A long bullish wick forms. Some candles pause. It looks like a reversal.

But there’s no shift.Just hovering.

Many jump in long the second they see the wick. And then price breaks straight through.

📌 Here’s how to flip this trap into a real buy:

• Let price sweep liquidity below the zone — signs of a purge - true wick bounce

• Watch for a CHoCH or BOS on M15, M5, or even M1

• Look for a strong bullish engulf from the reactive level

• Confirm via imbalance fill or price reclaiming broken structure

📍 If all that happens — the trap becomes your entry.

If not? Stand down.

📊 What Smart Traders Actually Do Differently

They don’t chase wicks.

And never enter just because price tapped a line.

IT IS ALL ABOUT READING STRUCTURE AND PRICE ACTION.

Here’s how:

• Mark the highest probability reaction zones — above and below current price;

• Set alerts, not blind entries;

• Wait for price to come into their zone and then watch what it does there;

• Look for confirmation: CHoCHs, BOS, engulfing candles, FVG fills, clean rejections;

• And always keep one eye on the news — because Gold reacts fast and violently when volatility hits.

• Repeat this work daily until they learn how to recognize signs faster and more secure.

That’s the difference between chasing the reversal… and trading the move after the trap.

Because in this game, patience isn’t just a virtue — it’s survival.

And Gold? Well, XAUUSD has no mercy for those in a hurry and not studying its moves day by day, month after month and so on. Learn structure and price action even if you join any channel for help if you are serious about trading this amazing metal.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

People don't like the truth! Let's be honest, people don't like honesty. They prefer ideas that affirm their own beliefs.

When I read articles and posts from newer traders, it's often from a place of "all in" diamond hands and the notion that things go up forever.

I've been a trader for over 25 years now, and the game isn't about making a quick buck, it's about making money over and over again. This got me thinking, the issue is when you deal with a small account you require leverage, small timeframes and of course the "shit" or bust mindset. If you lose a thousand dollars, $10,000 even $100,000 - what does it matter? That's no different than a game of poker in Vegas.

The idea of being 80% in drawdown, is alien to me. The idea of one trade and one win is also a crazy notion.

Instead of playing with the future, there is an easier way to work. This isn't about slow and boring, it's about psychology and discipline. 10% returns on a million-dollar account isn't all that difficult. Instead of aiming for 300x returns on an alt coin (due to the account size being tiny) You can make less of a percentage gain with a larger account size.

In terms of psychology - the word " HOPE " is used, way too often, it's used when you hope a stock or the price of Bitcoin goes up, it's used when you hope the position comes back in your favour, it's used when you want your 10,000 bucks to double.

This isn't trading, it's gambling.

The truth is, it's not the winners that make you a good trader. It's the way you deal with the losses.

Once you learn proper risk management, a downtrend in a market move is a 1-2% loss coupled with a new opportunity to reverse the bias.

As a disciplined trader, the game is played differently.

Let's assume you don't have $100k spare - prop firms are a great option, OPM = other people's money.

Remove the risk and increase the leverage, all whilst trading with discipline.

The market goes through many phases, cycles and crashes.

You don't always need something as catastrophic to take place, but if you are all in on a position. You need to understand that losses can be severe and long-lasting.

When everyone sees an oasis in the desert, it's often a mirage.

You only have to look at the Japanese lesson in 1989, when the Nikkei was unstoppable-until it wasn't. For that short space in time, everyone was a day trader, housewives to taxi drivers.

Everyone's a genius in a Bull market.

Then comes the crash. The recovery time on that crash?

34-years!!!

I have covered several aspects of psychology here on TradingView;

When it comes to trading, if you are able to keep playing. It's a worthwhile game. If you are gambling, it's a game whereby the house often wins.

Right now, stocks are worth more than their earnings. Gold is up near all-time highs, crypto, indices the same.

All I am saying is if you are all in. Be careful!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

ADA/USDT Trade Idea – 15m (Following V–Trend Setup)Bias: LONG

🔍 Trade Breakdown:

V-Structure Identified:

Market formed a clear V-reversal structure, shifting from a bearish downtrend into a bullish uptrend. This is a key part of my setup — I look for these V-shaped reversals as confirmation of potential long entries.

Trendline Break + Structure Shift:

The red descending trendline was broken with strong bullish candles. Price also broke above a key structure level, confirming the bullish trend shift.

Risk Management Zone (RM):

Price pulled back into my Risk Management Zone (RM) — a demand zone marked by previous consolidation and imbalance. I do not enter on impulse, instead I wait for price to return to this zone for a safer entry.

NO FOMO Zone:

Highlighted in red — I avoid entering if price doesn't respect this zone. It helps me stay disciplined and avoid emotional trades.

Entry & Target:

Entry: Within RM zone (~0.8780–0.8845)

Stop Loss: Below RM zone (~0.8739)

Target: 0.9266

This gives a solid risk-to-reward setup in alignment with the trend.

✅ Strategy Checklist:

V-shaped recovery ✅

Structure break ✅

Pullback into RM ✅

No FOMO entry ✅

RR > 1:3 ✅

📌 Let the market come to you. Stay disciplined, trust the setup.

#ADAUSDT #CryptoTrading #VTrend #SmartMoney #PriceAction #NoFOMO #15mSetup #TradingView

