$AMD PT $91-$93 then to $100AMD is that darling that continues taking share from Intel. We have formed a bull pennant with an inside CH. Appears friday we hit the top of the handle. We need to break that $84-81 range to get continuation to my $93 target. This will then get picked up once again by robinhooders and should propel it beyond $100. My top price (which is insane) is $111 which ends up being exactly the 2.618 Fib extension level. Be ready!! the NVDA drive should start waking people up for AMD. Tread lightly though as i am anticipating a pullback in the market either this week or next.

Robinhood

Robinhood Traders Will pbly Hate Me for This.. Or Thank Me LaterWe all make mistakes, and we can either think it's unfair or we just grow up a better person... In this case apply it to investing.. Wouldn't you like to learn something ?

I'm pretty rude in this one on purpose. But anyway my point here is that you need to understand that in a bubble... the last one standings are the one to pay the hard price or reality.

Just make sure you're not among them... What happened within the bubble is not the point. I really hope you made money and that you'll be smart enough to don't try getting more at the risk of losing it all..

McMillan Volatility Band Buy Signal in Natural Gas Futures $NG1!Confirmed MVB buy signal in Natural Gas futures . Daily Strategist subscribers entered this position with us at 1.781 using the mini-futures contract /QG. Initial stop set at 1.510. You can find out more about this indicator, as well as following us on trades like this one, by using the links in our signature below.

Buying climax/ short squeeze in Tesla My short trade has 3 parts to it: 1) technical price action 2) sentiment 3) fundamentals

TECHNICAL PRICE ACTION : As can be seen in the chart, at the end of a bullish move, we've got a final gap up which ends up forming dojis/ hammers/ or simply a big bearish candle. My point is, anything but bullish engulfings have marked the top and given a significant retracement almost EVERY time. This also typically happens on high volume.

SENTIMENT: Retail traders involvement is exceptionally HIGH ! Sentiment is overly optimistic

robintrack.net

The link above is from robintrack; which reflects the robinhood trader involvement. Retail buying has gone vertical in May & June; this corresponds to the last $400 of move from $800-$1200. Thus, it's quite likely to see a nice flush out of dumb money in the very near future.

FUNDAMENTALS : Extremely over-valued stock and in the next down leg of the overall market, this should come back down to reality. I don't think the recent Q2 delivery numbers are something to get too excited about (down~5% YoY) as Q2 revenue & EBITDA is probably going to be a massive negative surprise. Further, I think Q3 & Q4 will be dismal which will finally end the hyper growth story for this stock.

TAKEAWAYS:

1) I think Q2 earnings coming out in July should be a negative surprise

2) I'm seeing a potential down leg in the overall market in July

3) Target is ~900 (25%) correction sometime this month. And mid 500's (50% correction) before the end of the year.

PS. Of course I could be totally wrong as I have been in the past by shorting this stock at lower levels and its only continued to breakout higher!

So... What is next? Shortest recession in play?Stock market - Against all odds, S&P index has risen almost 32% since hitting a low for the year on March 23. The fact that it happened after a ferocious plunge of 35% between Feb. 20 and March 23, the most devastating sell-off since the great depression, made the feat even more remarkable.

As a matter of fact, the market posted its best quarter since 1998, with Nasdaq leading the way by soaring 30.6% for the quarter, the most since 1999.

Some speculated that the fast recovery was due to the big outflow of money from the fixed-income market into the stock market as emerging market fails to meet its debt obligation.

Others credited young investors (medium age of 31) on Robinhood (3 millions user added 2020, 13 millions total) with stock market's spectacular rally.

I personally doubt that the combined purchasing power of all Robinhood users is strong enough to sway the stock market.

