Nasdaq - This Is Still Not The End Yet!Nasdaq ( TVC:NDQ ) cannot resist bearish pressure:

Click chart above to see the detailed analysis👆🏻

Over the past three months, we saw such a harsh correction on the Nasdaq that a lot of people are freaking out entirely. However technicals already told us that something feels wrong and this is the result. If we see another -10% from here, buying the dip will most likely pay off.

Levels to watch: $16.000

Keep your long term vision,

Philip (BasicTrading)

Reversal

$OTHERS is the correction over? All is in the Chart!Check the yellow arrows and lines— CRYPTOCAP:OTHERS (all altcoins excluding the top 10) is following a correction pattern similar to CRYPTOCAP:BTC and the $SPX500.

📉 On the 1W timeframe, the MACD is overbought and currently in the middle of a correction. This typically signals a bounce in the coming weeks.

🕰️ If we compare this to the previous cycle, it appears we're at the early stage of what could become an altseason. Back then, it took around 10 weeks after this point to see the real breakout.

🗓️ Based on that, I forecast:

May: first major pump

July–August: consolidation

September–October: final leg up

Despite recent announcements from Trump, the 1W chart has not significantly changed—everything is progressing as expected.

📊 You can verify this macro alignment with my other analyses:

🔗 SPX500 (trendline shows bottom around Sept 2025 at 4700):

🔗 CRYPTOCAP:TOTAL (crypto market macro view):

🔗 CRYPTOCAP:BTC (warning posted on Feb 5, 2025):

📈 Everything is aligning—traditional markets, Bitcoin, and altcoins.

Still Have a Chance in This Sideways MarketPrice is currently moving within a wide sideways range between 2.670 – 4.000, which is roughly a 50% price fluctuation—still a tradable range if we can identify key reversal zones and market structure.

From the structure, we can see that BINANCE:ORCAUSDT has broken the previous high and formed a Higher High (HH)—a sign of strong buying momentum. This shift suggests that the support zone around 3.164 – 3.073 could hold and prevent the price from falling back to the bottom of the range at 2.670.

If the price revisits the support area (3.164 – 3.073), we can wait for bullish confirmation candles before entering. The potential upside target would be in the 3.862 – 4.000 zone.

Additional Notes:

Watch for signs of Higher Low (HL) confirmation around support

If HL forms successfully, this could be a base for continuation to the upper range

Pop and Flop in GOOGL?Google recently staged a sharp rebound, filling the gap perfectly after a major sell-off driven by tariff-related headlines. While I had personally expected a deeper move into the $137.36–$135.41 range, price found strong buying interest earlier than anticipated.

The area we bounced from is significant—it's essentially the origin of the move that led to Google’s all-time high in 2024. However, despite the bounce, GOOGL has lost support across all timeframes , which shifts my focus toward potential short opportunities.

I’m now watching for a reaction around the support-turned-resistance zone near $164 . There’s an untested monthly level at $161.72 , which could trigger a reaction, but the area I’m really eyeing is the weekly resistance zone from $164 to $165.87 . I believe this range could act as a strong reversal zone and spark a deeper pullback.

If that rejection plays out, here are the levels I’m watching for downside targets:

- Target 1: $157.04 (daily support zone)

- Target 2: $146.75 (leg end and major weekly swing low from September 2024)

- Target 3: $141.55 (previous leg low)

- Final Target: New lows below $140.00

This short setup was far more appealing before the recent bounce off the $140 zone, so I will remain cautious. However, if price starts reacting from this resistance zone and breaks back below the monthly at $161.72 —or even more convincingly, the local daily support at $160.67 —that would trigger confirmation for continuation to the downside.

Invalidation levels:

- A weekly close above $165.03

- A daily close above $170.60

Either of those would invalidate the short thesis.

Hey Look! Sellers are Getting Weaker You may notice that the recent price declines are becoming smaller (marked by the grey arrows). The red candlesticks are shrinking, indicating that selling pressure is weakening while buyers are gradually stepping into the market.

As sellers lose momentum, we can expect the support area between 2.779 – 2.713 to hold and potentially trigger a price bounce. For now, we wait for the price to reach this zone and look for a clear confirmation signal before entering.

From a chart pattern perspective, a falling wedge reversal is forming — a pattern often associated with bullish reversals. The 2.779 – 2.713 support area aligns with this pattern and can be considered a potential buy zone, provided we get proper confirmation.

