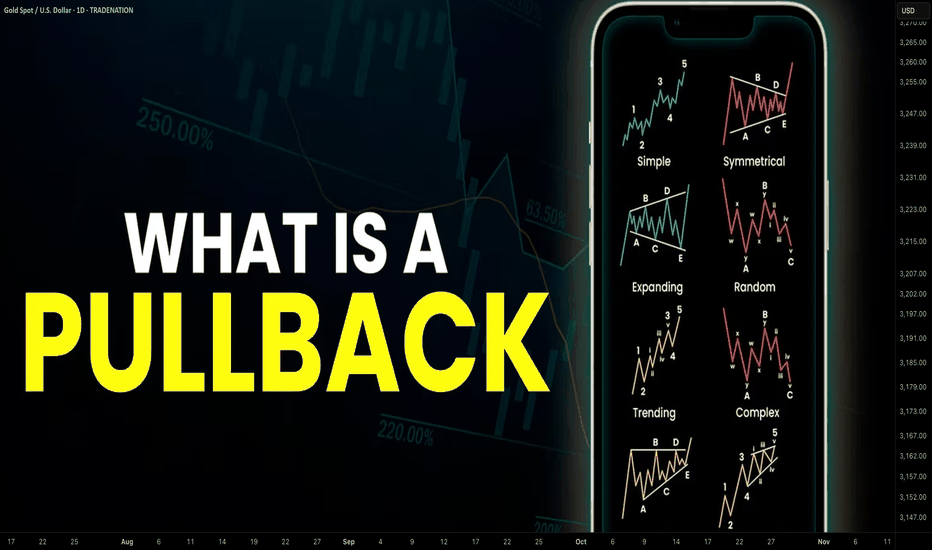

Learn What is PULLBACK and WHY It is Important For TRADING

In the today's post, we will discuss the essential element of price action trading - a pullback.

There are two types of a price action leg of a move: impulse leg and pullback.

Impulse leg is a strong bullish/bearish movement that determines the market sentiment and trend.

A pullback is the movement WITHIN the impulse.

The impulse leg has the level of its high and the level of its low.

If the impulse leg is bearish , a pullback initiates from its low and should complete strictly BELOW its high.

If the impulse leg is bullish , a pullback movement starts from its high and should end ABOVE its low.

Simply put, a pullback is a correctional movement within the impulse.

It occurs when the market becomes overbought/oversold after a strong movement in a bullish/bearish trend.

Here is the example of pullback on EURJPY pair.

The market is trading in a strong bullish trend. After a completion of each bullish impulse, the market retraces and completes the correctional movements strictly within the ranges of the impulses.

Here are 3 main reasons why pullbacks are important:

1. Trend confirmation

If the price keeps forming pullbacks after bullish impulses, it confirms that the market is in a bullish bearish trend.

While, a formation of pullbacks after bearish legs confirms that the market is trading in a downtrend.

Here is the example how bearish impulses and pullbacks confirm a healthy bearish trend on WTI Crude Oil.

2. Entry points

Pullbacks provide safe entry points for perfect trend-following opportunities.

Traders can look for pullbacks to key support/resistances, trend lines, moving averages or Fibonacci levels, etc. for shorting/buying the market.

Take a look how a simple rising trend line could be applied for trend-following trading on EURNZD.

3. Risk management

By waiting for a pullback, traders can get better reward to risk ratio for their trades as they can set tighter stop loss and bigger take profit.

Take a look at these 2 trades on Bitcoin. On the left, a trader took a trade immediately after a breakout, while on the right, one opened a trade on a pullback.

Patience gave a pullback trader much better reward to risk ratio with the same target and take profit level as a breakout trader.

Pullback is a temporary correction that often occurs after a significant movement. Remember that pullbacks do not guarantee the trend continuation and can easily turn into reversal moves. However, a combination of pullback and other technical tools and techniques can provide great trading opportunities.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Pullbacktrading

Mastering Volatile Markets: Why the Trend is Your Best Friend█ Mastering Volatile Markets Part 4: Why the Trend is Your Best Friend

In Part 1 , we covered reducing position size.

In Part 2 , we explored liquidity and execution strategies.

In Part 3 , we discussed the power of patience over FOMO.

Now,we're diving into one of the most important principles of all — especially in volatile, fast-moving markets: Follow the Trend. Trust the Trend. Trade With the Trend.

In wild markets like these, everything changes quickly. Indicators print overbought or oversold conditions well before the market even thinks about reversing.

Divergences can keep stacking up while the price continues trending for another 300, 500, or even 1000 points. Why? Volatility + Liquidity conditions = Extended trending behavior.

