XRP XRP failed to break through the $2.1597 resistance and is now heading back toward the $2.0216–$1.9000 support zone.

If this support fails to hold, lower lows may be on the horizon.

A bullish reversal requires a breakout above resistance and confirmation above the 200 MA.

🎯 Next targets: $2.4729 and $2.59

📉 Weak volume and rejection from key levels increase bearish pressure.

Ripple

XRP Weekly-Monthly Analysis / Retracement Levels for BuyTHEN - NOW@ XRP Weekly-Monthly Analysis / Retracement Levels for Buy (...and we keep going)

Weekly - Monthly trend: Bearish

Chart Pattern: Head & Shoulders (H&S) - Bearish Continuation Pattern

Bearish Candlesticks signals:

HANGING MAN (Bearish, Single Candlestick pattern) / Weekly Timeframe / 09 DEC 2024

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 27 JAN 2025

TWEEZER TOP (Bearish, Double Candlestick pattern) / 1 Day timeframe / 20 FEB 2025

FALLING THREE METHODS (Bearish, five-fold Candlestick pattern) / 1 Day timeframe / 07 MAR 2025

BEARISH ENGULFING (Bearish, Double Candlestick pattern)/ weekly Timeframe / 24 MARCH 2025

Retracement Fib Price Levels:

0.00% (3.4000)

23.60% (2.6879)

38.20% (2.2474)

50.00% (1.8914)

61.80% (1.5353)

78.60% (1.0284)

100.00% (0.3827)

Good prices for buy (the lower the better):

61.80% (1.5353) – Golden Zone / Golden Pocket

78.60% (1.0284) – Entry Zone

Between 78.60% (1.0284) and 100.00% (0.3827) is the Risk Zone, which we have the Neckline of the ‘’ Quadruple Bottom Pattern ‘’ at the price range ‘’ 0.6291 – 0.7850 ‘’

The more a support is tested, the weaker it becomes.This is my expectation for Ripple in the coming period.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

XRP Made a New Lower Low: What's NextFenzoFx—XRP (Ripple) trades at approximately $2.089 and made a new lower low in yesterday's trading session. The primary trend is bearish, as the price is below the 50-period simple moving average.

If the price holds below the immediate resistance at $2.218, the next bearish target could be testing the $1.80 support area.

Conversely, the bearish outlook should be invalidated if XRP/USD exceeds $2.218 and forms a new higher high.

Bitcoin BTCUSD The Move Down Is OverI posted this chart in February 2027, I was unable to update it. This is playing out exactly how I predicted. Bitcoin loves these double tops and the corrections are textbook almost every time. Bitcoin may double bottom but on a closing basis on the 5 day I am predicting that Bitcoin will NOT close lower than the measured move. Wicks below sure but on a cloing basis which the Line chart shows we are right on track. I think that by the middle to late April we are above the previous high and en route to new all time highs. There is no bear market coming any time soon. Bitcoin is going to astronomical numbers, numbers most cant fathom. None of this is financial advice this is just my opinion. Like and follow for updates. Thank you

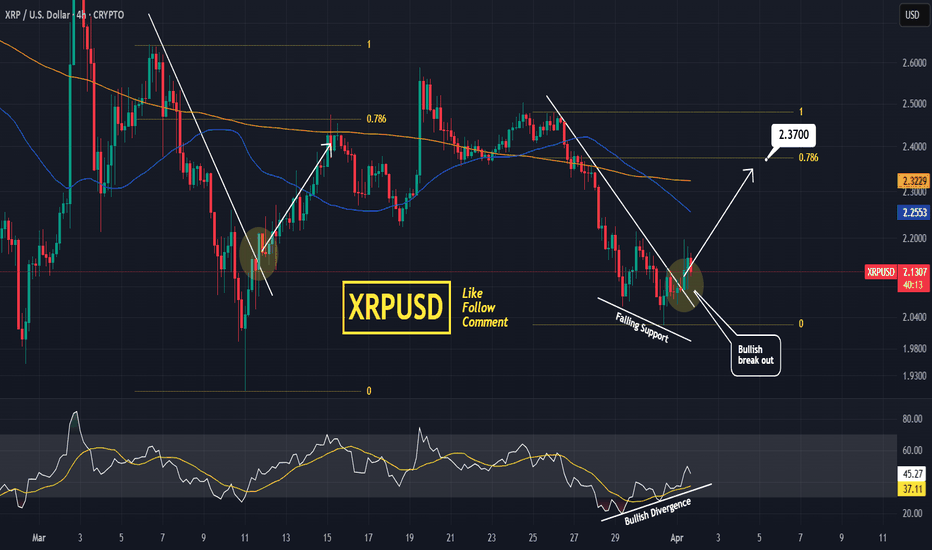

XRPUSD Falling Wedge bullish break out. Target 2.3700XRP broke above its Falling Wedge pattern. Being under the MA50 (4h) means that this is still a good short term buy opportunity.