Nonetheless, the stock market performance is not representative of the entire economy as there are more than 30 millions small & mid-sized company not listed on major U.S stock exchanges

GDP - What is even more incredible about the stock market's recovery is that it all happened after various sources estimated the GDP contraction to be around 30% to 50% in second quarter

Recently, Fed and policymakers projected the economy to shrink 6.5% (medium projection) in 2020 and the unemployment rate to be 9.3% at the end of the year

Corporate earning - According to data from S&P Capital IQ, 40 percent of the S&P 500, about 200 companies, have withdrawn their guidance and declined to make EPS estimate in 2020.

This lack of guidance has caused a lot of problem for the prediction of corporate earning.

A recent analysis by CNBC earnings editor Robert Hum showed enormous differences at historical level between the high and low estimates for the largest stocks in the S&P 500.

According to numbers compiled by the data provider FactSet, second-quarter profits will fall more than 40 percent.

Refinitiv is projecting about a 43% drop in second-quarter earnings.

Expect to get a more clear picture of corporate earnings around mid-July as banks release their corporate earnings.

Even though the stock market is reflecting more of future sentiment than current economic condition, the speed of its recovery seems to indicate that most investors believe that not only will the market erase all the losses in 2020, but also it will quickly resume the long-term growth trend equals that of 2019, which seems highly unlikely to me.

Again, it is hard not to notice the massive distortion between the stock market's performance and corporate earning.

Unemployment - Initially, the hope is that most temporary layoffs would not turn into permanent job loss. However, as lockdown extends, many furloughed employees are at the risk of becoming unemployed as more and more small businesses going out of the business.

Roughly 20 million Americans are currently receiving unemployment benefits and the insured unemployment rate is still high at 13.4%.

BLS said that discrepancy in unemployment # due to "misclassification" has been adjusted accordingly. An alternative measure of unemployment that includes discouraged workers and the underemployed fell to 18% from 21.2%.

Overall, better than expected unemployment # and steadily declining initial claim and continuous claim # have painted a much better picture for the labor market.

However, unemployment remains at historic levels. Output and employment remain far below their pre-pandemic levels, according to Federal Reserve Chair Jerome Powell

Pandemic - WHO reported around 180,000 new coronavirus cases last Sunday, the single-largest increase since the pandemic began, with two thirds of new cases coming from the Americas. Around half of the 50 U.S. states were also reporting a rise in new coronavirus cases, most notable in southern states that were previously spared from the Covid-19 ravage.

On Tuesday, United States recorded the biggest single-day rise in new cases since the pandemic began.

According to Bloomberg report, most experts believe a vaccine won’t be ready until next year.

Other factors -

Trade war with China and upcoming election...

#1. Median existing-home price last month was $284,600, up 2.3% from May 2019.

#2. The 30-year fixed-rate mortgage averaged 3.13% for the week ending June 18. Mortgage rates have drop to another record low.

#3. The number of Americans applying for home mortgages has hit an 11-year high.

#4. An index measuring homes in contract to sell, or pending sales, jumped by a record 44% in May.

#5. A record spike in U.S. retail sales, though the recovery happened after a huge dive of retail sales a month earlier.

#6. PMI has surged sharply after a huge plunge since the pandemic started. It is possible that the # is skewed by the lack of small business participation and the effect of China re-opened its economy ahead of other major economy.

I believe most current home buyers are not heavily impacted during this economic downturn and their purchase decisions are probably not indicative of the economic recovery.

Shortest recession is made possible because this economic crash was driven by the uncertainty of pandemic rather than economic fundamentals? I don't know. But if you only look at real estate and stock market, it surely seems so.

