XRP/USD Chart Hack – Rob the Market Before the Bears Do🏴☠️💸 XRP/USD Crypto Market Heist Plan: Thief Trader Style 💰📈

"Break the Vault, Rob the Trend – One Candle at a Time!"

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

To all fellow money makers, day robbers & chart thieves... welcome to the vault!

We’re diving into the XRP/USD (Ripple vs. U.S. Dollar) with a bold Thief Trading™ Strategy, blending technical mastery and market intuition.

📊 THE PLAN: Rob the Resistance – Swipe the Highs

🔥 Based on Thief Trading-style TA & FA combo, here's the master heist setup:

Long Bias ⚔️

Target: The High Voltage Resistance Zone

Status: Overbought + Trap Level = High Risk, High Reward

Market Mood: Bullish but risky – consolidation & reversal zones ahead

Crowd Behavior: Bearish robbers strong above, but we strike below

🧠 Thief Wisdom:

“The vault's open, but not every vault is unguarded. Wait, plan, attack with strategy.”

📥 ENTRY PLAN

The Heist Begins at the Pullback...

Use Buy Limit Orders (Thief Style: DCA / Layering)

Entry Zones: Near recent swing lows or within 15–30 min pullbacks

Let the price come to your trap – precision is our weapon

🛡️ STOP LOSS STRATEGY

Guard Your Loot – Always Secure Your Exit

SL Example: 2.8500 (3H TF swing low)

Customize SL based on:

⚖️ Your lot size

🎯 Risk tolerance

🔁 Number of entry layers

Remember: We don’t chase losses – we protect capital like it's gold

🎯 TARGET

Final Take-Profit: 4.0000

But hey… Thieves escape before alarms ring!

💡 If momentum slows, don’t be greedy. Exit smart, exit rich.

📡 FUNDAMENTAL + SENTIMENTAL OVERVIEW

The bullish bias is supported by:

📰 Macro Events

📊 On-Chain Signals

📈 COT Reports

🔗 Intermarket Correlations

📢 Sentiment Analysis

👉 Stay updated with the latest data — knowledge is the thief’s ultimate tool.

⚠️ TRADING ALERT – News Can Wreck the Heist

To survive news spikes:

🚫 Avoid entries during high-impact releases

📉 Use trailing SL to protect your open profits

🛑 Adjust exposure during uncertain volatility

❤️ SUPPORT THE CREW – BOOST THE PLAN

If this plan added value, hit the 🔥BOOST🔥 button.

It helps grow the Thief Trading Team, and together we rob smarter, not harder.

💬 Drop your feedback, thoughts, or charts below – let’s build the crew!

💎 Every candle tells a story. We don’t follow the trend – we rob it.

💣 Stay alert, stay rogue, and I’ll see you at the next market heist.