Last time it had a break out like today's (March 11th), it hit the 0.786 Fibonacci retracement level.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 2.3700 (the 0.786 Fibonacci retracement level).

Tips:

1. The RSI (4h) has been on a Rising Support while the price was on a Falling Support. This is a bullish divergence signal that prompted early today's break out.

Please like, follow and comment!!

Notes:

Past trading plan:

XRP tests Key Resistance Level F enzo F x—Ripple (XRP) has climbed from $2.026 and is currently testing resistance at $2.218. Despite this upward movement, the overall trend remains bearish as the price stays below the 50-period simple moving average on the 4-hour chart.

The nearest support level is $2.026. If XRP/USD drops below this point, the downtrend may strengthen, potentially driving the price toward $1.90 and then $1.80.

FXAN & Heikin Ashi TradeBINANCE:XRPUSD

In this video, I’ll be sharing my analysis of XRPUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

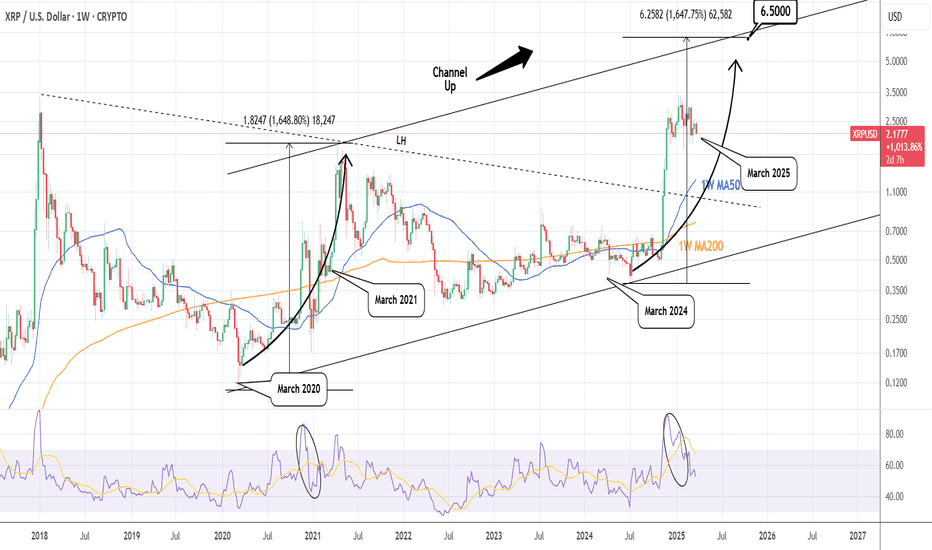

XRPUSD starting the parabolic rally to $6.000Ripple (XRPUSD) has been trading within a 5-year Channel Up since the March 2020 COVID flash crash. That COVID bottom initiated the first Bullish Leg of XRP, which was the previous Cycle's Bull run.

XRP has started the second Bullish Leg after the July 2024 Channel Up bottom and since basically December, the market has been under heavy volatility, entering a consolidation period similar to December - March 2021.

That was XRP's last accumulation phase before the 2021 Cycle Top. The 1W RSI patterns between the two Bullish Leg fractals are also similar, indicating that even though the current Bullish Leg has been more aggressive since November 2024, it is being harmonized now inside the parabolic growth Channel.

We expect a symmetrical +1668% rise in total for this Bullish Leg, similar to 2021, with our Target being marginally lower at $6.000, expecting it within July - October 2025.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XRP Weakens as Risk-Off Sentiment GrowsFundamentals:

XRP is under pressure as broader market sentiment turns negative. The cryptocurrency market continues to follow the Nasdaq, which is showing signs of weakness. With the index currently struggling, risk assets—including XRP—are seeing downside pressure. A stronger U.S. dollar is adding to the bearish outlook, weighing on both crypto and equities. Recent regulatory clarity on XRP failed to spark sustained gains, suggesting the news was already priced in.

Technicals:

Technical levels show that XRP is currently testing a key monthly support zone. If this level fails to hold, the next downside target could be around 1.5700. Bearish momentum is increasing, with sellers defending resistance zones aggressively. Volume patterns suggest that buyers are hesitant, leaving the market vulnerable to further declines. The RSI indicator is heading lower from previously overbought levels, indicating a potentially falling trend for now, reflecting growing bearish momentum. A break below the monthly support could accelerate selling pressure.

