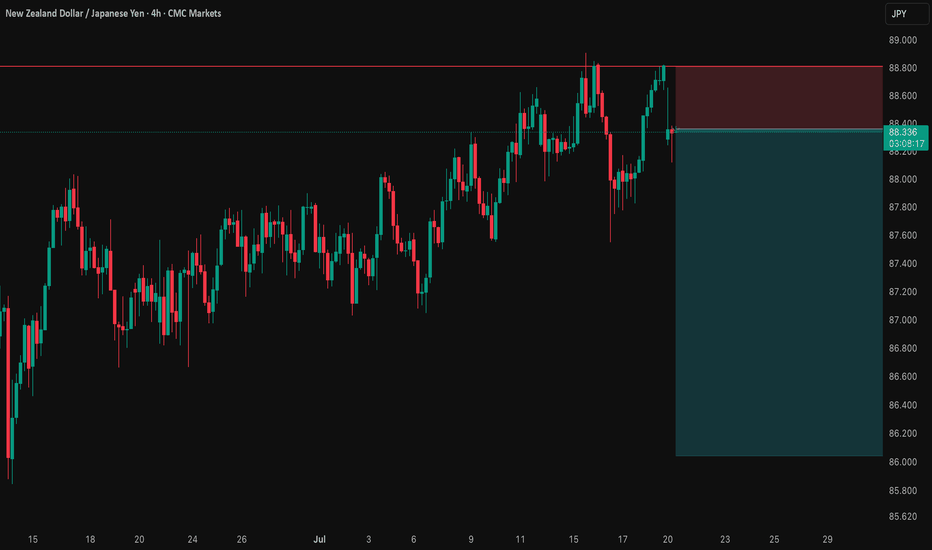

NZD/JPY: A Data-Driven Short SignalBefore I post a trade, I put it through a rigorous, multi-step analysis. Here’s exactly what I did for this NZD/JPY setup to build a data-driven case.

I Started with the 'Why': The Fundamental Story 📰

First, I identified the powerful divergence between the dovish RBNZ and the hawkish BoJ. This gave me my core bearish thesis for the pair.

I Challenged My Idea with Data: The Stress Test 🧠

A good story isn't enough. So, I ran this bearish idea through my mathematical models . My goal was to find any hidden risks and see if the hard data supported my fundamental view.

What My Analysis Revealed: A Warning and a Confirmation ⚠️

The data came back with two critical insights:

Confirmation: The models strongly validated the bearish direction with a high degree of mathematical probability.

Warning: They exposed a hidden danger—a standard entry had a very high probability of getting stopped out in the current market.

I Engineered the Solution: The Optimized Plan 🛠️

This is the most important step. I used these data insights to build a new trade plan from the ground up. The entry, stop loss, and take profit below are not guesses; they are the output of my analysis, specifically designed to navigate the risk the data uncovered.

The result is a trade with a huge 5.15-to-1 Risk-to-Reward ratio , where my fundamental view is now backed by a data-driven execution strategy. Let's get into it. 👇

The Complete Trade Plan

Strategy & Trade Parameters ✅

📉 Pair: NZD/JPY

👉 Direction: Short

⛔️ Entry: 88.35800

🎯 Take Profit: 86.04347

🛡️ Stop Loss: 88.80723

⚖️ Risk-Reward: 5.15

This setup represents my ideal trading approach: forming a strong fundamental thesis and then using disciplined, mathematical analysis to define the execution. The result is a plan where the direction is clear and the risk is precisely managed. Trade safe.

Rbnz

NZD/USD 2 moves away from wiping out June’s rallyThe RBNZ is widely expected to hold the Official Cash Rate at 3.25% this Wednesday.

NZIER’s Shadow Board advises against a cut, noting the economy remains weak but inflation pressures are mixed. Markets see just a 10–15% chance of a cut this week but still price for further easing by October.

NZD/USD has pulled back sharply from 0.6100, with price now possibly consolidating around 0.6000. This area coincides with a key support-turned-resistance level that capped price action in mid-June.

If the pair breaks below 0.5980, the next support sits near 0.5935 – a level that triggered a strong bounce on June 21. A break below that could open the way toward 0.5900 and 0.5860.

