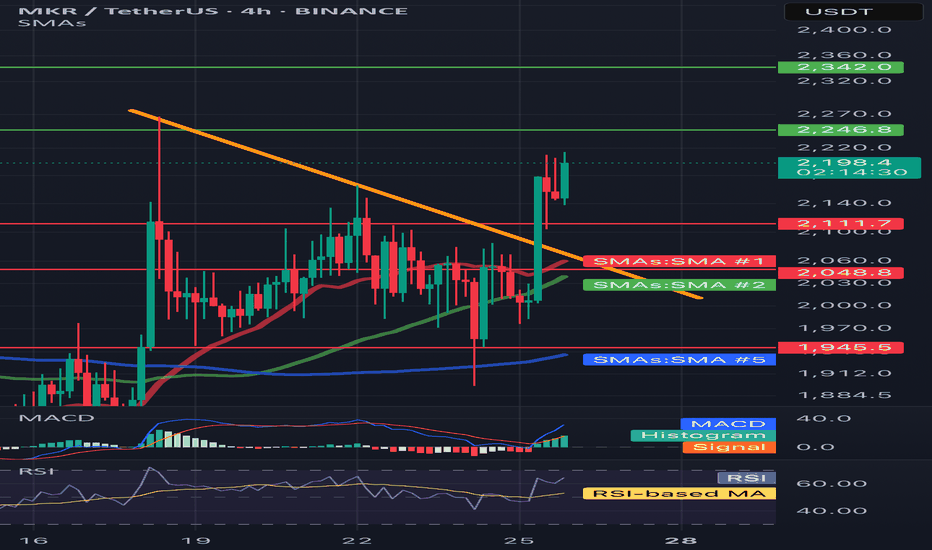

MKR/USDT 4H📈 Trend and price structure

• The price has just been above the downward trend line (yellow line), which suggests the potential reversal of the trend to the upward.

• Breaking was strong - a candle with a large growth volume and an increase +9.13%, which emphasizes the pressure of buyers.

⸻

🔍 levels of support and resistance

• resistance:

• ~ 2342 USDT - a clear level of resistance (green line) - may be the target for the next upward movement.

• 2246.8 USDT - first resistance to overcome.

• Support:

• 2111.7 USDT - level of local support after struggling (earlier resistance).

• 2048.8 USDT - SMA #1 (red medium), can be support at the back.

• 1945.5 USDT - strong support in the form of long -term SMA (blue line, SMA #5).

⸻

📊 Technical indicators

✅ MacD (below)

• The MacD line cut the signal line up - buy signal.

• The histogram is growing, which confirms the growth moment.

✅ RSI

• RSI has bounced from level 40 and is currently above 60 - it suggests upward momentum, but it is not yet purchased, so there may be room for further growth.

⸻

✅ Medium walking (SMAS)

• The price was pierced by SMA #1 (red) and SMA #2 (green) with impetus, which means a change in sentiment.

• If it stays above these medium - a bull signal.

• SMA 50 (green)> SMA 200 (blue) = potentially a golden cross is formed on a longer TF.

⸻

📌 Summary - technical scenario:

🐂 Bycza scenario:

• If the price lasts above 2111.7 USDT, it may continue to increase to USDTt and further up to $ 2,342.

• Confirmation will be the continuation of growth on MacD and RSI over 60-70.

🐻 Bear scenario (threats):

• If the price drops below 2048 USDT, possible correction up to 1945 USDT.

• RSI returning below 50 and Macd Cross down would be a reversal signal.

Resistence

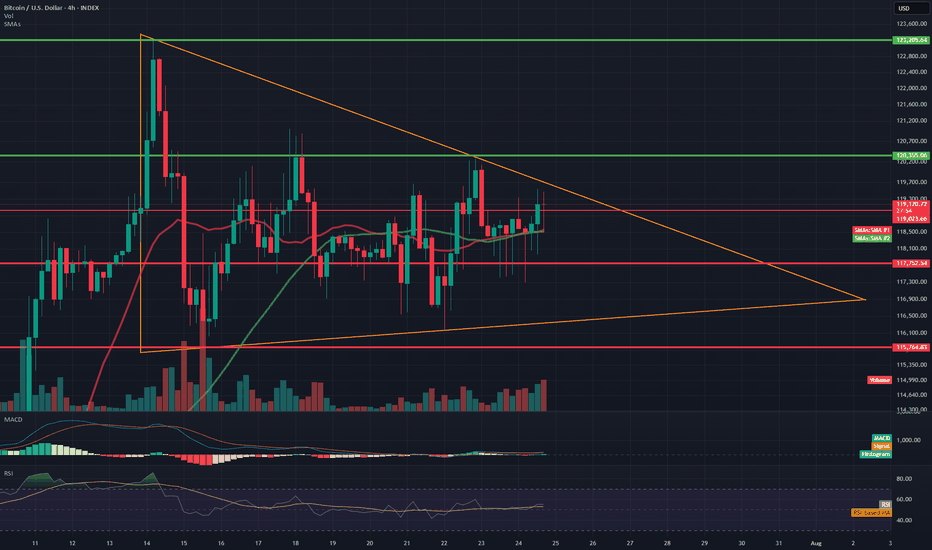

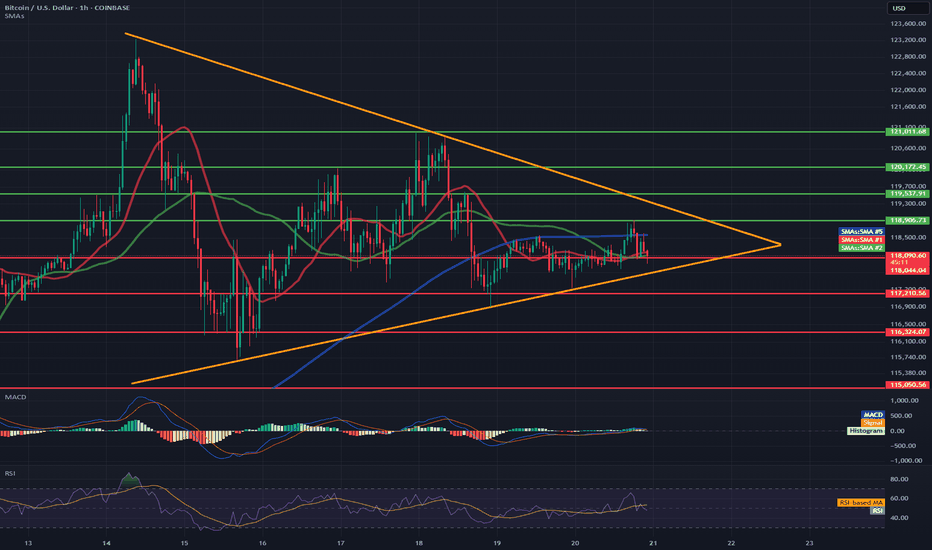

BTC/USD 4H Chart Review📊 Technical Structure (Symmetrical Triangle)

Formation: The symmetrical triangle (orange lines) remains intact—price continues to move within it.

