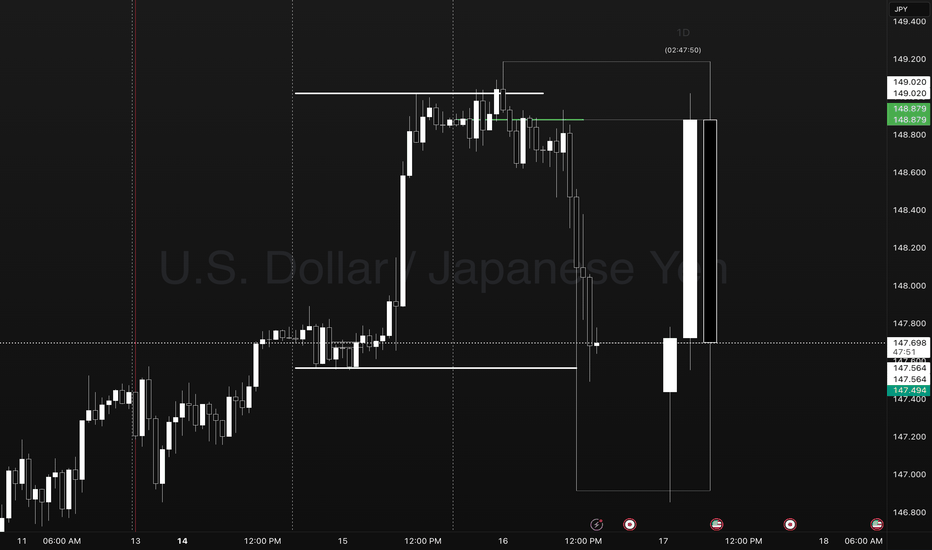

Pump Coil Dump Day 1-2-3 USDJPYUSDJPY Reversal Trade.

Points to Notice

Day 1 - Sets the new week high and low. Establishes a new week closing price as a target for a day 3 setup.

Day 2 - Typically expands Mondays range in the direction of the underlying oder flow. This occurs as a pump/ dump leading to the Asia and London coil sideways.

Day 3- We take note of the previous day high and low to observe price going into the NY session. In this case Price gave signs of a coiling reversal into the evening setting up for the move below Day 2 closing price.

Ideally what you want to see in this template is traders faked into a breakout move in the direction of the pump. This can present as a candle close above yesterdays high or closing price.

After trapping traders in we see the change in order flow creating a new lower low. This is the confirmation to look for an entry at the previous days closing price.

We set a stop at the high of day 3 level or at the previous days high with a target at the previous days low. In extreme cases we may see a setup that expands to the LOW level.

THE ONLY IMPORTANT DATA POINTS.

- PREVIOUS DAY HIGH AND LOW

- CLOSING PRICE

- LOW HOW LEVELS

- DAY COUNT

MARKETS ONLY DO TWO THINGS

- BREAKOUT, FAIL, REVERSE

- BREAKOUT, RETEST, TREND.

ONLY LEVELS THAT ARE TRADED

- PREVIOUS DAY HIGH (STOP LOSS)

- PREVIOUS DAY CLOSING PRICE (ENTRY)

- PREVIOUS DAY LOW (TARGET) CMCMARKETS:USDJPY FX:EURUSD OANDA:USDJPY

Rangetrading

GBP/JPY SELL SETUP - Range Resistance RejectionGBPJPY is showing classic range-bound behavior with a clear rejection setup at key resistance.

