Rangebound

ETHUSD Perspective And Levels: Range Bound Above Key Support.ETHUSD Update: The 310 buy trigger has been activated and price has retraced back into the support zone. At the moment this market is range bound and in order to show progress, the 313 to 325 resistance zone has to be taken out.

It is situations like this that especially require having a well defined plan and knowing your risk. I am long from 310, but not with an uncomfortable position. As long as this market can stay above the 276 support, it is still proving some stability. If price breaks below, which is possible, that will open the door for a revisit to the 260 and 230 support zones which I have been writing about.

My plan is to get out if price pushes below the mid 270s, and wait for stability to return before doing anything else. And if price pushes higher instead, I will look to add to my long position upon a break of the 330 resistance. Like I have written about before, I may not get the best prices, but I would rather have momentum going my way.

If you are a long term investor, and plan to hold and accept the risks involved, then building a position as price goes lower isn't unreasonable since none of the major supports like 208 have been taken out. If instead you are looking to capitalize on short term fluctuations. then you have to stick to your plan. This is why I calculate my risk/reward and my levels to add to the position if the market offers the opportunity and also why I add while momentum is in my favor and not against me.

An interesting note is that the two zones that price is stuck between, the 282 to 293 support and the 313 to 330 resistance happen to both be .618 areas relative to the recent bullish and bearish price swings. This is very typical of range bound price action. Also the ETHBTC market has not made a new high or new low, but I watch carefully because clues can appear on this chart first.

In summary, price needs to choose a direction and soon. A break below the 268 low will confirm bearish momentum and most likely push prices into the lower supports while a break above the 330 resistance zone will confirm bullish momentum and most likely retest the 350 area. The first sign of this would be a break above the 300 level. The big picture still has a bullish bias, so that may help price action along a more bullish path. The important thing to remember in situations like this, whether you are in a position or not, is the market must choose, not me or you. There is an element of randomness to all financial markets, and during times of indecision, there is little else we can do. Once the market offers a clearer picture, then it is all a matter of adjusting to the new information.

Comments and questions welcome.

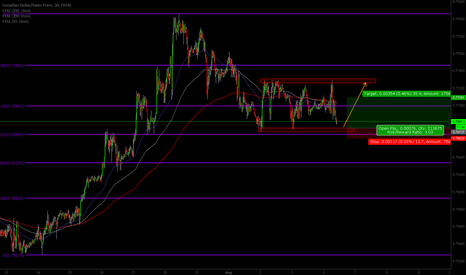

Reversal on Round Number for EURCADSince end of March 2017, 1.45000 price level has become and important key level as there was a shift from resistance to become support line. Another important level is 1.50000 because it is a round number and again, an important resistance level. For the past 2.5 months, EURCAD has been ranging in these 2 important level.

Price is now nearing support level, and I believe it may still go down slightly before giving a sign of a reversal. If price can indicates a reversal near 1.45400 level, then it will be good entry for a long trade, since 1.45400 was a resistance line at 28th of March (shown by blue arrow). Partial profit can be taken at 1.48000 with the rest of the quantity, I believe can roam even further to 1.5000 price level. Stop loss will be when price managed to reach 1.44300 price level.

GBPJPY 4H Range BoundThis chart shows projections of possible moves for the GBPJPY 4 H this week. It is currently range bound. Looks like it may drift back to the bottom of the range. There it can bounce back into the range or make a possible breakout short. If a bounce then a move back to the top. At the top of the range box price can 1 - bounce back into the range if the timing for a trend continuation is not there yet. 2 -

It can break the top of the range but fail to progress the trend continuation of making higher highs and higher lows and fall back into the range box. 3 - If the market is ready for a bullish continuation then higher highs and higher lows will progress to be made.

LTC = Long term coin - Predictions for next move LTC has been on an uptrend since April and doesn't seem to be breaking it soon. Price has currently retraced by 0.382 and looking at past history it will range trade at the fibo 0.382 support till it meets the trendline again which is projected to be somewhere around November. Expect trades to be long on LTC, the last All time high was 2 months ago, the next one will be too. Seems like a good opportunity to use Range trading based indicators to scalp till then.

ETHUSD Perspective And Levels: Tight Range Low Volume. Zzzzz.ETHUSD Update: New range bound condition established between 190 support and 205 resistance on declining average volume. With August 1st around the corner, I don't expect much follow through from this market.

The 205 resistance which I mentioned in yesterday's report continues to hold, (.382) of previous bear swing. A break higher would indicate that the bearish momentum that took the market to this area has been absorbed. As long as this level holds, price is likely to decline into the 183 to 163 support zone. There is a triple bottom that has formed under declining volume (see chart) which makes this bullish reversal formation less reliable.