On the upside, if the 0.6000 handle holds, short-term resistance lies at 0.6030, with stronger pressure at 0.6065.

NZD/JPY: Bearish Wedge Before RBNZ CatalystThis is a high-conviction trade idea for NZD/JPY , where a perfect storm of technical and fundamental factors is aligning for a significant short opportunity. The setup is clean, the reasoning is strong, and we have a clear catalyst on the horizon. 🚀

Fundamental Analysis 🌪️

The macro picture is the primary driver here, creating a powerful bearish case.

1️⃣ Monetary Policy Divergence (🇳🇿 vs 🇯🇵): This is the core engine of the trade. The Reserve Bank of New Zealand (RBNZ) is dovish, signaling rate cuts amid a fragile domestic economy. In stark contrast, the Bank of Japan (BoJ) is hawkish, having started a historic policy normalization to combat persistent inflation. This fundamental clash is strongly bearish for NZD/JPY.

2️⃣ Risk-Off Catalyst (🇺🇸): The market is nervous ahead of the July 9th US tariff deadline . This uncertainty is creating a classic "risk-off" environment, which typically strengthens the safe-haven JPY and weakens risk-sensitive currencies like the NZD.

3️⃣ The RBNZ Decision (🏦): The main event on July 9. The market expects a "dovish hold," meaning even if rates are unchanged, the forward guidance will likely be very cautious, highlighting economic risks and signaling future cuts. This is the catalyst that could trigger the sell-off.

Technical Analysis 📉

The 4H chart provides crystal-clear confirmation of the fundamental weakness.

1️⃣ Bearish Rising Wedge: Price is being squeezed into a classic bearish reversal pattern. This shows that buying pressure is exhausted, and the market is preparing for a move to the downside.

2️⃣ Key Resistance Zone: The wedge is pushing directly into a heavy supply zone between 87.80 and 88.00 . This area has acted as a firm brick wall 🧱, rejecting multiple attempts to move higher.

3️⃣ RSI Momentum: The RSI below the chart confirms the weakening momentum. It's failing to show strong bullish power, which supports the price action and signals that the uptrend is running out of steam. 💨

The Trade Plan 🎯

Based on this analysis, the plan is to enter with a limit order to get an optimal entry price on a potential final spike into resistance.

Direction: Short (Sell) 📉

Order Type: Limit Sell

Entry: 87.80 📍

Stop Loss: 88.40 🛡️

Take Profit: 86.00 💰

Risk/Reward Ratio: 1:3 ⭐⭐⭐

This setup presents a rare confluence of fundamental divergence, technical weakness, and a clear catalyst.

Trade safe and manage your risk.

New Zealand GDP expected to contract, New Zealand dollar recoverThe New Zealand dollar has posted gains on Wednesday. In the North American session, NZD/USD is trading at 0.6042, up 0.45% on the day. The New Zealand dollar sustained sharp losses a day earlier, declining 0.75%.

The New Zealand economy is in recession and the markets are bracing for a contraction in first-quarter GDP of 0.8%. The economy declined in Q4 2024 by 1.1%.

A weak GDP report would put pressure on the Reserve Bank of New Zealand to reduce interest rates at the next meeting on July 9. The Reserve Bank has been aggressive and lowered rates for a sixth straight time in May to 3.25%, for a total of 225 basis points.

Is the resilient US consumer showing cracks?

US retail sales slumped in May, falling 0.9% m/m. This was well below the revised -0.1% reading in April and worse than the market estimate of -0.7%. Annually, retail sales fell to 3.3%, down sharply from a revised 5.0%.

The monthly retail sales is particularly concerning because it marked a second straight decline. The pre-tariff spike in consumer spending has fizzled as the tariffs have taken effect. Consumers are wary that the tariffs will boost inflation and dampen consumer spending power and concerns about hiring have risen, prompting consumers to batten down the hatches in anticipation of tougher times ahead.

If additional key US data heads lower, this will increase pressure on the Federal Reserve to lower interest rates. The markets have priced in a hold at Wednesday's meeting at practically 100%, with little chance of a rate cut before September.

