Public

EU made a retracement Friday. Looking for Bullish movement!After Top- Down analysis i'm looking for EU to move to the upside.

This is not trading advice or a signal!

The Website should not be relied upon as a substitute for extensive independent market research before making your actual trading decisions.

SEND ABOVE 1USDT TO THIS ADDRESS, WE'VE GOT A TARGET🎯Meet Julia, She's been trying hard to get into college, and she finally got in, sad part is her family does NOT have enough to pay for her college tuitions.

There's only so far I can go in helping her as an individual...

I decided to ask the Public to help in her aid!

Here's the USDT ADDRESS:

TRC20; TL2QbgdAERJRc6KXCsT5viKCG72p9PsPNq

Make it count!🎯

VACQ: Vector Acquisition and Rocket Lab mergerNASDAQ:VACQ

I spot a nice triangle (or wedge?) signaling a major breakout. No idea if it's to really to the upside but my guess is that it's going green. There's that recent announcement that Rocket Lab is going public via SPAC called Vector Acquisition (VACQ) is promising. This IPO could be a game-changer. I'm still researching the company but they seem to have a lot of potential. Who knows!

Do your own research. This isn't financial advice and I'm not a financial advisor. I am not a cat.

References: www.rocketlabusa.com

Looking at NSE retail investors strategy🤓

If you are wondering what was public shareholders favorite stock in summer 2018, this is it:

Obviously, what did you expect? 😆

Compared to the N50 which of course has crashed recently but apart from that in an uptrend:

I will translate a story from punjabi (nah I'm jk it's in english)

Buying aggressively a fast falling stock with lots of reports of fraud and 0 institutional interest.

Maybe they can please insanity or several mental disability?

At least alot of those that retail sold the most (not short, just abandonned) are down a ton, ALTHOUGHT it wouldn't surprise me that they started buying as the price fell a lot.

We can look at a few other of retail favorite holdings nearly 2 years ago...

Alot of big gains in the past and then a crash. Basically the stocks which are the very best to short.

"Past performance is not indicative of future performance" is a sentence too complex to understand I guess.

Imma start a fund, set alert on retail picks, go short, profit.

Shorting stocks that are down 90% is probably one if the easiest ways to make money, probably the main issue is it does not scale obviously.

K that's enough for today. I am trying to imagine someone trying to convince me to try and teach traders and like I'd owe him one so I'm imagining myself "umm ok so biggest tip emm don't be complete idiots". I don't understand how this can have kept going for a century or more. When did "retail investing" become a thing? In the 1920s? Ye and all the problems started to appear then... Hitler etc. No one cares about the history, bunch of brainlets. Huge interest in finding out what the best indicator is and how much a day trader can earn. If these idiots ever make money I'm jumping off a cliff. Retail investing was nearly non existant in 1600-1800 right?

Goldman Sachs blames mom & pop investors for stock volatility (retail investing must be at ath by now)

www.marketwatch.com

I'll try posting about dumb money when I find data, I found robinhood users holdings and indian holdings, there must be more.

South Korea were all in crypto, so they must be interesting. They're supposed to be the country with highest IQ, would be funny to see what crap they invest in.

OOOOO It looks promising:

www.businesstimes.com.sg

www.straitstimes.com

😊

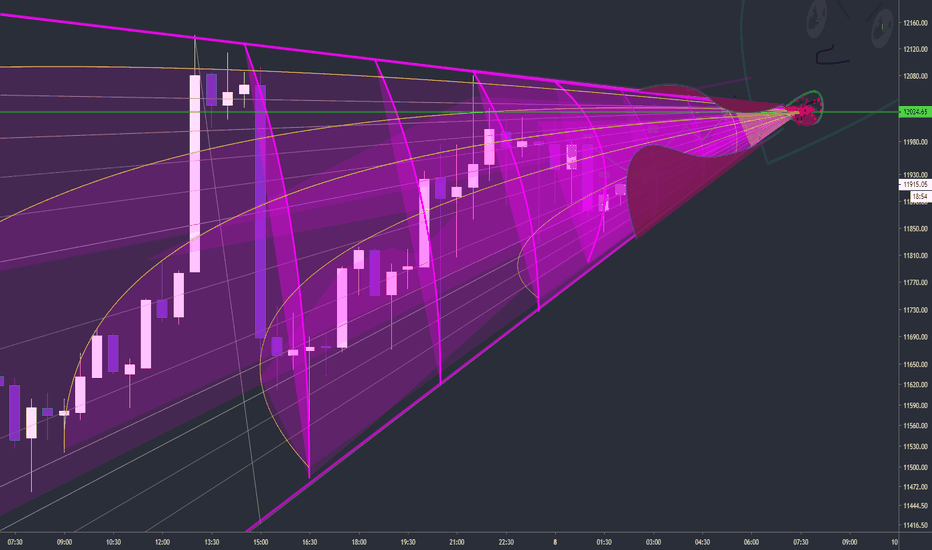

Bitcoin will go to 10500There's no need for any analysis. I don't even need to draw anything on my chart. BTC will retest 10500. None of your indicators can predict what's going to happen. None of your strategies predicted BTC to go up 30% and none of your strategies will predict BTC is going up to 10500. This is all about public sentiment. Please comment below and I'll get back to everyone in a week when it retests the recent high.

RMI Is About To Make A MoveRand Merchant Investment (RMI) Holdings is an investment holding company with a portfolio of insurance and investment products targeted at the commercial, corporate, retail and public sector. The group’s history can be traced back to 2010 with the spinning off of insurance assets from Rand Merchant Bank (RMB) Holdings, FirstRand and Remgro. RMI Holdings shares were subsequently listed separately on the Johannesburg Stock Exchange (JSE), although RMB Holdings and RMI Holdings still share the same management team.

Technicals

On the weekly time frame, we can see a corrective structure formation, indicated in pink. The daily time frame, indicated in blue, shows a 5 wave corrective structure which has completed. This would indicate that there should be a break to the upside soon. This break will be the start of wave 4 on the weekly structure.