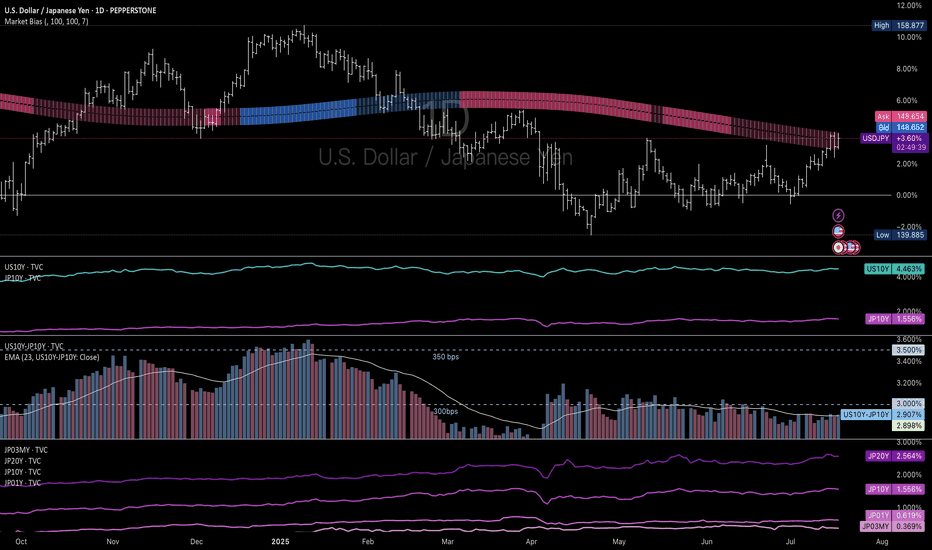

Good setup to short USDJPYRecently the risk emotions caused by the White House and inflation worries it produced drives long term US Treasury yields rising, with 20-yr yield cross up to 5% once again.

Yet, you can see that the yield difference are still at a dropping trend. Moreover, the Fed is expected to cut 125 bps in the next 15 months according to the swap market.

Combined with the techincal levels, it's a good price to get into a short position of USDJPY. I don't know about you guys. I'm in

Ratecuts

UCAD Bears Ready to Break 2 Month Long Falling Support??OANDA:USDCAD has been supported by a Falling Support Trend line since August 14th and here soon Price could potentially give us a Bearish Break to that Trend line!

Once a Breakout is validated, we could look for a Retest Set-Up for some Short Opportunities to take Price down to the Support Zone created by the August and September 2024 Lows.

An interesting fact to point out is if you observe the reaction of Price when it tests the Falling Support, we can see Price arc and the following reactions arc smaller, suggesting Bulls are losing strength on the push off of the Falling Support!

Price Action is being heavily driven by Fundamentals in the markets this week:

-USD-

ADP Non-Farm Employment - Previous 60K / Forecast 111K / Actual 37K

ISM Services PMI - Previous 51.6 / Forecast 52 / Actual 49.9

ISM Manufacturing PMI - Previous 48.7 / Forecast 49.3 / Actual 48.5

ISM Manufacturing Prices - Previous 69.8 / Forecast 70.2 / Actual 48.5

Unemployment Claims - Previous 239K / Forecast 236K / Actual 247K

*Average Hourly Earnings, Non-Farm Employment and Unemployment Rate are to be released tomorrow

-CAD-

BOC held Interest Rates @ 2.75%

Ivey PMI - Previous 47.9 / Forecast 48.3 / Actual 48.9

*Employment Change and Unemployment are to be released tomorrow

With BOC holding Interest Rates and the Federal Reserve possibly looking to cut rates because of a "softening labor market", this could fuel CAD to overcome the pair and put Bears in control to pull Prices lower!