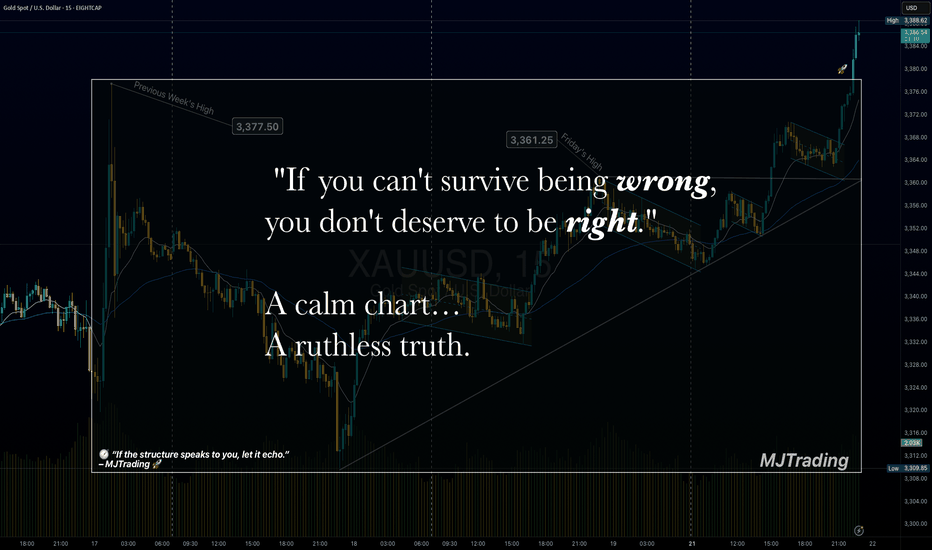

Survive first. Thrive later.🧠 Trading Psychology x Risk Management

"If you can't survive being wrong, you don't deserve to be right."

💬 A calm chart…

A ruthless truth.

Most traders obsess over being right.

But the market only rewards those who manage being wrong.

Risk control isn’t just technical — it’s emotional.

Survive first. Thrive later.

— MJTrading

Psychology Always Matters:

Click on them for notes in the caption...

#MJTrading #ChartDesigner #TradingPsychology #RiskManagement #MindfulTrading #CapitalPreservation #SmartMoney #XAUUSD #ForexDiscipline #15minChart #GoldAnalysis #MentalEdge #Gold

The Dangers of Holding Onto Losing Positions...One of the most common — and costly — mistakes in trading is holding onto a losing position for too long. Whether it's driven by hope, ego, or fear, this behavior can damage your portfolio, drain your capital, and block future opportunities. Successful trading requires discipline, objectivity, and the willingness to accept when a trade isn’t working. Understanding the risks behind this behavior is essential to protecting your capital and evolving as a trader.

-- Why Traders Hold Onto Losing Trades --

It’s not always poor strategy or lack of experience that keeps traders locked in losing positions — it’s often psychology. Several cognitive biases are at play:

1. Loss Aversion

Loss aversion refers to our instinctive desire to avoid losses, often stronger than the desire to realize gains. Traders may hold onto a losing position simply to avoid the emotional pain of admitting the loss, hoping the market will eventually turn in their favor.

2. Overconfidence

When traders are overly confident in their analysis or trading thesis, they can become blind to changing market conditions. This conviction may cause them to ignore red flags and hold on out of sheer stubbornness or pride.

3. The Sunk Cost Fallacy

This is the belief that since you’ve already invested money, time, or effort into a trade, you need to keep going to “get your investment back.” The reality? Past investments are gone — and continuing the position often compounds the loss.

These mental traps can distort decision-making and trap traders in unproductive or damaging positions. Being aware of them is the first step toward better judgment.

-- The True Cost of Holding Losing Positions --

Holding onto a bad trade costs more than just the money it loses. It impacts your entire trading strategy and limits your growth. Here’s how:

1. Opportunity Cost

Capital tied up in a losing trade is capital that can’t be used elsewhere. If you keep $8,000 in a stock that’s fallen from $10,000 — hoping it rebounds — you're missing out on placing that money in higher-performing opportunities. Inactive capital is wasted capital.

2. Deeper Compounding Losses

A 20% loss doesn’t sound catastrophic until it becomes 30%… then 40%. The deeper the loss, the harder it becomes to break even. Holding out for a recovery often makes things worse — especially in markets with high volatility or downtrends.

3. Reduced Liquidity

Successful traders rely on flexibility. When your funds are tied up in a losing position, you limit your ability to respond to new opportunities. In fast-moving markets, this can be the difference between success and stagnation.

Recognizing these costs reframes the decision from “holding on until it turns around” to “preserving capital and maximizing potential.”

Consider this simple XAUUSD (Gold) weekly chart example. If you base a trading strategy solely on the Stochastic oscillator (or any single indicator) without backtesting and ignoring the overall trend, focusing solely on overbought signals for reversals, you'll quickly see the oscillator's frequent inaccuracies. This approach will likely lead to substantial and prolonged losses while waiting for a reversal that may never occur.

-- Signs It’s Time to Exit a Losing Trade --

The hardest part of trading isn’t opening a position — it’s closing a bad one. But if you know what to look for, you’ll know when it’s time to let go:

1. Emotional Attachment

If you find yourself feeling “married” to a trade, it’s a warning sign. Traders often assign meaning or identity to a position. But trading should be based on data and strategy, not sentiment.

2. Ignoring or Adjusting Your Stop Loss

Stop Loss orders exist for a reason: to protect your capital. If you habitually move your stop further to avoid triggering it, you’re letting hope override risk management.

3. Rationalizing Losses

Statements like “It’ll bounce back” or “This company always recovers” can signal denial. Hope is not a strategy. When you catch yourself justifying a bad position without objective reasoning, it’s time to reevaluate.

Consider also reading this article:

-- How to Cut Losses and Move Forward --

Cutting a loss isn’t a failure — it’s a skill. Here are proven techniques that help you exit with discipline and confidence:

1. Use Stop Losses — and Respect Them

Set a Stop Loss at the moment you enter a trade — and stick to it. It takes the emotion out of the exit and protects your downside. Moving the stop is the fastest path to deeper losses.

2. Trade With a Plan

Every trade should be part of a bigger strategy that includes risk tolerance, entry/exit points, and profit targets. If a position hits your predetermined loss threshold, exit. Trust your system.

3. Apply Position Sizing and Diversification

Never risk more than a small percentage of your capital on a single trade. Keep your portfolio diversified across different instruments or sectors to avoid one position derailing your progress.

4. Review and Reflect

Post-trade analysis is vital. Review both wins and losses to learn what worked — and what didn’t. This practice sharpens your strategy and builds emotional resilience over time.

-- Why Cutting Losses Strengthens Your Portfolio --

There’s long-term power in letting go. Here’s what cutting losses early can do for you:

1. Preserve Capital

The faster you cut a losing trade, the more capital you retain — and the more opportunities you can pursue. Capital preservation is the foundation of longevity in trading.

