Ripple: Target Zone Ahead!Ripple’s XRP remains on track to reach our magenta Target Zone between $1.03 and $0.38, even though the price has recently settled into another consolidation phase. Under our primary scenario, we expect the bottom of the magenta wave (2) to form within this range. Once that low is confirmed, fresh upward momentum should unfold during the following impulse wave (3), which has the potential to push XRP above the resistance at $3.39 and toward new all-time highs. However, if XRP breaks out to the upside before establishing the projected low within our zone, this zone will be considered void. We currently assign a 38% probability to this alternative scenario.

Ripple

XRP/USD "Ripple vs U.S.Dollar" Crypto Market Heist (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S.Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2.0500) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (2.3000) Swing / Day Trade Basis Using the 5H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 1.6500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XRP/USD "Ripple vs U.S.Dollar" Crypto Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XRP Vs Bitcoin, A New All-Time High In 2025? Must Read!It is very interesting to see the difference between the BTC trading pairs of different big projects, they are all completely different and this can reveal quite a lot. Since the USDT pairs are all the same, lots of useful information can be extracted from the BTC pairs. We can learn a lot by studying these. We can know the real strength of a project, how people are behaving behind the scenes and support (or deny) our bias for future scenarios.

Here XRPBTC is so different compared to ETHBTC or ADABTC which I reviewed recently, three completely different charts.

Let's go straight to the point. XRPBTC is trading for the first time ever above MA200 on a stable basis. It pierced above in July 2023 but only momentarily, conditions now are completely different. It is above MA200 and to stay.

This is how I interpret this signal, XRPBTC is about to shoot up with major force, its biggest bullish wave since 2017 and possibly a new All-Time High. This is the only one, all the other BTC pairs look shaky for a new ATH because Bitcoin is so strong. This one seems to be able to do it easily, based on the chart.

The only way to keep it simple is by stopping now. But there are some long-term higher lows and the pair a good chart. The chart reveals long-term stability and a solid growing base. Something like this, "The project has been developing nicely and building a solid base in the background. This project is about to experience a major move that is likely to be out of proportion with the rest of the market."

This is likely due to new products XRP is launching. Whatever the reason, XRPBTC is to set to grow, long-term. The short-term can be anything this is not the focus here, the conclusion is a strong bullish wave alas 2017.

Namaste.

SHORT XRP/USDT🔥 #XRP/USDT

🔴 SHORT

🎲 Entry Zone: 2.1110

✅ Take Profit 1: 2.0675

✅ Take Profit 2: 2.0242

✅ Take Profit 3: 1.9545

✅ Take Profit 4: 1.8867

(Extended if Momentum Persists)

❌ Stop Loss: (A Strong Close Above 2.2100 Invalidates the Short Setup)

💱 Recommended Margin: 2.5% - 5%

🧳 Recommended Leverage: 5X - 15X

⚠️ Take Care of Risk Management for Your Account

XRP - Breakout will push the price to 5+ USDPrice got reject around the previous resistance line formed after hitting the new ATH on 2017. After 7 long years XRP was able to hit the previous ATH value.

After getting reject from the ATH XRP is trading inside the channel, a breakout from this channel would push the price to previous ATH and a strong breakout from previous resistance is needed to reach new ATH.

Lets see if the price break the channel.

Cheers!

GreenCrypto

Watching $2.10 for a Potential XRP ReversalRipple (XRP) is currently trading within a clear downtrend, and we’re now seeing a corrective move that’s pushing price back toward a key zone around $2.10, which has acted as both support and resistance in the past.

This area aligns closely with the descending trendline, making it a strong confluence zone to watch for a potential bearish reaction.

XRP - Choppy Market, Will We See $1.5 Again?After finishing the 5-wave structure in early 2025, XRP had a rough patch, trading between $3 and $2 and offering some pretty neat swing trade opportunities. Now, two months later, the big question is: will this range continue, or is a breakout on the horizon? Let’s break down the key levels and high-probability setups.