NZD/USD is testing resistance at 0.6035. Above, there is resistance at 0.6060

0.5990 and 0.5965 and providing support

New Zealand central bank sees less growth, FOMC says it will remThe New Zealand dollar declined as much as 0.67% earlier but has recovered. In the European session, NZDS/USD is trading at 0.5969, up 0.04% on the day.

A day after the Reserve Bank of New Zealand lowered interest rates, Governor Christian Hawkesby testified before a parliamentary committee on Thursday. Hawkesby said the central bank could hold rates in July and that rate decisions would be data-dependent. The Governor said he expected slower global growth would dampen New Zealand's recovery and there was uncertainty around the impact of the US tariffs.

The RBNZ has been aggressive, chopping 225 basis points in the current easing cycle, which has brought the cash rate down to 3.25%, its lowest level in almost three years. At yesterday's meeting, the RBNZ said that the cash rate was currently in a neutral zone, where it neither stimulates nor curbs economic growth.

FOMC minutes: Increasing uncertainly could mean "difficult tradeoffs"

In the FOMC minutes of the May 7 meeting, members expressed concern about the government's fiscal and trade policy. Members said that "uncertainty about the economic outlook had increased further", making it appropriate to remain cautious until these policies became clearer. Members warned that if inflation remained high and growth and employment weakened, the Fed might have to make "difficult tradeoffs".

There was another twist to the Trump tariffs saga as the US Court of International Trade declared the tariffs illegal. The Court ruled that Trump had exceeded his authority by imposing wide-sweeping tariffs against US trading partners. The decision puts a hold on the tariffs, but that may not last long as the US Justice Department has filed an appeal.

New Zealand dollar sharply lower, RBNZ cut expectedThe New Zealand dollar is sharply lower on Tuesday. In the North American session, NZD/USD is trading at 0.5950, down 0.83% on the day. A day earlier, the New Zealand dollar touched a high of 0.6031, its highest level since Oct. 2024.

The Reserve Bank of New Zealand is widely expected to lower rates by a quarter-point to 3.25% on Wednesday. With little doubt about the decision, investors will be focusing on the Reserve Bank's updated forecasts. The markets are looking at another rate cut in July and perhaps one more later in the year, which would lower the cash rate below 3.0%.

The RBNZ has been dealing with a weak domestic economy and a deteriorating outlook for the global economy due to US President Trump's erratic tariff policy. The RBNZ would like to continue trimming rates and restore consumer and business confidence.

New Zealand's inflation was higher than expected in the first quarter at 2.5%, up from 2.2% in Q4 2024. This is within the Bank's inflation target of 1%-3% and means that inflation levels won't prevent the Bank from lowering rates on Wednesday.

US durable goods orders plunges, consumer confidence surges

In the US, Durable Goods Orders declined by 6.3% m/m in April, after a 7.5% gain in March, which was the fastest pace of growth since July 2020. The soft reading managed to beat the market estimate of -7.8%. The Conference Board Consumer Confidence index, which has fallen steadily this year, surged to 98.0 in May, up from 86.0 in April and blowing past the market estimate of 87.0.

We'll hear from more Federal Reserve members on Wednesday, which could provide some insights into the Fed's rate path. The Fed has adopted a wait-and-see stance and is widely expected to hold rates for a fourth straight time at the next meeting on June 18.

NZD/USD has pushed below support at 0.5978 and is testing 0.5955. Below, there is support at 0.5928

There is resistance at 0.6005 and 0.6028

RBNZ rate decision coming upKeep your eyes on the rate cut tomorrow by the RBNZ and on the NZD reaction to all of it. We have an interesting technical set up building on FX_IDC:NZDUSD . Let's dig in...

MARKETSCOM:NZDUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

New Zealand dollar jumps as inflation expectations hits 1-year hThe New Zealand dollar is in positive territory on Friday. In the European session, NZD/USD is trading at 0.5906, up 0.54% on the day.

New Zealand's two-year inflation expectations climbed to 2.29% in the second quarter, up from 2.06% in Q1, its highest level since last May. The survey also predicted that one-year inflation expectations would rise to 2.41% in Q2, up from 2.15% in the first quarter, also the highest since last May.

