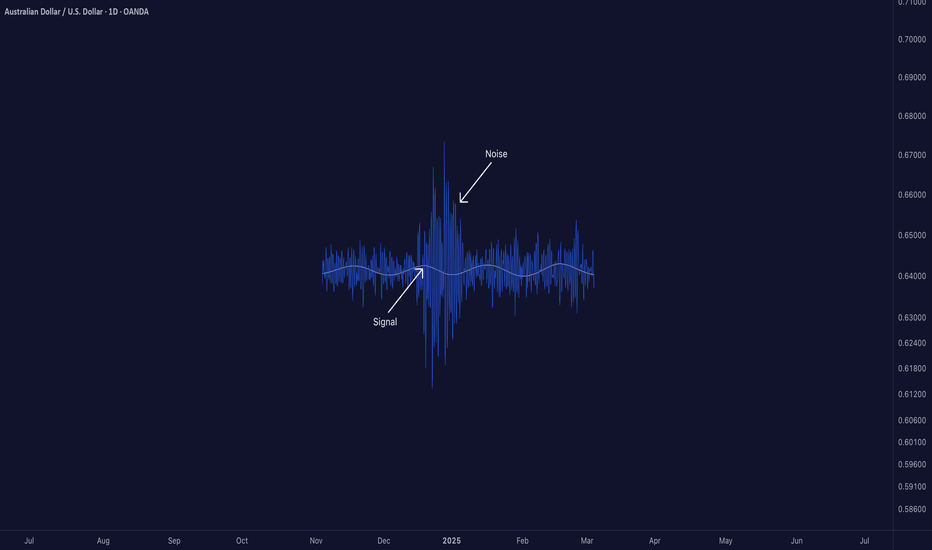

Signal-to-Noise Ratio: The Most Misunderstood Truth in Trading█ Signal-to-Noise Ratio: The Most Misunderstood Truth in Quant Trading

Most traders obsess over indicators, signals, models, and strategies.

But few ask the one question that defines whether any of it actually works:

❝ How strong is the signal — compared to the noise? ❞

Welcome to the concept of Signal-to-Noise Ratio (SNR) — the invisible force behind why some strategies succeed and most fail.

█ What Is Signal-to-Noise Ratio (SNR)?

⚪ In simple terms:

Signal = the real, meaningful, repeatable part of a price move

Noise = random fluctuations, market chaos, irrelevant variation

SNR = Signal Strength / Noise Level

If your signal is weak and noise is high, your edge gets buried.

If your signal is strong and noise is low, you can extract alpha with confidence.

In trading, SNR is like trying to hear a whisper in a hurricane. The whisper is your alpha. The hurricane is the market.

█ Why SNR Matters (More Than Sharpe, More Than Accuracy)

Most strategies die not because they’re logically flawed — but because they’re trying to extract signal in a low SNR environment.

Financial markets are dominated by noise.

The real edge (if it exists) is usually tiny and fleeting.

Even strong-looking backtests can be false positives created by fitting noise.

Every quant failure story you’ve ever heard — overfitting, false discoveries, bad AI models — starts with misunderstanding the signal-to-noise ratio.

█ SNR in the Age of AI

Machine learning struggles in markets because:

Most market data has very low SNR

The signal changes over time (nonstationarity)

AI is powerful enough to learn anything — including pure noise

This means unless you’re careful, your AI will confidently “discover” patterns that have no predictive value whatsoever.

Smart quants don’t just train models. They fight for SNR — every input, feature, and label is scrutinized through this lens.

█ How to Measure It (Sharpe, t-stat, IC)

You can estimate a strategy’s SNR with:

Sharpe Ratio: Signal = mean return, Noise = volatility

t-Statistic: Measures how confident you are that signal ≠ 0

Information Coefficient (IC): Correlation between forecast and realized return

👉 A high Sharpe or t-stat suggests strong signal vs noise

👉 A low value means your “edge” might just be noise in disguise

█ Real-World SNR: Why It's So Low in Markets

The average daily return of SPX is ~0.03%

The daily standard deviation is ~1%

That's signal-to-noise of 1:30 — and that's for the entire market, not a niche alpha.

Now imagine what it looks like for your scalping strategy, your RSI tweak, or your AI momentum model.

