PUMPUSDT at a Decisive Turning Point – Breakout or Breakdown?

🧠 Technical Overview:

PUMPUSDT has been in a sustained downtrend over the past several days, forming a clearly defined descending trendline that has acted as a dynamic resistance since mid-July. Now, the price is approaching this key level once again—and this time, momentum seems to be shifting.

Interestingly, the current structure is forming what appears to be a potential Inverse Head and Shoulders (IH&S) pattern, a well-known bullish reversal formation. If confirmed with a breakout above the neckline/trendline, this could spark a strong upward reversal.

---

📌 Key Technical Highlights:

Descending Resistance Line: Holding since July 15, acting as the primary ceiling on price action.

Inverse Head and Shoulders Pattern: Potential bullish reversal setup forming on the 2H chart.

Volume: Currently low but showing signs of increase near the potential breakout zone—a bullish early signal.

---

📈 Bullish Scenario (Breakout Confirmation):

If the price successfully breaks and closes above the yellow trendline, especially with a strong candle and volume confirmation, we could see a momentum-driven rally toward the following targets:

1. ✅ $0.003614 – Minor resistance zone

2. ✅ $0.003917 – Retest of previous consolidation structure

3. ✅ $0.004441 – Measured move target from IH&S pattern

4. ✅ $0.005251 – 0.618 Fibonacci retracement area

5. ✅ $0.006795 – Major swing high and liquidity zone

> Potential upside of 100%+ from current levels if momentum continues.

---

📉 Bearish Scenario (Trendline Rejection):

If the price fails to break above the trendline and faces another strong rejection, then sellers could regain control, leading to:

⛔ $0.002500 – Psychological support and consolidation base

⛔ $0.001950 – Local bottom and potential long-term entry zone

> A failed breakout could trigger a quick sell-off or stop-loss cascade below the IH&S setup.

---

🔍 Technical Summary:

Indicator Status

Descending Trendline Actively being tested

Volume Increasing near breakout zone

RSI Rising from oversold territory

Price Pattern Inverse Head & Shoulders (Potential Reversal)

Risk/Reward High, favoring breakout strategy

---

🧭 Strategy Suggestions:

Aggressive Entry: Enter on breakout candle close above trendline with volume confirmation.

Conservative Entry: Wait for breakout + successful retest of the trendline before entering.

Stop Loss: Below neckline or recent swing low (~$0.0025).

Take-Profit Zones: $0.0039, $0.0044, $0.0052 and beyond.

---

🧠 Final Thoughts:

> “Charts never lie—PUMPUSDT is building pressure beneath a key resistance. If it breaks, the move could be explosive. Are you ready to ride the wave?”

Microcap altcoins often fly under the radar—until they don’t. This setup is showing the classic signs of a potential breakout. Use sound risk management and watch the next candle closely.

#PUMPUSDT #CryptoBreakout #InverseHeadAndShoulders #TechnicalAnalysis #AltcoinSetup #PumpFun #BreakoutAlert #MicrocapGems #CryptoReversal #ChartPatterns #CryptoSignal #CryptoStrategy

Pumpalert

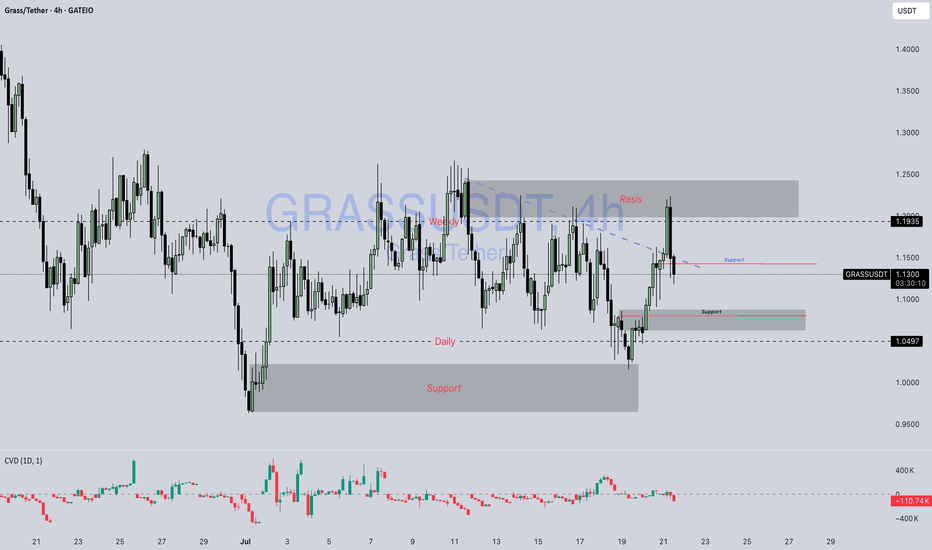

Grass / Usdt GATEIO:GRASSUSDT

📊 **Chart Overview – GRASSUSDT (4H):**

* 💰 **Current Price:** \$1.1362

* 🔻 **Previous Trend:** Downtrend has been challenged; price broke above the **descending trendline (blue dashed)**.

* 🟦 **Key Support Zones:**

* \$1.10 (recent demand area retest)

* \$1.05 (major support below, seen from earlier bounce zone)

* 🟥 **Key Resistance Zone:**

* \$1.19 – \$1.25 (major supply area where price got rejected again)

---

### 🔍 **Technical Breakdown:**

1. **Break and Retest Attempt:**

* Price **broke the descending trendline** and tapped into the \$1.19 resistance.

* Currently pulling back — possibly a **retest of the broken trendline** and the previous support near \$1.10–\$1.13.

2. **Supply Zone Rejection:**

* Strong rejection from **\$1.19–\$1.25**, which aligns with the upper supply zone.

* Sellers are actively defending this area.