McMillan Spike-Peak Buy Signal for S&P 500Confirmed spike-peak buy signal for the broad market. This system was initially designed to be used on the S&P 500 but can be adapted to other major U.S indices. We've also begun trading these signals by shorting $VXX using puts on that symbol. SPX, VXX, IWM, QQQ, SPY

333K ATH BOOMERS & ROBINHOOD MOON BOIZ TAKE BTC to 0!!!!Bitcoin has been marinating in the SCAM ZONE 10500-9000 while volatility has dwindled to a stand still. As POWWOW Mr. FED's printers CURE COVID 19 this week look out for a nice break out, maybe all the way up to 9900 before battling out of the SCAM ZONE and drawing swords with 11k. At this point BITCOIN is primed for a massive divergence from traditional assists then explodes past the OG ATH 20k. At this point BOOMERS will FOMO their collapsing 4o1K's and send BITCOIN into HYPERSPACE an EASY 333k ATH. AT THIS POINT BITCOIN will have entered an entire new dimension where time is irreverent and all laws of physics cease to EXIST. The Volatility form this transformation will send BITCOIN back in time CRUMBLING TO 0$. At this point THE ROBINHOOD MOON BOIZ will BUY THE DIP and rocket BITCOIN 100,000,000,000,000,000 x . THIS IS WHAT THE MEDIA ISN'T TELLING YOU.

Economic, geopolitic, monetary news. Issue No 6.1- The UN defended Antifa, Turkey straight up BOMBED the terrorist organisation

***********************

Yesterday or 2 days ago the UN "Human Rights" experts have criticized the US Attorney General for calling Antifa a terrorist organisation, whining that it goes against their right to peacefully protest (HAHA!) and was in violation of their right to... this is good... wait for it... free speech! (HAHAHAHA!).

Pompeo the foreign affairs minister or whatever the US calls it, criticized it and said the US were right to leave that "human rights" joke that includes Venezuela Cuba & China.

Critics mentionned the double standards of the UN, and then some have thrown out the idea of not sending anymore shekels to the UN, after which the UN immediatly removed their statement.

Talking about Shekels, Israel points out that while the radical left cries that the right are racists and anti-semitic, the real anti-semitic are the "good guys" on the left. I think Benjamin Netanyahu (had to copy paste this xd) is rather pro conservatives, at leats pro anything that's not communists. Hey and recently his son said he wanted all minorities out of Tel Aviv LOL. His view on Palestine is "well their language has no P in it, hence the country of Palestine cannot exist, check mate". The great replacement. That's just so wrong...

Ah, Turkey. Erdogan might be as hated as Trump by some, if not more. There have been several assaults and coup, but the rioters and rebel sodiers usually end up getting the hell beaten out of them by Erdogan supporters (civilians). Calms them down.

So as the title says:

The "not an organisation, just anti fascists independant people" Antifa terrorist organisation has some training camps in Syria, Iraq, probably more. So Turkey sent some fighter jets & bombers and distributed some democracy to them.

The (deep state controlled?) FBI says no no they're not Antifa training camps, but Turkey says they are...

It's a big mess, they are all marxists and friends that's for sure.

The PKK group in Syria (that got some democracy dropped on them) have been seen flying antifa flags (among other ones), even sometimes wearing the clothes.

Europeans and Muricans with Antifa ties have bought plane tickets to the region. I'm not going to make 10 hours of research in the subject, we'll see what happens next.

Here is an article from 2017:

gellerreport.com

There is also the Alex Jones project Veritas report, didn't look at this myself. Watched too many songs made from him going crazy to take him seriously. I'm personally pretty sure BLM is in the same mess as Antifa. All terrorists. And absolute morons defend them because "but their name says they're on the good side".

2- Expert scientists have sent kids to pedos for 30 years "they'll make loving parents"

***********************

Expert scientists authorative figures we should listen to - you would not want to get called a science denier would you? - came up with this wonderful idea in Germany that placing homeless children with pedophile men was absolute genius, assuming they'd make ideal loving caring foster parents.

Helmut Kentler (1928-2008) was in a leading position at Berlin's center for educational research. He was convinced that sexual contact between adults and children was harmless.

Pfff do I even need to continue? Leftist globalists in Berlin have done this practice for 30 years...

They passed around kids, and also used TAXPAYER MONEY TO GIVE REGULAR CARE ALLOWANCE TO FOSTER FATHERS.

The researchers found that several of the foster fathers were high-profile academics. Let me guess, marxists?