Short Trade Setup

Resistance Zone:

The weekly level and the 0.618 Fibonacci retracement are both around $2.5763 to $2.5792, aligning nicely with each other.

The anchored VWAP from the all-time high at $3.4 adds extra resistance at about $2.63.

Setup Details:

A low-risk short trade can be considered at the weekly level, with a stop-loss set above both the anchored VWAP and the swing high.

Target: The monthly open, aiming for an R:R of about 4:1.

Support Backup:

Additional support in this range comes from the 0.618 Fibonacci retracement (from a low at $1.9 to a high at $2.59), the weekly 21 SMA at $2.28, and a weekly level at $2.0942 just below the monthly open.

This support between the weekly level at $2.0942 and the monthly open is crucial for maintaining bullish momentum. If it holds, the bearish short setup stands; if it breaks, things could get tricky.

Long Trade Setup

When to Consider a Long:

If the support zone mentioned above fails, look for a long trade opportunity at the swing low around $1.77.

Support Confluence:

Primary Support: The swing low at $1.77, with lots of liquidity around that area.

Additional Layers:

The monthly level at $1.5988.

The weekly level at $1.5605 sits just below the monthly.

The 0.618 Fibonacci retracement from the 5-wave structure at $1.5351.

Anchored VWAP from the low at $0.3823, aligning with the weekly level.

And don’t forget the psychological level at $1.5.

Setup Details:

This long trade setup would offer an attractive R:R of roughly 6:1, targeting back to the monthly open for an approximate 33% gain, with a stop-loss placed below the $1.5 mark.

XRP's current trading range has provided some good short and long trade setups, a long opportunity at the swing low ($1.77-$1.5) could be the next big play. Whether you lean towards short or long, finding these confluence zones helps in making more informed, high-probability trade decisions.

If you found it helpful, please leave a like and a comment. Happy trading!

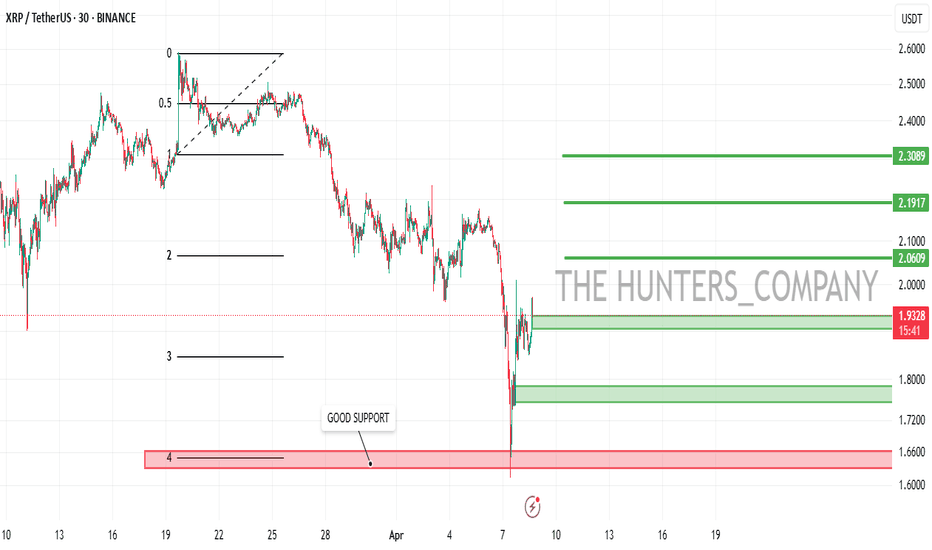

XRP/USDT:BUY LIMITHello friends

Due to the price drop, we have reached a good support area, which you can see is supported by good buyers.

Now we can buy in stages and with capital management in the specified areas and move to the specified targets.

Always buy in fear and sell in greed.

*Trade safely with us*

XRP Continues to Mirror BTC's Macro Pirce-Action; Only Slower.XRP since it was listed on Poloniex back in 2014 seems to have mirrored the overall price action of BTC over the years but at a much slower pace.

