Bears holding the highs in USDJPYThe most recent break below 110.5 indicates that this sell-off towards the end of the Fiscal year is looking impulsive in nature. This is a result of combination of flows from Yen repatriation for the FY end and risk-off via Central Bank uncertainty, Brexit and Meuller (now cleared).

Any pullbacks towards 110.2 and 110.5 should be considered corrective and countertrend offering great opportunities on the sell-side. The targets below for shorts come into play at 109.3.

I am actively adding exposure on all pullbacks as mentioned. Best of luck for those joining.

Ridethepig

A full spectrum of views..Here we are dissecting the Daily chart for Oil. From a technical perspective we are completing an ABC correction after an impulsive 5 wave sequence to the downside.

The first level of interest for shorts comes in at 61.14 with the possibility we can extend as high as 64.59. As long as we remain below here the moves will be considered corrective. In other words, a tick above the highs will invalidate the positions.

Whilst the downside remains the main area of interest here it is worth questioning whether the market has retrace far enough already to kickstart these flows..

Best of luck and thanks for all the support in keeping the account moving forward.

Are the highs almost in?Here we can see the market retesting support after failing to complete the 5th wave targets in the sequence. To put it simply, since Mueller has been cleared we have the fuel but anything beyond to the topside seems very difficult.

I expect bulls to come in over the next few sessions and clean the 5 wave sequence. A break of 2800 to the downside would allow for some more room towards 2740 which would ultimately be the level to watch for a base. Weakness beyond here would be very concerning.

Best of luck to all those in US Equities and positioning for the FY end.

Progress has been limited...Here we are tracking a very technical move as Dollar takes the steering wheel. Support has been broken and we are in free fall till 3500-3525.

Eyeballing a test of the bottom in the range here as we approach the end of the Quarter and Fiscal Year.

Best of luck all those trading Cryptos... the main target remains below at 2920 and 2300 for the extensions (see attached: "Eyeballing a -50% move in BTC" and "2300 looks within reach").

Thanks

Yearly lows set in place for USDMXNHere we can look from a bird's eye view and see that this is likely still a large triangle taking place.

We are testing the minimum targets of a 5 wave sequence from November highs. It is very possible that this can start forming a base at current levels since the target has been reached however extensions below come in at 18.53.

The likelihood of a base forming will increase if we trade above resistance at 19.20, this will give confidence and unlock 19.47 and 20.4 for initial targets in the triangle.

A very interesting cross to track over the coming Months and Quarters. Best of luck all trading it live.

Further downside unlocked in GoldWe have some important updates here on Gold after the previous chart (see attached: "Large triangle forming...?"). It is now clear we are in the final leg of an ABC sequence.

It is time to start paying attention to the Gold chart over the coming weeks, there is a very strong argument to be made for a top being formed here. This can retrace as much as 1255 here in another leg lower.

To the other side, if we price starts to stabilise around 1325 then we may have set the low in the "E" chapter for those following the triangle.

So to put it simply, what we have on the menu here to trade is the possibility of a top at 1325. If resistance holds here then we are unlocking a move back towards 1255 before eventually putting scaffolding up around a material low.

Alternatively, I will be ready to add upside exposure should be crack the 1325. Good luck all those trading Gold for Spring.

Copper next to lose its shine... Strong Dollar prevailsThose who have been following the Portfolio we are building on Tradingview will know where we are in the current Gold move (see attached ideas as we are not going to cover this here).

The upside in Dollar is here till Summer meaning we have a sharp leg to the downside in play for Copper. Gold has already moved first, and here expecting copper to start moving as collateral in this 'B' leg.

Keep a close eye on the DXY chart, let's open the discussion for all those Copper traders and see how it goes...

Best of luck all!

Impulsive move in play for USDTRY Here we are witnessing a very interesting move taking place for the Turkish financial system. After finishing a clear corrective ABC sequence since the August highs we are now in the early stages of an impulsive move to finish the more broader 5th wave in a very large sequence.

For those tracking the updates in USDTRY in the previous charts (see attached: "Starting 5th wave looks imminent..") this is the move we have been waiting for over the last few months. Finally it is here, time to stick the knife in and cause maximum pain for Turkey.

The fact that we are rallying in an impulsive manner means we are going to eventually crack 6 + and possibly even 7.80

Continuing to watch with interest, all positions are fully loaded here as has been the case for months. Time to sit on our hands and enjoy the moves.

Thanks

Tracking 1480-1475 in Russell..From the previous idea (see attached: "Russel leading the consolidation pack") you will know that Russell in many ways has been acting as a leading indicator for US Equities.

