ridethepig | EUR Market Commentary 2019.11.27With Trump Administration desperately attempting to add momentum to the $ downside via another Fed cut and pressure on ECB, combined with a convergence in US-EU differentials will lead to a long-term rebound in EUR. I am expecting volatility to expand into year-end after completing the 76.4% retracement.

For those tracking the USD long-term chart from last month:

From a waves perspective a very important year on the macro front which opened up the major monthly reversal targets:

Initial monthly targets: 1.15

Long-term monthly targets: 1.20

Best of luck all those tracking EUR as we enter the final few pages in the year, and importantly, thanks all for keeping the likes and support coming.

Ridethepig

ridethepig | USDTRY 2020 Macro MapWith the year almost up, a good time to update the USDTRY chart. Smart money has been tracking Turkish rates, the short end has been screaming weakness and markets not interest in any more BS with the dictator in charge. S400 remains a thorn in the shoe and blackmailing to close NATO bases is leaving a nasty aftertaste.

For those who have been tracking the previous swing, the underlying Lira weakness is set to continue over the coming years with an eventual grind towards the widely tracked 7.8xx target since 2018.

Expecting markets to remain on the back-foot as long as Erdogan remains at the helm, this will dislocate from the USD devaluation as simply the TRY side is far weaker... all short and medium term flows will lack follow through so targeting 6.00 in Q120, and 6.50 in Q420 seems reasonable. For those really wanting to stick the knife into the bearish TRY story 7.80 in 24m.

Thanks for keeping the support coming with likes, comments, charts and etc. And as usual the comments are open for all.

ridethepig | XAG Market Commentary 2019.12.17Here we can see price risks are still skewed to the topside, with CB's buying Gold at a rate unseen since the Nixon era meaning Silver will continue to move as collateral. Prices have trended in the same direction over the past 4 waves, the market appears to be underpricing the odds of future demand risks as well as a meaningful pick-up in risk due to completions and geopolitics.

The long term XAUXAG chart still looks to have formed a meaningful top so I expect to see Silver outperform Gold in 2020.

Here I stick to the $17 - $18 range and expect the metal to hit main targets within a 3m basis. Thanks all for keeping the support coming with likes, comments, questions, charts and etc. As usual jump into the comments with your ideas and views to open the discussion for all!

ridethepig | Gold & the "Santa Rally"Uncertainty around reflationary fears will add upside risks to prices in Gold for 1H20. Gold remains bid since the start of November, despite risky assets continuing to gain ground. CB's have been buying 20% of the Gold supplies, the same rate circa Nixon era, all whilst mainstream media paints the geopolitical landscape with a more constructive backdrop, any signs of complacency or gusts of wind from risk will likely drive more flows on the demand side in Gold from retail.

We are finally getting the breakout:

As widely covered here before, the physical Gold market remains incredibly resilient and first targets come into play at 1595:

Expecting another relative breakout versus S&P in 1H20:

On the mining side :

Yields:

For those tracking the end of year positioning flows for 2020 Q1, reflationary risks are around the corner!! After months of choppy waters , finally bulls are emerging from beneath the woodwork as we begin the flows towards 1650. I stick to my average forecast of $1650 and expect Gold to hit $1595, $1650 and $1800 on a 6, 12 and 24m basis. This is my final target in the 5 wave swing, afterwards I will expect Gold to enter in consolidation via profit taking.

Thanks for keeping the support coming with likes, comments, charts and etc. And as usual the comments are open for all.

ridethepig | EUR Market Commentary 2019.12.18Very little to update on EUR with flows on both sides clashing and causing minor chop inside the 1.11xx handle. Better numbers than expected from Germany this morning providing a gift for those adding on dips.

A quick review of the two positions we have traded live so far with the infamous "worm in the apple". A quick review of these charts:

As long as support at 1.110x holds I remain bullish looking for a break of 1.12xx to kill the year in FX markets. This will leave us in a very handsome position for the 2020 macro map:

Good luck all those buying EUR dips... Thanks for keeping the support coming!

