AVAX | Final Accumulation & Potential ReversalContext:

Price is in a major accumulation range, showing similarities to the October 2024 setup.

Green zones indicate strong demand/support; blue is key structural support.

Step-by-Step Scenario:

Accumulation Phase:

Price is consolidating above the $20 level, with repeated defenses of the support zone.

Spot Buys:

Orders set in the $19–$20 area to capture a potential “final shakeout.”

Spring/Reversal:

If price sweeps below $20 and quickly reclaims the level, this signals the final flush before reversal — mirroring the October 2024 bottom structure.

Upside Target:

First major resistance at $38, but the big objective is the $54–55 range, marking previous macro highs and supply.

Invalidation:

A sustained close below $14.1 would break the accumulation structure and invalidate the bullish scenario.

Range

SUI | Spot Buy Zone for PullbackPrice has pulled back after a local top and is heading toward a clear demand zone.

Key buy area sits around $3.12, aligned with 0.618 retracement and recent consolidation.

Strong structure below—if majors keep retracing, this is where risk/reward for new spot buys becomes attractive.

Plan:

Waiting for price to reach the green zone to accumulate spot.

Invalidation below $2.80, targeting a move back toward $4.45 and higher if momentum returns.

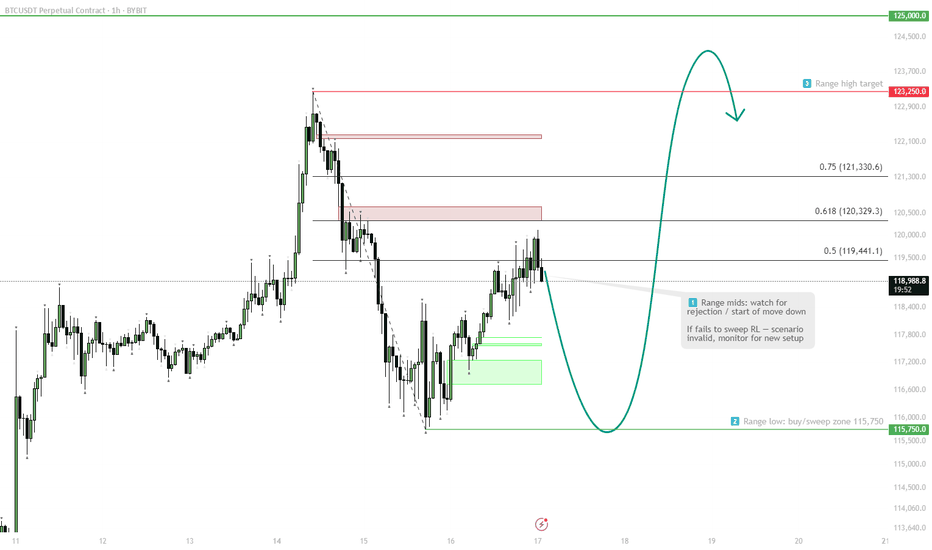

BTC | Short Bias — Targeting $113kPrice rejected perfectly off the 0.5 retracement and is now filling the previous imbalance.

Yesterday's daily close was decisively bearish, confirming downside momentum.

There’s a lack of convincing reversal signals at current levels.

Plan:

Main expectation is continued downside toward the $113k support.

Not interested in longs until price stabilizes at or below that level.

ENA | Range Low Reclaim — Targeting Midrange and AboveClear reclaim of the range low and a strong daily close confirm a bullish market structure shift.

Printing a higher high signals potential for continuation.

Dips toward the reclaimed range low are healthy, providing buy-the-dip opportunities.

Accumulation at the range low with invalidation below keeps risk tight.

Plan:

Accumulate pullbacks toward the range low.

Hold for midrange ($0.83) and upper range/major resistance.

PUMP | Watching for Base ConfirmationThe sharp downtrend is showing signs of exhaustion as price starts to consolidate and build a potential range.

If we see a sweep and reclaim of the range low, that would confirm the start of a new accumulation phase and signal a potential reversal.

The invalidation for any long attempt is a confirmed breakdown below the deviation or the origin of the reclaim.

Plan:

Wait for a clean sweep and reclaim of the range low to trigger a long entry.

Target resistance levels above, with stops set below the reclaim origin.

Bitcoin Facing Macro Volatility: Key Supports Hold Firm__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Dominant bullish bias on higher timeframes (1D to 2H).

Key Supports/Resistances: Key pivot zone at 114.7K–115.8K defended across all timeframes; major resistances at 119.7K, upside extension to 122.3K.

Volume: Peaks on breakout, normal to high volumes depending on TF, no signs of seller capitulation.

Behavioral Indicators: Risk On / Risk Off Indicator remains strong on all strategic TFs; ISPD DIV neutral except for a defensive buy signal on 1H.