Approaching the apex: The closer to the intersection of the triangle's arms, the greater the probability of a breakout. The current candle is testing the upper boundary of the formation (around $119,300), but has not yet broken it.

Direction: The formation is neutral, but tension is increasing. A breakout of either line (the upper boundary ≈$119,500 or the lower boundary ≈$117,700) could trigger a dynamic move with a range of around $3,000 (the height of the triangle at its widest point).

🧱 Support and Resistance Levels (Red and Green Lines)

Type Level (USD) Description

Resistance 123205 All-Time High – Possible Target After an Upward Breakout

Resistance 120556 Local Resistance – Triangle Breakout Range

Resistance 119200–119300 Currently Tested Level

Support 117752 Lower Triangle Boundary – Critical Defense Line

Support 115764 Next Local Support

📈 Technical Indicators

🔵 RSI (Relative Strength Index)

Currently: ~55 – indicates a neutral situation, having broken down from the overbought level (~74).

Indicates that the market has temporarily cooled down after a previous impulse. There is still room for further upward movement without exceeding 70.

🔵 MACD

The MACD and signal lines are approaching a crossover – if the MACD crosses the signal line upward, it could be a bullish signal.

The histogram is slightly positive – indicating weak but growing bullish momentum.

📊 Volume

Slightly increasing in the last candles – no confirmation of a strong breakout yet, but upward pressure is building.

🧠 Interpretation

Scenario Technical Conditions Movement Objective

🔼 Upward Breakout

Candlestick close above $119,500 USD 122,000–$123,200 USD

🔽 Downward Breakout

Close below 117,750 and confirmed by volume at 115,700, then 114,000 USD

🔄 Consolidation

Inconclusive, continued sideways movement

Between $117,700 and $119,500 USD

✅ Summary

Bitcoin is still in a neutral symmetrical triangle formation but is approaching a turning point.

The RSI has broken out of the overbought range, and the MACD is signaling a potential upside breakout.

Volume confirmation is still lacking, but technical conditions favor the bulls – if it manages to break above 119,500 and hold above, a move towards 122,000–123,000 USD can be expected.

In the event of a rejection, maintaining 117750 will be key; breaking it opens the way to 115700 and below.

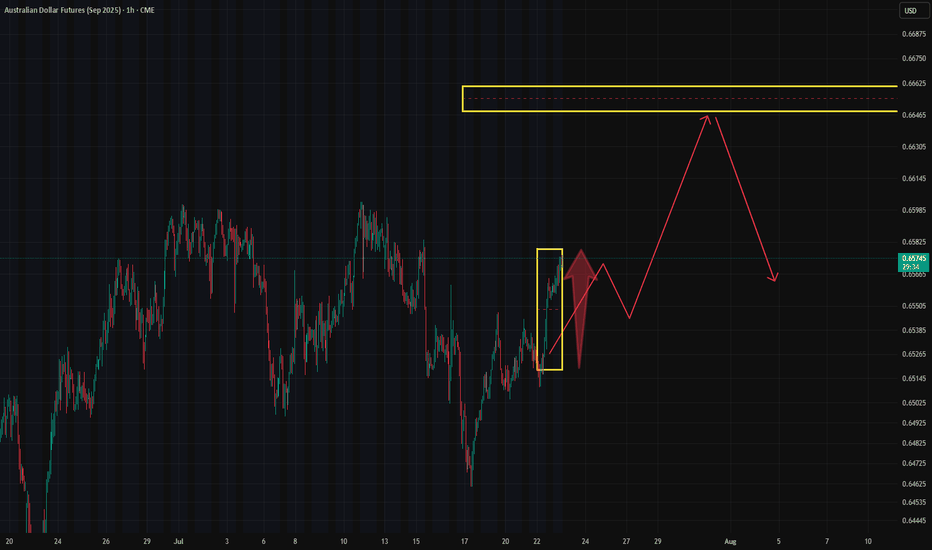

Australian dollar rose 0.8% but there is a "Wall" of naked callsAustralian dollar is up 0.8% in 24h — and almost eyeing the 0.66–0.665 zone .

That’s exactly where we’ve been seeing a systematic build-up of naked calls on the futures.

More “bricks” added to the wall yesterday.

Early, looking at the CME data , there’s been a meaningful inflow in deep-out-of-the-money call options at the 0.665 strike . And this has been happening for several days for now

We can’t say it’s one single player — CME reports don’t show that.

But the pattern is too consistent to ignore.

🧠 Why it matters:

As I’ve said before — these long call stacks can easily turn into zero-cost put spreads by selling futures at those levels.

🎯 Bottom line:

Seems the market isn’t betting on a rally in long term.

It’s preparing to defend the range .

Strategy: open shorts at "build-up" resistance zone

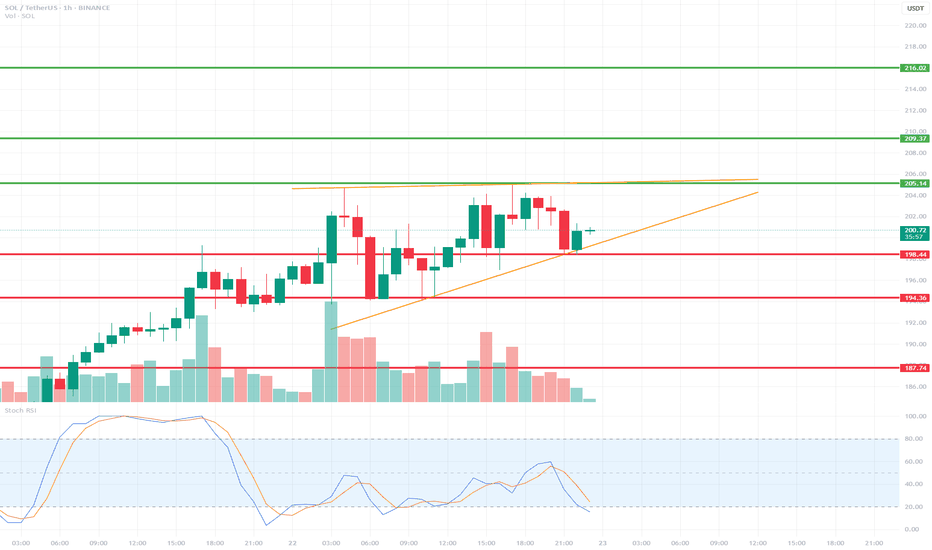

SOLUSDT 1H Short-Term🔍 Technical Structure:

Short-Term Trend:

SOL is currently in an uptrend, with local higher lows. This is evident from the orange uptrend line, which has been tested multiple times.

