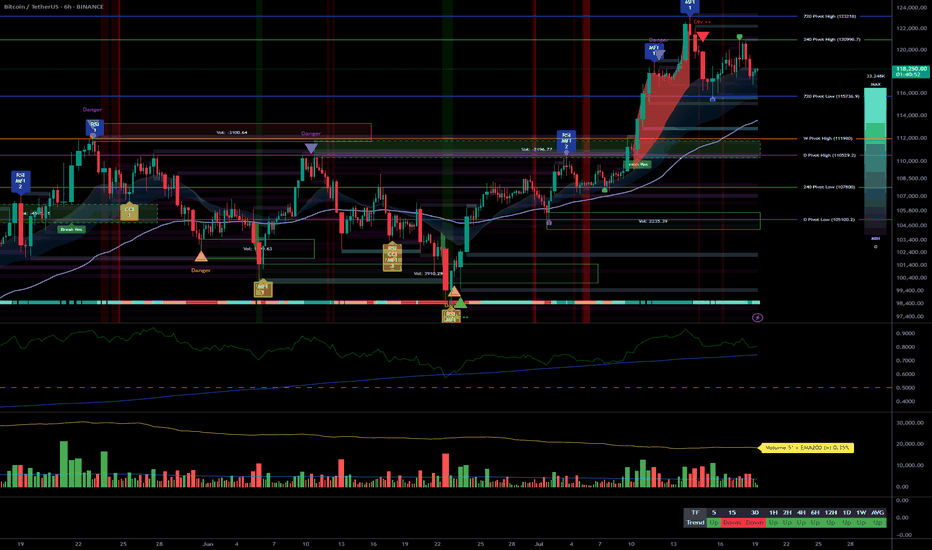

Bitcoin at 120,000: Decisive Breakout or Renewed Consolidation?__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strongly bullish on H1 and above; healthy consolidation below ATH.

Supports/Resistances: 120,000 USDT (pivot resistance), 116,400–117,000 (major support), 104,000–110,000 (long-term support).

Volumes: Normal, no anomaly nor climax detected.

Risk On / Risk Off Indicator: Strong buy signal on all timeframes except very short term. Sectoral health confirmed.

Multi-timeframe: Short-term bearish divergence on 15/30min, but robust technical structure above H1-D1.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Confirmed bullish across all timeframes; no major break detected.

Opportunities: Strategic buys between 116,400–117,000 (pullback); confirmed breakout above 120,000 (target 130,000).

Risk zones: Below 116,000 (potential correction to 112,000–104,000), false breakout at the top.

Macro catalysts: Monitor Fed (next FOMC July 29-30), volatility on risk assets, geopolitical tensions.

Action plan: Prioritize stop management, stay reactive ahead of macro events. Main scenario: buy confirmed pullback or validated breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D / 12H: Bullish structure intact but facing historical resistance (120k), strong supports in place (104–107k).

6H / 4H / 2H: Consolidation below resistance, no signs of exhaustion, tactical supports at 116,000–117,000.

1H / 30min / 15min: Weakness on shorter timeframes (sellers at top), confirmation of range polarization. No emotional excesses (ISPD DIV neutral), standard volumes.

Risk On / Risk Off Indicator: Strong buy except for very short-term fatigue.

Summary:

Multi-horizon bullish bias, technical and sectoral confluence for upside extension if clear breakout >120,000. Key support to hold at 116,400–117,000. Buy dips, ride breakout up to 130,000. Focus on risk management, flexibility advised as macro (Fed) nears.

__________________________________________________________________________________

Key macro events to watch

__________________________________________________________________________________

2025-07-18: Fed rate/volatility debate (Equity, Bonds, BTC).

2025-07-29: FOMC (potential pivot for risk assets).

__________________________________________________________________________________

Strategic decision & final summary

__________________________________________________________________________________

Main bias: Bullish, to be validated at key levels, favor buying dips/breakouts.

Risk management: Stop below 116,000, scale out progressively after 125k, reinforced protection ahead of FOMC.

Opportunities: Pullback 116,400–117,000 (RR >3); H4/D breakout >120,000 targeting 130,000 (RR >2).

