$SPX @spx6900 Trading RangeSP:SPX - HTF global range is in play at the moment.

I was bearish on SP:SPX for some time, but the speed of the dump exceeded my expectations for sure.

SP:SPX bounced from the very last key level. If the current low is lost, things could get very ugly.

------------

------------

Note:

Long trade projection is the most positive outcome possible.

As always, my play is:

✅ 50% out at TP1

✅ Move SL to entry

✅ Pre-set the rest of the position across remaining TPs

It's important to take profits along the way and not turn a winning trade into a losing trade.

Range

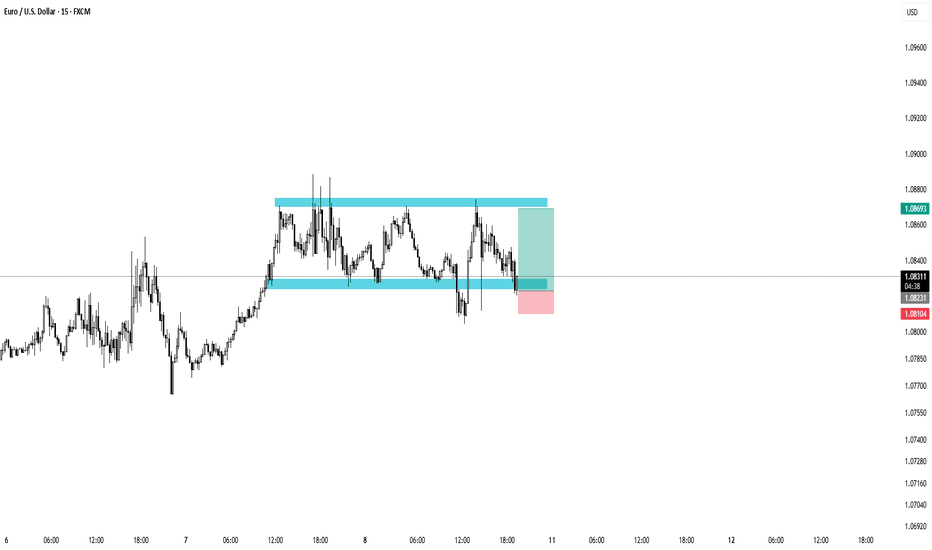

Euro can rebound from mirror line and start to move upHello traders, I want share with you my opinion about Euro. This chart illustrates how the price started trading within a range, where it initially corrected to the buyer zone and reached the mirror line. After that, it began to rise and, in a short time, moved up to the upper boundary of the range, which coincided with both the support level and the support area. Next, the price reversed and dropped back to the buyer zone, breaking through the mirror line. However, EUR soon resumed its movement within the range and eventually reached the upper boundary again. After consolidating near this area for a while, it made a slight correction before rebounding to the mirror line. Later, the Euro broke out of the range and eventually breached the mirror line, reaching the current support level, which aligned with the seller zone. Although it briefly rose after breaking this level, it recently reversed and fell back into the seller zone. At this point, the Euro might test the mirror line before starting to move upward, exiting the seller zone. Based on this, my TP is set at 1.1050. Please share this idea with your friends and click Boost 🚀

Bitcoin can rebound from triangle pattern to 90K pointsHello traders, I want share with you my opinion about Bitcoin. Not long ago, the price was trading within a range, where it quickly entered the seller zone and remained near this area for quite some time. BTC attempted to rise but failed, and after nearly reaching the upper boundary of the range, it dropped sharply. The price broke through the 94000 level, exiting the range as well, and then fell to the support level, which aligned with the buyer zone. Shortly after, the price made a strong upward impulse toward the resistance level before starting a decline within a downward triangle. Inside this pattern, BTC initially made a correction, climbed back to the resistance line of the triangle, and then resumed its decline. Eventually, the price dropped to the 78900 support level, where it touched the triangle’s support line and then began to rise. At the moment, BTC continues to climb near this level, and I expect it to rebound from the support line of the triangle and break above the resistance, signaling an exit from the pattern. If this happens, I anticipate further growth, so my target is set at 90000 points. Please share this idea with your friends and click Boost 🚀

