Quant

$QNT - THIS MIGHT BE HUGE! falling wedge, bullish div, retestshuge opportunity here on QUANT!

I love quant and its fundamentals so a trade opportunity on it really makes me want to enter asap to be honest

The price created a falling wedge in the past month, which is just about to breakout

the amplitude at the beginning of it was about 20%, so given the resistance around $115, we can expect a good 18%-ish rally until those prices if we see a strong breakout

ALSO, the price created a bullish RSI divergence, which historically almost always makes the price go up, and we might be seeing the start of the uptrend in just a few 4h candles, if not even on this one!

plus, we're approaching the huge $90 support level, which may mean something

BTC is also going to rally until 41 or 42 k in my opinion, so we might see some good momentum from quant

let me know what you think about this analysis and about the trade!

also drop a like and follow me here and on twitter if you enjoyed it!

🎯 HISTORICAL EDGE - 77.50% WIN RATE - 08APR22PRO TRADER : Do you see the HISTORICAL EDGE?

NEWBIE : silence ...

PRO TRADER : Ok, we got a 10day low yesterday. Today the SPY gaps up and closes positive on the day. This close is above the 200MA.

⬇️ ⬇️ ⬇️ RESULT ⬇️ ⬇️ ⬇️

🔱 This setup has occurred 40 times since 2007! 💎

🔱 The 1 day move from here has had 77.5% chance of being bullish 🟢 ( aka higher for the cash session 08APR)

🔱 The average move up has been 0.8%!

👉 Aka we predict that on the 08APR22 the general market (SPX) has 77.5% chance of closing 0.8% here from here!

😱. WARNING we posted a Outside UP month in the NDX100PRO TRADER : Hey, newbie! We posted an Outside Up Month on the NDX100, did you see?

NEWBIE : What is an Outside Up Month (OUM)?

PRO TRADER : It is a month where you get higher high, lower low and a close higher than the close of the previous month. It is a sign of strong momentum.

NEWBIE : Thanks, Pro Trader. How can I make money out of this?

PRO TRADER : Well it is not a signal but if you backtest it you will see that after the times the NDX100 has make an OUM

the stock market has traded higher in the next 8 months 91.3% of the times!!!

NEWBIE : Wow!

PRO TRADER : Also if you compare the gain after the times we get a OUM to those without OUM, you see 50% larger gains - so a bet to upside seems to pack a punch!

NEWBIE : Thank you, Pro! I will make sure I use the info!

QNT - Video Top-Down Analysis!Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

Here is a detailed update top-down analysis for QNT.

Which scenario do you think is more likely to happen? and Why?

Always follow your trading plan regarding entry, risk management, and trade management.

Good Luck!

All Strategies Are Good; If Managed Properly!

