EUR / JPY TREND WAVE COUNT, Based on Quarters Theory Trend WaveHello again, there's another analisys of my wave count on the EUR/JPY.

This wave count is made with the Quarter Theory Trend Wave psycology.

As you all can see in my chart, we've got a lot of chopness on the market during the Summertime Blues, but now in September the market is going to start the real cycle.

The market formed various false reversal and corrections.

We can expect a good move toward the 133.25 price point, wait for some correction, and start the strong trend again.

Trade big, risk small, huge reward.

This is my personal view only, trade at your own risk.

Quarterstheory

GBPUSD Setups 08/12 - 08/17 OutlookPrice Synopsis

GBPUSD has been in a downtrend since august 17th after confirming the double top with several bearish moves.

The entirety of the first wave down consisted of FIVE consecutive red days, with one day of "relief" followed by another five days of bearish activity. After the double top / "M" pattern was confirmed, over this 11 day window price had dropped approx. 800 pips.

There are notable gaps on the daily chart and market structure is indicating we could be approaching a reversal area now after a continued movement down for the past 7 days. It would be logical to see an upside move/wick on this upcoming weekly bar at least 50 pips above the open price

Week of 08/12 - 08/17 Trade Idea

Looking for buy entries to be confirmed between 1.272 and 1.269

Intended stop loss will be a maximum of 35 pips once an entry price has been decided on during SUN/MON price action

Minimum of 3:1 Reward to Risk with expected Target Levels at 1.28250 / 1.29 / 1.3 depending on candlestick development but must remain open minded to a possible sell scenario if price indicates the probabilities of a continued move lower towards 1.26 or the half quarter level at 1.25

Some Fundamentals

We know that the BREXIT referendum occurred in June 2016 and the plans for Britain to leave the European Union are expected to be final in March of 2019 however... several sources are indicating rising fear and uncertainty .

Upcoming dates to be mindful of include the 18th of October and the 13th of December 2018 EU Summit as the agenda will cover negotiations for trade deals, how the transition to independence will work, etc. On March 29 2019 Brexit is scheduled to happen and the suggested transition period to allow consumers and businesses to adapt is supposed to last until December 31 2020

I am not (yet) a licensed financial adviser and this analysis does not constitute as financial advice . This is for educational purposes and you accept sole responsibility of any and all trades you take... investing with real money involves risk!

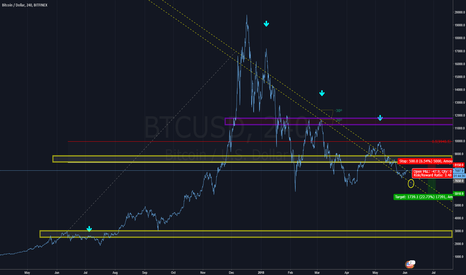

BTCUSD ShortsThis week has been incredibly volatile for Cryptocurrency and has continued to be BEARISH overall.

The possibility of seeing XRPUSD hit 30 cents was completed today

The possibility of seeing ETHUSD hit 300 is nearly there

When you look at the strength and momentum of downside movement on those two assets, you can clearly see they are moving differently than BTC is right now... but this could be a clue to anticipate further taking profit and another push down to make the low of 2018 on this asset as well.

There is a high selling pressure and while we await approvals on things such as ETFs and further guidance on how the markets will be regulated, it would be no surprise to see Bitcoin breach the next quarters zone and trade below 5750 by August 13.

If we see price pull back and move towards 6250 - 6400 watch for price action to CONFIRM the anticipated sell and give us a better than anticipated entry... the way the 08-10 20:00 candlestick on the H4 moved though leads me to believe a move ABOVE 6400 at this point in time would be unlikely

Price action on the small timeframes (M15) show a wedge forming with multiple wicks indicating price could potentially pop upwards before it drops (as a result of people getting liquidated on their sells and having to buy back in because they were stopped out of trades causing temporary relief) however it is definitely possible to expect during the Asian/London markets more movement lower.

