10Y: Positioning for a Falling Yield EnvironmentCBOT: Micro 10 Year Yield Futures ( CBOT_MINI:10Y1! ), #microfutures

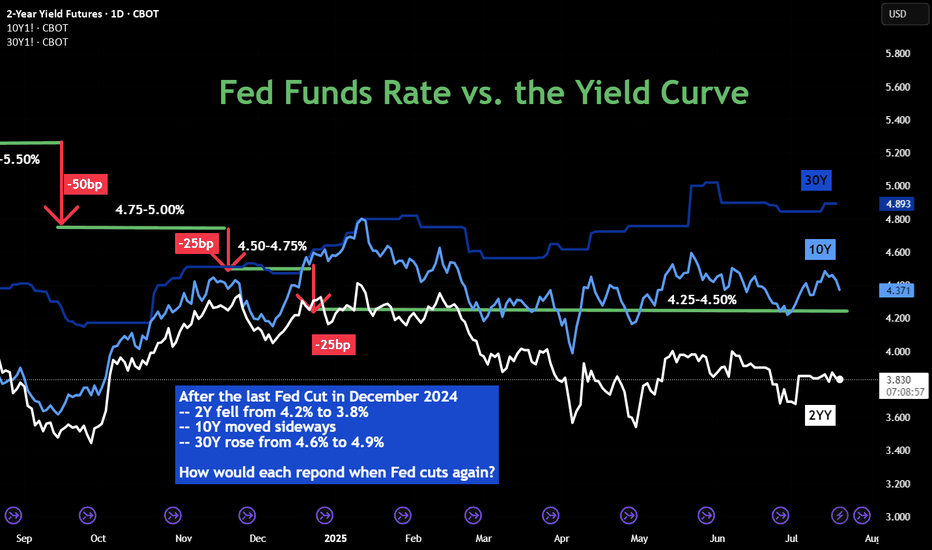

The Federal Reserve last cut interest rates in December 2024. Since then, it has kept the rates unchanged in its January, March, April and June FOMC meetings. While the official Fed Funds rate stays at 4.25-4.50% in the past seven months, we have seen diverging trends in the interest rate market:

• 2-Year Yield has trended down from 4.25% to around 3.85%;

• 10-Year Yield mostly moved sideways, currently at 4.42%;

• 30-Year Yield rose from 4.60% to top 5.00% in May, then pulled back to 4.89%.

The futures market expects the Fed to cut rates once or twice in the remaining four FOMC meetings in 2025, according to CME Fed Watch Tool.

• As of July 20th, there is a 95.3% chance that the Fed will keep rates unchanged in its July 30th meeting;

• The odd of lowering 25 bps is approximately 60% for September 17th;

• By the last 2025 meeting on December 10th, futures market sees just 6.4% chance that the Fed keeps the rates at current level 4.25-4.50%, while the odds of 1 cut to 4.00-4.25% are 29.2%, and the odds of 2 cuts to 3.75-4.00% are 64.3%.

The Fed’s Challenges

The Fed tries to fulfil its dual mandate established by the Congress: (1) to support maximum employment and (2) to maintain price stability. Its official targets are to keep the unemployment rate below 4%, as measured by the BLS nonfarm payroll data, and to keep the inflation rate at 2%, as measured by the PCE price index. When we face an outlook of rising prices and slowing employment, the Fed will have a hard time meeting both policy goals.

Firstly, as the Trump Administration raises tariffs for all trading partners on all imports, it’s a matter of time before the inflation rate picks up again. Even if many countries may reach trade agreements with the U.S., they will still get a bigger tax bill.

• According to the Bureau of Economic Analysis (BEA), the total US imports of goods and services was $4.1 trillion for 2024.

• Imports account for 14% of the US GDP in 2024, which is $29.2 trillion (BEA data).

• Simple math suggests that a universal 10% tariff hike could contribute to 1.4% in price increases, assuming all tariffs are passed through to the retail prices.

The most recent inflation data is the June CPI at 2.7% (BLS data). The tariff hike could easily push inflation to twice the Fed policy target. Therefore, cutting rates will be a very difficult decision if inflation rebounds.

Secondly, US employment growth has slowed down significantly in 2025. On July 3rd, the BLS reported total nonfarm payroll increased by 147,000 in June, and the unemployment rate changed little at 4.1 percent. Current employment growth is less than half the level in December 2024, which saw the data above 300,000.

There are weaknesses in the payroll data. All private sectors combined accounted for about half of the employment gain, or 74,000. Government jobs, while at a much smaller base, accounted for the other half.

Tariffs raise the cost of input, while business borrowing costs remain high at current rate level. To support growth and maximum employment, cutting rates make sense.

Finally, the Fed is under tremendous pressure from the Administration. President Trump openly and repeatedly calls for a 300bp cut.

In an ideal world, the Fed wants to make monetary policy decisions free of political interference. It may not be the case. Let’s look at the Fed rate decisions during the first Trump presidential term. The current Fed Chair was appointed to the role by President Trump in February 2018.

• The Fed raised interest rates four times in 2018, for a total of 100 basis points, with the Fed Funds rate increased from 1.25-1.50% to 2.25-2.50%.

• Under pressure from the White House, the Fed cut rates three times in 2019 for a total of 75 basis points, with the Fed Funds rate ending at 1.50-1.75%.

• In 2020, in response to the Pandemic, the Fed cut rates by 150 points, all the way to a zero-rate environment (0%-0.25%).

In my opinion, the Fed will cut rates this year, similar to 2019. Once the Fed Chair retires in May 2026, his replacement, who will be nominated by President Trump, will no doubt follow his guidelines and bring the Fed Funds rate all the way down to 1%-2% level.

While there is uncertainty in the timing and pace, we are likely to embark on the path to low interest-rate environment.

Shorting Micro 10-Year Yield Futures

A trader sharing a bearish view on interest rates could explore shorting the CBOT Micro 10-Year Yield Futures ($10Y).

Last Friday, the August 10Y contract (10YQ5) was settled at 4.425. Each contract has a notional value of 1,000 index points, or a market value of $4,425. To buy or sell 1 contract, a trader is required to post an initial margin of $300. The margining requirement reflects a built-in leverage of 14.7-to-1.

Let’s use a hypothetical trade to illustrate how to use a short futures position to take advantage of a potential Fed rate cut.

Hypothetical Trade:

• Short 1 10YQ5 at 4.425, and set a stop loss at 4.60

• Trader pays $300 for initial margin

Scenario 1: Fed keeps rates unchanged on July 30th, 10Y moves sideways

• If Futures price changes little after the July FOMC, the trader could close the position

• He could short the September contract 10YU5, with an eye open for the September 17th FOMC rate decision

• This is a futures rollover strategy.