It would appear that BTC makes the move first then XRP takes about 65% longer to make a move of equal significance.

We can see that BTC had a Major Pump in 2013 and that from there it traded within a range until 2017 before rising 5,424%

XRP's story appears to be the same but with the small twist that it is still trading within it's Multi-Year-Range that it's found itself trading within after a huge 2017 rise.

2022 will be coming to and end soon and it will soon be that XRP has traded 6 Years within this range and just like BTC in the past it appears to be holding on to a trendline, if XRP goes like how BTC went, then we should expect XRP to be nearing or even above the top of the range Several Months after it's first test of the trendline which would point us to February 2023.

If XRP's Multi-Year-Range Breakout lives up to BTC's, I would expect to see an approximate 5,400% pump from XRP's Range Highs which would take it up to the seemingly insane and "unreachable" target of $120.94

We even have some added Monthly MACD Hidden Bullish Divergence to back XRP up.

XRP - Two Longs on the Horizon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Medium-Term: XRP broke below the $2 support zone last week, shifting the momentum from bullish to bearish.

📍 As it retests the lower bound of the channel — which perfectly intersects with the orange demand zone and the $1.5 round number — I’ll be looking for short-term longs.

🚀 For the bulls to take over in the long term and kick off the next bullish phase, a breakout above the red structure at $2.15 is needed.

Which scenario do you think will happen first — and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

XRP: Fresh Gains Ahead? Bullish Setup Intensifies.XRP Price Poised for Potential Breakout? Bulls Eye Fresh Gains Amid Bullish Setup as Open Interest Surges

The cryptocurrency market is a relentless arena of volatility, sentiment shifts, and technical battles. Among the major digital assets, XRP, the native token of the XRP Ledger, often finds itself at the center of intense debate and speculation, largely due to its unique position, technological proposition, and the long-standing regulatory shadow cast by the Ripple vs. SEC lawsuit in the United States. Recently, however, a confluence of factors has ignited discussions about XRP's potential for a significant upward move. With the price consolidating and holding firm above the psychologically crucial $2 mark, coupled with a notable surge in derivatives' open interest, bullish traders are keenly watching for signs that XRP might be coiling up for its next major run.

The Significance of the $2 Threshold: A Psychological and Technical Battleground

Price levels ending in round numbers often act as powerful psychological magnets in financial markets, and $2 is no exception for XRP. Crossing and holding above such a level can signal a significant shift in market sentiment, transforming previous resistance into potential support. For XRP, reclaiming and maintaining ground above $2 carries several implications:

1. Psychological Boost: A sustained presence above $2 instills confidence among existing holders and can attract new buyers who perceive it as a validation of strength. It breaks a mental barrier that may have previously deterred accumulation.

2. Technical Support: Historically significant price levels often become areas where buying interest clusters. If XRP consistently finds buyers stepping in around the $2 mark, it establishes this zone as a credible technical support level. A strong support base is crucial for launching further upside attempts, as it provides a foundation from which bulls can stage rallies.

3. Confirmation of Strength: In technical analysis, breaking above a major resistance level (which $2 may have been previously) and then successfully defending it as support (a "resistance-support flip") is considered a strong bullish signal. It suggests that the underlying demand is robust enough to absorb selling pressure at that level.

The current price action, characterized by XRP holding above $2 despite broader market fluctuations, is therefore a key factor fueling bullish optimism. It suggests resilience and a potential accumulation phase where buyers are absorbing supply, potentially setting the stage for the next leg higher. However, a decisive break below this level could conversely signal weakness and potentially trigger further downside.

Decoding the Bullish Technical Setup: Chart Patterns and Indicators Aligning?