Multi-timeframe summary: Broad horizontal consolidation, no panic or euphoria detected. Major supports overlap, confirming structural strength amid macro volatility.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias: Bullish above 114.7K; neutral/slightly bearish below this key level.

Opportunities: Longs via scalping/range trading on reactions at 114.7–115.8K; swing accumulation on daily/4H stabilization above 115K.

Risk: Break below <114.7K, macro volatility around NFP/PMI, false breakouts.

Macro catalysts: Expanded US tariffs (Trump), NFP, PMI, Fed status.

Action plan: Reactivity on pivots, reduce exposure during macro events, hard stops <114.5K H4.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Working the 114723 pivot support. Bullish momentum, no excessive selling, Risk On / Risk Off Indicator “STRONG BUY”.

12H-6H: Building a bottom on the daily base; sustained volumes during sell-off, no panic, technical buy signals emerging.

4H-1H: Vigorous support defense, 1H ISPD DIV “buy” signal. Healthy range pattern; volumes up during rebound attempts.

30min-15min: Slow recovery after high-volume drop, no euphoria or capitulation. No “trap” or imminent squeeze, favorable for tactical trades.

Risk On / Risk Off Indicator: Higher TFs (1W/1D/12H/4H) show strong bullish signals, boosting risk confidence. Decorrelation with lower TFs allows flexible management, controlled accumulation, tight stops at 114.7K.

__________________________________________________________________________________

Macro & BTC Context Summary (Twitter)

__________________________________________________________________________________

Macro: US tariff shock, max volatility likely, amplified moves in equities and crypto.

Bitcoin: Sharp correction post-record close, but solid supports remain, no sign of trend end.

Integration: Technical status quo; favor defensive accumulation, caution on NFP/PMI.

__________________________________________________________________________________

Actionable Synthesis: Plan & Risk Management

__________________________________________________________________________________

Strategies: Longs/scalp >114.7K; swing/accumulate post daily/4H confirmation; partial TPs near 119.7K/122.3K.

Risk Zones: Hard stop <114.5K. Tight monitoring around NFP for volatility spikes.

Reward: Risk-to-reward >2 if buying lower range with strict stops.

__________________________________________________________________________________

Key Macro Events to Watch

__________________________________________________________________________________

2025-08-01: US NFP, unemployment, hourly wages – High volatility expected, possible swings

2025-08-01: ISM Manufacturing PMI – Short-term trend confirmation or invalidation

2025-07-30: FED conference – Range-bound / Moderate volatility

US Tariffs (Trump) – Global risk-off, caution BTC & tech

__________________________________________________________________________________

Conclusion

__________________________________________________________________________________

BTC consolidates steadily between 114.7K–122.3K despite macro shocks

Daily/H4 supports robust, Risk On / Risk Off Indicator strong on higher TFs

Accumulation/scalping favored as long as supports defended

Main risk = break of 114.7K, imminent macro volatility

SEI | Setup: Sweep & Reclaim Scenario:Wait for a sweep of the range low (RL) into the Daily FVG (gray box).

Look for a reclaim of RL as the trigger for a long.

Reasoning:

Sweep into FVG traps late sellers and sets up liquidity for a reversal.

Reclaiming RL after the sweep signals strength and confirms a local bottom.

No need to chase entries—best R:R is after liquidity is cleared and level is retaken.

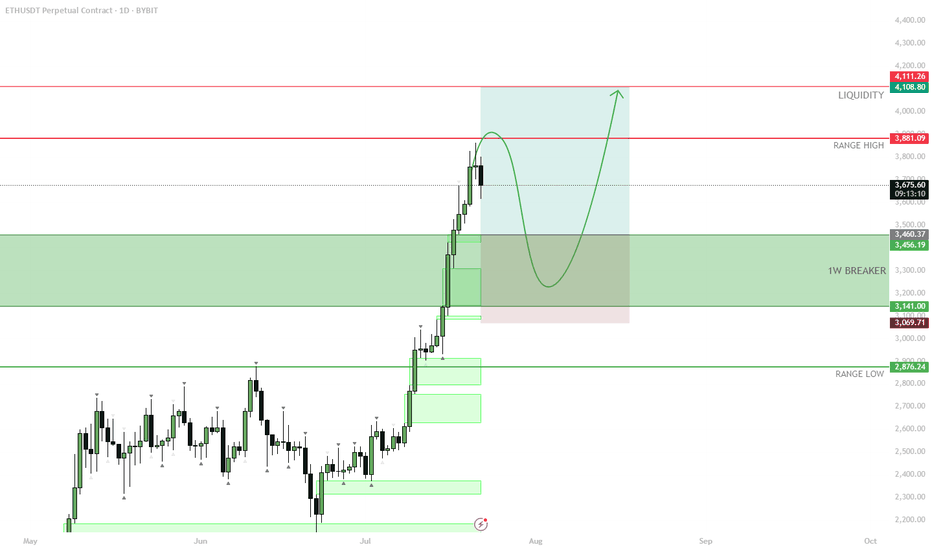

ETH | #4h #short — Range High Sweep & Short SetupScenario:

ETH swept the range high at $3,860, trapping late buyers and triggering stops. Watching for a retest of this level — if it holds as resistance and we see rejection, that’s a short trigger.