Scenario 2: Fed cuts 25 bps on July 30th, 10YU5 falls 250 points to 4.175

• Short position gains: $250 (= (4.425-4.175) x 1000)

• The hypothetical return will be 83% (= 250 / 300)

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Ratecut

S&P 500: Defying Tariff Headwinds, Breaking RecordsThe S&P 500 has staged a remarkable rally in 2025, shattering all-time highs and capturing global attention. This surge has unfolded despite the negative economic overhang of renewed tariff threats and ongoing trade tensions, raising critical questions for investors: How did the market overcome such headwinds, and what lies ahead for both the short and long term?

The Rally Against the Odds

Tariff Turbulence: Earlier this year, President Trump announced sweeping new tariffs, sparking fears of supply chain disruptions and higher costs for American companies. Historically, such moves have triggered volatility and corrections.

Market Resilience: Despite these concerns, the S&P 500 not only recovered losses from the spring but surged to new record highs, with the index climbing over 23% since April’s lows. Major tech companies, especially those leading in AI and innovation, have been at the forefront of this advance.

Investor Sentiment: The rally has been fueled by optimism around potential Federal Reserve rate cuts, robust corporate earnings, and expectations of long-term economic growth—even as the immediate impact of tariffs remains uncertain.

Short-Term Correction: A Healthy Pause?

While the long-term outlook remains bullish, several indicators suggest the market may be due for a short-term correction:

Narrow Market Breadth: The current rally has been driven by a handful of mega-cap stocks, leaving the median S&P 500 stock well below its own 52-week high. Historically, such narrow leadership often precedes periods of consolidation or pullbacks.

Valuation Concerns: Stock valuations are at elevated levels, and some analysts warn that earnings growth could slow as companies adapt to higher input costs and shifting trade policies.

Correction Forecasts: Some strategists predict the S&P 500 could correct to around 5,250 by the third quarter of 2025, citing factors like slowing consumer spending and persistent policy uncertainty.

Long-Term Outlook: Higher Highs Ahead

Despite the potential for near-term volatility, the long-term trajectory for the S&P 500 remains positive:

Fed Policy Tailwinds: Anticipated rate cuts and lower bond yields are expected to provide further support for equities, encouraging risk-taking and higher valuations.

Corporate Adaptation: Companies are actively offsetting tariff impacts through cost savings, supply chain adjustments, and strategic pricing.

Growth Sectors: Innovation in technology, productivity gains, and deregulation are setting the stage for sustained profit growth, especially in sectors like AI, robotics, and defense.

Key Takeaways for Investors

Stay Disciplined: While a short-term correction is possible, history shows that markets often rebound strongly after periods of volatility.

Diversify Exposure: With market gains concentrated in a few names, diversification and active stock selection are more important than ever.

Focus on Fundamentals: Long-term investors should look beyond headlines and focus on companies with resilient earnings and adaptive business models.

The S&P 500’s ability to break records in the face of tariff headwinds is a testament to the underlying strength and adaptability of the U.S. economy. While short-term bumps are likely, the path ahead still points toward new highs for those with patience and perspective.

This article is for informational purposes only and does not constitute investment advice. Always consult with a financial advisor before making investment decisions.

#spx500 #stockmarket #analysis #economy #us #nasdaq #fed #bonds #rates #trading

HOW IS CRYPTO SHAPING UP?Trump and tariffs have a firm grip on the economic world as of late, so where does that leave the crypto market?

TOTAL has a clear structure since the beginning of the bull market in 2023, in the last 3 days TOTAL has wicked into the bullish trendline support but sits within a bearish trend channel. This level also coincides with the bullish orderblock that started the leg up post US election so a very strong level of support here.

Do I think this is the end and the bottom is in? The chart would make a very good case for it however I believe that the Geo-politics outweigh Technical Analysis currently, at least in the short term. Everyone is watching for the latest news release/Trump announcement and all the time that is going on the market is very reactionary with less passive orders and more reactionary news based market orders. That taken into account in the short term this is a game of musical chairs with massive volatility swings and liquidations left right and center, a traders dream.

I'm very interested in how the FED will react to this, once we start getting emergency or early interest rate cuts that for me is when BTC will take the next step up and will flip to an investor/buy and hold environment, whether that's from here, lower or higher I'm not sure but but BTC needs a risk-on environment to thrive and Trump is doing his best to force J Powells hand.

potential NASDAQ bearish reversal in the makingThe Nasdaq appears to be showing signs of a bearish reversal as technical and macroeconomic factors align against further upside. After a strong rally, the index is encountering key resistance, prompting concerns among traders about the sustainability of the recent gains.

A pinbar candlestick pattern has emerged, signaling potential downside as buyers fail to sustain momentum. Historically, such formations indicate a rejection of higher prices, often leading to further declines. Additionally, selling pressure on rallies suggests that market participants are taking profits rather than betting on continued strength.

From a momentum perspective, the Moving Average Convergence Divergence (MACD) indicator is beginning to roll over, hinting at a potential shift in trend. If this bearish momentum continues, the Nasdaq could face increased selling pressure in the coming sessions.

Beyond technicals, fundamental factors are adding to the uncertainty. The announcement of new tariffs under former President Donald Trump’s trade policies is weighing on market sentiment. Moreover, while Federal Reserve rate cuts are traditionally viewed as bullish, historical data suggests that in some cases, they coincide with economic slowdowns, leading to weaker market conditions.

Looking at key downside levels, support can be found at 18,400, where buyers might attempt to stabilize the market. A break below this level could accelerate losses toward 16,500, a critical zone where stronger buying interest may emerge.

Traders should closely monitor price action and market reactions at these levels. Confirmation of bearish signals and continued weakness in bullish sentiment could pave the way for a more extended correction. Caution is advised, with risk management strategies essential for navigating the potential downturn.

Yield Curve Inversion Watch Chart - Fed Has To Cut!If you’re worried about a recession, you should be watching the Yield Curve Inverting.

Historically, an inversion signals a recession, but with a lag.

We can see this on the chart whenever the yield curve hits 0%

This shows the 2Y yield higher than the 10Y which is a signal that the market expects slow economic growth.

To counter-act the inversion, the Fed cuts the EFFR, although they are always late.

One would think that the Fed would learn from history, and get ahead of the curve this time around.

Only time will tell.

I’m cautiously optimistic as Treasury Secretary Bessent has stated that he has a weekly meeting with Fed Chair Powell.