Traders should watch for confirmation with increased volume on a breakdown. If support holds, a short-term bounce could be possible, but broader sentiment remains weak. Macro factors such as interest rates and economic data will influence risk appetite. Bitcoin’s price action will also play a role in determining XRP’s next move. A reclaim of key resistance levels could shift sentiment, but for now, bears are in control. Traders should manage risk carefully, considering potential volatility. A retest of lower support zones could provide better long opportunities.

For now, caution is warranted as XRP remains under downside pressure.

XRPUSDT.P — Is This the Beginning of the Next Pump?

BINANCE:XRPUSDT.P is bouncing back with style — and this long setup is giving off real “king of the charts” vibes. Look at that clean risk-to-reward!

Entry: 2.0905 USDT

Stop-loss: 2.0574 USDT

Take-Profit: 2.2238 USDT

R:R Ratio: 3.28

Why this setup matters:

Confirmed bounce off intraday support

Momentum shift with bullish engulfing candle

Targeting a clean resistance level for optimal exit

Tight stop, juicy upside — exactly what scalpers and day traders crave. Add to watchlist and get ready to trail that stop if momentum holds.

SELL SETUP - XRP/USDT (1D)🧠 SELL SETUP - XRP/USDT (1D)

Chart by: Asif_Brain_Waves

📍 Current Price: 2.1286

📍 Short-Term Liquidity Grab Target (DT T1): 2.2851

📍 Projected Drop Target: 1.5756

📉 Bias: Bearish

🔍 Narrative & Context:

Price has recently broken below key internal structure with inefficiencies (FVGs) left behind. Currently forming a potential retracement move toward the breaker block / imbalance near 2.2851 — a likely draw on liquidity (DT T1). This area aligns with previous support-turned-resistance and offers high probability for a reversal zone.

XRPUSD: The 5 year Channel Up is targeting 6.500XRP is neutral on its 1W technical outlook (RSI = 53.399, MACD = 0.310, ADX = 41.023) as since the Jan 13th High, the uptrend took a pause and turned into a sideways consolidation. As long as the 1W MA50 is intact, the Bull Cycle will be supported and since the dominant pattern is a 5 year Channel Up, we are on the latest bullish wave. As a matter of fact we have technically entered the last year of the bullish wave, which is so far identical to the March 2020 - April 2021 wave (also on RSI count). The market is currently (March 2025) on a consolidation much like March 2021. We estimate a similar +1,648% rise (TP = 6.500).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Ripple Partners with Chipper Cash To Boost Cross-Border PaymentsRipple partners with Chipper Cash to expand cross-border payments in Africa, leveraging blockchain for faster, affordable transactions.

Ripple has announced a strategic collaboration with Chipper Cash to expand its payment solutions to Africa after securing a win against the US SEC earlier this week. Through Ripple Payments, the collaboration intends to foster cross border payments in the African regions.

Notably, the crypto platform’s alliance with Chipper Cash provides a fast, low-cost, and efficient payment system that unites international treaties.

Despite the partnership and important victory over the SEC, Ripples native coin ( CRYPTOCAP:XRP ) seems unbothered by the development with the asset maintaining the $2.3 price pivot. A break above the 38.2% Fibonacci retracement point might cement a bullish breakout for CRYPTOCAP:XRP with eyes set on $5 and beyond.

Similarly, in the case of a cool-off, CRYPTOCAP:XRP might find support in the 65% Fibonacci retracement level before picking liquidity up albeit the RSI is at 48 which is a strong sign of a bullish reversal lurking around the corners.

XRP Price Live Data

The live XRP price today is $2.35 USD with a 24-hour trading volume of $2,950,161,398 USD. XRP is down 0.54% in the last 24 hours. The current CoinMarketCap ranking is #4, with a live market cap of $137,073,610,487 USD. It has a circulating supply of 58,205,697,378 XRP coins and a max. supply of 100,000,000,000 XRP coins.

XRP Pounced on by the group! RIPPLE XrpUsd Ready to Go? Now if you NOTE exactly where PRICE was at the EXACT TIME that 🟢SeekingPips🟢 Shared the last XRP CHART.

You can see that was a PERFECT ALIGNMENT of both TIME & PRICE.👌

ℹ️ Many SHORT TERM & INTRADAY TRADERS paid themselves at 🟢SeekingPips🟢 pre defined 🔴RED🔴 level @ 2.4980 for a PAIN FREE TRADE with A GREAT REWARD TO RISK OUTCOME.

🌎 You can also NOTE TWO VERY IMPORTANT THINGS WITH THIS TRADE...