Local Resistance:

205.14 USDT – yellow line – a resistance level that the price has touched several times but failed to break (this could be a double-top formation).

Local Support:

198.48 USDT – the price is currently testing this level as support.

194.36 USDT – lower, more crucial support (stronger upon a trend breakout).

187.74 USDT – important support that would be tested in the event of a larger breakout.

📉 Oscillator – Stoch RSI:

The Stoch RSI is currently in oversold territory (below 20), suggesting the possibility of a local rebound.

However, there has been no upward crossover yet, so there is no strong buy signal.

🔊 Volume:

We are observing a decrease in volume during the current correction, suggesting that the declines are relatively weak – there is no strong supply impulse.

🧠 Short-term scenarios:

✅ Bullish scenario:

Price is rebounding from the trend line (orange) and the 198.48 USDT level.

A break of the 205.14 USDT resistance could open the way to:

209.37 USDT

216.02 USDT (next target)

❌ Bearish scenario:

A break of the trend line and the 198.48 USDT level with the 1-hour candle closing below.

Possible decline to:

194.36 USDT (first support)

and further to 187.74 USDT if selling pressure increases.

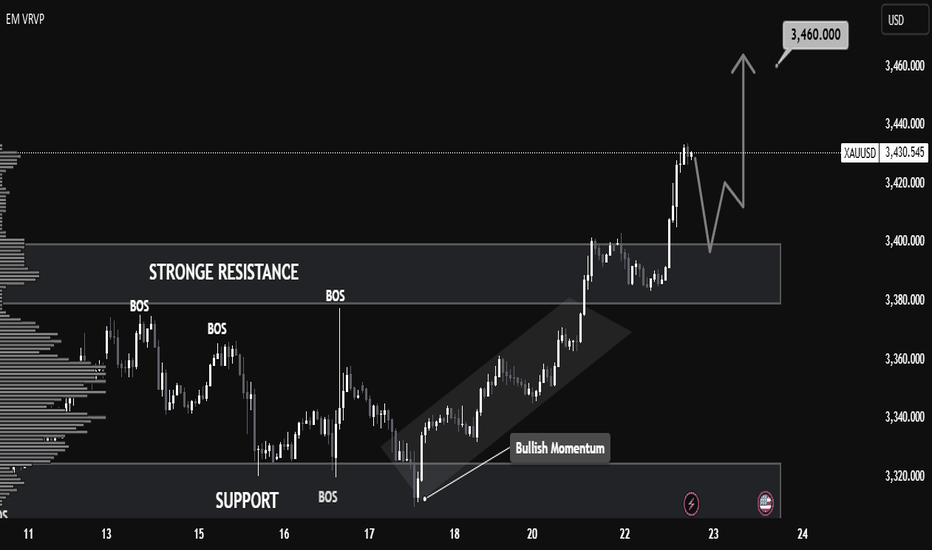

XAUUSD Technical Analysis – Resistance Turned Support, 📈 XAUUSD Technical Analysis – Resistance Turned Support, Bullish Continuation Expected

Gold (XAUUSD) has shown strong bullish momentum after breaking above the key resistance zone around $3,400, which now appears to be acting as a new support level. This structure shift signals a classic break-and-retest scenario, commonly observed in bullish continuations.

🔍 Key Observations:

Structure Shift: Previous resistance near $3,400 has been broken with strong bullish candles, suggesting buyer dominance. This level is now expected to serve as support.

Bullish Momentum: The move from the $3,320 support zone to above $3,430 was accompanied by clear trend formation and clean market structure, indicating sustained momentum.

Retest in Progress: Price is currently pulling back toward the new support zone ($3,400). If this area holds, a bullish reaction is expected.

Next Target: If support at $3,400 holds as expected, price could rally back toward the next resistance and projected target of $3,460.

📚 Educational Insight:

This setup illustrates the principle of resistance becoming support (RBS)—a foundational concept in technical analysis. After a breakout, a successful retest of former resistance often provides a high-probability entry point for trend continuation trades.

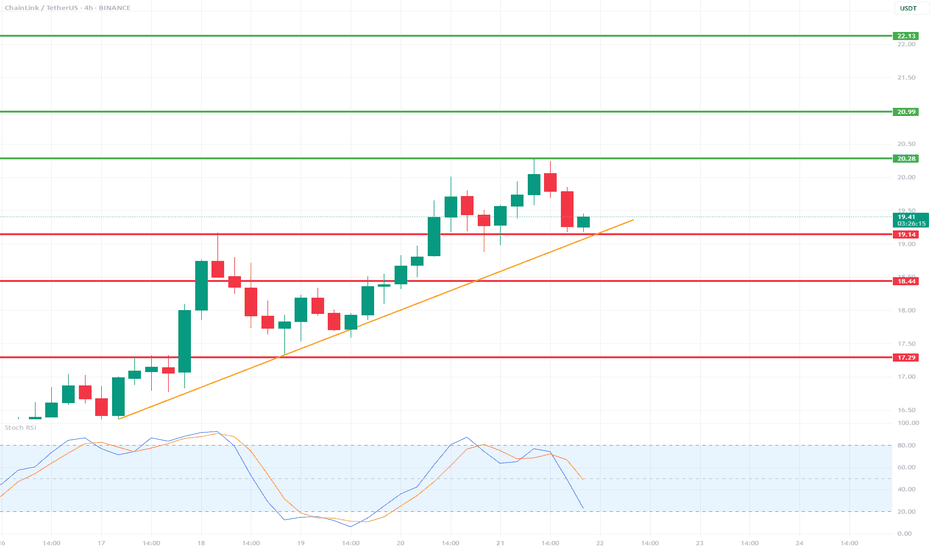

LINK/USDT 4H Chart📉 Indicators and Market Structure:

🔶 Trend:

Current trend: up, as long as it remains above the trend line and the 19.14 USDT level.

Local resistance: 20.28 USDT (recent high).

Next resistances: 20.99 USDT and 22.13 USDT (green lines).

Supports: 19.14 USDT, 18.44 USDT, 17.29 USDT (red lines).

🔷 Stochastic RSI (lower indicator):

Located in the oversold zone (below 20) and starting to reverse upward.

Potential signal of buying pressure if the %K and %D lines cross bullishly.

🧠 Scenarios:

✅ Bullish scenario (trend continuation):

Bounce from the trend line and the 19.14 level → breakout of 20.28 → test of 20.99–22.13.