ALPHA PROTOCOL: SEEKING IMMEDIATE EXTRACTIONYou have opened the grave of an economic cycle. Before we dig deeper into the nature and consequences of our discovery, we will discuss the background to the thesis and consider first what we know from history a few lessons;

(1) Every other time this happened it ended badly for the global economy via recession. A

(2) A Fed that lags and finances the Whitehouse will only add fuel to the flames... "it's different this time".

(3) The longer the delay in USD devaluation from Fed, the worst the blow is going to be in Equity markets. Assuming USD does not devalue materially into 2020 its repo will grow and continue expanding the balance sheet, one way or another eventually this is going to look like Fed has been financing the WhiteHouse and then the game is up.

Protectionism is a serious error. There is no yellow brick road to success with protectionism, and it is no surprise the US via media manipulation have the masses deluded. This is a necessary component to the makeup of the next economic cycle; but it must be in balance, any overshoots or undershoots will destroy the effectiveness in manipulation.

Central Banks have been buying 20% of Gold supplies, expressing a view on global risk at rates we have not seen since the Nixon era when mortgage rates were surpassed by wages and no surprises this is also happening again now! Those with a background in fixed income will know alarm bells are ringing louder than usual in bond markets with wages ticking higher than mortgage rates. This is not sustainable and when danger threatens and the crowd does not smell it, don't stand like a sheep, rather run like a deer.

Now that Pandora's Box has been opened, it is equally important to understand the consequences and have a pulse to guide us on how to proceed:

Utilities starting to form a top:

Consumer Staples in the decade long chart:

For those with a background in waves you will know this is a typical example of a 5 wave count. This is time to start paying attention for any signs of a meaningful top forming. We know that once this final wave is completed a corrective chapter will begin. This chapter down is only a third of the pages compared with the rally and we can 'read' through it quickly.

Rotation in full swing:

Cyclicals vs Defensives :

Tracking Unemployment closely :

Vol sitting on the launch pad

Use this chart to good advantage, time to start paying close attention for early signs of a turn. As usual thanks for keeping the support coming with likes and we can open the conversation in the comments for all to share ideas and questions.

ridethepig | Looking at AUDNZD from 40,000ftOn the AUD side, RBA crystal clear about conditions needed for further easing and unlikely in the near-term. Unemployment overshooting may be the start of a round of good data for AUD which will keep the RBA on hold meaning markets will need to price out all of those betting on a RBA Feb rate cut.

On the NZD side, RBNZ slightly hawkish surprise in the last meeting and see a lot of NZD shorts left that that need unwinding. Although into year-end NZD also spiking higher but rather than from good data it was with a positional squeeze into 0.66xx before running out of steam. With that in mind I see both AUD and NZD as bullish vs USD but AUD has more room to outperform if data holds:

A “ Royal Flush ” for us and the Commodity Currencies. As widely mentioned yesterday, stronger AUD employment data sending AUDUSD flying towards the 0.69xx handle:

I am looking to close longs at 0.695x which is still the same level in play from the larger swing into year-end:

For those holding since October when we loaded the breakup we will have to wait till 2020 to clear final targets:

For the AUD macro map:

For the NZD macro map:

As usual thanks for keeping the support coming with likes, comments, questions and etc! Feel free to jump into the conversations in the comments with your views/charts. If we get enough interest we will have a round of Fixed Income chart updates coming for AU and NZ.

ridethepig | CADNOK 2020 Macro Map A good time to map the strategy and flows for CADNOK as we approach year-end. As you will have noticed I am tracking for a major pullback in the cross over the first half in 2020, this is coming from large macro forces at play. Central bank coordination has opened up the opportunity for NOK to outperform CAD.

Firstly the reflation theme via USD devaluation is going to help Canada a lot less than the rest as Canada will receive a spillover from the US manufacturing recession.

Secondly we need to discuss the impact of Oil across both economies. CAD and NOK are affected by oil with divergencies in their breakevens. For example Canada breakevens are circa $45 compared with Norway at $23 per barrel. Meaning simply Norway has more breathing room for the fall in Oil:

The third and final leg to the stool is coming from yield differentials. After the more dovish than expected shift in stance from BoC, the window is open for a cut which has not been fully priced while Norges which was previously the last hawk standing has hit the pause button. I personally see room for another hike from Norges next year which is the leg I am looking to trade here.