Target:

Main target is the 1D FVG at $3,457–$3,477. Possible extension: sweep of range low if selling accelerates.

Why:

Failed breakout setups are classic mean reversion triggers, especially when supported by a visible liquidity pool (FVG) below.

Plan:

Wait for a retest and rejection to confirm short. Partial TP at the FVG zone, manage risk above the sweep high.

GBPAUD - Trading The Range - AGAIN!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been hovering within a big range.

Last week, as per our previous analysis, GBPAUD rejected the upper bound of the range and traded lower.

This week, GA is retesting the lower bound of the range acting as a support.

As long as the support holds, we will be looking for longs on lower timeframes, targeting the upper bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

ETH — Perfect Long Play: Pullback & 1W Breaker Reclaim

After the strong move, price is likely to retrace as longs get trapped and late buyers take profit.

Best scenario: ETH pulls back to the 1W breaker zone ($3,141–$3,456), which previously acted as resistance and could now flip into support.

Watch for bullish reaction and confirmation in the 1W breaker zone.

If support holds, enter long — targeting a return to the range high and then the liquidity zone ($4,108+).

Invalidation if ETH closes below the 1W breaker or loses range low ($2,876) support.

ETH has rallied hard. After such a move, it’s normal for price to pull back and test old resistance as new support. The ideal long is on confirmation of a bounce from the 1W breaker zone, which keeps risk controlled and sets up for a continuation move higher. This approach avoids FOMO and protects against reversal if the breakout fails.

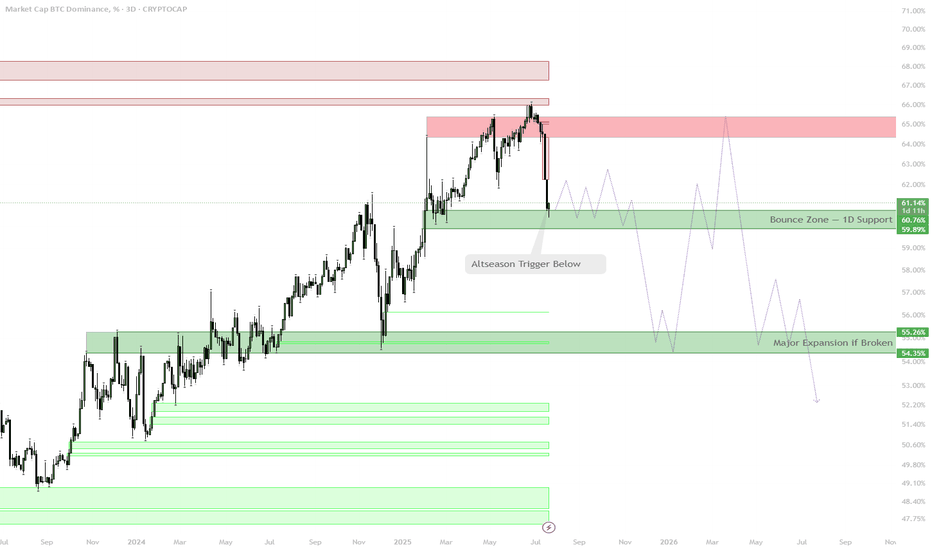

BTC Dominance — Bounces, Chop, and Next Wave Setup

BTC.D reached strong support, confirming euphoria top for now.

Currently, BTC.D is at the first key support (green zone 59.8–61.1%). This is a logical bounce zone where dominance could chop or rebound short-term.

If BTC.D holds and bounces here, expect more range-bound action, potentially retesting 64–65% (red zone).

If this support breaks, the next area of interest is the 54–55% green box. This would open the door for more sustained altcoin strength (altseason continuation).

Ultimately, a decisive break below both green boxes signals the start of a major altcoin expansion phase, with BTC.D trending lower toward 48–50% support.

BTC Dominance (BTC.D) is at a critical inflection point after rejecting at strong resistance and reaching daily support. Bounces from this area are typical as traders rotate profits, but sustained breakdown below support would mark a shift in market regime, favoring alts. Watching for confirmation — the next parabolic move in alts begins if BTC.D loses these green boxes.