Oh saw this banner at a mostly peaceful far left protest:

"No white supremacy

No pedo bashing

No Mike Cernovich"

They're promoting cutting off D's, even on little kids, killing babies up to birth oh and even AFTER birth.

They're for ending religion, raping children, removing police, sterelizing people, creating a white tax, and so on.

K maybe sheep normies that don't want to "look bad" or "be right wing" have to see that's gone a bit too far?

And lastly, Epstein did not kill himself.

Trump is way too soft. This has gone too far.

Might be the time for some super far right fascism to clean up the swamp.

3- Early Data Show No Uptick in Covid-19 Transmission From Protests, you don't say?

***********************

Not much to say here. As expected. Just getting proven right.

Remember that mass delusions are just like bear market capitulations:

The unextraordinary crowd all panic at the same time, then they learn the truth one by one.

I'm sure there's several quotes about that. I don't know how to spell it elegantly but I think I'm being clear enough.

'Nyway, tards are slowly finding out 1 by 1 what I said on day 1, with proof, posts are still on tradingview.

www.wired.com

www.wsj.com

"I can watch the Republic fall to tyranny and chaos. Or, I can go home with my sword in hand and run those maniacs to the Tarpean Rock!" Caesar speech to the 13th legion in the tv show Rome.

4- Trump held a rally in Tulsa, town of the black wall street massacre, record audience

***********************

Not a very well known event but... what a choice. Who knows might be on purpose.

Read about that 2 years ago, so when I heard Tulsa I went "wait what?".

99 years ago back in May a black man was accused a killing a white girl.

A mob of angry idiots - er I mean mostly peaceful protestors, confronted a wall of blacks that were protecting the killer from being lynched (the "wall" had started leaving when they ran into the peaceful protestors after the sheriff convinced them they'd be no lynching and the kind hearted jogger that was on his way to save an orphanage would receive a fair trial).

When the peaceful protestors from each side ran into each other there was some fighting and the peaceful blacks killed 10 whites, the whites killed 2 blacks.

And then... then they got real ang- I mean peaceful. Interesting to note this happened just after the spanish flu pandemic.

Big groups of mostly peaceful white protestors protested in the wealthy district known as "Black Wall street".

The left has not talked much about this, which is hilarous.

On one side they want to show that "aha racism and lynching", but if they mention this it will kill the narrative of "poor black men systemic racism live in poverty only voting dem can make them successful".

I don't even think they care that much, they're all busy mocking Trump for only having 3 times the attendance Obama had.

Oh and he broke records with online viewership. The marxists obsession with this man is amazing xd

Putin that normally tries to avoid commenting on the situation did say recently that covid brought forward the problems in the USA, and spoke of a deep domestic crisis with a side that dislikes Trump since 2016 (and grown since then), of which the riots were a manifestation.

5- 20-Year-Old Weak chined Robinhood Customer see a $730,000 Negative Balance, Suicides

***********************

Empathy test: Does this make you laugh? He really had a weak chin, they showed his picture.

He probably didn't even have a loss, he probably had an option but he was too bad to figure out he had to use it to compensate (or set a SL but I doubt Robinhood has this very advanced feature).

He left a note saying "He had no idea what he was doing". I can confirm ☝️, as well as concerning all Robinhood "investors".

He asked how a 20 yo with no experience and a small account (around 10k I think?) could be allowed to use advanced products and end up taking giant positions.

Maybe bring back military service? And parents? New generations need to get punched in the face, and reminded they are maggots by a sadistic drill sergeant (how do I sign up btw?). I was born after the end date for military service in France (I think the limit was 1984) so I never went there, and I don't know what it does but I jeard it's good. Oh and I don't need it myself, life has punched me and reminded me I was a maggot more than enough and I beat the odds and came out victorious.