📊 Market Analysis

Timeframe: Daily

Bias: Bearish (within established range)

Pattern: Range-bound market with resistance rejection

🎯 Trade Setup

Entry: 196.400 - 196.800 (on rejection candles)

Stop Loss: 199.200 (above range high)

Take Profit 1: 192.500 (mid-range)

Take Profit 2: 189.500 (range support)

📈 Technical Reasons

✅ Multiple rejections at 198.480 resistance level

✅ Range-bound market structure intact

✅ Bearish rejection candle formation

✅ Risk-reward ratio 1:2 to 1:3

🔍 Key Levels

Resistance: 198.480 (range top)

Support: 189.365 (range bottom)

Invalidation: Break above 199.200

⚠️ Risk Management

Position size: 1-2% of account

Watch for any break above resistance with volume

Weekly bias remains bullish - be ready to exit if range breaks up

💡 Trade Plan

Looking for price to respect the established range and move back toward support levels. This is a counter-trend trade within the range structure.

Remember: Trade your plan, plan your trade. Always manage risk first!

TV Today Network is currently near its key support zone.This is the 4 hour chart of TV TODAY.

Stock is trading in an ascending channel.

Post a corrective phase of 8–11%, the stock typically rebounds with a return of 11–14%, aligning with the upper and lower boundaries of the ascending channel.

VRVP is indicating two significant price levels—₹170 and ₹160—where notable volume accumulation has occurred, suggesting potential support or resistance zones at these levels.

If this level is sustain, then we may se higher prices in the Tv Today.

Crude oil futures Trade the range In this video I look at the current range that we are in and I have laid out a plan in the scenario that we break that range to the upside and what we could possibly expect .

I have given some reaction zones where I anticipate price to react when we reach there .

I have used Fibonacci, volume profile, and vwap in this video .

Thankyou for your support

EURJPY Analysis: Range Bounces & BreakoutHello traders!

EURJPY is in a daily range and is offering three trading scenarios.

The first scenario suggests the pair may react bearishly from the currently approached zone, setting up a bounce opportunity that could drive price lower toward the 162.130 area.

The second scenario anticipates a bounce toward the 158.400 area, if price reaches the support zone of the range.

The third scenario anticipates a breakout above the resistance zone, followed by a retest, which could present a strong opportunity for continuation toward the 169.300 area.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

Gold Setup: Range or Rip? Here's the PlaybookGold’s been on a tear lately — driven by safe haven demand as real yields soften and global uncertainty lingers.

But here’s where things get interesting...

We’re now watching what could be a textbook head and shoulders pattern start to take shape.

📊 Current Range:

Right now, price is stuck between 3380 and 3280 — and it’s acting like it knows it.

⚡ Possible Scenarios:

🔁 Scenario 1: Range Play

Short near 3380

Long near 3280

Let it ping-pong and catch the edges.

📈 Scenario 2: Breakout Long

Confirmation above 3380

Look for momentum follow-through into 3420+

📉 Scenario 3: Breakdown Short

Break below 3280

Eyes on the 3220s for a potential flush

🧠 The key? Drop to the lower time frames near these zones and wait for clean setups during active sessions — especially NY open or post-data volatility.

💬 How are you playing this? Breakout or bounce? Drop your take 👇

#gold #tradingview #futures #technicalanalysis #metals #xauusd #tradingstrategy #macro

XRP - Choppy Market, Will We See $1.5 Again?After finishing the 5-wave structure in early 2025, XRP had a rough patch, trading between $3 and $2 and offering some pretty neat swing trade opportunities. Now, two months later, the big question is: will this range continue, or is a breakout on the horizon? Let’s break down the key levels and high-probability setups.

Short Trade Setup

Resistance Zone:

The weekly level and the 0.618 Fibonacci retracement are both around $2.5763 to $2.5792, aligning nicely with each other.

The anchored VWAP from the all-time high at $3.4 adds extra resistance at about $2.63.

Setup Details:

A low-risk short trade can be considered at the weekly level, with a stop-loss set above both the anchored VWAP and the swing high.

Target: The monthly open, aiming for an R:R of about 4:1.

Support Backup:

Additional support in this range comes from the 0.618 Fibonacci retracement (from a low at $1.9 to a high at $2.59), the weekly 21 SMA at $2.28, and a weekly level at $2.0942 just below the monthly open.

