Long the retest of flipped resistance/ supportlot of factors at play here on the 1 day candles chart.

1. gold cross attempt

2. Stochs at 0 multiple days

3. Impulsive move down from impulsive move above $34

4. Goldman bullish story published

5. recently off of ex-dividend/ record date

6. 9/20 calls/ puts at 32.50 resolved

Reit

SRU.UN Monitoring LongWeekly candle blew by support indicating more down movement to come.

Monitoring support zone outlined. Great company anchored by Walmart and a great group of holdings.

Upside potential includes massive apartment tower currently under construction in northern GTA. Superb management/ leadership/ company.

waiting patiently to buy.

Smart Centres REIT LONGFundimentals

-Walmart is currently the biggest Tennant.

- Continued growth throughout GTA/ Ottawa

-Growth geared from industrial through residential

Technicals

-Currently trying to reverse at key weekly support level. Wait for confirmation ie: reversal candles.

Good Risk to reward + added benefit of monthly dividend.

NYMT BUY, safe high yield dividend stockWe chose this REIT as it has low P/E ratio 9.31 and price is flat however it is good to time entry.

Great opportunity to buy this stock right now as RSI hits oversold territory. Since 2017 this stock is trading between 6.8 USD - 5.45 USD. We recommend you to buy this stock as it has dividend yield 13.47% per year and current price is appropriate for the first entry. We can clearly see how the stock fluctuactes between quarters and falling after dividend pay out. We recommend second entry in the mid of October and selling after Q4 dividend or holding it.

Japan REITs: Hidden Gem to Diversify Your PortfolioJapan has long lost its charm to the international trading community. It has been a boring place to trade in for the past two decades, pretty much. In a mature market like Japan, you can't expect explosive growth like you can find in China.

However, this market offers a great source of diversification and income potential, if you know where you are looking.

The answer lies in Japan REITs. Properties in Japan, be it commercial, industrial, retail, hospitality, or residential, are coveted by mom-and-pop as well as institutional investors from the country and across the APAC region for their stable and (slowly) growing rental income.

The chart shows the largest REIT ETF listed in Japan (blue line) versus JPY and SP500 trendlines. You can clearly see the low correlation between JREIT and SPX.

In times of volatility in the US, and for those with international brokerage capabilities, why not consider this diversifier across the Ocean?

Disclaimers:

GMAS is long a few select names within the captioned ETF.

Investment carries risk.

Investment in foreign dividend stocks is subject to withholding tax. You may be able to claim better withholding tax rate based on your country's double taxation treaty status.

$TWO - REIT getting slammed with Rate Hikes / Bearish Bearish below $15

Looking to short it if it breaks support zone.

Good Dividends but unsure if it's worth buying at support level.

Swing Idea:

1. Short below $15 / Cover over $15.50

OR

2. Buy at support level and write a cover call when it gets to resistance level

I think it will fall more as the fed rate hikes will impact all the REIT.

I will monitor next week to see watch the daily chart. Only issue I have with TWO is they had a reverse split and have not been doing well. If it continues to fall in price, I think another reverse split will happen. Which is why I am bearish.

If you're an expert with REITS - please comment and advise with your thoughts on it. Thanks!

TWO is a good REIT to considerI like this name because of its massive dividend yield. This isn't uncommon in REITs, but TWO carries one of the larger yields in the industry. Their financial statements are healthy and the primary risk here is the state of interest rates in the US. My harmonic analysis shows two sin waves: a red and a pink. The red represents a macro trend wave and until the FED raised rates incessantly in 2018 this curve fit well to the price action. However, we can see that the trend was disobeyed mid to late 2018, something I attribute almost entirely to the interest rate risk every investor was fretting about at the time. REITs were hit hard during this period. The pink wave represents a mico-trend and still fits very well with the price action. Rates have cooled significantly since their 2018 highs, and so I believe this ticker has room to the upside. This is a long term play, so if you don't intend to store this capital for 3+ years then avoid this name as the volatility for day trading and options plays is relatively non-existent. However, with a 10+ year horizon one can capture an outstanding dividend yield while adding to positions at the troughs of the sinusoidal pattern. Doing this successfully will likely bolster dividend yields with capital gains.

The primary risk here is that US interest rates are still near historic lows. Unless the FED sees need to continue quantitative easing the path of least resistance is up. This bodes ill for REITs and could invalidate the $5 trading range I've highlighted. Until then, however, I see no reason why this name would deviate from its historic price pattern.