Monitoring: Macro (Fed, geopolitics), dynamic management according to market response to news.

Conclusion:

A validated move above 120,000 projects target to 130,000 (next statistical/on-chain extension). Deep dips can be bought above 104,000. Do not loosen risk management as Fed date approaches.

Risks

Quantum Computing - Why BTC isn't the biggest worryYou’ve probably heard that quantum computing could break Bitcoin’s encryption—and that’s true. But here’s the thing: Bitcoin might not even be the biggest target.

The real risks? Financial systems, national security, healthcare, and even the internet itself. These areas rely on the same encryption methods that quantum computers could crack, and the fallout could be far worse than a Bitcoin hack.

Let’s break it down.

1️⃣ Financial Systems: A Global Crisis Waiting to Happen

Imagine if hackers could:

Drain bank accounts at will.

Manipulate stock markets.

Fake trillion-dollar transactions.

This isn’t just about stolen crypto—it’s about economic chaos. Banks, stock exchanges, and payment systems all depend on encryption. If quantum computers break it, we’re looking at a meltdown way bigger than Bitcoin’s $3 trillion market.

2️⃣ National Security & Internet Privacy: A Hacker’s Dream

Governments and militaries use encryption to:

Protect classified intelligence.

Secure communications between leaders.

Guard critical infrastructure (power grids, water supplies).

If quantum computers crack these codes, entire nations could be exposed to cyberwarfare. Your private data? At risk too—email, messaging, even your online banking could be decrypted years later.

3️⃣ Healthcare, Supply Chains & IoT: The Hidden Vulnerabilities

Medical records could be leaked, exposing sensitive health data.

Smart devices (like home security systems) could be hacked.

Supply chains might collapse if logistics networks are breached.

These systems weren’t built with quantum threats in mind—and upgrading them won’t be easy.

🔴 The Bigger Picture: A "Civilizational Upgrade"

Switching to quantum-resistant encryption is like rebuilding the internet’s foundation. It’s necessary, but messy. Some experts compare it to the Y2K bug—but way harder.

🔷 So, Is Bitcoin Safe?

Not entirely—about 25% of all Bitcoin could be stolen if quantum computers advance fast enough. But compared to the risks facing banks, governments, and hospitals? Bitcoin might be the least of our worries.

🔷 What’s Next?

Governments & companies are already working on fixes (like NIST’s post-quantum cryptography standards).

The transition will take years—and hackers might exploit weak spots along the way.

Staying informed is key. If you’re in tech, finance, or security, this affects you.

ℹ️ Want to Dive Deeper?

Deloitte’s take on quantum computing & Bitcoin

Forbes on quantum risks beyond crypto

🤷♂️ Bottom line?

Quantum computing is coming—and while Bitcoin has risks, the real danger lies in the systems we all depend on every day.

❔What do you think? Will we be ready in time? Let me know in the comments! 🚀

Cybercriminals are winning—cybersecurity must strike back nowI recently created a website, but soon after launching it, I noticed it wasn’t appearing in Google searches. While researching how to fix this, I received an email with step-by-step instructions on what to do. Nothing about it seemed suspicious—not even the sender’s address. But when I used artificial intelligence (AI) to verify its authenticity, it was flagged as suspicious.

A few years ago, phishing emails had obvious red flags—poor grammar, strange formatting, or sketchy links. Today, with AI-powered tools at their disposal, cybercriminals are far more sophisticated. And if they’re getting smarter, cybersecurity must become smarter still.

The unbearable cost of a data breach

In 2024, the average cost of a data breach soared to nearly $5 million1. And that’s just the average—meaning many breaches resulted in far greater losses. While this number has been rising for years, 2024 saw a sharp uptick, underscoring how the widespread adoption of advanced AI tools is making cybercriminals smarter and attacks more costly than ever.

“Attack speeds could increase up to 100x as threat actors leverage generative AI” – Palo Alto Networks

In many cases, the true cost of a data breach goes beyond dollars and cents—it’s immeasurable. What happens when customer trust in a business’ security is shattered? The reputational damage could be irreversible. What if a hospital is hacked and a life is lost? The stakes couldn’t be higher. That’s why cybersecurity isn’t just a priority—it’s a necessity. And the world is finally waking up to that reality.