BTC DECEMBER FOMC Going into FOMC the consensus is we'll see a 25bps cut from the FED (95% chance), this would take interest rates from 4.75% to 4.5%. Because the expectation of a cut is so certain, we can assume that the markets have priced this in so baring any craziness in the form of a different result we should see market sentiment remain the same, bullish.

A FED pause,(although unlikely according to data) would be very bearish in the the short term in terms of volatility. I would expect to see price revisit the $98-99K mark where the 4H 200EMA would roughly be. In a bullmarket the 4H 200EMA can be used as a great support level often bouncing off of it.

For a 25bps cut which is the expected outcome, we have two paths IMO. The bullish path is consolidation under the ATH then a break above, retest and off we go towards $110,000. The bearish path is a loss of this key S/R level after a consolidation above support and break under with a confirmed retest of new resistance. I know it's typical "could go up, could go down", however it's the context that matters here.

Alts have taken a back seat for the last week or so, BTC.D at a key level and a rejection off this level would mean alts can play catch-up while as BTC consolidates. We very rarely see BTC drop and altcoins pump so this is the most likely outcome to me baring no upsets in FOMC.

BOJ RATE BRINGS USDJPY TO 145 LONG TERM The Bank of Japan's (BoJ) upcoming interest rate decision could be a pivotal moment for the USD/JPY currency pair, potentially driving it down to the 145 level. Here's why:

Narrowing Interest Rate Differential: If the BoJ decides to raise interest rates or signals an intent to do so in the near future, this would narrow the interest rate differential with the U.S. The U.S. has been maintaining higher interest rates compared to Japan's negative or near-zero rates. A reduction in this gap would make holding Japanese Yen (JPY) relatively more attractive, thus strengthening the JPY against the USD.

Market Expectations and Sentiment: Markets often react to expectations before they react to actual news. If there's a growing consensus or speculation that the BoJ might tighten policy, traders might preemptively adjust their portfolios, leading to a stronger JPY. Recent posts on X have hinted at expectations of BoJ rate hikes, which could fuel this sentiment.

Technical Analysis Indicators: From a technical standpoint, if the BoJ surprises with hawkish comments or actions, this could trigger a sell-off in USD/JPY. The pair has been hovering around key resistance levels, and a policy shift might push it below significant support levels, potentially aiming for 145. Technical analyses often look for signs of a break below current supports, which could be catalyzed by a BoJ decision.

Global Economic Conditions: The global economic landscape, including U.S. economic data like employment figures, inflation rates, and Fed policy, will also play a role. If U.S. data suggests a softening economy or if the Fed signals rate cuts, this would weaken the USD against other currencies, including the JPY. Conversely, a dovish BoJ might not lead to as significant a drop, but the current market sentiment seems to be banking on at least some tightening from Japan.

Psychological Levels and Market Dynamics: The 145 mark could act as a psychological level for traders, where large volumes of trading might occur due to this round figure. If the BoJ's actions or statements align with market expectations of a policy shift, this could accelerate the move towards this level, especially if there's already momentum in that direction.

10-year Treasury Yield Surging ahead last FOMC in 2024After a politically charged November, bond markets have shifted their gaze back to economic fundamentals, setting the stage for a crucial Federal Reserve meeting on December 17. Recent data—including a robust jobs report and rising inflation—have reignited debates over long-term yields and the Fed’s future rate trajectory.

With the Fed’s dot plot and 2025 outlook in focus, the bond yield rallies ahead of the meeting reflects heightened anticipation of pivotal policy signals. This piece unpacks the dynamics driving Treasury yields and explores a potential trade setup deploying CME Yield futures to navigate the unfolding market environment.

MARKETS ARE FOCUSSING ON ECONOMIC DATA AGAIN

In November, U.S. Treasury yields were more influenced by political factors than by economic data. The 10-year Treasury yield remained largely unchanged after the 13/Nov CPI report, which showed headline CPI rising to 2.6% year-over-year in October, up from 2.4% in September. While the higher inflation suggested potential risks to bond yields—given that prolonged inflation could lead the Federal Reserve to slow its pace of rate cuts—Treasury yields were mostly unaffected by the data.

Instead, yields declined sharply when markets opened on November 25, following President Trump’s announcement of Scott Bessent as his pick for U.S. Treasury Secretary. Bessent, a fund manager, is anticipated to prioritize tax cuts and fiscal caution. The announcement drove the 10-year Treasury yield nearly 30 basis points lower over the next week, reaching its lowest level in over a month.

In the past two weeks, however, market focus appears to have shifted back to economic data. The non-farm payrolls report for November, released on December 6, exceeded expectations with 227,000 jobs added. Additionally, October’s dismal figure of 12,000 jobs was revised upward to 36,000, providing further support to the positive sentiment.

The improved jobs report soothed investor concerns, signalling that the state of the US economy may not be as bad as previously perceived. The jobs report eventually drove a 5-basis point recovery over the following week.

The latest CPI report for November also reaffirmed the trend that investors were focussing attention on economic data as 10Y yields surged after the report, rising nearly 19 basis points from the 09/Dec low.

10Y-2Y spreads have also surged by 8 basis points since 09/Dec. Investors can monitor the yield spreads using CME’s Treasury watch tool .

Source: CME TreasuryWatch

The tool can also be used to monitor the yield curve. Over the past month, the decline in Treasury yields has been concentrated in shorter-term tenors (2Y, 3Y, and 5Y), while the 30Y yield has remained largely unchanged. In contrast, the increase in yields over the past week has been more uniform across all tenors.

Source: CME TreasuryWatch

The November report showed inflation rising even further to 2.7%, although in-line with expectations, it suggests that inflation may be more persistent than previously perceived. This has led to expectations of a higher inflation premium for long-term treasuries which may have contributed to the rally in 10Y treasury yields.

FED DOT PLOT REMAINS THE HIGHLIGHT NEXT WEEK

Markets are almost certain of a 25-basis-point rate cut at the FOMC meeting on 17/Dec, with FedWatch indicating a 97% probability of this outcome as of 16/Dec. However, the primary focus will likely be on the Fed's guidance for the rate trajectory in the coming year. Alongside the rate decision, the Fed is expected to release its dot plot and summary of economic projections at the December meeting.

The December meeting is crucial as participants closely monitor the outlook for 2025. At last year’s December meeting, the Fed projected significant rate cuts in 2024, which triggered a substantial equity rally and a decline in bond yields.

Source: CME FedWatch

Per CME FedWatch, market participants expect an additional 50 basis points of rate cuts in 2025. However, the Fed's September dot plot indicated expectations for 100 basis points of cuts in 2025. If the December dot plot reaffirms the projection of 100 basis points, bond yields could decline sharply.

