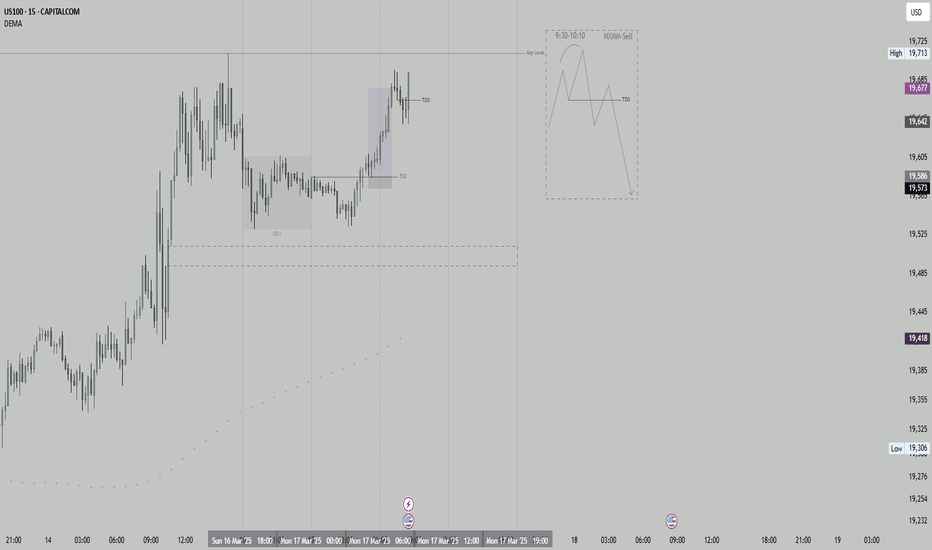

NQ! Short Idea (MXMM, Quarterly Theory)Dear Traders,

today I present you once again my current idea on the Nasdaq. We have swept a High Liquidity Area marked as my lower HTF PDA. Because of that we might see a stronger Pullback as shown on my Chart.

However, I will still keep my eyes open and wait for the 9:30 (UTC-4) Manipulation to look for a Market Maker Sell Model which I will only consider a after a Pullback into my Key Areas and Price Action showing interests of a bearish continuation.

(09:30 Manipulation, Liquidity Sweep + SMT Divergence, Break Of Structure, Any PD-Array)

Praise be to God

-T-

Quarterstheory

SOLUSD: How to Draw Quarter's Theory LevelsApplying Quarter’s Theory to SOL/USD helps traders identify key psychological price levels where institutional players might step in. With Solana’s volatility, these quarter levels (25%, 50%, 75%, and full dollar increments) act as crucial areas for potential reversals or breakouts.

Current Market Outlook

SOL/USD is currently trading around a major quarter level, signaling a potential shift in momentum. If buyers push above $150, the next logical upside target is $175, while a breakdown could send prices back to $125—both key quarter points.

How to Trade It

Aggressive traders can enter at quarter levels with tight stops, aiming for quick price movements.

Conservative traders should wait for a breakout confirmation and a retest before executing trades.

Renko charts can help filter noise and confirm trend strength, making it easier to spot clean setups.

Is SOL/USD Gearing Up for a Big Move?

With SOL/USD sitting at a crucial level, the next move could be significant. Will we see a drop toward $125, or is a deeper pullback coming? What’s your take? Drop a comment below!

NQ Short Idea (MXMM | Quarterly Theory)Hello guys, I hope everyone is having a profitable day.

I present to you my todays short idea. I want the London highs to be swept and price to manipulate into my Key Level. I will enter short once this happens and we have ChoCh + retrace into any PD Array (OB, FVG,...)

Praise be to God.

-T-

ES Week 49The price is in premium. and would need to retrace to a gap before continuing higher.

CBOT_MINI:YM1! is the closest to a Daily gap from Q2 of Q3 Tertiary and I would like the price to visit there before going higher.

This is also works with my CAPITALCOM:DXY analysis as when CAPITALCOM:DXY is a bull trend CME_MINI:ES1! in a bear trend.

Bitcoin Week 48When looking at BINANCE:BTCUSDT.P and BINANCE:ETHUSDT.P you can clearly see that BINANCE:ETHUSDT.P closed above the previous week high while BINANCE:BTCUSDT.P didn't what indicate us as a bearish SMT.

BINANCE:ETHUSDT.P reached to a 1D gap from previous Q1 week which will be a resistance area.

This is why I would be bearish to BINANCE:BTCUSDT.P this week.

I would like to target the previous gaps marked in the chart above

ES1 Week 48Seems like this week CME_MINI:ES1! closed above the high of the previous Tertiary Quarter while CME_MINI:NQ1! didn't which indicate as bear SMT.

What supports this idea is the fact that CME_MINI:NQ1! is between two daily gaps of previous weeks in the same month Q1.

This make me believe that we are looking to retrace to previous gaps and I'm bearish this week.

Crypto Week 47 AnalysisIt seems like that all Major 3 Crypto Coins are in Premium.

All of them are above True Week Open, True Month Open and True Year Open except for BINANCE:ETHUSDT.P Which is below True Year Open.

We are using a gap from previous Year Q4 that merge with a weekly gap. and we have a PSP in a weekly graph right about it.

Near True Year Open BINANCE:ETHUSDT.P there is a Gap from previous Monday in 3h graph.

I think I would like to see BINANCE:ETHUSDT.P getting into the 3h gap and targeting the True Year Open.

