Put

SPY WEEKLY OPTIONS STRADDLESPY APRIL 14 209 C @ $.17

SPY APRIL 14 207 P @ $.17

EXPIRE TOMORROW

RISK DISCLAIMER

Options involve risks and are not suitable for everyone. Option trading can be speculative in nature and carry substantial risk of loss. Only invest with risk capital.

topandbottomtradesignals.net

Get In Your Calls and Prepare PutsCOP continues to stay in a trend channel. Although it takes a while to bounce between the support and resistance levels, it is consistent. Expect COP to hit the resistance prior to earnings date. It will then decline after earnings and who knows how low it will go. Also anticipate the ups and downs of oil to keep this cyclical. Place your calls and prepare puts!

SPY WEEKLY OPTION BOUGHT ON BREAK OF 204 SUPPORTSPY WEEKLY OPTION BOUGHT ON BREAK OF 204 SUPPORT

SPY APR 8 204 P @ $.90

bought on break below 204 support

Also proprietary TOP signal received this morning

RISK DISCLAIMER

Options involve risks and are not suitable for everyone. Option trading can be speculative in nature and carry substantial risk of loss. Only invest with risk capital.

topandbottomtradesignals.net

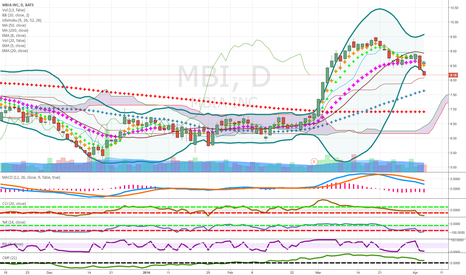

pennies to thousands long term short candidatebollinger bands widening stock to down side

large long term put activity in volume

get our book for short ideas on amazon

macd crossed down

relative strength weak

cci and percent r in bottom range

looks unlikely fed raising interest rates

below 200 on weekly

Looking for a short that wont go up as the S&P recovers? KODK is circling the drain. Their balance sheet and quarterly income is very unimpressive; they don't look like the books of a company on a rebound but rather a company winding down operations. Q4 2014 they had $260m~ assets over liabilities, that number is down to a scant $75m~. During the same period, cost of revenue is down about 17% vs revenue being down 'only' 13% but that's not terribly impressive.

Don't get me wrong, I like film cameras. Working in a dark room to print your own photos is great. But it is a niche market that doesn't match up with Kodak's half billion market cap (they don't even make cameras mind you!) The film market is dominated by Polaroid, toy cameras, and pre-owned sales. Film and paper are not a monopoly for Kodak in the 21st century with Fuji, Ilford and others long pushing Kodak out of frame.

This chart shows Kodak's next slide. The 1 day MACD is already breaking negative and the chart below is the 3-day MACD showing that the leveling/upturn from the start of this year is over. Kodak may as well have agreed to sell their wares exclusively at Radioshack. Much of what their current business is (business services etc) doesn't have the same economies of scale that Xerox and others have. They could have held some patents and licensed the remainder to get some revenue streams but it's too late now. Maybe Kodak is already "winding down" and doesn't want to acknowledge it publicly. They don't have to wind down to zero; they can still be a single factory film manufacturer, making a tidy profit for a few dozen employees. But a half billion dollar multinational? Sorry, but that image is fading fast.

Bottom line:

Buy put options for as far out as possible and sit on them---Take a higher strike price (>$8) if you are looking for a cheap bet, low strike price if you are looking for a super cheap bet.

EURUSDmacro money margin market models momentum net offer ofset open order options paid pair patient pips portfolio profit pullback put quoStill waitingte rally range rate realmoney retail risk sector sell settlement short slippage spot stoploss swap swiss takeprofit technical trade trading trader traderslife trend unemployment value volatility wedge work

High - Low Bollinger Bands These work better than the standard Bollinger Bands for setting extreme ranges.

