The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

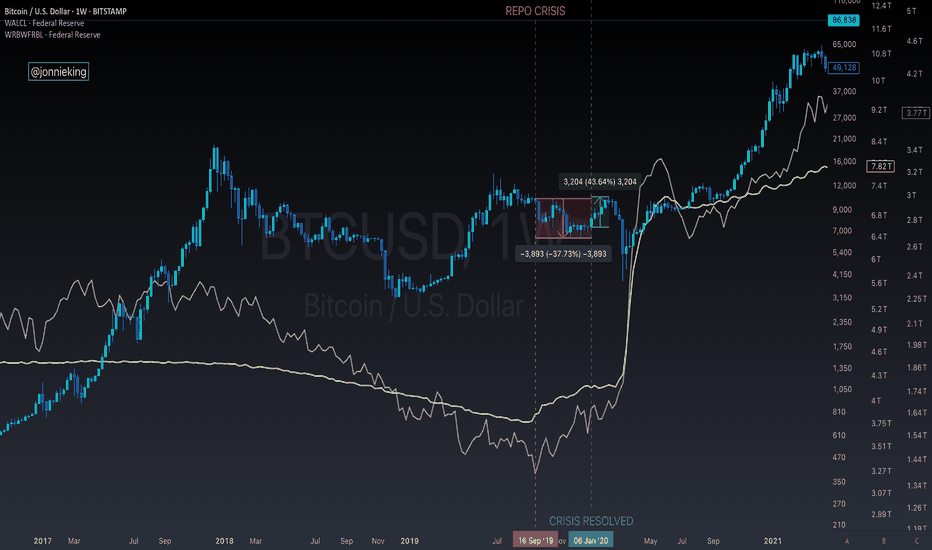

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

Quantitativetightening

THE LIQUIDITY PARADOX: Charting the Macro Environment for 2025WEN QE !?

TL;DR there will be NO Quantitative Easing this cycle.

YES the markets will still go to Valhalla.

LIQUIDITY DRIVES MARKETS HIGHER. FULL STOP.

Global M2 has a highly correlated inverse relationship with the US Dollar and 10Y Yield.

Hence why we have been seeing the DXY and 10YY go up while Global M2 goes down.

THE SETUP

We are in a similar setup to 2017 when Trump took office.

M2 found a bottom and ramped up, which toppled the DXY.

Inflation nearly got cut in half until July 2017, where it then slowly started to creep back up as M2 and markets exploded.

To much surprise, all this occurred while the Fed continued to RAISE INTEREST RATES.

This was in part due to policy normalization with a growing economy coming out of the financial crisis and having near 0% interest rates for so long.

In Q4 2014, the Fed paused QT, keeping its balance sheet near neutral for the next 3 years.

As inflation started rising, QT was once again enacted, but very strategically with a slow roll-off in Q4 2017. This allowed markets to push further into 2018.

THE PLAYBOOK

M2 Global Money Supply: Higher

Dollar: Lower

Fed Funds Rates: Lower

10YY: Lower

Fed Balance Sheet: Neutral

Inflation: Neutral

TOOLS

Tariffs

Deregulation

Tax Cuts

Tax Reform

T-Bills

HOW COULD WE POSSIBLY WEAKEN THE DOLLAR?

Trump has been screaming from the mountain tops; TARIFFS.

Tariffs will slow imports and focus more on exports to weaken the dollar.

The strong jobs data that has been spooking markets and strengthening the DXY will be revised to show it’s much worse than numbers are showing.

The Fed will pause QT, saying it has ample reserves, but not enable QE.

At the same time, they could pause interest rate cuts to keep a leash on markets and not kickstart inflation.

Then once all the jobs data is revised and markets get spooked at a softened economy (Q2), they will continue cutting.

WHY DOES THE FED KEEP CUTTING RATES EVEN WITH A STRONG ECONOMY?

In short, the Fed has to cut interest rates for the US to manage its debt.

THE US government is GETTEX:36T in debt.

In 2025, interest projections are well above $1T.

That would put the debt on par with the highest line items in the national budget such as social security, healthcare and national defense.

The Treasury manages its debt by issuing securities with various maturities. When rates are low, they can refinance or issue new debt.

As rates rise, the cost of servicing debt increases, and vice versa.

It’s one of the underlying reasons why the Fed cut (but no one will say it out loud)…

hence why everyone is so confused and screaming that they cut too early and the bond vigilantes have been revolting.

HOW DOES THE MONEY SUPPLY GO UP IF NO QUANTITATIVE EASING?

We’ve seen this before.