Confirmation will be a clear bullish candle with high volume and a Stochastic RSI cross up.

❌ Bearish scenario (trend break):

Closing below the trend line and the 19.14 level → correction towards 18.44, and then even to 17.29.

An oversold RSI could support continued declines if a rebound does not occur.

📌 Summary:

Currently, the key level is the trend line and support at 19.14 USDT.

The market is waiting for a reaction – a rebound or a downward breakout.

Stochastic RSI suggests a possible rebound, but candlestick confirmation is needed.

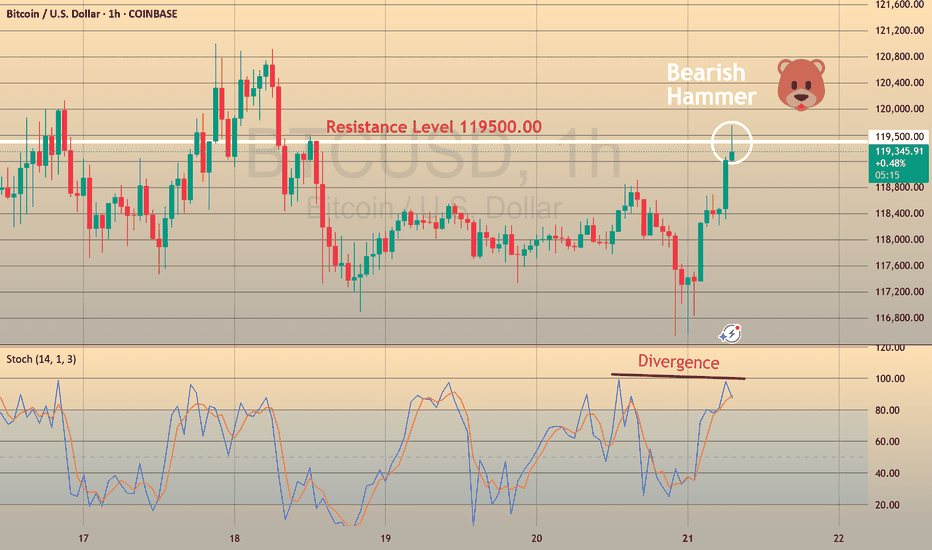

BTCUSD - BEARISH DIVERGENCE DETECTEDCAPITALCOM:BTCUSD

BTCUSD has been in a bullish trend over the past few hours and is now approaching the resistance at 119,500.00.

On the hourly chart, a bearish hammer has formed alongside a stochastic divergence, signaling potential downside.

⚡ This signal is reinforced by a strong resistance level above, adding weight to a possible pullback scenario.

📉 If BTCUSD rebounds from this level, consider Sell setups with take profit at the nearest support.

📈 If it breaks out, look for Buy opportunities on confirmation.

⚡ We use Stoch (14) to spot potential reversals when it exits overbought or oversold zones — helping you catch clear, confident entries.

BTC/USD Short-Term🔷 Pattern: Symmetrical Triangle (Consolidation)

The price is inside the triangle formation (orange lines) and is approaching its completion.

An impending breakout (up or down) is highly probable within the next few hours.

📉 Support Levels (red lines):

117.210 – local horizontal support.

116.324 – 115.050 – strong demand zone (potential target in the event of a downward breakout).

📈 Resistance Levels (green lines):

118.900 – 119.700 – local resistance zone.

121.011 – 121.813 – higher target in the event of an upward breakout from the triangle.

📊 Technical indicators:

✅ RSI (Relative Strength Index):

Currently: 69.05 – close to overbought levels, but not yet at an extreme.

Potential for a short-term pullback unless a strong breakout occurs.

✅ MACD:

Signal lines are tightly intertwined, histogram flat → no dominant momentum.

Waiting for a breakout signal (bullish or bearish crossover).

✅ SMA:

Price currently below the 50 and 200 SMA for 1 hour → slight downward momentum.

The 50-SMA (red) is turning down, which may signal a continuation of the sideways or downward trend.

📌 Short-term conclusions (1–6 hours):

Scenario 1: Bullish breakout:

Confirmation: H1 candle close above 118,900.

Targets: 119,700 and potentially 121,000–121,800.

Scenario 2: Bearish breakout:

Confirmation: H1 candle close below 117,200.

Targets: 116,300, then 115,000–115,300.

📍 Watch for:

Breakout of the triangle boundaries with volume.

RSI behavior relative to the 70 level.

MACD crossover and histogram.

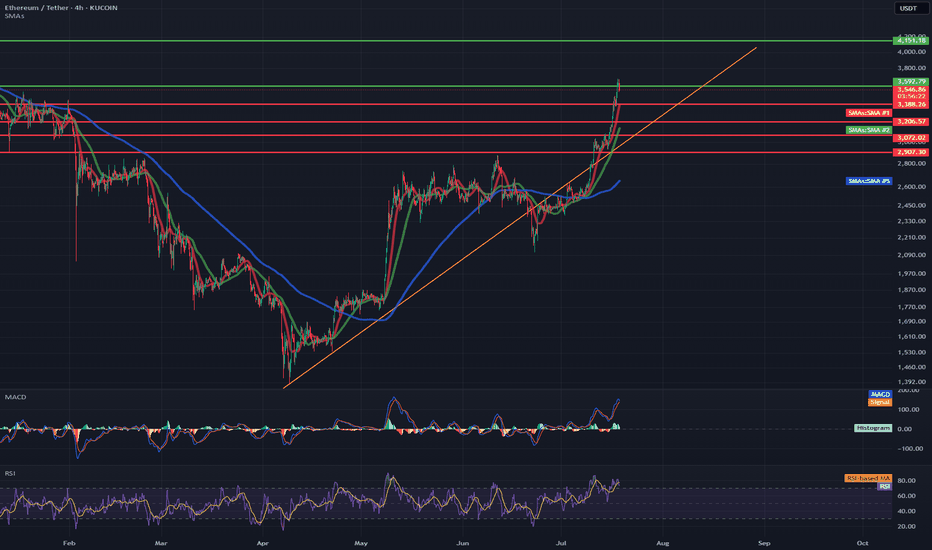

ETH/USDT 4H Chart✅ Market Trend and Structure:

Uptrend: The highlighted orange trend line shows continuous growth since mid-April. The price is trading above the 50- and 200-period moving averages (EMA and SMA), confirming bullish sentiment.

Current price: around 3556 USDT – very close to local highs.

Resistance break in the 3200–3300 USDT area, which now acts as support.

📈 Technical Levels:

Resistance (red horizontal lines):

3600–3650 USDT – local resistance resulting from market reaction.

