$LMFA Receives a take over offer and $1.25M in cash for Nov 2020To complete the transaction by November 2020

sec.report

Fresh funds from Craven House to conduct business giving it $6M more in cash for its regular operations:

sec.report

This is what book value feels like before a major take over:

sec.report

Reversemerger

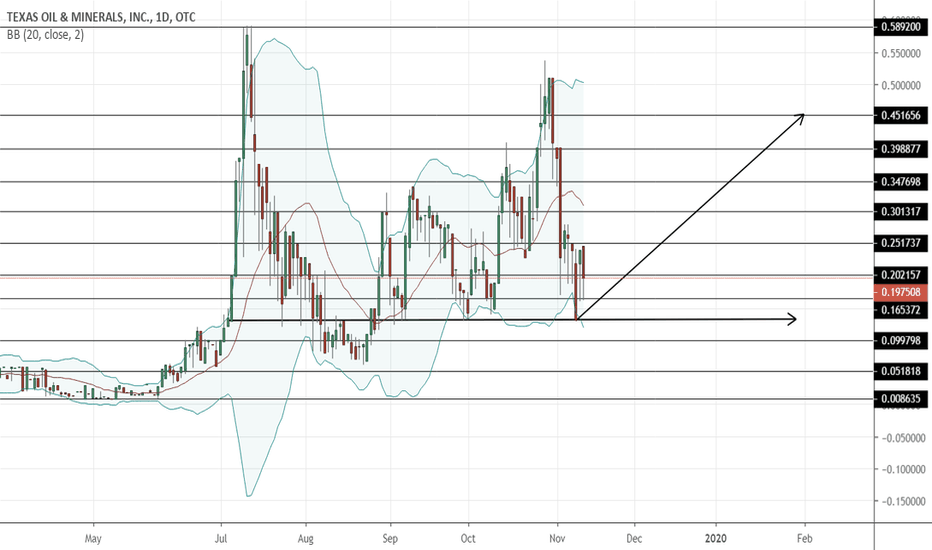

$CEI 133,442,000 Barrels of Oil Reserves PT $10.00As of March 31st, 2020 the company had an estimated proven oil reserve of 133,442,000 barrels of oil comprising of

54,850 million barrels of crude oil reserves - 43,955 million barrels of NGL reserves and 207,823 million cubic feet of natural gas reserves.

The company also has upcoming merger with the Viking Energy Group Inc. which is estimated to close within the next two months.

$RNWF Bio N Designation Uptd to Holding Company S/S Also UptdDESCRIPTION

Renewal Fuels acquires and invests in emerging growth and profitable companies with dynamic cultures and low overhead. Our goal is to bolster our balance sheet via acquisitions, joint ventures, and direct investments in companies.

SIC - Industry Classification

6719 - Holding companies, Misc

$RRRT Consolidates after News of the O/S Getting Reduced 65%$RRRT Posted two press releases in the last week stating that they are beginning to bring shareholder value back to the company. The release stated their goals:

TORONTO, Aug. 20, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- R-Three Technologies, Inc. (OTC: RRRT), after several years of inactivity, is pleased to announce that the company is taking measures to deliver increased value for shareholders, via an improved capital structure and the launch of several new, strategic initiatives.

As a first initiative, R-Three Technologies, Inc. (OTC: RRRT) has cancelled $564,000 of debt, as per company quarterly filing with OTC. Additionally, R-Three Technologies, Inc. will soon be announcing a new restructuring of its equity.

R-Three Technologies, Inc. (OTC: RRRT) has been working diligently on several other new measures that aim to drive shareholder value. These include new mergers and acquisitions strategy and the hiring of a new senior management team to execute these plans.

“We’re excited about the possibilities moving forward,” explains Stan Kolaric, CEO of R-Three Technologies, Inc. “Our shareholders have been very patient with us as we transition, and for that, we are grateful.”

The second PR a couple days later talked about reducing the S/S by as much as 65% by September 15th. Retiring 125 Mil of the 195 Mil O/S: www.globenewswire.com

TORONTO, Aug. 25, 2020 (GLOBE NEWSWIRE) -- via NEWMEDIAWIRE -- Continuing in its path to increase shareholder value, R-Three Technologies, Inc. (OTC: RRRT), announced today that it plans to retire 125,000,000 shares of Common Stock to the treasury no later than September 15, 2020.