President Trump and Treasury Secretary Scott Bessent have been telling you their playbook.

In 2017, deregulation and tax cuts led to an increase in disposable income from individuals and corporations.

Banks created more money in the markets through lending based on increased economic activity.

Global liquidity increased in other major central banks like the ECB, BOJ, and PCOB who were still engaged in QE, and / or maintained very low interest rates, which created more liquidity in the US money supply.

We’re seeing the same thing now with Central Banks around the world.

The tax reform allowed for the repatriation of overseas profits at a lower tax rate, which brought a significant amount of cash back to the US.

Like 2017, the US Treasury will increase short-term bill issuance (T-Bills), providing an alternative to the Reverse Repo (RRP), which reduces RRP usage. This provides liquidity to the markets because once the T-bills mature, funds can use the proceeds to invest in other assets, including stocks.

Banks will buy T-bills and sell in the secondary market or hold til maturity, where they can then lend the cash or invest in equities.

Another strategy to inject cash into the banking system would be standard Repo Operations. Here the Fed buys securities from banks with an agreement to sell them back later. This would increase lending and liquidity.

Hopefully now you can see why markets DON’T NEED QUANTITATIVE EASING !

That would for sure lead to rampant inflation (see 2021), and blow up the system all over again.

$RESPPANWW Fed Balance Sheet at 2020 Level Before QEVery interesting chart to watch here FRED:RESPPANWW

Clearly shows we're still in QT, but obviously markets have been pumping.

The Fed balance sheet is sitting at $6.9T which is the level in 2020 when the Fed continued its 2nd round of QE.

I doubt they would announce they are buying assets again at the next FOMC on 12/17, but quite possibly at the January or March 2025 meeting after Trump takes office.

What Is Quantitative Tightening and How Does It Work?What Is Quantitative Tightening and How Does It Work in Financial Markets?

Quantitative tightening (QT) is a critical tool central banks use to control inflation by reducing the money supply. In this article, we’ll break down how QT works, its impact on financial markets, and how it influences the broader economy. Read on to learn more about the effects of QT and how it shapes markets.

What Is Quantitative Tightening?

Quantitative tightening (QT) is a type of tightening monetary policy that central banks use to reduce the amount of money circulating in the economy.

When central banks like the USA’s Federal Reserve or European Central Bank engage in QT, they aim to tighten liquidity by reducing their balance sheets, typically by allowing bonds or other financial assets to mature without reinvestment or selling them outright. QT is a practice often used alongside hiking central bank interest rates, though not always.

The main goal of QT is to manage inflation by increasing borrowing costs and reducing demand for goods and services. By letting bonds mature or selling them, central banks effectively pull money out of circulation. This leads to fewer funds available for lending, which raises interest rates.

Higher rates make borrowing more expensive, encouraging businesses and consumers to cut back on spending, which can help cool down inflation. An example of this mechanism in action is the Fed’s QT program that began in 2022 to tackle high inflation by reducing the size of its balance sheet after years of quantitative easing.

QT is essentially the opposite of quantitative easing (QE), which is aimed at stimulating economic growth.

What Is Quantitative Easing?

QT and QE are both used to correct the economy’s course. However, while QT refers to the tightening of monetary policy, QE loosens it. During QE, central banks buy large quantities of government bonds and other assets to inject liquidity into the economy. This increases the money supply, lowers interest rates, and is intended to stimulate economic activity, particularly during downturns or recessions. QE was used extensively following the 2008 financial crisis and during the COVID-19 pandemic as a way to support economic recovery.

How Does Quantitative Tightening Work?

Quantitative tightening works by pulling liquidity out of the financial system, reducing the amount of money available for borrowing and investment. Central banks use a couple of specific methods to achieve this, which have a ripple effect on markets and the broader economy.

1. Reducing Asset Holdings

One of the most common ways central banks implement QT is by allowing bonds and other financial assets on their balance sheets to mature without reinvesting the proceeds. For example, the Federal Reserve might hold trillions in government bonds. When those bonds mature, instead of using the proceeds to buy new bonds, the Fed simply lets the money flow out of circulation. This reduces the central bank’s balance sheet and shrinks the money supply, contributing to higher borrowing costs.

2. Selling Bonds

Another method central banks use is the outright sale of government bonds or other securities. By selling assets, central banks increase the supply of bonds in the market. This can push bond prices down and drive yields higher, which makes borrowing more expensive for companies, governments, and individuals alike. Rising bond yields often lead to higher interest rates across the board, from mortgages to business loans—when there’s less money available for lending, banks raise the rates they charge for loans.

