#RLC/USDT#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.995.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 1.028

First target: 1.063

Second target: 1.102

Third target: 1.152

RLC

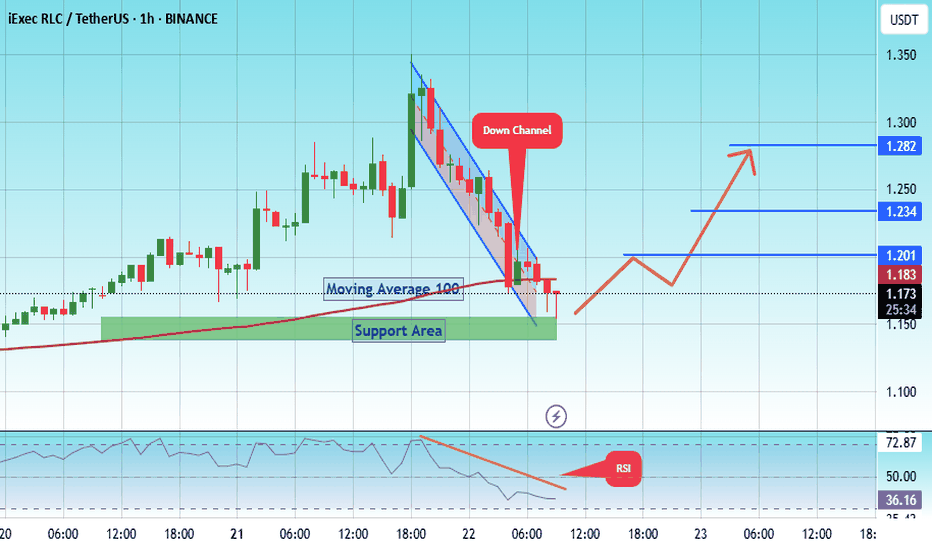

#RLC/USDT Pump Anticipated#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.155.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.143, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.170.

First target: 1.200.

Second target: 1.234.

Third target: 1.282.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#RLCUSDT #1D (Binance Futures) Descending wedge on supportiExec RLC just printed a dragonfly doji which may have marked the bottom on daily.

A morning star is drawing now, recovery towards 100EMA resistance seems around the corner.

⚡️⚡️ #RLC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 5.9%

Current Price:

0.9126

Entry Targets:

1) 0.9002

Take-Profit Targets:

1) 1.1854

Stop Targets:

1) 0.7859

Published By: @Zblaba

GETTEX:RLC BINANCE:RLCUSDT.P #DePIN #AI #iExec iex.ec

Risk/Reward= 1:2.5

Expected Profit= +126.7%

Possible Loss= -50.8%

Estimated Gaintime= 1 month

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.13

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.15

First target 1.17

Second target 1.20

Third target 1.25

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.98

Entry price 2.08

First target 2.19

Second target 2.28

Third target 2.38

$RLC Just broke out of it's Falling Wedge iExec RLCGETTEX:RLC has been on a down trend for Months!

Current Price: 1.73

Price action has continued in it's falling wedge for months and recently just broke out of it!

Expecting Price Action to continue upwards.

#RLC Targets: 2.09, 2.53, 2.96

This Idea Invalidates under 1.64

#RLC/USDT#RLC

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.40

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.61

First target 1.70

Second target 1.82

Third target 1.96

RLC Technical Analysis in a Weekly TimeframeHello everyone, I’m Cryptorphic.

I’ve been sharing insightful charts and analysis for the past seven years.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

RLC is showing a strong rebound from the support trendline and is likely to rally if the market remains bullish.

The resistance trendline at $3.58 will likely be the next testing level for RLC. On the downside, if RLC experiences another downtrend, it could drop as low as $0.717, where we have lower support.

The RSI appears to be gaining momentum, with a bit of room left before reaching the oversold zone.

Key levels:

- Primary Support: $1.3.

- Lower Support: $0.717.

- Primary Resistance: $3.58.

- Long-term Target: $16.5.