The rise in inflation expectations can be viewed as a "Trump bump" as consumers are concerned that US tariffs will lead to higher inflation. For the Reserve Bank of New Zealand, the increase is a reminder of the upside risks for inflation, but at the same time inflation and inflation expectations are within the Reserve Bank's target range of 1%-3%.

With inflation largely contained, the RBNZ is looking to continue lowering interest rates in order to boost the economy. The RBNZ cut rates last month to 3.5% from 3.75% and is expected to cut rates again at the May 28 meeting.

The problem for Bank policymakers is the uncertainty over President Trump's erratic trade policy, which has made it tricky to make growth and inflation forecasts. The US and China engaged in a tit-for-tat tariff war which resulted in massive tariffs, only to suddenly reach a temporary agreement to slash tariffs. Will this lead to a permanent agreement or will the US and China resume their damaging trade war? It's unclear what happens next, especially given the unpredictability of Donald Trump.

The US wraps up the week with UoM consumer sentiment and inflation expectations for May. Consumer sentiment is expected to improve to 53.4 from an upwardly revised 52.2. Inflation expectations surged in April to 6.5% from 4.7% and are projected to rise to 6.6%, as consumers remain anxious about inflation.

NZD/USD has pushed above resistance at 0.5885 and is testing resistance at 0.5909. Above, there is resistance at 0.5940

0.5854 and 0.5830 are the next support levels

New Zealand dollar extends losses, inflation expectations expectNew Zealand releases inflation expectations for the first quarter on Friday. Inflation expectations can manifest into actual inflation and are considered a market-mover. Over the past three quarters, inflation expectations have hovered around the 2% level, which is the mid-point of the Reserve Bank of New Zealand's target band of 1%-3%. However, inflation expectations are expected to climb to 2.4% in the second quarter, which could complicate the Reserve Bank's plans to further trim interest rates.

New Zealand consumer inflation rose 2.5% y/y in the first quarter, up from 2.5% in Q4 2024 and above the market estimate of 2.2%. This is comfortably within the RBNZ target band and enabled the Bank to cut rates to 3.5% from 3.75% last month.

The central bank left the door open to further rate cuts at the April meeting, stressing the risk to the New Zealand economy due to rising global trade tensions. New Zealand's largest trading partner is China and the temporary agreement between the US and China to slash tariffs is good news for New Zealand's export sector. The Reserve Bank meets next on May 28.

US retail sales in April posted a weak gain of 0.1% m/m. This was well below the upwardly revised 1.7% gain in March but edged above the market estimate of 0%. There was also soft data from the inflation front. Producer Price inflation declined 0.5% in April, down from the upwardly revised 0% in March and below the market estimate of 0.2%.

The Federal Reserve is virtually certain to hold rates at the June 30 meeting, but there is a 36% chance of a rate cut in July and a 50% likelihood in September, according to CME's FedWatch. Fed Chair Powell has adopted a wait-and-see stance due to the uncertainty over US trade policy. With inflation largely under control and the labor market in solid shape, Powell is no rush to lower rates.

NZD/USD is testing support at 0.5871. Below, there is support at 0.5844

There is resistance at 0.5920 and 0.5947

New Zealand dollar steady ahead of employment dataThe New Zealand dollar is showing limited movement on Tuesday. In the European session, NZD/USD is trading at 0.5970, up 0.05% on the day. With no key events in New Zealand or the US today, we can expect a quiet day for the New Zealand dollar.

New Zealand releases the employment report for the first quarter on Wednesday. The labor market is showing signs of weakening, with employment change posting two straight declines.

The markets are projecting a slight improvement, with an estimate of 0.1% for Q1.

The unemployment rate has accelerated for seven consecutive quarters and is expected to rise to 5.3% from 5.1% in Q4 2025. This would be the highest level since Q4 2016 and would support the case for the Reserve Bank of New Zealand to lower rates for a sixth straight time at the May 28 meeting. At the April meeting, members warned that the tariffs created downside risks for growth and inflation in New Zealand.

The RBNZ would prefer to continue lowering interest rates in increments of 25-basis points in order to boost the weak economy. Inflation is comfortably within the 1-3% target band but there are upside risks to inflation, especially with global trade tensions escalating due to US tariffs.

