USDCAD: Bearish Structure with Rejection from Key Supply ArraysGreetings Traders,

In today’s analysis of USDCAD, recent price action confirms the presence of bearish institutional order flow. As a result, we aim to align ourselves with this directional bias by identifying strategic selling opportunities.

Key Observations:

Weekly Timeframe Insight:

Last week's candle rebalanced a weekly Fair Value Gap (FVG), indicating internal range price action. As a rule of thumb, once internal imbalances are addressed, the draw typically shifts toward external liquidity—located at the swing low, where the weekly liquidity pool resides.

H4 Resistance Alignment:

On the H4 timeframe, price shifted bearish and has since retraced into a bearish FVG that aligns precisely with a reclaimed bearish order block. The alignment of these bearish arrays strengthens the case for continued downside, making this zone a high-probability resistance area.

Trading Plan:

Entry Strategy:

Look for bearish confirmation setups on the M15 or lower timeframes within the H4 supply arrays (FVG + OB confluence).

Target Objective:

The primary draw on liquidity lies within the discount range—targeting the liquidity pool below the most recent swing low.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Stay patient, wait for your confirmations, and trade in alignment with the flow of smart money.

Kind regards,

The Architect 🏛️📉

Reclaimedblock

USDCHF: Bearish Continuation Setup From Reclaimed Supply ZoneGreetings Traders,

In today’s analysis of USDCHF, recent price action confirms the presence of bearish institutional order flow. This reinforces our directional bias to the downside, prompting us to focus on strategic selling opportunities.

Key Observations on H4:

Weekly Bearish Order Block: Price recently tapped into a weekly bearish order block, which triggered a decisive market structure shift to the downside. This confirms the order block's validity as a firm resistance zone.

Bearish Fair Value Gap (FVG): Following the market structure shift, price retraced into an H4 FVG. This zone acted as resistance, maintaining bearish momentum.

Reclaimed Mitigation Block: After breaking through a previous mitigation block, the area now functions as a reclaimed order block. We expect this to serve as a high-probability resistance zone moving forward.

Trading Plan:

Entry Strategy: Monitor lower timeframes (M15 and below) for confirmation entries within the reclaimed order block.

Target Objective: The current draw on liquidity is the discount-side liquidity pools, which aligns with our bearish bias.

As always, remain patient, wait for solid confirmations, and manage your risk with precision.

Kind regards,

The Architect 🏛️📉

EURUSD: Bullish Continuation from Reclaimed Institutional ZoneGreetings Traders,

In today’s analysis of EURUSD, recent price action confirms the presence of bullish institutional order flow. As a result, we aim to align with this narrative by seeking high-probability buying opportunities at key institutional arrays.

Higher Timeframe Context:

On the weekly timeframe, last week’s candle retraced into a Re-Delivered Re-Balanced (RDRB) Array—a bullish structure often associated with institutional repositioning. From this zone, we anticipate continued bullish delivery towards the weekly liquidity pool, reinforcing a bullish directional bias.

Key Observations on H4:

Bullish Market Structure Shift: Price action on the H4 has decisively shifted bullish, aligning with the higher timeframe’s narrative and confirming our bias.

Reclaimed Order Block Support: Following the bullish shift, price has pulled back into a reclaimed order block—a previously institutional selling zone that, once broken and reclaimed, now acts as a high-probability support area. This becomes a key zone for seeking lower timeframe confirmation entries.

Trading Plan:

Entry Strategy: Look for confirmation entries within the reclaimed order block on lower timeframes (M15–M5).

Target Objective: The draw on liquidity resides at the long-term high, where a cluster of buy-side liquidity is expected to attract price.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Remain patient and precise in execution. Let the market confirm your bias before entering and manage risk appropriately.

Kind regards,

The Architect 🏛️📈

EURGBP: Bearish Continuation from Reclaimed Order Block!Greetings Traders,

In today’s analysis of EURGBP, we observe that institutional order flow on the H4 timeframe has recently shifted bearish. This provides us with a clear directional bias to look for shorting opportunities in line with the prevailing higher timeframe trend.

Higher Timeframe Context:

On the weekly timeframe, price action is currently drawing towards a Weekly Fair Value Gap (FVG). This bearish draw on liquidity confirms the macro-level bearish sentiment. With the recent bearish market structure shift (MSS) on the H4, we now have strong confluence between the weekly and intraday order flow, favoring continued downside.

Key Observations on H4:

Reclaimed Bearish Order Block: After shifting structure to the downside, price has retraced into a bearish reclaimed order block—a region previously marked by institutional selling. This return to the origin of prior sell-side imbalance offers institutions the opportunity to mitigate earlier positions and reinitiate shorts. The failure of price to break higher confirms bearish intent.

Confluence with Weekly Draw: The reclaimed order block aligns with the broader draw towards the weekly FVG, providing an optimal zone for bearish confirmation entries.

Trading Plan:

Entry Strategy: Look for lower timeframe confirmation entries within the H4 reclaimed order block.

