Real

USDBRL - wave b should bring it to range 5.04 - 4.97, before up As predicted in our post of June 3rd, the currency reached the target range and turned up as forecasted, completing the minor wave A. It seems to have finished tracing minute wave a of minor B. If this is the case, the next move should be to the down side up to the range of 5.04 to 4.87 when minute b should complete and minute c should elevate its quote to the range 5.40 to 5.50. FOLLOW SKYLINEPRO TO GET UPDATES.

SHORT VNQ, GET OUT WHILE YOU CANI have been tracking this ETF for a long period of time. We just broke one-year resistance and clear evidence on the fib retracement (specifically level 0.5) shows that the price was weakening.

Technicals aside, there is no reason as to why this should move upwards. This pandemic has taken out firms with high leverage, left more than 25 million Americans jobless, and monetary policy hasn't been as effective because people haven't been going out. Not only that, but the government will also now have to think twice about their spending, as our debt has dramatically increased this year accompanied by a significant drop in tax revenue. Consumers have less income and are looking towards their savings to live through this pandemic.

As we move to reopen, firms will look to deleverage and cut spending. This means that unemployment will most certainly not go back to its previous levels anytime soon and the average American will be in no position to take in debt in the form of a mortgage. I'd even argue to some extent that many will look to sell their homes.

So how does this relate to VNQ? Home prices haven't adjusted because a decrease in supply helped remedy the decrease in demand. If you analyze active listing for the months of April, you will see that in almost every market, there has been a significantly smaller number of homes being listed. Hence, there have been fewer homes being sold at the price pre-virus. These price levels were already thought to be reaching a bubble, but with this sudden change in demand, these prices will correct most certainly. As we look to reopen, people will look to sell their houses. Realtors will push people to sell their homes. This increase in supply accompanied by the withstanding lack of demand will drive housing prices all the way down.

I expect we will see these prices fall in areas with typically less demand than others first. Looking at listings in suburban areas, we are already seeing sellers change listings and drop their price, with still no buyer. It is still early to get out as prices haven't adjusted and many cities haven't reopened.

Now, residential real estate accounts for 14.53% of VNQ. The problem lies in commercial real estate, 40.48% of VNQ. As said before, firms will want to deleverage and cut spending. Not only that, but offices will be dead anytime soon as many companies will want to remain online for the next quarter or two. The only downside will have to do with hospitals and clinics, but as we flatten the curve, the need for hospitals will not be any larger than the need for them a month or two ago. Regarding specialized REITs, there are going to be numbers of people that will not be able to pay rent or will find the price of rent too high in comparison to their income. All in all, all we can see is red!

Hopefully, this doesn't truly occur because many will be hurt by this crash, but it is hard not to warn against the inevitable.

EURO/REAL ( $BRL 1W) we will witness historyIt is said that the market is always right. What the market is telling us right now is to sell real to buy euro. Let’s analyze the chart.

First and foremost, the pattern : A Cup and Handle

That broke out last week. The price is above all EMAs and all my indicators are favoring the upside. Meaning of a strong devaluation of the real against the EURO.

With new ATH the trend is clear ; it is up.

I speculate the next high value base on an Elliot’s Waves Fibonacci extension model.

It is just speculation, my skill with Elliot’s Waves is not that sharp yet. Do not take it as fortune telling.

I’m not a forex trader but if I was one, I know in which direction I would trade the pair EURO/REAL.

As time goes by, I will keep you updated on the evolution of the exchange rate, so make sure to follow me on Tradingview

Disclaimer : This is not financial advice as I’m not a financial adviser.

This is just my knowledge on what can be said and done from the chart.

Due to the volatile nature of the cryptocurrencies market, it can change on a day to day basis.

Everyone is wise to manage their risk properly when considering any trading decision or activities.

USDBRL - wave 5 finished, downward trend aheadUSDBRL crossed the upper line of the primary impulse waves' channel. Primary wave 5 finished with a throw-over crossing up the channel, a typical behaviour. Price should continue down in a corrective pattern. The odds for this scenario increases after prices crosses down 5.38. This analysis should be void if prices crosses up 5.72. FOLLOW SKYLINEPRO TO GET UPDATES.

New Age Retail: Comparison Not that I know these brands super well, but it's awesome to see retail expanding beyond brick and mortar, each of these is now worth $1B+.

Interesting to note, NASDAQ:REAL 's market cap just exploded (after the IPO equity lockup expired... went from below $200M to $1B+... the stock didn't react.

Brazilian Real to trade higherLooking at the recent changes in Brazil the technicals and fundamentals are lining up for a stronger BRL.

BRL may open stronger Thursday, as the central bank delivered an expected 50bp rate cut, but notably removed the following

sentences from the statement.

“In the Copom evaluation, the evolution of the basic scenario and the balance of risks

prescribes an adjustment in the degree of monetary stimulus, with a reduction of the Selic

rate by 0.50 percentage points. The Committee considers that the consolidation of the benign scenario for prospective inflation should allow an additional adjustment of equal

magnitude."

It also took out the phrase "in any further adjustments in the degree of stimulus" from the

following line in the October statement: “The Copom understands that the current stage of

the economic cycle recommends caution in any further adjustments in the degree of

stimulus.”

- S&P followed the rate decision by upgrading Brazil’s outlook from stable to positive.

Looking at the technicals the EUR/BRL is currently at the Monthly Pivot and is making lower highs and lower lows - finding resistance above.

There is a lot of possible liquidity below the Yearly Pivot as this acted as strong support from the summer.

