RNDR/USDT at a Critical Turning Point: Golden Pocket as the Key?✨ Overview:

Render Token (RNDR) is currently testing a crucial support zone — the Golden Pocket Fibonacci Retracement between 0.5 (3.616) and 0.618 (3.385). This zone not only represents a significant retracement level but has historically acted as a strong demand area, often serving as a springboard for major price reversals.

---

🧠 Detailed Technical Analysis:

🔸 Support Zone & Golden Pocket

Price has retraced back to the 0.5 – 0.618 Fibonacci zone, a high-probability reversal area.

This zone has acted as a demand base multiple times since February 2025.

How the price reacts here will likely define the next major trend direction.

🔸 Market Structure

The overall structure shows a mid-term downtrend, marked by lower highs and lower lows.

However, the current price action shows slowing bearish momentum, indicating potential hidden accumulation.

A potential double bottom pattern could be forming, hinting at a bullish reversal if confirmed.

---

📈 Bullish Scenario:

1. Strong Rebound from the Golden Pocket

Watch for bullish candlestick patterns (e.g., pin bar, bullish engulfing) near $3.38–$3.61.

Initial resistance levels: $4.16 – $4.72

If broken, mid-term targets could extend to $5.47 – $6.68

2. Double Bottom Confirmation

A confirmed double bottom with a neckline breakout around $4.16 would greatly strengthen bullish momentum.

3. Increased Buying Volume

A spike in volume during the rebound would validate bullish sentiment and potential trend reversal.

---

📉 Bearish Scenario:

1. Breakdown Below the Golden Pocket

If the price breaks below $3.385 with strong volume, we could see a move down toward $2.77, the next significant support.

2. Weak Bounce / Lower High

A failed breakout above $4.16 may indicate a bearish continuation after a temporary relief rally.

---

📌 Summary:

RNDR is currently at a technically sensitive zone. The Golden Pocket between $3.38 and $3.61 is the key area to watch. A strong bullish reaction could signal the start of a trend reversal, while a breakdown could trigger further downside continuation. Traders are advised to wait for clear confirmation via price action before committing to any strong positions.

---

🔖 Key Levels to Watch:

Level Description

3.38 – 3.61 Golden Pocket (Potential Buy Zone)

4.16 Minor Resistance

4.72 Bullish Breakout Trigger

5.47 – 6.68 Mid-Term Reversal Targets

2.77 Strong Support if Breakdown Occurs

---

🧩 Chart Patterns Observed:

Potential Double Bottom – early bullish reversal signal.

Golden Pocket Reaction Setup

Descending Structure – still intact but weakening.

---

🔍 Trade Ideas:

🔄 Wait-and-see approach: Wait for clear bullish confirmation on daily candles.

🎯 Aggressive Long Entry: Around 3.40–3.60 with a tight stop-loss.

⚠️ Short Opportunity: If a strong breakdown below 3.38 occurs with volume confirmation.

#RNDR #RenderToken #RNDRUSDT #CryptoAnalysis #GoldenPocket #FibonacciRetracement #DoubleBottom #PriceAction #SupportResistance #AltcoinSetup #CryptoSignals #TechnicalAnalysis