Euro can decline to support area, after which it will rebound upHello traders, I want share with you my opinion about Euro. By analyzing this chart, we can see that the price entered a range before dropping into the buyer zone, which aligned with the lower boundary of the range. After that, it reversed and started to rise, eventually reaching the upper boundary of the range, which coincided with the 1.0515 support level and support area. The price then immediately turned around and fell below but soon bounced back to the support area, consolidating there for a while before breaking lower. Following this, the Euro reversed direction and began to climb, soon reaching the upper boundary of the range and breaking out of this pattern, surpassing the 1.0515 level as well. After this move, it continued to rise within a wedge pattern, eventually reaching the 1.0775 support level, which aligned with another support area, and broke through it too. The price then touched the resistance line of the wedge and made a corrective move toward the support line of the pattern. In my view, the Euro could enter the support area before rebounding toward the resistance line of the wedge. Based on this, I set my TP at 1.1000, as it aligns with this resistance level. Please share this idea with your friends and click Boost 🚀

BTCUSDT Major supports and resistances after FallWe were expecting this fall from 108K$ and now most of target almost hit:

Now we can expect maybe some range here for a while near 77K$ support zone and soon after that more fall is also expected or if the red trendline break to the upside then market is again bullish.

Major supports now:

A. 78000$

B. 72000$

C. 69000$

Major Resistances now:

A. 85000$

B. 89000$

C. 93000$

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

BITCOIN - WHERE ARE WE? When zooming out and looking at the Bitcoin chart, despite how crazy the market has been in recent weeks it comes down to a simple market structure with three separate clearly definable ranges:

RED RANGE (Accumulation) - From FEB '24 until the US election BTC chopped in primarily the top half of a range with five separate midpoint retests with progressively shallower rallies that eventually broke out with a catalyst from the political world.

BLUE RANGE (Expansion) - After a 10 month accumulation range the next phase in the bull cycle was expansion, a rally above ATH and into price discovery. An extremely thin inefficiency rally.

Now price currently is at the midpoint of this range and despite the geo-political waterfall of bad news BTC has held up better than I had expected given that usually a rally that goes straight up has no support levels on the way back down. The chart does suggest a retest at $73,700 at some point before deciding which direction to go in after that.

GREEN ZONE (Distribution) - For the last 3 months Bitcoins price has been extremely volatile, bouncing between $91-108K, the range containing price perfectly with weekly retests of the range bottom and a swing fail of the range high. That SFP set off the beginning of BTCs sell-off eventually breaking through the bottom and back into the blue range.

With Bitcoin at the midpoint of the middle range it's a perfect time to have a data release in CPI, A volatile news event that can be a catalyst for a larger market move and with Tradfi selling off, this CPI is the most important of the Trump administrations term so far:

CPI DAY

PREVIOUS: 3.0%

FORECAST: 2.9%

ACTUAL: ??

Bullish - sub 2.8% print. At least the market sell-off is having a positive effect on inflation and isn't painful for no reason. BTC reclaims blue midpoint with a view to retest blue high.

Bearish - 2.9% or higher. Market sell-off hasn't has an immediate effect on inflation so the sell-off is bad in all aspects, except for the Trump admin moving closer to their wish of a weaker dollar and lower interest rates. FWB:73K blue range bottom retest on the cards.

Gold can reach seller zone and then drop to support levelHello traders, I want share with you my opinion about GOLD. Looking at this chart, we can observe how the price moved within an upward channel before reaching the resistance line and making a corrective move down to the support line. After that, Gold climbed to the support level, which aligned with the buyer zone, and eventually broke through, exiting the channel. Following this breakout, XAU began trading within a range, briefly pulling back to the buyer zone before resuming its upward movement. Shortly after, Gold reached the seller zone and consolidated there for some time, as this area coincided with the upper boundary of the range. Later, the price made a correction down to the support level before reversing direction. Since then, the price has been rising steadily, and at this point, it remains in an uptrend. Given this setup, I expect Gold to re-enter the seller zone before initiating a decline toward the support level, which aligns with the lower boundary of the range. Based on this, my target is set at the 2850 support level. Please share this idea with your friends and click Boost 🚀

US Light Crude (WTI) - Buy SetupTechnical Analysis:

The overall trend remains bearish, but the price has stalled at a major support level of 6568.7, corresponding to the September 2024 lows. WTI has been rangebound for several months, with the upper end of the range at 8044.3. Yesterday's Doji candle signals indecision, and today’s early move higher suggests potential upside. While speculative, the risk/reward setup appears attractive.