3888 USDT – next historical resistance level.

4133 USDT – established long-term target (green dashed line at the top).

Support:

3300 USDT – strong support after a previous breakout.

3080 USDT – previous high, now the next support level.

3070 / 2900 USDT – key technical support levels in the event of a larger correction.

📊 Indicators:

MACD:

The MACD is in a strongly bullish zone, but:

The histogram is flattening.

A bearish crossover pattern is possible in the following candles – a signal of weakening momentum.

RSI:

RSI ~74 – is in the overbought zone, which often heralds a correction or at least consolidation.

A value above 70 confirms the bullish trend but may suggest that momentum is overheated.

📌 Conclusions and Scenarios:

🔼 Upside Scenario (trend continuation):

If the price remains above 3300–3350 USDT, it could move towards 3888, and then 4133 USDT.

A break above 3650 USDT on heavy volume will be a strong continuation signal.

🔽 Corrective scenario (short-term pullback):

The RSI and MACD suggest a possible correction.

Potential pullback to:

3300 USDT (retest of previous resistance as support).

SMA 200 (~2600 USDT) with a deeper downward move.

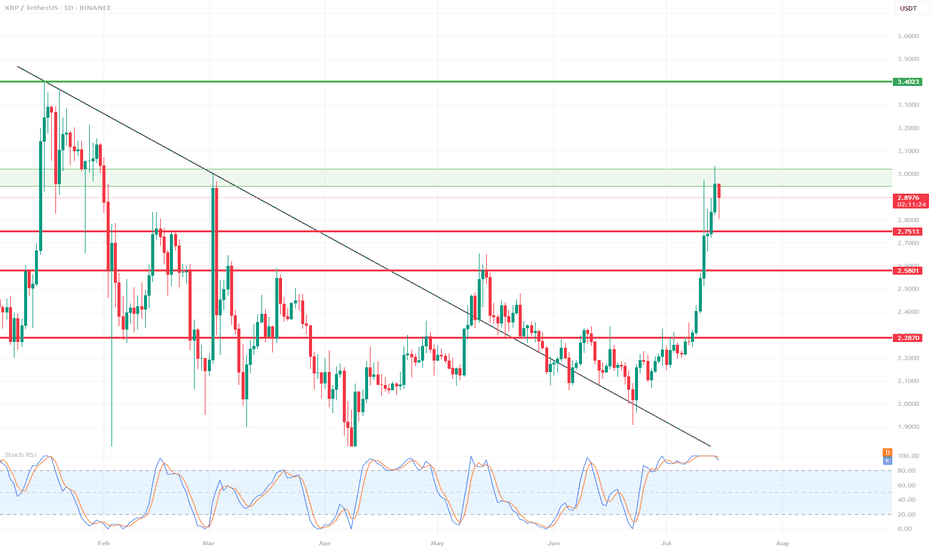

XRP 1D Chart Review📊 Support and Resistance Levels:

🔼 Resistance:

$2.95 - $3.02 – currently being tested, a local resistance zone. Price slightly rejected.

$3.40 – another strong resistance level from the previous high (visible on the left side of the chart).

🔽 Support:

$2.75 – the closest, recently broken support level.

$2.58 – another local support level.

$2.28–$2.30 – a very strong support zone that has been tested multiple times.

📈 Pattern and Momentum:

A breakout from a wedge-shaped downtrend with very high volume and long bullish candles indicates strong demand.

We are currently observing a correction/rejection at $3.02 – a possible short-term pullback.

🔄 Oscillator – Stochastic RSI:

The Stochastic RSI oscillator is in the overbought zone (near 100) – indicating possible consolidation or correction.

The curves are starting to curve downwards – a potential signal for a slight correction in the coming days.

🧠 Scenarios:

✅ Bullish (continued growth):

If the $2.95–$3.02 level is broken strongly and confirmed (e.g., by a daily candlestick closing above it), the target will be $3.40.

In this case, a quick rally to $3.40 is possible without major obstacles.

⚠️ Bearish (correction):

If the $3.02 zone holds as resistance, the price could retrace to $2.75 (the first local support).

If downward pressure persists, $2.58 could be tested.

📌 Summary:

XRP is in a strong uptrend after breaking out of long-term resistance.

In the short term, overbought prices on the Stoch RSI could trigger a correction to $2.75.

Key resistance: $3.02 – breaking it could signal further gains towards $3.40.

It's worth monitoring price reaction in this zone and candlestick confirmation.

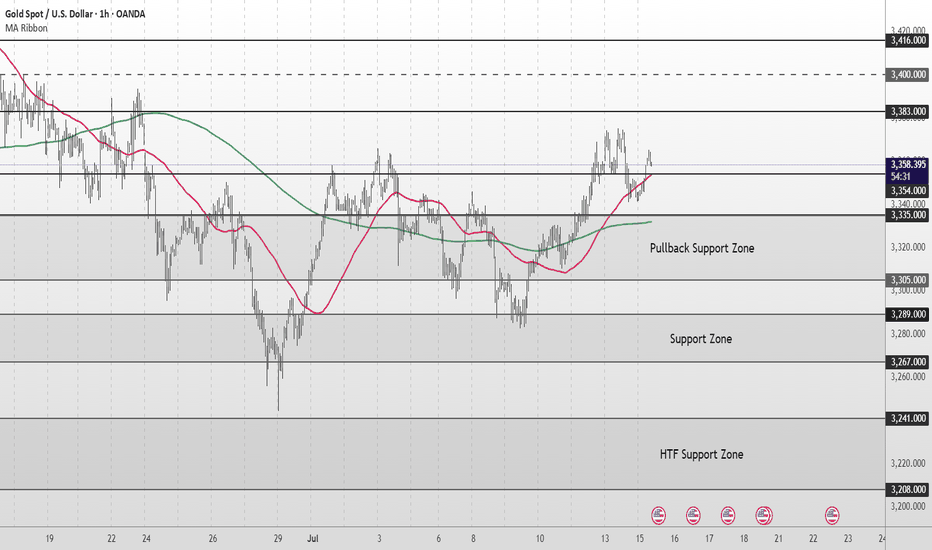

Gold Short Term OutlookGold has extended its recovery after holding above the Pullback Support Zone and is now trading around 3,359, attempting to build momentum toward higher resistance levels.

The structure remains bullish with price trading above both the 50MA and 200MA , which are starting to slope upward and act as dynamic support.

A confirmed break and hold above 3,354 would open the path toward the next resistance cluster at 3,383 and potentially 3,400, with 3,416 and 3,440 as higher-timeframe resistance targets.

If price fails to hold above 3,354 and begins to fade, watch the Pullback Support Zone (3,335–3,305) closely for signs of renewed buying interest.