What I use these for is to use an oscillator to find an buy / sell signal then take that to the H L Bollinger bands and mark the spot. Most of the time, you will find that the price does not exceed this spot for the duration (length) of the H L Bollinger bands.

This makes them good for doing Credit Spreads such as Put Vertical Spreads and Call Vertical Spreads. Since the price will normally not exceed the bands at the extreme point, the trader can profit from the time decay and other factors.

Reaffirming short from Dec 20, more trouble ahead for BTCAs I stated on 12/20, it was pretty much impossible for BTC to not sink further and significantly. Though it did have a short rebound for X-mas that was destined to be short lived. BTC is only down 7.25% since I made my prediction but with what the 3 hour through 2 week indicators show is trouble. The shorter 4 and 6 hour indicators show a reversal underway following this slight recovery. The one and two day MACDs have still not bottomed out; and worst of all, the 1week and 2week MACDs are looking like they've peaked. This would be their first downward movements since Aug/Sept when we were at 1500CNY/235USD. The StochRSI at 1week is showing its first downward cross since the early Nov. drop as well I would NOT take this lightly.

I'm still optimistic in the medium-term and I'd be very surprised if prices got anywhere near that low, but January could get really cold, really fast. If you are still in BTC I would have your alarms set and be ready to trade or at least hedge with a put option or two. If you are out, just don't get back in too quickly, it can be tempting to see the 2-hour MACD/RSI going positive and panic-buy, but I'd advise against it. 1 day indicators should be able to show us the way when it is time to return.

This industry is primed to suffer more than any other.The chart above shows assorted real estate stocks, they aren't cherry picked and were random (except RAIT Financial), but you can see the trend.

Get the hell out of real estate. Seriously if you have any real estate or RAIT stocks it is a great time to sell. This housing market has gone nuts from the years of 0%. Rental vacancy rates are at a 30 year low and rental prices are through the roof (pardon the pun), with houses that would have a $700 mortgage going for $1200+ with ease. Housing prices are way up too and are around pre-crisis levels.

NO I AM NOT SAYING THIS IS ANOTHER HOUSING BUBBLE. I'm not stupid, c'mon.

Real estate stocks certainly haven't gone crazy in recent years, given residual investor uneasiness about the sector. However, many symbols have made some nice gains since '08 and they are going to get hammered. As you can see on the chart all these symbols are RAITs and real estate and they are sliding already. A rate hike, even if the FOMC says it's only .01%, will be seen as the start of higher interest rates and thus a decrease in home sales. So get some put options on the sector, I'd say go 4-12 months out with strikes 15%+ lower than last price, it'll pay off. Even if Yellen announces no rate hike in Dec., everyone thinks it's coming, and that's all it takes.

The housing market really does need it though, prices are getting a bit too high and rental prices are insane high. Also, don't confuse real estate stocks and bank/financial stocks, banks will benefit from the rate hike (increased lending and profits from interest).

USDJPY H4 HOW TO TRADE A DESCENDING TRIANGLE + PULLBACK SHORT £$Clean and insightful USD/JPY publish with overview on trading a Descending Wedge - just my opinion anyway :)

The base range is the distance from the highest point of the range to our marked low point.

We then take this same distance to determine the potential size of the breakout

Note how close USD/JPY came to reaching this potential level

in my experience price often pulls back to the level of its breaks out before continuing in set directional trend, lets see if that happens.

Stop inside of wedge, target still base range, proportional boxes give an idea of the momentum expected in short falls,

Fibonacci retracement level based of major high/low points within descending wedge, notice how it highlights key levels of price action within the wedge

161.8% level also strong confluence with potential target

Channel commodity index also in steady down motion

Good Luck and Happy Trading :)

AUDUSD GREAT H4 SHORT POTENTIAL VERY TIGHT STOP GREAT CHANNEL £$Very clean detailed S/R x Fibonacci retrace analysis, 62.8% retracement occurring last 2 candles suggest bullish momentum is dying out!

