Rigetti: Quantum Mirage or Computing's Next Frontier?Rigetti Computing, a pioneer in quantum computing, recently commanded market attention with a significant 41% surge in its stock. This jump followed a critical technological breakthrough: achieving 99.5% median 2-qubit gate fidelity on its modular 36-qubit system. This represents a twofold reduction in error rates from previous benchmarks, a vital step toward practical quantum applications. Rigetti's superconducting qubits offer gate speeds over 1,000 times faster than competing modalities like ion traps, leveraging semiconductor industry techniques for scalability. The company plans to launch its 36-qubit system by mid-2025 and aims for a 100+ qubit system by year-end, underscoring its rapid technological roadmap.

Beyond technical achievements, strategic partnerships and government contracts bolster Rigetti's position. A substantial $100 million manufacturing deal and a $35 million equity investment from server giant Quanta validate Rigetti's modular architecture. Government backing also provides a stable revenue stream, including a $1 million DARPA award for developing "utility-scale quantum computing" and a $5.48 million Air Force consortium award for advanced chip fabrication. The company further secured three UK Innovate awards for quantum error correction. These collaborations signal confidence from both private industry and national defense initiatives, crucial for a sector still in its nascent stages of commercialization.

Despite these positives, Rigetti's financial metrics reflect the high-risk, high-reward nature of quantum investment. While its market capitalization stands at a robust $5.5 billion, Q1 2025 revenue declined over 50% year-over-year to $1.5 million. Operating expenses remain substantial, with the company operating at a loss. Rigetti's valuation hinges on future potential rather than current profitability, trading at a high price-to-sales ratio. This places immense pressure on the company to meet ambitious technological milestones and rapidly scale revenue in the coming years, transforming speculative bets into tangible commercial success.

The broader quantum computing landscape is marked by intense competition and geopolitical implications. Giants like IBM and Google, also leveraging superconducting qubits, race alongside Rigetti. The sector's projected market size varies wildly, reflecting ongoing uncertainty about widespread commercial adoption. From a geostrategic perspective, quantum computing poses both a national security threat to current encryption and an opportunity for military advancement, driving a global race in post-quantum cryptography. Rigetti's extensive patent portfolio, comprising 37 quantum computing patents, underscores its intellectual property differentiation. However, macroeconomic factors, including rising interest rates, could tighten venture capital funding for speculative high-tech ventures, adding another layer of complexity to Rigetti's path forward.

Quantumcomputing

Quantum Computing - Why BTC isn't the biggest worryYou’ve probably heard that quantum computing could break Bitcoin’s encryption—and that’s true. But here’s the thing: Bitcoin might not even be the biggest target.

The real risks? Financial systems, national security, healthcare, and even the internet itself. These areas rely on the same encryption methods that quantum computers could crack, and the fallout could be far worse than a Bitcoin hack.

Let’s break it down.

1️⃣ Financial Systems: A Global Crisis Waiting to Happen

Imagine if hackers could:

Drain bank accounts at will.

Manipulate stock markets.

Fake trillion-dollar transactions.

This isn’t just about stolen crypto—it’s about economic chaos. Banks, stock exchanges, and payment systems all depend on encryption. If quantum computers break it, we’re looking at a meltdown way bigger than Bitcoin’s $3 trillion market.

2️⃣ National Security & Internet Privacy: A Hacker’s Dream

Governments and militaries use encryption to:

Protect classified intelligence.

Secure communications between leaders.

Guard critical infrastructure (power grids, water supplies).

If quantum computers crack these codes, entire nations could be exposed to cyberwarfare. Your private data? At risk too—email, messaging, even your online banking could be decrypted years later.

3️⃣ Healthcare, Supply Chains & IoT: The Hidden Vulnerabilities

Medical records could be leaked, exposing sensitive health data.

Smart devices (like home security systems) could be hacked.

Supply chains might collapse if logistics networks are breached.

These systems weren’t built with quantum threats in mind—and upgrading them won’t be easy.

🔴 The Bigger Picture: A "Civilizational Upgrade"

Switching to quantum-resistant encryption is like rebuilding the internet’s foundation. It’s necessary, but messy. Some experts compare it to the Y2K bug—but way harder.

🔷 So, Is Bitcoin Safe?

Not entirely—about 25% of all Bitcoin could be stolen if quantum computers advance fast enough. But compared to the risks facing banks, governments, and hospitals? Bitcoin might be the least of our worries.

🔷 What’s Next?

Governments & companies are already working on fixes (like NIST’s post-quantum cryptography standards).