Best of luck all those in CADNOK, a very good pair to add to your FX portfolio.

Buying AUDNZD Aggressively !!A timely update to the previous AUDNZD weekly chart and after completing the initial selloff we are set for a major leg to the topside. Before we dig into the Fundamental and Technical side I recommend for those following to start by reviewing the previous charts to understand how and why we are trading the lows:

On the AUD side, markets are pricing an RBA move in Q120 with 50bps cut 60% priced in. Should see some unwinding for those outguessing a surprise like we did with RBNZ. Australian surpluses is providing a mattress to AUD as the historically low yield pick-up is allows deficits to be financed. Perhaps what is most interesting of all and highlights the underlying shift towards the USD devaluation / reflationary theme comes from real money managers who have started to take profits on their AUD shorts after RBA delivered in June & July are once again reaching extremes and ready to unwind again.

On the NZD side, NZD is not expected to outperform AUD however the housing market is showing signs of strength as collateral from AUD. Markets have reduce further the over pricing of RBNZ cuts, which is what has supported NZD in the short-medium term. For the fiscal side, we had highlights going overnight to NZ announcing a big round of fiscal spending. Markets have since gone overboard selling AUDNZD. In any case, here is the NZDUSD map for 2020:

For the technicals I am tracking an impulsive swing to the highs after markets completed plumbing the 1.03xx lows via NZ fiscal flows (a mouthful). Those with a background in waves will know we have market the lows in a multi year 5 wave sequence which we traded live here:

….and can lean on the AUD macro directional side:

Lastly for those following NZDCAD and AUDCAD flows are sitting comfortably in profits and can let the rest run for our final targets:

Best of luck all those trading the lows and buying dips. Please keep your support coming with likes and jump into the conversation comments with your views and charts as usual!

ridethepig | AUD Market Commentary 2019.12.17A good time to update the AUD chart-pack after the updates from a dovish RBA. Soft on wages and consumption with emphasis on outlook reassessment in Feb. Unless we see the domestic story pickup dramatically in Australia it will continue to keep AUD stuck in low gear. Support is found here at 0.685x and sizes I’m seeing should be enough to carry us towards the widely tracked 0.695x target:

Buying dips makes sense...

Bulls in full control:

Macro Chart suggests a lot of upside for AUD:

NZD dips are also starting to look more attractive:

Thanks for keeping the support coming with likes, comments and etc. Good luck all those buying dips in AUD.

ridethepig | GBP Fast Flows A very simple trigger for those wanting to cover some shorts from the initial elections entry; the key 1.315x support is holding and pressure has been completely absorbed.

We are trading the bottom of the clearly defined range from the elections; 1.315x <=> 1.355x and markets rather than going overboard on risk will want to keep their cards closer to their chest until 2020. If we do lose 1.315x this will trigger a panic leg and immediately put us into impulsive territory in the macro chart below.

Macro prints today from the UK were better than expectations and will be enough to keep BOE on hold and unlocks another test of 1.35xx. I will continue to use this pivot to position for the long-term flows:

A perfect double top in the making? Smells like it...

Thanks for keeping the support coming with likes, comments and questions. This is for advanced traders only as we are using the short-term range to decrease risk and scale into our position for a long-term trend . As usual with any questions feel free to open below.

Shedding A Few Pounds For Christmas...GBPUSD rejected at 1.35xx which acting as major resistance after the country went back on the leadership merrygoround. Here actively selling into all rallies in GBP crosses, although there is a caveat to Pound shorts in the immediate term. With Johnson and a ruthless Downing Street in full control of the press and hitting the “right” headlines the positive narrative around Brexit will continue and therefore dips will be perceived as attractive too many.