~Rich

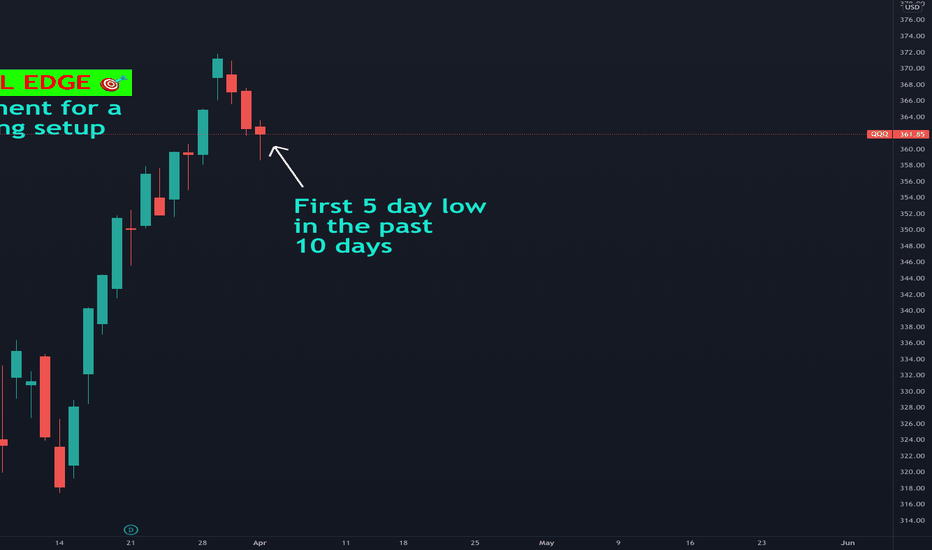

🎯 HISTORICAL EDGE - 76% WIN RATE - 04APR22PRO TRADER : Do you see the HISTORICAL EDGE?

NEWBIE : Yeah we close under the 200D MA

PRO TRADER : Close! The QQQ made a 5day low for the first time in the last 10days AND it closed under 200D

⬇️ ⬇️ ⬇️ RESULT ⬇️ ⬇️ ⬇️

🔱 This setup has occurred 25 times since 2000! 💎

🔱 The 10 day move from here has had 76% chance of being bullish 🟢 ( aka higher from here)

🔱 The average winner has been 4%!

👉 Aka we predict that in the next 10days QQQ has 76% chance of closing 4% here from here!

QNT LONG 300%+ Here we have QNT , covering this one for all of the 'financial system collapse theorists' / 'Great reset people'

Simply, working out of trend structure, fibb set up, reacted of 88.6 and 77.8. We have had some divergence print prior to the upmove, and we are retesting some support here, and potential divergence on RSI while support holds. Looking to dca an entry down here. enjoy.

Your FAQ About Quant Trading I have received many questions about quantitative analysis/quant trading. This post is to address these FAQ I receive and point you in the right direction if this is something you are interested in!

If I missed any questions, please leave them in the comments and I will add an addendum!

Q: What is quantitative analysis/quant data?

A : Quantitative analysis is the practice of applying mathematics and statistics to stock trading data. It involves the process of data mining and drawing statistic inferences between related and unrelated variables to look for correlations in data that can be used to predict future stock movement.

Q: What is a “quant”?

A: There are two types of quants or quant traders. This is more applicable to hedge funds and banks who employ these people, but essentially, there are quantitative modellers and quant developers/programmers.

Quantitative modellers (which is essentially, what I am) are generally statisticians who have a degree in applied mathematics or statistics. They employ statistical theories to develop working mathematical models of stocks and attempt to quantify stock behaviour into mathematical formulas and determine probability of meeting certain conditions (i.e. price).

Quant developers/programmers generally have degrees in computer science or computer engineering and software development. They take these models from the statisticians and program them into software to create high frequency trading algorithms and longer-term trading algorithms. They will also use this data to develop software to manage and view risk quantitatively.

Q: Is quantitative analysis the same as technical analysis?

A: No. Technical analysts apply a type of qualitative data analysis. While technical analysis attempts to, loosely, base itself on mathematical principles, it is an attempt to qualitatively represent quantitative data. As such, technical analysis is slightly more susceptible to biases. Whereas one TA may view a Fibonacci level as indicating bullish movement, another may view the same level as indicating bearish movement. It is dependent on the TA’s own sentiment and their ability to recognize sentiment and context.

Contrast this to a QA, the range that one QA comes up with will likely be very similar to the range of the other QA. That is because QAs all apply the same statistical strategies and tests to identify the data and trends. Biases for QAs are generally counter-intuitive to the process. QAs should not care about what the context or sentiment is, they simply follow the algorithmic processes which are characterized as “If – Then” statements.

Q: How does “quant” trading work?

A: Traditional quant trading and the quant trading done by hedge funds and banks are accomplished through computers that execute algorithms directly with exchanges. They do not operate through brokerages, they have a direct link to the exchange where they can quickly enter and exit trades that have satisfied the algorithmic conditions.

For retail quants like myself, it varies. As I am a quant modeller and not a programmer, I must execute my own trades based on the conditions being met. This introduces the possibility of bias on my part and this bias has gotten me into trouble before!