Trading involves risk and I am not a financial adviser. You are responsible for any actions you take in the market :)

BTCUSD Price Action UpdateWith Bitcoin current trading below the half quarter of 7500 and with the amount of supply / wicks on the candles we can see... it leads me to believe we may start the new weekly candlestick of July 23 with a BEARISH movement. As of right now, I am targeting 7200-7100 and will be anticipating shorts on ETHUSD and XRPUSD as well. The profit taking could occur across the board in the Cryptocurrency market to start off the week as we do also have a FULL MOON on July 27!

High likelyhood to see this pullback occur and then we could get the setup that brings price over 8000 before the August 10 Bitcoin ETF decision that the SEC will be making. Trading of course involves risk if you are participating with real money and because I am not a financial adviser please hold yourself accountable for any action you take!

There are many factors that I could list detailing WHY I am looking for this movement to happen and they will be discussed on live stream this week :)

EURJPY Short IdeaSelling EURJPY at 131.9

Stop loss 132.2 (just below the quarter level)

Target 1 = 131.3

Target 2 = 130.9

Target 3 = 130.6

Anticipating "Midweek Reversal" Setup with the divergence/double top occurring as well as the psychological effect of getting a bearish engulfing candlestick pattern at the 132 level while we are in an obvious uptrend

Trading with real money involves risk.

I am not a licensed financial adviser, nor is this analysis investment advice. Hold yourself accountable

AUDUSD Short IdeaHigh likelihood AUDUSD will continue trading lower to retest/surpass the structure at 73200

Anticipating a test of the 72500 quarter level considering the upcoming economic event on Wednesday (Unemployment Change & Employment Rate) and considering the existing bearish momentum on the larger picture

Heavily bearish week expected to break the low of last week

Big bearish daily candle & overall trend direction since 2018 started

H4 showing no signs of reversal as of right now

Asian / London Markets may present opportunity for a confirmed sell position around 0.74

Stop loss above 0.743 (no more than 30 pips depending on your entry)

Target 1 = 61.8 Structure at 0.732

Target 2 = 0.726

Trading with real money involves risk.

I am not a financial adviser nor is this financial advice.

Hold yourself accountable!

ETHUSD Short OpportunityEntry 537.72

SL 555.72

Target 1 = 500.72

Target 2 = 472.72

Trading Involves Risk, I am not a financial advisor nor do I give financial advice.

This technical analysis considers quarter level theory, supply and demand, fibonacci, the trend, fundamentals, backtesting, daily volume/volatility and timing.

I am Fearless and I take Risks ;)

I am always learning and I am grateful for the markets.

I love trading!

waiting for confluenceso to begin with we have a engulfing pattern on the monthly to give us a bullish bias BUT WE DO HAVE MOVING AVERAGES SAY WERE BEARISH, we have a weekly bullish bias but we do have broken structure on the 4h and 1h for a bearish bias, i do have my red key support and resistance and i do also have quarters theory and a Fibonacci on my 4h so were going to have to wait and see what plays out if i do get my divergence on my 61.8 on the 1h i will take the buy. if we continue in the uptrend that were currently in on then i will wait for a retest around the price of quarter 1.29250 which is also on our key Fibonacci 38.2 which will be in confluence with our monthly daily and weekly buy. we can hold up to previous quarter 1.3000 if we get our awaiting confluence.

ETHUSD Short Opportunity June 3 2018Ethereum Bearish Scenario

Supply and Demand imbalance caused by a NEW Monthly Candlestick, upcoming G7 Summit on June 8 where Cryptocurrency will be on the Agenda prior to the G20 gathering later this month...

Regulators plan to implement RULES in July and many investors are likely hesitant to open positions in Crypto until further guidance

Those still holding onto ETH/BTC could swing price and create a new low prior to the New Moon Wednesday June 13 and by the end of this hour I'd expect Momentum to bring price closer to 615

XAUUSD 2019 ProjectionBy Q1 of 2019 we could see gold trade as high as 1450!

Remember Technical Analysis is Personal Perspective and there are many fundamental factors that contribute to the Price Movement on Gold including, but definitely not limited to:

Manipulation

Fiat Currency

Large Investors (Switzerland, Russia, Independent Individuals etc) that have accumulated a long term position

Economic Events such as the news filled week ahead (Monday May 28 through Friday June 1 when the G7 Summit begins)

Official Price Target is much higher considering Historical Human sentiment and directional trading.