www.tradingview.com

The Fed Cuts Balance Sheet Runoff by 80% - BULLISH!RISK-ON 🚨

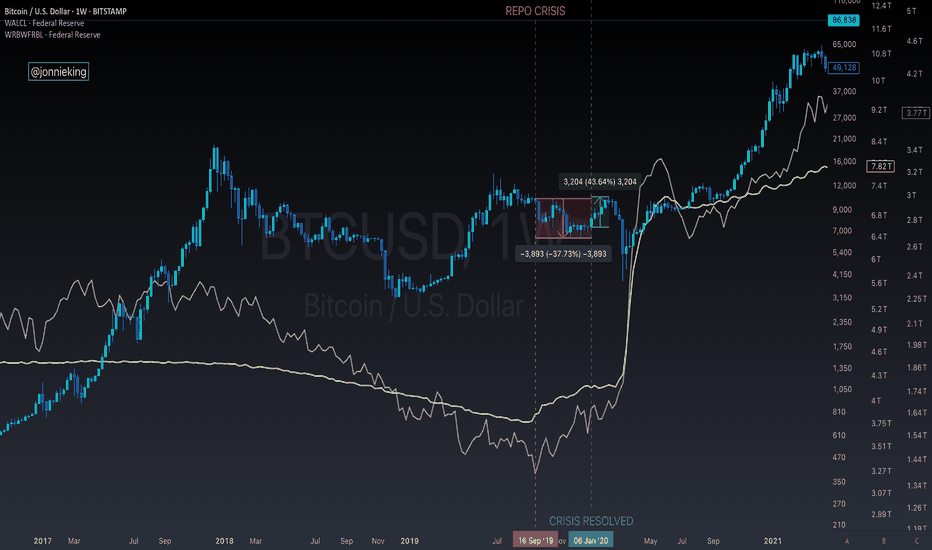

I’m seeing so many people incorrectly analyzing the September 2019 emergency repo OMOs, which were short-term liquidity injections from the Fed, and then comparing it to the price of BTC going down, before QE officially started in March 2020 because of the pandemic.

Here’s what really happened.

September 15, 2019 was a tax deadline, pulling ~$100B out of markets as large corporations paid the IRS and funds flew into the TGA.

Meanwhile, the Treasury issued new T-Bills to rebuild cash reserves following the post-debt ceiling resolution in August, draining another $50-100B as big banks and institutions absorbed the securities.

During this time, the Fed continued reducing its balance sheet (QT) down to $3.76T, but the balance sheet did not leave enough slack for unexpected cash drains to the system, such as corporate taxes and Treasury issuance.

Unfortunately, the Fed was flying blind and did not have a hard number estimate for “ample reserves” in the banking system.

These reserves were largely hoarded by a few of the larger banking institutions due to Liquidity Coverage Ratio (LCR) rules and a higher IOER at 2.1% vs the ON RRP rate of 1.7% - a 40 bp spread.

This caused a liquidity crisis in the US repo market because bank reserves held at the Fed ($1.36T) were too low and repo lending dried up. Banks weren’t able to access each other’s reserves to fund daily operations.

SOUND FAMILIAR !?

The US just resolved its CR to avoid a government shutdown, and they will be refilling the TGA by issuing new T-Bills. The reverse repo facility is also nearly drained.

Today, we heard the Fed will be reducing its securities runoff from $25B - SEED_TVCODER77_ETHBTCDATA:5B on April 1st, an 80% adjustment.

One of the main drivers is they wanted to get ahead of another 2019-style repo crisis (although they won’t say this), rather than being reactive and having to perform emergency OMOs once again.

Now to go back to my original point with people saying the Fed reducing its balance sheet runoff is a big nothingburger based on BTC price action in 2019.

BTC dumped because of the repo crisis, NOT because markets needed QE.

By early 2020, the liquidity crisis was resolved, and BTC pumped ~45% before the pandemic hit in March and nuked the chart.

Proof is in the pudding - just look at the 2017 bull market.

QT started in October 2017, and the market ripped until early 2018.

The Fed reducing its balance sheet runoff by 80% is definitely a signal of risk-on for educated market participants, as it leaves more reserves in the financial system, which gives banks more liquidity to loan the market.

i.e. M2 go up.

But keep listening to your favorite large accounts who are all of a sudden macro gurus, what do I know 🤓

Rising from the Ashes: EURO's Path to RecoveryGood day traders,

Trust we all profited from the FOMC report of yesterday.

Please take a moment to go through my outlook and expectation on Euro in the coming weeks into the new year.

Overview

EUR/USD appears to be rebounding after a sharp decline triggered by yesterday's FOMC report, where the FED delivered a hawkish 25bps cut, which drove higher market-driven borrowing costs, a stronger dollar and a sharp drop in stocks. From the start of the week EURUSD had previously been consolidating, during which weak buyers (traders) were caught off guard by a false breakout to the upside, reaching a weekly high of 1.05342 on Tuesday.

Idea

The subsequent sell-off drove the pair to a four-week low of 1.03439, just above the November 22nd low of 1.03324. This drop aligns with a key Fibonacci reversal pattern under Elliott Wave theory, suggesting the potential for a significant rally. If this pattern holds, EUR/USD could gain approximately 400 pips (1.08150) in the coming weeks, with the recovery likely extending into the new year.