Target: The short-term target remains the Weekly Fair Value Gap, supporting a discount-side delivery.

As always, remain disciplined in execution. Let the market confirm your bias before entering, and manage risk according to your rules.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

Kind Regards,

The Architect 🏛️📉

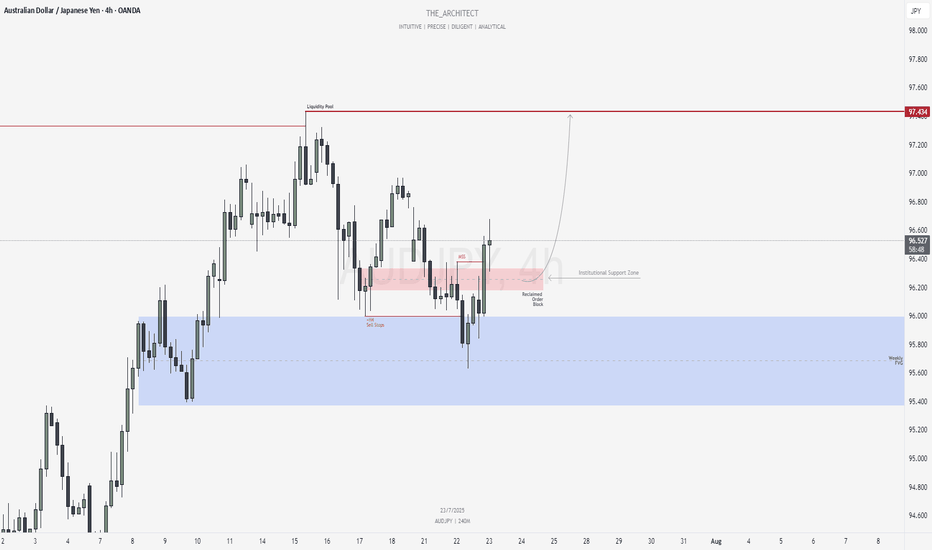

AUDJPY: Bullish Structure Shift Signals Institutional Buy ZoneGreetings Traders,

In today’s analysis of AUDJPY, we observe a recent bullish market structure shift (MSS), signaling potential for continued upward movement. With this in mind, we aim to capitalize on buying opportunities at key institutional points of interest to target higher premium prices.

Higher Timeframe Context:

The weekly timeframe maintains a clear bullish narrative. This long-term bias is now supported by a bullish MSS on the H4 timeframe, offering strong confluence and alignment across both macro and intermediate structures. This increases our confidence in expecting further bullish continuation.

Key Observations on H4:

Weekly Fair Value Gap (FVG) Support: Price recently pulled back into a weekly FVG and has rebalanced that inefficiency. This reaction aligns with the H4 MSS, reinforcing the weekly FVG as a strong institutional support zone.

Reclaimed Bullish Order Block: After the MSS, price retraced into a bullish reclaimed order block—an area where previous institutional positioning occurred. Since price has now reclaimed this level, it becomes a high-probability zone for renewed buying interest in the direction of the dominant trend.

Lower Timeframe Confirmation: This reclaimed order block will serve as our primary zone of interest to seek confirmations on the lower timeframes for precise entries.

Trading Plan:

Entry Strategy: Wait for bullish confirmation within the reclaimed H4 order block zone before entering long positions.

Target: The primary objective is the H4 liquidity pool situated at premium prices, which the market is likely to be drawn toward.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:

As always, execute with discipline and align your trade management with your overall plan.

Kind Regards,

The Architect 🏛️📈

NAS100USD: Bullish Continuation from Reclaimed SupportGreetings Traders,

In today’s analysis on NAS100USD, we identify ongoing bullish institutional order flow, and as such, we aim to align our trading opportunities with this upward bias.

Key Observations:

1. Retracement and Institutional Support:

Recent price action shows a healthy retracement, with price finding institutional support at the rejection block. This was followed by strong displacement to the upside, resulting in a bullish market structure shift. This suggests the retracement may be complete, with further bullish continuation likely.

2. Reclaimed Order Block as Key Support Zone:

Currently, price is approaching a reclaimed order block—a zone where institutions previously initiated buying before price traded higher. When price returns to this area, institutions often reclaim the zone to initiate new long positions. This reclaimed block is further strengthened by the alignment with a fair value gap (FVG), enhancing the zone’s validity as institutional support.

Trading Plan:

We will monitor this reclaimed FVG zone for confirmation of bullish intent. Upon confirmation, we will look to enter long positions targeting liquidity pools in premium pricing zones, where buy-side liquidity is likely to reside.

Stay disciplined, wait for confirmation, and ensure the idea aligns with your broader strategy.

Kind Regards,

The Architect

NAS100USD: Bearish Continuation Likely After Liquidity GrabGreetings Traders!