In the US, the Federal Reserve is virtually certain to maintain interest rates at 4.25-4.5% on Wednesday. The meeting will be interesting as Fed Chair Powell is expected to push back against pressure from President Trump to lower rates. The Fed is likely to remain on the sidelines until the uncertainty over US tariffs becomes more clear. Trump's zig-zags over tariffs has triggered wild swings in the financial markets, but Trump has said some trade agreements will be announced soon.

NZD/USD is testing support at 0.5968. Below, there is support at 0.5940

There is resistance at 0.5995 and 0.6023

New Zealand's central bank expected to lower rates by a quarter-The New Zealand dollar has rebounded on Tuesday. NZD/USD is trading at 0.5615, up 1.3% on the day. This follows a 5% plunge over the past two days.

The Reserve Bank of New Zealand is widely expected to lower interest rates by a quarter-point at its rate meeting on Wednesday. The markets have priced in a quarter-point cut at 75% and a jumbo half-point cut at 25%. The RBNZ slashed rates by a half-point in February, a response to weak economic growth and an inflation rate of around 2%, the midpoint of its target band.

The market meltdown and escalation in trade tensions due to new US tariffs could force the RBNZ to lower rates faster and deeper than previously expected. There is massive uncertainty in the air and the central bank will have to re-evaluate inflation and growth expectations, given the tariff turmoil.

There is growing talk of a global recession, which would badly hurt New Zealand's export-reliant economy. China is New Zealand's largest trade partner and the escalating trade tensions between the US and China could turn into a New Zealand nightmare. China has imposed 34% reciprocal tariffs on the US, drawing a threat from President Trump that he will counter with a 50% tariff if the Chinese tariff is not removed.

The RBNZ is dealing with the tariff crisis without Governor Adrian Orr, who suddenly resigned last month in the middle of his five-year term. The government has appointed Christian Hawkesby as Governor for a six-month term, after serving as the acting governor after Orr resigned.

RBNZ rate decision coming upWe are keeping a close eye on the RBNZ interest rate decision and if it will stick to its 25bps cut, or not. Let's dig in.

FX_IDC:NZDUSD

MARKETSCOM:NZDUSD

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

AUD and NZD: WTH? RBNZ now in focusRisk aversion intensified on Friday, sending the Australian dollar down 4.56% and the New Zealand dollar 3.53% lower.

The declines followed a move by US President Donald Trump to impose a 10% tariff on imports from both Australia and New Zealand. Australian Prime Minister Anthony Albanese confirmed there would be no retaliation, noting the US represents less than 5% of Australia’s export market. New Zealand, with a higher 12% exposure, also ruled out countermeasures.

For the New Zealand dollar, markets will now be focused on this week’s Reserve Bank of New Zealand decision, where a 25-basis point rate cut is widely expected. Barring further tariff news, this could be the most important event determining whether this sell-off continues.

RBNZ lowers rates by 50 bps, NZ dollar gains groundThe New Zealand dollar has posted gains on Wednesday. NZD/USD is trading at 0.5721 in the European session, up 0.31% on the day.

The Reserve Bank of New Zealand slashed the cash rate by 50 basis points, bringing the cash rate to 3.75%. The markets had priced in the cut at 90% so there was no surprise at the jumbo cut. This lowered the cash rate to its lowest level since Nov. 2022. The RBNZ demonstrated again that it can be aggressive, as it has cut rates by 175 basis points since the easing cycle started last August.

The New Zealand dollar is stronger on Wednesday, which is somewhat surprising, given the jumbo rate cut and the RBNZ's signal that further rate cuts are on the way in the coming months.

The rate statement noted that the members were confident lowering rates as CPI remained near the midpoint of the 1%-3% target band. At the same time, members expressed concern that economic activity in New Zealand and abroad were "subdued" which posed a risk to economic growth.

The statement also made a brief mention of "trade restrictions" which could dampen economic growth. No mention was made of US President Trump's tariff threats but policymakers are clearly concerned that US tariffs, even if not aimed directly at New Zealand, could chill the global economy and hurt the country's key export sector.