Beyond the $2 level itself, chart patterns and technical indicators are providing further clues that bulls are closely monitoring. While specific patterns evolve rapidly, several common bullish setups could be in play or forming:

1. Consolidation Patterns: Often, before a significant price move (either up or down), an asset enters a period of consolidation. This can take the form of patterns like:

o Ascending Triangles: Characterized by a horizontal resistance line and a rising trendline of support (higher lows). A breakout above the horizontal resistance is typically considered a bullish continuation signal.

o Bull Flags or Pennants: These are short-term continuation patterns that form after a sharp price increase (the "flagpole"). They represent a brief pause before the trend potentially resumes. A breakout above the flag/pennant's upper boundary signals a likely continuation of the prior uptrend.

o Range Consolidation: Price trading sideways between defined support and resistance levels. A decisive break above the range resistance, especially on high volume, can signal the start of a new uptrend.

2. Moving Averages: Key moving averages (MAs) like the 50-day and 200-day simple moving averages (SMAs) are widely watched indicators of medium and long-term trends.

o Golden Cross: A bullish signal occurs when the shorter-term MA (e.g., 50-day SMA) crosses above the longer-term MA (e.g., 200-day SMA). This indicates that short-term momentum is strengthening relative to the long-term trend.

o Price Above Key MAs: XRP trading consistently above both the 50-day and 200-day MAs is generally viewed as a sign of a healthy uptrend. These MAs can also act as dynamic support levels during pullbacks.

3. Momentum Indicators:

o Relative Strength Index (RSI): This indicator measures the speed and change of price movements. An RSI reading above 50 suggests that bullish momentum is dominant, while readings above 70 indicate potentially overbought conditions (though an asset can remain overbought during strong uptrends). A sustained RSI above 50, possibly bouncing off this level during dips, supports a bullish outlook.

o Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two exponential moving averages (EMAs). A bullish signal occurs when the MACD line crosses above the signal line, especially if this happens above the zero line.

o

If multiple technical indicators and patterns align – for instance, XRP holding above $2, breaking out of a consolidation pattern, trading above key MAs, and showing strong momentum on the RSI and MACD – the case for a potential run becomes significantly stronger.

Open Interest Surges: Fueling the Fire or Adding Risk?

A particularly noteworthy development often accompanying potential price breakouts is a surge in Open Interest (OI) in the derivatives market (futures and perpetual swaps). Open Interest represents the total number of outstanding derivative contracts that have not been settled. It essentially measures the total amount of capital committed to that market.

• Rising OI + Rising Price: This is generally considered a bullish sign. It suggests that new money is flowing into the market, primarily opening long positions, reflecting increasing conviction among buyers that the price will continue to rise. The new longs add buying pressure and fuel the uptrend.

• Rising OI + Falling Price: This is typically bearish, indicating new money is entering to open short positions, betting on further price declines.

• Falling OI + Rising Price: This might suggest that the rally is driven by short-covering (short sellers buying back to close their positions) rather than new buying interest, potentially making the rally less sustainable.

• Falling OI + Falling Price: This often indicates that traders are losing conviction and closing out existing long positions, potentially signaling the end of a downtrend but not necessarily the start of an uptrend.

The reported surge in XRP's Open Interest while the price holds above $2 aligns with the bullish interpretation (Rising OI + Stable/Rising Price). It implies that traders are increasingly betting on upside continuation, adding capital to back their bullish theses.

However, high Open Interest also introduces risks. A large number of leveraged long positions makes the market vulnerable to a "long squeeze." If the price unexpectedly drops (perhaps due to negative news or a broader market downturn), it can trigger cascading liquidations of these leveraged longs. This forced selling adds intense downward pressure, potentially leading to a sharp price crash. Therefore, while rising OI can confirm bullish sentiment, it also amplifies potential volatility in both directions.

Fundamental Factors: The Ever-Present Shadow of the SEC Lawsuit and XRPL Developments

No analysis of XRP is complete without considering the fundamental factors, dominated by the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). The lawsuit, initiated in December 2020, alleges that Ripple conducted an unregistered securities offering through its sales of XRP.