JASMY Falling Channel BreakoutBINANCE:JASMYUSDT just broke out of its falling channel, with strong volume despite it being a weekend move, and is attempting to reclaim the previous support zone around $0.016.

Observations

• Second clear breakout from a descending structure in the last year.

• Good volume spike backing the move — first meaningful demand since the December peak.

• Attempt to reclaim the $0.016 support zone, which had acted as a base throughout 2024.

Key levels

• A daily close above the resistance would confirm the breakout.

• Holding above ~$0.016 would be an even stronger bullish sign.

• Next major resistance at $0.041-$0.045 from the previous supply zone.

• Watch the 1-year EMA above $0.021 as a potential shorter-term resistance.

If momentum continues, this could be the start of a larger trend reversal, with $0.041 as the first upside target.

LTO - Shift in Momentun in Action!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 LTO is a perfect practical example of a momentum shift in action.

It’s clear that the bears are losing steam — the impulse moves marked in red are becoming flatter and smaller, forming a wedge pattern.

Moreover, LTO just tapped into a key weekly support zone near the $0.03 round number, making it a prime area to look for potential long setups.📈

🚀For the bulls to confirm this momentum shift in their favor and aim for the $0.05 round number as the first target 🎯, a break above the last major high marked in green at $0.0345 is essential ✅.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

BTC/USD Long Setup – Bullish Reversal PlayAfter a sharp drop, BTC is testing a key liquidity zone around 78.2k. The market structure suggests a potential bullish reversal, with a fakeout and recovery in sight.

📌 Trade Idea:

Entry: After confirmation of a reclaim and bullish structure break (above ~79.3k)

SL: Below recent low ~77.6k

TP: 82.8k zone

RRR: ~3.2

📅 Timeframe: 30min

📈 Bias: Counter-trend long

🔁 Watch for: Price reaction at current support and market structure shift

🚨 Wait for confirmation – patience is key in volatile conditions!

Apple - All This Was Expected!Apple ( NASDAQ:AAPL ) perfectly plays out:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, Apple perfectly retested the rising channel resistance trendline and has been creating the expected bearish rejection. This could perfectly form the next all time high break and retest, which would eventually lead to another significant move higher.

Levels to watch: $190

Keep your long term vision,

Philip (BasicTrading)

ETH - is the worst over ? Can we expect reversal ?As shown in the chart, ETH has reached the trendline support and is currently trading near a key support zone. This critical level will determine whether ETH initiates a reversal from its long-term downtrend that began last December.

I anticipate this support to hold, leading to a strong rebound in ETH's price. If the reversal occurs from this zone, ETH could reach its peak around Q4 2025.

Let’s see how it unfolds!

Cheers,

GreenCrypto

ALT Market cap - Dip before 3TThe Crypto Total Market Cap Excluding BTC (CRYPTOCAP) is currently testing a critical support zone at the 21-month Simple Moving Average (SMA). Historically, this moving average has acted as a strong dynamic support, marking significant market reversals and uptrends.

✅ Price is bouncing off the 21 SMA, similar to previous bull market cycles.

✅ The recent correction appears to be a healthy retest of support rather than a trend reversal.

✅ The formation of higher lows suggests bullish momentum building up.

✅ If price holds above this level, we could see a strong rally in altcoins, pushing the total market cap higher.

A successful bounce from the 21 SMA could trigger a bullish continuation, leading to a market expansion toward 1.6T - 2.3T levels in the coming months.

🔸 A monthly close below the 21 SMA could invalidate this setup, leading to a deeper correction.

🔸 Key support zone to watch: $900B - $950B

🔸 Breakout confirmation: Monthly close above $1.1T

If history repeats, this could be the perfect accumulation zone before the next major altcoin season! Keep an eye on the monthly close and volume confirmation for the next big move.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

Potential Reversal on the NAS100. key level around 20700.0?The Nas100 has been in a downtrend since mid-February, primarily due to President Trump's tariffs, among other factors. The bearish trend began at a high of 22225.5 and has aggressively declined to 19171.0 without any significant corrections on the 1-day chart. However, currently, the price is forming a correction phase, and I am focusing on the 0.5 Fibonacci level, which is around 20700.0. This level coincides with a previous weekly higher high and higher low area.