3. **Bullish Case:**

* If GRASS holds above **\$1.10**, it may gear up for another push toward **\$1.19–\$1.25**.

* A clean break and hold above \$1.1935 could open room toward \$1.30+.

4. **Bearish Case:**

* Failure to hold \$1.10 or a breakdown below \$1.05 could invalidate bullish bias and revisit the lower demand zone near **\$0.95–\$1.00**.

---

📌 **Market Summary:**

GRASS is at a **critical zone**, attempting to flip trendline resistance into support. The reaction from \$1.10–\$1.13 will be key to deciding whether it can revisit higher supply levels or turn back toward major support.

---

⚠️ **Disclaimer:**

*This is **not financial advice**. All information provided is for **educational and informational purposes only**. Always perform your own analysis and manage your risk properly before trading.*

---

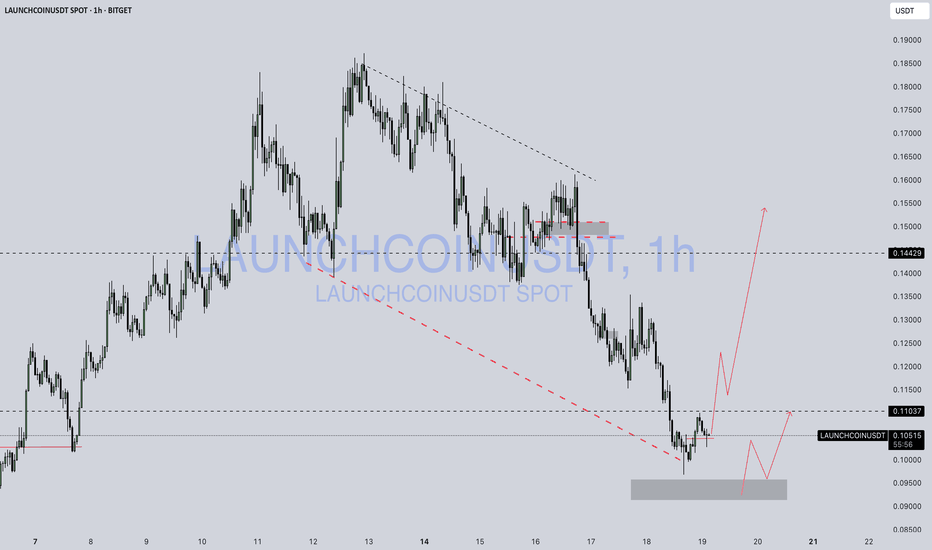

Launchcoin / UsdtBITGET:LAUNCHCOINUSDT

📊 **Technical Analysis – LAUNCHCOIN/USDT (1H, Bitget):**

* 💰 **Current Price:** \$0.10578

* 🟥 **Major Support Zone:** \$0.09000 – \$0.09800 (gray box)

* 🟩 **Resistance Levels:**

* \$0.11037 → short-term resistance

* \$0.14429 → major breakout target

* \$0.19350 → extended resistance zone

---

### 🔍 **Chart Insights:**

1. **Falling Wedge Formation**

A visible falling wedge (marked by dashed trendlines) typically signals a **potential bullish reversal**. Price is currently near the lower end of the pattern.

2. **Projected Scenarios (Red Arrows):**

* 🔁 **Scenario A:** Retest of the **support zone (\$0.090–\$0.098)** before a possible bounce.

* 🚀 **Scenario B:** Immediate breakout from \$0.110 → rally toward \$0.144 if bulls step in strongly.

3. **Key Confirmation Levels:**

* Holding above \$0.098 = Bullish interest.

* Break and close above \$0.110 = Momentum shift.

* Below \$0.090 = Breakdown risk increases.

---

📌 **Conclusion:**

Market is in a **make-or-break zone**. Structure favors a rebound if buyers protect the demand area, but confirmation via volume or a bullish candle close is crucial.

---

⚠️ **Disclaimer:**

*This analysis is for educational and informational purposes only. It is **not financial advice**. Always conduct your own research and use proper risk management before making any trading decisions.*

War news are actually good news for Crypto & GoldI Love Global Peace and hope all Wars end soon.

Here are my thoughts about Crypto when war Starts between two countries or more.

i think After wars so many reasons will help Crypto to see gain specially for Bitcoin which is the King of this market.

Some of the major Reasons in my view are:

A. Countries currency or Markets start to fall :

Usually with starting of war, we have two countries that are involved and due to negative effects of war on different Economic parameters cause weaker country or both currencies lose the power of Their currencies and it start To dump.

weak countries Bank can get hacked or worst scenario a countries currency can get 0 by the time.

most of the times Their stock markets also Face with huge losses.

B. People start to Buy more Gold or Bitcoin and ...

with things mentioned above and other reasons their People start to Buy more Crypto usually and Metals like Gold.

C. People start to migrate to other countries with their Crypto Wallets Only

Some start to leave their countries and Sell their Cars homes and ... and turn them to BTC or... and transfer their money and life to a peaceful country.

D. Spies and bribery gets more in those countries which all is done with Crypto usually

Corruption & Spy jobs and ... increases in those countries usually and the money on this Fields usually transfer Via Crypto or Gold and Silver which is harder to track.

And with these reasons which mentioned Above usually in the past all the Attention comes to Metal like Gold and the Value of it increase in Wars, but now Days Bitcoin(&Crypto Tokens) also gets more value and attention in war in my personal View and See gain in price too.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

LTC/USDT Short-Term Breakout Confirmed !LTC/USDT has broken above a key descending trendline resistance, signaling a bullish breakout. The price is now retesting the $115-$116 zone, flipping it into support. A successful hold above this level could lead to a rally toward the next resistance at $140-$147. Traders should monitor the $100-$105 support zone in case of a pullback. This breakout shows strong potential for upward momentum in the short term.