Fundamental Analysis:

The latest Commitment of Traders (COT) Report indicates increasing long positions in Oil, suggesting that institutional investors ("Smart Money") may be accumulating around current levels.

Seasonal Trends:

Historically, between March 18 – May 21, Oil has delivered positive returns 76.47% of the time, with an average gain of 5.56% over the past 34 years.

Trade Setup:

Entry: 6630 – 6765

Stop Loss: 6462 (below the 2024 low at 6568)

Target: 8044 (upper end of the long-term range)

Disclosure: I am part of Trade Nation's Influencer Program and receive a monthly fee for using their TradingView charts in my analysis.

APT on the move!APT has been trading within a range between $5 support and $7.7 resistance.

Currently, APT is hovering around the lower bound of the range, so we will be looking for longs as long as it holds.

For the bulls to take over in the long term, a break above the $7.7 resistance is required.

Disclaimer:

This content is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with a professional before making any investment decisions.

EURO - Price can make correction, after strong movement upHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

A few days ago price entered a flat, where it at once declined to support level, which coincided with support area.

The price entered this area and then started to grow, so EUR rose to $1.0520 points in a short time.

After this movement, Euro turned around and fell to $1.0215 support level again, making a strong gap.

Next, price turned around and in a short time rose to $1.0520 level and some time traded near it.

Later, price broke this level and rose until to $1.0720 points, but recently it turned around and started to fall.

So, I think that the Euro can make a correction movement to $1.0525 support area, after movement up.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Bitcoin may rebound up from buyer zone to 94100 resistance levelHello traders, I want share with you my opinion about Bitcoin. A few days ago, the price was moving inside a downward channel, where it reached the support line and immediately bounced back up to the channel’s resistance. After that, BTC continued its decline, testing the resistance level, which aligned with the seller zone. The price briefly dipped below this level but quickly reversed and rebounded. Eventually, Bitcoin exited the channel and moved into a range, reaching its upper boundary before turning downward again. In a short period, the price dropped to the seller zone, where it consolidated for some time. BTC then attempted to push higher but failed and resumed its decline. Breaking below the 94100 resistance level, the price moved further down, fluctuating between support and resistance lines. Bitcoin eventually fell to the support line, breaking through the 83400 support level, which aligned with the buyer zone. However, this breakdown turned out to be a false move, as BTC immediately rebounded and surged back above that level. Currently, BTC is continuing its upward movement. I anticipate that the price may first test the buyer zone before resuming its growth. Additionally, if it manages to break through the resistance line, it could keep climbing higher. With this in mind, my TP is set at the 94100 resistance level. Please share this idea with your friends and click Boost 🚀

Bitcoin Pressing the RangeThis is a wild candle, not often do we see this much pressure.

If this weekly closes back inside the range, it's pretty clear imo that the trend will simply continue. BTC has cleared the imbalance and already wicked back upside of the range low, wild stuff.

Not bulltarding, just simple TA.

Bitcoin can break support level and continue to fall in channelHello traders, I want share with you my opinion about Bitcoin. Looking at the chart, we can see that the price moved into a range, where it initially surged to the seller zone, touching the upper boundary. After that, it quickly reversed and dropped to the lower part of the range, which aligned with the 93900 level, before bouncing back up. The price made another attempt to reach the seller zone, but this time it broke out of the range and started declining within a downward channel. Inside the channel, BTC initially touched the support line but struggled to gain momentum and continued to fall. Not long after, the price broke through the 93900 level, retested it, and then dropped further to the support level, which overlapped with the buyer zone. It even briefly broke this level, reaching the channel’s support line before making a sharp recovery. Following this bounce, BTC quickly reclaimed the broken support level and is currently trading near the 88100 mark. In my view, Bitcoin could rise to test the channel’s resistance line before resuming its downtrend and breaking the support level again. Based on this, I’ve set my TP at 85000 points. Please share this idea with your friends and click Boost 🚀