The transition will take years—and hackers might exploit weak spots along the way.

Staying informed is key. If you’re in tech, finance, or security, this affects you.

ℹ️ Want to Dive Deeper?

Deloitte’s take on quantum computing & Bitcoin

Forbes on quantum risks beyond crypto

🤷♂️ Bottom line?

Quantum computing is coming—and while Bitcoin has risks, the real danger lies in the systems we all depend on every day.

❔What do you think? Will we be ready in time? Let me know in the comments! 🚀

Beyond Bits: Is D-Wave Quantum the Unseen Power?D-Wave Quantum is rapidly solidifying its position as a transformative force in the burgeoning field of quantum computing. The company recently achieved a significant milestone with its Advantage2 system, demonstrating "beyond-classical computation." This breakthrough involved solving a complex simulation problem for magnetic materials in minutes, a task that would have required nearly a million years and the equivalent of the world's annual electricity consumption from the most powerful classical supercomputers. This distinct achievement, rooted in D-Wave's specialized quantum annealing approach, sets it apart from other industry players, including Google, which primarily focuses on gate-model quantum architectures.

D-Wave's unique technological focus translates into a formidable commercial advantage. It stands as the sole provider of commercially available quantum computers, which excel at solving intricate optimization problems—a substantial segment of the overall quantum computing market. While competitors grapple with the long-term development of universal gate-model systems, D-Wave's annealing technology delivers immediate, practical applications. This strategic differentiation allows D-Wave to capture and expand its market share within an industry poised for exponential growth.

Beyond its commercial prowess, D-Wave plays a critical role in national security. The company maintains deep ties with elite U.S. national security entities, notably through its backing by In-Q-Tel, the CIA's venture capital arm. Recent installations, such as the Advantage2 system at Davidson Technologies for defense applications, underscore D-Wave's strategic importance in addressing complex national security challenges. Despite its groundbreaking technology and strategic partnerships, D-Wave's stock experiences considerable volatility. This reflects both the speculative nature of a nascent, complex industry and potential market manipulations by investment houses with conflicting interests, highlighting the intricate dynamics surrounding disruptive technological advancements.

Quantum Race: Who Will Become the “NVIDIA” of the Quantum Era?Quantum Computing Race: Who Will Become the “NVIDIA” of the Quantum Era?

As the quantum computing sector accelerates, companies like D-Wave Systems, Rigetti Computing, Quantum Computing Inc. (QUBT), and IonQ are emerging as key players—each competing to become the dominant force in what could be the next trillion-dollar tech frontier. The comparison to NVIDIA in the AI and GPU revolution is no longer far-fetched, as these firms race to define the future of computing.

Despite their different technological paths—D-Wave with quantum annealing, Rigetti with superconducting qubits, IonQ with trapped-ion systems, and QUBT with hybrid quantum-classical platforms—these companies are now tightly interlinked in market perception. A strong earnings report, product milestone, or government contract from one often fuels sector-wide hype, lifting stock prices and investor sentiment across the board.

This mutual influence is driven by the belief that success by one player helps validate the entire industry. In that sense, these firms are collaborative competitors, pushing the space forward while fighting for leadership. Quantum computing is still in a developmental phase, but the potential is massive—targeting breakthroughs in AI, cybersecurity, materials science, finance, and more.

With analysts forecasting the global quantum computing market to exceed $1 trillion by 2035, the question is no longer if the sector will explode, but who will lead it.

For now, no clear winner has emerged, but momentum is building. And in this space, a breakthrough by one can ignite a rally for all—making the quantum sector one of the most exciting and interconnected areas in tech today.