A clean break below that zone would shift focus to the deeper Support Zone (3,289-3,267) and potentially the HTF Support Zone (3,241–3,208) if selling pressure builds.

📌 Key Levels to Watch

Resistance:

‣ 3,364

‣ 3,383

‣ 3,400

‣ 3,416

Support:

‣ 3,354

‣ 3,335

‣ 3,305

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔎 Fundamental Focus

All eyes are on today’s U.S. CPI release

BTC/USD 1H ShortTerm🔍 Trend:

The short-term uptrend remains in effect, supported by the orange trendline.

The price has tested dynamic support but has not yet broken it.

🟥 Supports (Important Levels):

🔻 1. 119.550

Key support.

The price is currently testing it. Holding = potential upside rebound.

Breaking = greater downside risk.

🔻 2. 117.260–118.040 USD

Clear demand zone (reinforced by prior consolidation).

If the price breaks below current support, this is the next logical stopping point.

🔻 3. 115.237–115.500 USD

Strong weekly support – very important in the event of a stronger correction.

Historically, it has responded many times.

🟩 Resistance:

🔼 1. USD 121.673

The nearest local resistance – this could pose a problem for further growth.

🔼 2. USD 123.961

The last local high. Breaking it confirms the continuation of the uptrend.

🔼 3. USD 125.785

The next resistance – a potential target after a breakout to the upside.

📈 Technical Indicators:

RSI (classic):

Still below 50, but starting to reverse slightly upward – neutral with a slight potential for a rebound.

Stochastic RSI:

Gives a long signal – the lines have crossed in the oversold zone and are pointing upward.

📊 Scenarios:

🟢 Bullish:

Maintaining the current support zone (119.5–120k).

Breakout above 121.673 → target: 123.961.

Breakout of 123.961 = trend confirmation and target: 125.8k+

🔴 Bearish:

Break of the trend line and support at 119.550 → possible quick decline to 117.2k–118k.

If this doesn't hold, target: 115.2k

✅ Summary:

Decisive moment – tested trend line + support = rebound or breakout point.

The Stochastic RSI indicates a potential upside breakout, but the RSI needs confirmation.

Careful monitoring of volume and reaction to 120k in the coming hours.

AUDUSD: Short Setup Ahead of Key Data OANDA:AUDUSD

AUDUSD is hovering near a rising trendline, with price action compressing and signaling a potential downside break in the coming sessions.

Just above, the 0.65900 resistance zone has capped recent rallies, and the pair’s failure to clear this level strengthens the case for a reversal.

Later today, we will see Westpac Consumer Confidence data for Australia, which could act as a catalyst for a sharp move. A weaker-than-expected print would likely pressure the Aussie further.

📋 Entry Checklist:

✅ Testing rising trendline, signaling potential breakdown

✅ Strong resistance at 0.65900 holding rallies

✅ Key consumer sentiment data could trigger volatility

📈 Trade Plan:

🔻 Sell Entry: 0.65600

❌ Stop Loss: 0.66200

✅ Take Profit: 0.65000

(Tap 👉 Trade Now 👈 on mobile to copy SL & TP easily)

📰 Fundamental Snapshot:

The Reserve Bank of Australia (RBA) surprised markets by holding rates steady at 3.85%, diverging from expectations of a potential cut. The RBA remains cautious amid persistent inflation risks driven by high labor costs and weak productivity, suggesting rates may stay restrictive longer.

Governor Michele Bullock highlighted that inflation could remain above forecasts, while Deputy Governor Andrew Hauser emphasized monitoring global uncertainties, including U.S. tariff developments, reflecting the RBA’s sensitivity to external headwinds impacting growth and trade.

MKR/USDT 4H Chart🔍 1. Technical Pattern:

The chart shows a descending wedge (orange lines) that has broken out upward.

The breakout occurred on increasing volume (a signal of bullish strength).

The price is currently trading above a resistance line, which is now acting as support (~1980 USDT).

📊 2. Support and Resistance Levels:

Support (red lines):

1903 USDT – local consolidation support.

1801 USDT – strong support at the previous bottom.

1727 and 1632 USDT – fallback zones in case of strong declines.

Resistance (green and blue lines):

2120 USDT – first target after the breakout.

2168 USDT – another strong resistance from the previous consolidation.

2312 USDT – high resistance, potential target if the uptrend continues.

📈 3. Indicators:

🔹 Stochastic RSI:

Close to the overbought zone, but not yet giving a sell signal.

A short consolidation or correction may occur in the coming hours.

🔹 MACD:

The MACD line is above the signal and the histogram is still rising – a buy signal.

No signs of weakening momentum.

🔹 RSI:

The RSI is rising, but not yet in the overbought zone (>70).

Shows the strength of the trend, but there is room for further upward movement.

🧠 Summary and scenarios:

✅ Bullish scenario:

If the price remains above 1980 USDT, the next targets are:

2120 USDT

2168 USDT

Potentially 2312 USDT with continued demand

⚠️ Bearish scenario (less likely at this time):

If the price returns below 1980 USDT and does not regain this level:

Possible return to 1903 or lower (1801 USDT).

EURUSD Eyes Key Levels Ahead of DataFOREXCOM:EURUSD

EURUSD is trading within the 1.1680 – 1.1810 range 📊, continuing its upward momentum during the Asian and early European sessions 🌏⬆️.

⚡️ Markets are now focusing on potential trade negotiations with India and the EU 🤝, which could shape near-term currency moves and risk sentiment 🌐.

📈 Today at 12:30 p.m. UTC 🕧, the U.S. Jobless Claims report 📑 may trigger volatility across all USD pairs ⚠️. Stronger-than-expected data could delay Fed rate cuts 🕰️🔻 and push EURUSD below 1.1700 🩻, while weaker figures may weigh on the U.S. dollar 💵⬇️ and lift EURUSD above 1.1800 🚀.

👀 We will monitor these levels closely for potential breakout opportunities. Stay tuned for live updates!

LINK/USDT (Chainlink to Tether) from the 4H interval⚡️ Technical situation – quick overview

✅ Breakout from the descending channel (purple lines)

✅ Resistance zone 14.42 – currently being tested

✅ Target within the breakout range – around 17.73 USDT

⚠️ Stochastic RSI in the overbought zone – local correction possible

🟪 Descending channel – broken!

The descending channel that has been in place since mid-May has been broken upwards.

Such breakouts often signal a change in the local trend.

Theoretical range of movement = channel height (~3.30 USDT) added to the breakout point (around 14.42) = ~17.73 USDT – perfectly aligned with your resistance level.