“Our investors benefit from our reducing the number of shares outstanding,” explains Stan Kolaric, CEO of R-Three Technologies, Inc. “Further, the overall market benefits, as we can provide a more realistic view to the market of R-Three Technologies, Inc. market cap valuation and continue on the path to launch of several new strategic initiatives.”

$JADA Begins Ascent on 2nd Leg After Cldtin on Massive R/M DDRead This: First off, good morning! For those of you that have been following $JADA’s trading for awhile, there have consistently been double and triple prints over the last 2 months of trading.

And I stress the word CONSISTENTLY. For those not aware of what this means, you can read more about it here, but the long story is that there is a secret buyer behind the scenes: whenindoubtgetout.wordpress.com

On top of this, Joe Arcarro has a successful record of taking shells public, and the price of these shells has gone from sub .01 to $’s. Pay no attention to anyone telling you otherwise, he currently has multiple shells in process right now.

We saw the necessary paperwork filed to bring $JADA current, which was submitted end of Jily (Financials and Attorney Letter). It took a few weeks because OTC was most likely backed up due to Covid—19. Now everything is in place for the shell to be sold.

As we saw 2 days ago, Arcarro is no longer listed as the owner. So things are progressing behind the scenes. The speculation is that Coinbase is the R/M candidate, which would be beyond imaginable. And Coinbase is holding their 1st Investor Day today. We saw the stock run BIG yesterday, and it was the first time we saw an institutional MM show himself on the bid. But keep in mind, even if it isn’t Coinbase, you know it’s going to be huge whoever comes in.

This is the cleanest shell with tje nicest share structure I’ve ever seen on the OTC in my 20 yrs. of trading. Joe Arcarro owns 90% of the O/S, the other 70 milliom are restricted leaving a float of 2.5 million! If you add up everything that has been happening.

The float traded almost 3x over, with record volume and making new record highs. On top of this, multiple double and triple prints, institutional market maker on bid and trading the float multiple times over. This means there is also a big short position that needs to be covered.

Once the R/M takes place there will be a CUSIP change which will force all short shares to be accounted for and covered! Stay tuned, don’t lose sight of what is before us, this is truly going to be one for the OTC record books!

$CSPS Chart Still Intact Waiting for Massive Marketing Campaign $CSPS Rumors have it that a massive marketing campaign is to take place next week. If all holds true the stock could see the potential for a huge surge up following updates from the company on the anticipated plans and future revenues projections for this year.

$SBES On Tear Back Upwards Ahead of Possible $10 Bil Merger Deal$SBES Has consolidated and is now on a tear back upwards following more signs and DD pointing towards a merger deal with a $10,000,000,000 valued company RockySaaS

The anticipated PPS of the stock by April-May is said to be around .30-.50 possibly going even higher with Anticipation and FOMO.

$SBES Completes First Leg Consolidation And Readies for .02+ Brk$SBES Has completed its first major leg run and consolidation and is now gearing up for the breakout past .02 The company is in plans to merge with RockySaaS under its parent company Panshi a $10 Bil revenue generating company. All signs lead to this R/M taking place and filings are said to drop before the EOY into possibly January.

$CSPS Formerly Known as $QALB Announces MASSIVE Share Reduction$CSPS Is now on a clear breakout path with the announcement of a massive share reduction of the A/S from 700,000,000 to 250,000,000 and a cancellation of ALL Preferred shares!!!

The company also stated it wishes to become fully SEC reporting and has filed the paperwork in order to do so and become OTCQB as soon as possible. It plans to be listed on the NASDAQ at some point next year.

PPS Target $10

backend.otcmarkets.com

$SBES On Full Tear Recovery and Tear Once Again W $10 Bil R/MCompany's CEO has stated updates and filings are en-route and the company will be Pink Current and ready for the next steps.

Traders have already connected massive revenue generating company RockySaaS with $SBES in addition Xu who is the CEO of $SBES, his brother is also their CFO.

More details in the attached past post. PT Still stands at .10+

$QALB EPIC DD Compilation Released *Must Read* $10+ ValuationQuestions for Richard at $QALB

Just want to know how much is left to dilute. All those after hour trades are dilution. I figure if 1.7 million is the new float how much more of the 800-900k does he have left to go.

- There will be some stock added to the system in coming months in a orderly fashion. Proceeds will be used to fund up coming market awareness campaigns. Plus we need more stock in the system to meet the requirements for up listing. I am looking at applying to the TSX-V as well and they have a minimum requirement that.