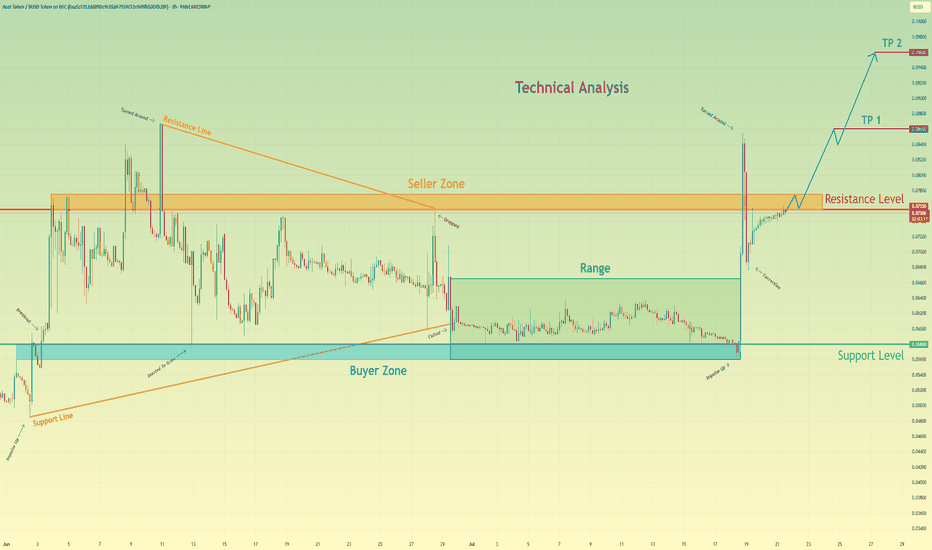

Acet Token will break resistance level and continue to move upHello traders, I want share with you my opinion about Acet Token. Looking at the recent price action, we can see a clear narrative unfolding. The asset initially formed a large wedge pattern, experiencing a trend reversal that led to a breakdown and a period of prolonged consolidation within a defined range between the buyer zone around 0.0580 and the upper boundary. Recently, however, the market showed a strong impulse, breaking out of this range and decisively moving upwards. Currently, the price of act is testing the key resistance level at 0.0755, an area historically defined as a seller zone. The hypothesis is that after this powerful impulse, the asset will manage to break and hold above this resistance. A successful retest of the 0.0755 level would likely signal a continuation of the uptrend, paving the way towards our specified take-profit targets. The first goal is set at TP 1 at 0.0860, with a further extension to TP 2 at 0.0960, capitalizing on the anticipated bullish momentum. Please share this idea with your friends and click Boost 🚀

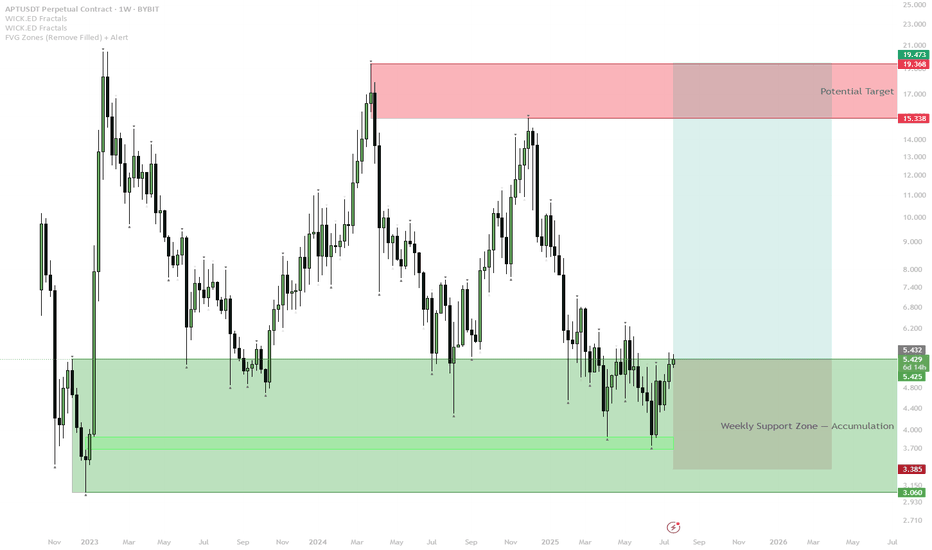

APTOS Weekly Bottom Formation — Early Signs of Reversal

APT has retested and held the long-term weekly support zone (green box) multiple times, confirming strong demand and buyer defense.

Current price action is pushing off the support with a series of higher lows, suggesting the start of a new bullish cycle.

Scenario A (Bullish):

— If APT holds above $5.40 and weekly closes stay above this green zone, expect gradual momentum toward the $15–$19 resistance (red box).

— First target is $15.30, with extension to $19.50 if trend accelerates.

Scenario B (Invalidation/Bearish):

— If price fails to hold $5.40 and breaks back below $3.40, setup is invalidated. In this case, expect retest of lower support at $3.00 or lower.

Aptos is showing a classic bottoming structure on the weekly timeframe, with clear accumulation at major support. Sellers have repeatedly failed to break the lows, while buyers step in on every dip. This increases the probability of a mid-term reversal toward the upper resistance band. Weekly structure remains bullish above support; only a major breakdown below $3.40 would invalidate the scenario.