2. Reduce Emotional Stress

Sitting in a losing trade weighs heavily on your mindset. The stress can cloud your judgment, increase risk-taking, or cause hesitation. Exiting early reduces this emotional drag and keeps you clear-headed.

3. Reallocate to Better Setups

Exiting losing trades frees up both capital and mental energy for higher-probability opportunities. This proactive approach builds momentum and reinforces the idea that it’s okay to be wrong — as long as you act decisively.

Consider also reading this article:

-- Final Thoughts: Discipline Over Denial --

Holding onto losing trades may feel like you're showing patience or commitment — but in reality, it's often denial wrapped in hope. Trading is about probabilities, not guarantees. The most successful traders aren’t the ones who win every trade — they’re the ones who manage losses with discipline.

Letting go of a bad trade is a show of strength, not weakness. It’s a deliberate choice to protect your capital, stay agile, and refocus on trades that serve your goals. The market doesn’t owe you a comeback — but with a clear head and disciplined approach, you can always find your next opportunity.

✅ Please share your thoughts about this article in the comments section below and HIT LIKE if you appreciate my post. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

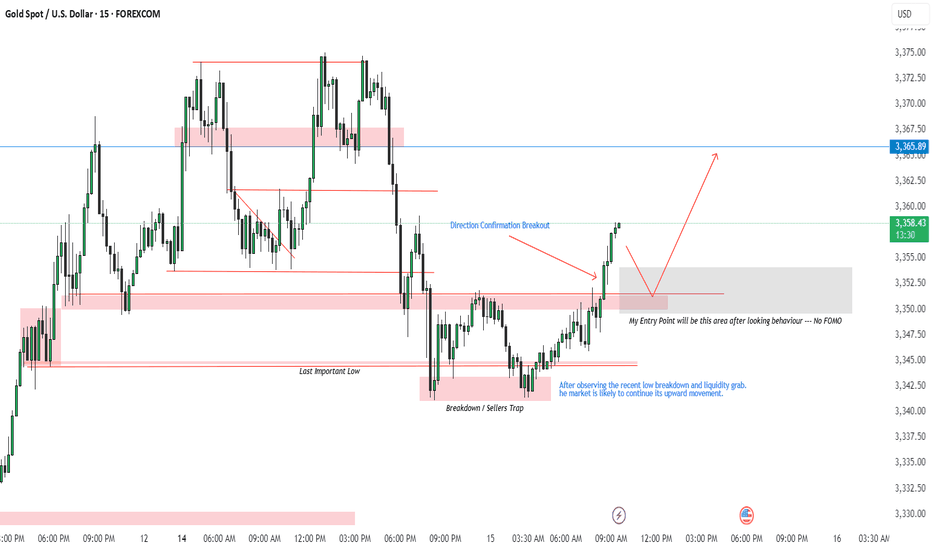

XAUUSD Trade Plan | 15 July 2025After observing the recent low breakdown and a clear liquidity grab, we saw a strong direction confirmation breakout. This suggests that the market is likely to continue its upward momentum.

🔄 Breakdown/Seller Trap triggered the reversal

🔹 Last Important Low respected

📈 Breakout confirms bullish direction

✅ Plan:

I’ll be watching for a pullback into the grey demand zone (highlighted area) for a potential long entry.

🕵️♂️ No FOMO — I’ll only enter after price shows clear bullish behavior in this zone.

🎯 Target: 3,365.89 resistance

📍 Entry Zone: Grey box (based on previous structure)

Let me know your thoughts — are you also watching this zone?

#XAUUSD #GoldAnalysis #LiquidityGrab #SmartMoneyConcepts #PriceAction #TradingPlan #TradingView

Two Brains, One Trade: Why You Freeze Under PressureBy MJTrading:

In trading, your biggest opponent isn’t volatility.

It’s your own neural wiring.

Every trader operates with two main systems:

🧠 System 2 – Rational, deliberate, planning (Prefrontal Cortex)

🧠 System 1 – Emotional, instinctive, fast (Amygdala & Limbic Brain)

Before entry, System 2 is in control. You feel calm, logical.

But the moment money is at risk—especially in drawdown or after a missed TP—System 1 takes over.

💥 Stress hormones spike

💥 Focus narrows

💥 Long-term thinking disappears

💥 You freeze, or act impulsively

You knew what to do.

But you didn’t do it.

Because in that moment, your rational mind wasn’t driving anymore.

⚖️ Set & Forget vs. Floating Managers

Different trading personalities react differently under pressure:

🔹 Set & Forget Traders

Rely on automation or predefined exits to bypass emotional hijack.

They reduce cognitive load, but often feel regret when price goes “a little more.”

🔹 Floating Management Traders

Rely on intuition and live feeling. They stay with the chart, adjusting based on flow.

When calm and trained, they shine.

But under pressure, they’re more vulnerable to emotional loops:

– hesitation

– premature exits

– revenge tweaks

– system betrayal

🧘♂️ What can you do?

✔️ Pre-plan decisions

Make the hard calls before emotions kick in.

✔️ Mental rehearsal

Visualize trade management scenarios—yes, like athletes do.

✔️ Create fallback protocols

So if you freeze, your system still knows what to do.

🧠 For Those Who Want to Go Deeper:

“Thinking, Fast and Slow” by Daniel Kahneman

Understand System 1 & 2 thinking—and how cognitive bias shapes all decisions, not just trades.

“The Hour Between Dog and Wolf” by John Coates

A stunning look at how biology, hormones, and risk-taking collide in traders' brains.

🔓 Final Thought:

If your strategy works in theory, but breaks in real-time—

It’s time to work on your neural execution layer.

Because in trading, you don’t rise to your level of analysis—

you fall to your level of emotional wiring.

— MJTrading

#NeuroTrading #TraderTypes #TradingPsychology #SetAndForget #FloatingManagement #MindOverMarkets #EURUSD #MJTrading

Previous psychology Ideas:

Shorting Isn’t the Problem. Being a Psycho Bear Is.😵💫🪓 Shorting Isn’t the Problem. Being a Psycho Bear Is. 🔻📉

Hollywood is never wrong:

The genius from The Big Short is the psycho from American Psycho .