Ai16Z | From Meme to Money making machineai16z is the new star in the meme token galaxy, built on the lightning fast Solana blockchain and launched on the playful daos. fun platform. With AI backing it and a cheeky nod to the a16z VC fund, this token’s got serious meme mentum.

Today’s Price Check

-Current Price: $1.27 (+5% in the last 24 hours)

-All-Time High (ATH): $1.38 (hit on Dec 29, 2024) – just 5.86% below the peak.

-Circulating Supply: 1.10 billion tokens (max supply also 1.10 billion).

-24-Hour Trading Volume: A whopping $75.84 million.

Market Flex

ai16z is traded on 24 markets and 14 exchanges, with Gate.io leading the pack. It holds a cozy 0.04% share of the total crypto market, boasting a market cap of $1.43 billion. Oh, and word on the street? It’s on Binance’s radar for a potential listing

Riding the Meme Wave

Move over, SHIB, PEPE, and DOGE—ai16z is stealing the spotlight in the meme coin market rally. Its lowest price ever? A humble $0.01019 on Nov 3, 2024. Fast forward to now, and it’s up an insane 12,650% from that rock bottom price.

The Whale Tale

December 28 was a big day for ai16z, thanks to a crypto whale who made some serious moves. This savvy investor withdrew 10M USDC from Coinbase and snagged 13.16M ai16z tokens when they were undervalued on Dec 11.

The result? In just two weeks, their $10 million investment ballooned to a jaw-dropping $15.66 million, netting a sweet $5.66 million profit. That’s the kind of whale flex you all dream about.

ai16z is proving it’s more than just a meme, it’s a mover and shaker in the Solana ecosystem.

Virtuals Protocol makes you Real MoneyVirtuals Protocol is a decentralized platform designed to incentivize the creation and monetization of AIdriven personas for various virtual interactions, including gaming, metaverses, and online engagements. By aligning incentives, the protocol empowers users to develop and leverage AI personas to enhance digital experiences and unlock new revenue streams

37,000% Gains ? Even My Calculator Gave Up!

Trading Volume: In the last 24 hours, VIRTUAL recorded a trading volume of $524 million dollar, reflecting a 66% increase compared to the previous day. This significant rise signals heightened investor interest and increased market activity.

Supply: VIRTUAL has a circulating and maximum supply of 1 billion tokens, ensuring transparency and predictable tokenomics.

Price Movement: The all time low price of VIRTUAL was $0.0075, recorded on January 23, 2024 Since then, the token has surged by an impressive 37,000% , highlighting its substantial growth and potential

VIRTUAL is actively traded on 37 markets across 24 exchanges, with Gate. io being the most prominent trading platform. Notably, Binance listed the VIRTUAL/USDT pair with 75x leverage on December 10th, 2023, providing investors with enhanced opportunities for portfolio diversification. The token is also being closely monitored for a potential listing on Coinbase, which could further increase its accessibility and market visibility.

Where ‘Gem Hunting’ Turns Dreams Into Decentralized Dollars"

While new investors might initially find these numbers hard to believe, the concept of "gem hunting" is a proven strategy in cryptocurrency. Gem hunting involves identifying undervalued projects with significant upside potential before they become widely recognized. As demonstrated by Virtuals Protocol's meteoric rise, a single "gem" can offer transformative financial opportunities, changing an investor's life and career trajectory

This highlights the importance of education, research, and strategic investment when navigating the cryptocurrency space

CoW Protocol | Trump’s Secret Weapon for Milking CryptoTrump Used COW to Milk Crypto and He’s MOOOving Big Bucks!

Cow pumped 100% since our first signal also shot up over 30% couple of days ago after World Liberty Financial (WLFI), a DeFi project connected to none other than Donald Trump, executed a $ 2.5 million trade to grab 759.36 ETH through CoW

But we know all Dogs and Frogs in crypto zoo What is CoW Protocol !?

CoW Protocol is like the wild west of trading – totally free and unrestrained, it’s a decentralized protocol that uses Batch Auctions to figure out the best price for your trades. It’s not just any auction, though – it's all about finding the sweet spot where traders’ needs align, aka the "Coincidence of Wants" (CoWs). This magic happens when multiple buyers and sellers meet at the same price. The protocol pulls liquidity from every nook and cranny of the blockchain to make sure no one is left high and dry.

Instead of relying on the usual suspects like Automated Market Makers (AMMs) or Central Limit Order Books (CLOBs), CoW Protocol does its thing by running batch auctions, where multiple trades happen at once. These auctions are like a giant, hyper-efficient sale at a market where the best negotiator wins. The "solver" who can get the best deal—by finding matching CoWs or hunting down the cheapest liquidity—gets to settle the batch. So, it's like a shopping spree, but for crypto.

The real kicker? CoW Protocol saves you money. How? It optimizes gas fees, reduces liquidity provider costs, and gives you some sweet protection from front-running and miner extractable value (MEV)—stuff that normally eats away at your profits. If the market is a battlefield, CoW Protocol is like having an impenetrable shield to keep your wallet safe.

CowSwap: The CoW Protocol’s Trading Buddy

CowSwap is like the Uber of CoW Protocol—it’s the trading platform built on top of CoW, acting as a Meta DEX aggregator that finds you the best prices by bouncing between different AMMs and aggregators. CowSwap's mission? To get you the best deal possible, depending on which venue has the most liquidity at the time. No more guessing which exchange has the best price!

CoW Protocol Price Today

CoW Protocol's price today is a healthy $1.15, up by a cool +33% in the last 24 hours. It's like it woke up and decided to crush it.With a circulating supply of 293.4 million tokens and a max supply of 1 billion, there's plenty of CoW to go around. In the last 24 hours, $232.95 million worth of CoW tokens changed hands.

It’s rocking 24 markets and 19 exchanges, with Binance being the busiest one. At the moment, CoW Protocol has a tiny 0.01% share of the entire crypto market, but it’s sitting pretty with a market cap of $341 million.