Conclusion

The recent low is expected to act as a firm support level, and a breach of the November low appears unlikely. This anticipated rally could mark the beginning of a period of recovery and optimism for the euro.

Cheers! Merry Christmas and Happy New Year in advance.

USD/JPY price action: breakout rally after hawkish FedThe USD/JPY pair has surged over 2% to reach 157.51, marking the yen's weakest level in four months. This significant rally follows recent interest rate decisions by the Federal Reserve and the Bank of Japan. Despite the Fed's 25bps rate cut, the US dollar has gained strength due to the market's anticipation of only two rate cuts in 2025, contrasting with earlier expectations of four. This decision maintains the interest rate differential between the US and Japan, benefiting carry trade strategies. Meanwhile, the BoJ has kept its short-term rate steady at 0.25%, its highest since 2008, with potential rate hikes forecasted if economic conditions align. The US's optimistic economic projections, with rising GDP, inflation, and job growth, further bolster the dollar's appeal. As global economic uncertainties and political changes unfold, traders should monitor central bank signals to navigate the USD/JPY's trajectory and carry trade opportunities.

BTC breaks above 65,000On the back of a larger than expected FED rate cut of .50 risk assets breathe a sigh of relief long held in since the rate cut rumors of Q2 2024. The gains were cemented by a cooler than expected PCE of .1% as opposed to the expected .2% this is the FED’s preferred measure of inflation putting some level of ease to risk asset investor that the FED may turn face on the easing of monetary policies. If this continues a fear people have a of 70’s style inflation issue will be put to rest. China also joined the party will an AGGRESSIVE stimulus packages direct to the people and promises to do more if need be. They also encouraged stock buy backs, if you know anything about the investment market in China the options for quality investment are very limited as the Real Estate market was the main choice but since the Evergrande collapse Chinese investor have had little to no choice. This makes a scenario for crypto investment as an alternative to stocks but the CCP obviously like control so we will if that plays out.

How this affect Crypto bros the short of it is when global liquidity goes up so do assets especially when people get cash in hand example 2020-2021 when everyone and their dog was investing. Now while stimulus direct to consumers is like throwing gas on the fire the FED rate cuts are like throwing a log on embers. The rate cuts take about a year to affect the general economy but the immediate effect is bank to bank loan rate i.e it’s cheaper to take on debt. Now with the rise of NASDAQ:MSTR strategy with other companies this will make it cheaper for companies to take on debt so companies like Metaplanet and other yet to disclose will find the “BTC Yield” more significant to offset loan cost. And lastly all risk assets benefit from low rate environments.

In sum NFA but I would buy CRYPTOCAP:BTC as always and load up on alts while BTC out perform my mix ideally 75% BTC 15% alts and 10% cash for dippy dips

M2K: SmallCap May Get a Big Lift with Rate Cuts UnderwayCME: Micro E-Mini Russell 2000 Futures ( GETTEX:M2K )

Global financial market orbits around Federal Reserve’s interest rate decisions. Hiking interest rates means monetary tightening while cutting them signals easing.

In the past three years, we have witnessed a full cycle of Fed hikes and now its reversal.

• In March 2022, as inflation rose rapidly, the Fed started a series of rate increases, pushing the Fed Funds rate up by 525 basis points from 0-0.25% to 5.25-5.50%.

• In September 2023, after 11 consecutive rate hikes, the Fed put the brake on. It kept the Fed Funds unchanged for a full year in eight FOMC meetings.

• Last Wednesday, the Fed finally entered the long-awaited rate cut cycle. It slashed interest rates by a supersized half point, or 50 basis points, in its first cut since 2020.

According to the Bureau of Labor Statistics (BLS), the latest reading of headline CPI is 2.5% in August, down 6.6% from its peak in July 2022. We may conclude that the Fed has largely completed its mission of combating inflation.

The BLS data shows that the U.S. unemployment rate has risen to 4.2% in August 2024 from 3.6% two years ago in August 2022. Fed’s easing signals its pivot to the second mandate, to support full employment. Lowering interest rates could reduce borrowing costs, and in return help business expansion and employment.

Russell 2000: SmallCap may get the biggest Boost

The discounted cash flow (DCF) model estimates the present value of an investment based on its expected future cash flows. A lower cost of capital (CoC) shall cause the price of the investment to go up, other things equal.

Small companies would gain the most compared to larger corporations. In the preceding rate hike cycle, they were hit hard as credit standards got tightened and credit spreads expanded. We will now see the reversal.