Same actor (C. Bale) — two sides of the same trader.

🎭 I made this chart because I see this often on TradingView:

People who prefer to short. Hoping for collapse.

Even Rooting for war. To Celebrating blood short profit.

Perma-bears who hate seeing price go up because they missed the trade.

Let’s be real — that’s not trading.

That’s emotional self-destruction masked as 'strategy'.

We just saw over $1B in shorts liquidated as Bitcoin ripped through $118K.

And still — some refuse to let go of their bias.

This chart says it all:

🔹 The "Smart Bear" — does research, uses structure, trades what’s real.

🔻 The "Psycho Bear" — needs things to collapse, just to feel right.

💔 And here’s the truth I want to share with you today:

If you catch yourself unable to celebrate others making money ,

If you feel angry when price pumps and you missed it,

If you’re wishing for collapse or chaos just so you feel seen...

Something’s off. That’s not trading. That’s pain talking.

Buying is more than just a trade — it’s hope , it’s optimism , it’s love .

Being bullish is an act of belief in the future.

And yes — we sometimes need to short. We do it with clarity.

But I’m a bull who sometimes must go short. Not a bear who wants the world to burn.

“We go long. We go short. But we never go blind.”

📉 Don’t let bitterness guide your charts.

📈 Let discipline, structure — and a bit of heart — guide you instead.

One Love,

The FXPROFESSOR 💙

⚠️ Disclosure:

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Let your winners run🧠 Fear | Hope | Growth – When Trading Meets Emotion

The message on the chart isn't just poetic — it's real psychology.

🔹 Fear wants to cut your winners short.

It sneaks in after a small move in your favor.

"What if it reverses? I better lock this in."

And just like that, a great trade turns into a missed opportunity.

🔹 Hope drags you into holding too long.

It dreams: "Maybe it doubles... maybe this time it'll be massive."

But it's not guided by data — it's driven by fantasy.

🔹 Discipline is what sits in the middle.

Quiet. Neutral.

It doesn’t scream or seduce — it just follows the plan.

And that’s where Growth lives — not just on the PnL, but in your psychology.

When Bitcoin pushes toward new ATHs, these emotions get amplified.

The real question becomes: Can you manage yourself, not just your trade?

📌 A Real Example from My Desk

In my earlier BTCUSD idea — “Another Edge – Decision Time” (shared above) —

I sent that setup to one of my managed clients.

He entered long exactly at the edge of the channel — a clean, strategic buy.

Price moved beautifully in our favor…

But he manually closed the trade at 106,600 — long before the move matured.

Why?

Because fear of giving back profit overwhelmed the original plan.

The chart was right. The timing was right.

But the exit was emotional, not tactical.

✅ The trade made money.

❌ But the lesson is clear: a profitable trade doesn’t always mean a disciplined one.

🎯 Final Takeaway:

“Fear kills your winners. Hope kills your timing. Discipline grows your equity and your character.”

🗣 What would you have done in that position?

Held longer? Closed at resistance? Let it run toward ATH?

Let’s talk psychology — drop your thoughts 👇

#MJTrading

#TradingPsychology #BTCUSD #FearHopeDiscipline #LetYourWinnersRun #PriceAction #BTCATH #ForexMindset #CryptoStrategy

Trading at the market topHello,

The stock market is back at an all-time high. This often brings excitement for existing investors—and a sense of anxiety or even FOMO (fear of missing out) for those who stayed on the sidelines when prices were lower.

It’s tempting to jump in, especially with headlines filled with optimism and portfolios showing green across the board. But this is also a time for caution and patience.

After a sustained rally, price levels often outpace fundamentals like earnings growth, economic stability, or interest rate trends. In such moments, valuations can become stretched, and investor sentiment overly euphoric conditions that typically precede short-term pullbacks or corrections.

Buying at the top locks in risk, not value.

If you're feeling late to the party, remember that good investors don’t chase prices—they wait for prices to come to them.

The best opportunities often come in moments of fear, not euphoria. And while this market high may go higher still, history shows that eventually, corrections come—and those prepared for them are the ones who win in the end.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD - The One That Survived All Ages - Trading PsychologySummer light reading between trades💫

From Ancient Gods to modern banks — Gold never needed marketing to be priceless.

Gold was never invented.

It was found, worshipped, stolen, buried, and bled for.

Long before charts, before forex pairs, before brokers — it was power.

So if you're wondering why this metal moves the world?

Let’s take it back — way back.

But before we dive into history, here’s why traders are addicted to XAUUSD:

It’s fast. Ruthless. Liquid. It can deliver a week’s profit in one candle — or wipe you out in seconds.

If you understand structure, it will reward you like nothing else.

If you’re lazy, impulsive, or just guessing?

It’ll humble you fast and without mercy.

The Discovery – Gold Before Currency

• Gold was first discovered in Paleolithic caves (~40,000 B.C.), admired purely for its beauty.

• Ancient Egyptians called it “The flesh of the Gods” — Pharaohs were buried with it, because in their mind, you couldn’t enter the afterlife without gold.

• No value was assigned — it simply was value.

Empire Fuel – Gold as the Engine of War

• The Roman Empire used Gold Coins (Aureus) to expand its reach.

• Spain and Portugal built fleets just to steal it from the Americas.

• Entire wars were started and sustained by it — Gold wasn’t a luxury; it was national survival.

Gold & the Banks – Trust in a Metal

• 1816: The UK made Gold its official standard.

• By the early 1900s, most major economies followed — every currency was tied to the physical rulling metal .

• Why? Because you can’t print trust. But you can weigh it.

• Even today, central banks don’t hoard crypto or tech stocks — they hoard Gold, quietly, relentlessly.

Collapse, Rebirth, and Chaos – The Modern Era of Gold

• 1971: U.S. President Nixon kills the gold standard.

➤ Until then, every dollar had to be backed by real gold in U.S. vaults.