Current target in BINANCE:ETHUSDT.P is True year Open

After touching it I'll be bearish since the price is in a major Premium.

Futures Week 47 Monday AnalysisAs I see it the close target of both ES and NQ is the True Month Open.

On both of the True Month Open there is a gap from previous Monday in 6h chart.

The bullish movement that we had this week is supported by SMT between CME_MINI:ES1! , CME_MINI:NQ1! and CBOT_MINI:YM1! and 6h gap from previous Tuesday (Q2).

I don't see any relevant higher time frame gaps that the price can encounter until the True Month Open so my current target is that.

In my opinion CME_MINI:ES1! will get to the True Month Open first and will liquidate it, at the same time CME_MINI:NQ1! will get to a 90 minutes gap at AM session (Q3) and won't liquidate the True Month Open and we'll get a bearish SMT

Exploring Ilian Yotov's Quarter Point Theory: Refine Your Entry

The quarters theory challenges the notion that financial markets are chaotic and that market prices are random by demonstrating constant orderly movement of price from one Quarter point to the next. In this publication, I will delve into the fundamentals of Yotov's Quarter Point Theory, its significance, and how it can be applied effectively in forex trading.

What is Quarter Point Theory by Ilian Yotov?

Ilian Yotov's Quarter Point Theory is a technical analysis strategy used in forex trading to identify potential entry and exit points. The theory is based on the observation that currency prices tend to gravitate towards specific levels known as "quarter points," which are key psychological and technical levels in the market.

Key Concepts of Quarter Point Theory

• Quarter Points: These are price levels that divide a currency pair's price range into four equal parts. For example, if a currency pair is trading between 1.2000 and 1.3000, the quarter points would be 1.2250, 1.2500, and 1.2750.

• Psychological Levels: Quarter points often act as psychological barriers where traders tend to place buy or sell orders, causing price reactions at these levels.

• Support and Resistance: Quarter points can act as support and resistance levels, where prices may consolidate, reverse, or experience significant movement.

Identifying Quarter Points

To apply Quarter Point Theory, traders need to identify the high and low of a currency pair's price range. These values are then divided into quarters to determine the quarter points.

The quarters theory focuses on the 1000 pip range between major whole numbers in currency exchange. Each 1000 pip range can be divided into 4 equal parts called Large Quarters

Each Large quarter has exactly 250 pips (1000/4 =250).

A Large Quarter Point (LQP) is a price that marks the beginning and the end of each Large Quarter (250 pips range).

Large Quarter Points that coincide with Major whole numbers are called Major Large Quarter Points (MLQP). MLQP signals the end of a 1000 PIP range and the beginning of a new 1000 pip range.

A Major Small Quarter point is simple the number that coincides with a whole number, for example, 1.30, 1.31, 1.32, 1.33, 1.34…. Each of these numbers mark the beginning of a 100 pip range.

Here is an illustration of this:

Using Quarter Points in Forex

When you study price around this theory, you may notice that price has a tendency to print the high of the day or low of the day around quarter point levels. Here is a example of this over a 5 day period on EURUSD:

With this new-found knowledge, you could integrate this into your strategy. Once you have a directional bias for the day and you have an AOI for entry, you simply need to identify the quarter point within that range and anticipate a reaction at that level.

For a deeper dive into this theory, I highly recommend reading the original work by Ilian Yotov's. If you would like a free pdf copy, drop me a message or leave a comment, I'd be happy to share this with you.

Happy Trading

GBPUSD - Long trade after CPI data ICT Concepts x Quarterly Theory

Top of the morning! Beautiful trade on the GBPUSD yesterday.

I blended ICT Concepts and Quarterly theory.

I will be posting more updates on this approach as time goes on.

Higher time frame narrative:

Monthly timeframe:

-The current monthly candle has bullishly engulfed the two previous bearish monthly candles.

-Price is currently trading above a monthly balanced price range that lines up with a previously violated monthly order block.

-A monthly FVG exists above current price, it is clear that institutional order flow is bullish.

Weekly timeframe:

-Weekly bullish FVG + Order block above the 50% level of a previously respected weekly order block. This offers us an area of high probability support. Our lower time frame entry point can be found in this area...

Daily timeframe:

-Daily bullish order block offers support and is in line with the weekly bullish FVG and order block.

-Bullish dragonfly doji candle printed the previous day, giving further confirmation that there is a lot of interest at our point of interest.

-Classic buyday template, price dropped lower from it's midnight open price to accumulate before expanding to the upside(Power of 3).

Quarterly theory:

Weekly profile observed: AMDX, bullish power of 3- Accumulation on Monday, manipulation on Tuesday, anticipated distribution on Wednesday.

Daily profile observed: Bullish PO3

Session profile observed(NY AM session): AMDX, bullish PO3

Monthly cycle: Quarter 3 - Third week of the month

Weekly cycle: Quarter 3 - Wednesday

Daily cycle: Quarter 3 - New York morning session

Trade entry:

Limit order, Quarter 3 of daily cycle

Entry model for this particular trade? Hourly FVG + Order block at optimal trade entry level (OTE, 0,62 - 0,79 level)

$US30 Final week Idea. I'm still a bit bullish on US30 even with the selling pressure we had this week in the market.

1. We're sitting over a Quarter point that was used as a support on the 17th followed by a retest on the 24th.

2. Last week created a bullish structure that market is already respecting, this structure also lines up with my quarter point levels.

3. we previously retested a supply zone at $3700-37100.