When liquidity is thin, and volatility is high, strong trends tend to last longer than usual:

Breakouts run further.

Breakdowns fall deeper.

And counter-trend trades? They're often a fast ticket to losses.

█ What Pro Traders Know Better Than Anyone:

In volatile markets, trend-following isn't optional — it's survival.

But wait, it is obvious that trends aren't perfect straight lines. So how can one even realistically “follow” a trend, especially in volatile markets.

Well, the key is to expect the unexpected. Experienced traders trade logically, we expect pullbacks, fakeouts, stop hunts, snapbacks and/or channel breaks. In fact, we prepare for them.

It is detrimental to assume the trend is over just because of these moves. Most of these are liquidity traps, not real reversals.

█ Here's What Pro Traders Do Differently:

⚪ They Identify the Core Trend Direction

Pro traders use price structure, trendlines, moving averages, VWAP , or higher timeframe levels to identify the trend direction. Once identified, every trade respects the trend.

Let me explain with an example.

→ Uptrend Identification:

Say you notice that the price of Gold (XAUUSD) has been consistently making higher highs and higher lows. What should you do?

You use the 100-period moving average (MA) and see that price is staying above it, indicating an uptrend. You wait for price to pull back to the MA, giving you a low-risk entry to join the uptrend rather than chasing the trend.

→ Downtrend Identification:

In a downtrend, USD/JPY keeps making lower highs and lower lows. You observe the 100-period moving average pointing down. This is your cue to look for short entries , avoiding countertrend buys that could trap you.

⚪ They ONLY Look for Entries at Key Trend Channel Levels

Professional traders don’t chase the price or try to catch every move. Instead, they patiently wait for price to return to key areas within a well-defined trend channel , either the upper boundary (in a downtrend) or the lower boundary (in an uptrend).

→ In an uptrend:

Pro traders draw a trend channel based on the price move. When price pulls back to the lower boundary of the channel (often aligning with demand zones), they start looking for long entries, aiming to trade with the trend and target a new high.

→ In a downtrend:

The same logic applies, but in reverse. Price pulls back to the upper boundary of the channel (supply area), offering a clean short opportunity to continue with the trend and target a new low.

But here’s what separates pros from amateurs:

→ They expect fakeouts, spikes , and temporary breaks beyond the trend channel — especially in volatile conditions.

→ They don’t panic when the price briefly moves outside the channel. Instead, they wait for confirmation signals (like a rejection candle, break of structure, or momentum shift) before entering.

→ This gives them both a logical entry point and a favorable risk-reward setup — aligning with the larger trend direction while staying protected if the trend fails.

⚪ They Treat Countertrend Moves as Opportunities to Enter WITH the Trend

When a countertrend move happens, pro traders see it as an opportunity to enter with the prevailing trend, rather than trying to catch a reversal.

→ Counter-Trend Move in an Uptrend:

Let's say S&P 500 is in a strong uptrend, and it experiences a sharp pullback of 5%.

While many retail traders panic and try to short the market, pro traders see this as a buying opportunity at a lower price, anticipating the trend will continue after the correction.

→ Counter-Trend Move in a Downtrend:

For Gold (XAU/USD) , if the price falls sharply from $1,900 to $1,850 and then retraces back to $1,875 (a previous support-turned-resistance level), pros see this as an opportunity to sell into the trend rather than buying into what could be a false recovery.

⚪ They Accept That Trends Can Look "Overbought" or "Oversold" for a Long Time

In volatile, trending conditions, RSI can stay above 70 for hours or even days, and divergences can build for a long time without price reacting.

→ RSI Above 70 in an Uptrend:

Bitcoin (BTC/USD) rallies from $40,000 to $60,000. Despite RSI being above 70 for a few days, pro traders don't fight the trend because momentum is strong. Instead, they look for a pullback to the 100-period MA for a safer entry.

→ Divergence in Downtrend:

The EUR/USD shows a bearish trend , but the RSI starts to build a divergence as the price keeps making lower lows. Pro traders ignore the divergence because the trend is still strong. They wait for a clear break of the trendline or confirmation that price has reversed before considering a long trade.

█ Summary of Part 4 — Trend is Your Best Friend

You can't control how far a trend will run…but you can control whether you're with or fighting against it.

And trust me, fighting a strong trend in a volatile market is a battle retail traders rarely win.

Here’s what you should take away from this article:

Volatile markets = Extended trends

Indicators can lie — trend structure tells the truth

Fakeouts & pullbacks are normal

Don't fight the trend — trade with it

Use counter-moves to enter the trend

Patience & trend-following = Survival + Profit

█ What We Covered:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Patience Over FOMO

Part 4: Trend is Your Best Friend

That's it! You've now completed the Mastering Volatile Markets series.