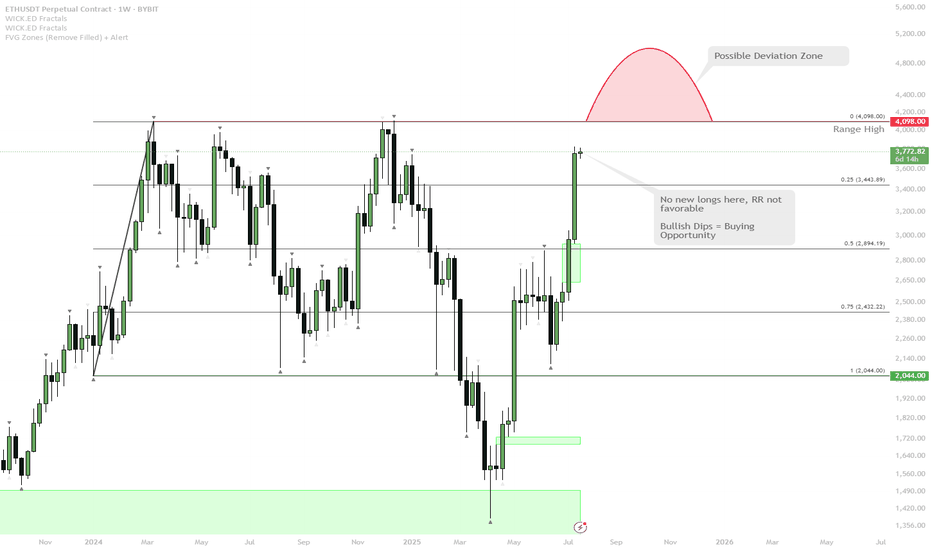

ETH Approaching Major Resistance — Watch for Range High Deviatio

ETH has rallied strongly and is now testing the range highs around $4,100.

The most likely scenario is a direct tap or wick above the range highs — this is a classic spot where the majority expects continuation, but also where deviations (fakeouts) frequently occur.

If price closes above and holds, it could trigger further upside. However, the risk/reward (RR) for fresh longs here is not attractive after such an extended move.

A deviation above range high (quick push above, then close back inside) is possible and would be a bearish signal in the short term.

After this wave, any deep dips in ETH will likely be a high-conviction buy, given the strong bullish momentum.

ETH is showing extremely bullish momentum as it approaches a major weekly resistance at the range high. The obvious play here is a sweep or break of this level, but with the move being so extended, a deviation or fakeout becomes increasingly likely. While momentum is still up, waiting for a dip or failed breakout (deviation) is a better risk/reward play than chasing longs here. Any meaningful pullback will likely present an excellent buying opportunity given the macro strength.

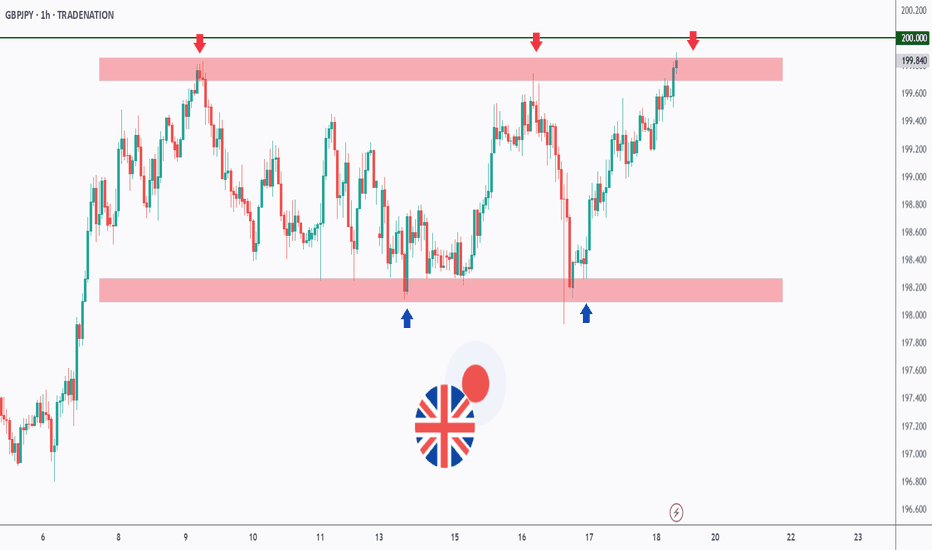

GBPJPY - Trading The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPJPY has been hovering within a big range.

This week, GBPJPY is retesting the upper bound of the range and $200 round number.