Source: Federal Reserve

BOND YIELDS HAVE RALLIED HEADING INTO THE MEETING IN THE PAST

The 10-year Treasury yields have rallied ahead of three of the last four FOMC meetings, with the increases notably concentrated in the three days leading up to the meetings. Given the recent trajectory of 10-year yields, a similar pattern may be likely this time.

The 10Y-2Y spread has shown a similar trend, increasing ahead of the last three FOMC meetings. However, following the November meeting, the 10Y-2Y spread declined. This suggests it may be prudent to position ahead of the meeting to mitigate potential post-meeting volatility.

Hypothetical Trade Setup

Market participants are nearly certain of a rate cut at the upcoming FOMC meeting, but the summary of economic projections is likely to carry greater significance. Currently, market expectations for rate cuts in 2025 are more conservative than the Fed's previous dot plot. If the Fed reaffirms expectations for more aggressive rate cuts next year, bond yields could sharply reverse their two-week rally.

While the 10-year yield outlook remains uncertain and subject to risk, the 10Y-2Y spread has a more optimistic trajectory. The spread stands to benefit from expectations of further rate cuts and its ongoing normalization trend. Additionally, historical trends suggest that positioning before the FOMC meeting may be advantageous, as the spread corrected after the last meeting.

Investors can express a view on the steepening of the 10Y-2Y yield spread using CME yield futures.

CME Yield Futures are quoted directly in yield with a 1 basis point (“bps”) change representing USD 10 in one lot of Yield Future contract. This simplifies spread calculations with a 1 bps change in spread representing profit & loss of USD 10. The individual margin requirements for 2Y and 10Y Yield futures are USD 330 and USD 320, respectively, at the time of writing. However, with CME’s 50% margin offset for the spread, the required margin drops to USD 325 as of 16/Dec, making this trade even more compelling.

The below hypothetical trade setup provides a reward to risk ratio of 1.94x:

Entry: 13.5 basis points

Target: 30 basis points

Stop Loss: 5 basis points

Profit at Target: USD 165 (16.5 basis points x USD 10)

Loss at Stop: USD 85 (8.5 basis points x USD 10)

Reward to Risk: 1.94x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Target Reached on GMETV Followers, TV has taken down and removed quite a few of my posts/videos due to my QR tag being embedded in them. I was then subsequently suspended for a few days. So, I wanted to come back and just update you on a few of those posts that were removed. GME was one of them. GME reached the W-pattern target and has entered a large liquidity block. I have decided to sell here a few days ago for some nice profit. My signal has not flashed red yet, but I wanted to capture those nice gainz while I had them.

I implemented my new indicator into my trading process in September of this year. Since that time we have not had a single loss recorded on our stock tracker! ZERO! None. All wins. Currently, we are in floating profit on all stock trades and killing it! Congrats to those who are following me in these trades.

Our average time in each stock trade is around 17 days. This is exactly where I want to be in order to give you all the time to enter the trades and exit as I post my signals.

To tell you the truth, we are doing much better than I imagined and are even beating our rate of profit on the crypto tracker! We have 12 exits for 12 wins, and the current trades will all exit in profit, equalling a 100% win rate over the last two months.

I knew I had stumbled across something remarkable when I accidentally found my indicator combo while studying the charts. I am super excited about what the future holds for all of us!

Today, I have raised the stops on all of my stock entries. I feel we may be starting to get a bit over-heated. I want to capture those profits while I have them.

Best,

Stew

XAUUSD - Gold after the FOMC?Gold is located between EMA200 and EMA50 in the 4H timeframe. Gold reached its analysis target of the previous day. In case of upward correction due to today's economic data, we can see supply zone and sell within that zone with appropriate risk reward.

The downward correction of gold has led to the visibility of the demand zone and it is possible to look for buying positions. It should be noted that both buying and selling positions will be short-term.

The Federal Reserve reduced its interest rate by 0.25%, aligning with market expectations, bringing the total rate down from 5% to 4.75%. In the Federal Open Market Committee (FOMC) statement, a line mentioning increased confidence in inflation returning to target was removed, initially prompting markets to react hawkishly. However, Fed Chair Jerome Powell quickly downplayed this change, stating that it held no special significance.

In his remarks, Powell assessed the U.S. economic outlook as positive and indicated that the Fed would continue with its contractionary monetary policies. He noted that inflationary pressures are easing and that the inflation rate is gradually nearing the 2% target. Powell emphasized the importance of reducing the risk of an economic recession and thus stressed that the Fed’s approach would remain cautious to ensure economic growth and labor market stability, with interest rates managed in a controlled manner.

During the press conference following the Fed meeting, a reporter asked Powell if he would resign if asked by Donald Trump. Powell replied simply and firmly: “No.”

Meanwhile, according to The Wall Street Journal, sources close to Trump have stated that there is still no organized plan to end the war in Ukraine, nor is there any clear idea on how to convince Vladimir Putin and Volodymyr Zelensky to agree to negotiate. One idea under discussion involves Ukraine agreeing not to join NATO for the next 20 years. In exchange, the United States would continue providing extensive military aid to Ukraine as part of a strategy to deter Russia from further aggression.

BTCUSDT.P Support prevents the price from falling

Hello, intraday traders! Hope all is well with you.

BTC on the 30-minute chart looks like it’s trying to push the price up after support held for most of the day. Tonight, we have a SEC decision about rate cuts, which will definitely impact the price. All moving averages are pointing upward, and volume is steady.

This is not financial advice—stay safe!

XAUUSD - gold waiting for the Federal Reserve meeting!Gold is below the EMA200 and EMA50 in the 4H timeframe. In case of an upward correction by the FOMC today, we can see a supply zone and sell within that zone with a suitable risk reward.

Donald Trump’s victory in the Tuesday presidential election could alter the economic outlook of the United States and influence the Federal Reserve’s policies in the coming months. Concerns about how much pressure Trump might exert on the U.S. central bank in his second term have resurfaced.

In his campaign, Trump has pledged to impose stricter tariffs on America’s trading partners, deport millions of unauthorized immigrants, and extend the tax cuts approved in 2017. If these policies are implemented, they could exert upward pressure on prices, wages, and budget deficits, creating significant challenges for the Federal Reserve.

Under these circumstances, the Federal Reserve will face increased obstacles in achieving its 2% inflation target while maintaining employment levels. Furthermore, if Trump continues his pattern of public criticism of Jerome Powell, the Fed chair, the U.S. central bank may find itself under political scrutiny.