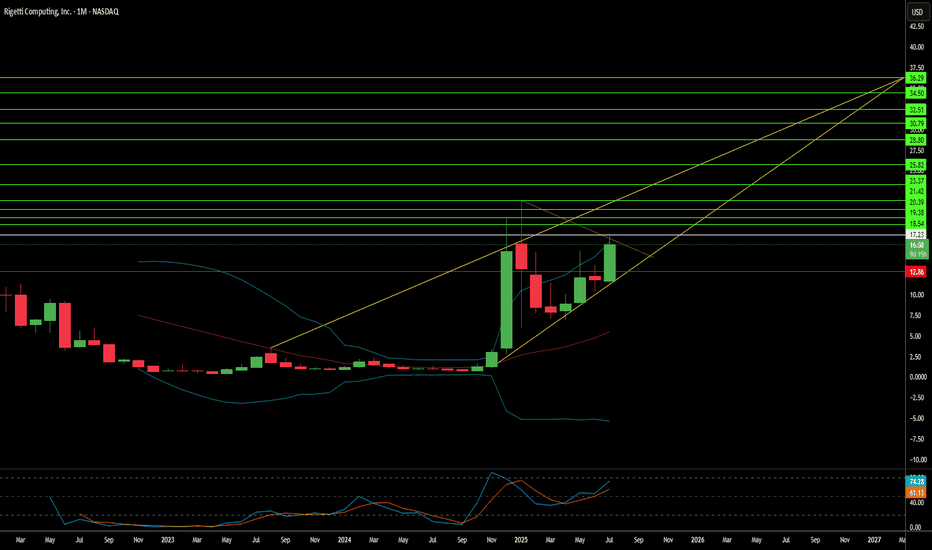

Rigetti's Quantum Leap: Can RGTI Ride the Hype to $100?Rigetti Computing Inc. (RGTI) is a notable company in the quantum computing space, focused on developing superconducting qubit systems. As of late May 2025, the stock is trading around $14.19, marking a sharp rise from its earlier levels this year.

The stock has rallied more than 1,200% over the past six months, pushing RGTI toward the upper boundary of its current ascending channel. The $15.00–$15.50 range is acting as a psychological resistance area. After such a strong move, a technical pullback toward the $12.50 zone would be considered healthy, potentially allowing the stock to reset while remaining within its bullish structure. If $12.50 fails to hold, the next notable support sits near $7.59, a previous area of accumulation.

Rigetti’s growth outlook is supported by several key drivers:

Technological Innovation: The company is on track to roll out more advanced quantum systems, including a 36-qubit system by mid-2025 and a 100+ qubit system by year-end. These advances are built on its modular chip architecture, aimed at scaling performance.

Strategic Collaborations: Rigetti has been expanding its reach by partnering with leading cloud platforms, making its quantum systems more widely accessible and integrated with broader tech ecosystems.

Government Support: The company is also involved in government-backed quantum initiatives, strengthening its credibility and positioning in the national quantum strategy.

As the global quantum computing market continues to gain momentum, Rigetti is well-positioned to benefit. If the bullish trend persists, some forecasts suggest the stock could potentially reach the $100 level by the end of 2026.

Traders and investors should watch key levels: $12.50 and $7.59 on the downside as support, and $15.50 as the immediate resistance to confirm momentum or identify pullback opportunities.

Time to take profits on $QBTS

I Have been bullish on most of the quantum computing stocks for awhile now. NYSE:QBTS

For about a year or so now, trump winning the election didn't change my thoughts at all. I'm not surprised at all that NYSE:QBTS is performing so well however it is important to know when to take profits, and this is one of those times. You're free to leave a small percentage of some QC stocks in your portfolio, I will leave some with trailing stops though for the most part I have taken profits, and quite nice profits they were.

Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investments designed to capture emerging market opportunities and solidify its leadership in diversified industrial technologies. This forward-looking approach is evident across its core business segments, driving innovation and market expansion.

Key initiatives underscore Honeywell's trajectory. In aerospace, the selection of the JetWave™ X system for the U.S. Army's ARES aircraft highlights its role in enhancing defense capabilities through advanced, resilient satellite communication. Furthermore, the expanded partnership with Vertical Aerospace for the VX4 eVTOL aircraft's critical systems positions Honeywell at the forefront of urban air mobility. In the realm of quantum computing, Honeywell's majority-owned Quantinuum subsidiary recently secured a potentially $1 billion joint venture with Qatar's Al Rabban Capital, aiming to develop tailored applications for the Gulf region. This significant investment provides Quantinuum with a first-mover advantage in a rapidly expanding global market.

Geopolitical events significantly influence Honeywell's operational landscape. Increased global defense spending presents opportunities for its aerospace segment, while trade policies and regional dynamics necessitate strategic adaptation. Honeywell addresses these challenges through proactive measures like managing tariff impacts via pricing and supply chain adjustments, and by realigning its structure, such as the planned three-way breakup, to enhance focus and agility. The company's strategic planning emphasizes leading indicators and high-confidence deliverables, bolstering its ability to navigate global complexities and capitalize on opportunities arising from shifting geopolitical currents.

Analysts project strong financial performance for Honeywell, forecasting substantial increases in revenue and earnings per share over the coming years, which supports expected dividend growth. While the stock trades at a slight premium to historical averages, analyst ratings and institutional investor confidence reflect positive sentiment regarding the company's strategic direction and growth prospects. Honeywell's commitment to innovation, strategic partnerships, and adaptable operations positions it robustly to achieve sustained financial outperformance and maintain market leadership amidst a dynamic global environment.