This trade for me is a channel trade, I use Fibonacci and S/R to add confluence. Please zoom out and examine these areas

The diagonal channel is 3 - 4 months old and very valid and we have seen price already bounce off the top channel 4 times.

Very tight stop any violation of channel suggest full trend reversal.

Commodity channel index overbought currently heading south with break of diagonal bottom

Good luck and happy trading :)

EURUSD SHORT LONG TIME FANTASTIC POTENTIAL STRONG LEVELS £$ Drawn S/R horizontal lines on W1 very strong levels coincide with diagional ray and key Fibonacci levels.

Fib retrace shows 23.6% reversal occurring, Ichimoku suggesting a bounce off kumo -

Channel Commodity Index reverse also respecting diagonal channel.

First target 0% on Fib retrace, trailing stop from then on -

Stop based on historical kijun-sen flat line, slightly above visual red stop level on short position target

Good luck and happy trading!

Sell Facebook before the news is out I'm short $FB with $89 puts that expire in few weeks, $87.5 puts that expire in August and whole assortment of other FB puts. IMO this is like trading with inside information, the news is available, but hidden well in Facebooks last 10K filing in January 2015. FB says " We are being examined by the IRS" in that filing. They also say "We are unable to estimate the full range of possible adjustments" At issue is a tax loss carryforward tax credits that FB has taken but not eligible for. Evidently the IRS code says that a tax loss carry forward cannot be transferred if ownership of a corporation changes by over 50%. That happened to Facebook when it went public. So far FB has taken tax credits on $3 Billion of a $7 Billion tax loss carryforward which will be denied by the IRS. FB profits will turn into losses when FB has to restate earnings. You can find this information hidden in Notes to Financial Statements in the Income Tax section of the 10K. Technically FB indicates a sell by the Stochastic indicator and other indicators on a daily chart. The fundamental news outweighs all the technical indicators imo. Sell Facebook ASAP. Stop loss at $89.50

The perfect time to short Facebook is now.FB has hit resistance at $83. Three times was not a charm for $FB as it could not close above $83. The daily stochastic indicates a sell today. My favorite indicator at present is the Aroon up, I use it to indicate tops in FB when it hit 100. It did hit 100 on Thursday and went lower on Friday. When it hits 0 in about 15 days, I expect FB to between $74 and $77. $FB could be much lower if the news about FB using tax credits for a tax loss carryforward that it was not entitled to are published by national media. Evidently the billions of dollars in tax credits for a tax loss carryforward are not transferable if ownership changes in a Corporation by greater than 50%. This happened when Facebook went public. The loss of these tax credits will cause FB to pay Billions of dollars in back taxes and profits over the last 3 years will turn into losses imho. I'm short FB with $83, $82, $81 and $80 puts with expirations from 6/26 to 7/10/2015. I have notified numerous news agencies to this information which can be found in FB's 10k filed in January 2015. It is hidden well in notes to financial statements in the income tax section. FB says "we are unable to estimate the full range of possible adjustments" in the 10k I estimate Billions of dollars in "Adjustments". Fb sugar coats the news as thinking it will affect only the future tax loss carryforward tax credits. The reality of this situation is that past tax loss carryforward tax credits that FB has taken over the last 3 years will be denied because of the change in ownership of greater tha 50% with the IPO.

$GPRO We cleared some key levels but a bigger move is coming$GPRO We cleared some key levels but a bigger move is coming. Notice the key levels we have passed and every time it has lead us to the next key point. I have made a killing the past 3 days trading the weekly OTM calls. I still have calls expiring Friday and calls expiring 1/2/15. I also grabbed 10 of the 1/17/15 $50 puts for $.43 just before the close today. I believe that if we do not continue to push through this key level we are going to head towards $53 in a hurry. I am overall long, but i am not going to be surprised to see a massive pullback.