Market awareness campaign coming

- Market Awareness plan being developed this week

Confirmed

- The expectation on their end when this started in October was a share price of .02-.03 when the market awareness campaign started.

Confirmed

- Looking at Google ads, Print Ads, online ads and if possible CNN Money.

Confirmed

- Press releases about revenue, profitability will happen after the market awareness plan is in full gear.

Confirmed

- Co-list in Germany on the Frankfurt exchange where they have a lot of strong contacts

Will co-list once we trade back above $1.00 and we become fully reporting in the US

- We will revisit later when the Form 10 is filed and the stock price is back over $1.00

Ask when will they stop raising the float

- Will look at increasing again when they get closer to NASDAQ to create liquidity.

Maximum will be 5,000,00 OVER TIME to meet the 10% requirement for the NASDAQ listing. This will be tied in with the market awareness campaign. As the volume and price increases we will dribble stock into the system and then reinvest the proceeds back into the market awareness campaign.

Are you looking at reducing the A/S since the O/S probably won’t increase over 100 mil

- Yes, at some-point. Drop it down to 200,000,000 or something similar.

Plan for the marketing campaign, timeline

- Currently interviewing people and will be hiring multiple IR firms to represent specific regions of the US, one for the Western and Eastern part of the United States.

Confirmed

2019 goals:

- Form 10 has been drafted

Confirmed

- FINRA has been filed for new cusip, ticker symbol and name change.

Confirmed

- Fully audited 12/31 end of year reporting to become a fully reporting SEC company

Confirmed

- OTCQB by March

Confirmed...if not sooner. All depends on how quickly we can get the audit done.

- CSE

Looking at the TSX-V as well.

- NASDAQ

Looking at the NYSE as well.

- Frankfurt, Germany stock exchange co-list

Should be able to list on Frankfurt as soon as we go OTCQB. Looking into that now.

Would you say the short position is still 1 Million

- 600-700k

That is reasonable estimate based on our calculations.

Do you know if shorted shares are required to be covered when a ticker and CUSIP changes?

- They are supposed to, but, he’s been in situations where shorts covered and he’s seen it where shirts didn’t cover. But, yes they are supposed to cover when the ticker, cusip and name change happens.

Confirmed

Contract based question. Are there government contracts? If so, now or in the future? Are there private contracts? If so, now or in the future?

- Private sector, Large contracts - They are going after the Country Clubs of America - 2 Million contract, (April Sound is the gated community). April Sound had their own private security and employed DeLane Potter who ran their in house security. DeLane Potter quit and they are now looking at working with QALB.

Confirmed

- DeLane Potter is now the CEO of QALB.

Confirmed

***- There’s enough demand that they expect to see $50-100 million in revenue just in Texas alone.***

- Public Sector - Port Security for Houston - have been talking with the Coast Guard, but, they are really waiting for the April Sound contract to go through. They have been invited to several meetings and Richard believes that QALB has gone through the approval process with the Coast Guard. But, this isn’t going to be actively pursued until after the first of the year and the April Sound contract is in place.

Post from Trulia website: ‘I am an ex-April Sound security officer , and there is a lot of burglaries and toilet papering houses and break ins, not to mention the security personnel has gone wayyy down hill since LT. Delane Potter left.’

Challenges

- Being able to maintain and handle the growth.

Confirmed

- With one of the biggest areas of focus will be managing the growth.

Confirmed

Press releases about revenue and future expected revenue

- Will happen after the market awareness plan is in full gear.

Confirmed

OTC Markets Pink Current - Why the delay in becoming Pink Current

- They were missing the attorney agreement

OTC now has the attorney agreement. They want the Attorney Letter to include September 30, 2019. That is being prepared now.

- Nancy Rodriquez reviewing, she was on vacation for a week and is now back from vacation.

Confirmed

- Attorney agreement filed and approved.

Confirmed

Realistic annual projections with current contracts in place?

- Will be updating executive summary

Working on that this week

- update pro forma over the next 3 days

Working on that this week

- Trying not to put too much revenue in this year.

Confirmed

What revenue in contracts are upcoming?

- Will be in the updated pro forma

Confirmed

How many countries are you serving?

- Initially, just the US there’s enough business here to become a mid level company. Once they move to NASDAQ they can look at Europe, the UK and Canada post NASDAQ.

