XAUUSD | New perspective | follow-up detailsThe $1,860 level held price strongly "supported" while participants in this market await next week's U.S. inflation data that could influence the Fed's rates policy. Last week's trading session was characterized by a consolidation phase as price action was caught within the $1,880 and $1,860 range to pronounce the indecision at this juncture in the market. This video illustrates the technical perspective as we anticipate trading opportunities off the breakout or breakdown of the channel in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

Reversalpattern

GBPUSD | Perspective for the new week | Follow-upThe GBPUSD traded in a relatively tight range during the course of last week's trading session as participants digest economic data and try to parse speeches from a series of Fed policymakers for clues of the likely future pace of the Federal Reserve's rate hikes. In this video, we looked at the current market structure from a technical standpoint and identified potential trading set-up ahead of the new week.

00:38 Reference to last week's daily commentaries and results

04:00 GBPUSD Technical analysis on Daily chart

06:55 Highlight of Macroeconomic event for the week

07:51 GBPUSD Technical analysis on 4H Timeframe

09:50 Conclusion on next week's expectation for GBPUSD

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USDJPY | Perspective for the new week | follow-up detailsThe U.S. labor market report remained surprisingly strong despite ongoing efforts by the Federal Reserve to tamp down demand. The US Dollar rallied about 2% on Friday following higher-than-expected non-farm payroll data which came in at a whopping 517,000 through the middle of January. This video illustrates a technical perspective on the current market structure to decipher potential trading opportunities in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD | Perspective for the new week | Follow-upThe Greenback's biggest gains in the last week have been against the Pound sterling after the BoE's dovish hint that it may have finished raising interest rates after a 50 basis points hike last Thursday. However, the higher-than-expected non-farm payroll data of 517,000 jobs in January did not help matters as the Pound slumped further to close the week below the 1.21000 level hereby recording a 2.7% decline in value. This video illustrates a detailed technical perspective on what to expect from the current market structure in the new week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

XAUUSD | New perspective | follow-up detailsFollowing a massively profitable week for us (see the link below for reference purposes); The Gold tumbled almost 3% on Friday after a blockbuster U.S. jobs report for January which came in with whopping 517,000 jobs hereby triggering profit-taking activities on the yellow metal’s long-running rally since the beginning of the year. Price is currently trading at a critical point where the bullish trendline and the $1,860 share a confluence on the daily timeframe. This video illustrates the technical perspective of the current market structure to figure out trading opportunities for the new week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USOil | New perspective for the week | Follow-up detailAmidst reports that oil loadings from Russia's Baltic ports were set to rise by 50% this month; the price of oil continues to drop as the $82.50 level remains a strong ceiling for selling pressure - a feat which has lasted for 3 months now. Also, OPEC+ is expected to meet on Feb. 1 to decide its monthly production targets and this is one event major players in the market will be looking forward to making a well-informed decision on trading possibilities. From a technical standpoint, we have decided to utilize the $80 key level as a yardstick for trading activities in the coming week and this is detailed in this video.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD | Perspective for the new week | Follow-upThe dollar tested a new nine-month low as economic data from the U.K. strengthened the case for more interest rate hikes. Despite a rosy year for the Pound sterling, Last week's trading session was so choppy that price action remains sandwiched between the 1.24500 and 1.22500 zone to indicate an indecisive grip in this market as sellers continue to reject the 1.24500 hereby stalling further growth. With the incoming week laced with a series of high-impact macroeconomic events, the consolidation phase noticed insinuates that major players are probably on the sidelines looking forward to these events for the green light. So, it is likely going to be a volatile week - In this video, we looked at the current structure from a technical standpoint and identified positional set-ups that we shall be using to guide trading activities in the coming week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

XAUUSD | New perspective | follow-up detailsGold was unable to crack the psychological level at $1,950 to bring fresh hopes of a new wave of bullish momentum and this can not be unconnected to the reassuring U.S. economy as the fear of recession recedes at least in the meantime. Data reported on Friday reveals that the PCE Index grew 5% in the year to December, versus an annual expansion of 6.8% in June further bringing a positive light to the Greenback. From a technical perspective, we have identified a potential trend continuation pattern as the $1,920 zone continues to reject selling momentum throughout last week's trading session. We still keep the option of a sell-off open considering the continued sell pressure below the $1,940 zone which might lead to an outright breakdown/retest of both the trendline (identified on the 4H timeframe) and the $1,920 zone.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