Stay calm, adapt quickly, and trade smarter — that's how you survive (and thrive) in volatile markets.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Short re-test and "Buy re-test" signals allow to trade the trendI am a huge fan of buying pullbacks in an uptrending market and shorting pullback in a down trending markets. This is why I always try to code algos that look for those continuation setups.

That Impulse Master Indicator haunts for those buyable and shortable setups

A PullBack Idea on NOTcoin | Updatewe can have a long trade in pullback! i try it :)

because of the high risk, This idea is'nt recommended, but it's suitable for the low volume of the test.

At the end of the week, NotCoin's movement will end with the closing of the one-day candle (as well as the weekly candle) in the price range of $0.03000.

Understanding the Perfect Buy Point in Swing TradingIntroduction

Swing trading is a strategy that traders use to capitalize on the "swing" or change in the prices of stocks. It involves holding a stock for a period ranging from a few days to several weeks to profit from price changes or 'swings'. A critical aspect of swing trading is identifying the perfect buy point (PBP), which is the most opportune moment to enter a trade.

The Concept of Perfect Buy Point (PBP)

The Perfect Buy Point is the price level at which the probability of gain is significantly higher than the risk of loss. It's not just about buying at a low price but buying at the right time when a stock is poised to increase in value.

Identifying the Perfect Buy Point

To identify a PBP, swing traders often rely on technical analysis, a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts look for patterns and signals that indicate the momentum is shifting in a way that suggests a move upwards.

Key Patterns for PBP

The Base Pattern (Point A)

The base is a pattern that looks like a consolidation or sideways movement in the price chart. After a decline, the stock begins to round out the bottom, creating a 'U' shape. The PBP occurs when the stock breaks out of this base on the upside with increased volume, signaling the start of a new uptrend.

The Pullback Pattern (Point B)

A pullback occurs after a stock has advanced and then begins to decline slightly. The PBP in this context is identified when the stock finds support and begins to turn upward again. The support level should be noticeable, and the upward turn should come with a surge in volume, confirming the strength of the trend continuation.

Graphic Analysis

In the attached graphic, two scenarios (A & B) illustrate potential PBPs. Each shows a different pattern leading up to the PBP, providing a visual representation of the textual description above.

Factors to Consider

Volume: Look for a significant increase in volume at the PBP. This is an indication that large investors are supporting the move.

Price Action: The stock should move through the buy point decisively, not just inch past it.

Market Environment: It is also essential to consider the overall market trend. Buying during a market uptrend will increase the chances of a successful trade.

Conclusion

The perfect buy point is a moment when the balance of evidence suggests a stock is likely to move higher. It is a combination of price action, volume, and pattern recognition. The graphic provided illustrates two classic scenarios for identifying PBPs. By understanding these concepts and combining them with a disciplined trading approach, you can enhance your ability to make profitable swing trades.

Remember, no matter how effective a strategy, there's always a risk involved in trading. It's crucial to manage your risk and use stop-loss orders to protect your capital.

Learn What is PULLBACK and WHY It is Important For TRADING

In the today's post, we will discuss the essential element of price action trading - a pullback.

There are two types of a price action leg of a move: impulse leg and pullback.

Impulse leg is a strong bullish/bearish movement that determines the market sentiment and trend.

While a pullback is the movement WITHIN the impulse.

The impulse leg has the level of its high and the level of its low.

If the impulse leg is bearish, a pullback initiates from its low and should complete strictly BELOW its high.

If the impulse leg is bullish, a pullback movement starts from its high and should end ABOVE its low.

Simply put, a pullback is a correctional movement within the impulse.

It occurs when the market becomes overbought/oversold after a strong movement in a bullish/bearish trend.

Here is the example of pullback on EURJPY pair.

The market is trading in a strong bullish trend. After a completion of each bullish impulse, the market retraces and completes the correctional movements strictly within the ranges of the impulses.

Here are 3 main reasons why pullbacks are important:

1. Trend confirmation

If the price keeps forming pullbacks after bullish impulses, it confirms that the market is in a bullish bearish trend.

While, a formation of pullbacks after bearish legs confirms that the market is trading in a downtrend.

Here is the example how bearish impulses and pullbacks confirm a healthy bearish trend on WTI Crude Oil.

2. Entry points

Pullbacks provide safe entry points for perfect trend-following opportunities.