➤ After that? Dollars became promises, not assets.

• Welcome to the fiat era — where money has no anchor, just hope.

• Gold, no longer “money,” became something more powerful:

➤ The panic button, the global fallback, the last honest asset when everything else crumbles.

• And crumble it did:

🔹 2008: Banks collapse — Gold soars.

🔹 2020: Global lockdown — It explodes.

🔹 2022–2024: War, inflation, debt ceilings, de-dollarization — Gold reclaims the throne.

When fear wins, this metal doesn’t blink. It rises.

From Ancient Tombs to 2025 – Gold’s Unshakable Throne

• Today, you stare at candlesticks.

You mark order blocks, gaps, and key level zones.

But beneath that technical setup is a story written in blood, empire, and survival.

• Gold has outlived Kings. Outlasted currencies. Outsmarted every attempt to replace it.

You can crash a stock. You can ban a coin.

But you can’t cancel this number 1.

• And now? It’s 2025.

The world is uncertain. Digital assets are volatile.

And Gold is still the most traded, most hoarded, most feared asset on Earth.

• You’re not here by accident. You chose to trade this beast — not because it’s easy, but because you know what it means to master chaos.

So you’re not trading a metal.

You’re trading a legacy, so pay respect.

Every setup is a whisper from history — and every move on Gold is just the past repeating itself…

Only this time, the empire isn’t outside.

It’s YOU.

And your chart is your battlefield. So make an effort and study XAUUSD before trading it.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Following Price Flow to the Next TargetPrice swept liquidity below the previous day’s low and then powered back up, breaking structure to the upside. Now it’s sitting above the 50 EMA, moving through fair value gaps left by the rally. I’m watching for a possible pullback into the FVG zone near the EMA. If that level holds, price could look to reach for the liquidity above around 3,365.

But here’s what matters most. Even if this ends up being a losing trade, I’d rather take that loss knowing I stuck to my plan than catch a random win by breaking my rules. Because long-term, winning trades that come from impulse actually set you up for future damage. They teach bad habits.

Losses that happen inside your system? Those are simply the cost of doing business. They protect your discipline and keep your edge intact. Over time, that’s exactly what allows you to stay in the game and grow your account.

The Market Rewards the PatientLast week was probably one of the slowest weeks I’ve ever had. I found two setups, but neither one truly materialized. They just didn’t meet all the conditions in my plan. It was tough. I won’t pretend it wasn’t tempting to drop my rules and chase other strategies just so I could be in the market.

But deep down, I knew exactly what I wanted. I want to be consistent . I want to trade like a professional . So I held back. All week, I watched and waited. No trades taken. It was boring, honestly . But that boredom protected my capital.

Instead of forcing trades, I spent the entire weekend backtesting , drilling into my strategy even more. I wanted to be sure that when my moment came, I’d recognize it without hesitation.

Then this week started. I didn’t know if it would be any different, but I trusted my process and stayed ready. Eventually, one clean setup appeared. I shared it here on TradingView. I managed my risk properly , took half my usual size at just 0.5%, and let the trade run. It almost hit my stop, but I didn’t touch it. It was simple: either TP or SL .

And this time, it hit TP. A clean 1:4.

This was a powerful lesson. Following my plan didn’t just lead to a winning trade. It protected my capital all of last week when the market wasn’t offering quality setups. That patience and discipline paid off.

That’s how you build consistency. That’s how you survive long enough to catch the trades that truly matter.

EURCAD: Liquidity taken, imbalance left behindPrice swept the liquidity above the previous day’s high and then broke structure to the downside. That’s often a sign that smart money was hunting stops before shifting direction. Now I’m watching for price to come back and fill the imbalance (FVG) it left after the break.

If that happens and price respects the FVG zone, we could see a continuation lower with the next target being the previous day’s low where more liquidity is likely sitting.

I’ve also added the 50 EMA here as confluence. It helps keep me trading in line with the broader market flow and stops me from fighting the trend.

This is one of those spots where patience is key . Let the market return to the zone on its own terms, wait for a reaction, and keep protecting your mindset just as carefully as your capital.

How to Trade the Forex Market on Memorial & Independence days?Trading the foreign exchange (Forex) market on major U.S. holidays like Memorial Day (May 29th) and Independence Day (July 4th) presents a unique set of challenges and requires a strategic shift from typical trading days. While the global Forex market remains technically open 24/5, the closure of U.S. banks and financial institutions leads to significantly reduced liquidity and trading volume, altering the market landscape.

Here’s a comprehensive guide on how to approach Forex trading on these holidays:

Understanding the Market Conditions: The "Quiet" Danger

The primary characteristic of Forex trading on U.S. holidays is a sharp drop in liquidity, especially in currency pairs involving the U.S. dollar (USD). With American traders and institutions away from their desks, the volume of transactions plummets. This "quiet" market environment can be deceptive and carries specific risks:

Wider Spreads: With fewer market participants, the difference between the bid and ask prices for currency pairs tends to increase. This makes it more expensive to enter and exit trades, eating into potential profits.

Increased Volatility and Spikes: Don't mistake low volume for a flat market. With a thin order book, even moderately sized orders can cause sharp, sudden price movements or "spikes." These moves can be unpredictable and may not follow typical technical patterns.

Price Gaps and Slippage: The reduced liquidity can lead to price gaps, where the market jumps from one price to another without trading at the levels in between. This increases the risk of slippage, where your order is executed at a less favorable price than intended.

Ineffectiveness of Some Strategies: Strategies that rely on high volume and momentum, such as breakout trading, are more likely to fail. A perceived breakout may lack the follow-through to become a sustained trend.

Strategic Approaches for Trading on Memorial Day and July 4th

Given the unique market conditions, traders should adopt a cautious and well-considered approach. Here are several strategies to consider:

1. The Prudent Approach: Step Aside

For many traders, particularly novices, the most sensible strategy is to avoid trading altogether on these holidays. The increased risks and unpredictable market behavior can easily lead to unnecessary losses. Consider these days as an opportunity to study the markets, refine your overall trading plan, or simply take a break.