The Federal Reserve officials have decided to lower interest rates by 25 basis points today, following a half-point reduction in September. The September forecasts indicate another quarter-point cut for December and a full one-percentage-point cut planned for 2025.

Following the rate announcement, Powell is likely to address questions in a press conference about the impact of the election on Fed policies. During Trump’s first term, he faced repeated criticism from him, and recently, Trump has criticized Powell for delays in policy decisions.

XAUUSD - Will Trump cause gold to fall?If gold reaches the bottom of the descending channel, which is also in response to the demand zone, we can look for gold buying positions.

Donald Trump won in Wisconsin and got 10 electoral votes, and Trump's total electoral votes reached 277 electoral votes. In this way, Donald Trump became the 47th president of the United States.

The rise in long-term interest rates and the broad sell-off across the Treasury yield curve reflect public expectations for an inflationary mix of domestic (fiscal and immigration) and foreign (tariffs) policies from Trump.

Also, we see movements in short-term US dollar swap rates related to the hawkish revision of Fed interest rate expectations. In line with forecasts and public expectation, markets still expect the Federal Open Market Committee (FOMC) to cut interest rates by 25 basis points to 4.75% tomorrow.

$TOTAL Crypto Market Cap Trying to Breakout - Retail IS ComingOnly thing we’re waiting for is the Crypto Total Market Cap to breakout.

Golden Cross on the horizon.

That’s why we’ve seen lack of volume in breakouts for CRYPTOCAP:BTC and Alts.

Means money is just switching from coin to coin, primarily from Tether in circulation, hence why CRYPTOCAP:USDT.D is going down.

CRYPTOCAP:TOTAL breakout will be fueled by retail, which should slowly come in the next couple weeks leading into another round of rate cuts on the 14th, followed by Donald J. Trump being declared the President of the United States the very next day 🇺🇸❤️

YOU'RE NOT BULLISH ENOUGH 🎯

Event-Driven Strategy using Bitcoin Weekly FuturesCME: Bitcoin Weekly Futures ( MIL:BFF )

On Thursday, October 10th, The Bureau of Labor Statistics (BLS) reported that the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2% on a seasonally adjusted basis, the same increase as in August and July. Over the last 12 months, the all-items index increased 2.4% before seasonal adjustment.

However, the headline CPI came in ahead of the 0.1% monthly gain and 2.3% year-over-year rate expected by analysts polled by Dow Jones. As a result, both the US equity markets and cryptocurrencies slipped on Thursday.

While the year-over-year headline CPI is the lowest since February 2021, digging into the category data reveals sticky inflation. Noticeable data includes:

• Food: +2.3% YoY. However, Eggs jumped 39.6%, while “nonconcentrated juices + soft drinks” category was up 15.3%.

• Motor vehicle insurance: +16.3% YoY

• Video discs + other media: +11.6% YoY

• Admission to sporting events: +10.3% YoY

• Health insurance: +7.5% YoY

High prices affect day-to-day life and contradict the notion of low inflation. The fact is that prices have gone up a lot in the past few years. Even though they rise more slowly now, the absolute price levels remain high. Examples from my personal experiences:

• The $9 price tag for 1-1/2 dozen eggs caused me to reduce purchase to 1-dozon for $5. I still remember the good old days of 99-cent per dozen large eggs.

• I watched a WNBC match featuring Indianapolis Fever and Catlin Clark in the summer. A seat close by the basketball court costs $200. Adding up hotel stay, fuel cost and a $50 T-shirt, this felt like a vacation budget.

• A recent doctor’s visit required copayment of $100. Six months ago, the same clinic charged $75. This is a 33.3% increase.

Event to Watch: The Next Fed Rate Decision

Retrospectively, it appears that the Federal Reserve acted a bit too aggressively with the supersized 50-bp rate cut in September. With the sticky inflation data, the Fed’s next move on November 7th is uncertain.

According to CME Group’s FedWatch Tool, as of October 11th, the futures market expects the Fed to cut 25 basis points at the next FOMC meeting, with an 88.4% probability. Gone are the odds of another supersized cut. Meanwhile, the probability of a no-cut increases to 11.6%.

www.cmegroup.com

Driven by the lowered expectation on Fed rate cuts, on Thursday, the Dow Jones Industrial Average closed down 0.14% to 42,454, and the S&P 500 slipped 0.21% to settle at 5,780. Meanwhile, the Nasdaq composite shaved up 10 points (-0.05%) and closed at 18,282.

The cryptocurrency market has a more pronounced reaction. Bitcoin gave up the psychologically important $60K level, lost $1,442 (or -2.36%) and settled at $59,564. Meanwhile, ETHER gave up $57.2 (or -2.38%) and closed at $2,356.

However, market sentiments are still very bullish. By Friday, strong Q3 earnings reported by JPMorgan and Well Fargo helped push the stock market up again, with the S&P 500 breaking 5,800 and making its 45th all-time high in 2024.

In my opinion, Bitcoin futures would be a good instrument for event-driven trades on the Fed rate decisions, given its higher volatility.

Introducing Bitcoin Friday Futures

Bitcoin Friday futures ( MIL:BFF ) are weekly, USD-settled contracts that offer a more precise way to gain bitcoin exposure and manage risk relating to such exposure. Each contract represents 1/50 of a bitcoin, ensuring capital efficiency and accessibility. The contract size of BFF is 1/5 of that of Micro Bitcoin Futures ( NYSE:MBC ), which is 1/10 of a Bitcoin.

These shorter-dated contracts expire and settle to the CME CF Bitcoin Reference Rate New York Variant (BRRNY) every Friday at 4:00 p.m. New York time and may track the spot price of bitcoin more closely.

Futures contracts traditionally expire on a monthly or quarterly basis, such as BTC and MBT, whereas BFF will settle weekly every Friday. Because of this shorter duration, BFF will have a shorter cost of carry resulting in a price that may more closely track bitcoin’s spot price.

Bitcoin futures price = bitcoin spot price + financing costs to carry the position to expiration

Two consecutive Fridays will be listed at any time. A new BFF contract will be listed every Thursday at 6:00 p.m. New York time such that market participants will be able to trade the nearest Friday plus the next two Fridays giving traders the choice to hold or not hold exposure over the weekend depending on their preference.

Trade Setup using BFF for the FOMC Event

The Federal Open Market Committee will release its next rate decision at 2:00 PM Eastern Time on Thursday, November 7th.

The BFF contract expiring Friday, November 8th will begin trading at 6:00 PM Eastern Time on Thursday, October 24th.