Gold might descend to a support level, breaching the resistance Hi, traders. I'd like to share with you my thoughts on Gold. On this chart, we can observe that the price has recovered from the mirror line and begun to rise. Shortly later, it approached the support level, broke it, and hovered for a while before returning to the mirror line. Later, the price broke through the support level once more and resumed trading inside a range. During this phase, it climbed to the resistance level, which coincided with the seller zone, before retreating to the mirror line. Gold then dipped into the buyer zone before quickly rising over the mirror line and into the seller zone. Following this movement, XAU corrected below the mirror line and resumed its upward journey. Shortly later, the price approached the resistance level, broke through it, and departed the range. For a while, gold traded above the seller zone, but it subsequently plummeted and is presently hovering at the 2930 resistance level within the sale zone. I anticipate Gold will climb little before continuing to drop, eventually shattering the resistance level. Furthermore, I believe that following the breakout, it will prolong its slide toward the 2865 support level. Please share this idea with your friends and click Boost! 🚀

:

📉 XAU/USD - Bearish Reversal from Seller Zone! 🚨

💰 Gold Spot (XAU/USD) - 1H Chart Analysis

Key Insights:

🔹 Resistance Level Held Strong – Price tested the seller zone but failed to break through, signaling strong bearish momentum.

🔹 Buyer Zone Played Out – Earlier, buyers pushed the price up from a strong accumulation zone, but exhaustion is visible now.

🔹 False Breakout & Range Formation – A range developed at the top, indicating distribution before a potential drop.

🔹 Support Level in Sight – If the price follows the projected path, we might see a test of the $2,865 - $2,850 zone soon.

📊 Trading Plan:

📌 Bearish Bias: Look for short opportunities as long as price stays below resistance.

📌 Confirmation Needed: A break below $2,930 would strengthen bearish sentiment.

📌 Targets: $2,900, then $2,865 - $2,850.

🚀 What do you think? Will gold break down or bounce back? Drop your thoughts in the comments! 👇🔥

#gold #xauusd #trading #forex #priceaction #technicalanalysis

Gold might descend to a support level, breaching the resistance Hi, traders. I'd like to share with you my thoughts on Gold. On this chart, we can observe that the price has recovered from the mirror line and begun to rise. Shortly later, it approached the support level, broke it, and hovered for a while before returning to the mirror line. Later, the price broke through the support level once more and resumed trading inside a range. During this phase, it climbed to the resistance level, which coincided with the seller zone, before retreating to the mirror line. Gold then dipped into the buyer zone before quickly rising over the mirror line and into the seller zone. After this movement, XAU corrected below the mirror line and resumed its upward journey.

Shortly later, the price approached the resistance level, broke through it, and departed the range. For a while, gold traded above the seller zone, but it subsequently plummeted and is presently hovering at the 2930 resistance level within the sale zone. I anticipate Gold will climb little before continuing to drop, eventually shattering the resistance level. Furthermore, I believe that following the breakout, it will prolong its slide toward the 2865 support level. Please share this idea with your friends and click Boost! 🚀

📊 XAU/USD – Key Levels for the Week Ahead 🔍

Gold (XAU/USD) is trading within a well-defined range, testing the seller zone near resistance while eyeing the buyer zone near support.

🔴 Resistance Level: 2,930 - 2,940 (Seller Zone)

🟢 Support Level: 2,865 (Buyer Zone)

📉 Potential Scenarios:

1️⃣ Bearish Rejection from resistance could push price down to the support level (2,865).

2️⃣ Breakout Above 2,940 may signal further upside potential.

3️⃣ Range-Bound Movement between support and resistance until a clear breakout.