Effects of Quantitative Tightening on the Broader Economy

Quantitative tightening has significant ripple effects across the broader economy. As central banks reduce liquidity, it impacts everything from borrowing costs to consumer spending and business investment.

1. Higher Borrowing Costs

One of the most immediate effects of QT is the rise in interest rates. As central banks shrink their balance sheets, bond prices fall, pushing yields higher. This, in turn, raises the cost of borrowing for businesses and consumers. There may also be interest rate hikes alongside QT, further tightening lending conditions.

Mortgages, personal loans, and corporate debt all become more expensive, discouraging borrowing. For businesses, higher financing costs can limit expansion plans, reducing investment in growth or innovation. Households, meanwhile, face elevated mortgage rates, leading to reduced demand in housing markets and potentially lower home prices.

2. Reduced Consumer Spending

As the cost of borrowing rises, consumers have less disposable income. Higher interest rates on loans and credit cards mean households spend more on servicing debt and less on goods and services. This can slow down retail sales and reduce overall consumer demand, which is a critical driver of economic growth. Lower consumer spending typically affects sectors like retail, real estate, and manufacturing, which depend on a high volume of transactions.

3. Slower Business Growth

QT also impacts businesses by making it more expensive to access credit. Companies that rely on borrowing to finance operations, new projects, or expansions find it harder to justify taking on debt. With higher interest payments eating into profits, many businesses may delay or scale back investment plans. In addition, small and medium-sized enterprises (SMEs) that depend on bank loans for cash flow are often the hardest hit.

4. Inflation Control

While QT can slow economic activity, its primary goal is to rein in inflation. By reducing the money supply and making credit more expensive, it cools down demand. Lower consumer and business spending can reduce price pressures, helping to stabilise inflation. This was a key objective when the Federal Reserve resumed QT in 2022 to counter post-pandemic inflation.

5. Potential Economic Slowdown

However, if QT is too aggressive, it risks triggering an economic slowdown or even a recession. Tightening financial conditions leads to reduced economic growth, as seen in 2018 when markets reacted negatively to the Federal Reserve’s balance sheet reductions.

How Does Quantitative Tightening Affect Financial Markets?

Quantitative tightening can have significant effects across different financial markets. By reducing liquidity, it influences the behaviour of key assets, from bonds to equities, and can reshape market conditions in profound ways.

1. Bond Market

QT often leads to higher bond yields. When central banks like the Federal Reserve reduce their bond holdings or stop reinvesting in new ones, the supply of bonds in the market increases. As bond prices drop, yields rise to attract new buyers. This rise in yields means governments and corporations face higher borrowing costs. For instance, during the Federal Reserve’s quantitative tightening efforts in 2018, US Treasury yields rose significantly as more bonds became available in the market.

2. Stock Market

Equity markets often react negatively to QT. As liquidity tightens, the cost of borrowing rises for businesses, which can squeeze corporate profits and reduce their ability to invest or expand. Investors also tend to move away from riskier assets like stocks when bonds offer higher yields, as bonds become more attractive for their safety and improved returns. In 2018, US stocks experienced heightened volatility when the Fed’s quantitative tightening efforts combined with rate hikes led to market corrections.

3. Foreign Exchange Market

QT can also impact currency values. As central banks tighten monetary conditions and raise interest rates, their currencies often strengthen relative to others. This is because higher yields and interest rates attract foreign investment, increasing demand for the currency. For example, when the Fed began QT in 2022, the US dollar strengthened as investors sought better returns on US assets like Treasury bonds. See how the US dollar strengthening occurred for yourself in FXOpen’s free TickTrader trading platform.

4. Credit Market

QT reduces the availability of credit as banks and financial institutions face higher borrowing costs themselves. As liquidity is drained from the system, lenders tighten their credit conditions, making loans more expensive and harder to get. This can slow economic growth as businesses and consumers find it more costly to finance investments or purchases.

In effect, QT creates a tighter financial environment by reducing liquidity, pushing up borrowing costs, and shifting investor behaviour across various markets. Each asset class feels the impact in different ways, but the overall effect is a more cautious, less liquid financial system.

The Bottom Line

Quantitative tightening is a powerful tool central banks use to manage inflation by reducing liquidity and increasing interest rates. While it helps control rising prices, QT can impact borrowing costs, investment, and market stability. Understanding how these mechanisms work is crucial for informed trading.

Ready to take advantage of different market conditions? Open an FXOpen account today and start navigating more than 700 financial markets with low-cost, high-speed trading conditions, and four advanced trading platforms.

FAQ

What Is Quantitative Tightening?