A trade could be set up on or after October 24th, and closed by November 7th or 8th, after the market reacts to the Fed decision and before contract expiration.

While the market overwhelmingly expects the Fed to cut 25 bps, new data could change the expectations dramatically in the next four weeks. The most important data points are:

• BLS Nonfarmed Payroll and Unemployment, November 1st

• US Presidential Election, November 5th

Separately, the next BLS CPI release will be on November 13th, after the BFF November 8th contract. We could use the BFF November 15th contract to trade on that event.

As an educational writeup, I do not offer a personal view on the future direction of BFF prices. With basic information provided here, traders could apply their own view to set up a trade on BFF.

Generally, if the Fed cuts rates in December, stocks and cryptocurrencies could get a lifting as lower rates reduce the cost of capital. Meanwhile, if the Fed pauses and decides on no-cuts, the uncertainty on interest rate trajectory could cause risk capital to fall.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

CNH: Chinese Currency Could Return to the 6.3-6.9 LevelCME: USD/Offshore RMB Futures ( CME:CNH1! )

Last week, I discussed how China’s huge stimulus package, coupled with the Fed’s supersized rate cut, could improve global energy demand and lift crude oil higher.

As soon as the stimulus was announced, China’s stock market staged a huge rally. The Shanghai Stock Exchange (SSE) index moved from below 2,800 on September 24th to close at 3,336.5 on September 30th, up 19% in a week. One-month return for the SSE and notable Chinese stocks are listed here:

• SSE: +17.5%

• Yonghui Supermarkets: +59.9%

• JD: +51.3%

• BABA: +32.5%

• BIDU: +25.5%

China's stock market is closed on October 1st-7th for observation of the National Day holiday. Would the China rally continue when the market resumes trading on Tuesday?

Goldman Sachs just released a research note, saying: Unless China does QE now, the current market rally will crash and burn, and the economy will be a crater. If China does do QE, oil will soar, and gold and bitcoin will be orders of magnitude higher.

While this is presented as two alternative paths, there is only one way to go, in all practical purpose. After going all out last month with unprecedented fiscal stimulus, the Chinese government could not afford to see the stock market and the housing market to tank again. It really needs to finish the job by injecting fiscal stimulus into the economy. Now that the market sensation has already turned positive, government spending would trigger consumer spending as well as investment from the private sector. Such a multiplier effect could lift the Chinese economy higher.

Everything looks bright, with one small problem: China-listed stocks are off-limited to most foreign investors due to financial regulations and the foreign currency control regime.

China’s currency could strengthen as its economy recovers

I hold the view that the China’s currency could appreciate as its economy improves. Outside of China, investors could invest in USD/RMB futures to hitch the economic hike.

To start the discussion, let’s first make some clarification to the confusing terms in the FX market. The USD/RMB exchange rate is quoted as the number of RMB per dollar. The current USD/RMB rate is 7.09, meaning each dollar could exchange for 7.09 RMB.

When the RMB appreciates against the dollar, the price quote would get lower, not higher. For example, the rate 6.50 means you now need 6.50 RMB to get one USD dollar. In RMB terms, this is 0.59 Yuan less than the current USD/RMB rate 7.09. In this scenario, the RMB gains value relative to the dollar.

While the RMB appreciation equates to the dollar depreciation, in charts, the lines representing USD/RMB and the dollar index should move in the same direction.

• For dollar index, the line moving up means dollar gaining value.

• For the USD/RMB, the line moving up means the dollar appreciating against the RMB.

• These two things usually occur at the same time.

In 2023, as China’s economy did not rebound after the end of the pandemic closedown, the RMB depreciated more than 10% against the dollar, sending the rate from 6.69 to 7.37.

In 2024, the two lines diverged due to different economic forces.

• Dollar index moves down with the market expectation of the Fed cutting rates, reducing the interest earned from holding dollar asset.

• The USD/RMB quote moves up because of the slowdown in China’s economy.

In my opinion, the two lines will converge again, both moving down in Q4. Dollar index will get lower as the Fed continues rate cuts. The USD/RMB quote will also go lower, as improvement in China’s economy would strengthen the country’s currency.

For someone with a bullish view of RMB, he could establish a short position in CME USD/Offshore RMB Futures ( NYSE:CNH ). Remember, shorting means the expectation of the quote to go lower, which actually means RMB appreciating against the dollar.

The contract has a notional value of $100,000. At Friday closing price of 7.061, each December contract (CNHZ4) is worth RMB 706,100. CME Group requires an initial margin of RMB 14,000 for each CNH contract, long or short, at the time of writing.

Hypothetically, if CNH bounced back to 6.70, its previous high in January 2023, the quote difference of 361 pips (=7061-6700) would produce a gain of RMB 36,100 (=0.361x100,000) for a short position.

The risk of shorting the CNH is that the Chinese government did not follow through with a fiscal stimulus, and the market rally is short lived.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Interest Rate Strategies: Trade Smarter with Fed Rate DecisionsInterest Rate Strategies: Trade Smarter with Fed Rate Decisions

Trading interest rates may seem straightforward at first: buy when cuts end and sell when they fall. However, this approach often defies expectations, as determining when rate cuts truly end isn't as simple as pointing to a rate pause following a cut. While today’s Federal Reserve rate decisions are made during scheduled (and unscheduled emergency) Federal Open Market Committee (FOMC) meetings, this wasn’t always the case. Before the 1990s, the Fed often made changes outside of meetings. The shift to exclusively deciding rates during FOMC meetings was implemented to provide greater transparency and predictability for markets.

Topics Covered:

How Are Interest Rates Traded?

Three Interest Rate Trading Strategies.

Key Insights from Backtesting Interest Rate Trading Strategies.

Interest Rate Trading Indicator (Backtest For Yourself).

█ How Are Interest Rates Traded?

This strategy focuses on trading around Federal Reserve interest rate decisions, including hikes (increases), cuts (decreases), and pauses. These decisions are believed by many to have both short- and long-term effects on the market.

Key Strategy Concepts Backtested:

Buy on Rate Pauses or Increases: Go long (buy) when the Fed pauses or raises interest rates, typically signaling market stability or optimism.

Sell on Rate Decreases: Go short (sell) or close longs when the Fed cuts rates, often indicating economic concerns or slowing growth.

Buy on Specific Rate Decreases: Enter trades when the Fed implements specific rate cuts, such as 50 basis points (bps) which represents 0.5%, and analyze market reactions over different time horizons.