USUAL | UNUSUAL PUMPsUSUAL Suspects: The Stablecoin Revolution Nobody Saw Coming!

After 300% pump lets see whats unusual here

USUAL is like the cool kid of stablecoin projects focused on making secure, decentralized fiat stablecoins while letting the community call the shots. The magic happens with the USUAL token, giving users control over governance. Using multi chain tech, USUAL grabs Real World Assets (RWAs) from big league players like BlackRock and Mountain Protocol, turning them into USD0 a stablecoin that’s on-chain, transparent, and way more trustworthy than your flaky ex.

Why Is USUAL "Unusually" Cool?

1.Multi-Chain Mastery: Plays nice with multiple blockchains, so USD0 isn’t stuck on one network like your grandma’s ancient landline.

2.RWA Wizardry: Collects tokenized real-world assets from legit pros and backs the stablecoin like it’s guarding Fort Knox.

3.Power to the People: Governance is decentralized, meaning you (yes, YOU!) help steer the ship with the USUAL token

4.OnChain Transparency: USD0 is like that one friend who overshares—totally transparent and verifiable, plus it’s compatible with your favorite DeFi apps.

5. Community Takeover:It’s all about the users power, value, and decision-making are in your hands. No middlemen allowed.

USUAL’s Price Parade

- Today’s Price: $0.603 (up a spicy +23.8% in the last 24 hours).

- All-Time High: $0.632 (Dec 9, 2024 so close, yet so far at -4.57%).

- Supply Stats: 494.6M tokens circulating, with a max supply of 4B tokens.

- Trading Volume: $52.76M in the last 24 hours, traded across 2 markets and 4 exchanges (Binance being the star)

- Market Cap: $299M, grabbing 0.01% of the crypto market pie.

Basically, USUAL is doing the stablecoin hustle while keeping things unusually exciting

kava will be massive in q1 of 2025KAVA/USDT on the monthly chart exhibits an extremely bullish setup, signaling a potential for significant upside starting from January. The asset has shown strong accumulation at lower levels, with the price consolidating within a clear range. Indicators such as RSI and MACD reflect growing bullish momentum, and the breakout of key resistance levels could spark a strong rally.

The chart structure suggests a solid base formation, typically a precursor to a sustained upward move. Volume trends indicate renewed interest, supporting the possibility of a substantial price surge. Entering now offers an excellent opportunity to capitalize on the anticipated upward trajectory, particularly for long-term spot positions.

With favorable macro conditions aligning, January could mark the beginning of a significant bull run. Risk management remains crucial, but the current levels present an attractive entry point for spot traders aiming to maximize potential gains in the coming months.

Kaia | Turning 1 Second Blocks Into a Billion Dollar BusinessHow Kaia Makes Ethereum Look Like It’s Running Dial Up Internet !

Kaia is a public blockchain built to deliver enterprise grade reliability and high performance, with a vision to become Asia's premier blockchain platform. It supports fast transaction finality with 1 second block times and can handle up to 4,000 transactions per second, making it ideal for large-scale applications. Kaia also ensures a seamless development process through Ethereum Virtual Machine compatibility, allowing developers to migrate Ethereum-based dApps effortlessly.

Where Slow Developers Pay Extra for Their Lazy Code

Encouraging High Quality Applications

As a scarce resource, KAIA encourages developers to write efficient code. Inefficient applications incur higher transaction fees, motivating developers to optimize for cost-effectiveness.

Consensus Nodes

The network's health relies on Consensus Nodes, which validate transactions and maintain the blockchain.CNs are compensated in KAIA tokens, incentivizing consistent and reliable operation

KAIA as a Utility Token

KAIA, the blockchain's native cryptocurrency, is used to pay transaction fees for smart contract execution, asset transfers, and other network activities. These fees sustain network operations and promote efficiency.

Kaia Price & data

Current Price:$0.23 (+20% in the past 24 hours)

AllTime High:$0.243 (reached on December 1, 2024), currently 0.48% below ATH

Circulating Supply:5.86 billion coins

Maximum Supply:5.86 billion coins

24Hour Trading Volume: $74.73 million

Market Capitalization: $1.42 billion, representing 0.04% of the cryptocurrency market.

Kaia is actively traded on 24 markets and 27 exchanges, with Binance being the most active platform

lets talk about the chart, as you see whales hold the uptrend and there is a chance for pullback as well. meme szn is over now and its time to new projects to show who is run this alt szn

If you're new to the exciting world of crypto, here's a golden nugget of advice:

invest in your knowledge before investing your money. The crypto bull market might look like a get rich quick train, but without understanding the basics, you could end up with a one way ticket to confusion or worse, losses.

Once you've sharpened your skills, you’ll be ready to ride the bull market like a pro, turning your insights into profits and your dreams into reality. Knowledge first, then let the money-making adventure begin

Cetus Protocol | CZ, Cetus & BinanceWhen the Protocol Is More Stable than Your Love Life!

Cetus is a decentralized exchange aka DEX and concentrated liquidity protocol developed on the Sui and Aptos blockchains. Its mission is to establish a robust and adaptable liquidity network that simplifies trading for users and assets. Cetus aims to deliver an optimal trading experience and enhanced liquidity efficiency to DeFi users by building a concentrated liquidity protocol alongside various interoperable functional modules

Cetus Protocol pumped 60% after Binance Partnership News!

Also the trading volume jumped 900%, now you see why CZ end up in jail

The price of Cetus is $0.42, reflecting an 11% decline over the past 24 hours. The ATH of $0.49 was achieved on November 10, 2024, putting the current price down by 12% from its peak

Cetus Protocol has a circulating supply of 588.30 million tokens out of a maximum of 1 billion. Over the last 24 hours, its trading volume has reached $172.43 million. CETUS’s lowest recorded price was $0.026 on June 12, 2023, making the current price approximately 1,500% higher than its all-time low.