The quantitative tightening definition refers to a monetary policy used by central banks to reduce liquidity in the economy. This involves decreasing the central bank’s balance sheet by selling bonds or allowing them to mature without reinvestment. QT is typically aimed at curbing inflation by raising borrowing costs and slowing economic activity.

How Does Quantitative Tightening Work?

QT works by reducing the supply of money in the financial system. Central banks achieve this by selling government bonds or letting them mature. As the bonds leave the market, interest rates rise, making borrowing more expensive for businesses and consumers.

How Does Quantitative Tightening Affect the Stock Market?

QT can negatively impact stock markets. As interest rates rise and liquidity tightens, borrowing costs for companies increase, which can hurt corporate profits. Investors may shift towards so-called safer assets like bonds, reducing demand for stocks and contributing to market volatility.

What Is the Difference Between QT and QE?

Quantitative easing (QE) increases the money supply by buying bonds, while quantitative tightening (QT) reduces liquidity by selling bonds or letting them mature. The main difference between quantitative easing vs tightening is that QE stimulates economic growth, while QT aims to control inflation.

What Does It Mean When the Fed Is Tightening?

When the Federal Reserve tightens, it implements policies to reduce money supply and raise interest rates. This helps control inflation by making borrowing more expensive and slowing economic activity.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Is QE really around the corner? Let's compare to GFCThe argument for US Quantitative Easing soon and subsequent pumpamentals in the equity market are often discussed on socialmedia these days.

Let's look at the GFC and see when they announced QE back then.

February 7, 2007 – HSBC’s Subprime Losses

July 31, 2007 – Bear Stearns Hedge Fund Collapse

September 18, 2007 – Fed Begins Rate Cuts

September 15, 2008 - Lehmann Brothers Bankruptcy

November 25, 2008 - Fed announces QE: federalreserve.gov/newsevents/pressreleases/monetary20081125b.htm

Were are we today?

Stonks at ATH, Gold at ATH, Bitcoin ATH. Valuations historically expansive and growth expectations on stonks gigantic accompanied by a lot of passive investment.

Okay so all I'm trying to say here is that there were times where they were very strict in doing QE and only as a last resort in the depths of a crisis.

Also when it happens it is not the immediate start to a bull market (at least during a crisis event).

Also the balance sheet of the FED seems still full to me with 7 trillion to burn through. Is it really time to increase again?

I know that the argument for soon QE to create liquidity(inflation) to handle the looming global debt crisis everyone is talking about is also out there.

I also think that they will be faster this time to announce QE, they might just still take couple of months and a little bit of crisis.

Quantitative Tightening Effects on the Markets This video tutorial discussion:

• What is QE and QT?

• Each impact to the stock market

• The latest QT, how will the stock market into 2024?

Dow Jones Futures & Its Minimum Fluctuation

E-mini Dow Jones Futures

1.0 index point = $5.00

Code: YM

Micro E-mini Dow Jones Futures

1.0 index point = $0.50

Code: MYM

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Financials Gain With Tech In PainWhen central banks raise rates, financial sector outperforms. That is until credit crumbles by which time all bets are off.

As federal funds rates spike and stay elevated for longer, lending rates will climb higher relative to deposit rates. Net Interest Margin ("NIM") which is the difference between lending and borrowing rates continues to favour financial services firms.

Inflation while softening remains high in developed and emerging markets. Hopes of Fed pivot on rates is fading as inflation is starting to spike again in some countries. Central banks on either side of the Atlantic are determined to tame it down.

Continued rate hikes push economies into recession, crush consumer demand while increasing credit (corporate & personal) defaults. At that stage, even the financial industry (“financials”) starts to feel the pinch. But growth and tech stocks will be hurt even more. These stocks will plummet as present values of future distant profits get discounted at higher rates.

As financials gain from attractive NIMs, growth stocks meanwhile are likely to get hammered from elevated rates. This case study articulates a spread trade to harness yields from these anticipated market moves.

Investors with portfolio exposure to S&P Financial Select Sector Index ("Financials Index") can participate in industry's outperformance. This index provides exposure to banks, mortgage firms, consumer financial firms, capital markets and insurance firms, among others.

A long position in CME E-Mini Financial Select Sector Futures and a short position in CME Micro E-Mini Nasdaq-100 Index Futures will deliver >2.7x reward to risk ratio.

HISTORICAL NEXUS BETWEEN TECH-HEAVY NASDAQ & FINANCIALS INDEX

Over the last 10 years, the ratio of the Financials Index relative to Nasdaq-100 touched a high of 0.0917 in July 2013 and a low of 0.0342 in November 2020. The ratio rises when financials outperform Nasdaq.