█ Strategy: Long during Pauses and Increases, Short during Decreases

This section examines the effectiveness of going long on rate pauses or increases and shorting during decreases. This strategy performed well between 2001 and 2009, but underperformed after 2009 and before 2001 compared to holding positions. The main challenge is the unpredictability of future rate changes. If you could foresee rate trends over two years, decision-making would be easier, but that’s rarely the case, making this strategy less reliable in certain periods.

2001-2009

Trade Result: 67.02%

Holding Result: -31.19%

2019-2021

Trade Result: 19.28%

Holding Result: 25.22%

1971-Present

Trade Result: 444.13%

Holding Result: 5694.12%

█ Strategy: Long 50bps Rate Cuts

This section evaluates trading around 50 basis point (bps) rate cuts, which is a 0.5% decrease. Large cuts usually respond to economic stress, and market reactions can vary. While these cuts signal aggressive economic stimulation by the Fed, short-term responses are often unpredictable. The strategy tends to perform better over longer timeframes, as markets absorb the effects.

1971-Present

Trade Duration: 10 trading days — Average Return: -0.19%

Trade Duration: 50 trading days — Average Return: 2.41%

Trade Duration: 100 trading days — Average Return: 2.46%

Trade Duration: 250 trading days — Average Return: 11.4%

2001-Present

Trade Duration: 10 trading days — Average Return: -2.12%

Trade Duration: 50 trading days — Average Return: -1.84%

Trade Duration: 100 trading days — Average Return: -3.72%

Trade Duration: 250 trading days — Average Return: 1.72%

2009-Present

Trade Duration: 10 trading days — Average Return: -15.79%

Trade Duration: 50 trading days — Average Return: -6.11%

Trade Duration: 100 trading days — Average Return: 7.07%

Trade Duration: 250 trading days — Average Return: 29.92%

█ Strategy: Long Any Rate Cuts

This section reviews the performance of buying after any rate cut, not just large ones. Rate cuts usually signal economic easing and often improve market conditions in the long run. However, the size of the cut and its context greatly influence how the market reacts over different timeframes.

1971-Present

Trade Duration: 10 trading days — Average Return: 0.33%

Trade Duration: 50 trading days — Average Return: 2.65%

Trade Duration: 100 trading days — Average Return: 4.38%

Trade Duration: 250 trading days — Average Return: 8.4%

2001-Present

Trade Duration: 10 trading days — Average Return: -1.12%

Trade Duration: 50 trading days — Average Return: -0.69%

Trade Duration: 100 trading days — Average Return: -1.59%

Trade Duration: 250 trading days — Average Return: 0.22%

2009-Present

Trade Duration: 10 trading days — Average Return: -3.38%

Trade Duration: 50 trading days — Average Return: 3.26%

Trade Duration: 100 trading days — Average Return: 12.55%

Trade Duration: 250 trading days — Average Return: 12.54%

█ Key Insights from Backtesting Interest Rate Trading Strategies

The first assumption I wanted to test was whether you should sell when rate cuts begin and buy when they end. The results were inconclusive, mainly due to the difficulty of predicting when rate cuts will stop. A rate pause might suggest cuts are over, but that’s often not the case, as shown below.

One key finding is that the best time to be fully invested is when rates fall below 1.25% or 1.00%, as this has historically led to stronger market performance. But this can be subject to change.

█ Interest Rate Trading Indicator (Backtest For Yourself)

Indicator Used For Backtesting (select chart below to open):

The 'Interest Rate Trading (Manually Added Rate Decisions) ' indicator analyzes U.S. interest rate decisions to determine trade entries and exits based on user-defined criteria, such as rate increases, decreases, pauses, aggressive changes, and more. It visually marks key decision dates, including both rate changes and pauses, offering valuable insights for trading based on interest rate trends. Historical time periods are highlighted for additional context. The indicator also allows users to compare the performance of an interest rate trading strategy versus a holding strategy.

$BTC Going For It! $65k Next UpJust as expected Bitcoin is being rejected from the 200MA.

Bulls still appear to be in control, so we should test the .618 Fib ~$65k.

The real line in the sand is breaking through the trendline ~$68k.

IF we close above that, the bulla will be in full swing!

I'm still keeping 10% cash on the sidelines regardless for one last generational buy opp, although those days are looking numbered.

There's still a lot of macro conditions that are concerning, hence the Fed 50 bps rate cut.

Lower Rates Expected by 9/27/24Ahead of the Fed meeting Wednesday the market was pretty much 50/50 split on whether the fed funds rate would be cut by 25 or 50 basis points. After the 50bps announcement the counter intuitive move occurred, which was rates began rising, but this should have been a surprise. This was as straight forward "buy the rumor, sell the news" gets. Today however it appears the rates attempted to rally past 3.76% but failed.

3.76% happens to be the 50% fib level from the recent highs to lows and now we'll look to see the 10-yr break below 3.70 for a sustained move lower. Marking this as a "Long Investment Idea" since lower rates imply higher bond prices, don't be fooled by the rate chart.

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto RalliesMarket Update - September 20th, 2024

Takeaways

The Federal Reserve cuts rates: The Federal Reserve announced Wednesday it will cut the federal benchmark interest rate by a half-percentage point (50 basis points), lowering the range to between 4.75% and 5%. Crypto markets responded well to the move, with the price of bitcoin pushing past $63,000.

US crypto legislation still possible this year: US senator Cynthia Lummis (R-WY) said in an interview Tuesday she thinks crypto legislation could be passed during the lame-duck session of Congress.

US spot bitcoin ETFs pull in $187 million in inflows: US spot bitcoin ETFs drew $187 million in inflows Tuesday, marking the fourth consecutive day of inflows after a significant drawdown.

Republicans ask for clarity on crypto airdrops: US representative Patrick McHenry (R-NC) and other top Republican lawmakers sent a letter to SEC chair Gary Gensler asking for clarity on crypto airdrops.

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto Rallies

The Federal Reserve announced Wednesday it is lowering the benchmark federal funds rate by a half-percentage point (50 basis points) to between 4.75% and 5%. It marked the first interest rate cut in more than four years and signaled the Federal Reserve is ready to ease up on its fight against inflation.

The move marked the first time since 2008 the Federal Reserve had cut interest rates by 50 basis points at one meeting. Many analysts had expected a quarter-point percentage cut, but cooling inflation and a soft labor market allowed Federal Reserve chair Jerome Powell to be more aggressive. In August, the Consumer Price Index (CPI), a key inflation metric, dropped to 2.5% year-over-year, roughly hitting Powell’s 2% inflation target.

The long-anticipated move sparked the broader markets. And crypto prices also rallied, with bitcoin pushing to roughly $63,500 and ether increasing to roughly $2,350 respectively.