This is why most trading signals don’t survive live markets — the noise is just too loud.

█ How to Build Strategies With Higher SNR

To survive as a trader, you must engineer around low SNR. Here's how:

1. Combine signals

One weak signal = low SNR

100 uncorrelated weak signals = high aggregate SNR

2. Filter noise before acting

Use volatility filters, regime detection, thresholds

Trade only when signal strength exceeds noise level

3. Test over longer horizons

Short-term = more noise

Long-term = signal has more time to emerge

4. Avoid excessive optimization

Every parameter you tweak risks modeling noise

Simpler systems = less overfit = better SNR integrity

5. Validate rigorously

Walk-forward, OOS testing, bootstrapping — treat your model like it’s guilty until proven innocent

█ Low SNR = High Uncertainty

In low-SNR environments:

Alpha takes years to confirm (t-stat grows slowly)

Backtests are unreliable (lucky noise often looks like skill)

Drawdowns happen randomly (even good strategies get wrecked short-term)

This is why experience, skepticism, and humility matter more than flashy charts.

If your signal isn’t strong enough to consistently rise above noise, it doesn’t matter how elegant it looks.

█ Overfitting Is What Happens When You Fit the Noise

If you’ve read Why Your Backtest Lies , you already know the dangers of overfitting — when a strategy is tuned too perfectly to historical data and fails the moment it meets reality.

⚪ Here’s the deeper truth:

Overfitting is the natural consequence of working in a low signal-to-noise environment.

When markets are 95% noise and you optimize until everything looks perfect?

You're not discovering a signal. You're just fitting past randomness — noise that will never repeat the same way again.

❝ The more you optimize in a low-SNR environment, the more confident you become in something that isn’t real. ❞

This is why so many “flawless” backtests collapse in live trading. Because they never captured signal — they captured noise.

█ Final Word

Quant trading isn’t about who can code the most indicators or build the deepest neural nets.

It’s about who truly understands this:

❝ In a world full of noise, only the most disciplined signal survives. ❞

Before you build your next model, launch your next strategy, or chase your next setup…

Ask this:

❝ Am I trading signal — or am I trading noise? ❞

If you don’t know the answer, you're probably doing the latter.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

Quanttrading

Why the Best Strategies Don’t Last — A Quant TruthOver the years, I’ve built strong connections with traders on the institutional side of the market.

One of the most interesting individuals I met was a former trader at Lehman Brothers. After the collapse, he transitioned into an independent quant. I flew to Boston to meet him, and the conversations we had were eye-opening, the kind of insights retail traders rarely get exposed to.

We didn’t talk about indicators or candlestick patterns.

We talked about how fast and aggressive algorithmic trading really is.

He told me something that stuck:

" People think hedge funds build one algorithm, run it for years, and collect returns. That’s rarely the case. Most algos are extremely reactive. If something stops working, we don’t fix it — we delete it and move on. That’s how the process works."

This isn’t an exception — it’s standard practice.

What stood out most in our talks was how adaptable these algorithms are. If market conditions shift — even slightly — the logic adapts immediately. These systems aren’t built on beliefs or opinions.

They’re built to respond to liquidity, volatility, and opportunity — nothing more.

This level of responsiveness is something most retail traders never factor into their approach, but it’s core to how modern markets operate.

█ How Quant Funds Use Disposable Strategies — And What Retail Can Learn

One of the most misunderstood realities in modern trading is how top quantitative funds like Two Sigma, Citadel, and Renaissance Technologies deploy, monitor, and replace their strategies.

Unlike traditional investors who develop a strategy and stick with it for years, many quant funds take a performance-first, outcome-driven approach. They:

Build hundreds of strategies,

Deploy only the ones that currently work, and

Retire or deactivate them the moment performance drops below their internal thresholds.

This is a deliberate, statistical, and unemotional process — and it's something that most retail traders have never been taught to think about.

█ What This Means

Quantitative firms often run:

100s of models simultaneously,

Each targeting a specific edge (e.g. trend-following, mean reversion, intraday order flow),

With tight risk controls and performance monitoring.

When a model:

Falls below a minimum Sharpe ratio (risk-adjusted return),

Starts underperforming vs benchmark,

Experiences a breakdown in statistical significance…

…it is immediately deprecated (removed from deployment).

