Pypllong

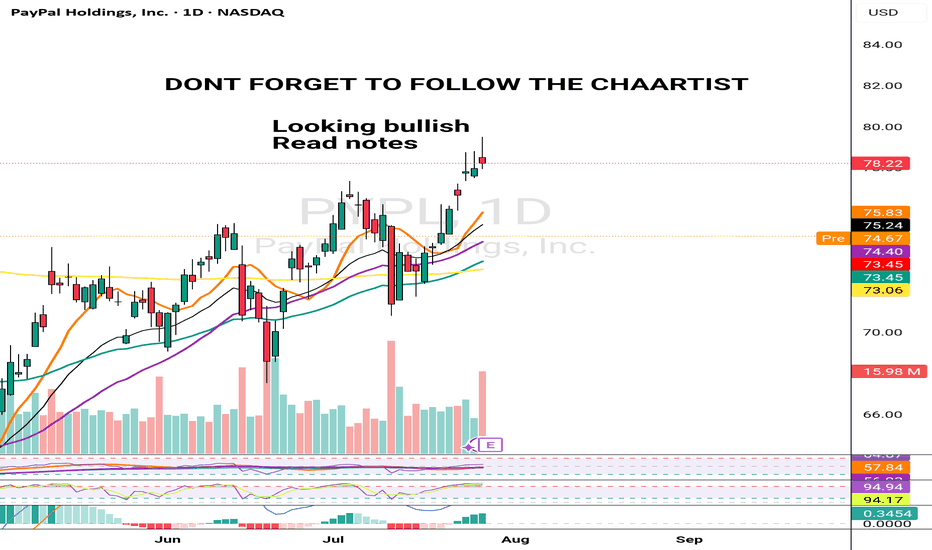

PYPL IS BEING PREPAREDI think the price will rise from the 65-67.5 price range. It is a nice range and we can see it as a test of the area it breaks. Although 75 is the first resistance, it should not bring much selling. After staying above 78, I expect a movement towards the 86 gap and the 110 region.

PayPal | PYPL | Long at $64.00From a technical analysis perspective, PayPal NASDAQ:PYPL is in the early stages of a potential downward trend reversal/stabilization based on my selected simple moving averages. With a current P/E of 15x, recent earnings beat, low debt, and earnings growth potential/estimates, PayPal is in a personal buy zone at $64.00.

Target #1 = $72.00

Target #2 = $85.00

Target #3 = $93.00

Target #4 = $117.00

PayPal Analysis: A Strong Surge Fueled by Market InnovationsPayPal (NASDAQ: NASDAQ:PYPL ) continues to make significant strides, as demonstrated by its recent partnership with Amazon, which is propelling the stock's impressive rally. In its latest update, Amazon announced the integration of PayPal into its *Buy with Prime* feature, allowing shoppers to pay using PayPal while leveraging Amazon’s Prime benefits. This partnership is a huge win for PayPal, as it will likely lead to broader usage across e-commerce platforms, giving more consumers and businesses access to its services.

Overview

The *Buy with Prime* feature allows Prime subscribers to make purchases on non-Amazon websites, offering free delivery and returns—enhancing the overall e-commerce experience for both merchants and buyers. Now, with PayPal in the mix, the payment experience becomes even more seamless. By 2025, Prime members will be able to link their Amazon accounts to PayPal, effectively bridging two e-commerce giants to create an easier, faster checkout experience.

PayPal’s new positioning as a strategic payment gateway on such a massive platform as Amazon could open doors to a larger customer base. The partnership builds on Amazon’s success with *Buy with Prime*, which has seen a 45% year-over-year increase in orders through merchant websites and a 16% increase in revenue per shopper since its expansion.

This also follows PayPal’s rollout of its own stablecoin, PYUSD, which is pegged to the U.S. dollar and brings it deeper into the realm of digital currency solutions. With the additional integration of the Ethereum Name Service (ENS) to their crypto services, PayPal (NASDAQ: NASDAQ:PYPL ) is diversifying its offerings across both traditional and digital finance, positioning itself as a leader in the evolving fintech landscape.

Technical Analysis

At the time of writing, PayPal (NASDAQ: NASDAQ:PYPL ) stock is up 6.24% during Thursday’s market trading session, reflecting strong investor sentiment following this string of developments. Technically, the stock is currently overbought, with the RSI (Relative Strength Index) standing at 73.88, signaling that the stock may be due for a short-term pullback or consolidation phase. However, this overbought level should not immediately deter investors, as the upward momentum suggests a continuation of bullish trends.

PayPal (NASDAQ: NASDAQ:PYPL ) has consistently performed well this year, with several key developments driving its upward trajectory. The RSI level could hint at potential price corrections or cooling periods, but it also signifies strong demand in the market. The stock has been trending upwards steadily since mid-summer and shows no signs of slowing down, especially with the positive news surrounding Amazon’s integration and the company's own innovations in digital payments.

It’s worth noting that gaps in the stock's price chart created earlier in the year might signal a possible retracement to fill those gaps. Nevertheless, the overall trend remains bullish, and PayPal’s stock could consolidate before pushing higher. The robust fundamentals supporting PayPal’s growth, including strategic partnerships and innovations in the fintech sector, could provide a solid foundation for sustained long-term growth.

