RE

RE5.13.20 RE This video is an important insight to how I look at markets. Do not freak out. I posted this for one of my students but I want other traders to look at it. My two students will know how to handle this, yet there is value to looking at how I would approach this. Intuitively this will be very appealing to many people who are watching, but to others you need to watch a little bit longer and give it a chance. You will not be able to look at one or two charts like this and trade. Do not worry about it, but trawl some of these lines, take a snapshot and reproduce the lines, it will be worthwhile. When I start back to trading, I will not be a signal service and tell you when to trade, but you will have a very good idea of how I look at markets and what I'm probably up to when you get facile enough to draw the lines, and look at structure, price action, and expansion and contraction of markets. 135 patterns, our patterns. When markets move lower, the professionals will run the stops. When markets find a bottom, sellers will try to push the market lower, and if it's a bullish market the sellers will fail to make new lows. We will talk about all the stuff. And if you are a short order cook at a takeout hamburger place, instead of having nightmares of a commercial stove filled with greasy hamburgers, you will start having nightmares about range boxes and 135 reversal patterns, and this will be your clue that you're starting to see the market in a more proficient and accurate way. After all, I think we can agree that some nightmares are better than others.

Overly Bullish Prediction of Our Total Market CapIf the market cap doesn't break down after touching bases with ~212 Billion i could see ~425 Billion by the end of the year.

Possibly an ALT season while BTC crashes, but that's unlikely as of now.

Watch for a break into the lower end of my Pitchfork projection.

Safe trading you guys.

Gold in Re-Accumulation?Gold is expected to be trading in re-accumulation instead of distribution in view of a "Spring" event.

Spring is a exhaustion of supply, indicating demand is expected to be back in control.

A breakout from the creek (resistance), we will expect Gold to trade further.

1st TP: 1,550 level (Previous high +2.618% Fibo)

2nd TP: 1,600 (Whole Number Effect + 4.236$ Fibo Level

Stop: 1,460 (Spring Low)

Potential trade setup: USD/CAD analysisprice has rallied to the downside and broken a key weekly trendline with a significant bearish engulfing candle, however 1.32500 proved to be a minor area of support in which price seems to have sustained this level and could potentially retest the key trendline which is confluence with the ideal 61.8% fib level and MA acting as additional resistance before conceding potential new sellers in the market to further drive price into the lows of targeted zones like 1.32000-1.31000

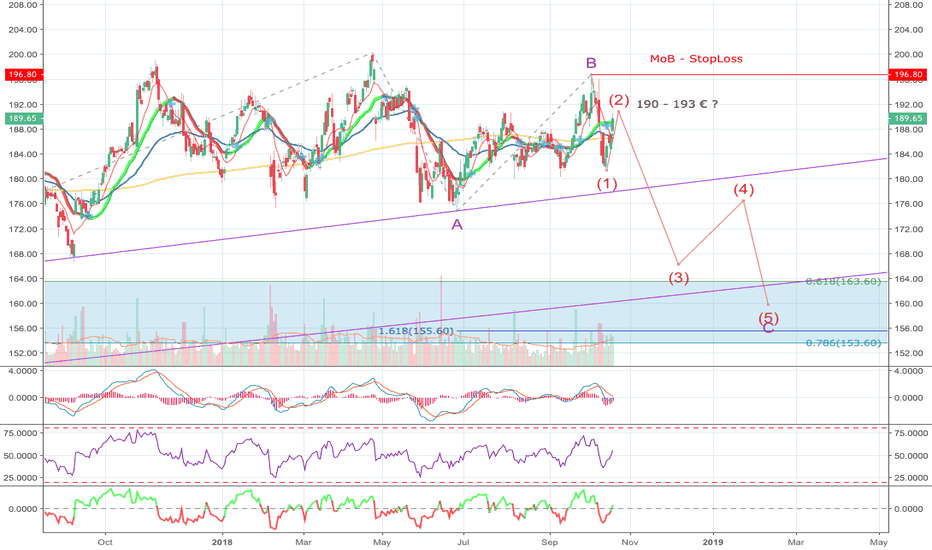

Munich Re - Down - ShortTermThe Pacific Ring of Fire is increasing in activity. The volcanic eruptions and earthquakes and their consequences such as tsunamis have increased significantly compared to the previous two years.

At the same time, the sun is in a solar minimum.

Huge sun holes at the North + South Pole and the equator seem to release relatively many solar winds.

Is there a connection here?

Does the neutrino radiation of the Sun in the Earth change into matter?

Anyway, the increased volcanic eruptions and earthquakes will affect the biggest reinsurer in the world. This should then be reflected accordingly in the chart and move the stock from the current $ 190 to $ 160.

Currently, the chance risk ratio-(CRR)-is very good for this trading plan, as the stop loss at $ 196.80 leads to a-CRR-of 4 to 1.

GBPAUD 4H TRADESPrice is in route toward the 50 sma

Macd has fallen below red signal line

Long Trade

Buy Stop @ 1.8543

Take Profit @ 1.8595

Short Trade

Macd is falling

Sell Stop @ 1.8445

1st Take 1/2 Profit @ 1.8405

2nd Take 1/2 of balance Profit @ 1.8355

3rd Take Profit @ 1.8310

Re-enter trade short on a 15m break-hook-go of the 1st and 2nd take profit levels

Find an appropriate SL

JSE_FSR: First Rand Wyckoff Re-accumulation after DeclineFirst Rand (JSE_FSR) has been undergoing re-accumulation after decline which is the weakest type of re-accumulation. Price has jumped the creek and backed up to the trading range. There is now showing Signs of Strength (SOS) with lower volume. The stock has show prior leadership even thou it is not in the best performing sector. Will be looking for the breakout on the daily or inter day TF to go long.

JSE_CPI: Capitec Wyckoff Re-accumulation after DistributionAfter Capitec's (JSE_CPI) trouble at the beginning of the year the stock has been undergoing re-accumulation. It has jumped the creek and is showing Signs of Strength (SOS). The stock has shown prior leadership. Waiting for a back up to 95500 to go long.

JSE_J200: Top 40 Wyckoff Re-accumulation Johannesburg Stock Exchange (JSE) Top 40 Index has undergone re-accumulation and broken out above the trading range (Jumped the creek). Now it has backed up to the creek and gone into a lower TF re-accumulation. Waiting for signs that it will break the back up range on the daily TF. For now it seems that it is still ranging.