EURJPY | Perspective for the new weekDespite price action being caught within a channel between the 143.000 and 138.000 level since the beginning of the year; We have identified a flat channel on the 4H timeframe which we shall be using to guide our trading activities for this week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

YOU : POSITION TRADEClear Secure: Talk About A Bullish Economic Moat

• Clear Secure is capturing strong demand for its identity verification platform as a service to save time at security checkpoints.

• Partnerships with airports, airlines and even the Transportation Security Administration highlight competitive advantages to drive growth.

• An outlook for accelerating earnings can send the stock higher.

• Looking for a helping hand in the market? Members of Conviction Dossier get exclusive ideas and guidance to navigate any climate.

Clear Secure, Inc. (NYSE:YOU) offers a secure identity verification platform. If you've recently traveled through one of 46 major airports, you'll likely have seen the "Clear" checkpoints as a separate lane in the security process. Clear Pass focuses on the ID verification side of the airport screening process. The other step is the actual security area where travelers and carry-on luggage are checked for contraband.

With the company's history going back more than a decade, the game changer now is a belief that the operation has finally reached a critical mass with enough locations where the service can make sense to a wide range of travelers. This concept is related to the network effect where the value of the service grows as its user base expands.

Furthermore, the platform is being utilized in other applications where security screening is a requirement and there is room to capture efficiencies in the process. Members of Clear Plus also have the option to use the features at entertainment venues and stadiums where a security line often forms.

Clear also offers a Health Pass which gained prominence during the pandemic with validation of COVID testing results and digitization of vaccine status that many types of business in certain areas embrace. Notably, this feature now integrates with Apple Inc.'s (AAPL) "Health App".

YOU Key Metrics

YOU released its Q3 earnings in mid-November with EPS of $0.05, which beat estimates by $0.05 as consensus was looking for a flat result. Revenue of $116 million climbed by 72% year-over-year, with the strength largely driven by the recovery of the airline industry compared to pandemic disruptions at the start of 2021. Management notes success with in-airport and various partner channels driving memberships captured in a climbing number of bookings along with retention of customers.

On the financial side, keep in mind that there was a GAAP loss of -$65.6 million although this mostly reflected share-based compensation and the timing of the vesting from previously issued warrants. More favorably, the underlying shift towards profitability is evidenced by the adjusted EBITDA measure which reached $11.9 million compared to negative -$14.5 million in the period last year. The company also reported a positive free cash flow of $5.3 million.

The expectation is that earnings will maintain this more positive momentum going forward. For Q4, management is guiding for revenue of around $124 million, implying a growth rate of 54% compared to Q4 2021, and up 7% on a quarter-over-quarter basis.

Finally, we can mention Clear Secure maintains a solid balance sheet, ending the quarter with $700 million in cash and cash equivalents against effectively zero long-term financial debt. The position is strong enough that the Board of Directors declared a special $0.25 dividend which was paid in December.

Are There Risks?

The key for the company will be to maintain the pace of signups for new members while finding success in international markets. Longer-term, Clear Secure will need to become the global standard for secure identity verification not just in travel, but also leisure, and other industries with a visible presence in more and more countries as part of the bullish case.

The other side to the discussion would be the risk that growth simply begins to disappoint while the expected earnings fail to materialize. One concern is that the company may have already captured the "low-hanging fruit" of hard-core heavy business travelers where the Clear Pass makes the most sense, at least from the U.S. market. By this measure, doubling the number of cumulative platform users from here will be more difficult.

There is also an argument that if "everyone" is using Clear/TSA PreCheck, it begins to defeat the purpose of a priority security lane membership. It's not there yet but could become a problem at certain airports if the platform is too successful. Going further, a skeptic would also point to the regulatory risks where the service no longer becomes viable based on changing laws in the future or even in a scenario of a headline-making failure in the system that would undermine confidence in the company's security protocol.