The ratio hovered around 0.072 on average from 2013 until the onset of pandemic linked monetary stimulus. It plunged when the monetary policy taps were let loose. Valuations of tech, high-growth, non-profitable firms soared relative to staid financials.

However, with QE substituted by QT i.e., from monetary easing to tightening, financials are set to fight back.

Frail demand with layoffs is the uncertain path ahead for tech. In contrast, financials appear poised with resilient balance sheets to swing the ratio back in its favour.

DEMYSTIFYING S&P FINANCIAL SELECT SECTOR INDEX

The Financials Index is market cap weighted and rebalanced quarterly. As of end February 2023, there were sixty-seven companies in total with the top-10 representing 53% of the index. Top-10 index constituents by weight and their 12-month price targets are summarised below.

Price targets (PT) for the top-10 point to an average appreciation of 12%. The average of maximum PT among the top-10 delivers a spectacular gain of 29%. However, the average of minimum PT among the same group shows a drop of 8%. Clearly analyst targets are skewed towards a healthy upside gain with limited downside risk.

FEDERAL FUNDS RATE TO STAY HIGHER FOR LONGER

In speaking to Barron’s, Brian Moynihan, CEO of Bank of America said that the Fed is going to have to leave the rates at a higher structure than people may believe. The Fed were late to the game, and they have got to keep rates high for long until it works through the system.

ELEVATED RATES HURTING DEMAND BUT INVESTORS REMAIN EERILY BULLISH

Tech sector is feeling the heat of melting demand. Revenues of S&P 500 tech firms is expected to grow only 2% this year. It is the slowest since 2016 as per Bloomberg Intelligence.

Q4 earnings have been sending worrying signals for the largest tech companies. Earnings from Apple, Microsoft, Alphabet, Amazon & Meta missed estimates by 8% on average, as per Bank of America.

Despite cracks in Q4 earnings, investors’ enthusiasm for tech stocks remains bubbly. Nasdaq is up 13% this year.

Rising share prices coupled with shrinking earnings estimates is pushing Nasdaq valuations into lofty zone. The Nasdaq is now priced at 24-times one-year forward earnings, compared to an average of 20-times over the last decade. Overpriced by 20% based on historical standards.

In contrast, financials price-earnings ratios, as represented by Financial Select Sector SPDR ETF is at a humble14.5-times. Every dollar of earnings per year requires $14.5 in financials compared to $24 in Nasdaq. In theory, the Nasdaq is 66% more expensive than financials.

Bullish markets this year has pushed Nasdaq stocks well ahead of price targets. This phenomenon might be the result of a bear market rally or short covering or rising retail participation or all of them. Consequently, ratio of financials to Nasdaq has slumped 9% so far this year setting the scene for an attractive spread trade entry.

TRADE SET UP

As central banks are determined to keep inflation down by keeping rates higher for longer, this paper demonstrates a long position in CME E-Mini Financial Select Sector Futures expiring in June 2023 (“financial futures”) and a short position in CME Micro E-Mini Nasdaq-100 Index Futures expiring in June 2023 (“Micro Nasdaq”) will deliver >2.7x reward to risk ratio.

Spreads require that the notional values of each leg of the trade to be identical. Each financial futures provides an exposure to $250 x S&P Financial Select Sector Index. Meanwhile, each Micro Nasdaq provides an exposure of $2 x Nasdaq-100 Index.

As of March 3rd, financial futures expiring in June 2023 settled at 446.4 while the Micro Nasdaq settled at 12,446.50.

Balancing each leg of the trade requires 2-lots of financial futures (2 lots x $250 x 446.4 = $223,200) and 9-lots of Micro Nasdaq (9 lots x $2 x 12,446.50 = $224,037).

Entry: 0.0359 (446.4/12,446.5)

Target: 0.0405

Stop: 0.0342

Profit at Target: $ 28,800

Loss at Stop: $10,350

Reward-to-Risk Ratio: >2.7x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Narrow Focus Delivers Greater ImpactFamous American Author Alfred Paul Ries once said, “Good things happen when you narrow your focus”. Global macro conditions and monetary environment could make that quote apt for US equity market investing too.

Given the backdrop of price behavior, this case study argues that a spread trade comprising of Long Dow Jones Index and short S&P 500 index provides a potential reward to risk of 1.01.

The charts above clearly point to the strong performance in Dow Jones Industrial Average Index (DJIA Index, a narrow market index comprising of 30 stocks) relative to the broader S&P 500 index (an index of 500 stocks).