This support between the weekly level at $2.0942 and the monthly open is crucial for maintaining bullish momentum. If it holds, the bearish short setup stands; if it breaks, things could get tricky.

Long Trade Setup

When to Consider a Long:

If the support zone mentioned above fails, look for a long trade opportunity at the swing low around $1.77.

Support Confluence:

Primary Support: The swing low at $1.77, with lots of liquidity around that area.

Additional Layers:

The monthly level at $1.5988.

The weekly level at $1.5605 sits just below the monthly.

The 0.618 Fibonacci retracement from the 5-wave structure at $1.5351.

Anchored VWAP from the low at $0.3823, aligning with the weekly level.

And don’t forget the psychological level at $1.5.

Setup Details:

This long trade setup would offer an attractive R:R of roughly 6:1, targeting back to the monthly open for an approximate 33% gain, with a stop-loss placed below the $1.5 mark.

XRP's current trading range has provided some good short and long trade setups, a long opportunity at the swing low ($1.77-$1.5) could be the next big play. Whether you lean towards short or long, finding these confluence zones helps in making more informed, high-probability trade decisions.

If you found it helpful, please leave a like and a comment. Happy trading!

Quotes Dropping? Here’s How to Find Support & Gain Best DealHave you ever found yourself wondering how to make sense of fluctuating quotes?

What if I told you that the powerful key lies in understanding the power of expected range volatility?

Ready? Let me 5 min to introduce you how understanding expected range volatility can give you the edge you need to succeed.

The expected range volatility (ER) provides a framework for understanding how much the asset could move within a specific timeframe. Statistically, price movements within the expected volatility corridor have a 68% probability, based on CME market data and a Nobel Prize-winning calculation formula. This means that traders can rely on these insights as a powerful filter for making more precise entry points into trades.

Key insight: when the market is quiet, and we approach certain price levels, there’s a 68% chance that the price won’t break through those boundaries.

The ER formula is available on the CME exchange's website, and in just a few minutes, you can input the data to get incredible results. It’s truly amazing!

I remember the first time I stumbled upon the ER tool. It felt like finding a gold mine in the trading world! I was amazed that such a powerful resource was available for free, yet it remained unnoticed by 95% of traders.

At that moment, I began to explore the trading community and was shocked to see how underestimated this tool was. I couldn’t find a single author who utilized such valuable data in their analysis.

But once I began to focus on expected range volatility and the data provided by the CME, everything changed. Since that I never make intraday trades without ER data was checked.

Limitations:

• Market Dynamics: Short-term price movements can be unpredictable due to various factors like market sentiment, news, and economic events. The Expected Range provides a statistical estimate but does not guarantee outcomes.

• Assumptions: The formulas assume that price movements follow a log-normal distribution , which may not hold true in all market conditions.

So, what about you? Do you utilizing the power of expected range volatility in your trading strategy? Share your thoughts in the comments below! And if you want make deeper insights , don’t forget to subscribe us.

In the world of trading, knowledge is power.

No Valuable Data - No Edge!🚀💰

Fri 4th Apr 2025 AUD/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Buy. Enjoy the day all. Cheers. Jim

Bitcoin (BTC/USD) Technical Analysis & Trade Setup Market Structure & Key Levels:

The Bitcoin (BTC/USD) 4-hour chart displays a descending channel breakout, followed by a range-bound consolidation phase.

Key Support Levels:

$78,000 - $77,320: A strong demand zone where buyers have previously stepped in.

$80,000: Psychological support level.

Key Resistance Levels:

$84,340: Short-term resistance currently being tested.

$85,996: Next major resistance level.

$89,363: Target resistance level if a breakout occurs.

$92,331: A higher timeframe resistance level.

Chart Pattern & Price Action:

Descending Channel (Early March)

Price was in a downtrend, forming a descending channel pattern.

The breakout from this channel led to a shift in momentum.

Range Consolidation (Current Pattern)

After the breakout, BTC entered a sideways accumulation phase (marked by the red box).