When cybercriminals compromise a target, their intention is to infiltrate the organisation via a weak link and move deeper into the network. E-crime breakout time refers to how quickly they escalate control—spreading from the initial breach to critical systems, stealing data, disabling security, or deploying ransomware. Some attackers achieve this in under an hour, making rapid detection and response crucial. In 2024, the fastest recorded time attackers were able to do this was 51 seconds2.

Attackers aren't always relying on emails—the nuisance calls we receive can often be quite nefarious. Vishing (voice phishing) attacks involve cybercriminals using phone calls to impersonate trusted entities, such as banks, government agencies, or service providers, to trick victims into revealing sensitive information or transferring money. These scams have surged dramatically, with a 442% increase in vishing in H2 2024 vs H1 20243, highlighting how criminals are exploiting human trust over the phone to bypass traditional cybersecurity defences.

A few weeks ago, I saw a post on LinkedIn of a man surrounded by police officers. He was telling the story of how he physically hacked into an organisation, walking through security checkpoints, accessing restricted areas, and pushing his luck until he finally got caught. But this wasn’t a real attack—it was a penetration test, a controlled security exercise designed to identify vulnerabilities before actual criminals exploit them. Organisations conduct these tests because hackers are employing increasingly sophisticated social engineering techniques—manipulating people rather than systems—to bypass security and gain access. The threat is growing, with 79% of attacks in 2024 being malware-free, up from 40% in 20194, proving that cybercriminals don’t always need malware when they can simply trick humans into opening the door.

High profile attacks underscore geopolitical risks

At the outset of 2024, concerns about cyber risks in the election year were widespread. While many countries navigated the electoral cycle without major known cyber incidents, Romania's December presidential election was notably annulled due to allegations of Russian interference. Far-right candidate Calin Georgescu's unexpected lead in the first round prompted investigations revealing a coordinated online campaign and cyberattacks supporting his candidacy, leading the courts to void the election.

In the same month, the US Treasury Department reported a significant cybersecurity breach attributed to Chinese state-sponsored hackers. The attackers exploited a third-party software provider to access Treasury workstations and unclassified documents. The breach involved the theft of a security key, allowing remote access to the department's systems. Although China’s foreign ministry denied these allegations, the incident underscores the growing intersection of geopolitical and cybersecurity risks.

Executives are concerned about risks from AI

A recent World Economic Forum survey5 of executives revealed that 66% believe AI and machine learning will have the biggest impact on cybersecurity in the next 12 months. Yet, 63% admitted their organisations lack processes to assess the security of AI tools before deploying them—highlighting a critical gap between innovation and risk management.

Cybersecurity must stay one step ahead

Cybersecurity must constantly innovate, leveraging cutting-edge technology to stay one step ahead of evolving threats. This relentless race between defenders and attackers is what makes cybersecurity such an exciting and dynamic field. Recent headlines around quantum computing suggest that the age of quantum might be closer than we once thought—a future where a quantum computer could shatter even the most sophisticated encryption effortlessly. This would redefine cybersecurity as we know it. Whether it’s quantum computing, AI, or blockchain, every breakthrough introduces new vulnerabilities, and safeguarding them must be a proactive pursuit, not a reactive one. Because if we wait until the attack happens, it might already be too late.

Sources:

1 IBM, 2025.

2 Source: CrowdStrike 2025 Global Threat Report, March 2025.

3 Source: CrowdStrike 2025 Global Threat Report, March 2025.

4 Source: CrowdStrike 2025 Global Threat Report, March 2025.

5 Source: World Economic Forum, Global Cybersecurity Report 2025.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Warning Signs for Traders: Are You at Risk?Trading can be exciting and profitable, but it's important to spot habits that might hurt your success. Here are key warning signs to help you become a more disciplined and successful trader:

Constantly Checking Charts : If you find yourself compulsively opening your charts every hour and feeling physical discomfort if you don't, it's time to reassess your approach. Constant monitoring can lead to impulsive decisions and increased stress.