Traders can look for pullbacks to key support/resistances, trend lines, moving averages or fibonacci levels, etc. for shorting/buying the market.

Take a look how a simple rising trend line could be applied for trend-following trading on EURNZD.

3. Risk management

By waiting for a pullback, traders can get better reward to risk ratio for their trades as they can set tighter stop loss and bigger take profit.

Take a look at these 2 trades on Bitcoin. On the left, a trader took a trade immediately after a breakout, while on the right, one opened a trade on a pullback.

Patience gave a pullback trader much better reward to risk ration with the same target and take profit level as a breakout trader.

Pullback is a temporary correction that often occurs after a significant movement. Remember that pullbacks do not guarantee the trend continuation and can easily turn into reversal moves. However, a combination of pullback and other technical tools and techniques can provide great trading opportunities.

Please, let me know if you have any questions! Also, please, support this post with like and comment! Thank you for reading!

Traders' Inverse Relationship with Breakouts⚡Retail traders often find themselves entangled in false breakouts or breakdowns. However, it's important to recognize that taking advantage of breakout opportunities isn't inherently flawed. The key lies in being mindful of the associated risks and never trading beyond what is considered an acceptable level of risk. By doing so, traders can protect themselves from unnecessary losses and navigate the market more wisely.

⚡Another crucial aspect of successful trading is planning for potential failures. While the solution seems simple – cutting losses and exiting the trade – it's essential to define what constitutes failure beforehand. Identifying these conditions before entering a trade allows traders to establish clear criteria for when it's time to step back and avoid further losses.

⚡To increase their chances of success with breakout trades, traders can consider adopting a strategy of trading pullbacks after a breakout has occurred. Typically, stocks pull back to retest their breakout levels, presenting attractive trading opportunities. While this approach can mitigate some failures, it's important to acknowledge that no trading strategy is foolproof. There may be instances where traders miss out on certain opportunities due to a lack of pullbacks, leading to feelings of "Fear of Missing Out" (FOMO). Remember, trading involves inherent uncertainties, and no strategy guarantees a 100% success rate.

⚡Lastly, traders should keep in mind that support levels offer potential buying opportunities, while resistance levels indicate potential selling opportunities. Being attentive to these key levels can assist traders in making informed decisions and improving their overall trading performance.

Regards

Do hit boost 🚀 for motivation.

Pullback Buy in RDFNRDFN is a stock we bought in my Alpha Stocks service on June 27 when it broke out above resistance at 11.50.

It rallied 50% over the next three weeks but has now pulled back to a level where I would consider adding to or taking a new position.

Redfin is a powerful stock, but it also has a history of 15-20% pullbacks throughout its up moves. As of Friday morning, the stock is 20% off its high with support at the 21-day exponential moving average which has contained this surge thus far.

Traders may consider buying here with a stop loss near $13.

Top 3 Pullback Trading StrategiesAs traders, we all know the market can be unpredictable, but by understanding and utilising pullback trading strategies, we can take advantage of temporary price reversals to enter positions at more favourable prices. In this article, we’ll dive into the world of pullback trading, explain the concept of mean reversion, and look at how to use tools like the moving average indicator and Fibonacci retracements to identify potential pullback levels.

What Is a Pullback?

In the past, you might have seen stock traders discussing their plans to wait for a pullback to load up on shares and wondered, “but what is a stock pullback?” In fact, pullbacks occur in prices of all tradable assets, including commodities and forex trading pairs, such as EUR/USD and AUD/USD, not just in stock prices.

A pullback refers to a temporary reversal in the price of an asset after a period of upward or downward movement. If you’ve ever heard of “correction” or “retracement,” these are just other terms used to describe pullbacks. It's where the price cools off slightly before continuing its overall trend, and it is often the result of profit-taking by traders and technical factors, like key areas of support and resistance.

Why Do Pullback Trading Strategies Work?

Trading pullbacks in trends plays into the notion that “the trend is your friend.” In other words, trading in the direction of the higher-timeframe trend will typically yield the best results. But why does this strategy work? The easiest way to think about it is in the context of “discount” and “premium” pricing.

Discount and Premium Pricing

Imagine you have a bullish trend, like the one in the example above. Here, traders run the risk of buying at one of the many highs that make up the trend, paying more for a single unit of an asset than is potentially necessary (paying a premium) and resulting in sub-optimal risk/reward. Given the premium pricing, the number of buyers will taper off until sellers take control and push prices lower.

Conversely, pullbacks allow traders to get in once the price cools off, meaning they can enter at a discount. At this point, buying pressure will be at its strongest as many know these low prices often won’t last and that they can offer much better risk/reward ratios, maximising the profit for traders from the overall bull trend.

