Royal Dutch Shell DilemmaI have no strong opinion with respect to which way Royal Dutch Shell may go next week. Tanks are getting full everywhere but on the other hand several European markets are now starting to relax the temporary measures that have been put in place because of Covid-19. This being said it's also clear we'll be looking at several months of continued measures a full lift of measures will not happen before late summer (at best).

RDSA

DEAD CHEAP OIL SHARES - Time To Buy!Hi traders.

Following the turmoil with oil prices falling globally as demand for oil weakens, I am planning on purchasing shares in certain oil firms. One of these firms include Royal Dutch Shell (RDS.A). As oil prices are dwindling down, I would expect the earnings report released towards the end of April to be terrible news for the firm. Thus, I would ideally buy shares at low prices, to ride it on the upside wave as the market recovers from the pandemic. Entries from the lows made from during the pandemic could prove to be extremely profitable in the long term.

This is just technical analysis . Do not follow this trade blindly!

If you managed to read it this far down, thanks for reading this! If you could, please do offer your ideas & perspectives on this pair. Buy or Sell and why? Additionally, drop me your charts for it, that'd be great so I can see where you are coming from.

Please drop a follow! I need reputation points!!

Tried to be smart at the start of the year. On 3 Jan I bought some RDSA stock expecting things to heat up in the ME since the Iranian General got drone striked in Irak. Also, there could have been another Benghazi situation in Irak.

Based on this news I decided to buy RDSA a dutch, vertically integrated oil giant that is not very exposed to the ME and could do well if the oil would be trading high. Moreover, after good econ data in the US worldwide econ growth seemed to be trending up or at least stable.

At that time WTI was double what it is today, 63 US.

Fast forward to today :

Now, well, shit hit the fan.💩

End of January we got news of the Wuhan Virus. 🦠🦠

the Wuhan virus has now put Italy on lockdown and travel is being cancelled all over Europe. not good for oil demand. 🛢

9th of march we see oil prices at 30 US.

This is because the OPEC cartel decided over the weekend not to cut production (to limit supply and hence get a better price).

RDSA would turn a nice profit at 60 USD oil. at 30 USD its not.

the current drawdown in position is now close to 42%. Quite painful.

Now the situation is very ugly and the Balance sheet is under pressure. Is buying the Dip a good Idea? Hard to say.

I do doubt that the buyback program or dividend will stay the same.

Another major oil company owned by mr. Buffet has cut its dividend today from .79 to .11 (that is a solid 86% cut).

Shell RDSA Bargain buy nowWith P/E ratio at multi year lows, too much fear in the market, stay calm and pick the value stocks for long term investment.

Shell amongst one of them.

LONG RDS.AExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

Royal Dutch Shell Stock Price To SkyRocket In WeeksShell's stock price is now bullish. In a couple of weeks, the price could rally up to 2391 and possibly pullback to re-test the weekly support to commence another uptrend to above 2500

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

LONG RDSAExpecting bounce from extremely oversold weekly and daily levels. If stop breached, be prepared to catch new daily reversal on lower levels with a tight stop.

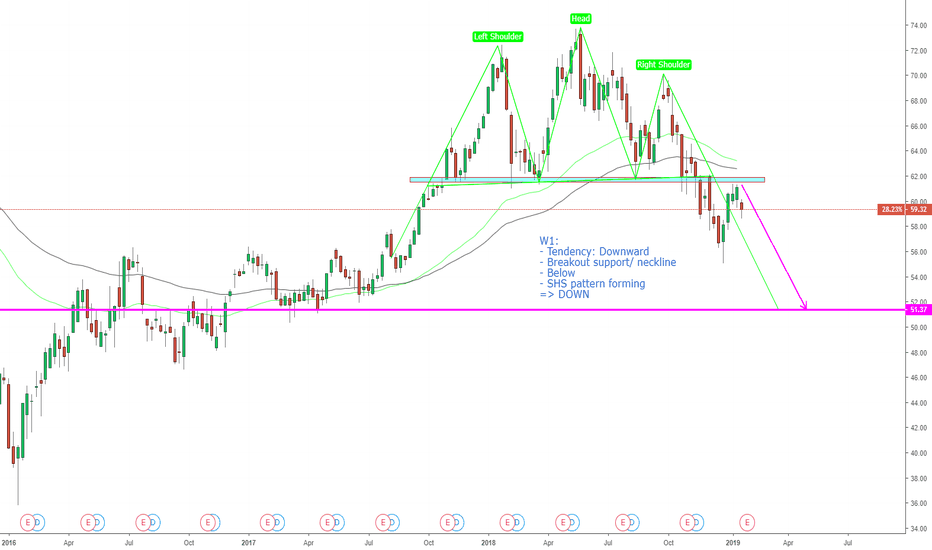

RDS.A, SHS pattern forming: SellRDS.A, SHS pattern forming: Sell

W1:

- Tendency: Downward

- Breakout support/ neckline

- Below

- SHS pattern forming

=> DOWN

RDS.A, SHS pattern forming: SellRDS.A, SHS pattern forming: Sell

W1:

- Tendency: Downward

- Breakout support/ neckline

- Below

- SHS pattern forming

=> DOWN

ROYAL DUTCH SHELL PLC (RDS.A): Impulse Waves On The Way?Find Winning Trades In Seconds >> efcindicator.com (Special Discount)

After an ABC correction, the S1 support was able to handle the fall. It seems that we are already starting a reversal.

Exxon_(NYSE: XOM)_May_14_2018The Exxon stock suffered setbacks after the Q1 earnings report where it emerged that the revenue did not grow in line with rising oil prices. Furthermore, the debt burden was quite huge at over USD 30 billion. Compared to competitors such as Chevron, Royal Dutch Shell, BP, XOM was lagging in key metrics.

This triggered a sell-off that brought the stock price to almost 2 year lows since oil prices crashed. Now the stock has surged past two key support/ resistance levels and there seems to be a bullish support underneath. However, if the oil price rally does not continue, I expect XOM to fall to $75-$80 trading range. On the other hand, if the oil price stays at current levels or move higher (which I doubt as the oil market itself has fundamentally changed; lot more focus on renewables and with shale oil, it is beneficial for the producers to just keep pumping more), I am confident that XOM will be soon staring at $90.

I am bullish on XOM in the long term. In the near term, I would wait to see if the price holds up at the key support level before taking on a position around $79-80. I will also wait to confirm that the slope of the 200 day SMA turns positive. The 20 day SMA has crossed the 50 day SMA in a bullish manner. For the confirmation of a long term bullish trend all three SMA need to have a positive slope with the short term SMA crossing the long term SMA.

RDS.A - Inverse Head and Shoulders PatternA pretty clear inverse head and shoulders pattern has formed, it's a little cleaner on the weekly time frame. I will be watching for a break above the neckline for a possible long position.

RDSA in the money put/shortwith recent fluctuations in the shell i expect a comperable swingback to the long turn support. as such a oppertunity arises to make money through going short or buying a in the money put at 24.6. i would like to hold this put/short till januari or februari.

While aex might hit a al time high coming kalander year, i expect a pullback around christmas.

Royal Dutch Shell trendline holdRDS bounced off the trendline support by closing above it. I am expecting a bounce or breakout from this resistance/support area we current are at.

HIGH VOL: KEEP WATCHING!!!Look guys, this is the same Fib retracement that has HELD since the Jan-Feb selloff. Do not take my word for it. Look at my previous predictions, load the new data, and see how much money was made.

MPC has had a history of bucking the market. When SPX was down 2%, this was down 7%. When SPX was up 3%, this was up over 8.5%. This is a lower liquidity, higher volatility play.

I am NEUTRAL on MPC. To be honest, I've put no money into for a long time. Money could have been made straddling the 2nd fib level, but the reaction to Brexit (not the market reaction to Brexit itself) has caused everybody to look at everything closer, and rightly so.)

Here's what we know: MPC is range-bound in the 2nd fib level. We also know it's good for a 8% pop or drop in a one session. Is that within your risk tolerance?? It's not within mine.

Conclusion: IF YOU DO NOT HAVE TO TRADE, DO NOT TRADE. I honestly would not look at this stock until after earnings (July 28th). That will give the market plenty of time to digest new capital inflows from stock buy-backs, and allow for a reaction that may be based on technicals vs. fundamentals.

There is money to be made, but patience is a virtue. If you see something I don't?....Please share! I need to eat too...