Impulse Trading on Minor Changes : Do you get the urge to jump into a trade at the slightest percentage change of a currency? This habit can be detrimental. Reacting to every minor fluctuation often results in overtrading and can erode your capital.

Trading Without Stop Losses : Having open trades without setting stop losses is a recipe for disaster. Stop losses are crucial in managing risk and preventing significant losses.

Checking Apps Before Starting Your Day : If your first action in the morning is to check your trading app or charts before even washing your face, it's a sign that trading is consuming your life. This habit can lead to burnout and poor decision-making.

Not Keeping a Trading Journal : Failing to document your trades and thoughts can hinder your progress. A trading journal helps you learn from past mistakes and successes, allowing for continuous improvement.

Tips for Better Trading:

These warning signs highlight areas for improvement. By addressing these habits, you can enhance your trading strategy and outcomes. Here are some tips that have helped me become a better trader:

Set Specific Times to Check Charts: Limit chart checking to specific times of the day. This helps reduce stress and impulsive decisions.

Develop a Clear Trading Plan: Outline your trading strategy, including entry and exit points. Stick to your plan to avoid knee-jerk reactions to market movements.

Use Stop Losses: Always set stop losses to manage risk effectively. This practice can save you from significant losses and emotional distress.

Establish a Morning Routine: Start your day with a routine that doesn’t involve trading. This helps create a balanced life and a clear mind for trading decisions.

Maintain a Trading Journal: Documenting your trades, strategies, and outcomes helps you learn from your experiences and refine your trading methods.

By recognizing these warning signs and implementing these tips, you can cultivate a more disciplined and successful trading practice. Happy trading!

Things you might like:

- Trend Key Points Indicator have been used to draw important key levels and key points.

- Abnormal Pin Bar indicator

Ruble developing ground to restructure third world economiesOn the presented chart we have prepared, you can see correlations of Ruble currency with Telecoms, Steel producing, Concrete producing, Land transport and Medicine. As you can see Ruble is building a solid ground to become a back end for the developing world destroyed by conflicts and fist fights. ATR is going down and from the june it shows backward correlation with Ruble. This is good because this means Ruble can rise without volatility. Telecommunications prices are falling after this event. Steel producing showing strange pattern and can be a risk for the Ruble. Concrete producing and transportation developing a good foundation. Transportation industry is still and strong. And medicine industry showing weakness but we see rise in pharmaceuticals profits so we hope this will drag whole venture up.

Inflation dominates financial stability risks for central banksDespite the banking industry turmoil, central banks continued to raise rates last week. This marked moves from the European Central Bank (ECB) by 50Bps, Federal Reserve (Fed) by 25Bps, Bank of England by 25Bps, Swiss National Bank by 50Bps, Norway by 25Bps, the Philippines by 25Bps, and Taiwan by 12.5Bps. Central banks appear determined to show they have the tools in place to nip financial stability issues in the bud and so monetary policy is free to deal with inflation.

The Fed is likely nearly done

The March Federal Open Market Committee (FOMC) turned out to be on the dovish side. This was evident in the written statement in which the FOMC anticipates – “some additional policy firming may be appropriate” from “ongoing increases in the target range will be appropriate”. There was a risk that if the Fed chose not to hike rates, it would raise concerns about further financial system weakness. The reason given was that financial instability was "likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation”.

The Fed has clearly signalled to the markets that it can control financial contagion from spreading by providing large amounts of liquidity. Over the past weeks we have seen a combination of measures to stabilise the market turmoil, including 1) The Fed’s proposal to provide immediate deposit protection and emergency lending 2) the intervention by Swiss Authorities to merge Switzerland’s two biggest banks and 3) the resumption of a dollar swap facility among central banks.

If the banking crisis calms down and the economic data looks anything similar to the January/February reports, another rate hike at the May FOMC meeting should not be ruled out. Conversely, ongoing market dislocations could outweigh the data and push the Fed into pause mode. Currently the implied probability for Fed Funds Futures looks for a rate cut during the summer. That scenario can only materialise if the risks emanating from the banking system continue to deteriorate from a market and/or economic perspective.