Mean Reversion

This concept relates to the idea of mean reversion, which states that prices tend to return to their average over time. By entering a position during a pullback, traders can buy an asset at a lower price, or at a discount, with the expectation that the price will eventually return to its average.

Notice that in the chart above, for example, the retracements typically fall below the midpoint of the previous retracement and the 50-period moving average before continuing higher. Additionally, we can see that the further the price moves away from these two averages into areas of previous premium or discount, the more likely it is to reverse.

As you’ll see, these ideas form the basis for several commonly used pullback trading strategies. Understanding how the concepts work, however, will help you develop your skills as an effective pullback trader and allow you to trade under a variety of market conditions.

Using Pullback Strategies in Forex and Other Markets

The following strategies can form the basis of a solid stock pullback strategy, but their uses aren’t limited to just stocks. You can use them while forex trading or in the commodities and crypto* markets. Just note that pullback trading will be most effective in trending markets and less so in ranges.

To get the best understanding of how these strategies work, you can try applying them to live charts using the TickTrader platform.

Strategy #1: Moving Average Pullback Strategy

Using the principle of mean reversion, we can start putting it into practice with moving averages. Moving averages often provide ideal areas of dynamic support and resistance and are a versatile tool in any pullback trader’s arsenal.

Requirements: You can use a simple moving average (SMA) or an exponential moving average (EMA), which gives more weight to recent prices. It may be a good idea to try experimenting with both to see which one you prefer.

Traders often use a 21, 50, or 200-period moving average, so again, you can try experimenting to find the most suitable one for you. We’ll use a 50-period MA, expressed as MA(50).

Entry: First, a trend will need to have been set in motion. Traders usually either set a limit order at the moving average or enter with a market order based on price action that supports their idea.

Stop Loss: Stop losses are typically set above the high or below the low that originated the leg before the pullback, as seen in the example above. Given that these trends can last for a long time, you may trail your stop just above or below key swing highs and lows as the trend progresses.

Take Profit: Some traders begin to take profits at the high or low that originated the retracement, denoted by “Potential Target” in the example. So, when entering during a bullish pullback in an overall bear trend, traders can use the low that started the retracement as their first target. Subsequent levels of support or resistance are also commonly used as profit targets.

Strategy #2: Fibonacci Retracement Pullback Strategy

Using Fibonacci retracements is also a common way to find entries in pullbacks. Recall that the price will often cross above or below 50% of the retracement. Sometimes, it’ll reverse to the key Fibonacci levels of 0.618 and 0.786 in a larger bull trend or 0.382 and 0.236 in a bear trend. Don’t forget that 0.5 itself is a Fibonacci level.

Requirements: You just need the Fibonacci retracement tool that can be found in most charting software, like TickTrader. In a bullish trend, apply the first point to a swing low and the second to a swing high. Apply it to a swing high and low for a bear trend.

Entry: Entries here can be adjusted to your preferred style of trading. Some traders will simply set a limit order at 0.5, while others will place them at 0.786 or 0.236 to maximise risk/reward. Alternatively, you can break up your order into three, setting limits at 0.5, 0.618, and 0.786 to cover all bases for a bullish trade or 0.5, 0.382, and 0.236 for a bearish one.

Stop Loss: Like the Moving Average strategy, traders often put a stop loss above the high or low that originated the leg before the pullback. For instance, the second entry above would mean placing the stop at the 0.618 level of the Fibonacci retracement. You can also try putting stops above or below nearby engulfing candles for better risk/reward. Alternatively, you could choose to trail your stop below swing lows or above swing highs for bullish and bearish trades, respectively.

Take Profit: Some traders will start taking profits at the nearest major swing points, while others use the 1.618 extension of the pullback to set their profit target.

Strategy #3: Breakout Strategy

Finally, in markets where the overwhelming trend is too strong to allow for a deeper pullback, you may try to trade the breakout. In a bullish breakout, for example, the price might quickly back up to test the resistance-turned-support before shooting higher. Note that some breakouts are merely false breaks designed to trap traders and force prices into a deeper retracement - just look at the significant highs in the first picture in this article.

To counteract these traps, you can look for high volume on the movement that caused the break, as well as the close of the candle. Candlestick patterns, such as shooting stars and hammers, can typically signal false breaks.

Entry: After a bullish breakout above a recent swing high on high volume, traders will usually set a limit order at or just above the high or wait for price action to confirm that the high is now acting as support before entering with a market order. Conversely, traders will enter in the same way for a bearish breakout but use swing lows instead, setting orders at or just below the low or looking for price action confirmation to enter.