No ego. No "fixing it."

Just replace, rebuild, and redeploy.

█ It runs live… until it doesn’t.

If slippage increases → they pull it.

If volatility regime changes → they pull it.

If too many competitors discover it → they pull it.

If spreads tighten or liquidity dries → they pull it.

Then? They throw it away, rebuild something new — or revive an old one that fits current conditions again.

█ Why They Do It

⚪ Markets change constantly

What worked last month might not work this week — due to regime shifts, volatility changes, or macro catalysts. These firms accept impermanence as part of their process.

⚪ They don’t seek universal truths

They look for temporary edges and exploit them until the opportunity is gone.

⚪ Risk is tightly controlled

Algorithms are judged by hard data: drawdown, volatility, Sharpe ratio. The moment a strategy fails to meet these metrics, it’s shut off — just like any risk engine would do.

⚪ They don’t fix broken models — they replace them

Time spent “tweaking” is time lost. New strategies are always in the pipeline, ready to rotate in when older ones fade.

█ Research & Real-World Validation

"Modern quantitative funds must prioritize real-time adaptability and accept that any statistical edge has a short shelf life under competitive market pressures." Adaptive Trading Agents” (Li, 2023)

Donald MacKenzie’s fieldwork on HFT firms found that algos are treated like disposable tools, not long-term investments.

Studies on adaptive algorithmic trading (e.g., Li, 2023; Bertsimas & Lo, 1998) show that funds constantly evaluate, kill, and recycle strategies based on short-term profitability and regime changes.

A former Two Sigma quant publicly shared that they regularly deploy hundreds of small-scale models, and once one fails risk thresholds or decays in Sharpe ratio, it’s immediately deprecated.

Walk-forward optimization — a method used in quant strategy design — is literally built on the principle of testing a strategy in live markets and discarding it if its forward performance drops.

█ Why Retail Rarely Hears This

Retail traders are often taught to:

“Stick with a system”

“Backtest 10 years”

“Master one setup”

But in the real quant world:

There is no perfect system. There are only edges that work until they don’t. And the moment market structure shifts — new volatility, different volume profile, regime change — the strategy is gone, no questions asked.

█ What This Means for Retail Traders

⚪ Don’t idolize “one perfect system.”

What worked in April might not work in June. Treat your strategies as temporary contracts, not lifelong beliefs.

⚪ Build modular logic.

Create systems you can tweak or retire quickly. Test new regimes. Think in frameworks, not fixed ideas.

⚪ Learn from regime shifts.

Volatility, spread, volume profile, macro tone — track these like a quant desk would.

⚪ Use metrics like:

- Win streak breakdown

- Market regime tracker

- Edge decay time (how long your setups last)

█ Final Thought

The best traders — institutional or retail — understand that there’s no such thing as a permanent edge. What matters is:

Having a repeatable process to evaluate strategy performance,

Being willing to shut off or rotate out what’s no longer working,

And staying adaptable, data-driven, and unemotional.

If you start treating your strategies like tools — not identities — you’ll begin operating like a professional.

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

QNT Is Breaking Down — Are You ReadyYello Paradisers, Have you seen what just happened with #QNTUSDT? After weeks of grinding higher, the structure has cracked and that crack could turn into a landslide if you're not ready. This isn’t the time for hope or guesswork. It's the time for strategy.

💎#Quant has broken below a major ascending trendline that’s held since April, marking a pivotal shift in its momentum. The market just printed a clean Change of Character (CHoCH) around the $105–106 level, right at the confluence of a key support-turned-resistance zone. That CHoCH level, once a strong foundation for bullish continuation, has now flipped into a headwind. As long as the price stays below this range, we remain in the danger zone.

💎 Adding fuel to the fire is the major supply zone looming above, from $122 to $128. This area has already triggered rejection in the past and will now serve as the final invalidation for any short-term bullish dreams. A reclaim of this zone is highly unlikely in the near term, given the structure and momentum.