In a follow-up press conference, Governor Adrian Orr said that the Bank expected to lower the cash rate to 3% by the end of the year. This forecast was lower than the November projection of 3.2% by year's end. The central bank is expected to deliver smaller rate cuts of 25-bps in the coming months.

NZD/USD is testing resistance at 0.5713. Above, there is resistance at 0.5731

0.5686 and 0.5668 and the next support levels

AUD/NZD could be veering towards a breakoutThe RBNZ just delivered their third 50bp cut in a row, and they have left the door open for further easing this year. And given I expect the RBNZ's cash rate to remain beneath the RBA's for the remainder of the year, it could pave the way for a bullish breakout on AUD/NZD.

Matt Simpson, Market Analyst at City Index and Forex.com

New Zealand dollar slips ahead of expected RBNZ cutThe New Zealand dollar is sharply lower on Tuesday. NZD/USD is trading at 0.5700 in the North American session, down 0.62% on the day.

The Reserve Bank of New Zealand meets on Wednesday for the first time this year. The RBNZ lowered rates by a half-point at the last meeting on Nov. 27 and the markets have priced in another half-point cut on Wednesday at 90%, which would bring the cash rate down to 3.75%. The central bank held rates for over a year but has aggressively cut rates by 125 basis points in the current easing cycle.

The RBNZ has telegraphed its plan to cut rates by a half-point on Wednesday and we could see a limited response from the New Zealand dollar, since the decision has been priced in. Still, the US/New Zealand rate differential will widen and that could spell headwinds in the near term for the New Zealand dollar, which plunged 13% in the fourth quarter 2024 but has gained 1.9% since Jan 1.

What can we expect from the RBNZ after tomorrow's anticipated rate cut? The RBNZ's updated forecasts are expected to show the cash rate declining towards 3 percent, but in smaller increments of quarter-point cuts. This will depend on the strength of the economy and the direction of inflation. Another factor which could affect the rate path is the new US administration which has already started imposing tariffs.

New Zealand is vulnerable to US tariffs as the US is its second-largest trading partner, accounting for about 12% of New Zealand exports. Even if the US does not target New Zealand with tariffs, the trade war between the US and China has clouded the inflation outlook and is will likely hamper global growth.

NZD/USD is putting pressure on support at 0.5691. Below, there is support at 0.5643

0.5781 and 0.5829 and the next resistance lines

Massive week for Aussie and Kiwi markets The Reserve Bank of Australia’s first meeting of the year is days away with money markets pricing in an 86% chance of a 25bps cut and a 14% chance that rates unchanged.

However, Australia Finacial Review’s John Kehoe suggests market expectations of a 90% probability for a cut may be overstated, arguing the decision is closer to a 50/50 call.

If the RBA cuts rates on Tuesday, it could support the government's message that cost-of-living pressures are easing and could lead to an early election announcement. If rates remain unchanged, the prime minister may delay the election until mid-April or May, hoping for a cut at the RBA’s next meeting on April 1.

Meanwhile, the RBNZ is expected to cut rates this week, with markets pricing a 68% chance of a 50bps cut and a 32% chance of a 25bps reduction. A Reuters poll of 33 economists found 32 expecting a 50bps cut. However, ASB chief economist Nick Tuffley anticipates smaller 25bps cuts in April and May instead.

Watch NZDUSD and AUDUSD because of RBNZ & RBA next weekThe RBA and the RBNZ are expected to deliver rate decisions next week, so there might be an slight opportunity for the bulls to capture a move higher, before those Banks deliver. Also, the current weakness in DXY could give a small helping hand for the bulls. That said, the positivity might be short-lived, as both Banks are expected to announce cuts, with the RBNZ potentially going for the bigger 50 bps cut.

Let's see what happens.

MARKETSCOM:AUDUSD

MARKETSCOM:NZDUSD

FX_IDC:AUDUSD

FX_IDC:NZDUSD

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

NZDUSD - The uptrend of the dollar is over?!The NZDUSD currency pair is below the EMA200 and EMA50 in the 4-hour timeframe. In case of upward correction, we can see the supply zone and sell within that range with appropriate risk reward. A valid break of the support area will provide us with the continuation of the downward path of this currency pair.