Stop Loss: Traders can choose to set stops below the range that the breakout occurred from or above or below an engulfing candle, like in the Fibonacci strategy.

Take Profit: As with the two strategies mentioned, some will just trail their stops above or below key swing highs and lows to ride the long-term trend and maximise their profits. Others choose to use the most recent swing high or low to take partial profits before closing their position at a suitable level of risk/reward.

Closing Thoughts

Pullback trading can be an effective strategy for traders looking to ride trends. By taking advantage of the concepts of premium/discount pricing and mean reversion and using technical analysis tools like moving averages and Fibonacci retracements, traders can get involved at optimum points in the market before the trend continues.

It’s also worth remembering that any pullback can signify a market reversal. Always be cautious and use these pullback strategies in conjunction with other forms of technical analysis before considering making a trade. Once you feel ready, you can try opening an FXOpen account to put your skills to the test. Happy trading!

At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

The Role of ChatGPT in Algorithmic TradingThe Role of ChatGPT in Algorithmic Trading

1. Introduction

In recent years, algorithmic trading has become an increasingly important aspect of the financial markets. Algorithmic trading involves using computer programs to execute trades based on predetermined rules and algorithms, with the goal of maximizing returns and minimizing risk. The use of algorithms allows traders to make rapid, data-driven decisions and respond to market conditions faster than traditional human traders.

Natural language processing (NLP) is a field of computer science that focuses on the interactions between computers and human language. In the context of algorithmic trading, NLP techniques are used to analyze vast amounts of financial news, social media, and other sources of information to identify potential trading opportunities. By analyzing this data, traders can make informed decisions and gain a competitive edge in the market.

One of the key tools used in NLP for algorithmic trading is ChatGPT, a large language model trained by OpenAI. ChatGPT is a powerful tool that can analyze vast amounts of text data and generate human-like responses. Its capabilities include natural language understanding, machine translation, text summarization, and text completion.

With its ability to analyze and understand large amounts of text data, ChatGPT is an essential tool for traders looking to gain a competitive edge in the market. For example, ChatGPT can be used to analyze financial news articles and social media posts to identify companies that are likely to experience a significant change in their stock price. By analyzing the sentiment of these articles and posts, ChatGPT can determine whether there is a positive or negative outlook for a particular company, which can be used to inform trading decisions.

In addition to sentiment analysis, ChatGPT can also be used to generate summaries of news articles, which can save traders valuable time and allow them to quickly digest important information. ChatGPT can also be used to generate text responses to customer inquiries, freeing up traders to focus on more important tasks.

Overall, the use of NLP and ChatGPT in algorithmic trading is becoming increasingly important. As the amount of data available to traders continues to grow, the ability to quickly and accurately analyze that data will become essential for achieving success in the market. With its powerful NLP capabilities, ChatGPT is poised to play a significant role in the future of algorithmic trading.

2. NLP Techniques for Algorithmic Trading

Natural language processing (NLP) is an essential tool for algorithmic trading, enabling traders to quickly and accurately analyze large volumes of text data. In this section, we'll explore some of the key NLP techniques used in algorithmic trading, including analysis of financial news and social media, sentiment analysis, and identification of potential trading opportunities.

One of the most powerful applications of NLP in algorithmic trading is the analysis of financial news and social media. By analyzing news articles and social media posts, traders can gain insight into the market sentiment and identify emerging trends or potential trading opportunities. For example, if a large number of news articles and social media posts are discussing a particular company, it may be an indication that the company is about to experience a significant change in its stock price.

Sentiment analysis is another important NLP technique in algorithmic trading. Sentiment analysis involves using NLP algorithms to determine the emotional tone of a particular piece of text. By analyzing the sentiment of news articles, social media posts, and other sources of information, traders can gain insight into the market sentiment towards a particular company or industry. This information can then be used to inform trading decisions.

Identification of potential trading opportunities using NLP is another key application of this technology. By analyzing large volumes of data, including news articles, social media posts, and other sources of information, traders can identify emerging trends or potential trading opportunities. For example, by analyzing news articles and social media posts, traders may identify a new technology that is rapidly gaining popularity, indicating a potential investment opportunity.

Overall, the use of NLP techniques in algorithmic trading is becoming increasingly important. With the amount of data available to traders continuing to grow, the ability to quickly and accurately analyze that data will be essential for achieving success in the market. NLP techniques, including the analysis of financial news and social media, sentiment analysis, and identification of potential trading opportunities, are powerful tools that can help traders gain a competitive edge and achieve success in the market.