▪︎1) Our ORIGINAL Stop Loss has still been untouched even after the 100% retracement of our original ENTRY.

▪︎2) Now anyone who was not in the group or followed 🟢SeekingPips🟢 original chart share at the time of our entry and instead decided to jump in as price was already moving up would have made a poor choice.❗️

By waiting on the next 240m bar/candle to close you could have theoretically left a limit order at original entry area and would have been easily filled for a STRESS FREE trade so far.🚀🚀🚀

What's the lesson here❓️

Know what you want to see and do not act beforehand.

If you miss your FIRST entry have a PLAN for your SECOND ATTEMPT.

Note the word PLAN.

⚠️ As per 🟢SeekingPips🟢 BIO Without A PLAN it's NOT TRADING But GAMBLING.

🎲

XRP/USDT:BUY LIMITHello friends

You can see that after the price fell in the specified support area, buyers came in and supported the price and created higher ceilings and floors.

Now we can buy at the specified levels with capital and risk management and move with it to the specified targets.

*Trade safely with us*

$XRP Eyes $10 as SEC Case ClosesAnalysts predict that XRP CRYPTOCAP:XRP could reach $10 by 2030 after the SEC officially dropped its lawsuit against Ripple. Ripple CEO Brad Garlinghouse confirmed that the regulator will not appeal the court’s decision, marking the end of the legal battle that began in 2020. As of March 24, 2025, XRP CRYPTOCAP:XRP trades at $2.46, up 2.17% in the past 24 hours, with a market cap of $143.29 billion.

Despite bullish prospects, challenges remain. Market volatility and competition from Ethereum and stablecoins could slow growth. Analysts at InvestingHaven believe XRP’s success depends on Ripple’s network expansion, though crypto market instability remains a key factor.

While a 306% rise to $10 by 2030 seems feasible, today’s market is less competitive than in 2017 when XRP CRYPTOCAP:XRP surged 64,000%. Investors are closely watching regulatory changes and macroeconomic conditions that could impact the coin’s future trajectory.

$XRP Adds $100 Billion to Its Market Cap in a YearShort-term charts depict XRP CRYPTOCAP:XRP as highly volatile and, at times, disappointing. Despite favorable external factors, the token has gained only 14.96% over the past year. However, the long-term outlook tells a different story—XRP is up 277.50% year-over-year and 385.54% since Donald Trump's pivotal re-election.

XRP’s market capitalization reflects this surge, skyrocketing by approximately $107.6 billion from $34.7 billion to $142.34 billion. The impact of Trump’s November victory is even more pronounced, with XRP’s market cap jumping $113.7 billion from 28$28.6 billion since November 5.

Most of these gains occurred before January 20, when the most crypto-friendly president in history took office, and SEC hardliner Gary Gensler stepped down—marking a turning point for regulatory sentiment toward digital assets.

RIPPLE What Next? XRP To Make It's Next Move! XrpUsdT GO or NO? ⚠️ The next 240 minute bar could be key in decrypting what XRP is likely to do next.

ℹ️ The way is clear for it to begin building a BULLISH base from here however, the way 🟢SeekingPips🟢 sees it there still remains a fair amount of liquidity below current price in the form of stop orders and buyers stop losses.❗️

✅️ VOLUME viewed on the LOWER TIMEFRAMES may hold the clues from here.🚀

🟢SeekingPips🟢 pips has this on his RADAR and will be updating his thoughts on this CRYPTO regularly this week.📈

XRP with likely levels, and alternatives for April 'flash crash'Here's my latest XRP chart, which includes potential levels that could be hit, along with an alternative path for the 5th wave, assuming the bottom is already in on the chart.

- If wave 4 is already complete, then the wave 6 "flash crash" low would likely be higher than the chart shows, perhaps staying within the lower white trendline (thicker white line).

- If wave 4 isn't complete, then the wave 6 "flash crash" would likely go outside the lower white trendline (thicker white line), targeting the green fair value gap (FVG) in the chart or somewhere between that FVG and the lower white trendline, sweeping the previous lowest low of the entire pattern.

- The fair value gap that absorbed the "Trump Crypto Reserve" tweet breakout—which quickly failed after hitting the gap—would likely be filled during the 5th wave (false breakout leg), taking out that high before the April "flash crash."

- The real breakout, the 7th wave, would likely take out the previous all-time high and run to the top of the pattern, reaching the area of the upper white trendline (thicker upper white line).

I will be going over this chart again very soon for anyone who follows me.

Keep in mind that the "flash crash" in April is a theory and may not come to fruition or could be off in timing. However, I do believe that the breakout will begin in May, even if the "flash crash" does not occur in mid to late April.

Good luck, and always use a stop loss!