iExec RLC · Trading at Bottom with a Bullish BiasiExec RLC (RLCUSDT) is still trading at bottom prices but the overall market conditions are good. Good for the future because the market moves in waves alternating always between rising and falling.

RLCUSDT went bearish between May 2021 and June 2022, 399 days. Then it went bullish from June 2022 to March 2024, 630 days. Then it went bearish again between March 2024 and present day, August 2025. More than 510 days.

While RLCUSDT has been bearish more than a year, the action is still happening as a long-term higher low. That is, prices today and at the lowest—16-June 2025—are still higher compared to the low in June 2022.

Of course before being bearish in 2022 the market was bullish between March 2020 and May 2021, 427 days. Here we can clearly see the fluctuations between bear and bull, uptrends and downtrends.

The last uptrend came in 2021 and we are due a new one. Crypto grows every four years and market conditions are perfect for the next run. The market has been mixed, sideways and neutral for years on end, the long-term higher low is a single of strength. After the current retrace is over, you can prepare for a major bullish wave.

Namaste.

RLCUSDT

#RLC/USDT#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.995.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 1.028

First target: 1.063

Second target: 1.102

Third target: 1.152

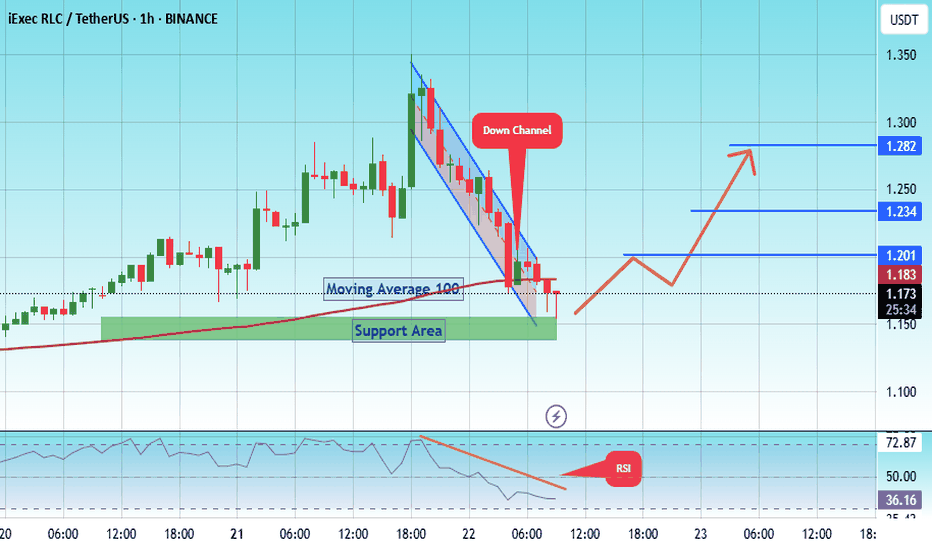

#RLC/USDT Pump Anticipated#RLC

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.155.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.143, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.170.

First target: 1.200.

Second target: 1.234.

Third target: 1.282.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#RLCUSDT #1D (Binance Futures) Descending wedge on supportiExec RLC just printed a dragonfly doji which may have marked the bottom on daily.

A morning star is drawing now, recovery towards 100EMA resistance seems around the corner.

⚡️⚡️ #RLC/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 5.9%

Current Price:

0.9126

Entry Targets:

1) 0.9002

Take-Profit Targets:

1) 1.1854

Stop Targets:

1) 0.7859

Published By: @Zblaba

GETTEX:RLC BINANCE:RLCUSDT.P #DePIN #AI #iExec iex.ec

Risk/Reward= 1:2.5

Expected Profit= +126.7%

Possible Loss= -50.8%

Estimated Gaintime= 1 month

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.13

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.15

First target 1.17

Second target 1.20

Third target 1.25

RLC Risky Long Idea (Snipe)Here will try to go with a Snipe Entry on RLCusdt Pair if it gives me that price.

I believe if the entry area holds we are going to see a quick pump towards next levels.

Highly Risky Trade.

Strategy

Have leveraged entries set at 1.3750 and under.

with stops flat at 1.3580.

Note: Not a Financial Advice

DYOR

#RLC/USDT#RLC

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 1.98

Entry price 2.08

First target 2.19

Second target 2.28

Third target 2.38

Key Moment for RLC: Breakout Opportunity or Bearish Threat?Yello, Paradisers! Is #RLCUSDT setting up for a powerful bullish continuation, or are we facing a bearish rejection? Let’s dive into the key levels you need to watch right now.