QBTS trend reversal comingSee this beautiful trend forming here, time to get out only to dip back in once levels hit the right Fib levels. Line of resistance is evident, holding around $11 while line of support firmly at $5.70/6-ish. I'd ride this down to $7-ish, then buy back long at those levels. Enjoy the ride!!!!

IONQ: Price at Mid-Term ResistancePrice has reached a key mid-term resistance zone (29-32) for a bounce since Apr bottom.

As long as price remains below the 32 (with max. extension to 34) resistance area, I continue to favor the scenario of another leg lower unfolding in the coming weeks.

Should price break and hold above 32–34, the current trend structure would require reassessment.

Thanks for your attention, and best of luck with your trading!

The Collaborative Edge: Pfizer's Innovation Secret? Pfizer's success in the biopharmaceutical industry hinges on its internal capabilities and a strategic embrace of external collaboration. This proactive approach, spanning diverse technological frontiers, fuels innovation across its operations. From partnering with QuantumBasel and D-Wave to optimize production planning using quantum annealing, to collaborating with XtalPi to revolutionize drug discovery through AI-powered crystal structure prediction, Pfizer demonstrates the tangible benefits of cross-industry partnerships. These initiatives showcase a commitment to exploring cutting-edge technologies to enhance efficiency and accelerate the identification of promising drug candidates, ultimately improving patient outcomes and strengthening Pfizer's competitive position.

The article highlights specific examples of Pfizer's collaborative endeavors. The Pfizer Healthcare Hub in Freiburg acts as a catalyst, connecting internal needs with external innovation. The successful proof of technology in production planning using quantum annealing resulted in significant time and resource savings. Furthermore, the partnership with XtalPi has dramatically reduced the timeframe for determining the 3-D structure of potential drug molecules, enabling faster and more efficient drug screening. These collaborations exemplify Pfizer's strategic focus on leveraging specialized expertise and advanced technologies from external partners to overcome complex challenges in the pharmaceutical value chain.

Beyond these specific projects, Pfizer actively engages with the broader quantum computing landscape, recognizing its transformative potential for drug design, clinical studies, and personalized medicine. Collaborations with technology giants like IBM and fellow pharmaceutical companies underscore the industry-wide interest in harnessing the power of quantum computing. While the technology is still in its early stages, Pfizer's proactive participation in this collaborative ecosystem positions it at the forefront of future healthcare breakthroughs. This commitment to synergy, from basic research to market research, underscores a fundamental belief in the power of working together to drive meaningful advancements in the pharmaceutical industry.

Will Tomorrow’s Secrets Remain Safe?The financial world stands at a critical juncture as the rapid advancement of quantum computing casts a shadow over current encryption methods. For decades, the security of sensitive financial data has relied on the computational difficulty of mathematical problems like integer factorization and discrete logarithms, the cornerstones of RSA and ECC encryption. However, quantum computers, leveraging principles of quantum mechanics, possess the potential to solve these problems exponentially faster, rendering current encryption standards vulnerable. This looming threat necessitates a proactive shift towards post-quantum cryptography (PQC), a new generation of encryption algorithms designed to withstand attacks from both classical and quantum computers.

Recognizing this urgent need, global standardization bodies like NIST have been actively working to identify and standardize quantum-resistant algorithms. Their efforts have already resulted in standardizing several promising PQC methods, including lattice-based cryptography (like CRYSTALS-Kyber and CRYSTALS-Dilithium) and code-based cryptography (like HQC). These algorithms rely on different mathematical problems believed to be hard for quantum computers, such as finding the shortest vector in a lattice or decoding general linear codes. The finance industry, a prime target for "harvest now, decrypt later" attacks where encrypted data is stored for future quantum decryption, must prioritize adopting these new standards to protect sensitive financial transactions, customer data, and the integrity of financial records.

The transition to a quantum-safe future requires a strategic and proactive approach. Financial institutions need to conduct thorough risk assessments, develop phased implementation roadmaps, and prioritize crypto agility – the ability to switch between cryptographic algorithms seamlessly. Early adoption not only mitigates the looming quantum threat but also ensures regulatory compliance and can provide a competitive advantage by demonstrating a commitment to security and innovation. As technology leaders like Cloudflare begin to integrate post-quantum cryptography into their platforms, the financial sector must follow suit, embracing the new cryptographic landscape to safeguard its future in an era defined by quantum capabilities. Adopting post-quantum cryptography is essential, as merely using a different mathematical method does not ensure protection against quantum computing threats.