Renderusd

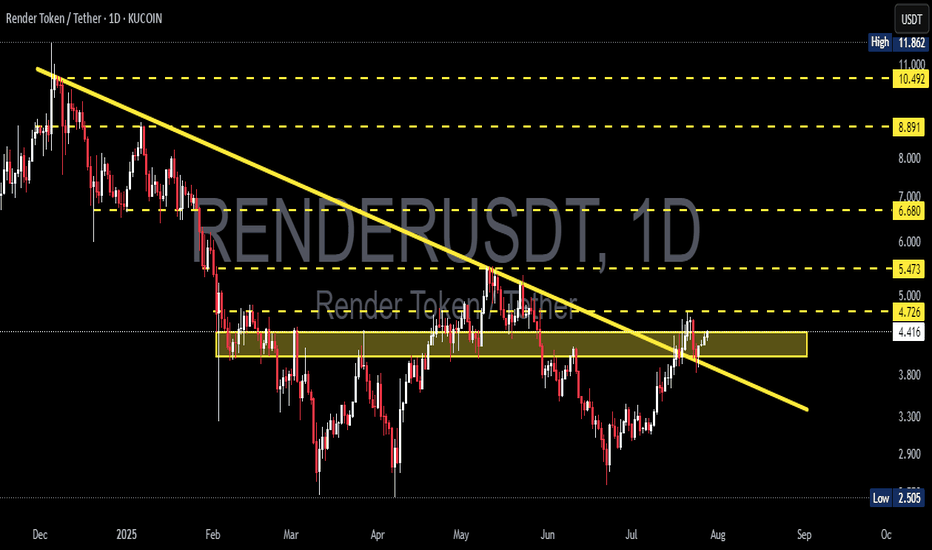

RENDERUSDT Breaks Major Downtrend – Will Bulls Sustain!🧠 Market Context & Structure:

RENDERUSDT is currently presenting one of the most technically compelling setups in recent months. After enduring a prolonged downtrend since late 2024, price action has finally broken above the major descending trendline that has acted as dynamic resistance for over 7 months.

This breakout signals a potential shift in market control from sellers to buyers, marking a critical phase transition from bearish pressure to a possible bullish reversal.

---

📊 Key Technical Levels:

Descending Trendline (Breakout Confirmed): Clean breakout with bullish momentum—first signal of a structural shift.

Major Consolidation Zone (Supply Zone): $4.41 – $4.72

↪ Previously acted as strong resistance; now being tested as potential support reclaim.

Critical Support (Retest Area): $3.80 – $4.00

↪ If the breakout fails, this zone will be the next major defense for the bulls.

Upside Resistance Targets:

⚡ $5.47 – Minor horizontal resistance

🚀 $6.68 – Key resistance from prior swing highs

🧨 $8.89 and $10.49 – Mid-term bullish targets if trend continuation holds

---

🔍 Pattern Analysis:

Descending Trendline Breakout

A textbook reversal pattern, where a successful breakout above the long-term trendline signals a shift in momentum.

Supply Zone Reclaim

Price is now attempting to reclaim a previously rejected supply zone. If successful, it may indicate the beginning of a Wyckoff-style markup phase.

---

🟢 Bullish Scenario (Optimistic Outlook):

Price holds above $4.72, validating the breakout with strength and possibly retesting the area as new support.

A clear continuation may drive the price toward $5.47 and $6.68 in the short to medium term.

Rising volume and strong bullish candlesticks (e.g., marubozu or bullish engulfing) will further confirm momentum.

---

🔴 Bearish Scenario (Caution Required):

If price fails to hold above $4.41 – $4.72 and closes back below the breakout zone:

This would suggest a false breakout (bull trap).

Potential downside toward $4.00 or even $3.50.

Selling pressure could re-emerge, especially if broader market sentiment turns negative.

---

🧠 Market Psychology:

Traders are watching closely to see if this breakout is real or a trap.

This is a decision zone, where early profit-taking clashes with new momentum entries.

A strong close above $4.72 with increasing volume may invite more participation and confirmation of a trend reversal.

---

🧭 Conclusion:

RENDERUSDT is at a critical technical crossroads. The breakout from the long-standing descending trendline is a major bullish signal—but the real test lies in whether bulls can hold and flip resistance into support.

If successful, we could witness the early stages of a mid-term bullish trend, with potential targets reaching up to $10.49 in the coming weeks. However, caution is advised in case of a breakdown back below the key zone.

#RENDERUSDT #RenderToken #CryptoBreakout #TrendReversal #TechnicalAnalysis #BullishBreakout #DescendingTrendline #SupportResistance #CryptoCharts #WyckoffMethod #Altcoins