However, other quant traders that are more on the computer programming side, develop their own trading algorithms that will automatically execute their trades, etc. To do this, you need a broker that allows third party integration, in order to integrate your trading platform directly with your developed software. I have no idea how to do this, but I know there are brokers out there that allow this to happen and I know quant retail traders who do, do this.

Q: What do I need to be a quant trader?

A: Generally, you need a solid understanding of statistics and/or computer programming. In order to effectively develop a working model of a stock, you really need to have a strong understanding of statistics; however, I do know some quants that apply machine learning to their modelling which works okay from what they tell me and can avoid the hassle of developing complex mathematical models of stocks (which takes a long time, I speak from experience!).

You also need software and to have a working understanding of a programming language (knowing Excel as a programming language is sufficient!). You need either some form of statistical analysis software or programming software. Software that I frequently see advertised being used at quant firms and banks (at least in Canada) include MATLAB, C++ and Python.

I personally use SPSS (in lieu of SAS and MATLAB) and Excel (in lieu of Python/C++).

Python is much more powerful generally than Excel and even MATLAB, equally as powerful as SPSS and SAS in its ability to analyze statistical problems and has the ability to actually do more critical appraisals of information than SPSS, SAS, MATLAB and Excel can do. However, for mathematical modelling, I tend to prefer SAS or SPSS combined with Excel but this is mostly because I am a statistician and this software presents the results in a way that I am familiar with (I’m an old dog with no interest in new tricks). A software engineer or programmer would most likely prefer Python. Specifically Anaconda has the same functionality as MATLAB (or so I am told).

Q: Is there a cost to the software?

A: So, Python is free! So if you know how to use Python or you are interested in learning, you can download it free online! It is open source and very powerful! If your novice, I recommend downloading Python Anaconda, it has everything you need!

Excel and SPSS (what I use) tend to be costly. Excel is the cheaper alternative, I think it costs me about 75$ a year (however, I am still a student so I get the student discount, not sure full price).

SPSS, MATLAB, SAS are extremely expensive. In excess of over 2,000 USD. There is an option to do an annual licensing agreement for less, but the price would add up.

Q: Do I need a degree in mathematics or computer programming?

A: NO! You don’t. You can learn this stuff from books and reading. Having a degree doesn’t even guarantee you that you will understand this stuff. I speak to some of my classmates about what I do, and they still don’t understand what I am doing (despite also having MScs in statistics hahaha). It all comes down to your critical application of knowledge! Education is very important, IMO, but its not everything and everyone has the potential to learn if they are truly motivated to!

My background was I started as a nurse with a bachelors of science. I fell in love with mathmatics and statistics in my undergrad and ended up pursuing higher education in mathematics, specifically applied statistics.

Q: How is quant trading different then technical trading?

A: So, as I wrote above, technical trading is the qualitative appraisal of quantitative data. I am not a technical trader and can’t speak too indepth about this process.

But I can contrast a little bit, which I will do below!

A technical trader may look to see that a particular price point was respected and not surpassed over a number of days. They would likely label this as strong support and would assume that a break of this support would lead to more sustained selling.

Contrast to a quant trader, I do not pay attention to any one specific price point. Price action tends to be more on the random side. So I rely on all of the data over many years of trading to develop working ranges and variances between the data. From this, I can determine the range that a stock likes to operate in (whether it be +/- 10 points or, if its TSLA, +/- 30 to 60 points). From here, I can use previous day data to predict a likely range for the next day. When I have that range, I can then express my hypothesis in conditional algebraic forms, like:

IF Condition 1 met THEN statement 1 correct AND statement 2 incorrect; or

IF Condition 2 met then statement 2 correct and statement 1 incorrect.

I then follow linear algebraic principles to identify those conditions and subsequents.

For example, for today, SPY opened around 420.28. The range that I calculated for SPY today was 415 to 427. So, the problem that I needed to solve mathematically was:

If Condition X met then SPY = 427; OR

If Condition Y met then SPY = 415.