Can RGTI go for a new ATH?The stock reclaimed the IPO VWAP (purple line) every time sellers tried to press the stock, signaling strong buyer interest and establishing a new base. The ATH VWAP (black line) remains overhead, but immediate resistance is now at $11.95.

A clean break above $12 could ignite a momentum squeeze, with minor resistance at $12.97 before a potential run toward $15. The stock’s resilience above IPO VWAP suggests bullish control; watch for volume confirmation on a move through $12.

A Stop Loss level is set at $10.33.

With the NVDA event, the news can quickly become highly volatile, so it’s advisable to trade with caution.

Quantum Doom for Bitcoin?Bitcoin, the leading cryptocurrency known for its promise of a decentralized structure, faces an existential crisis due to advances in quantum computing that threaten its cryptographic foundation. The article "Bitcoin's Imminent Collapse: The Quantum Threat and Cryptographic Vulnerabilities" outlines a convergence of risks – technological breakthroughs, government influence, and market dynamics – that could potentially bring Bitcoin's value to zero.

At the heart of the danger lies the SHA-256 algorithm, which secures the Bitcoin blockchain. Quantum computers, such as those from D-Wave, which claimed to have achieved "quantum supremacy" in 2025, may soon be able to reverse the hashing operation, revealing private keys and destabilizing the entire network. This potential breach, known as "Q-Day," could severely damage trust in Bitcoin and lead to a mass exodus of investors.

The forecast becomes even more alarming given the mysterious origin of SHA-256, developed by the NSA (U.S. National Security Agency) and standardized by the National Institute of Standards and Technology (NIST). The article raises disturbing questions about the possibility that the NSA possesses unknown vulnerabilities or "backdoors" within the algorithm. Past seizures of Bitcoin by the U.S. government, such as the recovery of a hacker's wallet in 2021, suggest an extraordinary ability to bypass its security – perhaps through undisclosed inside knowledge.

Meanwhile, NIST's push for post-quantum cryptography (PQC) hints at the impending obsolescence of SHA-256, but Bitcoin's failure to adopt these alternatives critically exposes it. This lack of preparedness increases the risk, as rivals with quantum computers could act before defenses are strengthened.

Market signals add another layer of concern. The approval of Bitcoin ETFs in 2023 by financial giants like BlackRock and Vanguard suggests a strategic move where institutional players offload risks onto less experienced retail investors. Combined with repeated government seizures that cast doubt on Bitcoin's anonymity, a scenario is emerging where the cryptocurrency stands on the brink.

The conclusion is that Bitcoin's vision of decentralization may not survive this perfect storm – a quantum threat, cryptographic weaknesses, and orchestrated market shifts. For stakeholders, the message is clear: adapt quickly or risk potential collapse.

Can MicroStrategy Save Bitcoin's Destiny?MicroStrategy’s dramatic stock decline has become a bellwether for the broader digital asset market. As its share price plunges, the company’s deep ties to Bitcoin spotlight a precarious balance between corporate strategy and the volatility inherent in the crypto space. This unfolding scenario challenges investors to reconsider the intertwined fates of traditional finance and digital innovation.

The company’s approach to using Bitcoin as a primary treasury reserve has been revolutionary and risky. Aggressive accumulation strategies, including debt financing and Bitcoin-backed loans, have magnified the impact of market fluctuations. With critical support levels now under threat, the risk of forced asset sales looms large—an event that could cascade through the crypto ecosystem and undermine confidence in digital currencies.

Amid these challenges, MicroStrategy is also pursuing bold financing initiatives to stabilize its operations. Plans to raise $21 billion through a preferred stock offering signal a dual objective: securing necessary capital and further investing in Bitcoin. This move reflects an ongoing commitment to a Bitcoin-centric strategy, even as recent transactions have resulted in significant unrealized losses.

In parallel, the cryptocurrency landscape faces unprecedented headwinds from regulatory pressures, geopolitical tensions, and emerging technological vulnerabilities. Financial professionals are compelled to balance risk with opportunity, rethinking investment strategies amid an environment where innovation meets uncertainty at every turn.

The looming threat of quantum computing adds another layer of complexity. As quantum technologies advance, their potential to break current cryptographic standards—on which Bitcoin’s security fundamentally relies—poses a significant risk. Should quantum computers overcome encryption protocols like SHA-256, the very foundation of blockchain technology could be compromised, forcing the industry to adopt quantum-resistant measures rapidly. This challenge not only underscores the volatility of the digital asset market but also inspires a deeper exploration into safeguarding the future of decentralized finance.