SECTOR WEIGHTINGS

Based on sector weights as published by S&P Global on 31/Oct, the table below sets out the comparative analysis of the two indices.

Information Technology - DJIA: 19.5%, SPX: 26.3%, Difference: -6.8%, DJIA Significantly Underweight Information Technology

Health Care - DJIA: 22.2%, SPX: 15.3%, Difference: +6.9%, DJIA Significantly overweight Healthcare

Financials - DJIA: 16.2%, SPX: 11.4%, Difference: +4.8%, DJIA Overweight Financials

Consumer Discretionary - DJIA: 13.3%, SPX: 10.9%, Difference: +2.4%, DJIA Overweight Consumer Discretionary

Industrials - DJIA: 13.9%, SPX: 8.3%, Difference: +5.6%, DJIA Significantly Overweight Industrials

Communication Services - DJIA: 2.9%, SPX: 7.5%, Difference: -4.6%, DJIA Underweight Communication Services

Consumer Staples - DJIA: 7.5%, SPX: 6.9%, Difference: +0.6%, DJIA Overweight Consumer Staples

Energy - DJIA: 3.6%, SPX: 5.4%, Difference: -1.8%, DJIA Underweight Energy

Utilities - DJIA: 0%, SPX: 3%, Difference: -3%, DJIA Underweight Utilities

Real Estate - DJIA: 0%, SPX: 2.6%, Difference: -2.6%, DJIA Underweight Real Estate

Materials - DJIA: 0.9%, SPX: 2.5%, Difference: -1.6%, DJIA Underweight Materials

The DJIA has heavier weightage to Health Care, Financials, Consumer Discretionary, Industrials and Consumer Staples with underweight on Technology, Telecommunications, Utilities and Real Estate sectors.

We live in times of unprecedented pace of monetary conditions tightening with high interest-rate expected right through 2023 until policy pivots creating fears of looming recession and continuing geo-political conflicts.

Against such a backdrop, historically Financials and defensive sectors such as Consumer Staples, Industrials, and Health Care have outperformed rate-sensitive and growth sectors such as Technology, Real Estate and Telecommunications.

TECHNICAL ANALYSIS

The CME Micro E-mini Dow Jones Industrial Average Index futures ( MYMZ2022 ) completed a golden crossover (10d & 200d MA) on 9/Nov. A golden crossover is generally seen as a bullish signal of an uptrend. Furthermore, the MYMZ2022 closed above the R1 for the pivot indicator on 25/Nov. If this level holds, this price point could act as a support level.

RSI for MYMZ2022 exhibits an overbought market condition with RSI at 71.25 as of closing 25/Nov. The stochastic indicator also points to the market having overbought with a reading of 97.74. Notably, the stochastic indicator displayed an intersection on 8/Nov which points to a potential reversal in the uptrend.

Meanwhile, the MESZ2022 is currently trading below the long-term (200-day) moving average and has not had a golden crossover yet. MESZ2022 also failed to breach R1 of the standard pivot twice and closed below it on 25/Nov. The pivot R1 and the long-term moving average both point to strong resistance at this level. RSI was 61.86 as of 25/Nov. The stochastic indicator shows that MESZ2022 is overbought with a reading of 94.16. Notably, the stochastic indicator displayed an intersection with the 3-day SMA signaling a potential reversal in the uptrend.

According to Goldman Sach’s 2023 Equities Outlook, they expect equities to cool off from their current rally in 2023. This is supported by historical performance during similar economic conditions. Moreover, both DJIA and S&P500’s technical signals also point to them being overbought. This could mean a correction is due for both of them. However, the DJI stands on a much stronger footing, technically, as it finds support at the long-term MA that it intersected this month. As such, the Dow is expected to be more resilient than the S&P 500 during the impending correction.

COMMITMENT OF TRADERS’ REPORT

According to CME’s Commitment of Traders (COT) report, S&P 500 traders have established net long positions. Dealers had long OI of 17.4% compared to short OI of 16.1%. Asset Managers and institutional investors had a long OI of 40.3% compared to 22.1% short. By contrast, Dow futures had dealer/intermediary long OI of 35.3% compared to 16.3% short. While institutions were 22.3% long compared to 8.9% short.

Notably, leveraged positions for S&P 500 had 26.6% short OI against 6.5% long while DJI had a roughly balanced 22.3% for long and 21.4% for short.

Charting DJIA/SPX shows that the ratio rallied in October and broke through all the resistances for the pivot indicator. November saw the ratio cool off. Both RSI and Stochastic indicator cooled off during this and currently stands neutral. The stochastic indicator recently displayed a crossover which could indicate a reversal in the downtrend.