Gartley and Shark completionAs we look at the pink harmonic we can see that it has met the the first TP at .382, and has been making consecutive lows (minus NFP data). Highlighted by the orange markers are our TP1 & TP2.

WE also see highlighted in pink we have a bullish butterfly pattern that the first TP on it being .382 was met and not only does the .618 look like the next resistance , as well there is a pervious high that has a line from the top if you look left ,that line, aligns up perfectly to the .618 level on the butterfly.

After that^ ... We hopefully will see a completion of Bullish hartley (highlighted in gray). Its B point met perfectly with the .618 and may make its D point at the TP2: of the bullish butterfly i mentioned earlier. STAY Tuned.

EUR/USD short medium swingWatching the euro for a short position based on mostly technical's, and the general fundamentals of the dollar right now. Looking for a reversal at the 61.8 level i have marked in conjunction with a reactive trend line. If price reacts properly i'm looking for price to move down to the monthly support of 1.22000 for about 90 pips. Time will tell and patients will pay:)

I'm going to be posting everyone of my trade ideas on here so be sure to follow my page! thank you.

USD/JPY short long term swingI'm going to be watching usd/jpy like a hawk for the next few weeks. Many fundamentals are going to need to be considered at this time along with our technical analysis. There is a potential to see a strong yen leading into possible regulations on artificial weakening of Asian currencies. This plays in with the key levels we have been watching. We saw a push to 107.500 key level on NFP day leading to a nice rejection. Long term we are looking to see price break 105.500 key monthly support, this would most likely lead to a drop to around the 101.100 area for about 400 pips. But time will tell and patients will pay:)

GBPJPY medium swing short idea Price is currently sitting near monthly round number level. I'm expecting push up to the 50% retracement area along with triple top formation for extra confirmation for short entry then continuation to next 250 pip quarter level. This is in conjunction with my prediction that japan might receive tariff exemptions from the U.S. thus strengthening the Yen.

I Spy with My Eyes... Bearish S&PTraders!

This is my first Public SPY Update and we are going to be discussing some of the fundamentals and technicals influencing the market at this time.

For those of you who do not know... this is an ETF that tracks the S&P 500 and I am bearish on this market at this point

Lower Structure Zone at 225 (ceiling) / 210 (floor)

Key Bull Level = 270

Key Bear Level = 245

Important Dates to Consider

November 8 2016 = US Presidental Election Day with Price Gapping Up to lead the Bullish Run

January 20 2017 Trump Inaugurated while price was sitting at the 225 Quarter Level

January 20 2018 One year Aniversary Structure + "Last Leg Up" & Divergence coming into alignment

*** February 1 to 9 Candlestick Formations ***

Jerome Powell new US Federal Reserve Chair Feb 2018

March 17 2018 New Moon

April 15 2018 ** New Moon (270)

Timeframe Scanning Significance Indications

Weekly 200 EMA is at 221 and there is high volatility and bearish momentum (strength) within the candlesticks

Daily 200 EMA is at 259 and the candlestick formation when Jerome Powell was brought into office looks (almost) identical to the weekly "last leg" candle

H4 200 EMA (lagging indicator) at the time of this publication nearly coincides with yellow eclipse

H1 Clear Divergence in the 200 EMA and candle formations with several instances of price gapping down followed by a LOT of bearish momentum (strong, full candlesticks)

Trading can contain substantial risk and is not suited for every investor. An investor could potentially lose all or more than their initial investment. "Risk capital" - is money that can be lost without jeopardizing ones financial security or life style. Only "risk capital" should be used for trading and only those with sufficient risk capital should consider trading. I am not a licensed financial advisor nor does I give out financial advice. You assume full risk and responsibility for your trading activity. Past performance is not indicative of future results. Individual results will vary due to a variety of market and timing conditions.

EUMarket closed at a multi-year high last week as the bullish sentiment in the euro continues and dollar weakness persists. Price completed a bearish butterfly harmonic at the 1.2250 quarter point and I expect a slight retracement to the broken resistance to establish newfound support for another bullish impulse to the 1.25 quarter point.