3. Predictive Models with ChatGPT

Predictive models are an essential tool for algorithmic trading, enabling traders to identify patterns and predict future market trends. In this section, we'll explore how ChatGPT can be used to develop predictive models and the advantages of using this technology.

At its core, predictive modeling involves using historical data to identify patterns and predict future trends. This process involves analyzing large volumes of data to identify patterns and trends that can be used to inform trading decisions. With the increasing amount of data available to traders, the ability to quickly and accurately analyze that data is becoming essential for achieving success in the market.

ChatGPT is a powerful tool that can be used to analyze large datasets and identify patterns that may be missed by other analytical tools. With its ability to understand natural language, ChatGPT can analyze vast amounts of financial news, social media, and other sources of information to identify patterns and trends. This information can then be used to develop predictive models that can be used to inform trading decisions.

One of the key advantages of using ChatGPT in developing predictive models is its ability to understand the context of the data it is analyzing. Unlike other analytical tools, which may only be able to identify patterns based on simple statistical analysis, ChatGPT can analyze text data to understand the context and nuances of the information being analyzed. This allows traders to identify patterns and trends that may not be immediately apparent using other analytical tools.

Another advantage of using ChatGPT in developing predictive models is its ability to learn from new data. As more data becomes available, ChatGPT can be trained to recognize new patterns and trends, improving the accuracy of its predictions over time.

4. Machine Learning with ChatGPT

Machine learning is a critical component of algorithmic trading, allowing traders to develop sophisticated models that can identify patterns and make real-time trading decisions. In this section, we'll explore how ChatGPT can be used in machine learning models for algorithmic trading, the advantages of using this technology, and some examples of its use.

Machine learning involves using algorithms to analyze large amounts of data, identify patterns, and make predictions. This process involves training the algorithm on historical data to recognize patterns that can be used to inform trading decisions. With the increasing amount of data available to traders, the ability to quickly and accurately analyze that data is becoming essential for achieving success in the market.

ChatGPT can be used in machine learning models to analyze text data and make real-time trading decisions based on that data. For example, ChatGPT can be used to analyze financial news and social media to identify patterns that may not be immediately apparent to other analytical tools. This information can then be used to inform machine learning models that make real-time trading decisions.

One of the key advantages of using ChatGPT in machine learning models for algorithmic trading is its ability to understand natural language. Unlike other analytical tools, which may only be able to analyze structured data, ChatGPT can analyze unstructured data such as news articles and social media posts. This ability to understand the context of the data being analyzed is essential for developing accurate machine learning models.

Another advantage of using ChatGPT in machine learning models is its ability to learn from new data in real-time. As more data becomes available, ChatGPT can be trained to recognize new patterns and trends, improving the accuracy of its predictions over time. This ability to adapt to changing market conditions is essential for achieving success in the algorithmic trading market.

There are several examples of machine learning models that use ChatGPT in algorithmic trading. For example, ChatGPT can be used to analyze financial news to identify patterns and inform machine learning models that make real-time trading decisions. ChatGPT can also be used to analyze social media sentiment to inform trading decisions based on public perception of a particular stock or market.

5. Limitations and Future Directions

While ChatGPT and NLP techniques have a lot of potential in algorithmic trading, there are also limitations to their use. In this section, we'll discuss some of the challenges associated with using ChatGPT and NLP in algorithmic trading, as well as potential future directions for these technologies.

One of the main limitations of using ChatGPT and NLP in algorithmic trading is the potential for bias in the data being analyzed. NLP techniques rely on training data to identify patterns and make predictions, but if that data is biased in some way, it can lead to inaccurate predictions. For example, if a machine learning model is trained on historical data that reflects biased trading practices, it may perpetuate those biases in future trading decisions.

Another limitation of using ChatGPT and NLP in algorithmic trading is the potential for the model to be fooled by fake or misleading information. As we've seen in recent years, social media platforms can be manipulated by bad actors to spread false information or manipulate public sentiment. If ChatGPT is trained on this misleading information, it can lead to inaccurate predictions and trading decisions.

Despite these limitations, there are several potential future directions for ChatGPT and NLP in algorithmic trading. One of these is the development of more sophisticated machine learning models that can better handle unstructured data. While ChatGPT has shown promise in this area, there is still much work to be done to improve the accuracy of these models.

Another potential future direction for ChatGPT and NLP in algorithmic trading is the use of natural language generation (NLG) to create more sophisticated trading strategies. NLG involves using machine learning to generate human-like language that can be used to describe trading strategies and other complex financial concepts. This can help traders better understand the decisions being made by their machine learning models and make more informed decisions.