2. Trade with Reduced Size and Realistic Expectations

If you do choose to trade, it is crucial to adjust your risk management:

Lower Your Position Sizes: This is the most critical adjustment. Trading with smaller lots will mitigate the potential impact of sudden price spikes and wider spreads.

Adjust Profit Targets and Stop-Losses: Be realistic about potential gains. The market may not have the momentum for large moves. Consider setting smaller profit targets. At the same time, be mindful that tighter stop-losses can be easily triggered by short-term volatility.

3. Focus on Non-USD Currency Pairs

Since the holidays are U.S.-based, currency pairs that do not involve the U.S. dollar may be less affected, although a general decrease in global liquidity is still expected. Cross-currency pairs such as EUR/JPY, GBP/JPY, or AUD/NZD might exhibit more "normal" behavior than majors like EUR/USD or USD/JPY. However, remain vigilant for lower-than-usual volume across the board.

4. Employ Range-Bound Strategies

In low-liquidity environments, currencies often trade within a defined range. Strategies that capitalize on this behavior can be more effective than trend-following approaches. Look for well-established support and resistance levels and consider trading the bounces off these levels.

5. Be Wary of News from Other Regions

While the U.S. market is quiet, significant economic data or geopolitical news from other regions (Europe, Asia) can still impact the market. With low liquidity, the reaction to such news can be exaggerated. Stay informed about the global economic calendar.

A Day-by-Day Look

Memorial Day (Last Monday of May): This is a major U.S. holiday, and its impact will be felt throughout the 24-hour trading period. Expect very thin liquidity during the Asian and European sessions, which will worsen significantly during what would typically be the busy New York session.

Independence Day (July 4th): The impact of July 4th can sometimes extend beyond the day itself. Often, the trading day before (July 3rd) will also see reduced volume as traders close positions ahead of the holiday. On July 4th, expect market conditions similar to Memorial Day, with a significant drop in activity and the associated risks.

In conclusion, while the allure of a 24-hour market is a key feature of Forex, wisdom lies in recognizing when not to trade with your usual strategy and size. Approaching U.S. holidays like Memorial Day and Independence Day with caution, a revised strategy, and a keen awareness of the risks is paramount for preserving your trading capital. For most, these are days best spent on the sidelines.

Navid Jafarian

Why Gold Trading is Not Easy for Beginners - Trading PsychologyGold Doesn’t Just Teach Trading. It Teaches You Discipline.

1. Why Gold? Why Not Everything Else?

Gold is the most honest manipulator in the market.

It respects structure down to key intraday levels—but builds traps around it like a pro.

It fakes direction, sweeps liquidity, teases early entries, then moves beautifully for anyone patient enough to wait.

And it’s daily: one premium buy and one killer sell almost every day—hundreds of pips on the table for eyes that can see.

Other assets feel slow once you lock into Gold’s rhythm.

So what to expect:

2. The Phases Before Profit

• Lucky Dumb Money

Early wins boost your confidence. You increase your risk. It all feels easy—until the market proves otherwise.

• The Slap

Suddenly, things don’t work anymore. Indicators stop making sense. Emotions interfere. Results shift, and frustration creeps in. This is the breaking point for most traders. 6 months to 1 year on XAUUSD and they are out.

• The Awakening

This is when clarity begins. Indicators are dropped. Structure, liquidity, and timing take center stage.

What once looked random now starts to make sense.

Progress begins the moment YOUR EGO gets quiet.

Consistency only follows those who choose patience over panic.

3. Gold Is a Mirror

Gold doesn’t just reflect your trades — it reflects YOU.

Every personal flaw shows up on the chart: impatience, doubt, greed, fear, ego.

It mirrors your decisions, your reactions, your emotional patterns — all of it.

Blaming the market delays growth.

But the moment you turn inward, you begin to see the truth:

your results reflect your level of discipline, clarity, and self-awareness.

Gold forces you to evolve.

Not just as a trader, but as a thinker, a decision-maker, a human.

That’s why it’s not for everyone. Some people are not ready to recognize who they truly are yet.

4. What Leads to Profitability

What actually leads to profitability in Gold?

It’s fast. It’s full of adrenaline.

But you have to get a routine - consistent, structured, and effective — when applied with discipline.

→ One pair only. Mastery on XAUUSD

→ Structure first. Liquidity, imbalance, session timing

→ Fewer trades, cleaner entries

→ Smaller lots, more control = emotions are in check

→ Relentless observation. Learn from each execution and adjust with intention

This is what leads to results.

Not noise. Not hope. Just precision and presence — again and again.

5. You Won’t Win Until You Commit

You don’t need to destroy your schedule or stay up all night.

But you do need to make time for growth.

Signals won’t help if you’re not willing to understand the asset you’re trading.

Gold filters out shortcuts, distractions, and surface-level effort.

But those who take it seriously earn every pip — and they earn it with clarity, not luck.

So stop asking,

“How long until I’m profitable?”

Start asking,

“Am I ready to do what Gold actually demands?”

CONCLUSION:

Most traders don’t fail because Gold is too complicated—

they fail because they try to figure it out alone.

They chase signals, skip the process, and ignore the real path to consistency:

invest in education, proper mentorship, and trading psychology coaching.

The ones who grow fastest are those who seek guidance early—

from people who live and breathe this market, and understand structure, mindset, and pressure.

If you choose to go at it alone, that’s also a good choice.

Just know: it will take longer. It will test your patience and your clarity.

But when the structure clicks… when you stop chasing setups and start executing with confidence…

When you secure 3–4 solid trades a week and avoid unnecessary losses—

everything changes. Trading becomes calm. Focused. Even enjoyable.

Whichever path you take, the outcome depends on the same thing:

Gold won’t just test your trades.

It will develop your discipline.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Embracing Uncertainty

In trading, the illusion of certainty is often our biggest enemy.

Even the cleanest setups—like a MTR (Major Trend Reversal)—can fail.

Mark Douglas said it best:

“Anything can happen.”

This simple truth is what keeps professional traders humble and disciplined.

Respect the market, manage your risk, and never assume you know what comes next.