💎Now with the trendline cleanly broken and the market unable to hold higher lows, all eyes are on the lower support zones. The $85 region may provide a temporary cushion, but the real magnet lies deeper. We are closely watching the $72–75 area for signs of temporary relief, but the main high-probability reaccumulation zone is sitting all the way down at $55–60. This zone will likely attract smart money accumulation if the market gets there, it will not be by accident.

💎 This isn’t the time to be catching falling knives. Unless #QNT can reclaim the broken trendline and push back above the $106–110 range with conviction, the path of least resistance is down. That also means every lower high that prints now is an opportunity for trained eyes.

Stay ready. Stay focused. And always play the long-term game like a pro.

MyCryptoParadise

iFeel the success🌴

Algorithmic vs. Quantitative Trading: Which Path Should You TakeI’ve always wondered why anyone would stick to traditional trading methods when algorithms and mathematical models could do all the heavy lifting.

I started questioning everything:

• Why do so many mentors still swear by discretionary trading when algorithms could handle all the heavy lifting?

• Do they really have solid proof of their “own” success, or is it just talk?

• Or are they keeping things complex and discretionary on purpose, to confuse people and keep them as members longer?

• Why deal with the stress of emotions and decisions when an algorithm can take care of it all?

• Imagine how much further ahead you could be if you stopped wasting time on manual trades and instead focused on market research and developing your own models.

When I first got into trading, I thought Algorithmic Trading and Quantitative Trading were basically the same thing. But as I dug deeper, I realized they’re two completely different worlds.

Algorithmic Trading: It’s simple – you set the rules and the algorithm executes the trades. No more sitting in front of the screen “controlling your emotions” and trying to manage every little detail. Instead, you let the algorithm handle it, based on the rules you’ve set. It frees up your time to focus on other things rather than staring at price charts all day.

But here’s the thing – it’s not perfect. You’ll still need to test the rules to make sure the data and results you’re getting aren’t overfitted or just random.

Quantitative Trading: A whole different level. It’s not just about executing trades; it’s about understanding the data and math behind market movements. You analyze historical price, economic, and political data, using math and machine learning to predict the future. But it can be complex – techniques like Deep Learning can turn it into a serious challenge.

The upside? This is the most reliable way to trade, and it’s exactly what over 80% of hedge funds do. They rely on quant models to minimize risk and to outperform the market.

So, which path should you choose?

Quantitative Trading can feel overwhelming at first, I recommend starting with the basics. Begin with Pine Script coding in TradingView—start building a foundation with simple strategies and indicators. As you grow more confident, start coding your own ideas into rules and refining your approach to eventually automated your trading strategy.

TradingView is a great tool for this, and I’d highly suggest grabbing the Premium plan. This will give you access to more data and features to make your learning journey smoother.

Dive into the Pine Script documentation , and begin bringing your ideas to life.

I promise, the more you focus on this, the better and more independent you’ll become in trading.

Every day, aim to get just 1% better.

To Your success,

Moein

$BNB LONG. Bossco Algo caught every $BNB bullrun.

BINANCE:BNBUSDT long entry has been in play. Bossco Algo caught every BINANCE:BNBUSDT bullrun.

Pity that TV took down my old post since it referenced an outside URL where entries are called in real time ...

Model Architecture:

• 1,000+ hours of quantitative research.

• 1,000+ machine hours of backtesting & forward testing.

• Based on pure price action, zero bias, zero emotions (see methods tested 👇)

• Long & Short, Execution on 4H timeframe

All methods tested:

Why share?

• It's my model, so I get the model signals first. I'll already be positioned in my longs, so I don't really care if you enter or not. Hedge fund PMs literally have dinners where they talk their own book after positioning.

• Signals are on a high timeframe on liquid assets, so you should be able to get in at the same price. You can't stop hunt me, because I don't post stop losses.

I will never give away the code or the techniques selected . No one gives away proprietary quant models that actually work. Please don't ask.

I don't plan on ever making signal access paid, since I want a public record of proof that the signals are real. I make my money through trading, not scam discords or courses.

Model output is for research purposes only. Not financial advice.

$LINKUSDT LONG. Bossco Algo caught every $LINK bullrun

BINANCE:LINKUSDT long entry has been in play. Bossco Algo caught every BINANCE:LINKUSDT bullrun.

Pity that TV took down my old post since it referenced an outside URL where entries are called in real time ...