6- Lebanese pound megacrash on the black market, official rate unchanged

***********************

This lil country has had troubles for months/years. It's Lebanon not Lybia. Lybia (once a rich country) doesn't even exist anymore, they're back to slave trade and are a failed country (The US & UK brought democracy there). Since I'm on the subject of Lybia, the mass stabber in the UK recently, is from Lybia, giving some democracy back.

It got really bad for Lebanon since April. And with the lockdowns it got worse.

I can't short sell on the black market so I don't pay too much attention, but I do know that recently the currency megacrashed on the black market. -50% in 1 week. The official exchange has not moved, I think the central bank asked it too but it didn't.

It's just another perma bear story, bulls in denial, but can't really trade this, so whatever.

You might need to google this if you are interested if you want the clean story, and more complete. I'm just throwing it out off the top of my head, from vague memories, that's how I remember it.

Oh and since I mentionned Lybia, another thing. Yesterday during the Tulsa rally I think Trump used the words "military–industrial complex". He talked about the racket a bit. Not the first time he uses those words. And he also said "we have secured the Oil fields, we got the Oil". Ye not hard to find why he is so hated.

If you are wondering I have exactly 0 bets running. I mean look...

Might see some meh moves here and there, but mostly just getting ready for big booms and stupid uncertainty / 3 months sideways to end.

3 months to make a 3 days move... Not really because the ATR went really high recently, that's part of the problem I guess. Oh well, no need to rush it anyway.

Achilles Trading Group - ACIA breaking out ?Currently in a squeeze, 8 EMA crossed 21 EMA looking bullish and can cross-resistance. We are off to the races?

Robinhood traders will be tasting reality of a bubbleAfter two gaps as a result of the partnership with Kim Kardashian, this equity looks to be in bubble territory.

Stoch shows overbought.

Possible rush of Robinhood investors hearing their favorite app mentioned.

Could it continue to go up?

Yes. More influeners joining can bring it up higher.

But there are more reasons on the technical end for it to go down.

NNDM Hello, i would like to talk about my fav stock atm. Disclaimer I bought a large positon at .75 on RH and a small postion on Webull at .77. NNDM is in the 3d printing business which is valued at 9billion dollars and I believe its gonna be a trillion dollar business is the future due to demand for technology innovation compared to raw materials we have.

NNDM 3D prints such technologies and came out they just 3D printed a 3D touch sensor. This is my first time charting this, so this TA will be a Neutral till I can chart it a few days out. Just at face value since ipo it has went from $75 to a low of .55 centish.

Now if you look from since the dump after the second public offering we have just broke the down trend line and we are looking to hold the 50ema on the hourly, which if we do its bullish.

TA

-First targe was/region of interest is .8248 , Second is 1.094 and Third is 1.2377 . These targets are based on swings in dumping and pumping at that location. To remain bullish we need to stray above the 50ema or stay in a steady uptrend line with lows as of .7642 or going up .7583 going up to .7701 by tomorrow. Remaining above that price would be bullish.

-MACD is bullish and coming off of over sold levels

-RSI Neutral

-Watch zone .7169 and .7461

I took a stake into NNDM due to the demand for electronic products and growth of pushing technology innovation and seeing its MC is 3million dollars give or take, there is room of growth and has been getting new partnerships and contracts in the defense department. 3D printing technology in my eyes will dip its toes into the Technology market worth $5.5tillion dollars. defense market worth ove $600 billion, and space market (speculative) over $360 billion with it hitting $500billion in 2024. All these sectors will need complex technology components that NNDM can offer.

Biggest mistakes theory in practice.The biggest mistakes and biggest reasons why traders lose keep being repeated. It is more clear when we can see it actually happen.

Here we can see the number of holders as well as the increasing money pour in into an Oil ETF while the price is going down.

When it will go up those that didn't hang themselves will break even so remind me to check robintrack.

United States Oil Fund number of Holders on Robinhood went parabolic as Oil prices plunged

robintrack.net

Nosediving right now.