Then I must use algebra and statistics to determine what Condition X and what Condition Y are.

If you read my ideas, you will notice that I express my ideas in linear algebraic form. For my post about SPY today, this is what I had wrote:

A break above 424 would indicate bullish sentiment and likely continuation towards 427.

A break below 418 would indicate bearish sentiment and likely continuation towards 415.11.

If you notice, this can be expressed as a conditional (algebraic) statement:

IF X > 424 THEN 427 is met; OR

IF X < 418 THEN 415 is met.

Now I don’t manually do this because it would be to labour intensive. Which is why I say you need to know a programming language. You can program Python, Excel, MATLAB, C++, etc. to do this for you and identify those ranges. But you need to have the theory in order to understand how to get there and how to give Excel, Python, C++ or MATLAB what it needs to solve the problem for you.

Q: Can you recommend books or videos on quant trading?

A: So, I have not found any quantitative retail traders on youtube. There are 2 quant developers that actively post on YouTube who have okay content, one being Trading Jesus and the other is Korean Yuppie (who is still kind of novice and hasn’t posted much). Both are from the perspective of quantitative developers; however, this is a completely different skillset from a quantitative modeller. But equally interesting and informative!

In terms of books, I would recommend general statistics books and books on programming language like Python or even books on Excel. Excel is generally an under-rated platform that is capable of quite advanced data analysis. Don’t under-estimate it! Excel is involved in my trade planning, execution and profit taking process. It is the thing that dictates what I should do and where I should enter/exit.

You also need a solid understanding of the market, how it is organized and how it functions. So general books about market theory and trading are also useful. I have no

real recommendations as I haven’t read any books, aside from The Trading Zone, which I found insightful but not helpful. Most of the information you need is available for free online. I wouldn’t invest a huge amount of money in books that are mostly fluff, especially books on day trading.

Equally, avoid courses! Don’t buy people’s courses and don’t trust trading “gurus” from YouTube.

Hope this answers all of your questions, again please let me know if you have any that I have not addressed!

Thank you, take care and as always, trade safe!

🎯 HISTORICAL EDGE - 🟢 RESULT FOR 15FEB💁♂️ TRADER: Did you take the signal, Newbie?

👶 NEWBIE: No, what happened?

💁♂️ TRADER: We anticipated a move to the upside ⬆️ on the 15FEB since we had a rare historical setup on the 14FEB.

👶 NEWBIE: And...?

💁♂️ TRADER: SPX posted a move to the upside with 1.5%🟢 AND given this an estimate for the general market, the move to the upside dragged many names up (NEW+5.5%, OXY+5.6%, CTRA+4.87%, PSX+4.18% etc etc.). These setups move the whole market - pay attention next time, Newbie.

🎯 HISTORICAL EDGETRADER: Do you see the HISTORICAL EDGE?

TRADER: Yesterday we posted a LOWER HIGH, LOWER LOW and LOWER CLOSE for the 3rd Day in a row!

NEWBIE: So what?

TRADER: It was also a MONDAY

NEWBIE: And?!

TRADER: We refer to this as TURNAROUND TUESDAY. CHECK out the STATS what happens the next day when this setup occurs

⬇️ ⬇️ ⬇️ RESULT ⬇️ ⬇️ ⬇️

This setup has occured 22 times since 1993! 💎 We backtested the results:

The 1 day move has had 65% chance of being bullish 🟢 on the next day (aka market session on 15FEB)

The average winner has been 2 times larger than the average loser

Trading Tip: Alchemy Pay ($ACH) major profitable swing/scalping Recently I've been looking a lot at Alchemy Pay $ACHUSDT for profits. It's been having major swings for quite some time.

While Bitcoin has not been providing the necessary intervals for making large profits, ACH is definitely a good substitute right now.

Traders should also look at:

$DAR

$QNT

$CHR

QUANT, scalping heaven turning liability and vice versaUntil recently, Quant, trading pair $QNTUSDT was a scalping heaven with a very predictable chart that allowed easy scalping trades while moving against Bitcoin's trend.