Atos Reverse Stock Split – Another Round of Price Manipulation?Atos Confirms Bullish Continuation, Invalidating Consolidation and Bearish Retest

Atos has officially invalidated neutral consolidation and a bearish retest, choosing a bullish continuation as it currently trades at $0.0046.

Atos Needs a Pullback to $0.0028–$0.0034 After 84% Surge

Following a massive 84% rally from $0.0030 to $0.0055, Atos now requires a technical pullback to retest and confirm support.

Target Pullback Zone: $0.0028–$0.0034

A retracement into this range would provide a healthy consolidation, allowing bulls to regroup before another breakout.

Holding this zone would strengthen the bullish structure, preventing excessive volatility and reinforcing confidence in further upside.

If $0.0028 holds, the next bullish wave could see Atos push beyond $0.0055 and target new highs.

This pullback phase is crucial for maintaining trend stability and ensuring Atos builds a strong foundation for the next bullish leg. If buyers defend $0.0028–$0.0034, the stock could be positioned for another sharp upward move.

Atos SE Reverse Stock Split Analysis – March 2025

Atos SE has announced a reverse stock split at a 10,000-to-1 ratio, aiming to reduce the number of outstanding shares and stabilize stock price volatility. This move follows prior capital increases and a drastic decline in share value.

Key Impacts of the Reverse Split:

Structural Change, Not Value Addition:

The total market capitalization and shareholders' equity remain unchanged.

For example, a holder of 30,000 shares at €0.0049 each will receive 3 shares at €49 each, maintaining a €147 portfolio value.

Market Sentiment & Perception:

Large-scale reverse splits are often perceived negatively, as they may signal distress.

Atos must demonstrate financial stability and growth potential to prevent further investor sell-offs.

Liquidity & Trading Adjustments:

Shareholders with fractional holdings (<10,000 shares) will need to adjust positions before April 23, 2025, or risk forced liquidation.

The new shares will start trading under a new ISIN code (FR001400X2S4) from April 24, 2025.

Potential Post-Split Volatility:

If investor confidence remains weak, the stock could face renewed selling pressure despite the higher nominal share price.

However, if Atos improves its fundamentals and strategic outlook, the split could help attract institutional investors who prefer stocks with higher unit prices.

Final Take:

While the reverse split does not inherently add value, it aims to enhance trading conditions and market perception. The real impact depends on Atos' ability to execute a successful turnaround strategy beyond the technical stock adjustment.

Atos Reverse Stock Split – Another Round of Price Manipulation?

Atos SE has once again announced a massive reverse stock split (10,000-to-1), following a sharp decline in share value. While this move is framed as an effort to reduce volatility and stabilize trading conditions, history suggests a pattern of price manipulation that leaves retail investors at a loss.

A Look Back – The 2024 Split Manipulation

The last time Atos conducted a share split (13,497 new shares for every 24 old shares), the price artificially pumped from €0.15 to €1.70 right before the official announcement. This created a false sense of demand, trapping investors at high prices, only for the stock to collapse afterward. Many retail traders ended up buying high and losing money.

Current Manipulation – Selling Off Before the Split

Now, we see a similar pattern playing out again—Atos is trading at record-low levels below €0.0030 ahead of the reverse split. This suggests that once the new shares start trading at a higher nominal price, investors may again face forced sell-offs and further declines, leading to more financial losses for shareholders.

Key Takeaways:

The reverse split does not add value—it only reduces the number of shares outstanding, while total market capitalization remains unchanged.

Shareholders with less than 10,000 shares must adjust their positions before April 23, 2025, or risk forced liquidation.

Without strong fundamentals, the post-split price may drop again, just like last time.

Investors should remain cautious and consider the risks before making any decisions. Atos must prove its financial stability rather than relying on stock restructuring to create the illusion of recovery.

What Lies Beneath Rigetti’s Quantum Ambitions?Rigetti Computing, Inc. stands at the forefront of quantum innovation, chasing a future where computational power reshapes industries. Yet, allegations of securities fraud have cast a formidable shadow over its aspirations. The Rosen Law Firm’s investigation, sparked by claims that Rigetti may have misled investors with overstated progress or understated risks, intensified after a 45% stock drop on January 8, 2025—triggered by Nvidia CEO Jensen Huang’s assertion that practical quantum computers remain 20 years distant. This collision of legal scrutiny and market shock prompts a tantalizing question: can a company’s bold vision endure when its foundation is questioned?