Gold offers a potential investment solution

There is no doubt that the investment landscape is fraught with elevated uncertainty and, of course, the volatility that comes with it. Gold is benefitting twofold from its safe haven status alongside the earlier than expected pivot in monetary policy by the Fed. While the Fed does not currently see rate cuts this year, in contrast to market expectations, its projections raise the prospect of rate cuts for 2024 which remains price supportive for gold.

The Commodity Futures Trading Commission (CFTC) has now largely caught up with publishing futures positioning data for gold following the disruption in February due to a ransomware attack on ION Trading. We now know there was a slump in positioning during February, but net longs in gold futures rose back above 154k contracts on 14 March 2023 as the banking crisis was unfolding.

Laying an emphasis on quality stocks

Rising concerns about financial stability tends to cause negative feedback on the real economy. Quality has stood the test of time, displaying the steadiest outperformance over 10-year periods. Dating back to the 1970s, quality has displayed the highest percentage 89% of outperforming periods in comparison to other well-known factors.

The WisdomTree Global Developed Quality Dividend Index (Ticker: WTDDGTR Index) offers investors an exposure to dividend paying stocks in developed markets with a quality tilt. The WisdomTree Global Developed Quality Dividend Index has outperformed the MSCI World Index (Ticker: MXWO Index) by 1.54% over the past five years. The emphasis on quality, by tilting the portfolio exposure to stocks with a high return on equity has played an important role in its outperformance versus the benchmark.

Over the past five years, we also observed the allocation and selection of stocks within the information technology, financial and healthcare sectors contributed meaningfully to the 1.54% outperformance versus the MSCI World Index as highlighted below.

The lifestyle of your savings, and why Big Mac?I've mentioned the word "risk" many times before, and it really is a very important word in the investment process.

Today I would like to focus on a risk that you should pay much attention to as a future investor: market risk, or in other words, the risk that you will have to sell the shares you bought cheaper than the price at which you bought them, and suffer a loss in doing so. You will face this risk all the time, which is absolutely normal, because at any time events can happen which will cause the value of the stock to fall.

It can be said that investing in stocks is a series of profitable and unprofitable operations. So don't get discouraged and pour ashes on your head if your first trades are unsuccessful. That's part of the process. Investing is not a one-time transaction to make a quick profit, it's a way of life for your savings.

Remember the fundamental and simple rule of investing - the expected return is roughly equal to the risk you take. So, when you place money in a bank deposit, the only risk you take is that your money will depreciate by the difference between the rise in prices and the deposit rate.

The easiest way to explain this is with Big Macs. Let's say you have the money to buy 100 Big Macs. But you don't spend it, you put it under your mattress. A year later, because of a price increase of, say, 7%, you can buy not 100, but 93 Big Macs with the money from under the mattress. Every time you put money "under the mattress," you reduce the purchasing power of your savings. To preserve it, you can put your money in a year's deposit at the bank. That way, in a year, you'll withdraw the original amount from the deposit, plus a profit in the form of interest. Even if prices go up, as in the last example, you can buy 99 Big Macs, not 93.

Why not 100? Because the interest rate on a deposit is usually less than the percentage increase in prices (that is, inflation ). In our example, it was 6% versus inflation of 7%.

If you choose not to keep money "under the mattress" and not to open a deposit, but to invest in stocks, then at the end of the year you can buy, for example, 150 or only 50 Big Macs, because you are dealing with a potentially more profitable and therefore more risky instrument.

This is how the fundamental law of investing works, let me remind you again: as much risk as possible profit.

Thanks to this law we can refine our formula: investing in stocks is buying a share of a company with the goal of getting a future profit from its sale and being aware of the risk of a possible loss. Awareness of the risk of possible loss is an obligatory variable of our formula, an obligatory ingredient of our investment recipe.

Awareness of the problem is already a big step towards its solution. It's impossible to completely eliminate risks, but with proper management their impact can be minimized.

So, after studying the entire series of posts, you will get the necessary knowledge and practical skills to:

- find shares of companies interesting for investment;

- evaluate the financial condition of companies;

- determine the conditions for buying stocks;

- determine the conditions for selling stocks;

- manage risks;

- take into account the results of your operations.