Confirmed

What exact type of security services are you providing? I.e. Monitoring assets or people? Both? Who?

- Both, public and private contracts

Confirmed

- They are looking at guarding containers on container ships at the Port of Houston.

Confirmed

- Also talked about providing security for people who attend the GSA and other summits and conferences.

Confirmed

Share structure; intentions? I.e. are you keeping it the same or restructuring upon name change? - authorized shares increase, float increase, any restricted shares increase (quantities)?

- The change in control issued around 50 million in restricted to take control of the shell, won’t be tradable. Fully dilutable is 53 Million and have been issued in certificates and are in John’s safe.

Confirmed

- John Kuykendall - CFO

- Rock Rutherford - President

- DeLane Potter - CEO

- Not only restricted, but subject to rule 144 dribble out rule

- NASDAQ within 6 months 3-5 dollars a share

- Frankfurt market will be a co-list, currently speaking with some market makers. Won’t be a problem once they are on NASDAQ and trading.

- Float may increase by about 1 Million shares.

Confirmed

Why are you utilizing a Gmail account?

- He’s a consultant and because he lives in British Columbia rule 51509 applies he has to be arms length. Otherwise, there is a large expenditure and forms to be filed.

Confirmed

When can we expect the first update on the company operations after pink current.

- Expect it pretty quick, been focusing on the structure of the stock and on the name change.

- Definitely by EOY

Confirmed

Also what he believes the float to be at the moment and if we’re close to the 1.7 mil required for NASDAQ

- If we have to have 10% in the float then that number will be closer to 5 million but we will look at it more closely when we go to apply for the NASDAQ. That is still a little ways out and hopefully our stock will be trading over $3+ a share by then. It is all tied in to market cap and valuations.

Will there be further acquisitions in the future under the new company once we transition to it

- Going after other security companies owned by boomers who are wanting to retire and sell the client list. Tried buying a couple companies and the problems are there usually mom an pop shops and the record keeping is horrible, you inherit skeletons and employees you may not want.

Confirmed

- Business model for acquisitions will be buying the book of business (client list) and not the business itself.

Confirmed

- In the first three years, there are currently 7000 companies earning 5 million and under. These are the companies they will be focusing on. No one is attempting to do what they are going to do. They are currently looking at going after 100-200 million in revenue a year from those 7000 companies. Most are not run well. They want to establish themselves as a top notch company and will be cherry picking.

Confirmed

$TOMI Anticipating News of Its Seismic Series Festival in NevadaThe LineUp for the Festival are: Modestep, Virtual Riot, Barely Alive, PhaseOne, Terravita and much more.

$TOMI Back at Major Support After Name Change Delay Caused DumpAbsolutely nothing has changed with the company except with a delay at FINRA after the wrong person posted the information sent in for the name change of the R/M. I anticipate the same documents have been sent in with the right person already this time and awaiting the name change once again, which shouldn't take as long as last time, due to all the documents being required already being available for submission this time.

$TOMI Name and Ticker Change Tomorrow Shorts to Cover by EODShorts struggled to keep it under .50 the last couple days but an anticipated surge in PPS is projected once the Name and Ticker change to Golden Ventures is complete as many company updates are projected with this huge multi-million revenue producing company coming into this tiny O/S Float.

$QALB RSI and Techs Reset for Next Leg Up + Updates CloseMajor short attack on $QALB today but it held its ground, float is 3/4’s locked, not much left before were trading over $5 don't sleep on this, huge catalysts coming. Attorney letter, PR, uplistment, R/M. Tick tock goes the clock imo.

$TOMI To Become one of the Biggest R/M's Fully Approved NowNews out today name change and ticker change confirmed and approved by FINRA for the R/M into Golden Triangle Ventures, should see some massive short covering by Friday when it goes into effect, massive multi-million dollar merger with a Health, Tech, and Entertainment Company. Check out the DD on it in past posts.

www.globenewswire.com

$QALB 1 Mil Float R/M with GSA with Revs of $105 Mil last year$QALB Hugelyyyy undervalued and under the radar stock that’s being heavily accumulated following PRs by the company and officer changes, then this DD compilation dropped today: investorshub.advfn.com could very well see $10-$15+ with this float of less than a mil when news and PRs drop.