💰 Until then… chart smart, trade savage. 🐱👤💵

Rippleanalysis

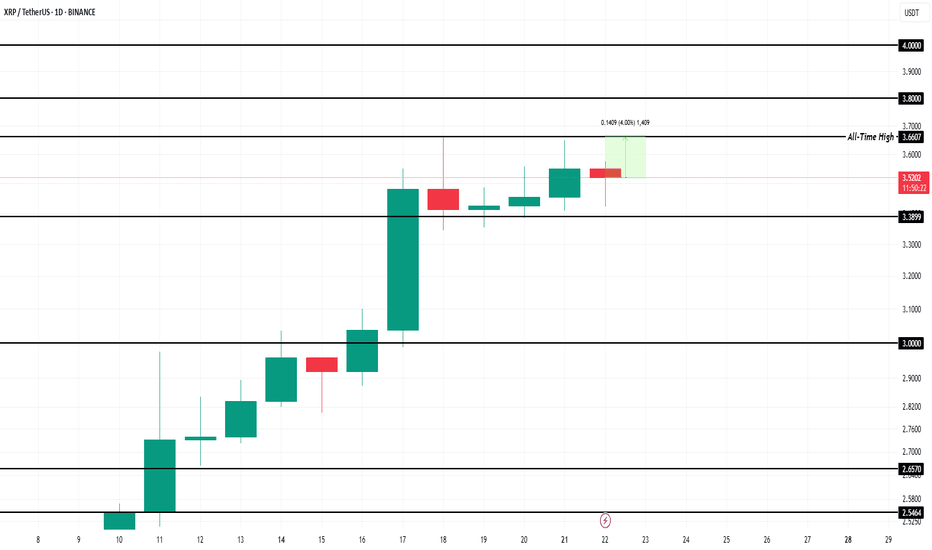

XRP Price Reversal Likely After $2.81 Billion Selling In 7 DaysBINANCE:XRPUSDT is currently trading at $3.48, only 4% away from its all-time high . Over the past week, exchange wallets saw an influx of nearly 450 million XRP, valued at more than $2.81 billion . This spike in supply indicates that holders are moving their assets to sell, usually a bearish indicator in market cycles.

Despite the proximity, BINANCE:XRPUSDT price is showing signs of weakness and is clinging to the $3.38 support level . Without renewed buying interest, this support may not hold much longer.

If investor selling continues, BINANCE:XRPUSDT could fall through $3.38 and test the $3.00 support . A drop to this level would erase the recent gains and confirm a near-term bearish reversal. The loss of $3.00 could signal a longer consolidation phase or deeper correction.

However, if market participants absorb the sold supply and restore demand, BINANCE:XRPUSDT could rebound quickly . In this scenario, the altcoin might surpass $3.66, breach $3.80, and aim for $4.00 . Such a move would invalidate the bearish outlook and set a new all-time high.

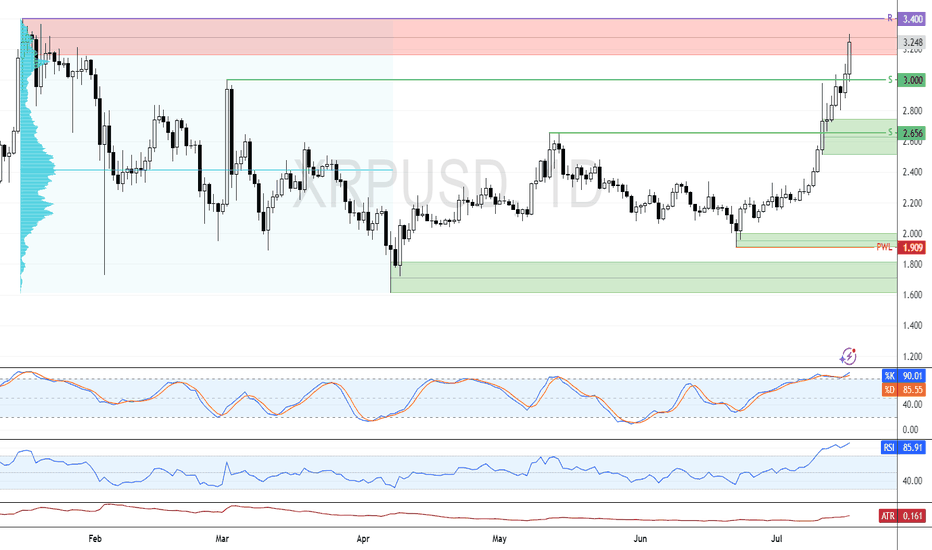

XRP: Order Block at $3.40 Could Cap The RallyFenzoFx—Ripple's bullish momentum resumed nonstop, offering no clear pullback for entry. Currently, XRP is testing resistance at $3.40 within an order block. Momentum indicators remain in overbought territory, signaling short-term overpricing.

Volume profile shows limited resistance at present levels, suggesting a likely retest of $3.40. If this resistance holds, a pullback toward support around $3.00 is expected. This level can provide a discount to join the bull market.

XRP Cools Near $3.00 Amid Overbought SignalsFenzoFx—XRP remains bullish after piercing $3.00 earlier this week but cooled near resistance. Trading around $2.90, Stochastic (~84) and RSI 14 (80) indicate overbought conditions, suggesting consolidation.

We anticipate a pullback toward $2.66 support before resuming the uptrend. Alternatively, a decisive break above $3.00 would target $3.21 next.

XRP/USDT Monthly Chart: History Repeating Itself?Hey traders! Let’s dive into this monthly XRP/USDT chart. I’ll be honest — I’m skeptical about this outcome, but let’s break it down because it could actually happen!