The Conservative majority was clear and simple to trade, particularly in GBPAUD :

GBPUSD

In any case well done all of those in shorts from the 1.35xx election highs … you will remember “ perception is more important than reality with FX ” … Remain nimble to take some chips off the table. A squeeze below 1.315x will make me excited.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

Thanks all for keeping the support coming with likes, comments, questions, charts and etc. As usual jump into the comments with your ideas and views to open the discussion for all!

ridethepig | MAJOR BREAKOUT IN PLAY FOR EURUSDWith Fed & ECB cleared a good time to update the EURUSD chartbook:

We have positioned live in two textbook cases:

For the technicals EURUSD remains rangebound till we break above the highs. Only a close above will suggest a more important base is in place and upgrade my thesis to a conviction. Plenty of resistance above the market, I see scope for 1.16 in 2020 but would expect this to attract some profit taking. Good luck to those trading EURUSD already in longs or for those waiting patiently on the sidelines for the breakout to form.

Thanks for keeping your support coming with likes and jumping into the comments!

ridethepig | BTC Worm In The AppleBTC - Choppy trading persists - a touch of excitement as we break back above the prior downward sloping trendline from last week, however the market is mindful that $ shorts are becoming more widely expressed and I am awaiting the spillover into BTC via the next key risk driver.

Expecting BTC dips to continue to be met with demand/covering interest and a close above 7250 is needed for us to get excited. Largely ignoring broader cryptocurrency gyrations and heavily XBTUSD, EOSUSD, ETHUSD and XRPUSD influenced, intraday. For the execution here we have infamous Worm In The Apple alerts triggered... In usual circumstances it will be a good opportunity for bears to load, however smart money who understand the macro flows in play will ping the lows into year-end.

On the longer term chart we can comfortably lean on BTC:

Thanks for keeping your support coming with likes and comments! As usual jump into the comments below with your views, charts, questions and etc.

ridethepig | CNY 2020 Macro MapIn a nutshell, I am expecting Copper to keep Chinese Equities afloat and recover Q120 with less uncertainty via fiscal policy and a rebound in exports. For those following the latest Hang Seng / Copper chart:

For the macro side, CNY will find a strong bid via trade tensions easing as we move into 2020 US elections. China's outlook for future generations is changing and while Trump protectionism causes USD devaluation via FED permanent operations. Flow wise I am expecting a lot of business to be done within 1H20 in FX markets, my main targets for 2020 remain at 6.85xx with momentum picking up in the decline through 2021.

The reflationary theme is picking up traction and if we see the Dollar materially decline it will be enough to provide some further growth to Chinese exports in Q1, however from Q2 onwards it will be countered via capex softening and provide a choppy consolidation range. I look for this to break in the second half of 2021 which will complete the macro driven pullback towards my main swing target at 6.50.

From a technical lens it should be no surprise we are trading the same key 6.949x from before in USDCNH:

While for those tracking the long term dollar devaluation we have covered the macro side in previous charts:

Good luck all those planning FX trades into 2020. The environment is going to become increasingly difficult as investors position around US election risks, more 2020 FX outlook reports along with other strategy research in the coming days and weeks. Thanks for keeping the support coming with likes and comments!

ridethepig | JPY Capital FlowsAfter getting the breakout we were tracking for in USDJPY we are now back and revisiting our infamous "Loading Zone" area at 109.3x right in time for BOJ to maintain the status quo.

Outside of a knee jerk via risk I expect USDJPY to hold 108 - 109 range until we clear BOJ next week. Odds of Japanese rates being taken further into the red is declining, meaning the BOJ is likely to sound hawkish via maintaining the status quo flows towards 100. Japanese consumption is falling alongside production after the tax hike and we are already starting to see this show up in store closures throughout the country, however, you can see some are already starting to argue a case for Global manufacturing recovery (unlikely with protectionism via Trump).

JPY inflows will continue to come via risk as long as BOJ remains on hold and warrants increasing bearish exposure. Looking to add more $JPY shorts into the 109.3x resistance with clear jurisdictions mapped on both sides, resistance is initially found at 109.3x. While to the downside support is located at 108.2x which holds the key to unlocking the 2020 macro leg towards 100.

Thanks for keeping the likes and comments coming, as usual jump into the conversation with your charts and questions!