This is interesting timingwise, especially when the break to new highs in S&P and NQ occurred was not comparable in Russell. So here we are now only needing to track the 1480-1475 region. This is the 38.2% retrace and we 'know' in advance is the level bulls would want to turn for continuation.

Should we break lower then it will really knock confidence and imply we are starting to show early signs of an impulsive selloff. This will also bring into question the more meaningful top.

Tracking it very closely with Mueller cleared...Best of luck all and thanks for the support!

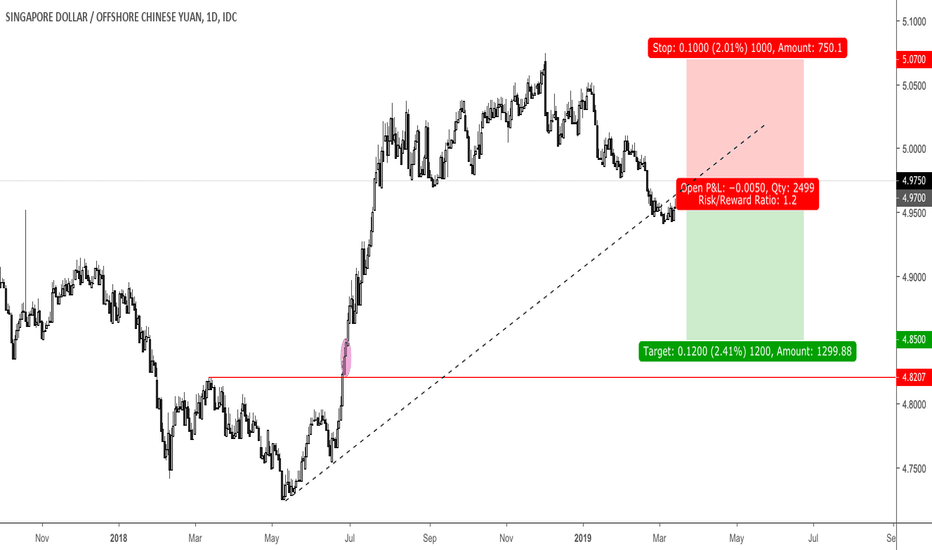

Year of the Bull? Not according to the fundamentals...With large account deficits, disinflation and widening interest rate differentials there are many reasons to not be bullish China.

Whilst on the political side there is a desperate need to keep CNY stable and stronger because China needs to attract capital inflows for the second half of 2019.

Why?

Because they are trying to facilitate the process of inclusion in equity and bond indexes to make China more attractive for FDI.

Risks to this trade are for deterioration in Chinese macro data and if equity markets sell-off.

Best of luck all and thanks for keeping the support coming with likes, comments, follows and etc.

Second stage of EM rally?After previously tracking the reversal (see attached: "Another key reversal in play in USDRUB") finally the break of 65 has come. From a technical standpoint this was important as it unlocked the 62.5 lows.

Russia has been one of the out performers on the currency board so far this year and I continue to see scope for more gains, irrespective of the very near term reversal in dollar.

The risk here to the setup is coming from sanctions related risk. Russian authorities have been quick to take measures to insulate the economy (reaction to DASKAA bill).

Best of luck all those trading EM and thanks for keeping the likes and comments rolling

Aggressively buying Brazil for the long termHere we have a very wide ABC in play with the C leg finishing at 7.25 - 7.28.

From a technical perspective, the market has presented a flawless 5 wave impulsive move with a three wave retracement. Those who are betting on the upside will be coming in here at the 50 and 61.8% weekly retracement levels at 5.09; and we can expect a continuation.

There is scope here for as high as 7.25-7.28... here actively working a lot on the buy side in Brazil.

Best of luck, hope this helps and lets see how it goes.

Short USD/JPY via risk=> Here we are isolating the Yen once more and expecting a worsening outlook of US assets to continue which will raise the prospect of asset repatriation out of the US.

Whilst risk may be rebounding temporarily as the FED attempts a dovish shift, and US-China trade tensions are likely to continue de-escalating, USDJPY will still like remain on offer amid broader USD weakness.

Here we also expect the rebound in risk sentiment to be temporary rather than fixed, meaning JPY will see some inflows. If Japanese banks tighten conditions further we will have a greater incentive for real money to reduce their exposure in the US.

The only risk here is if risk on sentiment stays supported and the US macro outlook improves.

For those interested in more details on the "flash crash" please see our previous USDJPY weekly chart!