In conclusion, while ChatGPT and NLP techniques have a lot of potential in algorithmic trading, there are also limitations to their use. By addressing these limitations and exploring new directions for these technologies, we can continue to improve the accuracy and effectiveness of algorithmic trading models. As the amount of data available to traders continues to grow, the importance of these technologies in the trading industry will only continue to increase.

6. Conclusion

In conclusion, ChatGPT and natural language processing techniques have become increasingly important in algorithmic trading. By analyzing large amounts of unstructured data from sources such as financial news and social media, ChatGPT can help identify potential trading opportunities and provide valuable insights to traders.

One of the key advantages of using ChatGPT in algorithmic trading is its ability to analyze and understand human language. By analyzing sentiment and other linguistic patterns, ChatGPT can provide valuable insights into public opinion and market trends, which can be used to inform trading decisions.

Another advantage of ChatGPT in algorithmic trading is its ability to analyze large datasets and identify patterns that may not be immediately apparent to human traders. By using machine learning models to analyze historical data, ChatGPT can identify trends and make predictions that can help traders make more informed decisions.

Looking to the future, it's likely that ChatGPT and other NLP techniques will continue to play a significant role in algorithmic trading. As the amount of data available to traders continues to grow, the importance of these technologies in the trading industry will only continue to increase.

However, there are also potential challenges and limitations associated with using ChatGPT and NLP in algorithmic trading. It's important to be aware of these limitations and to work to address them in order to ensure that these technologies are used in a responsible and effective way.

Overall, the use of ChatGPT in algorithmic trading represents an exciting development in the field of finance. By using machine learning and natural language processing techniques to analyze large amounts of data, traders can gain new insights and make more informed decisions. With continued research and development, the potential applications of ChatGPT and other NLP techniques in algorithmic trading are sure to grow and evolve in the years to come.

💢BUY GBPUSD at the best price and get +220 pips profit💰🔰You can see the analysis of the pound to US dollar currency pair in a 15-minute time frame (GBPUSD_ 15min) 🔍🧨

💥Considering that the price has managed to break the Down trend line🖤, the best place and price to buy this currency pair is at the intersection of DEMAND1 zone and DEMAND2 zone and the Down trend line🖤 to ❗pullback❗ to it, and if the price can reach this place , can experience upswing🔺🚀 to Resistance🧡

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

_____📈TRADER STREET📉______

⭕️SELL EURCAD at the best place and time 🔥🔰You can see the analysis of Euro to Canadian dollar in the four-hour time frame (EURCAD _ 4H)🧨🧨

💥As it is clear from the picture, it can be said that the price has a Range behavior❗🧐 If the black🖤 ascending trend line is broken and the price stabilizes❗ below this line and then the price pullback❗ to the trend line, we can expect the price to fall to the first DEMAND zone🔻

SUPPLY zone and DEMAND zones are specified in the picture👌

Do you think this analysis can be profitable❓

I hope the analysis was useful for you🤍🌹

📌Please introduce the channel to your friends 🙏🏻

__________📈TRADER STREET📉___________

How to trade intraday pullbackHello friends,

Market finally picked a direction and it looks like it's gonna continue downtrend. Many novice traders are long biased and they find it very difficult to trade in down-trending market. Today, I am going to share a simple strategy for making quick gains by trading pullback in a downtrend.

Below is a chart of NASDAQ:AMZN in daily timeframe. You can see that price is in a downtrend.

Below is 5 minutes timeframe chart of NASDAQ:AMZN .

You can see that above chart fulfills all the rules mentioned below. For this trade, Risk to Reward ratio is 1:3.

Checklist -

1. Price is making LL while RSI is making HL - Bullish Divergence(highlighted in the chart)

2. RSI is below 30 - Price is oversold

3. Price is showing signs of reversal - Long lower wick candle(highlighted in the chart)

4. Above three confluences occurs during the first 1.5 hours of market open before market goes into mid-day chop

5. Risk to Reward ratio is at least 1:2 (shown in the chart)

Entry -

1. Enter at the next candle open after reversal confirmation

Exit -

1. Set Stop-loss below the recent low

2. Set Target at the first resistance

RMRKUSDT see and watch :)

It has reacted well to the desired support area and it seems that it can continue its movement from here to the specified areas ...

EURUSD to the moon ? xDOANDA:EURUSD

Hey guys , so here we are with EURUSD on monthly timeframe :

the long term downtrend is broken and now we are at pullback to this trendline ...

If we see a bullish candle (on monthly) then EUR may go higher in the future .

what do you think ??

mention your idea about EURUSD on comments .