Russell 2000 is the benchmark stock market index for US small companies. CME Micro E-mini Russell 2000 futures ( GETTEX:M2K ) were settled at 2,252.6 on Friday, up 10.05% year-to-date.

For a comparison, the S&P 500 gained 19.50% YTD as of Friday, while the Nasdaq 100 was up 17.59%. In my opinion, the major stock indexes rose on the back of the AI-driven technological breakthroughs, where Big Tech dominated but few Small Cap companies could benefit. In this new cycle, lowered borrowing costs and the abundance of credit could help small businesses improve their balance sheets.

The Fed is expected to continue cutting rates in the next two years. Corporate bond yields could likely return to the 2-3% range. The credit spreads, including Baa-Bbb, Baa-Bb, and Baa-Ccc, would likely get smaller. This could bring further boost to the Russell index.

Could we quantify the impact of rate cuts? Let’s illustrate this with a $1 million payment, to be received in five years.

• Applying the BBB corporate bond yield of 4.88% as the CoC, present value of $1 million will be $788,019.

• If the CoC moves down by 250 bps to 2.38%, the PV will be increased to $889,046.

• This shows that a 2.5% reduction in CoC could boost the PV by 12.8%.

The same concept would work on the Russell index. CoC could drop either due to interest rate decrease or because of the narrowing of credit spread, which favors smaller companies. The result would be an increase in the market value of Russell component companies.

For someone with a bullish view of the Russell 2000, he could establish a long position in CME Micro E-mini Russell 2000 futures. The contract has a notional value at $5 times the index. At Friday closing price of 2,252.6, each December contract (M2KZ4) is worth $11,263. CME Group requires an initial margin of $760 for each M2K contract, long or short.

The Fed will next convene on November 5th-6th and meet one last time in 2024 on December 17th-18th. In my opinion, if the Fed continues lowering rates in these two meetings, Russell 2000 could likely move up further.

Hypothetically, if the Russell is 5% higher by December, the 113-point increase would translate into $563 (=2252.6*0.05*$5) gain per contract for the long holder.

The risk of long futures is the index going down. If inflation spikes unexpectedly, the Fed could possibly pause its rate cuts, casting doubt on the future rate trajectory. For more experienced traders, put options on the E-Mini Russell 2000 futures could be deployed to hedge the downside risk.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Clean Break To The UpsideFalling Wedge Pattern

Success rate : Falling wedge statistics - In 82% of cases, the exit is bullish. - In 55% of cases, a falling wedge is a reversal pattern. - In 63% of cases, the pattern's price objective is achieved when the resistance line is broken.

Why should you buy into bonds after a rate cut?

HERE ARE 5 REASONS...

When a central bank cuts interest rates, bonds can become more attractive for several reasons:

1: Bond Prices Tend to Rise: When interest rates fall, the yield on new bonds is lower, making existing bonds with higher yields more attractive. As a result, the price of existing bonds rises, which benefits those who already own them or buy in anticipation of further price increases.

2: Fixed Returns Become More Attractive: After a rate cut, returns from savings accounts and other short-term investments decline. Bonds, offering a fixed rate of return, become more appealing, especially for income-focused investors looking for stability in a low-rate environment.

3: Lower Future Borrowing Costs: A rate cut often signals that borrowing costs will stay low, benefiting businesses and governments that issue bonds. This may lead to more bond issuances, and investors can capitalize on buying bonds before yields drop further.

4: Hedge Against Economic Uncertainty: Rate cuts often occur during economic slowdowns or periods of uncertainty. Bonds, particularly government or high-quality corporate bonds, are seen as safer investments compared to stocks, making them attractive for risk-averse investors.

5: Capital Gains Potential: As bond prices increase with falling rates, there is an opportunity for capital gains. Investors can potentially sell bonds at a higher price than they were purchased for, profiting from the price appreciation.

In short, buying bonds after a rate cut can offer both income stability and the potential for price gains, especially in a low-interest-rate environment.

Fed's Bold Rate Cut Raises Stakes for BoE and BoJ Both the Bank of England (BoE) and Bank of Japan (BoJ) are not expected to cut interest rates at their respective meetings today and tomorrow.

The US Federal Reserve just chose to cut its own rate by 50 basis points. So, how might the BoE and BoJ decisions be affected?