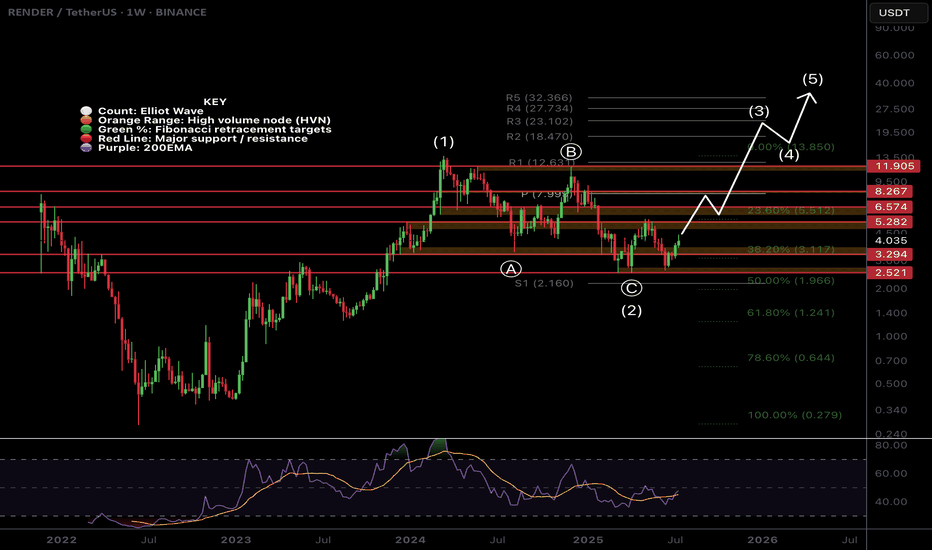

$RENDER Weekly Brings Clarity!CRYPTOCAP:RENDER weekly chart shows long term strength through the depth of the Fibonacci retracement not even reaching 0.5.

The depth of the recent swing low been so close wave (C) does concern me that the larger correction is not yet over and maybe price does want to visit the 'alt-coin' golden pocket of the 0.618-0.768 Fib retracement Where the would be a High Volume Node (not drawn).

For now the upside target is the weekly pivot but the local chart has a lot of work to do first with daily 200EMA!

Safe trading

$RENDER At Major Resistance!CRYPTOCAP:RENDER has been relatively weak. Looking at the local chart it appears we have finished a wave (3) at the daily 200EMA and descending resistance.

Price has overcome the High Volume Node (HVN) support flipped resistance but a strong at coin pull could see fresh lows for Render.

There is also daily bearish divergence on the RSI.

The Elliot Wave count could also be an ABC corrective wave up which has now terminated.

If its a new motif wave and a major bottom has formed , wave 2 should find support at the HVN, daily pivot and 'alt-coin' golden pocket between 0.168 and 0.782 Fibonacci retracement

Safe trading

RENDER: Is the Correction Over?RENDER has surged nearly 20% at its peak recently. This prompts the question of whether the wave 2 correction low may already be in place. We continue to consider this scenario as our alternative outlook, in which we would anticipate direct gains above the resistance levels at $6.08 and $11.82 (probability: 40%). However, our primary expectation remains that a new low will be set within our magenta Target Zone (coordinates: $5.43–$1.81) before the projected upward moves unfold.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Is #RENDER Ready for a Reversal or Will it Continue to Fall?Yello, Paradisers! Is this just another range before a full reversal or a sneaky trap waiting to punish early buyers of #RENDER? Let's see the latest analysis of #RENDERUSDT:

💎After several weeks of slowly bleeding within a clean descending channel, #RENDERUSDT is now attempting a breakout from that structure. While the move isn’t confirmed just yet, this is the first real signal that sellers are losing momentum, and a shift could be on the table. Price is currently hovering just above the $3.15–$3.20 zone, and the next few candles will be key.

💎If buyers step up and push #RENDER through this upper trendline with strength, we have a clear runway toward the moderate resistance at $4.20. And if that gets taken out, the next strong resistance area comes in at $5.35, where we expect heavy distribution. But for now, it’s all about reclaiming and holding above this descending structure.

💎So what gives this setup real potential? The demand zone at $2.97 held like a fortress. If it fails, the next line of defense is a strong demand zone at $2.50. Buyers defended it multiple times and sparked a mini-reversal off the bottom of the channel. This demand zone is our launchpad, and as long as the price stays above it, bulls are still in control.

💎But make no mistake: if price loses $2.97, the bullish setup is invalidated. That would open up a deeper drop back toward $2.50 or lower, and we’ll step aside to wait for a better entry again.

Stay patient, Paradisers. Let the breakout confirm, and only then do we strike with conviction.

MyCryptoParadise

iFeel the success🌴

#RENDER/USDT#RENDER

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 4.20.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 4.41

First target: 4.60

Second target: 4.78

Third target: 4.98

#RENDER/USDT#RENDER

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 3.55

Entry price 3.75

First target 3.92

Second target 4.14

Third target 4.40

RENDERUSDT likely to head towards 7 and beyondThis one looks very promising.