Model Architecture:

• 1,000+ hours of quantitative research.

• 1,000+ machine hours of backtesting & forward testing.

• Based on pure price action, zero bias, zero emotions (see methods tested 👇)

• Long & Short, Execution on 4H timeframe

All methods tested:

Why share?

• It's my model, so I get the model signals first. I'll already be positioned in my longs, so I don't really care if you enter or not. Hedge fund PMs literally have dinners where they talk their own book after positioning.

• Signals are on a high timeframe on liquid assets, so you should be able to get in at the same price. You can't stop hunt me, because I don't post stop losses.

I will never give away the code or the techniques selected . No one gives away proprietary quant models that actually work. Please don't ask.

I don't plan on ever making signal access paid, since I want a public record of proof that the signals are real. I make my money through trading, not scam discords or courses.

Model output is for research purposes only. Not financial advice.

$ETH LONG. Bossco Algo caught every $ETH bullrun.

BINANCE:ETHUSDT long entry has been in play. Bossco Algo caught every BINANCE:ETHUSDT bullrun.

Pity that TV took down my old post since it referenced an outside URL where entries are called in real time ...

Model Architecture:

• 1,000+ hours of quantitative research.

• 1,000+ machine hours of backtesting & forward testing.

• Based on pure price action, zero bias, zero emotions (see methods tested 👇)

• Long & Short, Execution on 4H timeframe

All methods tested:

Why share?

• It's my model, so I get the model signals first. I'll already be positioned in my longs, so I don't really care if you enter or not. Hedge fund PMs literally have dinners where they talk their own book after positioning.

• Signals are on a high timeframe on liquid assets, so you should be able to get in at the same price. You can't stop hunt me, because I don't post stop losses.

I will never give away the code or the techniques selected . No one gives away proprietary quant models that actually work. Please don't ask.

I don't plan on ever making signal access paid, since I want a public record of proof that the signals are real. I make my money through trading, not scam discords or courses.

Model output is for research purposes only. Not financial advice.

$DOGE LONG. Bossco Algo captured every $DOGE bullrun.

BINANCE:DOGEUSDT long entry has been in play. Bossco Algo caught every BINANCE:DOGEUSDT bullrun.

Pity that TV took down my old post since it referenced an outside URL where entries are called in real time ...

Model Architecture:

• 1,000+ hours of quantitative research.

• 1,000+ machine hours of backtesting & forward testing.

• Based on pure price action, zero bias, zero emotions (see methods tested 👇)

• Long & Short, Execution on 4H timeframe

All methods tested:

Why share?

• It's my model, so I get the model signals first. I'll already be positioned in my longs, so I don't really care if you enter or not. Hedge fund PMs literally have dinners where they talk their own book after positioning.

• Signals are on a high timeframe on liquid assets, so you should be able to get in at the same price. You can't stop hunt me, because I don't post stop losses.

I will never give away the code or the techniques selected . No one gives away proprietary quant models that actually work. Please don't ask.

I don't plan on ever making signal access paid, since I want a public record of proof that the signals are real. I make my money through trading, not scam discords or courses.

Model output is for research purposes only. Not financial advice.

$SOL LONG in play. Bossco Algo captured every $SOL bullrun.

BINANCE:SOLUSDT long entry has been in play. Bossco Algo caught every BINANCE:SOLUSDT bullrun.

Pity that TV took down my old post since it referenced an outside URL where entries are called in real time ...

Model Architecture:

• 1,000+ hours of quantitative research.

• 1,000+ machine hours of backtesting & forward testing.

• Based on pure price action, zero bias, zero emotions (see methods tested 👇)

• Long & Short, Execution on 4H timeframe

All methods tested:

Why share?

• It's my model, so I get the model signals first. I'll already be positioned in my longs, so I don't really care if you enter or not. Hedge fund PMs literally have dinners where they talk their own book after positioning.

• Signals are on a high timeframe on liquid assets, so you should be able to get in at the same price. You can't stop hunt me, because I don't post stop losses.

I will never give away the code or the techniques selected . No one gives away proprietary quant models that actually work. Please don't ask.

I don't plan on ever making signal access paid, since I want a public record of proof that the signals are real. I make my money through trading, not scam discords or courses.