📌 Market Outlook: Watching price action near key levels for confirmation before entering trades! 🚀

Gold can drop to support level, breaking resistance levelHello traders, I want share with you my opinion about Gold. On this chart, we can see that the price rebounded from the mirror line and began to rise. Shortly after, it reached the support level, broke it, and hovered around this area for some time before dropping back to the mirror line. Later, the price broke through the support level once again and started trading within a range. During this phase, it climbed to the resistance level, which aligned with the seller zone, before pulling back to the mirror line. Gold then dipped into the buyer zone but quickly surged above the mirror line, entering the seller zone. After this movement, XAU corrected below the mirror line before resuming its upward trajectory. Not long after, the price reached the resistance level, broke through it, and exited the range. For some time, Gold traded above the seller zone, but recently, it dropped and is now hovering near the 2930 resistance level within the seller zone. I believe that Gold might rise slightly before continuing its decline, eventually breaking the resistance level. Additionally, I anticipate that after the breakout, it could extend its decline toward the 2865 support level. Please share this idea with your friends and click Boost 🚀

Euro can drop from seller zone to 1.0350 pointsHello traders, I want share with you my opinion about Euro. Looking at the chart, we can observe that the price was moving within a downward channel. After bouncing off the resistance line, it quickly dropped to the 1.0480 resistance level. It then broke below this level and continued to decline inside the channel until eventually breaking out and transitioning into a ranging phase. Within this range, the Euro dipped into the buyer zone, even slightly below it, before reversing and making a strong upward impulse toward the resistance level, briefly entering the seller zone. After that, the price dropped back into the range and soon made a sharp gap down, returning to the buyer zone. However, following this movement, the Euro started to rise again, climbing back to the 1.0480 resistance level in a short period and forming another gap in the process. The price even touched the seller zone before pulling back slightly and is now hovering near the 1.0480 level. Given this setup, I anticipate a rejection from the seller zone, leading to a decline. Based on this, my TP is set at 1.0350 within the range. Please share this idea with your friends and click Boost 🚀

Euro will break resistance level and continue to grow nextHello traders, I want share with you my opinion about Euro. A few days ago, the price was trading within a range. It dropped to the seller's zone but immediately rebounded to the upper boundary of the range. Shortly after, the price began to decline, falling below the resistance level, breaking it, and exiting the range pattern. Following this move, the price dropped to the support line and continued to hover near it. Occasionally, it bounced back toward the resistance level but quickly reversed downward. The Euro continued to fall, reaching 1.0175 and breaking through the support level, which aligned with the buyer's zone. From there, it began to climb near another support line. Later, the price broke the support level once again but then rallied to the resistance level, breaking through that as well. Afterward, EUR formed its first gap, followed by a sharp drop to the buyer's zone, creating a second, stronger gap and breaking the support line. Subsequently, the Euro started to climb within an upward channel, where it formed a third gap. At the moment, it remains in this upward trajectory. Based on this, I believe the Euro will continue to rise within the channel and eventually break the resistance level. Once the breakout occurs, I expect the price to maintain its upward momentum, so my TP is set at 1.0550. Please share this idea with your friends and click Boost 🚀

JUPUSDT Swing Long IdeaJupiter is the second largest DEX on Solana and its price has been ranging for almost 1 year.

If all of crypto is getting ready to bounce JUP looks primed to breakout of the range,

RSI is crossing above the RSI MA and midpoint,

MFI is crossing above the midpoint,

JUP has outperformed TOTAL according to MA Based relative performance,

We recently saw the largest ever volume and volume MA.

All of this makes me think JUP wants to breakout from this range soon, hopefully TOTAL and BTC will allow that to happen.

HelenP. I Gold will rebound up from support zone to $2940 pointsHi folks today I'm prepared for you Gold analytics. Not long ago, the price entered a consolidation phase, where it initially climbed toward support 2, aligning with the support zone and even pushing slightly higher. Afterward, Gold dropped to the trend line near the lower boundary of the range and began oscillating around this line. Shortly after, Gold dipped below the trend line but surprisingly continued to climb and eventually broke out of the consolidation. The price then retested support 2 and rapidly advanced toward the trend line, followed by a brief correction before moving back to the trend line. Soon, Gold broke through this trend line near support 1, which also matched the support zone, and completed a retest. Following this, Gold rebounded to 2945 points before pulling back to the trend line for a correction. Recently, it broke the trend line again. At the moment, I anticipate that XAUUSD will drop to the support zone and then rebound, aiming for 2940 points while breaking back above the trend line. If you like my analytics you may support me with your like/comment ❤️