Cetus Protocol is traded on 21 markets across 25 exchanges, with Binance being the most active. It holds a 0.01% share of the cryptocurrency market, with a market capitalization of $ 251 million

Arkham | ARKM’s Bat Signal was Lit!The Dark Knight of Blockchain Sleuthing

Arkm is 400% up since our first signal and 100% up since got listed on OKX so lets double check it

Arkham isn’t just a blockchain analysis platform it’s like Sherlock Holmes with a PhD in AI, out here doxxing wallets and decoding on chain secrets. Its main weapons of choice? The Analytics Platform, which spies on exchanges, funds, whales, and your favorite meme coins, and the Intel Exchange, where blockchain gossip is bought and sold like trading Pokémon cards

From Whale Watching to Wallet Doxxing

Instead of sticking to one blockchain, Arkham’s AI system, ULTRA, plays detective across the entire crypto universe, connecting dots that most wouldn’t even know existed. You get the tea on everything from shady transactions to whale movements, all while sitting in your pajamas.

Oh, and the Intel Exchange? It’s like Craigslist for blockchain nerds. People bid, bounty, and barter for address labels and insider scoops, all using ARKM tokens. It’s a hustler’s paradise for anyone with the intel to monetize kind of like being a blockchain bounty hunter.

The mastermind behind all this is Miguel Morel, a crypto veteran who knows his way around both markets and investors. Speaking of investors, Arkham has a lineup that could make a startup founder weep with envy, including an OpenAI cofounder (ooo, mysterious), Palantir’s Joe Lonsdale, and crypto big shots like Tim Draper. Together, they’ve poured over $10 million into Arkham, valuing it at a cool $150 million.

Where do you snag some ARKM tokens? Binance is the hotspot, with ARKM/USDT volumes hitting millions daily. Just don’t expect all-time highs anytime soon—ARKM is currently chilling at 39.82% below its peak. Still, it’s sitting pretty at 731.40% above its all-time low.

With a market cap nearing $752M and a fully diluted valuation of $2.38B, Arkham might just be the blockchain snoop the world didn’t know it needed. but Wen lambo(I mean Batmobile)?

ARKM gets ready for 2.5, 2.7 and 2.9$ and if BTC do correction we will back to 1.9$ support

XLM | Stellar the Brightest STAR in the Blockchain SKYCrypto alts pump one by one and star of tonight show is Stellar

But What is Stellar ?

Stellar is an open source, decentralized protocol designed to facilitate the transfer of digital currencies into fiat currencies globally. Its native cryptocurrency, known as Lumen, powers the Stellar blockchain.

The primary goal of Stellar is to bridge financial institutions with blockchain technology, enabling affordable and efficient transactions, particularly in developing markets. Established in 2014 by Ripple cofounder Jed McCaleb, Stellar shares some similarities with Ripple. However, Stellar has distinguished itself as one of the most successful altcoins, with a market cap exceeding $1 billion.

While Ripple primarily caters to banks and large corporations, Stellar focuses on individuals and small businesses. Nonetheless, Stellar’s robust partner network, which includes financial institutions, supports worldwide instant currency conversion.

Initially, the Stellar Foundation issued over 100 billion lumens. However, about half of these were burned in November 2019, reducing the maximum supply to 50 billion lumens. This coin burn briefly boosted XLM's price, though the increase was short-lived.

Key Features of Stellar and How It Works

Stellar employs a federated Byzantine agreement aka FBA algorithm instead of traditional mining for transaction validation. This unique approach eliminates the need for approval from cryptocurrency miners, enabling faster transactions compared to many other blockchain systems.(only nerds read this part!)

What is Stellar Used For?

Stellar is primarily designed to streamline cross-border payments. Its mission is to make international transfers quick, affordable, and user-friendly. The system works by converting the sender's currency into Lumens, which is then converted into the recipient’s currency.

For instance, if someone sends GBP from the UK to Russia, the Stellar network first converts the GBP into Lumens and then into rubles. Users typically access the network through partners like Stripe or Wirex, which provide services integrated with bank cards. Transfers are processed in approximately five seconds.

Where to Buy XLM

XLM is available on both centralized and decentralized exchanges (CEXs & DEXs)

Stellar Price Info

- Current Price**: $0.43 (up by +54% in the last 24 hours) YES, BIG ALTS CAN PUMP HARD TOO

- All Time High (ATH): $0.94, achieved on January 4, 2018, currently down -54% from its ATH.

- Circulating Supply: 30.01 billion lumens.

- Maximum Supply: 50 billion lumens.

- 24Hour Trading Volume: $3.14 billion.

- Most Active Market: Upbit.

- Market Share: 0.37% of the total cryptocurrency market.

- Market Capitalization: $13.06 billion.

XRP and XLM: The Batman and Robin of Global Finance

The World Bank and other major financial authorities are increasingly acknowledging XLM & XRP's potential as a game-changing tool in the global financial ecosystem. Versan Aljarrah, founder of Black Swan Capitalist, recently emphasized this in a post on Twitter, discussing the significant roles XRP and XLM could play in shaping the new global financial system.

Aljarrah pointed out that XRP is specifically designed to enhance institutional liquidity for cross-border transactions, making it a vital asset in the evolving landscape of global finance. Meanwhile, XLM offers a robust infrastructure tailored for efficient peer-to-peer transactions, positioning it as a key player in facilitating everyday financial interactions

Technical analysis

Xlm bulls broke 0.15$ major resistance and now ready to break the second wall which is 0.45$, if btc pullback then Xlm correct then gets ready for second pump,next targets are 0.53, 0.57 and 0.59$. most indicators shows bullish signals and the volume looks good

Crypto recap | Wen $ 100K BTC ? Crypto Weekly: ETFs, Meme Coins, and RFK’s Bitcoin Obsession

We’ve had a wild week in crypto, so let’s dive into what’s happened so far

1. Bitcoin Reaches Record $99,000 , Should We Sell Our Kidneys Now?

Bitcoin momentarily climbed to an all time high of $99,000. Its current value stands at $98,400, reflecting a 1.5% increase over the past 24 hours and YES over 500% since our first call

2. SEC Chair Gary Gensler to Resign in January 2025

The US Securities and Exchange Commission has announced that its Chairman, Gary Gensler, will step down on January 20, 2025.