DYOR, NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

Short position on RLCUSDT 49Min/ Trading SetupBINANCE:RLCUSDT

KRAKEN:RLCUSD

Market can start a high volatile movement, so be don't forget to risk-free your position.

Mid-risk status: 4x-5x Leverage

Low-risk status: 2x-3x Leverage

⚡️TP:

On the chart

➡️SL:

On the chart

🧐The Alternate scenario:

🔴If the price stabilize above the trigger zone, and stabilize above resistance line, the setup will be cancelled.

#RLC/USDT#RLC

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 1.95

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 2.00

The first goal is 2.20

Second goal 2.32

Third goal 2.47

RLC short setupFrom where we entered "start" on the chart, RLC correction seems to have started.

It appears to be completing a bearish triangle now.

We will look for sell/short positions in the red range.

The target can be the green box.

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#RLC/USDT#RLC

The price is moving within a falling channel on a 1-day frame, which is a retracement pattern

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum

Entry price is 3.20

First goal 4.09

Second goal 4.48

Third goal 5.05

NEARING A HEAD AND SHOULDER PATTERNIn this idea, I'll tackle the bullish pattern, inverse head and shoulders forming for $BINANCE:NEARUSDT. Currently, it is sitting on the neckline, and I've been monitoring this coin two days ago. I'm now lending this idea as it could have a potential for a breakout anytime soon. More details for the technical analysis for NEAR in my idea threads below. Stay tuned :)

RLC/USDT Break alert!! Bullish momentum for RLC movement.💎 Paradisers, #RLC is indeed a coin worth monitoring closely.

💎 Having successfully broken out of the descending resistance, RLC is showing bullish momentum, especially after a recent false breakout.

💎 However, the current rejection near the resistance area around $3.3 suggests a potential pullback to the lower time frame (LTF) demand area before resuming its upward trajectory. To confirm a return to bullish movement, RLC needs to break above the resistance level, potentially leading to a retest of our target strong resistance area.

💎 Should RLC fail to bounce from the LTF demand area and instead break below it, this could signal continued downward movement, with the next significant level being the key support area around $2.1.

💎 If RLC reaches the key support area, it becomes crucial for the price to bounce from this level, as it represents a critical support zone. Failure to do so could lead to further downside momentum, confirming bearish sentiment and potentially pushing the price even lower.

MyCryptoParadise

iFeel the success🌴

$RLC looks amazing for a midterm

Trading the double bottom pattern involves identifying a bullish reversal pattern on a price chart and making trading decisions based on the pattern's confirmation. Here's a step-by-step guide on how to trade the double bottom pattern:

**Identify the Double Bottom Pattern**: A double bottom pattern appears on a price chart after a downtrend and consists of two consecutive troughs (lows) with a peak (high) between them. The lows are approximately equal and signify a possible reversal in the downward trend.

**Confirm the Pattern**: Before initiating a trade based on the double bottom pattern, it's essential to confirm its validity. Look for several signs to confirm the pattern:

` - Volume: Ideally, the volume should decline as the pattern forms and increase when the price breaks above the confirmation level.

- Symmetry: The two troughs should be roughly equal in depth and width, forming a "W" shape.

- Price Breakout: Wait for the price to break above the peak (high) between the two troughs, confirming the pattern.

`

**Entry Point**: Enter a long position (buy) once the price breaks above the peak (high) that separates the two bottoms. Some traders prefer to wait for a slight pullback after the breakout for a better entry point.

**Stop Loss Placement**: Place a stop-loss order below the lowest point of the double bottom pattern or slightly below the breakout level. This helps to limit potential losses if the pattern fails to hold, and the price resumes its downtrend.

**Take Profit Target**: Calculate the distance between the lowest point of the pattern (the bottom of the "W") and the peak (high) that separates the two bottoms. Then, project this distance upwards from the breakout point. This distance can serve as a potential target for taking profits.