As always, scale in near the lows.

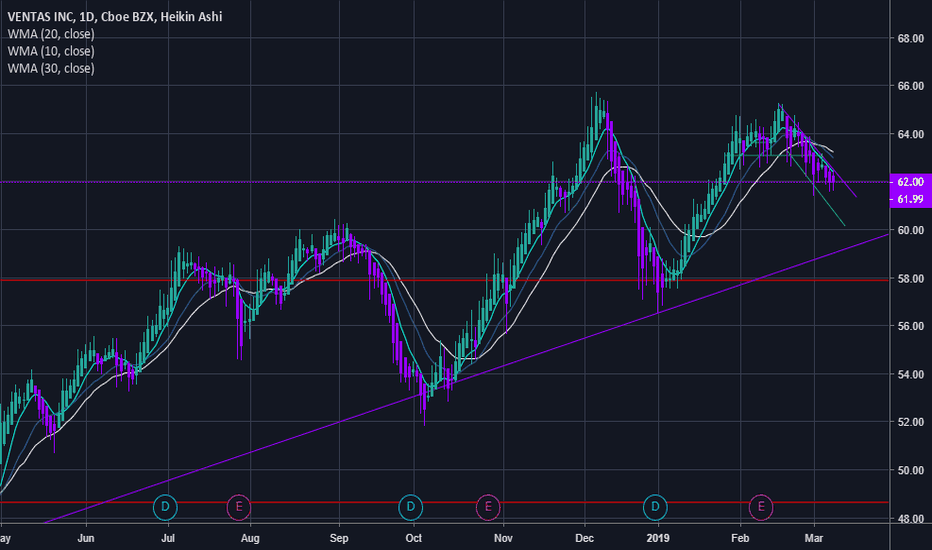

REIT's & Real Estate Breaking Dec 24th UptrendREIT's are looking like the first sector to definitively break the big uptrend since December 24th.

Big move here breaking out of 2 month wedge to the downside.

All momentum indicators are also pointing downward (macd, stochastic) and we've had demark exhaustion signals as well. Easy short entry here.

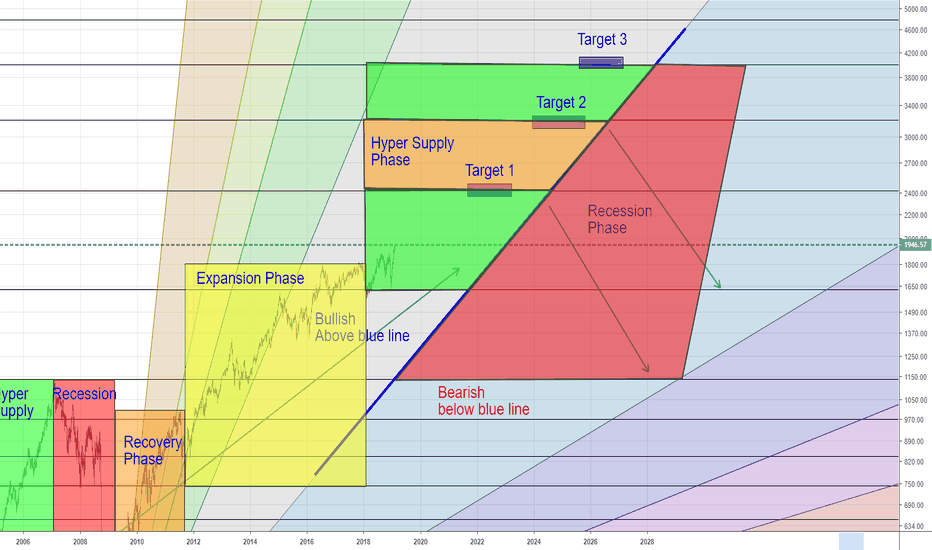

Real Estate Market CycleThe "Real Estate Market Cycle" is made up of four distinct phases.

Recovery

Expansion

Hyper Supply

Recession

There isn't an exact length of period of time each phase must last, but taken as a whole, the entire cycle averages 17 to 18 years from peak to peak.

Looking at the previous cycle (1989-2007) we can use Fibonacci and geometry to see where we currently are in the cycle and predict where we are going.