• The SEC Lawsuit: This remains the single most significant factor influencing XRP's price potential, particularly concerning US-based investors and exchanges.

o Positive Outcome/Settlement: A favorable ruling for Ripple, a clear settlement defining XRP as not being a security, or favorable legislation clarifying the status of digital assets could remove a massive cloud of uncertainty. This would likely lead to relistings on US exchanges and potentially trigger a substantial price rally, potentially decoupling XRP somewhat from the broader market trend.

o Negative Outcome: A ruling deeming XRP a security could have severe negative consequences, potentially limiting its utility, hindering adoption (especially in the US), and causing a significant price decline.

o Ongoing Uncertainty: As long as the case drags on, it acts as a headwind, potentially suppressing XRP's price relative to other cryptocurrencies that don't face similar regulatory challenges. Positive developments or perceived wins for Ripple during the legal proceedings often cause short-term price spikes.

• XRP Ledger (XRPL) Developments and Adoption: Beyond the lawsuit, the underlying technology and its adoption matter.

o On-Demand Liquidity (ODL): Ripple's primary use case for XRP, facilitating low-cost, instant cross-border payments, continues to see adoption, primarily outside the US. Growth in ODL volume signifies real-world utility.

o Central Bank Digital Currencies (CBDCs): Ripple is actively engaging with central banks globally, exploring how the XRPL could potentially support CBDC initiatives. Success in this area could significantly boost the ledger's profile and potentially XRP's utility.

o Other Use Cases: Developments around NFTs, decentralized finance (DeFi), and smart contracts on the XRPL, while perhaps less mature than on other blockchains, contribute to the ecosystem's overall value proposition.

Will Buyers Push XRP Further? Potential Targets and Risks

Given the confluence of factors – holding the $2 support, potentially bullish technical setups, and rising open interest – the question remains: can buyers sustain the momentum and push XRP significantly higher?

• Potential Upside Targets: If the bullish scenario plays out and XRP breaks decisively upwards, potential resistance levels and targets could include:

o Recent swing highs (e.g., $2.20, $2.50, depending on recent price action).

o Psychologically important levels ($2.50, $3.00).

o Fibonacci extension levels based on previous price swings.

o The previous all-time high (around $3.40 - $3.84 depending on the exchange data).

• Key Risks: Despite the bullish signals, significant risks persist:

o SEC Lawsuit: Any negative news or ruling remains the primary threat.

o Market-Wide Correction: A downturn in Bitcoin or the broader crypto market could easily drag XRP down, regardless of its individual setup.

o Failure at Resistance: If XRP attempts to rally but fails to break through key overhead resistance levels, it could lead to a reversal.

o Breakdown Below Support: A decisive drop below the $2 support level would invalidate the immediate bullish thesis and could open the door to lower targets (e.g., $1.80, $1.50, or key moving averages).

o OI Liquidation Cascade: As mentioned, high open interest could fuel a sharp sell-off if sentiment sours.

Conclusion: Cautious Optimism Warranted

The current situation for XRP presents a compelling, albeit complex, picture. The ability to hold the crucial $2 support level is a significant show of resilience. Combined with potentially forming bullish technical patterns and a notable surge in open interest suggesting fresh capital inflow and conviction, the ingredients for a potential price run appear to be gathering. Bulls are rightly eyeing fresh gains, encouraged by these developments.

However, caution remains paramount. The cryptocurrency market is inherently volatile, and XRP carries the unique and substantial burden of the SEC lawsuit's uncertainty. While technicals and derivatives data might point towards bullish potential in the near term, fundamental risks and the ever-present possibility of market-wide corrections cannot be ignored. A breakdown below $2 support or negative news from the legal front could quickly invalidate the bullish outlook.

Traders and investors considering XRP must weigh the potentially explosive upside against these considerable risks. Monitoring the $2 level, key resistance zones, developments in the SEC case, and overall market sentiment will be crucial in navigating XRP's next potential move. While the setup looks promising for the bulls, confirmation through decisive price action and continued positive momentum is needed before declaring that XRP is definitively "ready to run."