🟢 Key Resistance Levels (green):

Level Meaning

14.42 USDT Current tested resistance – psychologically significant

15.65 USDT Local high + June price gap

17.73 USDT Potential target after a breakout – range from the formation

🔴 Support Levels (red):

Level Meaning

12.73 USDT Support from the pre-breakout consolidation

11.91 USDT Key defensive level of the uptrend

11.07 / 10.12 USDT Historical support with strong demand reactions

📉 Stochastic RSI (oscillator):

Currently deep in the overbought zone (above 80).

This may indicate local exhaustion of momentum and a short correction before further upward movement.

However: in strong trends, the RSI may remain high for an extended period – it does not automatically provide a sell signal.

📈 Bullish scenario:

Retest of the 14.42 level as support → confirmation of the breakout

Then a move towards:

15.65 – local stop

17.73 – final target from the channel breakout

🟩 Stop-loss: e.g., below 12.73 USDT (loss of key support)

📉 Bearish scenario:

False breakout and decline below 14.42

Loss of the 12.73 level → possible quick decline to 11.91–11.07

🔴 In this case, a new swing low could open the way to 10.12 USDT.

📌 Summary:

Element Rating

Technical Pattern ✅ Breakout from a descending channel (bullish signal)

Current Level ❗ Test of Key Resistance – Decision Point

RSI (Momentum) ⚠️ Overbought – Correction Possible

Upside Potential (Target) 📈 17.73 USDT

Threat ❌ False breakout and return to below 12.73 USDT

🧠 My suggestion (not investment advice):

Observe the price reaction at 14.42 – if it holds above and consolidation forms → a signal to continue.

If the 4H/1D candle closes below, consider caution, as this could be a bull trap.

ETH/USDT 1W Chart📊 Trend structure (Price Action)

Downtrend (historical):

A series of Lower Highs (LH) and Lower Lows (LL) — a classic downtrend.

Confirmed by the orange downtrend line.

A change in structure — a possible beginning of an uptrend:

A Higher Low (HL) has recently been formed after a Lower Low (LL).

Suggests a possible end to the downtrend and an attempt to break out upwards.

Currently:

The price is testing the upper downtrend line.

A breakout above the orange line may confirm a trend change.

🟢 Key Resistance Levels (Green Lines):

Level Meaning

3.058 USDT Potential target after a breakout from consolidation

2.767 USDT Nearest strong resistance - currently being tested

3.427 USDT Deep resistance level from the previous high (HH)

🔴 Key Support Levels (Red Lines):

Level Meaning

2.234 USDT Nearest support - previous breakout

1.883 USDT Early 2023 support

1.507 USDT Local bottom

1.204 USDT Historical support - LL extreme

📉 Stochastic RSI (Momentum Indicator):

Currently in the overbought zone.

This may suggest a short-term correction before an actual breakout.

However, in a strong uptrend, the indicator may "hang out" in the overbought zone for a long time.

📈 Potential scenario:

If the breakout above 2.767 and the orange trendline holds:

A possible move to 3.058 USDT as the first target.

Extended target: 3.427 USDT (HH).

If the breakout fails:

Correction to 2.234 USDT or lower.

There is a risk of returning to a downtrend.

✅ Bullish signals:

Higher Low (HL) formation after Lower Low (LL).

Testing the upper downtrend line with an attempt to breakout.

Volume is increasing (based on candles).

⚠️ Bearish threats:

Stochastic RSI in the overbought zone.

Breakout not confirmed by 100% (needs a weekly closing candle above 2.767).

Resistance at 3,058 could halt the move.

📌 Conclusion:

Ethereum (ETH) could be on the cusp of a new uptrend, but a breakout above 2,767 USDT is needed for confirmation. If it does, a move to 3,058 and then 3,427 is possible. However, the current overbought level on the Stochastic RSI could signal a short-term correction before the trend gains strength.

XRP/USDT 4H📊 1. Trend and moving averages

Red line (SMA 10) – short-term, currently rising, which suggests upward momentum.

Green line (SMA 20) – also in the upward trend and below the price – dynamic support.

Blue line (SMA 50/200) – probably SMA 50 or 200 – the price has broken through it from below and is currently above it – this is a pro-growth signal.

📌 Conclusion: In the short and medium term, a reversal of the trend to growth is visible.

📈 2. MACD (Moving Average Convergence Divergence)

The MACD line has crossed the signal line from below, which is a buy signal.

The MACD histogram is rising and is above zero – further confirmation of the upward trend.

📌 Conclusion: The upward momentum is increasing.

💪 3. RSI (Relative Strength Index)

RSI is currently at ~62, which means that:

We are still ahead of the overbought zone (70).

RSI is rising – it suggests bullish buyer pressure.

📌 Conclusion: There is still room for further growth before the market is overbought.

🔍 4. Market structure and resistance/support

The price is in the 2.30–2.35 USDT zone, which previously acted as resistance.

The closest resistance is around 2.38–2.40 USDT – the level from May, where the decline occurred.

The closest support is around 2.20 USDT (in line with the green SMA) and stronger at 2.05–2.10 USDT (earlier consolidations).

📌 Conclusion: Breaking 2.40 opens the way to a test of 2.50 and above.

🧠 Technical Summary

Aspect Rating

Trend (SMA) ✅ Up

MACD ✅ Buy

RSI ⚠️ Near overbought

Resistance/Support ⚠️ Resistance at 2.38–2.40

Movement Potential ✅ To 2.50 or higher

📌 Potential scenarios:

✅ Bullish (uptrend scenario)

A hold above 2.30 and a breakout of 2.40 could give an impulse for further gains towards 2.50–2.60.

Strong confirmation would be an increase in volume.

⚠️ Bearish (correction scenario)

A rejection from 2.38 and a drop below 2.20 could initiate a retest of support at 2.05 or even 1.95.

Is BTC getting ready for a new ATH?🔍 1. Key Support and Resistance Levels (Horizontal Lines):

🟢 Resistances (Green Lines):

114,295.54 — strong resistance resulting from previous highs.

112,767.65

111,009.00

110,685.35 — current key level that price may try to retest after a potential breakout.

🔴 Supports (Red Lines):

108,496.55 — current level being tested, also coinciding with local resistance from the past.

107,687.57

105,888.74

102,909.85

100,848.07

98,208.22 — strong long-term support; in the past, this level was reacted with a strong bounce.

🔶 2. Downtrend channel marked with orange lines:

The upper downtrend line acted as resistance.

The lower uptrend line acted as support.

The price recently broke above the upper line, but is now testing it again - this could be a retrospective retest.

➡️ If the close of the H4 candle is above this line - a possible confirmation of the breakout.

📊 3. Stochastic RSI indicator (at the bottom of the chart):

Currently in the uptrend phase after a bounce from the oversold level (<20).