As we transition into the New York session, increased market volatility is expected. Currently, NAS100USD is showing signs of potential further bearish continuation. This outlook is supported by a draw on liquidity toward downside liquidity pools and a notable inefficiency—an unfilled gap left earlier in the week.

Key Observations:

1. Unfilled Gap – A Draw on Liquidity:

The market has left behind an inefficiency in the form of a price gap, which typically acts as a magnet for price. Although such inefficiencies are not always filled immediately, they often become targets for future price movement as the market seeks balance.

2. Reclaimed Order Block Breach – Engineered Liquidity:

Price has recently broken below a reclaimed order block that was serving as a temporary resistance zone. This indicates that the market was hunting for liquidity at a relatively premium price—above a key resistance level. The presence of relatively equal highs in this area further supports the notion that this was an engineered liquidity zone.

Engineered liquidity refers to zones designed by smart money to entice retail participation. Once sufficient liquidity is gathered, institutions then drive price through these zones to execute large sell orders at a premium.

3. Downside Targets – Liquidity Pools and Gaps:

With resistance now confirmed as engineered liquidity, smart money is likely to shift focus to the downside. Key targets include liquidity pools at lower price levels and the aforementioned inefficiency, which represents an area of fair value—ideal for profit-taking and potential continuation of institutional selling.

Trading Strategy:

Monitor price for confirmation within any short-term retracements. Selling opportunities aligned with institutional intent may present themselves as price gravitates toward the inefficiency and deeper liquidity zones.

Stay focused, remain patient, and ensure all trades align with your trading plan.

Kind Regards,

The Architect

NAS100USD: Reclaimed Order Block Signals Further DownsideGreetings Traders!

In today’s analysis of NAS100USD, we observe a momentary shift into bearish institutional order flow, confirmed by the formation of successive lower lows. This structural development signals the potential for continued downside movement.

Key Observations:

Bearish Institutional Order Flow:

The consistent break of lows supports a bearish bias, providing a framework for seeking short opportunities in alignment with institutional intent.

Confluent Bearish Arrays:

Key bearish arrays—including the mitigation block and a reclaimed order block—are currently aligned. These zones, if respected, could serve as strong resistance and provide high-probability entry areas for short positions.

Trading Strategy:

Should price retrace into these arrays and provide confirmation, we can look to enter sell positions with the expectation of further downside aligned with the prevailing order flow.

Stay disciplined, remain patient, and trade only with confirmation.

Kind Regards,

The Architect

NAS100USD: Transitioning from Sell-Side to Buy-Side CurveGreetings Traders,

In today’s analysis, NAS100USD has been delivering bearish institutional order flow, characteristic of the sell-side curve. However, bullish institutional order flow is beginning to emerge, indicating a potential shift to the buy-side curve. This creates an opportunity to explore buy setups, provided confluences align with confirmation.

Key Observations:

1. Bullish Order Block as Support:

Price is currently reacting to a bullish order block, which is aligned with a Fair Value Gap (FVG). This confluence establishes a strong institutional support zone.

2. Reclaimed Order Block:

A previously reclaimed order block has been broken to the upside, suggesting that it may now act as support, reinforcing bullish momentum.

3. Discount Pricing:

Price is currently within a discount zone, making it an attractive area to seek buy opportunities with targets at premium liquidity pools.

Trading Plan:

Entry Strategy:

Look for confirmations around the bullish order block and reclaimed order block to justify entering long positions.

Targets:

Aim for liquidity pools at premium levels, such as highs, where institutions are likely to offload positions.

By aligning with the emerging bullish narrative and observing institutional behavior, we can position ourselves to capitalize on this potential market shift. As always, patience and confirmation are key.

Kind Regards,

The Architect

NAS100USD: Are We Witnessing the Start of a Bullish Takeover?Greetings Traders!

In today’s analysis of NAS100USD, the overall trend remains bearish; however, compelling signs suggest a potential shift toward bullish price action. Here are the key confluences supporting this outlook:

Key Observations:

1. Higher Highs Established:

Recent price action has formed higher highs, indicating a potential shift from breaking bearish structure to targeting bullish objectives.

2. Transition to Buy-Side Curve:

Significant structural breaks suggest a move away from the sell-side curve into the buy-side curve. This transition redefines key bullish order blocks created during the sell-side curve as reclaimed order blocks, now acting as strong institutional support zones.

Reclaimed Order Blocks Explained:

These occur when bullish order blocks, previously hedged during sell-side curve are reclaimed by institutions. The down candles within these zones signal areas where institutions are likely to initiate new buying opportunities.

Trading Strategy:

Entry Zones:

Look for buying opportunities within reclaimed order blocks, which now function as robust institutional support zones.

Targets:

Focus on liquidity pools located at key highs, double tops, or failure swings. These areas serve as institutional profit-taking zones where buy stops reside, offering favorable order pairing opportunities.

By aligning with institutional behavior and following the transition to the buy-side curve, we can strategically capitalize on potential bullish momentum. Stay vigilant and await confirmation before entering trades.

Kind Regards,

The Architect