All until Bitcoin started side trading movements which completely destabilised Quant, and completely blocked traders funds for more than 48 hours until it started moving again, unfortunately in a downtrend that increased losses even more.

Now, QNT started to proceed back into an uptrend after its major pump up from ~95 price area.

If Bitcoin continues its uptrend with minor dips, we can see QNT to regain its scalping spot with a trend against BTC. However, it is advisable scalping traders apply extra vigilance as QNT can switch to sideways trading for more than 48 hours.

🎯 HISTORICAL EDGE - MORE TO DROPHey guys!

Todays Historical edge comes from an interesting pattern.

📈 The Pattern: SPX closes down over 2% and above 5day low, but yesterday it closed at 5day high.

We backtested and saw strong edge.

⬇️ ⬇️ RESULT ⬇️ ⬇️

📍 Edge: 🔴 Bearish

🔄 Occurrence since 1990: 25x (frequent)

🏔 Highest edge: 4days later

🎲 Probability of bullish move: 28% - aka this suggest a bearish move over the next 4days.

QNTUSDT Strong rise but no break-out yet confirmed.Quant is on a very strong 1D rise today, the strongest since November 09 2021. Even though this is the 4th straight green 1D candle, the restoration of the bullish trend long-term can't yet be confirmed. As you see the price has been trading within a Channel Down since the September 11 2021 market top. The 1D MA50 (blue trend-line) has been acting as Resistance since November 15. Even though the MACD made a Bullish Cross, this rise is just a rebound pricing the new Lower High within the Channel, as were all previous MACD Bullish Crosses since October 16.

The condition to fulfil in order to confirm a bullish break-out and resume of the bullish trend long-term is for the 1D RSI to break above its 57.850 Resistance, which has been holding since September 23 2021. A break above it, should see QNTUSDT break above the 1D MA50 as well and target the top of the Channel Down to roughly 210.00 - 220.00, while a break above it, sets in motion the next Fibonacci extensions (1.5 and 2.0). At the same time a break below the bottom of the Channel Down, should target the -0.5 Fibonacci extension.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

QNT Daily Outlook$qnt #qnt nice H4 close. Here is the daily outlook with fib extension levels that line up nicely with the support that was lost at .236.

Potential paths from here after strong LTF close.

Also worth noting, Daily tag of MA20 and SuperTrend.

——————————————————————————————

Top 10 trading tips:

1. DO NOT FOMO into a trade. Let it come to you. Don’t force it.

2. Find a strategy that works for you and be consistent. Operate like a machine and less like the wind.

3. Let your winners run and cut your losers short.

4. You will not win every trade, but if you are disciplined with great RM you don't need to be right all the time to win!

5. Before you enter a trade, know your target AND your exit strategy.

6. When you are up, you can use a trailing stop or trim off some profit at a logical resistance point with a stop loss at breakeven.

7. Set your trade parameters up front so you keep your self accountable and remove emotions from the equation. (stop loss, take profit levels, etc)

8. Don't fight the trend. The trend is your friend.

9. Don’t enter a trade based on one indicator.

10. Horizontals > Diagonals

Please note:

- This is not financial advice.

- I do not take every trade I post.

- Never trade off of someone else's chart until you DYOR!

🎯 HISTORICAL EDGE - VIX helping the BULLS 🐂👋 Hey team!

Today we see that the VIX 🌊 made a dramatic reversal after closing more than 10% below its 10D MA 👇

Why is this special? Because a few days ago we were above it by more than 10% 👆

We reviewed when has this happened in the past (since 1993 to be exact)🧪.

⬇️ ⬇️ ⬇️ RESULTS ⬇️ ⬇️ ⬇️

This type of event has occurred 40x since 1993 and we see strong historical edge 8️⃣ days later with a batting average of 77.5% to the upside! 📈

We also see that 90% of these times we have closed above the closing price of SPX on the day it occurred (31JAN in our case) at some point next week!