If the ascending channel highlighted below maintains, then a DJIA and SPX spread trade would be viable over the next few months. Take profit could be set as R1 and R2 of the pivot indicator. Stop loss could be set at the Pivot point. In the chart these levels have been adjusted by accounting for the 20-day historical volatility.

IF HISTORY IS ANY GUIDE

Analysing the ratio over the long-time frame we can see that the rally over the past month is not unexpected. The DJI/SPX ratio rallied during past instances of Quantitative Tightening as well. For instance, during 2018-19, with tightening monetary conditions, the ratio rallied to 9.363 compared to a low of 8.233 in 2016.

The ratio also spiked after the tightening in 2006-08 from a low of 8.447 to a high of 10.075. Also in 2000-01, from a low of 6.984 to 9.691. Considering that the Fed has hiked rates in an aggressive manner this time around, the rapid rise in this ratio is also not unexpected.

From past data, we can see that the ratio does not peak until the peak of the hiking cycle or a few months after that. From Fed statements we can see that although the pace of hikes is expected to slow, a pivot is not expected anytime soon.

TRADE SET UP

To establish market neutral spread trade at inception, a ratio of 7:6 lots (DJI:SPX) is required with a long position on 7 lots of DJI and a short position on 6 lots of SPX. The ratio of 7:6 ensures that the exposure to DJI and SPX is neutral with equivalent notional on each position.

As such, 7 lots of Micro E-mini Dow Jones Average Futures March Expiry ( MYMH3 ) will be required which have a required margin of $750 each for a total of $5,250. Each contract of MYMH3 provides exposure to $0.5 x Dow Jones Index. Six (6) lots of Micro E-mini S&P 500 Futures March Expiry ( MESH3 ) will be required which have a required margin of $750 each for a total of $6,360. Each contract of MESH3 provides exposure to $5 x S&P 500 Index.

After factoring in margin credits, the anticipated total margin required for this trade is $12,000. The total notional for the trade would $120,000 SPX spread against $119,689 on DJI based on prices as of closing on 25/Nov.

This case study suggests entering the spread trade at the current DJI/SPX ratio of 8.522 with a target ratio of 8.671. This would yield profit of $2,140.

Where the trade is held to second target of 8.806 it would yield a profit of $4,054. In case the trade goes sour and the ratio contracts, we would exit the trade at the level of 8.236 which would result in a loss of $4,026. This leads to a reward to risk ratio of 0.53 for the first target and 1.01 for the second target.

SPREAD TRADE MARGIN

CME offers margin credits for spread trades. Clearing brokers might charge differently from the Exchange imposed margins.

MARKET DATA

CME Real-time Market Data help identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

DISCLAIMER

Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

This material has been published for general education and circulation only. It does not offer or solicit to buy or sell and does not address specific investment or risk management objectives, financial situation, or particular needs of any person.

Advice should be sought from a financial advisor regarding the suitability of any investment or risk management product before investing or adopting any investment or hedging strategies. Past performance is not indicative of the future performance.

All examples used in this workshop are hypothetical and are used for explanation purposes only. Contents in this material is not investment advice and/or may or may not be the results of actual market experience.

Mint Finance does not endorse or shall not be liable for the content of information provided by third parties. Use of and/or reliance on such information is entirely at the reader’s own risk.

These materials are not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject Mint Finance to any registration or licensing requirement.

The Impact of Economic Factors on the Stock MarketHi there! So, I heard that the economy is in a bit of a rough patch because the FED is raising rates, there's some quantitively tightening happening, and there's a potential recession on the horizon due to a supply shock from the Russia-Ukraine war and China's pandemic restrictions.

It looks like we might be heading into a recession, which is sooo not good news. The stock market will definitely be feeling the effects if the index falls below its moving average of 200 days. It's not looking great, I have to say. But don't worry, there are still ways to protect your investments. Some technical indicators you might want to keep an eye on include the relative strength index (RSI), the moving average convergence divergence (MACD) indicator, and the Bollinger bands. These can help you evaluate the strength of the current trend and potentially identify opportunities to buy or sell.

Also, outside the SPX index there are still ways to further protect your investments. For example, you might want to consider reducing your exposure to risky assets and increasing your holdings of safe-haven assets like government bonds. Just remember to stay positive and keep an eye on the market!