Now on the 1D Chart

We can observe that the price bounced from 19171.0. After being choppy for a few days, the price has now broken the lower high structure. It appears that the price is aiming to return to the key level around the 20700.0 area, where we also have the aforementioned weekly levels.

The price seems to be making a gradual approach to the mentioned level, which I find favourable. As this develops on the daily chart, I will continue to monitor this setup in preparation for a bearish sell opportunity, when the price breaks the 1-day correction.

Thank you for reading! 🙋🏼♂️

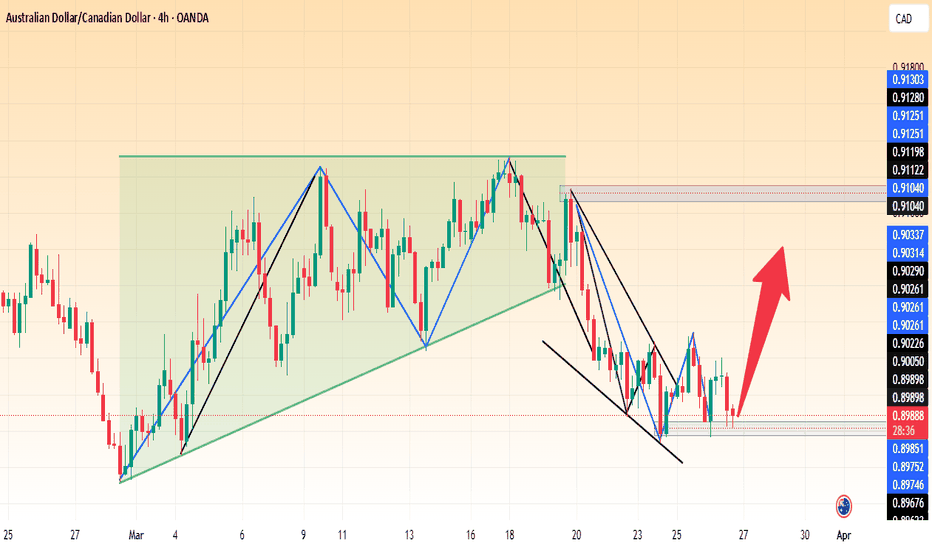

AUD/CAD – Potential Bullish Reversal from Key Support📊 Chart Analysis

1️⃣ Accumulation Zone : The price previously traded within a rectangular consolidation range before breaking down.

2️⃣ Bullish Reversal Pattern : A falling wedge has formed, indicating a possible breakout to the upside.

3️⃣ Key Support : The price has tested the 0.8980 - 0.8970 zone multiple times and is showing signs of rejection.

4️⃣ Potential Upside : A breakout above 0.9030 - 0.9050 could confirm further bullish momentum.

🚀 Trading Plan:

📌 Entry : On a breakout above 0.9025

🎯 Targets :

First target : 0.9100

Extended target : 0.9130

🛑 Stop Loss : Below 0.8965 to minimize risk.

🔔 Confirmation Needed: Wait for strong bullish price action before entering long trades. 🚀🔥

Nasdaq - The Most Decisive Point Ever!Nasdaq ( TVC:NDQ ) might break below all structure:

Click chart above to see the detailed analysis👆🏻

After breaking above the major channel resistance trendline just a couple of months ago, the Nasdaq is now being dominated by bears and starting to break everything back to the downside. So far we didn't see any confirmation but the next couple of days will decide just everything.

Levels to watch: $20.000, $16.000

Keep your long term vision,

Philip (BasicTrading)

NZDJPY - Shifting Trends Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉NZDJPY has been overall bearish , trading within the falling channel marked in red.

However, it is currently retesting the lower bound of the channel which lines up perfectly with the support zone marked in blue.

📈As per my trading style , as long as the support zone holds, I will be looking for buy setups on lower timeframes.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCHF Correction Due To Produce A Reversal Pattern?OANDA:USDCHF has been in a Correction Wave since the beginning of January and we now see that Price may have finally found Support at the 1.809 Fibonacci Extension Level of the Correction Wave.

With both Lows in March finding Support at the 1.809 Fibonacci Extension Level, Price is beginning to form what looks like a Reversal Pattern, the Double Bottom!

** Confirmation of Pattern will come when Price Breaks and Closes Above .8863, then we will be looking for a Long Opportunity to present itself as a Break and Retest Set-Up. The Retest will Validate the Trade Idea!