Read more on :

seekingalpha.com

Dan Victor, CFA, Seeking Alpha, Jan. 05, 2023 3:19 PM ET

CRWD ~ Inverse H&S built, ready to pop higherHere's a 30m chart to highlight detail of the inverse head and shoulders built on CRWD.

Green line weekly support goes back to the lows of August 2020. Purple box is a large daily gap left from late last year up to $138 area. If looking from peak to trough of the head and shoulders, it's roughly $16 from neckline to low of the head, in a breakout of neckline it could be considered within an expected move to move a similar distance to the upside. That's around the 124.00 area.

If looking at the daily chart, LBR momentum indicator is showing a slowing of downside momentum, further adding that a short term bottom may be put in here. Daily RSI is right around 50 as well so there is room to go higher without hitting "overbought" levels.

Earnings are a bit away still. No position currently, but will be looking to open one soon depending on price action.

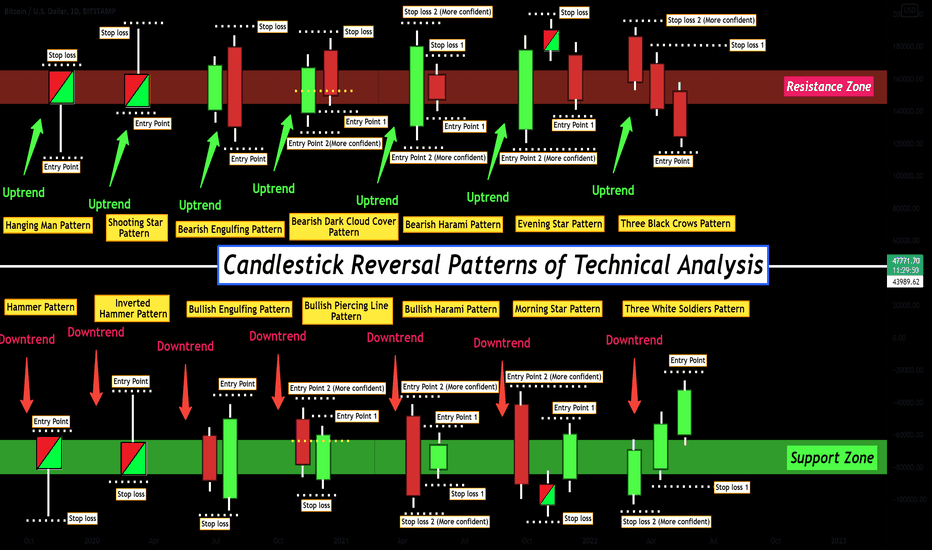

Candlestick Reversal Patterns of Technical Analysis !!!👨🏫 In this post, I tried to show you the most important Candlestick Reversal Patterns of Technical Analysis with Entry points & Stop loss points . you can use these patterns for Triggers of your traders at any timeframe ⏰ (These patterns are more valid at higher timeframes).

Please do not forget the ✅ 'like' ✅ button 🙏😊 & Share it with your friends, Thanks, and Trade safe.

What Is A Candlestick ❗️❓

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period. It originated from Japanese rice merchants and traders to track market prices and

daily momentum for hundreds of years before becoming popularized in the United States. The wide part of the candlestick is called the "real body" and tells investors whether the closing price was higher or lower than the opening price

(black/red if the stock closed lower, white/green if the stock closed higher).

Bullish Pattern 🌅:

🟢 Hammer Pattern : A hammer is a price pattern in candlestick charting that occurs when a security trades significantly lower than its opening, but rallies within the period to close near the opening price. This pattern forms a hammer-shaped candlestick, in which the lower shadow is at least twice the size of the real body. The body of the candlestick represents the difference between the open and closing prices, while the shadow shows the high and low prices for the period.

🟢 Inverted Hammer Pattern : The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. It often appears at the bottom of a downtrend, signaling a potential bullish reversal. The inverted hammer pattern gets its name from its shape – it looks like an upside-down hammer. To identify an inverted hammer candle, look out for a long upper wick, a short lower wick, and a small body.