Currently, it appears that we are in the relatively early stages of hyper supply. This phase began with the passage of the Trump tax cuts and fuel was thrown on the fire with the capitulation of the Fed following the Christmas '18 blood bath in stocks.

The hyper supply phase can be lengthy but can also be short.

Absolute worst case, we have a year left in the hyper supply phase.

But more likely is we have 3+ years remaining. Somewhere between 3 and 7 years from now.

APTS weekly buy signal.APTS breaking up out of resistance pattern on daily with weekly very oversold. Buy at 15.50 stop below 13.50 or previous supports at 12.20.

Safe Haven - add dividends REIT sectorReal Estate sector has shown to be safe haven and not oversold sector to other stock sectors, which were way oversold to value.

I give thanks today for understanding enough, but still expect growth here. Mid-term stocks usually do well in ensuing 6 mo.

period, however during bearish times a safe haven is a consideration.

If you have another sector, make it a conversation. FOREX, Crypto, and calls/puts would be only other if considered a sector.

Does anyone have link for history of when shorting (calls/puts) was created and why? Please comment @pokethebear.

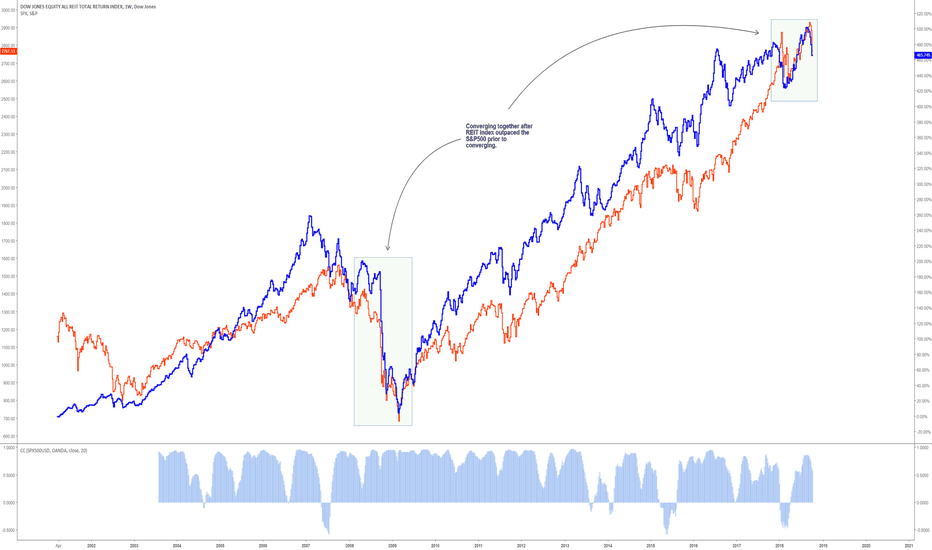

REI REIT index is identical to 2008, impending drop comingIf you take a look at the behaviour of the REI index before, during, and after the 2008 recession and present day. The REIT is in blue, the S&P500 is in red.

Before

REI index is outpacing the S&P500

During

REI index is converging with the S&P500

the indices both fell together with the REI falling more aggressively

After

REI index recovers quicker and begins to outpace the S&P500 again

We are in the during phase.

CRXPF - 420 REIT breakout in volume readying for Oct. 17th??US Cannabis REIT Crop Infrastructure breaking out since early Sept. in heavy volume.

CRXPF IIRT

1865 Acres added this month. Several customers have submitted dried crops for testing (pesticides, THC, etc. for legal sale) and looks very promising. 15 business days to go.

october 17th is Canada legal date, Crop Infrastructure Corp, formerly Fortify Resources Inc, is a Canada-based company engaged in the Real Estate Investment Trust business Sector. The Company is primarily engaged in the business of investing, constructing, owning and leasing greenhouse projects as part of the provision of turnkey real estate solutions for lease-to-licensed cannabis producers and processors offering operations. The Company's portfolio of projects includes cultivation properties in California and Washington State, Nevada, Italy, Jamaica and a joint venture on West Hollywood and San Bernardino dispensary applications. CROP has developed a portfolio of assets including Canna Drink a cannabis infused functional beverage, US and Italian distribution rights to over 55 cannabis topical products and a portfolio of 16 Cannabis brands.

Currently cost is at 236 Fibretracement and baseline of current trajectory, yes trajectory excitement beware and still entry signal showing on daily chart.