Bank of America projects the BoE will leave its Bank Rate at 5.0%, with the pound potentially gaining. However, gains could be capped if policymakers lean dovish. Additionally, a currency strategy note from HSBC says that the sharp appreciation of the British pound against the U.S. dollar may be nearing its limits.

Masamichi Adachi, chief Japan economist at UBS Securities, cautioned that if the BoJ raises rates Friday, just days after the Fed's rate cut, “markets would likely face increased turbulence.”

Crypto $TOTAL Market Cap Sell The News Event IncomingSOUR GRAPES

Markets barely budge after the Fed cuts a massive 50 bps.

This is due to uncertainty with participants feeling there is something “broken” in the system.

However, long-term this is BULLISH.

The Crypto CRYPTOCAP:TOTAL Market Cap could see another small pump leading into the weekend to test its downtrend line, but I expect next week for the markets to “sell the news” pretty hard.

Should retest the lower order block ~$1.77T next.

50-50 Odds for Big Rate Cut this Wednesday The Federal Reserve’s upcoming rate decision is teetering on a knife’s edge, with the odds of a significant cut climbing. According to the CME’s FedWatch tool, the chances of a 25 or 50-basis-point reduction are now evenly split at 50-50.

The decision from the cental bank comes in on Wednesday.

Former New York Fed President Bill Dudley, speaking last week, bolstered the case for a more aggressive move, stating the federal funds rate could be up to 200 basis points above neutral. Dudley argued there’s a “strong case” for the Fed to start big.

However, major banks are possibly leaning toward the Fed starting small. In a note, Bank of America’s analysts suggested “a small chance” of a 50bps cut, while UBS’s Brian Rose also acknowledged the possibility, though was not factoring it into his baseline.

AU Bears "Head" Down to Target .6570Here I have AUD/USD on the Daily Chart!

From Friday's High @ .67672 to its Low @ .66597, we can see we get the Confirmation of a strong reversal pattern with the Break of the Neckline of the Head & Shoulders!

Now what I'd like to see off the same High and Low of Friday is Price give us a 38.2% Retracement of the Low & Pullback to test the Neckline for potential Sell Entries.

( .67008 - .6697 )

Swing High of Head to Neckline = 126.9 Pips

Neckline - 126.9 = .6570 (Target)

Fundamentals:

AUD's undoing comes from a mix of a rise in Unemployment to 4.2% and Retail Sales ending August coming in @ 0%

With the horrible run of jobs reports for the USD to start September, it managed to recover to end the week and give the idea that a 50 bps Rate Cut is less likely sitting at a 30% change and a 25 bps Rate Cut more likely at a 70% chance at the Sept 18th meeting.

-RBA Interest Rate sits @ 4.35%

-Fed Interest Rate sits @ 5.5%

This upcoming week will be VERY news heavy for USD seeing as there is:

-Core CPI, CPI m & y on Wednesday, Sept. 11th

-Core PPI/ PPI m/m & Unemployment Claims on Thursday, Sept 12th!

Harmonic Crab Variation + Bullish RSI Divergence - GUHere I have GBP/USD on the 30 Min Chart!

Price has found Support from the July Highs!

Upon reaching the Low @ 1.30493 I notice a couple things:

-Price is moving Lower, RSI is moving Higher = Bullish RSI Divergence

-Price has created what looks to be a variation of the Harmonic Crab Pattern (not exact values)

Harmonic Crab XACBD Values:

X-B ( .382 - .618 )

A-C ( .382 - .886 )

B-D ( 2.618 - 3.618 )

X-D 1.618

We continue to see price move higher and I believe we will see Higher Highs up to the 1.3130 - 1.3140 Area!

Fundamentals:

GBP has been positive in the analyst eyes this week with the Claimont Count Change with impressive numbers and Unemployment down from 4.2% to 4.1%!

-GBP will have GDP releasing Wednesday Sept. 11th with forecasts to be Positive!

USD not only has Rate Cuts starting next week but this week is heavily loaded with CPI & Core CPI Wednesday along with PPI, Core PPI & Unemployement Claims Thursday Sept. 12th!

$DJI <> Rate CutsRetail investors often mistakenly believe rate cuts are bullish and will profit, but history suggests otherwise. In the last two decades, we have witnessed three major rate-cutting events that occurred a few months before market peaks, each followed by 40%+ corrections. We have observed similar patterns with retail investors becoming bullish as rate cuts are announced. Markets typically become euphoric for a few months, with retail investors buying at the top, only to experience major drops shortly after.