3. Former Chinese Official Yao Qian Dismissed Over Crypto Bribery Allegations

Yao Qian, exDirector at the China Securities Regulatory Commission, has been expelled from the Communist Party and removed from office for serious misconduct, including abuse of power and crypto-related bribery. Once a key figure in China’s CBDC development, Yao is now under investigation by the Shanwei City Procuratorate for alleged violations, with his assets confiscated.

4. Bitcoin ETF Options Prepare for Launch

The SEC approved trading options for the iShares Bitcoin Trust in September 2024. Following a recent advisory from the CFTC, the Options Clearing Corporation (OCC) is set to facilitate these options, which will debut on November 19, 2024.

5. Trump Administration Eyes Crypto Policy Role

The Trump team is exploring the creation of a White House role dedicated to cryptocurrency policy. President-elect Trump is also scheduled to meet Coinbase CEO Brian Armstrong to discuss potential appointments. Discussions may include Armstrong’s support for SEC Commissioner Hester Peirce as SEC Chair.

6. Robert F. Kennedy Jr. Goes “All-In” on Bitcoin

Robert F. Kennedy Jr. revealed that most of his wealth is now in Bitcoin, declaring his strong commitment to the cryptocurrency. He has previously referred to Bitcoin as a “freedom currency” and a hedge against inflation.

7. Binance CEO Predicts Nations Will Compete for Bitcoin Reserves

Binance CEO CZ praised Michael Saylor's advocacy for Bitcoin and predicted that countries would soon race to acquire Bitcoin as a strategic reserve asset.

8. Polish Presidential Candidate Promises Bitcoin Reserves

Sławomir Mentzen, a Polish presidential hopeful, has pledged to establish national Bitcoin reserves if elected. Mentzen, an early Bitcoin investor, disclosed holding approximately $1.2 million worth of Bitcoin.

9. MicroStrategy Acquires Additional 51,780 BTC

MicroStrategy now owns 331,200 BTC, acquired at an average cost of $49,874 per Bitcoin. Its recent purchase of 51,780 BTC totaled $4.6 billion, averaging $88,627 per Bitcoin.

10. Meme Tokens Dominate Crypto Market Buzz

The meme token "Quant," created during a livestream, sparked controversy after a pump-and-dump scheme. Other meme coins, such as ANON and FLOKI, also gained traction, with Ethereum co-founder Vitalik Buterin purchasing ANON. Meanwhile, DWF Labs launched a $20 million fund for meme projects, and exchanges like Coinbase and Binance actively listed meme tokens.

Fundraising Highlights

- Rise: Secured $6.3M in Series A funding.

- Deblock: Raised $16.8M in seed funding.

- Shinami: Completed a $5.645M seed round.

- Valantis Labs: Gained $7.5M in funding.

- OpenLayer: Secured $5M in seed funding.

- Barter: Raised $3M for DeFi liquidity solutions.

- Noble: Completed a $15M Series A funding.

- Bitfinity Network: Secured $12M for Bitcoin Layer 2 development.

- Alluvial: Raised $4.3M for its Liquid Collective platform.

Dont miss this crypto cycle, opportunities like these don’t come around often!

Peanut the Squirrel | Forget Dogs, It's Squirrel Season!Wen Squirrels Take Over Binance: The Rise of 'Peanut' in the Crypto Jungle

Binance’s listing approach continues to surprise, recently bypassing several billion dollar meme coins in favor of two niche, lowcap tokens.the latest additions, “Peanut the Squirrel” and “Act I: The AI Prophecy”, have seen substantial growth post listing.

Could this indicate that Binance plans to list more meme coins as the current bull market continues?

Binance Listing Fees Drama

Listing on Binance is typically costly, yet the major crypto exchange has waived fees for PNUT and ACT, simplifying the process for new projects. Co founder Yi He disclosed on X that the listings were free for both tokens, shortly after a debate on the platform where he was accused of charging excessively for listings. The free listings came as a surprise to the market!

Before their listings, PNUT’s market cap was $123 million, while ACT’s was only $20 million. In choosing these tokens, Binance passed over larger-cap alternatives. In September, it similarly opted for the lower-cap "First Neiro On Ethereum" over the more established "Neiro Ethereum," citing a preference for community-driven, organic projects.

Since their listings, both PNUT and ACT have experienced rapid price increases. Peanut the Squirrel’s price is currently $0.83, an 90% gain over the past 24 hours. Its all time high of $0.90 was reached on November 13, 2024, putting it just 5% below that peak. With a circulating and max supply of 999.86 million tokens, PNUT’s trading volume over the past 24 hours is $1.27 billion, making Binance its most active exchange. It holds 0.03% of the total crypto market, with a market cap of $804.81 million.

First Neiro On Ethereum | NEIRO, Memes & Moontober Its Moontober and Neiro is 500% up since our first call so it's time to take a closer look at this rising star!