💎#RLC has made a strong rebound off its support, showing promising signs of strength. A successful breakout from the falling wedge pattern could confirm a bullish continuation. For this, we need a daily close above the trendline to validate the breakout. If this happens, the next target would likely be the minor resistance at $2.67. This level is crucial because a breakout here could lead to the highest probability of reaching the major resistance level.

💎If RLC fails to break the falling wedge and faces rejection with bearish candles, the price might drop back to retest the support zone around $1.87–$1.72.

💎The real concern arises if RLC fails to rebound from this support and breaks below it. In this case, the price would likely continue its downward trajectory toward the strong support at $1.30.

💎The $1.30 level represents the last line of defense for the bullish scenario. A rebound from here, followed by a reclaim of the $1.87 support, is necessary to reignite bullish momentum.

💎However, if RLC breaks below the major support at $1.30 and a daily candle closes under this level, it would confirm a bearish trend, with the potential for further downside and deeper dips.

Strive for consistency, Paradisers, and trade smart. This market rewards the disciplined and punishes the impulsive. Let’s stay focused and make the best decisions possible.

MyCryptoParadise

iFeel the success🌴

$RLC Just broke out of it's Falling Wedge iExec RLCGETTEX:RLC has been on a down trend for Months!

Current Price: 1.73

Price action has continued in it's falling wedge for months and recently just broke out of it!

Expecting Price Action to continue upwards.

#RLC Targets: 2.09, 2.53, 2.96

This Idea Invalidates under 1.64

RLCUSDT Critical Levels Ahead – Is a Big Move Coming?Yello, Paradisers! Is #RLCUSDT ready for a breakout, or is a pullback on the way? Here’s what to watch:

💎If #RLC successfully breaks above the key resistance at 1.835, we could be looking at a strong bullish move. The optimal approach here is to wait for confirmation of the breakout before entering the market. If this level holds and momentum builds, we could see a significant upward move toward our target area.

💎However, if RLC fails to break this resistance and faces rejection, the price is likely to return to the strong support area as it continues its current consolidation phase. This could signal a sideways movement before any clear trend emerges.

💎The bullish outlook becomes invalidated if RLC breaks below the strong support level at 1.28. A breakdown here would indicate potential for further downside movement, leading to a deeper dip.

Stay patient and disciplined, and remember: successful trading relies on strategic entry points and risk management.

MyCryptoParadise

iFeel the success🌴

#RLC/USDT#RLC

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.40

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.61

First target 1.70

Second target 1.82

Third target 1.96

RLC Technical Analysis in a Weekly TimeframeHello everyone, I’m Cryptorphic.

I’ve been sharing insightful charts and analysis for the past seven years.

Follow me for:

~ Unbiased analyses on trending altcoins.

~ Identifying altcoins with 10x-50x potential.

~ Futures trade setups.

~ Daily updates on Bitcoin and Ethereum.

~ High time frame (HTF) market bottom and top calls.

~ Short-term market movements.

~ Charts supported by critical fundamentals.

Now, let’s dive into this chart analysis:

RLC is showing a strong rebound from the support trendline and is likely to rally if the market remains bullish.

The resistance trendline at $3.58 will likely be the next testing level for RLC. On the downside, if RLC experiences another downtrend, it could drop as low as $0.717, where we have lower support.

The RSI appears to be gaining momentum, with a bit of room left before reaching the oversold zone.

Key levels:

- Primary Support: $1.3.

- Lower Support: $0.717.

- Primary Resistance: $3.58.

- Long-term Target: $16.5.

DYOR, NFA.

Please hit the like button to support my content and share your thoughts in the comment section. Feel free to request any chart analysis you’d like to see!

Thank you!

#PEACE

Short position on RLCUSDT 49Min/ Trading SetupBINANCE:RLCUSDT

KRAKEN:RLCUSD

Market can start a high volatile movement, so be don't forget to risk-free your position.

Mid-risk status: 4x-5x Leverage

Low-risk status: 2x-3x Leverage

⚡️TP:

On the chart

➡️SL:

On the chart

🧐The Alternate scenario:

🔴If the price stabilize above the trigger zone, and stabilize above resistance line, the setup will be cancelled.

#RLC/USDT#RLC

The price is moving within a bearish channel pattern on the 4-hour frame, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 1.95

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum, upon which the price depends

Entry price is 2.00

The first goal is 2.20

Second goal 2.32

Third goal 2.47