US Real Estate Slowdown Casts a Long ShadowLast week, U.S. housing starts, a key economic measure of new residential construction, dropped to their lowest level since 2020, with single-family housing starts hitting a 16-month low. Meanwhile, overall housing inventory has climbed to its highest point since 2020, and new housing inventory has reached levels not seen since 2008. Despite a moderating mortgage rate, high prices continue to deter buyers, failing to stimulate housing sales. Combined with the ongoing slowdown in commercial real estate, the sector may face prolonged challenges.

While the Real Estate Select Sector could see short-term gains from declining interest rates, a significant slowdown in the sector may dampen these benefits. A long position in Utilities Select Sector Index futures (XAU) to capitalize on lower rates, paired with a short position in Real Estate Select Sector Index futures (XLR) to hedge the real estate downturn, offers a balanced approach against XLR's short-term gains.

US HOUSING STARTS TUMBLE, INVENTORY SURGES

U.S. housing starts fell to 1.238 million as of July 29, a 6.8% decline from the previous week and well below analyst expectations of 1.340 million. Single-family housing starts dropped by 14.1% to 851,000, marking a sixteen-month low. Although Hurricane Beryl likely contributed to this sharp decline, the real estate sector faces a more significant, underlying challenge.

The U.S. housing market is grappling with a surge in inventory. According to Realtor.com, overall housing inventory stands at 884,000, the highest level since 2020. Similarly, data from the National Association of Realtors (NAR) shows inventories at 1.32 million, also the highest since 2020.

The situation is even more concerning for new housing inventory, which has reached its highest level since 2008. At July's sales pace, it would take 9.3 months to clear the backlog of new homes.

Notably, the slowdown in housing starts has intensified, even as mortgage rates have moderated from their peak in May. Despite a 10% decline in mortgage rates since early May, housing starts have fallen by 8%, indicating that easing rates are not driving a meaningful rebound in housing sales.

In addition to the struggles in the residential real estate market, the commercial real estate market continues to struggle with elevated vacancies and mark-downs. Last Month, Deutsche Bank stated that the commercial real estate market would be further pressured during H2 2024 as the recovery they had anticipated was not materializing.

INTEREST RATE CUT WILL PROVIDE SHORT-TERM BOOST

Despite the challenges facing the real estate sector, upcoming interest rate cuts are expected to provide a boost through further declines in mortgage rates. However, this near-term support may not be enough to offset a potentially prolonged downturn. Rising inventory levels are not being matched by significant price reductions, and with a weakening labor market, homebuyers' purchasing power is likely to remain constrained.

The real estate sector is not the only beneficiary of lower rates. As noted by Mint Finance in a previous analysis, the utilities sector also stands to gain from declining rates.

Therefore, hedging a short position in Real Estate Select Sector Index futures (XAR) with a long position in Utilities Select Sector Index futures (XAU) mitigates downside risk.

The XAU/XAR spread has outperformed an outright short in XAR as well as the SPX/XAR spread during rate cut driven rallies in the XAR this year and remained resilient during the recent rally in XAR.

HYPOTHETICAL TRADE SETUP

The U.S. real estate sector is burdened by a surplus of inventory, as home buying remains sluggish despite moderating mortgage rates. High prices, combined with financial strain in a weakening labor market, are likely to keep sales low for the foreseeable future. Additionally, ongoing challenges in commercial real estate add to the sector's difficulties.

Despite this negative outlook, the real estate sector may still see some benefit from upcoming interest rate cuts. Historically, the spread between Utilities Select Sector Index futures (XAU) and Real Estate Select Sector Index futures (XAR) has shown resilience during such periods, offering an improved reward/risk profile.

CME Select Sector Futures serve as a capital efficient instrument to implement spread trades between different sectors. A position consisting of short 3 x E-mini Real Estate Select Sector Futures (XARU2024) and long 2 x E-mini Utilities Select Sector Futures (XAUU2024) balances notional values on both legs. CME provides a 60% margin offset for this trade, reducing the margin requirements to USD 11,940 as of 19/Aug.

The hypothetical trade setup described below offers a reward/risk ratio of 1.4x

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Will Gold Hit $3,000 with Fed Rate Cuts and Geopolitical Risks?Gold has outperformed the broader U.S. stock market this year, with analysts predicting further gains as the Federal Reserve nears rate cuts. Gold surged to a new record high of over $2,500 per ounce, and some experts forecast it could reach $3,000 next year. Key drivers include potential Fed easing, geopolitical uncertainties, and increased demand from central banks diversifying away from the U.S. dollar. As interest rates decline, gold’s appeal as a safe-haven asset continues to grow.

