KE Holdings (BEKE) – Transforming China’s Real Estate MarketCompany Overview:

KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power).

Key Catalysts:

Strong Financial & Earnings Growth 💰

Analysts project 20.9% annual earnings growth and 26.7% EPS increase.

Reinforces BEKE’s leading position in China’s real estate sector.

Expanding Services & Market Reach 🌍

Acquisition of Shengdu Home Decoration (2022) strengthens BEKE’s homeownership services.

Broadens revenue streams beyond real estate transactions.

Strategic Backing & Partnerships 🤝

Tencent’s support enhances financial stability & collaboration opportunities.

Investment Outlook:

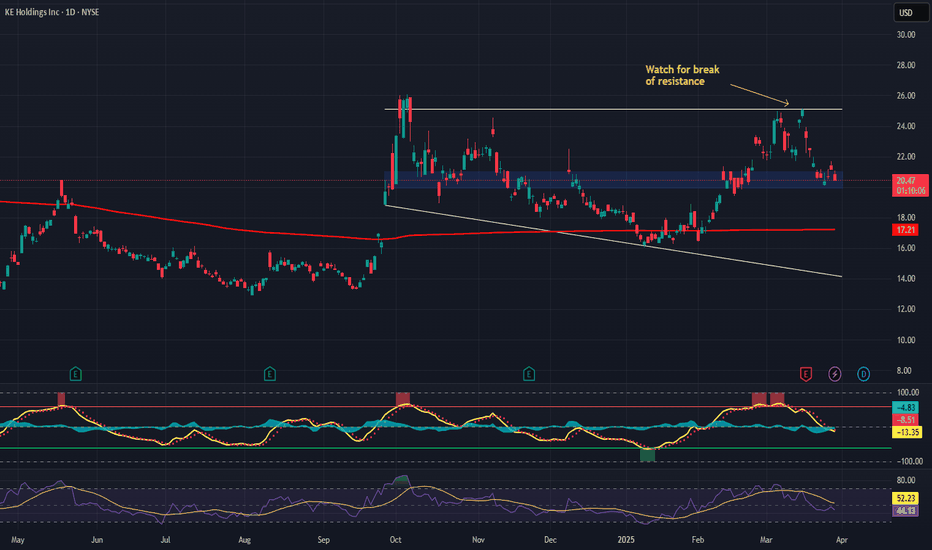

Bullish Case: We remain bullish on BEKE above $20.00-$21.00, supported by rising profitability & business expansion.

Upside Potential: Our price target is $36.00-$37.00, driven by earnings growth, platform expansion, and strategic alliances.

🔥 BEKE – Shaping the Future of Homeownership in China. #BEKE #RealEstateTech #GrowthStock