Price is bouncing between $82,000 - $84,500, showing low volatility and indecision.

Breakout Possibility (Bullish Bias)

A break above $84,500 could confirm a bullish move towards $85,996 and beyond.

The next major target is $89,363, which aligns with previous resistance.

Support Retest (Bearish Risk)

If BTC fails to break resistance, we might see a retest of $80,000 or even $78,000.

A break below $77,320 would invalidate the bullish scenario.

Wed 19th Mar 2025 GBP/CHF Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CHF Sell. Enjoy the day all. Cheers. Jim

JNJ Update | Swing Trade 2 PlaysShort term price action is at a high in which I'd like to see a retracement for a short opportunity. The long term play I would like to buy once price is near $150 to hold towards $180.

Last Post

*A break below the trendline followed by a retest and rejection would invalidate the trend based on my bearish TA.*

JNJ Update | $120Been a while since I looked at NYSE:JNJ and it looks like we could see a drop towards $120 instead of going up to what was said in the old post.

Hourly/Daily price action is at a range high ($168 - $143) so I would expect a lot of selling pressure especially with how AMEX:SPY and TVC:RUT is performing right now.

NQ - Feb 20th FrameworkWednesday failed to expand through Tuesday range.

Weekly range currently in a consolidation.

Consolidation protocol active.

I am neutral on price until a sweep on the external range. Once a sweep occurs, I will hunt the 15m cisd and target the opposing liquidity. This will confirm the weekly profile & the intraday profile. Need the alignment for a high probability trade.

Anything internal is lower probability for my model. Price MUST take external liquidity.

Consolidation Reversal weekly profile likely. Mon - Wed in a range, Thursday raids external range then reverses, Friday offers continuation to opposing liquidity.

NVIDIA Update Trade the Range

Update from the previous video entitled *The next long to take . If the position was taken then you should be +20% as it stands . Currently approaching a key area for some resistance . Earnings in 16 days and i highlight the range I expect us to stay inside of until the news release

VINE LOOKS BEARISH THEN 90% OR 300% INCOMINGAfter a failed breakout of the all time highs, we have broken the uptrend and look to aim lower. Unless the highs are claimed I'm currently bearish and looking for range lows to be tested for a long entry to back to the highs which can print 90% returns.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

$CELH Bounce Back January 2025 | +30% to +55% Upside PotentialNASDAQ:CELH

Celsius is going through a "drastic narrative issue" due to comments made by the CEO about a $120 million drop in sales. The issue is related to Pepsi orders, not overall sales. Pepsi had been overloading on Celsius inventory over the past year and is now trying to work through that excess inventory. Celsius' actual consumer demand has increased 10% year-over-year, so the sales decline is not a demand issue, but rather a Pepsi inventory management issue.

Celsius' ceiling is limited because Pepsi controls the distribution network, and Celsius has to "kneel to the king of Pepsi" in terms of order volumes. Based on Monster Energy’s multiples, Shay believes a fair valuation at $38-$42 (+40% to +55%). Pepsi’s inventory issue is a short-term headwind and we are confident in Celsius’ long-term growth potential.

On the technical side, there is a beautiful range trade opportunity from $27 up to $36 (+33%).

We are expecting this to bounce back heavily this January.

Mon 30th Dec 2024 AUD/NZD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/NZD Sell. Enjoy the day all. Cheers. Jim

Have you noticed Nvidia's Range? Waiting on a decision... The price continues to fluctuate, but not even the latest earnings report has been able to break out of this sideways channel (range) shown in the analysis.

Nvidia is a powerhouse when it comes to its earnings reports, and while the price does fluctuate, it hasn’t done so with the same aggressiveness seen in previous months.

At this point, we’re simply waiting for a decision—either wait for the price to break out of the channel, or, if you want to be more aggressive, look for the price to touch the demand zone to go long. You could do the opposite in the supply zone, but I don’t recommend it, as the overall structure remains bullish.

Thank you for supporting my analysis.

TRADE SAFE!