As long as the resistance holds, we will be looking for shorts on lower timeframes, targeting the lower bound of the range.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

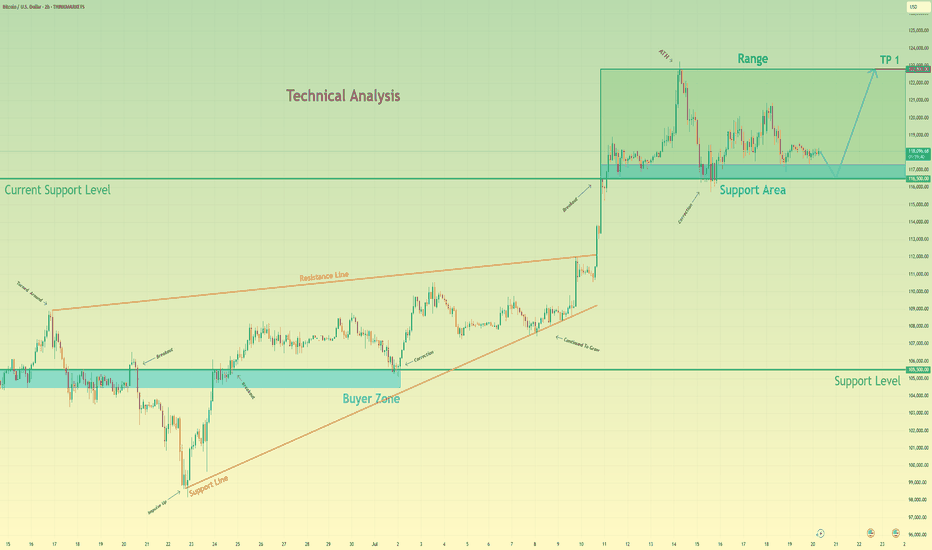

Bitcoin may bounce up from support area to 122800 pointsHello traders, I want share with you my opinion about Bitcoin. Analyzing the broader market context on the BTC chart, the past price action has carved out two significant technical structures: a wide trading range and a larger upward wedge pattern. The formation of this wedge indicates a generally positive market sentiment, though the narrowing price swings suggest a decrease in upward momentum. The foundation of the current structure was established around the buyer zone of 105500 - 104500, a level that has historically proven to be a robust floor. This historical behavior provides a critical reference for our hypothesis. Currently, we are observing bitcoin's price action closely, interacting with the current support area, located between 116500 and 117300. The character of the movement here is largely corrective and consolidative, pointing to a state of temporary equilibrium. This consolidation near the lower boundary of the wedge is a pivotal point. My thinking is that a final, brief dip to thoroughly test the 116500 - 117300 support area is a high-probability scenario. Such a move would effectively absorb remaining sell-side liquidity before a reversal. We can then anticipate an impulsive move upwards across the range. Therefore, the logical take-profit for this long position is set at 122800 points, as this level marks the upper resistance of the range and a natural target. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

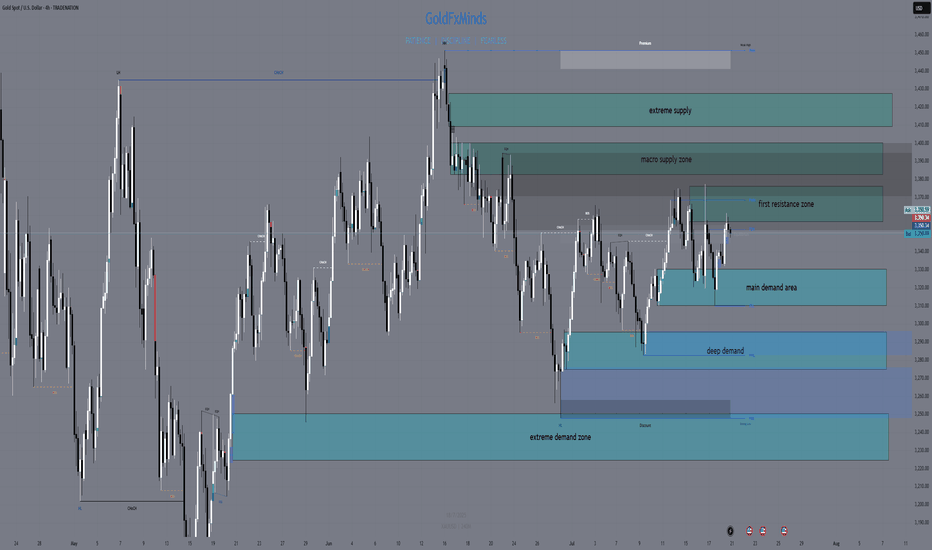

XAUUSD H4 Outlook – Full Structure & Macro | July 21, 2025Hello, GoldMinds! 💙

After a volatile week, gold remains caught in a wide H4 range, ping-ponging between structural supply and demand. Let’s break down the current picture so you can navigate the next big moves with confidence.

🌍 Macro & Bias

Macro context:

Last week’s US CPI print triggered a temporary rally, but gold failed to hold above resistance and quickly reversed as the dollar strengthened. Next week brings Fed Chair Powell’s testimony, global PMI numbers, and jobless claims—all catalysts for new volatility.

Bias:

Neutral on H4:

Gold is consolidating inside a broad sideways range.