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Trading cryptocurrencies involves significant risk, and you could lose your entire investment. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Some say bitcoin is an un-correlated asset. What about XRP ???This chart clearly shows how XRP is uncorrelated to the price of the S&P !!

Some experts in crypto say that Bitcoin is an un-correlated asset. However, if bitcoin is, XRP is even more so.

The chart moreover shows how the price of XRP broke out of an 7 YEAR BEAR FLAG !!!

It broke down decisevely in november 2024.

At the present moment it is making a halt, drawing a bear flag (n° 2) as it did after it broke down of a very similar bear flag in March of 2017 (n° 1).

How do you think this will resolve ?

Any more questions ?

This is a very bearish chart - for the SPX !!!

XRP Ripple Is Showing That Correction In Crypto Is OverHello, Skyrexians!

Let's continue to look at the different confirmations of the incoming growth on crypto. BINANCE:XRPUSDT is one the largest altsoins was in correction for 4 month. This was a global wave 4, now we have the confirmation that Ripple coin will reach new ATH.

Let's take a look at the daily time frame. Previous huge impulse consists of 5 waves. It was a global wave 3, now we are in the ABC shaped wave 4. The anticipated wave C has been finished inside the 0.61 Fibonacci Retracement. Also we can see the bullish divergence and increasing momentum at the Awesome Oscillator. Moreover, we can see the green dot on the Bullish/Bearish Reversal Bar Indicator , which is the great potential growth confirmation. The target for the next wave is approximately at $3.8, but can be recalculated further.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Ripple May Face Another Rally This YearRipple with ticker XRPUSD hit all-time highs for the final blue wave V as expected, so we should be aware of limited upside this year. However, despite recent slowdown, which we see it as an ABC correction within red subwave (IV), there can still be room for another rally this year, at least up to 4-5 area to complete final subwave (V) of V of an impulse on a daily chart.

Phemex Analysis #71: Pro Tips for Trading Ripple (XRP)Ripple ( PHEMEX:XRPUSDT.P )has seen significant developments with the launch of its US dollar-backed stable coin, RLUSD (launched in December 2024), integrated into its Ripple Payments platform to improve cross-border enterprise transactions. The stable coin, regulated by the NYDFS, has experienced substantial growth, approaching a $250 million market cap and nearly $10 billion in trading volume, exceeding Ripple's projections. RLUSD is increasingly used as collateral in both crypto and traditional finance markets, and NGOs are exploring its use for donations.

Despite the positive developments surrounding RLUSD, XRP's price has failed to hold above the $1.76 support level. XRP recently dropped to a low of $1.61 due to US tariff news that pushed the broader market downwards.

Today, we will explore several possible scenarios for XRP's price action in the coming days to identify potential profit opportunities in this uncertain market.

Possible Scenarios.

1. Bearish Breakdown Below Support:

If XRP breaks decisively below the $1.61 support level with significant volume, it could signal a continuation of the bearish trend.

Pro Tips:

Consider shorting XRP on a confirmed break below $1.61.

Potential support levels to target: $1.43, $1.28, or even $1.05.

Place a stop-loss order above a recent swing high (e.g., $1.65) to manage risk.

2. Rebound from Support:

The $1.61 level represents a recent low, and a price bounce is possible, especially if broader market sentiment improves. Besides, support levels like $1.43, $1.28, and $1.05 are targets to watch for too.

Pro Tips:

Watch for bullish reversal patterns around the support level (e.g., increased buying volume, RSI divergence, bullish candlestick patterns).

Consider entering a long position on confirmation of a rebound.

Potential resistance levels to target: $2.0, $2.17, and $2.45.

Place a stop-loss order below the targeted support level to protect against further downside.

3. Consolidation within a Range:

XRP might consolidate between the $1.61 support and the $2.0 resistance if market uncertainty persists.

Pro Tips:

Consider range-bound trading strategies: buying near $1.61 and selling near $2.0.

Utilize grid trading bots within this range.

Set stop-loss orders outside the range (below $1.60 and above $2.0) to prepare for a potential breakout or breakdown.