A low interest-rate environment is widely viewed as a greenshoot for risk assets including crypto, but it remains to be seen if a rate-cutting campaign will ultimately shoot bitcoin and other cryptocurrencies to all-time highs.

🌐 Topic of the week: Global Stablecoin Ecosystem

🫱 Read more here

S&P 500 forecast: Outsized rate cut music to bulls’ ears. S&P 500 forecast: The US stock market has shown impressive resilience following the recent volatility. Investors, thrilled by the Federal Reserve’s outsized rate cut, have pushed index futures higher. However, there are mixed opinions about what lies ahead. For now, it looks the S&P 500 will finish the week at a fresh record high.

Fed’s Rate Cut and Its Impact on Markets

The Federal Reserve’s decision to deliver a 50-basis point rate cut was largely welcomed by investors. The move was seen as a bold but necessary step to ease economic concerns without sending panic signals reminiscent of the 2008 financial crisis. Fed Chair Jerome Powell emphasised that the cuts are not part of a long-term strategy but rather a proactive measure aimed at stabilising growth, now that inflation appears to be on the path of returning to its target.

Markets initially sold off but quickly rebounded, with S&P 500 futures suggesting a potential new record high is on the horizon at the cash open today. The Dot Plot projection also boosted investor confidence, showing a possible 50 basis points of cuts this year and 100 next year, with the terminal rate expected to hit 3.0% by 2026. But what now?

Can the S&P 500 Rally Continue?

With the S&P 500 up nearly 19% year-to-date, investors are wondering if the rally can be sustained. On the surface, it appears that market sentiment is bullish, bolstered by the Fed’s actions and a series of robust earnings reports. Yet, looming risks, such as global economic slowdown in the Eurozone and China, may challenge this optimism. Moreover, seasonal trends indicate that September is typically a tough month for equities, adding a potential headwind to the current rally – although so far this hasn’t held investors back. With the US presidential election approaching, market volatility could spike, leaving investors hesitant to dive into new rallies without a clear trend.

S&P 500 forecast: Technical Analysis and Key Levels to Watch

Despite some volatility after the Fed’s rate cut, the S&P 500’s bullish trend remains intact. Traders should keep an eye on the support range between 5613 and 5670, with the upper end of this range marking the high from July. As long as the index holds above this support area, the short-term path of least resistance will remain upwards, potentially keeping the market on course to head towards 5800 or even the 127.2% Fibonacci extension level of 5827, derived from the drop in July.

However, a dip below 5613 would signal a shift towards bearish sentiment, potentially pushing the index down to its next support and short-term trendline around the 5480-5500 area.

Bearish Risks and Market Sentiment

While the bulls are currently in control, bearish traders are watching for signs of a reversal. A drop below recent lows, as suggested above, could signal the end of the short-term bullish bias, reminiscent of the July sell-off when overbought conditions led to a sharp decline. Then, the signal came in the form of a bearish engulfing candle on 17 July. Bearish traders need to wait for a similar confirmation before making any significant moves, given the overall bullish structure of this market.

Risk Management in a Volatile Market

Regardless of whether you're bullish or bearish, managing risk is critical in today's market. With heightened uncertainty surrounding the economy and upcoming elections, volatility is expected to remain high. Traders should stay nimble and be prepared for sudden shifts in the market’s direction.

In conclusion, while the S&P 500 forecast remains cautiously optimistic, several factors could derail the current rally. Staying informed and agile will be essential for navigating the coming weeks. We will, of course, highlight any major shifts in the trends, if observed. Stay tuned.

-- Written by Fawad Razaqzada, Market Analyst

Fed Kicks Off Rate-Cutting Cycle. Why the Muted Market Reaction?Central bank bros met traders’ loftiest expectations with a half-point cut to interest rates on Wednesday. But is that too good to be true and maybe even a signal of some problems with the US economy and looming fears over at the Fed?

Trading today isn’t the same as trading yesterday. Even though prices don’t really confirm it — there wasn’t a super-duper rally in stocks. Maybe gold XAU/USD flickered a bit, but it was mostly froth . And here we are — the first day of trading in an environment with lower interest rates.

Jay Powell, head of the Federal Reserve, announced on Wednesday the first trim to borrowing costs in four years. The move ushers in a new normal where US interest rates USINTR are projected to continue moving lower from their 23-year high of 5.5%.

The easing cycle kicked off with a jumbo-sized 50 bps (basis points) slash. Surprisingly, the Fed went for the juicier, bolder and more aggressive option, leapfrogging the less interesting and exciting cut of 25 bps.

First reactions across the board showed investors were hyped to get what they wanted — the broad-based S&P 500 hit an intraday record .

Shortly after, however, stocks across the board pulled back and markets became anxious over the outlook as the realization kicked in. If the economy is doing fine, why go big on cuts from the get-go?

What’s more, central bankers are keen to ax interest rates by another half point in 2024, ultimately wrapping up the year with the benchmark rate sitting at 4.25% to 4.5%. Christmas may come early — the Fed meets twice more this year, on November 7 and December 18.

Better Safe Than Sorry?

A super-sized half-point cut could actually be a pre-emptive measure to alleviate a strained economy. But if inflation is now largely in the rearview mirror , what could the problem be? The other mandate. The Fed has a dual mandate of keeping prices in check (inflation) and upholding a stable labor market (jobs).

“We will do everything we can to support a strong labor market as we make further progress towards price stability,” Jay Powell said at the annual Jackson Hole gathering last month. And indeed, America’s jobs have seen a pronounced slowdown over the past few months. In July, markets added just 89,000 jobs (revised from an initial estimation of 114,000 ). In August, hiring had picked up modestly to 142,000 , but below expectations for 164,000.

Pros and Cons of Bumper Cut

Essentially, this big-boy cut of 50 bps is a double-edged sword. It cuts into borrowing costs, making money more affordable, potentially stimulating businesses to add more jobs and grow their gig. And it also prompts consumers to take on debt and get that house.

But on the flip side, a cut of that magnitude risks stirring up price pressures again. To get to full employment, the Fed faces the challenge of knocked inflation waking up from its slumber.

The size of the cut at this particular time doesn’t mean anything without the markets’ reaction to it. Apparently, investors were unimpressed and shrugged it off as no big deal. Looking ahead, however, the stakes are high because stocks are at all-time highs.

The S&P 500 touched a record, Big Tech is leading the charge into artificial intelligence and investors can’t own enough of the highflyers Nvidia NVDA , Meta META , Apple AAPL , etc.

The actual picture will become clear once markets figure out what the Fed’s rate-cutting cycle means and what to do about it.