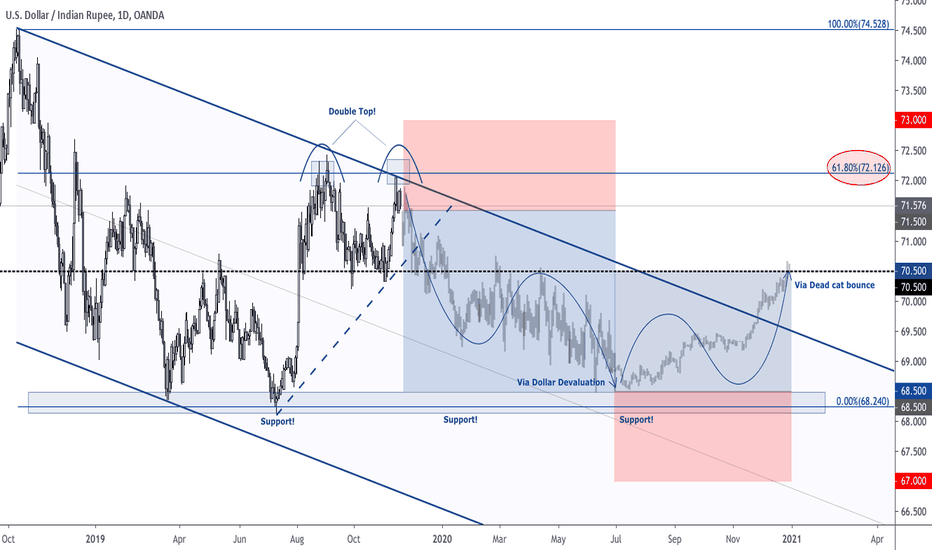

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

ridethepig | Gold One Last LookA very good time to update the Gold chart after clearing inflation and FOMC yesterday. As widely mentioned in the latest macro update in the institutional room:

" Here tracking for a slight uptick in inflation but nothing out of trend before the spotlight is turned onto forward guidance with Fed and 2020 dots. I expect the dots to tick down whilst leaving 2021 hikes on the table . "

Inflation making a return while risk markets remain less sanguine with protectionism, impeachment, election risk and late cycle fears refusing to abate. To understand how and why we are trading the current 1475 level its important to review and dig deeper into the chart archives, this entire 5 wave impulsive sequence began from the breakout we traded live here at 1200:

At this point after the breakout it was clear the large triangle formation was in play, for those with an understanding of waves this is a textbook case of an ABCDE pattern to mark the final chapters of the cycle:

...for those wondering if we also traded pullbacks in the opposite direction, the answer is yes:

Now that we have reviewed the flows to date and have an understanding of the why and how, we can start to build a case for adding to our longs. It should be no surprise that this valuation driven pullback attracted buying interest from the usual suspects:

It is the same story in particular for those trading XAU versus CNY:

In this regard, Gold reiterated the skew towards grinding higher at least for the next year. It appears unlikely that the bar for risk-on will be met by the end of 2020, with Brexit and US elections entering into the picture it is certainly more conceivable that further upside could play out in a way that triggers momentum towards 1650 targets.

Thanks for keeping the support coming with likes and jumping into the comments with your questions and charts!

Expecting Weakness In Dollar Into Year EndA timely update to the Dollar chart after clearing Fed minutes. Nothing to update after the third cut, Fed front loading the DXY decline over the coming months and quarters.

Firstly lets start with our Long-term Dollar chart:

Mainstream media selling the orderly brexit resolution and reflationary growth rebound to strategically converge the gap with the US. This is on track to work, a master stroke which will weaken flows into US assets.

EUR will benefit as collateral here with global yields higher it is going to squeeze the hand of the over leveraged US market, which will be the start of the turndown in US Equities:

I also see EURUSD rallying next year:

As widely expected since 2018...

For the short-term flows, all eyes on 98.00 as the key level in play for the rest of the year. Expecting market to turn offer into year-end and I target the 96 handle with potential for USD to continue the decline well into 2020.

Best of luck all those trading USD, jump into the comments with your ideas and charts!

ridethepig | Buying Dips In Euro...A very good time to update the Euro chart after the infamous "Worm in the apple". For those who have not played before I highly recommend seeing the textbook examples from the playbook here:

EUR holding well and failing to give anything back to bears after our flawless swing earlier in the week (but also not taking the widely mentioned key 1.11xx resistance). While its both unsurprising and clear that risk markets are less sanguine, perhaps what is surprising is the resilience the Euro has shown.