Conclusion.

XRP's price action is currently influenced by both the positive developments surrounding RLUSD and the broader market uncertainty. Traders should remain vigilant and adapt their strategies based on the prevailing market conditions. By carefully monitoring key support and resistance levels, analyzing trading volume and technical indicators, and implementing appropriate risk management measures, traders can position themselves to capitalize on potential opportunities in the XRP market. Whether the price breaks down, rebounds, or consolidates, a disciplined and informed approach is crucial for successful trading.

Tips:

🔥 Break free from "buy low, sell high"! Our new Pilot Contract empowers you to profit from ANY market direction on DEX coins with up to 3x leverage. Go long, go short, go further!

Check out Phemex - Pilot Contract today!

Disclaimer: This is NOT financial or investment advice. Please conduct your own research (DYOR). Phemex is not responsible, directly or indirectly, for any damage or loss incurred or claimed to be caused by or in association with the use of or reliance on any content, goods, or services mentioned in this article.

XRP just found bounce support on the bttm trendline of the wedgeLooking like a very valid pattern on the weekly hart. My guess is it will break upward somewhere around where I have arbitrarily placed the dottedmeasuredmove line, in which case the breakout target would be somewhere around $4.80 always a chance we retest the bottom trendline and even send a wick below. It before confirming a break upward though. *not financial advice*

Long Position XRP/USDT🚨 XRP/USDT – Intraday Outlook (15-min Chart)

After reacting strongly to the mid-term support at 1.630, XRP has been climbing steadily and is now testing short-term trendline support to break it down to 1.8153.

🔹 Current Price: 1.93

🔹 Support Zone to Watch: 1.8153 – 1.7083 (Possible Long Zone)

🔹 Upside Target: 2.15+

📉 A short-term pullback toward the Possible Long Zone could offer a high-probability long setup. If bulls step in around that level, we might see a trend continuation toward the 2.15 or even higher regions, signaling a potential bullish reversal on the mid-term.

📊 With the overall recovery trend still holding, traders should watch for a break-retest setup or a bullish confirmation in the demand zone.

🧠 Smart Play: Patience is key. Let the price come to your level and watch for confluence.

What do you think? Is XRP ready to reverse for good?

XRP at $1.9: Testing Key SupportXRP is currently trading at $1.9, a pivotal level, as the crypto market grapples with a 4.4% drop in the last 24 hours. Macro uncertainty, think US inflation data and Fed rate hike fears, is pressuring risk assets. Yet, XRP holds steady, buoyed by whispers of a Ripple partnership with a major European bank for cross-border payments and ETF speculation (unconfirmed).

Technical Analysis

Short-Term (Daily Chart):

Support: $1.90 (current), $1.80

Resistance: $2.00, $2.10

RSI sits at 48 (neutral), while MACD hints at bearish momentum. XRP’s testing the lower edge of a descending channel, holding $1.90 could trigger a bounce to $2.00, but a break below eyes $1.80.

Long-Term (Weekly Chart):

Support: $1.70, $1.50

Resistance: $2.50, $3.00

The 200-day MA is sloping down, signaling caution, but $1.70 is a solid base for bulls.

Potential Scenarios

Bullish: If $1.90 holds and $2.00 falls with strong volume, expect a push to $2.10 short-term, possibly $2.50 long-term if adoption news hits.

Bearish: A crack below $1.90 could test $1.80, with $1.70 next if selling ramps up.

Trading Tips and Context

XRP’s real-world use in payments and recent partnerships fuel long-term hope, but the SEC lawsuit looms as a risk. Short-term traders: trade the range between $1.90 support and $2.00 resistance, set stops tight (e.g., below $1.90 for longs). Long-term holders: $1.70 is your critical level. Keep an eye on SEC updates or ETF chatter for catalysts.