The market is waiting for a catalyst to break above 3375 or below 3310 before showing a real trend.

🔸 Structural Key Supply Zones (Above Price)

1️⃣ 3357–3375 | Main H4 Supply

Why it matters:

Aggressive NY and CPI rallies have been sold off here; price rejected every attempt to close above 3375. OB, liquidity cluster, inducement—this is the first real ceiling above price.

Trade logic:

Watch for M15/H1 reversal or exhaustion. No clean break = supply remains active.

2️⃣ 3384–3400 | Macro Supply

Why it matters:

All failed breakouts from early summer were stopped in this block. Liquidity pool and macro OB; every test led to sharp pullbacks.

Trade logic:

Avoid FOMO—only short with confirmation of rejection.

3️⃣ 3410–3425 | Extreme Supply

Why it matters:

The final upper ceiling for now. Any spike here is likely to see big profit-taking and volatility.

🔹 Structural Key Demand Zones (Below Price)

1️⃣ 3330–3310 | Main H4 Demand

Why it matters:

All major dips last week bounced here—bulls are active in this OB. It’s the base of the current “micro-range,” with clear LTF inducement and high volume.

Trade logic:

Look for bullish reversal (M15/H1) before trusting any long from here.

2️⃣ 3295–3275 | Swing Demand / Discount Zone

Why it matters:

The main structure support for July. Strong OB, historic liquidity sweeps—each deep flush has brought responsive buyers.

Trade logic:

Watch for reaction, but don’t knife-catch without a clear structure break.

3️⃣ 3250–3225 | Extreme Demand / HTF Liquidity Pool

Why it matters:

The “final line” for bulls. This zone has absorbed all major liquidations and created swing reversals since early spring.

📊 H4 Structure Logic

Current play:

Gold is stuck in a structural cage between 3375 and 3310.

Until price closes outside these edges, every spike is likely a liquidity hunt.

Pro move:

Only react to confirmation in these zones—don’t force trades in the mid-range!

🧠 Game Plan

Set alerts at each supply & demand zone.

Wait for confirmation: M15/H1 CHoCH, BOS, wicks, or volume.

Let the news come to you: Powell & PMI will likely force a test of an edge; be patient.

💬 What’s your bias for the week? Drop it below and tag a friend!

🚀🚀🚀 and Follow GoldFxMinds for sniper-level gold planning and deep-dive SMC education.

Posted using the Trade Nation broker feed as part of their influencer program for using their TradingView charts in educational content.

— GoldFxMinds 💙

Weekly XAUUSD Outlook | July 21–25GoldFxMinds | Structure-Based HTF Plan

Hello traders,

This week we’re back in key HTF territory. Price is compressing inside a premium structure zone, between clean supply and demand areas. Trend is still bullish, but momentum is weakening — so we focus on structure to guide us.

🟨 Weekly Bias: Neutral | Range Structure in Play

We currently have no confirmed bullish or bearish bias on the weekly timeframe.

Gold remains trapped in a macro range between:

🟥 Upper Resistance Zone: 3355–3380

🟦 Lower Demand Zone: 3280–3240

Last week’s movement created a wick grab near 3375 followed by a strong push down, but without a clean break of structure — meaning we’re still inside a distribution–accumulation trap.

📌 Until we see a clear breakout (above 3380 or below 3280), the weekly bias remains neutral.

This is not a time to force directional trades on the weekly.

Instead, we wait for Daily and H4 confirmation, and position ourselves around the edges of this weekly range.

🔹 Last Week Recap

Weekly candle created a wick into 3377, rejecting just under previous week’s high. No BOS, no liquidity sweep with continuation — just a clear rejection inside supply, confirming premium trap.

Weekly candle closed with a top wick and small body — price is compressing under resistance. Still bullish structure, but not impulsive.

🔹 Weekly Key Structure Zones

🔸 3365–3390 (Supply)

→ Reason: Rejection from prior weekly high (3377), aligned with clean OB and FVG left behind from June breakout.

→ Structure context: No bullish BOS above 3375. This is now an unbroken supply zone with strong wick rejections. Liquidity sits above.

→ Use: Wait for price to tap back in → look for M15–H1 reaction for possible sell if no BOS above 3390.

🔸 3430–3450 (Supply - Last Line)

→ Reason: Unmitigated impulsive candle OB from prior macro swing high. This zone marks the final structure before a full continuation toward new highs.

→ Structure context: If this breaks with a strong BOS, macro structure flips bullish again.

→ Use: Only engage if price clears 3390 with strong volume and closes → watch this for last reaction zone.

🔸 3285–3260 (Demand)

→ Reason: Last bullish OB + FVG combo from early July, unmitigated. Price never retraced to this base since the rally.

→ Structure context: No BOS down yet, so this is still valid bullish origin.

→ Use: If price pulls back aggressively this week, watch this zone for LTF confirmation (CHoCH or BOS bullish). This would be a clean discount buy.