🟢 Bullish Engulfing Pattern : A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the previous day's close. It can be identified when a small black candlestick, showing a bearish trend, is followed the next day by a large white candlestick, showing a bullish trend, the body of which completely overlaps or engulfs the body of the previous day’s candlestick. A bullish engulfing pattern may be contrasted with a bearish engulfing pattern.

🟢 Bullish Piercing Line Pattern : A piercing pattern is a two-day, candlestick price pattern that marks a potential short-term reversal from a downward trend to an upward trend. The pattern includes the first day opening near the high and closing near the low with an average or larger-sized trading range. It also includes a gap down after the first day where the second day begins trading, opening near the low and closing near the high. The close should also be a candlestick that covers at least half of the upward length of the previous day's red candlestick body.

🟢 Bullish Harami Pattern : The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle. The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

🟢 Morning Star Pattern : A morning star is a visual pattern consisting of three candlesticks that are interpreted as bullish signs by technical analysts. A morning star forms following a downward trend and it indicates the start of an upward climb. It is a sign of a reversal in the previous price trend. Traders watch for the formation of a morning star and then seek confirmation that a reversal is indeed occurring using additional indicators.

🟢 Three White Soldiers Pattern : Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of the current downtrend in a pricing chart. The pattern consists of three consecutive long-bodied candlesticks that open within the previous candle's real body and a close that exceeds the previous candle's high. These candlesticks should not have very long shadows and ideally open within the real body of the preceding candle in the pattern.

Bearish Patterns 🌄:

🔴 Hanging Man Pattern : The hanging man is a type of candlestick pattern. Candlesticks display the high, low, opening, and closing prices for a security for a specific time frame. Candlesticks reflect the impact of investors' emotions on security prices and are used by some technical traders to determine when to enter and exit trades. The term "hanging man" refers to the candle's shape and what the appearance of this pattern infers. The hanging man represents a potential reversal in an uptrend. While selling an asset solely based on a hanging man pattern is a risky proposition, many believe it's a key piece of evidence that market sentiment is beginning to turn. The strength in the uptrend is no longer there.

🔴 Shooting Star Pattern : A shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It appears after an uptrend. Said differently, a shooting star is a type of candlestick that forms when a security opens, advances significantly, but then closes the day near the open again. For a candlestick to be considered a shooting star, the formation must appear during a price advance. Also, the distance between the highest price of the day and the opening price must be more than twice as large as the shooting star's body. There should be little to no shadow below the real body.

🔴 Bearish Engulfing Pattern : A bearish engulfing pattern is a technical chart pattern that signals lower prices to come. The pattern consists of an up (white or green) candlestick followed by a large down (black or red) candlestick that eclipses or "engulfs" the smaller up candle. The pattern can be important because it shows sellers have overtaken the buyers and are pushing the price more aggressively down (down candle) than the buyers were able to push it up (up candle).

🔴 Bearish Dark Cloud Cover Pattern : Dark Cloud Cover is a bearish reversal candlestick pattern where a down candle (typically black or red) opens above the close of the prior up candle (typically white or green), and then closes below the midpoint of the up candle. The pattern is significant as it shows a shift in the momentum from the upside to the downside. The pattern is created by an up candle followed by a down candle. Traders look for the price to continue lower on the next (third) candle. This is called confirmation.

🔴 Bearish Harami Pattern : A bearish harami is a two-bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle. An uptrend precedes the formation of a bearish harami.

🔴 Evening Star Pattern : An evening star is a stock-price chart pattern used by technical analysts to detect when a trend is about to reverse. It is a bearish candlestick pattern consisting of three candles: a large white candlestick, a small-bodied candle, and a red candle. Evening star patterns are associated with the top of a price uptrend, signifying that the uptrend is nearing its end. The opposite of the evening star is the morning star pattern, which is viewed as a bullish indicator.