The chart screams déjà vu, with XRP’s price action mirroring the 2014-2018 period. Back then, XRP broke out from its 2014 ATH in 2017, leading to a massive rally. Fast forward to now, and we’re seeing a similar setup, but with a twist. XRP is struggling to break through the 2018 ATH resistance zone around $3.31, which reminds me of the Breakout Consolidation phase we saw in 2017. Historically, this consolidation led to a breakout, and the chart hints at a potential repeat!

If XRP breaks out soon, we could see a parabolic move, potentially targeting much higher levels. However, the current resistance is a tough hurdle, and if it fails, we might see a pullback to lower supports.

Key Levels to Watch:

Resistance: $3.31 (2018 ATH)

Support: $1.643 (previous consolidation low)

Breakout Target: To be determined (potentially parabolic)

Breakdown Risk: $0.650

I’m not fully convinced, but the setup is intriguing — could this be XRP’s moment to shine? What do you think? Let’s discuss below!

XRP Pushes Toward Breakout as Momentum BuildsFenzoFx—XRP is bullish, attempting a breakout above the $2.34 resistance. Stochastic at 70.0 and RSI at 63.0 signal strong momentum with room for further upside.

A close above $2.34 could push XRP/USD toward the next target at $2.48. However, the bullish bias remains valid only above the $2.16 support—dropping below this level could reverse the trend.

XRP: Break Above $2.338 Opens Path to $2.480FenzoFx—Ripple (XRP) eased near weekly highs of $2.338, with Stochastic and RSI 14 signaling overbought conditions. The trend stays bullish above the anchored VWAP or $2.165, but consolidation toward $2.2240 is expected before resuming.

A break above $2.338 would target the next supply zone at $2.480.

Ripple Consolidates with Bullish Bias IntactXRP was rejected at the previous week’s high of $2.34 and is currently testing support at $2.22. As long as it holds above $2.16 or the 50-SMA, the bullish trend remains valid, with $2.34 likely to be retested.

On the flip side, a close below $2.16 could trigger a decline toward $2.07.

Bearish Setup Forms for XRP Below $2.21FenzoFx—XRP trades around $2.18 after forming a long-wick bearish candlestick above $2.17 support.

Stochastic reads 83.0, indicating overbought conditions. A close below $2.16 with a bearish engulfing candle could lead to $2.08. A close above $2.21 would invalidate the bearish outlook and open the door to $2.33.

XRP Builds Bullish Outlook as $2.08 Support Holds StrongFenzoFx—XRP bounced from $2.14 and trades near $2.17, approaching resistance at $2.19. The market remains bullish above the $2.08 critical support. A close above $2.19 could lead to targets at $2.23 and $2.24.

The bullish outlook is invalidated if XRP/USD closes below $2.08.

Ripple: Lower Low ExpectedWe still expect magenta wave (2) to conclude within the magenta Target Zone between $1.03 and $0.38 – a range we consider attractive for long entries. That said, there's a 40% probability that magenta wave alt.(2) has already bottomed. If so, a direct breakout above resistance at $3.00 and $3.39 would confirm this alternative scenario and suggest that the corrective phase is already behind us.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

XRP (Ripple) is at a Critical Supply Zone: Will it Fall or Rise?FenzoFx—Ripple (XRP) is testing the resistance level, which expands from $2.40 to $2.46, with the Stochastic Oscillator hinting at an overbought market.

A new bearish wave could emerge if the resistance holds. In this scenario, the price could dip toward the 50.0% Fibonacci retracement level at $2.37, backed by the 50-SMA.

The bearish outlook should be invalidated if XRP/USD exceeds and stabilizes above $2.46.

Trade XRP/USD with low spread, no commission and no swap at FenzoFx.

Ripple: Target Zone Ahead!Ripple’s XRP remains on track to reach our magenta Target Zone between $1.03 and $0.38, even though the price has recently settled into another consolidation phase. Under our primary scenario, we expect the bottom of the magenta wave (2) to form within this range. Once that low is confirmed, fresh upward momentum should unfold during the following impulse wave (3), which has the potential to push XRP above the resistance at $3.39 and toward new all-time highs. However, if XRP breaks out to the upside before establishing the projected low within our zone, this zone will be considered void. We currently assign a 38% probability to this alternative scenario.