Stay sharp.

#MJTrading

#GoldTrading #XAUUSD #TradingPsychology #AnythingCanHappen #MarkDouglas #ForexMindset #TradingQuotes #PriceAction #RiskManagement #MindOverMarkets #ChartOfTheDay #MJTrading

Master Your Edge: It’s Not About Just Being Right

Most traders obsess over being right on every trade. But the truth is, consistent profitability doesn’t come from perfect predictions—it comes from disciplined risk management.

Mark Douglas reminds us:

“Trading is not about being right or wrong. It’s about how much you make when you’re right and how much you lose when you’re wrong.”

Focus less on proving yourself right, and more on protecting your capital when you’re wrong. That’s how professionals thrive in uncertain markets.

#MJTrading

#TradingPsychology #MarkDouglas #ForexMindset #TraderMindset #EURUSD #TradingQuotes #ForexLife #RiskManagement #TradingDiscipline #ForexEducation #ChartOfTheDay #PriceAction #MindOverMarkets

XAUUSD - Prop firm or your own account? - Trading Psychology"$100K Funded? Or $1K account you own?? Welcome to the Inside Battle of Every Trader"

You want capital, freedom and win big.

But the question is: do you do it with your own money, or someone else’s?

You’ve got the $100K funded dream on one side. Big leverage, strict rules, payout drama.

And on the other side? Your own $1K account. Zero limits, zero support, and a whole lot of emotional damage.

This is a breakdown of what really happens behind both paths — the adrenaline, the self-sabotage, the mind games, and the payouts that sometimes never come.

The Prop Firm Path: Pass, Survive, Then Pray

Phase 1: You trade with hunger.

You’ve got the goal in sight, and every move is calculated. You’re alert, focused, mechanical. The structure helps. The rules feel like a challenge. Everything feels possible.

Phase 2: You trade with fear.

Now you’re tiptoeing. The target’s smaller, but the pressure is suffocating. Hesitation.Overthink. You play defense — and that’s when you lose. You stop executing your edge and start trading to avoid failure.

Funded: The real test begins.

You go live, you trade well, you hit payout… and suddenly the firm has a problem. A new rule is “suddenly” enforced. A clause is reinterpreted. A delay happens. You’re told to wait. Or worse — your account is shut with no warning.

That’s the part no one prepares you for: the waiting, the silence, the mental snap.

Passing isn’t the end. It’s barely the middle.

✅ So, Should You Go Prop? Here's What You Need to Know

Yes — if you’re ready to treat this like a hostile contract.

If you’re trading a prop account, you are trading their rules, their terms, their timing. You are not a partner — you are a performer. And they are very comfortable pulling the plug.

If you do it:

• Be colder than the system.

• Read every rule twice.

• Trade Phase 2 like a surgeon — no ego, no rush.

• And never treat a payout like it's guaranteed — treat it like a fight you have to win more than once.

You don’t just pass. You survive.

And if you’re not ready to survive, stay out.

🚨 Do not forget — It’s Simulated Capital. And That’s the Game.

Let’s not pretend it’s hidden:

You’re NOT TRADING REAL MONEY. You’re executing on a simulated account that mirrors real conditions — nothing more.

When you get paid, it’s not because you “grew” capital. It’s because you performed better than the masses who failed their challenges and fed the payout pool.

This isn’t shady. It’s the model — and it works because most traders lose.

So don’t delude yourself into thinking you’re managing funds.

You’re monetizing discipline inside a challenge-based system.

And if you know how to work that system? You get paid.

If you don’t? You become someone else’s payout.

🔓 Trading Your Own Money: Real Freedom or Emotional Damage?

With your own capital, there’s no one watching — and no one helping.

You set the rules. You decide how aggressive, how cautious, how chaotic.

But the second you click “Buy,” your psychology comes for you like a debt collector.

Because real trading isn’t what’s on the screen — it’s what’s happening between your ears.

You lose your money, you lose your confidence.

You win big, and suddenly you think you’ve figured out the market — until the market slaps you for it.

There’s no one to blame, and that makes it ten times harder.

But here’s the part no one can take away from you: every lesson is yours.

Every win is clean. Every loss hits deep. And if you make it — you really made it.

💡 How to Make Self-Funded Work for You

✅ Start with small capital — but also invest in your trading education.

Join a group that teaches you how to trade, not signal groups that just give you orders when to buy or sell, without explaining why.

✅ Join a real trading community.

Surround yourself with people who post actual breakdowns — who teach, not flex.

Avoid ego chats. Avoid circus chats. Find people who show the why, not just the entry.

(If you’re reading this, you already found the right space.)

✅ Focus on fixing mistakes — not faking wins.

Nobody cares how many pips you caught if you blew 5 trades getting there. Get real about your risk management and lot size.

✅ Learn to stop after a win.

Don’t feed your dopamine. Protect your equity. Walk away while you’re still in control.

✅ Respect your losses. Don’t chase them.

Red days don’t destroy traders. Revenge trading does. Stop. Reset. Come back sharper.

✅ If you’re not paying yourself yet, don’t panic.

Some seasons are for building, not cashing out. Don’t force results just to feel good — let the system earn before it pays.

🔄 The Hybrid Advantage: Rent the rules. Own the skill.

Some traders don’t pick a side.

They use prop firms like a hired weapon — fast, effective, disposable and

Personal accounts like a vault — protected, scalable, sacred.

They switch between them based on market conditions, mental load, and long-term goals.

You don’t need to be loyal to a style just be loyal to your results.

🧠 Final Word:

Trading becomes real, sustainable, and successful only when your mind is at peace with the path you chose.

If you wake up anxious about your account — if you feel pressure before you even open the chart — that’s not discipline, that’s misalignment.

This doesn’t mean trading should feel easy. But it should feel right.

You should wake up curious to read price, not terrified to take a trade.

Whether you trade $100K or $1K, the real account is always in your head.

You should feel like this work belongs to you — not like you’re trying to survive someone else’s idea of success.