On chain analysis shows that four major entities are holding considerable amounts of NEIRO, Alongside Wintermute, which has gained attention for its trading activities, three other notable market makers and a venture capital firm with large NEIRO holdings

In addition to Wintermute, three other MMs and one VC are holding significant amounts of NEIRO_ETH in their wallets:

– GSR: 15M

– Toka_Labs: 5.114M

– Auros_Global: 3.6M

– Arrington: 5.107M

The accumulation of NEIRO by prominent market makers and VC firms shows growing confidence in the token's potential. These sizable holdings could indicate that these entities are strategically positioning themselves for future market activity or price increases

Investors and traders are expected to keep a close eye on NEIRO as these key players continue to maintain large stakes. The token's impressive price performance suggests it could attract even more trading interest from both institutional and retail investors like coinbase thinking why we don't make money while binance loads memes

Currently, Neiro is priced at $0.0021, marking a 40% increase over the past 24 hours

The circulating supply of Neiro is 420.69 billion tokens, which is also the maximum supply

Neiro’s 24hour trading volume stands at $ 725 million, and it is traded across 22 markets and 17 exchanges, with Binance being the most active ( CZ is back babe! )

Neiro currently holds a 0.05% share of the entire cryptocurrency market, with a market capitalization of $911 million which is damn good

One thing to watch out for: there are several fake cash grab Neiro tokens on various blockchains. So, when purchasing Neiro from DEXs, make sure to double check the contract address to avoid getting scammed

Stay vigilant!

FTM | Andre Cronje & SONIC UPGRADEThe Future of DeFi: Insights from Andre Cronje & the Sonic Network

Andre Cronje, a pioneer in decentralized finance DeFi, has long been a critical voice in the evolution of blockchain technologies. His journey, which spans revolutionary projects like Yearn Finance to his current work with the Sonic Network, provides valuable insight into the challenges and opportunities shaping the DeFi landscape

Evolving Challenges in DeFi and Regulation

Cronje’s recent discussions frequently highlight the shift in DeFi from its nascent, experimental stages to a more mature, regulated industry. As governments and regulatory bodies increase scrutiny, developers are forced to navigate a complex maze of compliance. Cronje emphasizes the importance of engaging traditional finance professionals to bridge the gap between on-chain technology and regulatory frameworks, a step he acknowledges was challenging but necessary. This convergence, though fraught with hurdles, marks a vital evolution as the DeFi space seeks broader legitimacy.

Sonic Network: A Vision for NextGen Blockchain Performance

At the forefront of Cronje’s work is the Sonic Network, a high-performance blockchain designed to tackle critical bottlenecks in DeFi. Built on innovations like the Carmen database and customized for Ethereum Virtual Machine (EVM) compatibility, Sonic addresses issues of scalability, speed, and usability. With features like over 10,000 transactions per second TPS and sub-second finality, Sonic is poised to redefine the user experience in DeFi applications. Its fee-sharing model also redistributes 90% of transaction fees back to decentralized applications (dApps), incentivizing innovation and reducing reliance on validators.

Technological Plateaus and the Need for New Leaps

Cronje frequently underscores that DeFi’s progress is not linear but iterative. The field has often reached technological plateaus, awaiting breakthroughs like the advent of zero-knowledge proofs or significant enhancements in execution environments. These advances, Cronje believes, will enable the next wave of DeFi applications, allowing for trustless exchanges, oracles, and execution layers to replace current, trust-dependent systems.

The Shifting Demographics and Culture of DeFi

One of Cronje’s more provocative insights pertains to the cultural shift within DeFi. The early days were dominated by technologists and developers motivated by pure innovation. Today, the space is increasingly influenced by meme coins and speculative trading, drawing in a demographic less interested in foundational technology. While this shift has broadened crypto's appeal, it raises concerns about the dilution of DeFi’s original ethos of decentralization and technological advancement.

App Chains vs Layer1 Models

Cronje also critiques the growing trend of app-specific chains (app chains), which allow projects to customize their execution environments. While he acknowledges their appeal, particularly for gaming and niche use cases, Cronje believes their economic and operational overheads make them impractical for many teams. Instead, he champions models like Sonic’s, where developers can deploy on a scalable Layer 1 network and retain a significant share of value without the burden of maintaining a standalone blockchain.

The Path Forward: Balancing Regulation, Innovation, and Adoption

Looking ahead, Cronje envisions a DeFi ecosystem that balances regulatory compliance with technological innovation. Projects like Sonic embody this vision by reducing barriers for developers and fostering sustainable ecosystems. However, he warns that achieving this balance requires addressing cultural shifts, incentivizing genuine innovation, and maintaining a focus on decentralization

Andre Cronje’s work and insights serve as a guide for navigating DeFi’s complex future. From overcoming regulatory challenges to pioneering the Sonic Network, he highlights the necessity of technological evolution and the importance of maintaining DeFi’s foundational principles. As the space continues to mature, Cronje’s vision underscores the need for resilience, adaptability, and a commitment to innovation.

let’s talk about the price

Right now, BTC is slowing down, and whales are swimming in altcoin oceans. The Sonic upgrade is a great reason to send FTM’s price to the moon, so buy the dip and wait for a month

next targets for FTM or better to say S are 1.3, 1.5 and 1.9$

ADA | Crypto, Congress & CardanoCharles Hoskinson & Trump Team Up to Tame the Wild West of Crypto

The trading volume for Cardano reached $ 5,150,683,356 over the last 24 hours, marking a significant 390% increase from the previous day and reflecting a recent surge in market activity.

Cardano's founder, Charles Hoskinson, has confirmed plans to work with the US government under Donald Trump's leadership to help shape cryptocurrency legislation. The primary objective is to establish clear regulatory frameworks for the cryptocurrency sector, which has long dealt with uncertainty and regulatory hurdles.

In his latest comments, Hoskinson emphasized that developing favorable policies for cryptocurrency would require support from both Democratic and Republican parties. This announcement comes as Cardano and other major blockchain networks, like Bitcoin, continue to face legal challenges from US agencies

Hoskinson underscored the significance of bipartisan cooperation, noting that the recent FIT21 bill passed in the House with support from over 60 Democrats, reflecting growing momentum for bipartisan crypto legislation.