BTC: Don't DCA YetMacro conditions couldn’t be any worse. Starting this month, the Fed unleashed its quantitative tightening (QT) plans, trimming the $9trillion balance sheet at an unprecedented scale (current run-off cap: $47.5bn/month initial; $95bn/month 3 month later; 2017 run-off: max $50bn/month). The last two quantitative tightening led to a sharp rise in yields in 2013 and a repo crisis in 2019 respectively. Unfortunately, this time around, the Fed has to deal with a much larger balance sheet and all-time high inflation rate since 1982. Without the ability to print real world supply of goods and services (factories, natural resources), the Fed has lever on the demand side, but lowering demand means hikes in unemployment (which the Fed is already targeting). With a 7% gap between short-term rate and inflation rate, can the Fed “just rise unemployment a little bit” without causing a recession? Extremely hard unless real world supply of goods and services picks up.

For us crypto traders and investors, the question is - isn’t bitcoin an inflation hedge, and if global market enters a recession, wouldn’t bitcoin be the risk-off asset of choice? My take on this is not in this cycle. Bitcoin has not experienced a proper traditional finance bear market yet and has performed poorly during past tapering and quantitative tightening environments. Different phases of quantitative easing, tapering, and quantitative tightening are marked on the chart above. After three rounds of quantitative easing from 2010, the start of tapering in 2014 marked the beginning of bitcoin’s 2-year bear market. In 2017, quantitative tightening started in October, and the 2018 crypto crash soon followed. In other words, bitcoin’s inflation hedge narrative hasn’t been officially tested or widely accepted. With arbitrage opportunities, scams, hack risks, and run-on-bank fear, the crypto market is no doubt in its early stage. While superior security and scarcity give bitcoin the potential to replace gold in a new era of currency, early-stage demand side volatility makes bitcoin subject to wild price swings. The current reality is we see rising correlation between bitcoin and the equity market year after year, and the volatility is further heightened by the derivative market. In the current cycle, bitcoin’s inflation hedge value is overpowered by its volatility, and it is hard for bitcoin to rally under gloomy global macro conditions before the market matures and stabilizes.

Do you agree? What’s your take on crypto under the current global macro? Support and comment below!

Hedge for High Interest RatesHere is great high interest rate hedge. While I wanted to use USINTR to compare, it didn't look obvious for easy analysis, so I used USIRYY instead since both are greatly correlated. The Fed keeps talking like a dove but acting like a hawk: like promising soft landings from transitory inflation, yet suddenly choosing rare 75 bps increase, even though they previously implied 50 bps would be the most. So, I expect next few rate raisings will be at least that much, possibly a full point even during this summer. That would be great for this ETF going up, which is currently on sale, thanks to more direct & intense QT from the Federal Reserve.

Hot Take: QT crashes market to pre covid pricesHot take: we see a crash all the way back to mid-covid lows / pre-covid prices. Get ready for 300$ TSLA, 8000$ BTC, 400$ ETH.

(That’s about the price level where this bearish divergence started from the QE fed infinite money printing machine….. wildly dubious speculation to be sure definitely not advice DYOR)

What do you guys think?

Bitcoin Pivotal Week AheadBTC has followed a descending parallel channel since Nov 2021 ATH shedding >52% in late Jan to.$32.9k. Since the low, BTC rallied to a local high of $48k in late March before resuming the gradual mark-down. Currently sitting >40% from ATH @ $38.8k.

Bitcoin Weekly Chart currently above 100 EMA while the 20 EMA has crossed below the 50.

Previous FOMC in early March following 25 bps hike, the market rallies in the face of a "hawkish sounding" Federal Reserve... casting doubt on the seriousness of reining in rampant inflation that's achieved highest levels in >40 years w/ no sign of slowing.

Critical juncture in price action, as BTC will likely put in a red daily candle Monday 5/2 and look for direction from the broader markets over May 3rd & 4th.

Potential for market upswing following the Fed's decisions is possible and would fall in line with March market response to Fed's seemingly hollow words.

The more like scenario is market realization that inflation is problematic and Fed's efforts to reduce central bank balance sheets via quantitative tightening has teeth and will continue the gradual market corrections we've seen in Q1.

Macro factors are indicating headwinds continue as GDP in Q1 was down, labor remains incredibly tight, prices remain unsustainably high.

Bitcoin likely to creep down to $35k range as the market considers Fed actions and decides on a direction.

Quantitative tightening called the 27 June 2018 sell offThe red line is the federal reserve balance sheet, total assets. Most of the rallies since the January high have been during weeks where the fed has temporarily stopped shrinking its balance sheet. Another shrink was disclosed late on 26 June. The fact that the sell off occurred after the disclosure, rather than the shrink itself suggests investors are trading the announcement, rather than the liquidity reduction itself.