Bitcoin Fortune Teller Update After the market bloodbath this weekend,

CRYPTOCAP:BTC closed liquidity at GETTEX:54K giving us a bullish setup for the short-time being.

Barring war breaking out between Iran / Israel, I expect a rally to ~$59,5 to be rejected where we then make our way down to close liquidity and form a double bottom ~$50,5 going into RATE CUTS on September 18th.

Does the Market Rally When the Fed Begins to Cut Rates?The relationship between rate cuts and the stock market, as illustrated in the provided graph, shows that major market declines often occur after the Federal Reserve pivots to lower interest rates. This pattern is evident in historical instances where the Fed's rate cuts were followed by significant drops in the S&P 500. Several factors contribute to this phenomenon, which are crucial for investors to understand.

Economic Weakness:

Rate cuts typically respond to economic slowdown or anticipated recession.

Each instance of the Fed pivoting to lower rates (1969, 1973, 1981, 2000, 2007, 2019) corresponds to significant market declines soon after.

Rate cuts signal concerns about economic health, causing investors to lose confidence, as reflected in the graph.

Delayed Impact:

Rate cuts do not immediately stimulate the economy; it takes time for their effects to propagate.

The graph shows that the majority of the market decline occurs after the Fed's pivot, indicating that initial rate cuts were insufficient to halt the downturn.

During this lag period, the market may continue to decline as economic data reflects ongoing weakness.

Investor Sentiment:

Rate cuts can trigger fear among investors, who interpret the move as an indication of severe economic issues.

The graph shows substantial percentage drops in the S&P 500 following each pivot, demonstrating how negative sentiment can exacerbate declines.

The fear of a worsening economy leads to a sell-off in stocks, contributing to further market drops.

Credit Conditions:

During economic stress, banks may tighten lending standards, reducing the effectiveness of rate cuts.

Post-rate cut periods in the graph align with times of economic stress, where credit conditions likely tightened.

Businesses and consumers may not be able to take advantage of lower borrowing costs, limiting economic recovery and impacting the market negatively.

Historical examples such as the crises in 2000 and 2007 highlight substantial market drops after rate cuts, as seen in the graph. In both cases, the rate cuts responded to bursting bubbles (tech bubble in 2000, housing bubble in 2007), and the economic fallout was too severe for rate cuts to provide immediate relief. The graph underscores that while rate cuts aim to stimulate the economy, they often follow significant economic downturns. Investors should be cautious, recognizing that initial market reactions to rate cuts can be negative due to perceived economic weakness, delayed policy impact, and deteriorating sentiment.

Double Bottom w/ Break of Confirmation!! - EGHere I have EUR/GBP on the Daily chart!

The Lows @ .83972 & .83827 seem to have found enough Support in this Zone since its last visit back in the summer of 2022!

After BOE decided to cut their Interest Rates to 5% on Thursday, we see the end of the week gave us quite a Bullish close above the Lower High @ .8490 CONFIRMING the Double Bottom Reversal Pattern!!

With the:

-Divergence of Price vs RSI @ Level of Support

-Break of Structure from LL to HH

-and Price on RSI Above 50

*All that's left is to wait for Price to retrace back down to the .8490 area where the Break of Confirmation of Pattern happened for some potential Buy Opportunities!!

ZW: Wheat to Rebound with Fed Rate Cuts and Dollar DevaluationCBOT: Wheat Futures ( CBOT:ZW1! )

On Friday, July 12th, the United States Department of Agriculture (USDA) released its latest World Agricultural Supply and Demand Estimates (WASDE).

(Note: The WASDE report is published monthly and provides annual forecasts for global supply and use of wheat, rice, coarse grains, oilseeds and cotton, as well as the U.S. supply and use of sugar, meat, poultry eggs and milk. Today’s analysis will focus on wheat.)

USDA’s balance sheet update for the 2023/24 US wheat crop showed a carryout of 702 million bushels (mbu), as exports were taken to 707 mbu. For the new crop, USDA raises the wheat stocks by 98 mbu to 856 mbu. Some of the increases was a larger carryover, but most came in the form of higher production.

USDA raised the wheat crop by 133 mbu to 2.008 billion bushels (bbu). Harvested acres was raised from 38.0 to 38.8 million acres. Yield per harvested acres was raised by 2.4 bushels per acre (bpa) to 51.8 bpa. Winter wheat was up 46 mbu to 1.341 bbu, as the Hard Red Wheat (HRW) total was projected at 763 mbu (+37 mbu), with Soft Red Wheat (SRW) at 344 mbu (+2 mbu) and white winter at 234 mbu (+8 mbu). The initial other spring wheat figure was tallied at 577.8 mbu, more than 56 mbu above market estimate.