He also acknowledged the potential influence of a future Republican-controlled Senate, House, and presidency, suggesting that the current political landscape could provide the crypto industry with a long-sought path to legal clarity.

Honestly this is the only miracle that could happen for ADA holders and the only factor that could move ADA cuz they missed so many opportunity includin ETFs

ADA next major resistance is 0.79$ and if BTC keeps lagging alts will follow the pump too

5 REASONS TO STAY IN THE CRYPTO MARKETThe end of September aka rektember historically the worst performing month of the year is in sight, and October is fast approaching.

1/ October aka ‘Uptober’ or better to say "Moontober" is historically one of the best performing months of the year and in the past two bull run years October’s have all been green – third time’s a charm? FYI last year we pumped 29% and so many of us ordered Countach

2/ It ain’t just October – Q4 historically yields the highest returns of the year

Excited for Uptober? Just wait till we hit No Loss November baaaby!

3/ M2 projections vs. CRYPTOCAP:BTC looking bullish

M2 tracks the global supply of money. The more money is in the system, the more of it can flow into crypto. Here’s Bloomberg’s 10week projection of M2 supply (black) overlaid with CRYPTOCAP:BTC ’s current performance (red)

4/ The bull market historically takes off at this point

See that white line? That’s the current cycle

as you see The crypto market seems to be following historical bull market trends closely. We've experienced a stronger than usual rally ahead of the halving, largely driven by expectations around spot Bitcoin ETFs. However, the post-halving rally has been weaker, bringing the market back in line with typical patterns seen in previous cycles.

Potential for Growth: If past cycles are any indication, the market is expected to gain momentum from this point onward. Historically, after a weaker post-halving phase, a significant upward surge is needed to complete the cycle.

Cycle Length Considerations: There is evidence suggesting that each crypto cycle is lengthening in terms of duration. This trend may reflect increasing institutional involvement, as longer cycles often point to a more mature and stable market

5/ Rate cuts are here!

The Federal Reserve has cut interest rates by 50 basis points in their first rate cut since March 2020.This is now the most unexpected Fed decision since 2009.

And lowered rates allow more money to flow into markets over time.

and after btc pump we will have sweet alt party so buckle up and be ready for printing money

ACT | These Pumps are Fun?PumpFun & Meme Mania

ACT is a meme token operating on the Solana blockchain, initially launched on Pumpfun and endorsed by AI. ACT stands out by reimagining user interactions with AI, moving beyond the traditional one on one assistant model to establish a collaborative peer network.

The current price of Act I: The AI Prophecy is $0.62, reflecting a 25% increase in the past 24 hours thanks to Binance listings. ACT has a circulating supply of 948.25 million tokens, with a maximum supply of 1 billion.The token was first issued on October 19 and has been hovering around a $20 million market cap over the weekend.

The token's 24 hour trading volume is $977 million, and it is actively traded across 28 markets and 20 exchanges, with Binance being the most prominent.Currently, Act I: The AI Prophecy holds a 0.02% share of the total cryptocurrency market, boasting a market capitalization of $616 million

In this cycle, meme tokens dominate and create extreme volatility, as their creators are often already planning the next meme project. Remember to set a stop-loss and avoid going all-in!

Which meme coins are you bullish on?

PEAQ | DePINs & DollarsPeaq's recent listing of its native utility token, across 12 crypto exchanges including Crypto. com, BitGet, and KuCoin positions the platform to capitalize on real world decentralized physical infrastructure networks aka DePIN and democratize the machine economy.

This listing facilitates user engagement with Peaq's decentralized infrastructure, now linking over two million devices globally.

In the past 24 hours, peaq’s trading volume reached $63 mil, a remarkable 15,592% increase from the previous day, highlighting a surge in market activity. Following Peaq's announcement, the PEAQ token is now accessible on exchanges like BingX, Bit2Me, CoinList, CoinW, Gate.io, Hashkey, KuCoin, and MEXC, with plans to be listed soon on LBank. Within the Peaq ecosystem, the token supports various functions, including transaction fees, validator node staking, and future participation in on-chain governance.

PEAQ’s initial supply totals 4.2 billion tokens, with an inflation rate starting at 3.5%, decreasing by 10% yearly until it stabilizes at 1%. This structured supply strategy is designed to foster sustainable growth within the DePIN ecosystem.

Peaq's platform supports a range of decentralized applications with real-world applications. Currently, it hosts over 50 DePINs spanning 21 sectors—including mobility, energy, connectivity, and decentralized AI—and plans to launch projects like Silencio, MapMetrics, DATS, Roam Network, and Teneo Protocol. These projects offer diverse services, from noise pollution data collection and "drive-to-earn" navigation to community-provided bandwidth and real-time social media data crowdsourcing.

The network operates with 32 genesis nodes managed by entities such as Bertelsmann Investments, Deutsche Telekom MMS, Lufthansa Innovation Hub, and the Technical University of Munich’s School of Management. With a Nakamoto Coefficient above 130 and a capacity of 10,000 transactions per second, Peaq aims to expand its throughput through upcoming updates.

In the coming months, Peaq plans to roll out stablecoin integrations, bridging solutions, fiat on-ramps, and decentralized exchanges, targeting projects that require blockchain infrastructure optimized for real-world applications and aiming to transform industries historically led by centralized players.

Peaq’s recent token sale on CoinList raised $20 million from over 14,000 contributors, with an oversubscription of $36 million. The platform also achieved a strong pre-launch ranking following a CertiK audit.

Enhanced interoperability with over 90 blockchains through LayerZero enables Peaq to ensure seamless liquidity and data flow. Additionally, Peaq provides modular DePIN functionalities, including self-sovereign machine identities, peer2peer payments, role-based access control, machine data verification, and machine data storage.

Alt szn started and its time to hunt some gems