CHECK THE SITE FULL PRO GOING STRAIGHT THE EDGE OF THE UNIVERS CHEK THE SITE FULLL PRO THIS COMPANY IS GOING NO WHERE ELSE BUT TO THE GRID AT THE EDGE OF THE UNIVERS ,, HEEEEEELOOOOOOOOOOOOOOOOOOOOOOOO M"C LYYYYYYYYYYYYYYYYYYYYYYYY....

BTW IM JUST A REGULAR GUY TO BE HONEST DONT LET ALL THE BS BTW IM JUST A REGULAR GUY TO BE HONEST DONT LET ALL THE BS CNN USA STYLE SHOK MANIPULATION BIG HEADLINES FOOL OR MANIPULATE U I JUST USE COMMON SENSE AND CHECK OUT THE COMPANIES AND TRUST MY JUDGMENT IF I BELIEVE IT IS A SUCCESSFUL AND SOLID BUSINESS TO INVEST IN JUST SENSE REASON LOGIC AND CALCULATION IS ALL U NEED ALL THESE BS CHARTS BS ARE A BUNCH OF BS TO INFLUENCE BS SQUIGLY SHIT LINES MY CHART IS BIGGER THAN YOURS POWER TRIP AND ALL THOSE STUPID SHOK HEADLINES THEY POST ON HERE ITS ALL BS JUST TRUST YOUR OWN JUDGEMENT U ARE AN INVESTOR BUYING SHARES IN A COMPANY THAT U BELIEVE IN .THAT'S IT THATS ALL. LOVE N RESPECT TO U ALL AND JUST IMAGINE IF EVERYONE JUST INVESTED A LITTLE IN THIS COIN OF ACTUAL SOILID VALUE ESPECIALLY AT THIS PRIC.. CHEK THE SITE FULLL PRO THIS COMPANY IS GOING NO WHERE ELSE BUT TO THE GRID AT THE EDGE OF THE UNIVERS ,, HEEEEEELOOOOOOOOOOOOOOOOOOOOOOOO M"C LYYYYYYYYYYYYYYYYYYYYYYYY....

$USDBRL $EWZ $BVSP - Brazilian Real Under PressureAs market volatility has come back with a vengeance and the US Dollar continues to remain strong, one EM currency that has been hit particularly hard this year has been the Brazilian Real ($USDBRL).

Sluggish growth forecasts, coupled with waning support for the Brazilian President has sent the Brazilian Real to its lowest level of the year thus far. The sharp declines have also been fueled by uncertainty over the US-China trade talks on the macro level. The combination of the two forces, the external macro headwinds and feeble domestic economy, have been a perfect storm for the under-performance of the $USDBRL in 2019.

Further more, on a technical basis, the $USDBRL continues to show deterioration within the Brazilian Real, with the 10-day EMA being a strong support for the currency pair.

We believe if this continues, $USDBRL 4.25 is the next stop.

2019-03-05 17:05 GBPUSD SELLopen conditions:

1. EMA(20) < MA(72)

2. Pull back up to EMA(20)

3. Pull back more than 30pip today

4. London market opened

Stop loss:

5. 30pips

6. 2% risk

Take profit:

7. 1.3075, 95pips

8. The top of the last range

Notes:

1. London opened at 8:00 in GMT, order opened at 9:05 in GMT, too earlier.

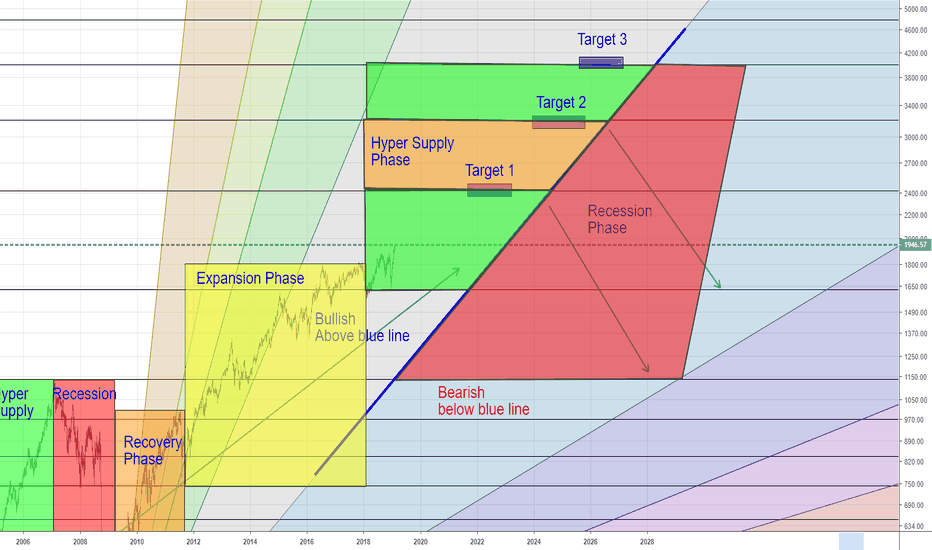

Real Estate Market CycleThe "Real Estate Market Cycle" is made up of four distinct phases.

Recovery

Expansion

Hyper Supply

Recession

There isn't an exact length of period of time each phase must last, but taken as a whole, the entire cycle averages 17 to 18 years from peak to peak.

Looking at the previous cycle (1989-2007) we can use Fibonacci and geometry to see where we currently are in the cycle and predict where we are going.

Currently, it appears that we are in the relatively early stages of hyper supply. This phase began with the passage of the Trump tax cuts and fuel was thrown on the fire with the capitulation of the Fed following the Christmas '18 blood bath in stocks.

The hyper supply phase can be lengthy but can also be short.

Absolute worst case, we have a year left in the hyper supply phase.

But more likely is we have 3+ years remaining. Somewhere between 3 and 7 years from now.