The %K line (blue) is crossed upwards by the %D line (orange) - a bullish signal.

Still below the overbought zone, which suggests that the potential uptrend still has room to develop.

🧠 4. Market structure and price action:

Price broke above the 108.496 level, but is currently struggling to stay above this zone.

A retest of the broken triangle could be a healthy move, provided that support is maintained in the 108k–107.6k area.

A break below and a close below 107.6k could mean a false breakout and a possible decline towards 105.8k or even 102.9k.

🧭 5. Possible scenarios:

✅ Bullish scenario:

Maintaining the 108.496 level and closing the candle above the upper orange line → continued growth.

The nearest targets are:

110.685 (first resistance),

111.009 and 112.767 next.

❌ Bearish scenario:

The price will not stay above 108k and will fall below 107.687.

Possible return to the previous consolidation range with the target:

105.888,

and then 102.909 or 100.848.

🧮 Summary:

Currently, the decisive moment is underway: a test of support after breaking out of the convergent triangle.

The Stoch RSI indicator gives a bullish signal, but the price must confirm the movement by behaving above 108k.

Retest and bounce - this is a bullish scenario.

A breakdown and return under the trend line - means that the breakout was false.

ETH/USDT 1D🔍 ETH/USDT - technical analysis (1D interval):

📉 Price: 2478 USDT (-4.36%)

🔧 Resistance:

• SMA 200 (green): ~ 2589

• Resistance zone: ~ 2715 → 2880 USDT

• SMA 100 (blue): ~ 2500 (just rejected)

🔧 Support:

• SMA 50 (red): ~ 2434 - currently tested

• Strong support: 2373, 2314, 2223 USDT

📊 indicators:

• MacD: freshly intersected, but the momentum is weakening

• RSI: ~ 45 - neutral/weak, under 50 (no bull strength)

• Trend: Still in the downward channel (yellow trend lines)

⸻

⚠️ Conclusions:

• Price rejected from 2500 (SMA 100) and flies down.

• If 2434 falls, a further discount is possible to 2373–2314.

• Lack of bulls with key resistance - the inheritance scenario dominates.

• Watch behavior at 2434 - this is now a key level.

BNB/USD (4h interval)🔍 1. Chart structure

Instrument: Binance Coin / USD (BNB/USD)

Interval: 4 hours

📐 2. Technical formations

🔸 Breakout from the descending wedge formation

The descending wedge (orange lines) is a bullish formation - it suggests a potential breakout upwards.

The breakout occurred dynamically, with a large breakout candle (confirmation of the formation).

The goal of breaking out of the wedge is usually the height of the entire formation - this is marked with an orange arrow.

📈 Breakout range (target): around $697–710

🟢 Potential next targets:

697.83 (local resistance/projection result)

710.73 (main wedge height projection)

728.12 (strong resistance from history)

📊 3. Supports and resistances

🟥 Support zones (red rectangles):

$648.5–637.5 – previous resistance, now tested as support after the breakout.

$608.5–592.5 – strong support from previous lows.

🔼 Currently, the price has tested the upper support zone (648–637), reacted positively and continues to move up.

🟩 Resistance levels (green horizontal lines):

679.88 USD – local resistance, first target after breaking out of the wedge.

697.83 USD – projected range from the formation.

710.73 USD – full technical range of the breakout.

728.12 USD – strong resistance from history, may be a long-term target.

📉 4. Trends and support lines

Purple upward trend line – currently the price is above, which confirms the short-term upward trend.

Its break may lead to a retest of 648–637 USD.

Only below this zone can a larger correction be considered.

📈 5. Stochastic RSI indicator

Currently in the overbought zone (above 80).

Possible temporary cooling – signal for local correction / consolidation.

It is worth waiting for the indicator to go down to around 20 to re-enter the long.

✅ 6. Scenarios

🔼 Bullish (base) scenario:

Staying above 648–637 USD.

Maintaining the uptrend line.

Continuation to 679.88 → 697.83 → 710.73.

🔽 Bearish scenario:

Breaking the purple trend line.

Returning below 648 USD → going down to the 608–592 zone.

Negation of the breakout from the wedge.

📌 Final conclusions

Breaking out from the descending wedge is a strong pro-growth signal.

The price behaves in accordance with technical analysis, testing the previous resistance as support.

Currently, the retest and consolidation phase is underway – maintaining the trend line and the level of $648 will be key.

The medium-term target is $697–710.

THELEELATHELEELA is giving resistance + cup and handle breakout above 414 level. Market participation has also increased in recent sessions. So if it sustains and closes above 414 then it looks very attractive and may start new momentum rally. 398 seems very good support. On upper side we may see momentum of 10-12%. Make sure that it sustain and closes above 414!

BTC with potential for $115,000/$120,000🔍 Market structure (Price Action)

📈 Trend:

The market previously formed higher highs (HH) and higher lows (HL) – a classic uptrend.

Then there was a correction and a lower high (LH) and lower low (LL) appeared – a potential change in the trend to a downtrend.

The last two lows are again HL (Higher Lows) – suggesting an attempt to return to the uptrend.

🔄 Key support and resistance levels

✅ Resistance (green horizontal lines):

117.469 – local resistance and potential breakout target from the current range.

115.802 – confirmed resistance from previous consolidations.

111.814 – strong local resistance (LH – Lower High formed there).

109.341 – current resistance, the price is currently testing it.

🛑 Support (red horizontal lines):

105.370 – local support, price reacted at this level in recent days.

102.650 – important support, level of previous HL.

100.095 – consolidation level before breaking out upwards.

98.213 – last LL – very important level in the context of defending the structure.

🧭 Structure of peaks and troughs

HH: Higher High – confirmed the previous uptrend.

LH: Lower High – first warning about changing the structure to down.

LL: Lower Low – confirmed a potential change to downside.

HL (x2): two more higher lows – suggest a possible return to growth.

📊 Stochastic RSI (at the bottom of the chart)

The oscillator is currently in the overbought zone (>80), approaching a downward crossover.

It suggests a possible short-term halt in growth or correction.

But in strong trends it may "stick" to the upper range.

📌 Potential scenarios:

🟢 Bullish:

If the price breaks above 109.341, it may test 111.814 and then 115.802.

Continuation of the HL → HH formation will confirm a trend reversal and further growth.

🔴 Bearish:

If the price does not stay above 109k and breaks below 105.370, there is a risk of a test of 102.650 and lower.

A break of 100.095 and especially 98.213 will negate the growth structure.

🧠 Conclusions:

The market is at a key decision point - HL formation vs. resistance zone.

Buyers' strength will be confirmed only after breaking 111-112k.

Stochastic RSI warns of potential pullback or consolidation.