At the beginning of 2025, the US dollar has continued its upward trajectory, solidifying its position as one of the leading global currencies. After delivering a strong performance in 2023 and 2024, the dollar has now risen by more than 1% against the euro and the British pound, outpacing other major currencies.

From an economic news perspective, recent reports have had little impact on the market. While data on jobless claims, affected by holiday factors, were assessed positively, reports such as construction spending and manufacturing PMI fell short of expectations. However, these statistics failed to create significant market movement, with US Treasury yields seeing only a slight uptick.

According to data published by S&P Global, the US manufacturing PMI for December 2024 stood at 49.4, a slight decline from 49.7 in November. This figure remains below the 50-point threshold, indicating contraction in manufacturing activity. Nonetheless, there has been a slight recovery from the mid-month figure of 48.3.

Manufacturing output in November declined for the fourth consecutive month, hitting its lowest level in 18 months. Additionally, new orders continued to fall, though at a slower pace compared to previous months. However, export orders experienced a steeper decline, primarily driven by economic weakness in Europe and Australia.

In the employment sector, there has been modest yet positive growth for the second consecutive month, reflecting manufacturers’ efforts to retain their workforce. Input cost inflation has reached its highest level since August 2024, largely due to concerns over trade tariffs and potential protectionist policies. Approximately 25% of firms attributed their increased purchases to tariff threats, highlighting concerns over the inflationary effects of such policies.

Despite current challenges, manufacturers are increasingly optimistic about the future. This optimism, which has reached its highest level in two and a half years, stems from reduced uncertainties following the elections and positive expectations of stronger economic growth and supportive government policies in 2025. However, the gap between current production levels and future expectations has reached its widest point in a decade, excluding the COVID-19 pandemic period.

The main driver behind the strength of the US dollar is capital inflows. While the US economy appears robust, this alone does not explain the dollar’s growth. A confluence of positive factors has made US assets attractive, with the country’s stock markets outperforming other global markets. Currently, a significant portion of global capital formation is concentrated in the US dollar and its markets.

Nevertheless, risks such as rising tariffs or restrictive fiscal policies could alter the dollar’s trajectory. For now, the market shows little concern about the Republican-led Congress, and the US dollar continues to assert its dominance in global markets.

Donald Trump, the US President-elect, recently tweeted that tariffs have brought immense wealth to the country and that he plans to continue these policies after assuming office on January 20. Trump also referenced border issues, calling Joe Biden the “worst president in US history.”

The chief asset strategist at HSBC Bank highlighted the hawkish messages from the Federal Reserve’s December meeting as a cause for concern. January is expected to be highly volatile, but these fluctuations could present intriguing investment opportunities.

New Zealand slides after Fed rate cut, NZ GDP nextThe New Zealand dollar has declined sharply on Wednesday. In the North American session, NZD/USD is trading at 0.5685, down 1.2% on the day. The New Zealand dollar has been in freefall, plunging 11.6% since Oct. 1.

New Zealand's economy is expected to contract in the third quarter by 0.4% q/q, after a 0.2% decline in Q2. If the economy contracted for back-to-back quarters as expected, it would mean that the economy is in a technical recession. Construction and manufacturing activity declined in the third quarter and a severe power crisis led to a decrease exports, all of which dampened GDP.

The Reserve Bank of New Zealand slashed rates by 50 basis points last month, lowering the cash rate to 4.25%. The central bank has trimmed rates by 125 bp since August but the economy is clearly in need of further cuts. Inflation is back within the target of 1% to 3% and we can expect another cut at the next meeting in February barring a surprise jump in inflation.

There wasn't much excitement around today's Federal Reserve meeting, as the market had priced in a quarter-point cut at close to 100%. This is exactly what happened, as the Fed cut rates for a third time this year. The Fed signaled that it expected to cut rates only two times in 2025, lower than previous projections of four rate cuts. With the US economy in solid shape and the downswing in inflation stalled, the Fed can afford to take its time before the next rate cut.

The market will hear from Fed Chair Powell shortly. Powell could reiterate that the Fed plans to cut rates "gradually", which means modest cuts of 25 basis points.