$SGDH Cleared for Take-Off after RSI Reset Court Hearing at 6PM This has been one of my long term plays and for good reason if you check my prior updates. After the hearing and approval tonight I see above .10 tomorrow and a push onto its second major leg up with a PPS target of .25 before the next consolidation period takes place.

$CYIO Reinstated/NVSOS Updated/Filings in the works/Possible R/MA/S: 100,000,000

O/S: 36,311,640

Float: 16,000,000 (Or Less)

Insiders own 69% of the Float

Their website domain was also updated in April of this year into April of next year.

The company was then reinstated on the 30th of September.

Now you have to ask yourself, why would the company get reinstated if the court ruling with the SEC Overstepping didn't rule in their favor?

With possible damages to $CYIO in the form of $20,000,000?

Here you can see the entirety of the case process: www.sec.gov

In my opinion we should get an update on the case in an upcoming PR and if they won any damages. They were waiting for the case to be closed before they could sell the shell, now that its sold they can move forward with the R/M.

The $CYIO shell was bought off the Canadagpi website, the first shell to be sold off there. The website is owned by David Xu (Not Robert Xu).

David's Chinese name is (Guiping) Xu

Here's some info on him: Rocky SaaS CFO, Bachelor of Arts in English Literature from Beijing Normal University, MS in Business Administration from the University of Illinois, and Ph.D. in Finance from the Chinese Academy of Social Sciences. Xu has more than 20 years of experience as a senior executive in North America and China. He has worked in GE Energy and Finance, American Parkson, World Bank International Financial Group Trust Insurance Company, Zurich Insurance Company (Canada), Shangwei Group, Haoshang Investment Group, Beijing Supply and Marketing Big Data Group and Hanergy Film Power Generation Group. During GE Finance, Xu managed $485 billion investment portfolio; he led tens of billions of industrial funds under the leadership of Big Data Group and Hanergy Group. He has professional certificates such as the six GE Sigma Green Belt and Black Belt of the United States. He is the chartered membership of the Canadian Insurance Accountant Association, the Chartered Senior Member of the Australian Institute of Public Accountants, and he also has the qualifications of Chinese fund practitioners.

He started as CFO of RockySaaS in April of this year, the same month the $CYIO website was extended.

After taking a position there the same month the $CYIO website was extended, is it possible our R/M candidate is Rocky? Well, let's take a look at Rocky shall we:

First let's take a look at the fact $CYIO now has a new registered agent. This means whatever company is merging in will have the same agent as well.

RockySaaS was incorporated 3 Months ago in June after being in business for several years:

RockySaaS is apart of Panshi Group which is a Multi-BILLION dollar company:

www.rockysaas.com

app.dealroom.co

Here's a recent article on Rocky: www.ktvn.com

When searching for our new officer David Greene we came up with the possibility that it maybe David A. Greene who was recently appointed as general council for Cetera on September 10 of this year:

www.prnewswire.com

Not to mention Cetera added 1,000 new advisors and $19,000,000,000 in assets already in 2019:

www.investmentnews.com

When searching some more we also found that Cetera does multiple Acquisitions a year, could there be a possibility that $CYIO maybe one of them later down the road after a company has been put into the shell?

Possible.

$CYIO has a long standing record with providing the portal for DOD.

They’ve recently been in pursuit of new employees and they have connections with CACI and IBM.

Their consultant www.linkedin.com helped to develop several key programs for them in recent years:

CYIOS Corporation

January 2013 – Present 6 years 7 months

Washington D.C. Metro Area

• Develop and manage new federal, enterprise and commercial vendor relationships to promote sales of Enterprise Project Portfolio Management (EPPM) cloud software, which is highlighted by the execution of an IBM integration partnership agreement in Q4 2015.

• Provide company strategy and solicit federal, enterprise and commercial agencies/businesses to purchase EPPM cloud software that provides real-time knowledge management, aggregating of all big data/BI, KPI metrics, human resource management and identification of areas that require business process improvements (BPI) using techniques like Six Sigma methodology.

IBM recently rolled out a new security system and app and this might have something to do with it:

www.ibm.com

Also very interesting to mention this recent job post shows they have multiple locations, not just their HQ in the Ronald Reagan building in Washington DC, they also have a Duty location in the Zachary Taylor building in Virginia:

www.ziprecruiter.com

ASP.NET Developer - Secret Clearance Preferred/Eligible

CYIOS Crystal City, VA

Expired: over a month ago. Applications are no longer accepted.