Ripple Trades Sidways: What's Next?FenzoFx—Ripple (XRP) remains above $2.091, trading sideways in a low-momentum market. With support at $2.091 and resistance at $2.218, the trend is bullish as prices stay above the 50-period SMA.

The uptrend could extend if XRP/USD closes above $2.218, aiming for $2.355. However, a correction may begin if prices fall below $2.091, with $1.999 as the next support.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

XRP Tests Critical Resistance LevelFenzoFx—XRP/USD has gained 23.0% since April 7, testing $1.999 as resistance. A close below this level could trigger a new bearish wave, targeting $1.736.

Conversely, if the price exceeds $2.10, the bullish momentum could potentially extend to $2.218.

Trade XRP Swap Free at FenzoFx Decentralized Broker

XRP Made a New Lower Low: What's NextFenzoFx—XRP (Ripple) trades at approximately $2.089 and made a new lower low in yesterday's trading session. The primary trend is bearish, as the price is below the 50-period simple moving average.

If the price holds below the immediate resistance at $2.218, the next bearish target could be testing the $1.80 support area.

Conversely, the bearish outlook should be invalidated if XRP/USD exceeds $2.218 and forms a new higher high.

Ripple: Short-term Sell-offs ExpectedRipple’s recent upward push didn’t prove to be sustainable. Anyway, we primarily anticipate another significant sell-off, which should drive the price down into our magenta Target Zone between $1.69 and $1. These declines should allow the corresponding corrective wave (4) to establish a proper low. Only after this bottom has been settled do we reckon with the extended rise of the magenta wave (5), which should target new all-time highs beyond the $3.39 resistance. If XRP breaks above this green level sooner than primarily expected, the magenta wave alt.(5) will begin prematurely. Under this 33% likely alternative scenario, the magenta wave alt.(4) would have already concluded with the February 3 low, and our magenta Target Zone wouldn’t be reached.

Ripple: Approaching Our Target ZoneWhat a strong sell-off for XRP! Since last Friday, Ripple has dropped nearly 45%, yet it still hasn’t reached our magenta Target Zone between $1.69 and $1. While XRP saw a strong rebound after the sudden plunge, the magenta wave (4) should still head for a lower low within our Target Zone in the short term. Only after this price range has been reached do we anticipate the following magenta wave (5) to strive for new record highs above the resistance at $3.39.

XRP: Is the $3.00 Breakout the Start of a New Rally!?XRP Token ( BINANCE:XRPUSDT ) , backed by Ripple , a pioneer in international financial transfers, this token has once again captured the market's attention. Is this growth sustainable or just a temporary surge?

Let's take a closer look.

Fundamental Analysis :

1- Legal Advancements(Recent Court Victories) : Ripple has achieved successes in its legal battles against the U.S. Securities and Exchange Commission (SEC), reducing legal uncertainties surrounding XRP and boosting investor confidence.

2- Strategic Partnerships(Collaborations with Major Financial Institutions) : Ripple has initiated partnerships with banks and financial institutions worldwide, especially in Europe and Asia, aiding in the broader adoption of XRP.

3- Increased Utility(Speed and Efficiency in Transactions) : Given its high speed and low transaction fees, XRP is being considered a suitable option for international transfers.

4- Institutional Investment(Approval of Exchange-Traded Funds (ETFs)) : The approval of ETFs related to XRP could lead to increased demand and, consequently, a rise in its price.

5- Leadership Changes(Changes in SEC Leadership) : With Gary Gensler stepping down as SEC Chair and the potential appointment of more crypto-friendly leaders, regulatory pressures on XRP are expected to decrease, potentially aiding its growth.

-----------------------------------------------------------

Now, let's take a look at the Technical Analysis of XRP .

XRP is trying to break the Resistance zone($2.92-$2.68) . However, the $3.00 Resistance level(Round Number) is preventing XRP from continuing to rise.

Of course, with the large volume of the candle breaking the Resistance zone , we can hope for an increase in XRP .

Regarding Classic technical analysis , the Rising Wedge Pattern has failed and will act as a continuation Pattern when a reversal pattern fails. ==>> Educational Tip

According to the theory of Elliot waves , it seems that XRP has succeeded in completing the main wave 3 and we should wait for the main wave 4 . It looks like the main wave 4 can end around $2.85 or $2.74 ( near the upper line of the failed wedge pattern ).