🔸 3210–3180 (Deep Demand)

→ Reason: Higher timeframe CHoCH origin zone, aligns with Fibonacci 61.8% retracement from entire May–July swing.

→ Structure context: Only in play if 3260 fails and we get clean BOS down on Daily.

→ Use: This is your swing buy zone if market breaks structure lower. Strong confluence for reaction.

🔹 HTF Structure Recap

Weekly trend: Still bullish (no BOS down), but compression under resistance

Structure range: Between 3390 and 3260 — price inside premium, no breakout yet

EMA Flow: Bullish but extended. Space for retracement.

RSI: Divergence above 3350 — supporting possible retrace.

🔹 Macro Events This Week

Tuesday: Powell speaks 🗣️ (volatility risk)

Thursday: Flash PMIs (usually directional)

Friday: Durable Goods & Home Sales 🏡

⚠️ Be patient on high-impact days. Let price come into your marked zones — don’t chase inside noise.

🔹 Summary & Plan

We are inside a macro range between 3390 (supply) and 3260 (demand). Structure is not broken — so we play both sides:

Sell Setup: If price taps back into 3365–3390 with no BOS → watch for reaction

Buy Setup: If price retraces into 3285–3260 → look for clean bullish CHoCH to validate

Middle area = chop. Wait for price to get to structure zones — don’t guess.

Thanks for reading 💛

We’ll drop daily and intraday outlooks once price moves closer to one of these structure zones. Until then:

🎯 Trade the reaction, not the prediction.

🔥 If you want these levels and sniper plans every day, follow , like 🚀🚀🚀 and drop a comment if you caught the move!

Stay focused, stay sharp, and never force a trade.

GoldFxMinds

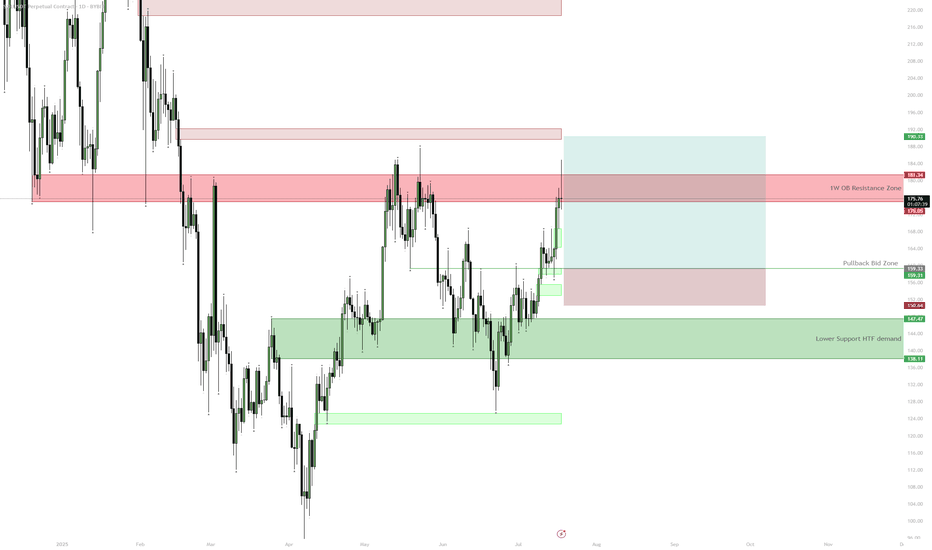

SOL — $180 HTF Resistance | Consolidation ExpectedSOL is approaching a key HTF resistance zone at $175–$181 with 1D RSI close to overbought. Unless price cleanly breaks above this area, a pullback to $160 or even the $138–$147 demand zone is likely before further upside. The setup provides a better risk/reward for longs on pullbacks after consolidation rather than chasing at resistance.

USDJPY - Trade The Range!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDJPY has been trading within a range between $140 and $150 round numbers and it is currently retesting the upper bound of the range.

📚 As per my trading style:

As #USDJPY is around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bitcoin may make correction movement to support levelHello traders, I want share with you my opinion about Bitcoin. Price recently printed a new ATH at 118800 points and then began to show signs of correction. Before this breakout, the price was stuck in a long downward channel, where it bounced inside the buyer zone (103000–103800) several times and reversed upward. After the final breakout, BTC entered a range phase between the support level (103800) and the support area (110300–111300), building energy before the massive move. Once the price escaped this range, a strong impulse up followed, pushing BTC above all major levels and reaching a new high. However, after hitting the ATH, the price started to stall and consolidate. Currently, we can see signs of weakness at the top — the structure is forming lower highs and looks unstable, which may indicate a potential retracement. Now the price is trading above the support area, but I expect a corrective move back toward the current support level at 110300. This level aligns with the top of the previous range and now acts as strong demand. That’s why I’ve set my TP at 110300 level — right at the beginning of potential buyer interest. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.