The securities fraud allegations strike at the heart of Rigetti’s credibility. As the company advances its cloud-based quantum platform and scalable processors, the probe—echoed by The Schall Law Firm—examines whether its disclosures painted an overly rosy picture, potentially luring investors into a speculative abyss. Huang’s sobering timeline only amplifies the stakes, exposing the fragility of trust in a field where breakthroughs are elusive. What does it mean for a pioneer to navigate such treacherous waters, where technical promise meets the demand for transparency? This riddle challenges us to dissect the interplay of innovation and integrity.

For Rigetti’s investors, the unfolding drama is both a cautionary tale and a call to action. With millions of shares and warrants poised for market entry amid a $0.515 stock price, the allegations fuel uncertainty and ignite curiosity about resilience in crisis. Could this investigation, if resolved favorably, strengthen Rigetti’s resolve and refine its path? Or will it unravel a quantum dream deferred? As the company balances cutting-edge pursuit with legal reckoning, the enigma deepens, urging readers to ponder the price of progress and the courage required to sustain it against all odds.

Short-Term Buy Position. 31$ - 40$IonQ (IONQ): Short-Term Buy Position with Bearish Confirmation Risks

IonQ is currently in a short-term buying zone after experiencing a long pullback from $44 to $31. The next key move is a rebound to at least $35, where the stock could face resistance at its November 2021 levels or attempt a rise toward $40 to create a bearish confirmation pattern.

If the bearish trend continues, IonQ could head toward $26, a critical support level where two key scenarios could unfold:

Consolidation between $20 and $26, signaling market uncertainty and potential range-bound trading.

Bullish channel formation between $26 and $35, which would suggest a gradual recovery and potential accumulation.

Long-Term Risk: A Steep Correction Like 2021

If IonQ fails to stabilize within these key price zones, it could trigger a major percentage drop of 80–85%, similar to its 2021 crash from $35 to $10.

Key downside levels to watch:

$26: Must hold to prevent deeper declines.

$20: Below this, the stock enters a high-risk phase.

$10: A worst-case scenario if bearish momentum intensifies.

Conclusion: Critical Levels to Watch

Short-Term Resistance: $35–$40 (needs to break for bullish momentum).

Long-Term Support Zones: $26 (major level) and $20 (critical risk point).

Failure to hold above $26 could result in a sharp decline, repeating the 2021 pattern with a potential 80–85% drop.

IonQ must stabilize above $26 to avoid a deeper correction, while a move past $40 could temporarily delay the bearish scenario. The next few months will be crucial in determining its long-term trajectory.

Can Quantum Leap Us into the Cosmos?Boeing's venture into the quantum realm is not just an exploration; it's a bold leap forward into a universe where technology transcends traditional boundaries. Through its involvement in the Quantum in Space Collaboration and the pioneering Q4S satellite project, Boeing is at the forefront of harnessing quantum mechanics for space applications. This initiative promises to revolutionize how we communicate, navigate, and secure data across the vast expanse of space, potentially unlocking new realms of scientific discovery and commercial opportunity.

Imagine a world where quantum sensors offer unprecedented precision, where quantum computers process data at speeds and volumes previously unimagined, and where communications are secured beyond the reach of conventional decryption. Boeing's efforts are not merely about technological advancement; they are about redefining the very fabric of space exploration and security. By demonstrating quantum entanglement swapping in orbit with the Q4S satellite, Boeing is laying the groundwork for a global quantum internet. This network could connect Earth to the stars with unbreakable security and accuracy.

This journey into quantum space technology challenges our understanding of physics and our expectations for the future. With its history of aerospace innovation, Boeing is now poised to lead in an area where the stakes are as high as the potential rewards. The implications of this work extend far beyond secure communications; they touch on every aspect of space utilization, from manufacturing in microgravity to precise environmental monitoring of our planet and beyond. As we stand on the brink of this new frontier, the question isn't just about what quantum technology can do for space, but how it will transform our very approach to living, exploring, and understanding the cosmos.

Can Quantum Security Save Our Digital Future?In the relentless evolution of cybersecurity, Palo Alto Networks is at the forefront, challenging the conventional with the introduction of the Quantum Random Number Generator (QRNG) Open API framework. This innovative approach not only aims to combat the looming threats posed by quantum computing but also redefines how we think about security in a digital world increasingly intertwined with AI and machine learning. By fostering collaboration across different QRNG technology providers, Palo Alto Networks is not just enhancing security measures but is also setting a new standard for industry-wide interoperability.