How the Hero Lock Itself Up Into A SELL SELL SELLGopro (NASDAQ: $GPRO) is down 28% since hitting a peak in the first week of October. A lock up withdrawal of 5.8M to start a charity was a signal that more "downside" was to come. On December 23, just about every share remaining in the lock up (borrowed money) will be made public, thus flooding the market with supply; driving the price down even further. Lean into the Puts two months out. Once Earnings is over, there might be a valuation adjustment to set a fair market value on the market. I'll close when I see a peak gain at 100% in profits. But til then I'm Bearish with a Full House Of Puts, so far in my favor. Read the article in the Business Insider for an explanation on borrowing for shares.

USD/GBP - Short Setup Developing - 1.70 Sept Puts Idea is simple:

1. Wait for market to recover to 1.7116 - 23

2. Buy September Put Options with a strike of 1.70 (personal preference)

3. Wait

Rules:

1. If market proceeds to make a new high above the 1.7190 High on the 15th of July.... Close position.

Why am I using options?:

1. Risk is fixed.

2. Greater leverage because we are expecting a SHARP selloff from this set up, not simply a drift.

2 for 1 on YahooYahoo has produced two high probability patterns that would fit well in a bearish channel. The cypher (purple) formed right after the rejection candle at $32.17 at the 1.27 extension measured from the X to A leg. Price also put in a double top at $39.64. A Gartley pattern (red) shortly appeared right after. The kill zone for the bearish Gartley pattern is at $38.33 at the .786 retracement measured from X to A. There's also confluence at $38.47 1.27 extension level measured from C to B leg of the Gartley. When there is confluence, there's strong resistance/support. I'm looking to short the gartley (red), and if price action heads up a little higher into the Cypher (purple), i'll scale in another size.

******************************************************************************

For inquires of education, live trading room, or prop trader funding email

epicdaytrading@gmail.com

Skype: epicdaytrading

PH: +1 940-448-0281

******************************************************************************

AKG - Gold sector starting to shine fundamentalllyThe gold sector has been rather sanguine of late and considering the lack luster performance of the underlying, that sector under performance is understandable. I believe there are areas within the gold space that are starting to offer 'value' investors some very interesting propositions. The great part of 'value' investing is we are often presented ideas when nobody else is interested. In fact, for one reason or another, the public is generally selling when we are thinking of buying. Because we are buying 'value' (and not too concerned about day to day fluctuations) we seem to get lots of time to accumulate our positions. Once these names put in 'technical' bottoms (which seem to come around our 'value' levels but can take some time to develop) price seems to take off very quickly. Anxiety can get high during those breakouts and FOMO can often lead to poor trade location decisions. So the question is, as 'value' investors what's the most efficient way to be a shareholder? Interestingly, Options by far are the most efficient way of become a stockholder but very few in the public understand how they work. Put-option-writes are, in my opinion, the only way investors should ever take long positions in large cap stocks. Not only does one buy the stock with the Put-option-write (keep in mind we fully expect to get exercised) but we also get to take advantage of bearish sentiment (through inflated premiums). Indeed, the case for writing options gets even more compelling if you understand how the modern day brokerage system works. If you chose to hold the position on margin in your brokerage account, you can literally collect enough of that bearish sentiment premium to pay the margin requirement to hold the stock indefinitely (as long as it stays 'option eligible') and get a little bit extra too - my 'get paid to buy stock' scenario....Here then above is a graphical demonstration of the WDB model in action. The model suggested we could get paid $3.10 by writing the August, 2014 $5.00 Put. If done and exercised, the margin requirement to hold the $5.00 position would be $1.50 (30% of underlying). Keep in mind, we were paid $3.10 (more than a 200% premium) ahead of time....Target to sell half the position is double our cash cost price ($3.80) which should create a 'risk free' trade on the remaining shares. That level seems achievable considering it is well below the natural 38.2 Fib & 200 week sma.

If my charts help you, or you use my indicators...

please consider a BTC donation to allow me to

continue my work :

1EBttA56cWsgtsZn83VGiNT8si7inZV5Z5

& follow me on Twitter @CRInvestor