CYIOS Corporation is seeking a .NET software developer who can hit the ground running, and work as part of a team supporting the Office of the Chief of Staff of the Army.

Duty Location:

2530 Crystal Drive (Zachary Taylor Building), Crystal City, VA

This also shows they are or were actively seeking employment of key positions as close as a month ago.

The company was pulling in (and most likely currently pulling in since some of their contracts are still active or may have been renewed recently) $7,000,000-$10,000,000 in revenues a year before they stopped filing:

www.zoominfo.com

Here is some info on the company from the past:

CYIOS Corporation is a leading DoD contractor providing cutting edge, innovative solutions since 1994. This innovation extends to three distinct areas:

Systems Integration

Web and Database Development

Business Process Management and Improvement

Systems Integration Innovation: CYIOS engineered Common Access Card (CAC) authentication solutions for remote access, document management and other areas for the U.S. Army. CYIOS' best practices for CAC authentication have been shared among Army bases around the world.

In another example, CYIOS architected and built an innovative remote access Citrix solution with thin client and COOP integration to support 10,000 end users.

Lastly, CYIOS used many innovative scripting techniques to manage and monitor a large and complex heterogeneous environment comprised of blade servers, virtual servers and various applications including MS Exchange, Internet Information Server and BlackBerry enterprise server.

Web and Application Development Innovation: CYIOS built America’s Army Online, the innovative prototype for Army Knowledge Online (AKO). This is the largest portal in the world with over 1.8 million users.

As part of that development CYIOS engineered the first online chat among Army leadership around the world. CYIOS continued innovating in knowledge management with the development of CKO, a virtual office solution for collaboration, accountability, knowledge management and teleworking that features document management and versioning, project and task management, email encryption, full text search, timesheets, meetings and reports.

Business Process Management and Improvement Innovation: In developing CKO, CYIOS integrated Lean Six Sigma best practices to improve workflow and measure performance.

CKO also serves as a performance-based contract management system, which is used internally on all CYIOS contracts to ensure maximum productivity and total accountability.

CYIOS also built the General Officer personnel management system using innovative web technologies to reduce manual processes, leverage collaboration and become a paperless office.

Lastly, CYIOS delivers solutions following innovative best practices of ITIL/ITSM to support configuration and change management for any organization.

CYIOS takes innovation quite seriously as our mission reflects: To provide Business and Technology Solutions by developing, designing, implementing and supporting innovative solutions through knowledge transfer, imagination and trust. Innovation is ingrained in CYIOS' culture and our talented employees have built a legacy that continues today for our customers.

CYIOS Corporation provides and implements innovative solutions to complex business problems in the areas of

Consulting

knowledge management

systems integration

application development

program integration

project management

and more

Our solutions integrate industry best practices with government initiatives to help our customers meet their mission critical goals.

Contract Vehicles

www.caci.com

Office of Senior Leader Development, OCSAContract No. W91WAW-08-C-0007

Information Management Support Center (IMCEN) End User Workstation (IDIQ)Contract No. W74V8H-05-D-0002

Navy SeaPort-e (IDIQ) Contract No. N00178-04-D-4024

Information Management Support Center (IMCEN) Desktop Support Services (IDIQ)Subcontractor to Tital/L-3

Contract No. W74V8H-05-D-0004

ITES-2S (IDIQ)Subcontractor to CACI

Contract No. W91QUZ-06-D-0019

Website: www.caci.com

Mission Oriented Business Integrated Services (MOBIS) GSA Department of Homeland SecuritySubcontractor to Technology & Management Services, Inc.

Contract No. GS-10-F-0343K

Verizon Federal Network Systems (FNS)Subcontractor Multiple Opportunities Web Site: www.verizonbusiness.com

We will get a more in depth view of what's going on once filings start hitting the OTCMarkets website. Until then it's very fun to speculate and connect all the dots.

$HDii On Major Breakout Following The Release of ALL Filings R/M$HDII Today dropped all required filings for the past 3 Years. The following iHub Posts has more DD on this amazing R/M that could end up being as big as $DCGD

investorshub.advfn.com

investorshub.advfn.com

investorshub.advfn.com

investorshub.advfn.com

investorshub.advfn.com

investorshub.advfn.com

All that is left is the Attorney Letter which could drop any-day, Pink Current, then the Merger Docs and slowly PRs about the new incoming company. With this S/S we could easily see $1.00+ LT IMO