Looking at the chart of XRPBTC ( BINANCE:XRPBTC ) in the weekly time frame , we can see that it seems that XRPBTC has succeeded in breaking the Resistance lines and is currently trying to break the Resistance zone , and if this zone breaks , we can see a further increase in XRP compared to Bitcoin(if the crypto market is bullish ) and vice versa if the crypto market is bearish , we can hope that XRP will experience a smaller decline than Bitcoin.

Based on the explanation above, I expect XRP to rise to at least a Potential Reversal Zone(PRZ) after the pullback is completed .

Note: If XRP returns below the Resistance zone($2.92-$2.68) again, we can expect a further decline of XRP.

XRP Analyze (XRPUSDT), 4-hour time frame⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

BEARISH DISTRIBUTION PARTTERN FOR XRP BEARSBINANCE:XRPUSDT Price action is building this descending triangle pattern. Now this is a Bearish pattern that fulfills downward about 78% of the time.

its important to Note that we are early in the formation of this distribution formation and there are many paths the market can take to fulfill this pattern.

PATH 1--> Price action break above the red trendline .. Enter short into the resistance block

PATH 2--> Price trades within the descending triangle .. Enter short as/when price hits red trendline.

Safe Trade Option ----> is to wait until the formation resolves .. (i.e a clear break and close outside the pattern) before you open trade positions

Like I said, we early to the trade. This formation should resolve in Feb 2025.. so plan the trade to manage fees, time and emotions.

Ripple: Another Dip Ahead?In the opening hours of the new year, XRP made a solid effort to recover from the minor weakness of the past two weeks. While the price surged over 25% between December 30 and the following five days, we classify this brief rally as a temporary counter-move, which should shortly transition into the final sell-off of the corrective magenta wave (4). Once the wave (4) low has been settled, the magenta impulsive wave (5) should break above the resistance at $3.28. However, if the price fails to sustain its next upward move and retreats significantly from this green line, the magenta wave alt. (4) will form another low before paving the way for the next upward impulse. This alternative scenario carries a 35% probability.

XRP Analysis==>>Correction Signs!!!XRP ( BINANCE:XRPUSDT ) is moving in the Resistance zone($2.63-$2.50) .

In this post, I want to show you some signs that XRP may still need to be corrected in a one-hour time frame :

1 -Regarding Classical Technical Analysis , XRP seems to have succeeded in forming the Rising Wedge Pattern .

2 -The formation of the Evening Star Candlestick Pattern in the Resistance zone can signify the reverse of XRP .

3 -The formation of the Bearish Gartley Harmonic Pattern can also be another sign of the decline of XRP .

4 -According to Elliott wave theory , XRP seems to be completing the main wave 4 .

I expect XRP to break the lower line of the Rising Wedge Pattern , which should drop to at least $2.38 . If the Support line is broken, the next target will be the Support zone($2.25-$2.17) .

⚠️Note: If XRP manages to break the Resistance zone($2.63-$2.50), we can expect an XRP pump.⚠️

XRP Analyze (XRPUSDT), 1-hour time frame⏰.

🔔Be sure to follow the updated ideas.🔔

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Ripple Stronger- Ok Ripple is back.

- Maybe the SEC will one day give up trying to perma-suppress XRP market to protect the big banks.

Little facts :

--------------------------------------------------------------------------------------------------------------

- XRP lost -96% from his 2018 ATH and bottomed hard around 0.12$.

- XRP lost only -86% from his 2021 last ATH to find a bottom around 0.28$.

- During those 2 years of bear market, XRP stayed most of the time very strong and resilient.

- Nothing was tremendous ( as it should be ), XRP just climbed with steady regularity.

- XRP stayed in the TOP5 of the Total Market.

- That's much better !

--------------------------------------------------------------------------------------------------------------

- So what we can expect for the next bull run ( if we don't have again a FUD at the bad time )

- We have to keep in mind that XRP have 100B Supplies.

- XRP price could grow at a maximum of 7$ at the end of the next rally.

- That would be around +2400% from the 2022 last bottom.

- His MarketCap could grow around 700B$ ( same as actual BTC MarketCap)

--------------------------------------------------------------------------------------------------------------

Happy Tr4Ding!