Range bound markets express equilibrium. It means both buyers and sellers are in agreement. A trending market is where there is an imbalance and one group dominates over the other. On the bigger picture, the buyers are still in control, since the 190 low is much higher than the 136 recent low. Higher lows typically lead to higher highs. Since this market depends on the outcome of 8/1, we must be prepared for anything, because events like this cannot be anticipated from a technical point of view.

The other factor that we are contending with is volume. Low volume makes price patterns, break outs and other signals much less reliable. These conditions are known for a much higher degree of randomness, and from my experience, are best to avoid. Keep in mind when your broker sends you an email explaining that your withdrawals are going to be halted, and that you need to put your request in by 7/31, that is going to create fear (especially when you follow their instructions, and they still delay your withdrawal). And you get this email after reading about one ICO scam after another. Not good for facilitating volume in a market.

I am still interested in buying into this market for a swing trade, and if I get my price validation within the price zone that my trading plan calls for, I am willing to take risk even before 8/1. I will just have to start smaller, and use a much wider stop than usual.

If for some reason price breaks out to the upside before 8/1, there are quite a few resistance levels to contend with like the 212 (former support), and the 230 area. I would be surprised if price can make this progress before Tuesday and expect it to continue to stay range bound or find a new range at lower prices.

In summary, 190 to 205 is the current range within a declining volume environment. Price patterns and signals are going to be less reliable, but I am prepared to get back in within the 183 to 163 support zone if the market shows me a reversal pattern. Risk is higher and must be adjusted for especially before 8/1. Otherwise I will stay flat and continue to watch.

Also I have a question to all my readers: What other markets would you like to see an evaluation on? I write about ETH because it seems this is what the community gets the most out of, but I follow many other markets as well.

$spg cup and handle forming -higher time frame shows price breaking through 50 day moving average meeting resistance at previous support at 163.5x area

-mid time frame is showing bullish price action breaking out of resistance area of 162.2x but right away meet resistance at 163.5x

-looking for price to consolidate and pullback in a tight range bound consolidation for a big breakout with momentum completing the cup and handle pattern on the higher time frame

GBPUSD Range Trade from 1.215 - 1.26GBPUSD ranging between well tested support and resistance levels at 1.215 and 1.26.

Based on existing uncertainty surrounding Brexit, and fears of 'Trump Rally' reversal I hesitate to predict the trend going forward, but as 'Brexit' appears to be at least partially priced in, I'm more comfortable buying below support, with a tight SL, and TP at 1.26. This strategy is supported by the high volumes accompanying bull candles at the bottom of the range, suggesting high Sterling demand at these levels.

This is all contingent on no major surprises in the economic releases for the next few weeks.

Range trading opportunity AUDUSD is currently trading in a defined range that has been in play of a while. Price is approaching the the support line of the ranging market as well as the 50 day and 200 day moving average . Stochastic RSI is also in oversold territory. Wait for price to move lower towards the 50 day and 200 day moving average and buy on the bounce. Profit target should be the resistance zone at 0.77199. A stop loss should be placed just below support around 0.00691.

Gold Trading range between 1220 and 1250 before big moveGold appears to be in a corrective state from a large bearish breakout. The 61.8 Fib level at 1220 should hold as support whereas the 38.2 level at 1250 will act a resistance. I see an upward break of the ascending trend line coming after the first test of 1250 before a retest of 1220.

The 2nd Test of 1250 will prove critical, a break above and the bearish trend can be considered over and 1450 should remain as a long term target.

A rejection of 1250 a second time and a break back below 1220 and we could see Gold nose dive back toward the 1000 level.

Will update ongoing

UK100, what's next?Hello guys! happy new year.

UK100 indice is printing a nice range here and as we can see, it's at a very important point. Break or reversal? Our 2 most important questions. AS usual, we're not the one to decide, so let's watch it and see what the market will decide in the next coming candles.

As for a personal analysis, I bet for a reversal. Price is at the resistance, we have a doji candle and not much volume in the market for price to break the 3 months high. Still, let's wait for the upcoming candles.

EURAUD is preparing somethingHello everyone, we can see a kind of breakout of 1.45 level, is it false or pullback for a continuation? I can't tell. I need more signal to decide about which direction to take. For now it seems coming back into the channel. if so, I will go short and target the support level for TP, SL somewhere near 1.46

Notice, this level have been holding price for a very long period of time. Since april 2015, price usually test it first. Not easy to break a psycho level like 1.46

Since november 2016, price is trapped between 1.45 and 1.46. For now, no decision have been taken