The company's commitment extends beyond technological innovation into practical applications, as evidenced by its strategic partnership with IBM and the UK Home Office to secure the Emergency Services Network. This initiative showcases Palo Alto Networks' capability to integrate advanced security solutions into critical infrastructure, ensuring resilience against cyber threats in real-world scenarios. Moreover, their achievement of the FedRAMP High Authorization for their cybersecurity platforms marks a significant milestone, affirming their role in safeguarding even the most sensitive government data.

But the implications of Palo Alto Networks' advancements go deeper, challenging us to rethink our approach to digital security. Their platformization strategy, which unifies disparate security tools into cohesive platforms, not only streamlines security operations but also leverages AI to provide smarter, more proactive defense mechanisms. This strategic pivot towards a more integrated and intelligent security ecosystem is not just about managing current threats but about preparing for an unpredictable future where digital threats could evolve beyond our current comprehension.

In essence, Palo Alto Networks is not merely responding to the cybersecurity challenges of today; they are reimagining them for tomorrow. By pushing the boundaries of what's possible with quantum security and platform integration, they invite us to question: Are we ready for a world where security is as dynamic and forward-thinking as the threats it aims to counter? This thought-provoking journey into the future of cybersecurity compels us to stay informed, engaged, and critically aware of how we protect our digital lives.

Can Intel Redefine the Future of Tech?Intel is at the heart of a technological renaissance, pushing boundaries across multiple fronts in the tech industry. From pioneering neuromorphic AI chips that mimic human brain functions for energy-efficient computing in everyday devices to quantum computing advancements with its Tunnel Falls silicon quantum chip, Intel is not just following trends but setting them. Introducing the Spiking Neural Processor T1 could revolutionize how smart devices process data, significantly enhancing battery life and reducing reliance on cloud computing.

In the quantum realm, Intel's release of a 12-qubit silicon chip to the research community marks a significant step towards practical quantum computing. This initiative fosters academic exploration and positions Intel as a leader in developing scalable quantum technologies. The potential here is vast, promising breakthroughs in computation that could challenge our current understanding of what's possible in data processing and security.

Moreover, Intel's strategic maneuvers in the chip manufacturing sector are particularly intriguing. With rumors of Apple potentially shifting its iPhone chip production to Intel, and government initiatives encouraging domestic production, Intel stands at a crossroads of innovation and geopolitics. This could lead to a reshaping of global supply chains, fostering technological and strategic advancements in national interests.

The question now is not just whether Intel can redefine the future of tech, but how its multifaceted approach will inspire a new era of computing, where efficiency, sustainability, and strategic autonomy are paramount. Intel's journey is a narrative of challenge and change, urging us to reconsider the limits of technology and the shape of our digital future.

Quantum Corporation: Major Levels to WatchGood morning, trading family!

Quantum Corporation is at a crucial point:

Above $34.50: A breakout could push us to $50 or even higher.

Below $29: The downside opens up to the $6–$12 range.

Stay sharp as these levels could define the next big move.

This Sunday, I’m hosting a Master Your Mind Traders Class to help you build a stronger trading mindset and strategy. Seats are limited—send me a DM for details!

Kris/Mindbloome Exchange

Trade What You See

Will Quantum Computing Make Our Digital Fortresses Crumble?In the race toward quantum supremacy, D-Wave Systems stands as a testament to humanity's relentless pursuit of computational boundaries. Their latest Advantage2 processor, boasting over 4,400 qubits, doesn't just represent an incremental step forward—it demonstrates quantum computing's transformation from theoretical promise to practical reality. With processing capabilities 25,000 times faster than its predecessors in materials science applications, we're witnessing the dawn of a new computational era.

This quantum revolution extends far beyond laboratory walls. NASA and Google's collaborative Quantum Artificial Intelligence Lab exemplifies how quantum computing is already reshaping our approach to complex challenges. From simulating planetary atmospheres to optimizing space missions, these systems tackle problems that traditional computers find insurmountable. The technology's ability to explore multiple solutions simultaneously opens doors to possibilities we're only beginning to imagine.

However, recent developments from Chinese researchers using D-Wave systems to breach encryption algorithms present a double-edged sword. While showcasing quantum computing's extraordinary potential, these breakthroughs signal a fundamental shift in cybersecurity paradigms. As we stand at this technological crossroads, the question isn't whether quantum computing will transform our world, but how we'll adapt to its profound implications for security, science, and society. The future isn't just approaching—it's already unfolding at quantum speed.