Model output is for research purposes only. Not financial advice.

thenexxtrade Alpha portfolio

Annualized Return : 17.9%

Sharpe Ratio : 1.27

Sortino Ratio : 2.67

Max DD : -11.4%

Volatility : 10.5%

In October 2023, we want to update you on our current investment strategy. We've been maintaining an 80% cash position over the past few months, a decision you can verify by visiting our Twitter account.

Our approach involves rebalancing on a monthly basis, steering clear of shorter time frames that often resemble gambling. We're integrating the returns generated by our proprietary system, compounding our gains with the alpha it produces.

Watch this space. We will bark when it time to allocate 100%.

Those who said don't time the market are those without the Alpha.

Understanding the Profitability of Trading.In the trading world, there are various methods to make money. However, in the fundamental approach to trading itself to earn money, we need to know that it has to be when you win bigger and lose smaller. Then, you might think about whether you should focus on winning more often or bigger. This article explores how to assess the profitability of the trading system with a simple formula.

Winning Rate and Risk-Reward Ratio

Two crucial factors affecting a trading signal's profitability are the winning rate and the risk-reward ratio. The winning rate is the percentage of trades that turn a profit.

A high winning rate can mean steady profits, but it doesn't guarantee overall profitability. The risk-reward ratio is the relationship between potential gains and losses in a trade.

A higher risk-reward ratio can lead to bigger profits, but it also demands a higher rate of correctness to stay profitable.

How They Impact Profitability

Let's use a simple example to understand how these factors affect profitability. Imagine a trading signal with a 60% winning rate and a risk-reward ratio of 2:1.

This means for every $1 risked, the potential profit is $2. If applied to 100 trades with a $100 risk per trade, the total risk is $10,000. Winning 60 trades would yield $12,000 in profit while losing 40 would result in a $4,000 loss.

The net profit in this case would be $8,000. This illustrates how the winning rate and risk-reward ratio impact a trading signal's profitability.

Evaluating Signal Effectiveness

To gauge the effectiveness of a trading signal, you need to consider a few factors.

Firstly, backtest the signal using historical data to assess its performance(Minimum 100 trading signals). Ensure the backtesting period covers various market conditions.

Secondly, forward test the signal using real-time data to evaluate its live performance. Finally, assess the signal's consistency and reliability over time(Real-time experience is different from backtesting). Signals that consistently generate profits are more reliable.

Key Aspects for Profitability

When assessing a trading signal's profitability, focus on a high winning rate and a favorable risk-reward ratio. The signal should adhere to sound trading principles, avoiding subjective factors for consistency and reliability.

The formula for Winning Rate and Risk-Reward Ratio

Here are simple formulas to calculate the winning rate and risk-reward ratio:

Winning rate = (Number of winning trades / Total number of trades) x 100

Risk-reward ratio = (Average profit per trade / Average loss per trade)

The higher these values are, the greater the potential for earning money through trading. However, having high values in isolation isn't enough for profitable trading.

Let's delve into a few examples to fully grasp this concept:

Example 1:

Consider Person A , who has a stellar winning rate of 90%, yet a risk-reward ratio of a meager 0.1. Now let's ask, will this individual amass wealth or rack up losses?

With his current risk-reward ratio, when luck favors, Person A walks away with a hefty $1,000. However, when faced with defeat, he incurs a significant loss of $10,000!

Their trading pattern? Win 9 times with a total earnings of $9,000, only to lose a much larger sum of $10,000 later. While this strategy may appear profitable in the short-run, it's unsustainable in the long-run, often resulting in accumulating losses.

Example 2:

Now, let's consider another scenario. Person B , with a winning rate of only 10% but a remarkable risk-reward ratio of 8. The same question arises - will this person amass wealth or rack up losses?

With their risk-reward ratio, when placed in favorable circumstances, Person B earns an impressive $8,000. Conversely, a bad day costs them a $1,000 loss.

Now, their trading pattern may seem paradoxical. They win once, earning a massive $8,000, then lose 9 times in a row for a total loss of $9,000. Despite the high-risk reward ratio, the low winning rate fails to buoy their profits. Ultimately making it a non-profitable strategy.