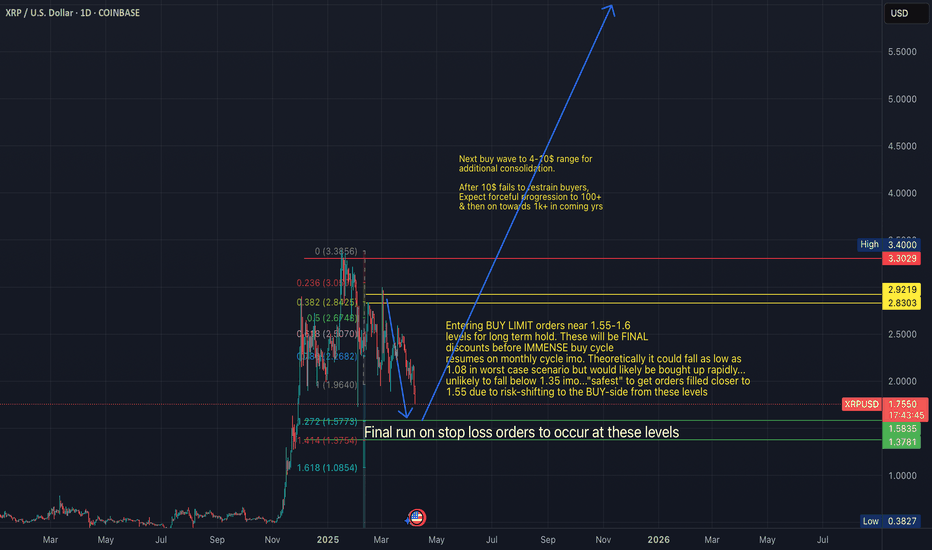

XRP now approaching buy zone at 1.55-1.60 levels as forecastedAs indicated in prior posts, XRP is now approaching the liquidity target levels at 1.55-1.60 levels as part of a final liquidity run.

Possibility exists for extended sell wave as low as 1.06 (worst case scenario imo) but most likely scenario is that 1.35-1.55 will be the zone in which the final low on the consolidation structure is formed. The next move is gearing up to be explosive towards 10$ & then on towards 100$ range once 10$ fails to hold as resistance.

I am convinced we will witness progress on towards 500's within several years (assuming comprehensive integration into financial system etc)...time will tell if we get into the 1,000's!!!

Hope this helped some of you gain (re-)entry at greater discounted levels!!

XRP XRP failed to break through the $2.1597 resistance and is now heading back toward the $2.0216–$1.9000 support zone.

If this support fails to hold, lower lows may be on the horizon.

A bullish reversal requires a breakout above resistance and confirmation above the 200 MA.

🎯 Next targets: $2.4729 and $2.59

📉 Weak volume and rejection from key levels increase bearish pressure.

XRP Weekly-Monthly Analysis / Retracement Levels for BuyTHEN - NOW@ XRP Weekly-Monthly Analysis / Retracement Levels for Buy (...and we keep going)

Weekly - Monthly trend: Bearish

Chart Pattern: Head & Shoulders (H&S) - Bearish Continuation Pattern

Bearish Candlesticks signals:

HANGING MAN (Bearish, Single Candlestick pattern) / Weekly Timeframe / 09 DEC 2024

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 27 JAN 2025

TWEEZER TOP (Bearish, Double Candlestick pattern) / 1 Day timeframe / 20 FEB 2025

FALLING THREE METHODS (Bearish, five-fold Candlestick pattern) / 1 Day timeframe / 07 MAR 2025

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 24 MARCH 2025

Retracement Fib Price Levels:

0.00% (3.4000)

23.60% (2.6879)

38.20% (2.2474)

50.00% (1.8914)

61.80% (1.5353)

78.60% (1.0284)

100.00% (0.3827)

Good prices for buy (the lower the better):

61.80% (1.5353) – Golden Zone / Golden Pocket

78.60% (1.0284) – Entry Zone

Between 78.60% (1.0284) and 100.00% (0.3827) is the Risk Zone, which we have the Neckline of the ‘’ Quadruple Bottom Pattern ‘’ at the price range ‘’ 0.6291 – 0.7850 ‘’