If we take the height of the Pattern and apply it to the Break of Confirmation, this puts the Potential Target at Previous Area of Support of the Correction Wave ( Point A ) in the .8975 area.

Fundamentals seem to Support the Bullish Idea with:

SNB Cutting Interest Rates by 25 Basis points from .5% to .25%

FED Holding Interest Rates @ 4.5% due to "Economic Uncertainty"

Unemployment Claims for USD came in as expected with no surprise and even 1K below Forecast ( Actual 223K / Forecast 224K )

Also Positive Outlook from Philly Fed Manufacturing Index and Existing Home Sales see USD rise.

Next Weeks Final GDP on Thursday, March 27th will be the next big News Event to bring some light to how the economy is doing and if USD will continue strengthening!

BTC shows signs of Downward trend with truncated wave5Bitcoins price uptrend from its recent lows appears to be out of gas. This can be shown using the elliot wave theory on the recent impulse wave where BTC price has produced a truncated wave 5

A truncated fifth wave signals exhaustion in the prevailing trend and warns of an imminent reversal. This pattern demonstrates that buyers (in an uptrend) or sellers (in a downtrend) lack conviction to push prices to new extremes. Truncations precede significant corrections or reversals.

The strength of Wave B (reaching higher than the truncated Wave 5) suggests significant countertrend momentum. This often occurs in flat corrections.

Typically, C waves extend to specific Fibonacci levels:

100% of A wave - This would target approximately $78,500

1.618 of A wave - (common C wave extension) - This would target around $76,000-$77,000

2.618 × A wave - (extended C wave) - This could reach as low as $73,000-$74,000

This seems to coincide with what I've been saying these past 3 months that the 74k level needs to be reached and the liquidity that price wants to take advantage of will need to be confronted before BTC will be able to reach this market cycles ATH.

Amd - Please Look At The Structure!Amd ( NASDAQ:AMD ) is about to retest massive support:

Click chart above to see the detailed analysis👆🏻

For about 5 years Amd has been trading in a decent rising channel formation. That's exactly the reason for why we saw the harsh drop starting in the beginning of 2024. But as we are speaking, Amd is about to retest a massive confluence of support which could lead to a beautiful reversal.

Levels to watch: $100

Keep your long term vision,

Philip (BasicTrading)

The Two-Faced Market: The Truth Behind Trend Reversals!🎭 The Two-Faced Market: The Truth Behind Trend Reversals! 📊🚀

📢 Ever entered a trade thinking you caught the perfect trend , only to get stopped out as the market reversed?

You're not alone. The market has a way of fooling traders—but if you understand its “two-faced” nature, you can stay one step ahead.

🔥 Why Trends Reverse (and How to Catch It Early!)

Most traders believe trends reverse due to "news" or "randomness." But in reality, the market gives signals long before the turn happens. Here’s what to watch for:

🔹 Momentum Divergence: The price makes a new high, but indicators like RSI/MACD don’t.

🔹 Volume Anomaly: The trend continues, but volume dries up—a sign of weakness.

🔹 Failed Breakouts: Price breaks a key level, only to fall back inside—trapping traders.

🔹 Candlestick Clues: Reversal patterns like engulfing candles or wicks rejecting key levels appear.

🚀 Mastering these signals can put you ahead of 90% of traders.

📊 Real Example: XAU/ USD Trend Reversal in Action

🔎 Breakdown of the setup:

✅ Step 1: Identify a trend (through market structure, trendline or moving average).

✅ Step 2: Look for failed breakouts against the trend

✅ Step 3: Look for trend-following setups

🎯 The Market’s Game: Recognizing The Shift

Trends don’t die suddenly—they fade before reversing. The best traders spot the early signs and position before the crowd.

💡 Have you spotted these reversal signs before? Drop a comment with your experience! 👇🔥

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SMPH Possible Trend ReversalAfter months of downtrend, SMPH seems to be somehow recovering from its bearish sentiment. From downtrend to sideways

Confluence

Macro: Shift from downtrend to sideways

Daily chart: higher lows

RSI: higher lows

Short term outlook: Looking like a 1 month short term uptrend.

Other Notes

Possibly looking to make a DB MB BO and hopefully a DB BT BO

Coming from a macro downtrend, sentiment shifting to defensive stocks. Property sector may not be the first mover post bearish sentiment since its not a defensive sector but perhaps the speculated rate cuts may help.

Earnings also released and looking good.