🔴 Three Black Crows Pattern : Three black crows is a phrase used to describe a bearish candlestick pattern that may predict the reversal of an uptrend. Candlestick charts show the day's opening, high, low, and closing prices for a particular security. For stocks moving higher, the candlestick is white or green. When moving lower, they are black or red. The black crow pattern consists of three consecutive long-bodied candlesticks that have opened within the real body of the previous candle and closed lower than the previous candle. Often, traders use this indicator in conjunction with other technical indicators or chart patterns as confirmation of a reversal.

XAUUSD | New perspective | follow-up detailsThis is video is a follow-up to the previous analysis on the XAUUSD where we close to the week with over 4,000 pips profit from multiple entries (see link below for reference purposes). Gold prices maintained their bullish traction for a fifth straight week in a row as bullish investors continue to push higher highs since the beginning of the year hereby closing last week's trading session around the $1,925 zone. Throughout the course of last week's trading session, Gold appears to be facing some strong resistance at $1,940 with a technical inclination that a retracement phase is long overdue at this juncture. We can not ignore the possibility of a breakout of the $1,940 level to incite another wave of bullish momentum. So, in this video, we have identified how to position ourselves in such a way that we can catch any of these moves.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GE: Strength Ahead of Earnings ReportThis old company struggled to reinvent after the banking debacle destroyed its consumer financing division. Older companies CAN reinvent and start a new life.

I'm showing the Weekly Chart first so you can see the support zone below and the strong resistance above, where the stock may head sideways for a time.

Around $67 is the high of a completed short-term bottom that provides strong support for the current price action.

The stock entered the strong resistance level of the Trading Range highs of 2021 - 2022 with what I call a "pre-earnings" run.

On the daily chart:

GE had a strong momentum run ahead of its earnings report. This was a pre-earnings run, which tend to develop 2-4 weeks ahead of the earnings release. The company is reporting Tuesday this week.

The strong reversal candle on Friday after 2 down days is also an indication that the report will be good.

Another come backPrice appears to be forming an inverse HS. I will take a few weeks more to complete the pattern, but you can start with a small position and add while the pattern is shaping out.

USOil | New perspective for the week | Follow-up detailThis is a follow-up video to last week's analysis as we were able to scoop over 1,200 pips profit (see link below for reference purposes). Thursday's data showed that U.S. CPI inflation eased in December 2022 and this data appears to be firing a bullish momentum as risk appetite for the Oil appears to have been bolstered. Last week's trading session witnessed a rise of approximately 7.00% to close the week around the $80 zone - a good sign of recovery. So, from a technical standpoint; the $80 Level shall be our yardstick for trading activities this week and this video gives a detailed illustration of what to look out for to either buy or sell the USOil for this week.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

It doesn't look like a bearish market anymoreIt appears that Nasdaq is turning back up. Not quite sure yet, but many Nasdaq stocks are making the same reverse pattern. Google just blew up today and among with Tesla that is oversold and others is very possible they push the markets to the upside. I closed all my short positions. We may see a pull back the next week but I wouldn't go short these days.

XAUUSD | New perspective | follow-up detailsThe Gold continues its bullish momentum as it neared a nine-month high on Friday to close the week at the $1,920 level which shall be the basis for our trading activities in the coming week(s). As confidence that the Fed is almost done with raising rates gets stronger by the day, will the Gold experience a retracement phase in the coming week? In this video, we reviewed the charts from a technical standpoint where we are expecting price action to transition into some tradeable structure around the $1,920 level.

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USDJPY | Perspective for the new week | follow-up detailsFollowing our previous analysis on the USDJPY where it was possible to scoop over 500 pips profit (see link below for reference purposes); price action is at a critical juncture at the moment as it oscillates around the 128.000 level. The Greenback weakens in the wake of the CPI and the Japanese Yen continues to soar ahead of the BoJ monetary policy and interest rate decision this week. Despite the US Dollar slipping to its lowest level since June 2022; there is still a long-term bullish momentum from a higher time frame's perspective (daily and weekly). Following Thursday's data showing that U.S. CPI inflation eased in December 2022, could this be a sign to anticipate a reversal pattern in the coming week or events from the BoJ will send a new wave of sell-offs in this market?

Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.