Determining Profitability

To assess whether you can make money based solely on the winning rate and risk-reward ratio, consider a formula called the required winning rate. It's defined as:

Required Winning Rate = 100 / (Risk-Reward Ratio + 1)

Let's look at two examples:

Person A has a 90% winning rate and a risk-reward ratio of 0.1. The required winning rate is 100 / (0.1 + 1) = 90.91%. Person A needs to maintain a winning rate of 90.91% to break even.

Person B has a 10% winning rate and a risk-reward ratio of 8. The required winning rate is 100 / (8 + 1) = 11.1%. Person B must achieve an 11.1% winning rate to avoid losses.

This formula helps determine the minimum winning rate needed to profit based on a strategy's risk-reward ratio. It emphasizes that both factors are critical for trading success. If the required winning rate isn't met, it may be wise to pause and further study the markets.

Assessing the profitability of a trading signal is essential for successful trading. Consider the winning rate, and risk-reward ratio, evaluate the signal's effectiveness, and emphasize key aspects. Use the required winning rate formula to understand the minimum winning rate needed for profitability. By making informed decisions, traders can improve their chances of consistent profits over time.

Follow and Boost for your financial success !

Write your thoughts in the comment section.

How much should the order amount be in quantitative trading ?First, you need to determine how your strategy calculates the order quantity, which can be based on:

1. Quantity of shares

2. Amount of money

3. Percentage

This article elaborates on the points of using "Fixed Order Amount" .

The amount of margin required for a trade depends on your risk tolerance.

Using "BOT | Trend" as an example,

In the backtested performance, a fixed "initial capital leveraged by 1x" is used as the order amount for each trade,

with a maximum drawdown of 25%, meaning the assets decrease by 25% from the "peak performance point" to the subsequent lowest point (1000 ➡️ 750).

Therefore, there are two key points to note here:

* The amount of margin required should consider “How much risk you can bear? ”

Assuming you currently have 1000 to operate "BOT | Trend," and you can tolerate a maximum loss of 500 (-50%), then the total amount of each trade (margin * leverage) can be set as 2000, and so on.

Example: Now you have 2000, and you can tolerate a maximum loss of 400 (-20%), then the total amount of each trade (margin * leverage) is 1600.

Practice: Now you have 5000, and you can tolerate a maximum loss of 2000 (-40%), then the total amount of each trade (margin * leverage) is ______ (Hint: What is 25% of 2000?).

* Timing to start running quantitative trading.

Running a "trend-following" quantitative trading strategy should not start during a continuous profitable period but rather when the strategy incurs losses (relative low point of equity). This is because for trend strategies, sideways market conditions can cause the strategy to go long at highs and short at lows, resulting in a depletion of funds during this period. Starting during a continuous profitable period is likely to encounter fund depletion right after entering because markets alternate between trending and ranging phases.

Answer: 8000

AUDUSD Selling opportunity Good day, traders. The Australian dollar, which is now in a correction phase, may shortly hit the support and resistance level of 0.680. Right now, the trend is downward. We'll be monitoring AUDUSD during the current trading week and the one after it in case a selling opportunity arises at the 0.680 area.

ETHUSDT Trading Plan---X--- : Potential reversal

square : demand and supply

The analysis is based on ORDERFLOW.

The trend structure in H4 is bull , so we are going to entry long positions before becoming bear .

We could identify some demand and supply zones by orderblock regarded as a large-scale buy or sell zone .

It was mentioned above , the trend is a going up , therefore we will hardly entry short positions , ALWAYS FOLLOW THE TREND .

There are 2 opportunities to trade

Long : 1675.74

SL : 1653.23

TP : 1886.46

RR=9.36

Long : 1632.18

SL : 1610.31

TP : 1886.46

RR=11.63

if price goes to the yellow line before reach our limit orders, the trades should be cancelled .

Quant: Sleepy 😴Quant is feeling a bit sleepy lately and doesn't want to leave the pink target zone - well, let's hope he wakes up soon to climb above the resistance at $228.30 to finish the pink wave . If our beloved coin continues to hit the Snooze-button and sinks further into the pink zone, our alternative scenario will be activated, as soon as the course drops below the support line at $94.08. In that case, Quant should sink to the lower area of the zone to complete the pink wave alt. .