NZD/USD is testing support at 0.5715. Next, there is support at 0.5665

There is resistance at 0.5801 and 0.5849

NZD/USD price action: kiwi softens amid economic uncertaintyThe NZD/USD pair fell to 0.57592, reflecting significant pressure from the Reserve Bank of New Zealand's (RBNZ) ongoing monetary easing strategy, which includes recent interest rate cuts and the potential for further reductions in 2025. This easing is meant to stimulate New Zealand's economic activity by boosting consumer spending and investment. However, the growing divergence between New Zealand's and the U.S.'s monetary policies could lead to additional depreciation of the kiwi. The Federal Reserve's consideration of interest rate hikes, amid rising U.S. inflation expectations, strengthens the U.S. dollar, potentially attracting global investors seeking better returns and causing capital outflows from New Zealand. These factors could further pressure the NZD. Meanwhile, China's upcoming economic stimuli, expected to be announced at the annual Politburo conference, could positively impact the kiwi due to New Zealand's strong trade ties with China. Additionally, upcoming U.S. inflation data will likely influence market expectations regarding future Fed actions, which could further shape NZD/USD dynamics. Traders should prepare for volatility in the NZD/USD pair as these global economic developments unfold.

Bullish momentum before the Interest Rate decision by RBNZTomorrow the 26th of November we have the RBNZ Interest Rate decision which it is 90% secure that they will decrease the interest rate from RBNZ with 0.25% , these twenty five basis points should be enough for us to see a Bullish swing trade generated on the GBP/NZD

Current Position would be with two Take profits

First level - 2.15400

Second level - 2.16100

GBPNZD - The pound, in relative peace!The GBPNZD currency pair is located between EMA200 and EMA50 in the 4H timeframe and has left its downward channel. In case of a downward correction, we can see demand zone and buy this currency pair in that zone with a suitable risk reward.

According to recent data, the UK’s economic indicators have shown various changes. M4 money supply, a key economic measure, has declined by 0.1%, compared to the previous figure of 0.6%. This drop may reflect reduced liquidity in the economy.

In the area of consumer credit, the Bank of England reported that this metric reached £1.098 billion, lower than the forecast of £1.3 billion and the previous figure of £1.231 billion. This may indicate a decline in consumer demand for credit.

Meanwhile, significant growth has been observed in the mortgage sector. Mortgage lending rose to £3.435 billion, surpassing the forecast of £2.7 billion and the previous figure of £2.541 billion. This increase suggests an improvement in the housing market and growing demand for mortgages.

Additionally, the number of approved mortgages reached 68,303, exceeding the forecast of 64,500 and the previous figure of 65,647. This growth further highlights increased confidence and momentum in the housing market.

Andrew Bailey, the Governor of the Bank of England, has addressed the financial and economic state of the UK, highlighting key concerns. He warned that price corrections could disrupt financing but expressed confidence that households and businesses would remain resilient against economic challenges.

He also predicted that the UK’s economic growth would continue “sustainably.” Bailey pointed to heightened global risks and uncertainties while emphasizing that there is no conflict between financial stability and economic growth. Additionally, he noted that geopolitical risks remain elevated.

According to Bloomberg and a CBI survey, tax pressures on UK businesses have caused a significant decline in the private sector. For the first time in two years, the budget has been identified as the main reason for reduced business activity.

Companies have warned that hiring plans are at their weakest level since the COVID pandemic. Business activity in the UK has been declining for the first time in over two years as firms reduced jobs and limited investments following the October budget. According to the Confederation of British Industry’s (CBI) monthly growth index, a £26 billion ($33 billion) increase in payroll taxes and prolonged uncertainty caused by a three-month wait for the next budget after the Labour Party’s decisive victory in the July 4 election have significantly impacted private sector sentiment.

The UK plans to review the design of its new labor survey in the spring. The Office for National Statistics (ONS) reported that overall employment levels are now 313,000 higher than before the COVID pandemic. The economic inactivity rate has decreased by 0.1% to 22.1%, while the unemployment rate has remained steady at around 4.2%. Employment rates for the period from April to June 2024 increased by 0.1%, reaching 74.6%.