You will have a ready-to-use strategy that will always help you find the answer to what to do or not to do with the stock at the current moment in time. You will not have to chain yourself to the monitor and do it all your time. You won't spend any more time doing it than you do watching the news or social media. You will learn to think like a intelligent investor, and you certainly will become one, if you are prepared to open yourself up to a very interesting and fascinating field of knowledge - stock investing. I sincerely wish you success on this path!

Why do we need wave analysis if we have heads and shoulders?

In the last idea, we looked at the bullish flag and the triangle. But something went wrong and everywhere the output was down. Fortunately, we only go in the breakdown, and therefore not lost anything. Also wave analysis ceased to give any signals. And all that with great probability has grown into an inverted head and shoulders. I considered before that the usual head and shoulders with output down, but the buyers did not let this happen. So I give my voice towards this setup. My colleagues also think too

USDJPY/ GBPJPY: BUY $YEN IF DATA MISSES; SELL £YEN IF DATA HITSThe Risky BOJ front run trade using CPI inferences

- I find it very interesting that the BOJ is releasing ALL of its key economic data (minus GDP) before making the easing decision, especially as we have already had CPI data this month so we will have an 2 CPI releases in one month which ive never seen happen before (CPI from JPY is usually due next week).

- This to me indicates strongly that 1) All of the data released e.g. CPI, employment, retail sales, industrial production has some weighting on the BOJ decision and 2) that CPI especially has perhaps the strongest weighting on the BOJ decision as they are releasing 2 CPI prints in one month which means they brought forward the measurement by a week - this means they value the CPI print strongly.

- Therefore, knowing this, in an ideal world either 1) ALL of the data will contract, which puts more pressure on a big BOJ easing package or 2) ALL of the data improves which eases the the pressure on the BOJ package - thus from here we are then able to take risk with an "educated" guess of what the policy will tend to be i.e. big or smaller.

Long USDJPY if CPI less than -0.4% and generally weak/ miss other data:

1. The rationale is that a lower than expected and last print shows the JPY economy is decelerating even more aggressively than in previous months and therefore the BOJ will me MORE inclinded to ease heavier, as the data suggests there is a bigger problem.

- Obviously the data/ CPI print imo acts as a function of BOJ easing, if we get massive misses across the slew of data then we should expect a bigger easing package than if there is only a slight miss - therefore we should treat our trades the same way.

2. Long USDJPY by xlots depending on the serverity of the data miss e.g. if CPI was -1.0% and unemployment ticked up to 3.4% i would do 3lots long usdjpy. If it was -0.5% and 3.3% i would do 1lot for example.

Short GBPJPY if CPI is greater than -0.4% and other data generally hits/ is positive

1. The rationale is the opposite of the above - we assume if data improves that the BOJ will be less inclined to do a big easing package so we expect yen to remain strong so we go long yen and short GBP.

- Once again the lot size is a function of the serverity of the data e.g. if CPI turned positive to 0.1% and unemployment dropped to 3% we would short 3lots. vs only 1lot if CPI ticked up only 10bps from last and unemployment ticked down only 10bps.

Risks to the view:

1. The First risk is that data in general is considered to have "underlying trends" so the fact one print is outstandingly bad/ good might NOT impact policy e.g. thin about US NFP that was less than 100k and shocked markets - but it was a one off so didnt make the FOMC cut rates back.

3. Data underlying trends thus can reduce the weighting this data is given e.g. even if CPI improved to 0.1% from -0.4%, the BOJ could argue this is a one off print as the underlying trend for the past 6m+ has been negative inflation thus they will go ahead with a big easing package.

- HOWEVER , the above point "3" in mind i believe data to the downside will be given a greater weighting than data to the upside, so we should have a short yen bias as weak data has been the underlying trend for most data points (especially CPI).

-Further, i also think tail-end/ RHS/ LHS results will be given a proportionately larger weighting in their decision so this should also be reflected in our trading e.g. if CPI was -2% from -0.4% i would be a much much more aggressive buyer of UJ than if a -0.5% print from -0.4% is seen. The same can be said to the topside, if i saw +1.5% inflation from -0.4% last i would be a much greater seller of GBPJPY than if i saw -0.3% CPI from -0.4%.