Global wheat stocks were raised by 4.97 million metric tons (MMT) to 257.24 MMT, with a bulk from the US, as both Canadian and Argentine wheat production were raised.

Wheat Futures drop across three futures markets, CBOT, KCBT and MGEX, after WASDE shows higher production.

• Jul 24 CBOT Wheat closed at $5.38, down 16 1/4 cents,

• Sep 24 CBOT Wheat closed at $5.50 3/4, down 20 1/2 cents,

• Jul 24 KCBT Wheat closed at $6.04, up 12 3/4 cents,

• Sep 24 KCBT Wheat closed at $5.67 3/4, down 16 cents,

• Jul 24 MGEX Wheat closed at $6.21, unchanged,

• Sep 24 MGEX Wheat closed at $5.97 1/2, down 21 1/4 cents

The weekly CFTC Commitment of Traders report showed CBOT wheat speculative traders net short 69,137 contracts as of July 9th, a reduction of 4,837-contract on the week. In KC wheat, they were trimming 2,292 contracts to 40,811 contracts by July 9th.

In my opinion, the futures market has quickly absorbed the bearish WASDE report. With wheat trading at historical low levels, a rebound may be brewing in the next few months.

Traditionally, August is the time to hedge weather risks in agricultural commodities. If summer weather in the Midwest and Great Plain regions turns out to be less than ideal, the previously expected higher yield will have to be adjusted downward, reducing total production.

In today’s market, how could the expected Fed rate cuts impact commodities?

Last Tuesday, July 9th, Fed Chair Jerome Powell appeared in a Senate Banking, Housing, and Urban Affairs Committee hearing on Capitol Hill.

The Fed Chair expressed concern that holding interest rates too high for too long could jeopardize economic growth. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

“At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.”.

The prospect for quicker rate cuts increased immediately after these dovish remarks. According to CME Group FedWatch Tool, the probability of a 25bp rate cut in September is now 90.3%. Futures traders look for 3-4 rate cuts by the end of the year, with a 53.8% probability for the Fed Funds rate lowering to the 4.25%-4.75% range.

(www.cmegroup.com)

Would the lower interest rates be bullish for commodities like wheat?

Firstly, lower interest rates will reduce borrowing costs. This will help business grow, with more jobs, income and consumption coming along the way. At the end, it will help increase the demand for commodities such as wheat.

Secondly, as a major agricultural commodity, wheat is priced in the US dollar and traded in the global market. In previous writings I explained that lower interest rates would result in currency depreciation, as prescribed by the Interest Rate Parity theory (IRP).

For foreign buyers, dollar depreciation means an appreciation of their local currency. The cost of importing wheat will be lowered when converted in local currency. Lower costs help increase the demand for wheat.

Trading with CBOT Wheat Futures

The 3-year price chart for CBOT wheat futures shows three distinguished patterns:

• From February to April 2022, wheat prices nearly doubled from about $7 to $13. This was driven by geopolitical crisis and the fear of global supply shortage.

• From May 2022 to July 2023, the Fed implemented 11 consecutive hikes, which helped cut wheat prices by half to about $6.

• From August 2023 to present, as the Fed kept interest rates unchanged in seven FOMC meetings, wheat prices moved sideways in the $5.50-$7.00 range.

As we can see here, Fed policy and geopolitical crisis have an outsized impact on wheat prices, as compared with fundamental supply and demand.

In my opinion, the supply and demand factors are already priced in the market. However, the impacts from Fed rate cuts and outcome of the upcoming presidential election are not yet fully grasped by the market. The expected Fed loosening cycle would have the opposite effect of the Fed hikes. Wheat prices could potentially move up the $7.00-$9.00 by 2025.

On July 12th, the March 2025 contract of CBOT wheat futures (ZWH5) settled at $5.975 per bushel. Each contract has a notional value of 5,000 bushels, or $29,875 at market prices. Buying (long) or selling (short) one contract requires an initial margin of $2,000 at the time of writing.

CBOT lists 15 monthly contracts of Mar, May, Jul, Sep, and Dec. Wheat traders could take up positions two years from now, for the month of July 2026. Trading on the 3rd or 4th contract month would satisfy the liquidity requirements while allowing time for market-impacting variables to change, based on my experience.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com