Quarterly

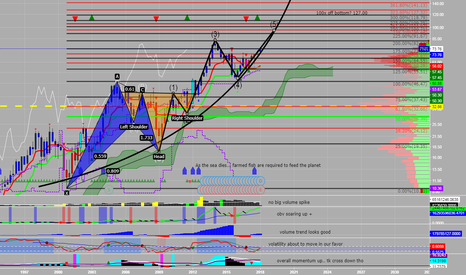

PNR Quarterly ChartPentair makes all kinds of equiment for fish farms which will be required in the not too distant future to maintain population growth as the seas continue to decline.

I see 30% pretty easily in the next few quarters. 100x off the bottom is 127 dollars another key level to watch if we dont correct very much after my (potential) wave 5 completes

Be sure to manage your risk

gl hf

xoxo

sn00p

Tesla Short Term Daily TurnaroundTesla's share price has just double bottomed on both the 200 day EMA and MA, two very strong trend support/resistance zones. Coupled with the pending quarterly earnings report tomorrow (November 1st, 2017), I expect a bullish week ahead. This is a very low risk trade with a stop loss ~$3 below the entry, which is right below the 200 EMA/MA, and an initial target of $338 just below the 0.236 fib, which is entirely dependent on the details of the earnings report. On the last earnings report on August 2nd when earnings were beat by 0.61 points (yet still at a loss below -$1/share) price immediately jumped from that daily open of $318 to the next daily open of $345 to continue upwards into the next week, topping at $370, an increase of 16%. I anticipate similar results for tomorrow if analysts earnings estimates are beat again.

Artificial Intelligence pioneers with NVDA, arrow or landNVDA is continues with crazy growth. We almost touched 170 briefly, which was extremely unexpected. Here is a view on the channel we are back to. Was it a quick previous of future to come?

After successfully reaching 155, as previously discussed and even 160-165, here is my new setup for the summer and next September. 190 is the new target, which with the current channel would be beginning of August. Not sure if there will be another big correction, but there is space for one. Based on previous trend of NVDA, we can expect between 25-35% drop. NVDA however is behaving very good so far after the massive sell of, which makes me think that the pump was in order to have buffer for last Friday sell off. The company recovered relatively quickly and together with Tesla, they were the only two closing positive on my stock watchlist. The 'deadzone' is marked in red, and currently is around 120. Waiting to reach 155 to unload last trade from previous setup and keeping one long to 190. Possible discounts coming months, looking for 141 down to 120.

Cheers and happy trading!

OKCoin quartliers buy zone If we're still respecting that trend 1255 could be a good buy zone on quarterlies

TRYRUB @ -17.30% one of (1482) best performer (4th Quarter) !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

EURGBN @ 0,00 % lowest performer (4th Quarter) of 1842 !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

TRYRUB @ -17.30% one of (1482) best performer (4th Quarter) !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Next week i`ll confirm or change my opinion about this SetUp :)

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

39 Currencies (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

EURGBN @ 0,00 % lowest performer (4th Quarter) of 1842 !Take care

& analyzed it again

- it`s always your decision ...

(for a bigger picture zoom the chart)

This is only a trading capability - no recommendation !!!

Next week i`ll confirm or change my opinion about this SetUp :)

Buying/Selling or even only watching is always your own responsibility ...

1482 Cross-Rates (4th Quarter Statistics) @ drive.google.com

39 Currencies (4th Quarter Statistics) @ drive.google.com

Best regards

Aaron

AUD/JPY - To repeat the breakdown of 2007/2008? Time will tell!Summary:

All signs are pointing to a significant breakdown in the AUD/JPY...

Commodity currencies are under extreme pressure due to a global slowdown and suppressed commodity prices.

In an extremely volatile and high risk market, investors will fly back into the Yen as a safe haven and dump commodity currencies.

We also have upcoming rate cuts coming out of the RBA, as well as a housing bubble that is soon to pop.

The crash in the Shanghai Index as well as slow growth out of China will put further pressure on the Australian Dollar.

Technicals:

We have broken a significant 7 year trend-line on the Quarterly + Monthly Charts indicating upcoming bearish pressure

We are also resting within the 200/250 EMA's on the weekly chart. If we break below these EMA's, I believe the AUD/JPY will start to turn. Be on the lookout for a possible EMA Death Cross in the near future

Looking at the daily, we are starting to put in lower highs and lower lows which may drive the AUD/JPY lower.

This is something I will be keeping an eye on....

USD/CHF - 25 Year Falling Wedge Breakout Confirmed USD/CHF has broken out of a 25 year falling wedge pattern that began in 1980.

You must purchase high-quality historical data such as eSignal to see past price action on this pair as TradingView only allows day up to 1992 on USD/CHF. The lower trend-line has 4 high quality touches rather than just the two TradingView displays.

When the EUR/CHF peg was removed, the USD/CHF pair suffered massive downside losses due to the rapid appreciation of the CHF. Looking at long-term charts, we can see that this CHF appreciation acted as a fundamental catalyst to retest the backside of the falling wedge after breaking out back in July 2014.

We also reacted beautifully off of the .618 Fibonacci Retracement creating a higher low on the monthly chart for USD/CHF. If the USD continues to appreciate against the CHF, we will end Quarter 1 of 2015 with a massive bullish pinbar on the quarterly chart for this pair.

Confluence:

1. 25 year falling wedge breakout - Bullish Reversal Pattern

2. Retest of upper trend-line / backside of wedge

3. .618 Fibonacci Retracement Respected

4. Higher monthly low formed

5. Price remains buoyant above monthly 50 EMA for the first time since 2001

6. 50/200 EMA Golden Cross about to occur on Weekly Chart. Last cross of these EMA"s was back in 2002 to the downside (Death Cross), last upside cross (Golden Cross) was 1997.

7. Strong USD Fundamentals align with this Bullish View. CHF needs to catch up with USD Index.

8. Price has traded above parity for 5 trading days

Radioshack Corp -RSH -Daily - Quarterly "Box" TrendlinesI like the idea of plotting the entire quarter around the price action so you can see where the stock is during the beginning and end of a quarter and how the quarters stack up against each other.

Then I noticed that a trendline across the top right corner of the quarter gave an interesting price level and then kept drawing them. Notice they are somewhat interesting in this chart of RSH.

Do some work on your own and see what you find.

Tim

9/27/2014 4:03PM EST