Conclusion

PayPal’s integration into Amazon's *Buy with Prime* program, combined with its recent innovations like PYUSD and ENS integration, sets the stage for sustained growth in the fintech and e-commerce sectors. While technically the stock appears overbought and could be due for a brief pullback, its long-term prospects remain strong due to these strategic partnerships and advancements. Investors should keep an eye on any potential consolidation phases, which could present attractive entry points for those looking to capitalize on PayPal’s continued success in both the traditional and digital finance spaces.

PayPal’s Stellar Q2 Report: Revenue & Earnings Beat ExpectationsPayPal Holdings (PYPL) has reported impressive second-quarter results, with earnings and revenue surpassing analyst expectations. The digital payments giant’s robust performance has led to a positive market response, with its stock climbing over 7% following the announcement. Here’s an in-depth look at PayPal’s Q2 achievements, strategic moves, and future prospects under the leadership of new CEO Alex Chriss.

Q2 Financial Highlights

- Earnings and Revenue: Under new accounting rules, PayPal’s earnings for Q2 rose 36% to $1.19 per share on an adjusted basis. Revenue increased by 8% to $7.9 billion, exceeding the FactSet consensus of 98 cents per share on $7.82 billion in revenue. This marks a significant turnaround for the company, which had seen its stock fall by 4% in early 2024.

- Transaction Gross Profit: The transaction gross profit grew 6.5% to $3.2 billion, beating analyst estimates by 1%.

- Total Payment Volume (TPV): The total payment volume processed from merchant customers increased by 11% to $416.8 billion, just shy of the $417.5 billion analysts had projected.

Strategic Moves and Leadership Changes

New CEO Alex Chriss has been proactive in steering PayPal towards sustainable growth amidst rising competition from tech giants like Apple and Google. Despite fears of market share erosion, PayPal’s branded checkout business has outperformed, easing competition worries.

- Maintaining Market Share: Chriss highlighted that PayPal has maintained its market share in desktop/web checkouts, which constitute 40-50% of all checkouts, over the past four years despite the competitive landscape.

- Profit Forecast Upgrade: For the second time this year, PayPal has raised its forecast for full-year adjusted profit, now expecting a "low to mid-teens percentage" increase in 2024, up from the "mid-to-high single-digit" growth forecasted in April.

Key Performance Metrics

PayPal’s Q2 results have demonstrated the effectiveness of its strategic initiatives and operational efficiencies:

- Adjusted Earnings Per Share: The company’s adjusted earnings per share rose to $1.19, up from 87 cents in the same period last year.

- Revenue Growth: Revenue climbed 9% to $7.89 billion on a foreign exchange-neutral basis.

- Transaction Margin Dollars: Transaction margin dollars surged by 8% to $3.61 billion, far exceeding expectations of a nearly 1% gain.

- Operating Margins: Adjusted operating margins expanded by 231 basis points to 18.5%, driven by cost-cutting measures and restructuring efforts.

Branded Checkout and Key Business Segments

PayPal’s branded checkout, Braintree, and Venmo have all contributed to the highest transaction margin dollars growth rate since 2021. CFO Jamie Miller emphasized that the company is focusing on high-quality profitable growth, which involves prioritizing higher-margin transactions over sheer volume.

- Branded Checkout Growth: Despite investor concerns, branded checkout grew by approximately 6% in the second quarter.

- Braintree and Venmo: Both platforms have seen significant improvements in profitability and user growth. Venmo, in particular, continues to be a major growth driver.

Future Outlook

Looking ahead, PayPal is betting on the resilience of American consumer spending, especially during key shopping seasons such as back-to-school and the holidays. The company’s strategic focus on maintaining market share, enhancing profitability, and driving user growth is expected to yield positive results.

- Profitability Focus: PayPal’s plan to prioritize high-quality, profitable growth is evident from its strategic moves and financial performance in Q2.

- Market Confidence: The market’s positive response to PayPal’s Q2 earnings report underscores confidence in the company’s ability to navigate competitive pressures and drive long-term growth.

Conclusion

PayPal’s impressive Q2 performance, underpinned by strong earnings, revenue growth, and strategic leadership, has set a positive tone for the rest of 2024. With CEO Alex Chriss at the helm, the company is well-positioned to leverage its strengths, navigate market challenges, and continue delivering value to its shareholders.

As PayPal ( NASDAQ:PYPL ) continues to adapt and innovate in the dynamic digital payments landscape, its focus on high-quality growth and operational efficiency will be crucial in sustaining its competitive edge and achieving long-term success.

PayPal - Is the stock dead?Hello Traders and Investors, today I will take a look at PayPal.

--------

Explanation of my video analysis:

With the Covid-Crash in 2020 we saw a beautiful bullish break and retest on PayPal in confluence with a retest of an ascending trendline. This retest was followed by a rally of +200% towards the upside. From there, PayPal stock declined more than 80% and it is likely that we will never ever see the previous highs again. If you decide to take a trade though, make sure to properly manage your risk.