The price is trading between weekly resistance WR1 and weekly support WS1.

The price may hit WS1 again before making a bounce and aiming for WR1.

With resistance facing some pullback at WR1, it is likely to attempt that resistance again only to break it this time and continue its journey to further upward.

Very nice long opportunity from WS1 zone.

I am loading this one heavy on WS1 hit.

Is RENDER About to Explode? Here is What You Need to Know!Yello, Paradisers! Could this be the final shakeout before #RENDER kicks off a fresh rally? After weeks of heavy bleeding, we're now spotting a textbook bottoming structure — and if you're not paying attention, you might miss one of the cleanest setups we've seen in a while. Let’s break it down.

💎#RENDERUSDT is attempting to solidify a double bottom formation right at a strong historical support zone between $2.50–$2.65. This area has already shown its strength in the past, and now the bulls are trying to use it as a launchpad again.

💎But the real battle zone is at the $4.00 to $4.20 range. This isn't just another resistance. It's a pivotal multi-resistance zone acting as the neckline of the double bottom and is stacked with congestion from previous price rejections. For bulls to reclaim control, we need to see a strong breakout above $4.20 — ideally supported by increasing volume.

💎If that breakout plays out, the next target comes in at $5.10 to $5.40, where partial profit-taking is expected. However, if bulls remain in charge and manage to suppress any selling pressure, we could be looking at a push toward the $6.70 to $7.00 resistance — a level with significant historical relevance.

💎On the flip side, if the breakout fails and we revisit lower levels, RENDER still has a solid basing support between $2.50–$2.65, keeping the bullish structure intact unless we lose this zone.

💎Additionally, the chart is showing signs of a potential golden cross formation forming soon, which would further reinforce the bullish momentum and confirm strength ahead.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

Render: Running on Empty?Render has climbed nearly 50% since the low in the second week of March but lost notable ground recently. The price remains within our magenta Target Zone between $5.43 and $1.81 and could still dip toward the lower boundary as it works toward completing the turquoise wave 2. Once a sustainable bullish reversal takes hold, we expect a strong rally in the turquoise impulse wave 3, which should target new all-time highs. The resistance at $11.88, which marks the top of the magenta wave from early December, should be surpassed decisively as momentum builds.

RENDER/USDT:UPDATEHello friends

Given the good return that the price has had, especially from an important support, it can be understood that the buyers have become strong and we can play behind their hands.

We have specified the buying steps for you and the goals have also been specified.

I hope you like it and support us.

*Trade safely with us*

Render about to turn?RenderUSD

Support levels at $4.00 And 3.91

Tight resistance levels at 4.11 and 4.30... if we can break 4.30 this should grind up to the 5.22 levels

I can see render making a rounded bottom here... and start its grind upward...if we break below the 3.92 there is a long way down so as always use cuation and remember that capital preservation is always #1 when trying to make money

RENDERUSDT Below Key Support—But Is a Massive Reversal Incoming?Yello, Paradisers! #RENDERUSDT just broke a critical support level, triggering a major downside move. But here’s where things get interesting—before this drop, RENDER left behind wickless candles at $8.70 to $8.80, signaling unfinished business at higher levels. Could a sharp reversal be on the cards? Let’s break it down.

💎Right now, #RENDER has tested the breakout support region between $3.40 - $3.15—the same level that originally fueled its last major rally. This is a key demand zone where bulls are likely to step in aggressively, triggering short-covering and possibly even a higher time-frame reversal.

💎Sellers need to be extremely cautious here. This zone has the potential to create a slingshot effect, where a sudden surge in buying pressure could trap shorts and send RENDER flying back up before they can react.

💎If bulls successfully defend this level, the first upside target sits at $5.65. A breakout above this could open the door toward $6.25 - $6.55, a pivotal resistance zone that will determine whether RENDER can regain full bullish momentum. Strength above this level would likely send the price surging toward the wickless candle at $8.80, where unfinished liquidity could be swept.

Patience and discipline are key here, Paradisers. The market often tests both bulls and bears before making decisive moves, so stay vigilant.

MyCryptoParadise

iFeel the success🌴

RENDER 1H Sell/ShortHi, dear traders. how are you ? Today we have a viewpoint to Sell/Short the RENDER symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You