For those macro players this is screaming loudly !!!! that FX positioning is changing into yearend and the flight to quality into USD is losing its importance . The technical jurisdictions are clearly mapped with 1.109x acting as resistance, if US data undershoots again today a break of the highs is in play. Those looking to add bullish exposure should track the 1.103x support.

Remember we can comfortably lean on the long-term swing:

I am expecting EUR to find a strong bid next year as we see a new chapter in growth differentials. This will act as a catalyst in the reversal of capitals flows from the euro area to the US and serve as support in EURUSD .

The risk to the thesis comes from European growth flopping next year, investors will therefore expect lower returns from the euro area and therefore European assets would sell off, weighing heavy on the currency.

Short-term threatening to enter into wide consolidation till year-end, price action eminent of strong support at current levels. I sense that a clean break of 1.11 is now being watched as the catalyst for fresh demand and am comfortable buying anything inside the 1.09xx handle, as opposed to chasing the breakout. Watching EURJPY through 120.70 for clues.

Good luck to all those trading the buy side and today's data. Thanks for keeping the support coming with likes and comments!

ridethepig | USDJPY Market Commentary 2019.11.26Here we are trading USDJPY at the highs in the range with macro risk-off themes still remaining in play and unchanged despite how the local news is selling the extended bull market.

On the monetary side, BOJ clearly have their hands tied with the ECB/FED coordination. To put simply, any BoJ easing will follow ECB/FED which will be positive JPY via risk factors.

On the rate differential sides, UST and JGB continue the decline which still indicates lower USDJPY. Here I am tracking for the leg towards 100 and beyond as USD devaluation kicks in.

On the technical side, tracking 109.0x steel resistance with 107.0x support holding the key to unlocking the swing towards 100.xx.

Good luck all those holding $JPY ... a very interesting environment as we enter into year-end.

ridethepig | NZD 2020 Macro MapA good time to update the roadmap for NZDUSD as we enter into the final chapter of 2019. The market has been heavily short NZDUSD all year, pricing in further cuts from RBNZ, the anticipation of a dovish CB was short-circuited and we are starting to see a reduction in their short positions. This was evident in my previous post:

From a strictly macro perspective, NZD is not expected to outperform however the housing market is showing signs of strength as collateral from AUD. I see room for markets to reduce further the over pricing of RBNZ cuts, which will support NZD in the short-medium term.

On the USD side, as widely mentioned here and in the Telegram channel, USD weakness is reaching out theatres and will be even more evident in high-beta currencies like NZD.

Those following will also know I am long NZD crosses, NZDCAD continues to make a lot of sense with CAD longs being unwound after the dovish BoC.

Important to note

key risks to this trade come from unexpected RBNZ intervention.

Good luck all those planning FX trades into 2020. The environment is going to become increasingly difficult as investors position around US election risks, my 2020 FX outlook reports along with other strategy research in the coming weeks. 2020 is setting up for fireworks on the FX board with expectations and valuations starting to diverge and with late cycle concerns creeping back in through the back door to put the cherry on top. For those interested can send a PM on Tradingview.

Chop! Chop!A well needed update to the EURCHF chart after previously tracking and failing to clear the ABC extension targets at 1.065x. For those following the previous charts before we broke down:

The yearly flows and expectations for 2020 will large be divided in a tale of two halves and as a result forecasts in the cross reflect that:

For the initial phase, we are tracking a test of the important 1.12x and 1.13x highs which will come via a zig-zag of 'orderly' Brexit triggering those who hedged in CHF to unwind and therefore CHF outflows, twinned with EUR funded inflows. This is the A' part in the sequence.

After clearing 1.12x and 1.13x and with a lot of work still to be done on the ladder, we transition into the second phase where I will look for a meaningful retrace to around the current lows at 1.092x which will provide the B'. These two phases will cover the majority of 2020 flows before completing a fresh breakup above 1.13xx in 2021 with a completed ABC sequence.

Thanks for keeping the support coming with likes and jumping into the comments with your views and charts!