--------

Keep your long term vision,

Philip (BasicTrading)

PYPL: The Future of Payments Isn't Just About Money !For me PayPal is more than just a payment processor. It's a platform that's changing the way we live, work, and play. And in a world that's always looking for the next smile, PayPal is the perfect partner.

Just think about it. With PayPal, you can send money to friends with a funny meme. You can buy a gift for your mom with a hilarious message attached. And you can even pay for your pizza with a joke about how you're going to eat it all.

The future of payments is about making people smile, and PayPal is leading the way. So if you're looking for a way to make your life a little bit more fun, then invest in PayPal. You won't regret it.

PYPL *KEY* LEVELHere is PYPL with a macro and micro point of view. 4h is showing a inverted head and shoulders pattern initiating but when zoomed into the 5m we can see that price closed at a gap down level signifying weakness of buyers at sitting unfulfilled sell orders. If price where to gap above these orders we can expect a strong continuation to the upside to follow through the INVS H&S. If we were to gap down at open expect an even stronger flush to the previous gap up level.

PYUSD - The PayPal StablecoinHi Traders, Investors and Speculators of Charts📈📉

PayPal announced yesterday on August 7, 2023 that it has launched a U.S. dollar stablecoin, called PayPal USD (PYUSD) . PYUSD is fully backed by U.S. dollar deposits and short-term U.S. Treasuries, and is issued by Paxos Trust Company. It is available to PayPal customers in the United States with PayPal Balance accounts.

PayPal has partnered with Paxos to launch PYUSD. Paxos is a leading blockchain infrastructure company that specializes in stablecoins. Paxos also issues the BUSD stablecoin, which is used by Binance. PYUSD was first announced in January 2022, but its launch was delayed due to regulatory concerns. However, PayPal has since received approval from the New York State Department of Financial Services to issue PYUSD.

PYUSD is currently valued at $1.00 per token. It can be used to buy, sell, hold, and transfer funds on PayPal. It can also be used to make payments to merchants that accept PayPal.

PayPal has been crypto-friendly for some time. In addition to PYUSD, PayPal also offers four other cryptos: Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. PayPal customers can buy, sell, hold, and transfer these cryptocurrencies on the PayPal platform.

PayPal's launch of PYUSD is a significant development in the cryptocurrency space. It is the first major financial technology firm to launch its own stablecoin . PayPal's move is likely to boost the adoption of stablecoins and cryptocurrencies in general.

💭 It's interesting to see how the fundamentals tend to follow the chart or vice versa. When we analyze the PayPal chart, we see a definitive completion of a bearish trend / downward cycle. According to Wyckoff Method and other market phases, the next cycle is the upward cycle / bullish phase. And so, this news comes at just the right time to kickstart a new market cycle!

_______________________

📢Follow us here on TradingView for daily updates and trade ideas on crypto , stocks and commodities 💎Hit like & Follow 👍

We thank you for your support !

CryptoCheck

NASDAQ:PYPL

SasanSeifi 💁♂️🔵PYPL👉12H⏩ 72$ / 75$ Hey there,

🔱By examining the chart n the 12-hour timeframe, you can see that the price is currently following a downward channel trend. However, there has been a positive response as the price has managed to grow within the midline of the channel, reaching around the $69 price range. It's currently consolidating in that range.💹

◼Looking ahead, in this 12-hour timeframe, one possible scenario to consider is if the support range around $66/$65 holds, we may see further price growth towards the important resistance level at $72, and even reach the supply zone around $75. To get a better understanding of the price trend continuation, it's important to observe how the price reacts to these resistance levels.💹

🔵Remember, always conduct your own analysis and consider other factors before making any trading decisions. Good luck!"✌✨

❎ (DYOR)...⚠️⚜️

🔹Sure, if you have any more questions or need further clarification, feel free to ask. I'm here to help!

🔹And if you found my analysis helpful, I would appreciate it if you could show your support by liking and commenting. Thank you! 🙌

PayPal is starting to recoverHi, according to my analysis of Paypal shares. There is a good buying opportunity. The stock appears. In a positive condition with the stock exiting the descending channel. And breaking the strong resistance at level 68. Which indicates a strong entry of buyers. Good luck to all

$pypl after earning 3 day rule The 3-day rule is a trading strategy that suggests waiting three days after a company releases its earnings report before buying or selling the stock. The idea is that the stock price will have had time to adjust to the news by then, and you will be less likely to make a rash decision based on emotions.

There are a few reasons why it's a good idea to wait three days after earnings before making a trade. First, the market is often volatile in the days leading up to and after earnings. This is because investors are trying to anticipate the company's results and how they will affect the stock price. As a result, the stock price can be very unpredictable during this time.

PayPal to find buyers at yearly lows?PayPal - 30d expiry - We look to Buy at 69.11 (stop at 65.31)

Levels below 69 continue to attract buyers. 67.58 has been pivotal.

66.39 has been pivotal.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

We look to buy dips.

This stock has seen good sales growth.

Our profit targets will be 78.51 and 80.51

Resistance: 75.30 / 77.80 / 79.30

Support: 73.00 / 71.09 / 69.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.