Good luck and all the best for those invested in the US.

"One and Done" ... An update to EURUSD for FEDOn the monetary side, Fed taking the spotlight so let’s start digging into the details…

Expecting the Fed to lower the “dots” signalling one hike in 2019 … a “one and done” approach. June seems unlikely now as the Fed has started to focus on inflation to keep equity markets happy.

My base case is for a hike in December meaning the dollar looks underpriced at current levels and with a lingering ECB easing risk premium EURUSD will start the leg lower after we clear Fed and PMIs.

From a technical standpoint we are sitting at strong resistance, any kneejerks higher (unlikely) will attract a lot of selling interest.

Best of luck all those trading Fed

ECB willingness to shift into easing mode again will be testedSoft macro data from France continues...

Markets are likely to want to test ECB willingness to shift into easing mode again so the downside risks for 1.09 remain in play for EURUSD. This will carry the rest of the EUR board.

A quick move in play here to kill the week off as we start the initial stages of a test in the lows at 0.745.

Best of luck all

The "House of Commons Circus" ContinuesAt this point markets have priced in the support for a Brexit extension of at least one-quarter. The votes today and tomorrow are unlikely to affect EURGBP significantly.

We are still tracking the same break to the upside that we have been for the past few weeks. There is a chance of a small move lower here with the headline on the extension of A50, however, risk investors are going to be underwhelmed with the coming weeks and this will be the catalyst for our break.

Round 2 is in play for the House of Commons tonight. The house are voting on whether it supports leaving the EU without a deal. Markets are overwhelmingly expecting this to be rejected, leaving the possibility of a Brexit extension (round 3) tomorrow the most likely scenario.

The pressure on brexiteers to deliver Brexit is mounting and my base case is for the deal to eventually pass meaning the UK will leave the EU with a Hard Brexit and the Pound will have to devalue to offset the immediate loss of access to the global trade stage.

Best of luck.

USDCHF Important updates for bullsHere we are once again looking at the 5th and final wave in the uptrend meaning it's time to add more exposure on dollar longs once more, we are in the beginning of an impulse wave.

The support line will come into play on the technical side and we are set to mark the turning point and kick start flows till the end of summer.

Let's track the charts closely, we have launched a smaller TF chart for those here who are trading the H1 initial part of this move as usual and I have attached the weekly charts too for those who are interested in the macro moves.

Best of luck

Bulls exhausting, whilst early bears squeezed. BIG move coming. As most of you already know the targets below remain in play.

The ECB introduced a risk premium on the EUR which is only going to increase as the EZ outlook softens. I like playing EUR against pockets of USD strength as we have the possibility for renewed pricing on Fed hikes in the picture and JPY via fiscal year-end repatriation flows.

Best of luck all shorts

Oil starting to look exhausted...Here we are tracking a large swing to the downside in oil. I would like to fade the highs here and target the range lows (see attached idea for those wanting to target 45 in the coming months).

This idea is for the coming sessions as crazy as it sounds, we have some monster moves coming on the demand side. The ECB confirmed the slowdown is real and the FED are going to continue the dovish tone meaning we have all the cards we need on the monetary side.

You may also see it wise to simply sell a break of the red trend line. Stops clearly marked above the highs at 58.30 whilst targets sit below at 55.4 and 52.9.

Thanks and best of luck.

AIM Vectors are intriguing Recessive Dystrophic Epidermolysis Bullosa (RDEB) is coming very soon, plus AIM Vectors with gene therapy entering into play.

On the technical side we have reached the end of the line for the ABC sequence, from here a very natural flow will take place back towards the highs.

Best of luck

Brent remains softAfter bouncing from the 200MA we are starting to run out of steam. Here I am expecting a return back towards the 49.89 and 41.20 lows over the coming weeks.

The ECB confirmed the global slowdown is real, the risk approval has gone. We are set for lower prices via the demand side. On the technical side A break of the 200 & 50 MA's will open up the downside with the 61.8% still due for a test.

Best of luck those positioning for the coming quarters.

Nat Gas Rejected This is the first time I have charted Nat Gas on Tradingview so we are starting with a blank canvas.

We completed a large 5 wave sequence in the first quarter of 2016 and have since bounced in what has been a corrective ABC. This has clearly completed and we are looking at a very aggressive rejection.

Support at 2.3 / 2.5 is approaching but the sustained weakness shows no signs of stoping. The aggressive move away from the highs look impulsive in nature and continuation of the sequence to the downside looks cooked.

All the best