RLC/BTC - iExec RLC: SuperTrend BBand Breakout◳◱ On the $RLC/ CRYPTOCAP:BTC chart, the Supertrend Bband Breakout pattern suggests an upcoming trend shift. Traders might observe resistance around 0.00004961 | 0.00006085 | 0.00008093 and support near 0.00002953 | 0.00002069 | 0.00000061. Entering trades at 0.0000428 could be strategic, aiming for the next resistance level.

◰◲ General info :

▣ Name: iExec RLC

▣ Rank: 287

▣ Exchanges: Binance, Kucoin, Hitbtc

▣ Category/Sector: Services - Shared Compute

▣ Overview: The iExec network provides computational resources to decentralized applications that wish to use them. The medium of exchange for the computational resources to be used must be paid using the RLC token. For example, if someone wished to run a decentralized application, without using typical computational resources from the likes of AWS, Azure, or any other big tech cloud provider, they can rent computational resources from the iExec network. The iExec network is comprised of Desktop Grid computing, also known as “volunteer computing”, where unused computational resources on the network can be used by applications, and platforms alike. All payments for computational resources utilize the RLC token as the medium of exchange.

◰◲ Technical Metrics :

▣ Mrkt Price: 0.0000428 ₿

▣ 24HVol: 7.619 ₿

▣ 24H Chng: 9.072%

▣ 7-Days Chng: 0.54%

▣ 1-Month Chng: -29.42%

▣ 3-Months Chng: 47.55%

◲◰ Pivot Points - Levels :

◥ Resistance: 0.00004961 | 0.00006085 | 0.00008093

◢ Support: 0.00002953 | 0.00002069 | 0.00000061

◱◳ Indicators recommendation :

▣ Oscillators: SELL

▣ Moving Averages: BUY

◰◲ Technical Indicators Summary : NEUTRAL

◲◰ Sharpe Ratios :

▣ Last 30D: -3.60

▣ Last 90D: 1.85

▣ Last 1-Y: 0.68

▣ Last 3-Y: 0.62

◲◰ Volatility :

▣ Last 30D: 1.21

▣ Last 90D: 1.56

▣ Last 1-Y: 1.02

▣ Last 3-Y: 1.43

◳◰ Market Sentiment Index :

▣ News sentiment score is N/A

▣ Twitter sentiment score is 0.64 - Bullish

▣ Reddit sentiment score is 0.36 - Bearish

▣ In-depth RLCBTC technical analysis on Tradingview TA page

▣ What do you think of this analysis? Share your insights and let's discuss in the comments below. Your like, follow and support would be greatly appreciated!

◲ Disclaimer

Please note that the information and publications provided are for informational purposes only and should not be construed as financial, investment, trading, or any other type of advice or recommendation. We encourage you to conduct your own research and consult with a qualified professional before making any financial decisions. The use of the information provided is solely at your own risk.

▣ Welcome to the home of charting big: TradingView

Benefit from a ton of financial analysis features, instruments and data. Have a look around, and if you do choose to go with an upgraded plan, you'll get up to $30.

Discover it here - affiliate link -

#RLC/USDT#RLC

The price is moving in a triangle pattern on the 4-hour frame, about to break to the upside

The area in green is a very strong support area, and the price rebounded from it at the price of 3.40

We have an upward trend on the RSI indicator

We have a higher stability than move Average 100

Entry price is 3.85

The first goal is 4.05

Second goal 4.43

Third goal 4.80

RLC/USDT Ready to Take Juicy Liquidity Present Above? 👀🚀💎Paradisers, eyes on #RLCUSDT as it dances within an ascending triangle, hinting at a thrilling upward breakout. If it breaches through, brace for a significant bullish wave.

💎Here's the twist: if #iExecRLC stumbles at the triangle's lower edge, we're banking on a bullish pivot from the $2.83 support. This level is drenched in liquidity, marked by past rallies and vibrant green candles.

💎If GETTEX:RLC dips below $2.83, watch for a bullish swing from the $2.078 zone. A failure to rebound here might unleash a sell-off spree. Stay nimble and prepared to shift gears as we chart #RLC's course through these market waves.