Whether you trade with a prop firm or your own account, or both, the goal is the same:

Mental clarity. Emotional control. Strategic confidence. You’ll know you’re on the right path the moment the stress fades — and the obsession becomes patience, structure and joy with success.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Gold XAUUSD Summer Price Action - Trading Psychology☀️ Summer Trading Blues? Here’s How to Stay Sharp Without Burning Out

Summer trading on Gold isn’t for the impulsive or the greedy. Liquidity dries up, sessions lose momentum, and the clean, aggressive price action we love? It goes on vacation too.

But that’s not a bad thing. It’s an opportunity.

This is the season where traders either burn out... or build.

Here’s how to keep your edge sharp while the markets slow down — and why a positive, focused mindset is your biggest asset until volatility returns.

Why Summer PA Feels “Off” on Gold

You’re not imagining it — gold price action does shift in the summer, and here’s why:

🏖️ Bank Holidays & Institutional Slowdowns

• Major global banks take scheduled breaks — including in the US, UK, EU, and Asia.

• Trading desks reduce activity, and high-volume players shift into passive management mode.

• This results in lower volume, fewer impulsive moves, and more algorithmic fakeouts.

📆 Official Holidays + "August Mode"

• US Independence Day (July 4), UK Summer Bank Holiday (late August), and more → NY and London sessions thin out or lack follow-through.

• Most institutional traders go on leave. Some desks run skeleton crews. No joke.

• Unless a major geopolitical catalyst (e.g. war escalation or surprise central bank move) hits the headlines, price will drift or trap.

🏄♂️ Retail Overreach & Emotional Traps & Vacation Time

• Retail traders often “force” trades in quiet markets to stay busy.

• This leads to chasing, overtrading, and emotional fatigue — the exact trap smart traders avoid.

• Most regular traders also go on vacation or scale back — unless they’re mentally obsessed with Gold and can’t let it go.

Bottom line:

Summer PA is slower, trickier, and full of emotional bait. Learn to read the stillness — not fight it.

💡 Your Summer Trading Mindset Kit

Instead of complaining about the range, use this time to train your mindset.

Here’s how:

⚖️ Stay Emotionally Neutral — Even When Price Isn’t

Summer markets bait your emotions: fake breakouts, slow reactions, and dead zones.

To stay in control, build structure around your execution:

✅ Pre-market: Make a clear plan with meaningful zones and set alerts — don’t wing it on hopes and dreams

✅ Post-market: Write down why you stayed out or why your trade was clean — not just wins or losses

Neutrality isn’t passive — it’s disciplined clarity, even when the chart’s doing nothing.

🎯 Focus Over FOMO

Short sessions. Laser focus. Clean execution.

→ Limit distractions

→ Trade only clear, structured setups

→ Respect no-trade days as productive days

Flow isn’t magic — it’s discipline + environment.

🤝 Find the Trading Circle That Matches Your Style — to reinforce your style

Not every group fits you — and not every voice deserves your attention.

Look for people who:

• Respect structure over noise

• Give thoughtful, honest feedback

• Celebrate patience and growth, not screenshots and bragging and 20-30 pips wins

A real trading circle matches your energy and raises your game — not your cortisol.

💭 Reconnect With Your “Why”

If you’re here just to “make money,” summer will test you hard.

Purpose anchors you when price doesn’t. Ask yourself:

• Why do I trade?

• Who am I becoming through this process?

No purpose = burnout.

Purpose = clarity, even in silence.

📈 Discipline Pays When Gold Doesn’t

Forget chasing fireworks in dead markets.

Summer rewards the trader who does less but does it right:

✅ You skipped noise? That’s a win.

✅ You waited for your zone? Pro-level move.

✅ You tracked your behavior? You’re not guessing — you’re evolving.

While others burn out chasing crumbs, you’re stacking discipline — and that’s what you’ll cash in when the real moves return.

Final Words: Quiet Traders Get Loud Later

Summer might be slow. But your growth doesn’t have to be.

While others force trades, smart traders sharpen edge.

You’re not falling behind by sitting out chop — you’re building mastery for when real money moves return.

🗓️ So in September YOU are going to show up: stronger, clearer, and 3x more prepared.

If this lesson helped you today and brought you more clarity:

Drop a 🚀 and follow us✅ for more published ideas.

Gold’s in a Trap — And That’s Exactly Why You Should Be CarefulGold is stuck in a tight sideways range. It’s been bouncing between $3,370–$3,380 for two days now. Everyone sees it. Every trader watching gold knows this level acted as support — and judging by the candle shadows, buyers are getting aggressive here.

So if you're purely technical — yeah, looks like a solid buy right now.

But here’s the twist…

___________________________________________________________

I’m not buying.

And I’ll tell you why — because it's too obvious.

When something screams "buy" from every chart and every textbook, that’s when you pause and ask yourself:

“Am I about to walk into a classic setup… or actually catch a real move?”

Because history shows us — these textbook setups often play out like this:

Motivation → Encouragement → Payback. (See Chart 2)

It goes like this:

Price breaks a visible high or low (Motivation)

Traders jump in and get some pips(Encouragement)

Then — brutal reversal (Payback)

Only then will everything get off the ground, and it will be fast, so that the "unnecessary" passengers who were "dropped off" should not have time to return to this train. So why are they "unwanted"? Well, here's one possible answer: because retail tends to hold losing trades too long , but gets spooked early on winners. We’re wired that way.

So what happens when everyone starts booking profits after a small bounce?

You get limit sell orders piling up , slowing momentum — sometimes even flipping the trend.

And then what do big players do?

Then come back in — buying at higher levels, averaging their positions. Not the best case scenario....

Key Takeaway:

______________________

Here’s my advice — especially if you’re in this game long-term:

1. Avoid those super obvious setups everyone else is jumping into.

2. Instead of asking, "Why should I open a trade now?"

Try asking: "Why shouldn’t I open a trade now?"

p.s.

If you liked this kind of deep-dive — follow along. We don’t just read charts. We read the market behind them.

Conclusion:

_________________________

📍 Gold is testing a key zone — but don’t let the crowd pull you in.

🧠 The first quick impulse is often a trap

📈 Stay sharp, stay ahead.