Trading was halted for this fund

www.streetinsider.com

> Stop fighting fundamentals & trends because "it's cheap" or "some indicator"

> Stop averaging in losers

> Cut your losses

You can be sure that when they get lucky and get out in the green (and rapidely take minuscule profits) you'll hear from them, and when they get wiped out on huge losers you'll never hear that story.

100% SPX - 60/40 - 80/20 - Portfolio Performance - GOLDBelow are three charts, the first depicts what i call the "Robinhood Investor" or the "Millennial Investor" which consists entirely of long equities, in this case the SPX. The second chart depicts a classic "60/40" allocation to stocks and bonds (in this case TLT, which i will come to in a moment). The final chart visualizes a portfolio of 80% equities and 20% physical gold.

100% SPX

60/40 SPX/TLT

80/20 SPX/GOLD

The first thing you will notice is "well, look at that the classic 60/40 portfolio, glad i listened to my financial adviser, yes it isn't as good as the 80/20 portfolio, but heck, 157% is pretty dang good!"

Well...yes and no...

As i said, the bond component of the 60/40 portfolio was TLT for simplicity.

BUT, not all bonds are created equal, and unless 40% of your portfolio consisted entirely of long-dated US treasuries, you did not get that return.

In fact, you may in fact be underwater in some of your bond holdings, depending on what variety they are.

Broad Bond performance

Above we have a variety of bond options, TLT (Long-dated US Treasuries) , HYG (high yield "junk" bonds), LQD (Investment grade bonds) and BND (global bond index fund).

It is true that TLT has done incredibly well of late up over 103%, but HYG is DOWN over 23% since 2008! BND is up around 16% and LQD is up 2nd only to TLT at 28%.

A 60/40 portfolio would most likely hold LQD, or something akin to it, a more aggressive portfolio may even hold HYG, and most would likely hold some kind of bond benchmark, such as BND. Therefore, the 60/40 portfolio performance is HEAVILY skewed in favor of bonds. Yet still fails to best Gold.

80/20 SPX/GOLD

The 80/20 portfolio achieved returns of over 173%, but more importantly, note the "Robinhood" performance, there are significant periods of draw-down, in fact, there are 13 YEARS during which the portfolio failed to do anything!

100% SPX

I don't know about you, but having you money do NOTHING for 13 years seems like poor financial management.

So what are the take aways of this exercise?

Firstly, blindly "buying and holding" equities over the long run is not a good idea (i am waiting for the FAANG fanboys to show up, what i have to say to that crowd is, if you think you can pick the next moonshot stock, please hit me up, i have some magic beans to sell you).

Secondly, the 60/40 portfolio does perform better than 100% equities, but you will sacrifice gains as a result, largely because bonds tend to do very little most of the time, therefore the 40% capital allocation to them, in my opinion, is better used elsewhere, i would even prefer to you that capital, or some of it, to hedge a long equity portfolio and go to cash rather than buy and hold during a downturn.

Finally, the best performer, the 80/20 SPX/Gold portfolio, this portfolio did experience more volatility than the 60/40 portfolio. But that should not scare anyone off, the period of draw-down from 2000 to 2005 was more to do with the time period i selected (post tech wreck) and the subsequent fall in the 80% of the portfolio that was long equities, NOT the 20% of Gold which had the portfolio consistently in the green from November 2005 to today.

-TradingEdge

CRYN ROBINHOOD STOCK POSSIBLE LONG TERM BUY TRADE IDEACRYN is a tech company. I found it on ROBINHOOD for under $1 per share.

BUY CRYN around $0.70 - $0.93

TP1: $1.30

TP2: $1.35

TP3: $1.40

SL: 0.10

At $1.40 is where we see resistance & the stock could go back down and yo-yo, up to down, to up again in this area. If the market is good in months to come this tech company could buy up. I have doubts as I see it employees less than 300 people from my research.

BIOC Still Failing To FillCOMMENTARY

BIOC is one of those penny stocks that have individual, good days. But when it comes to putting together a string of bullish action, it has yet to reach that milestone. Furthermore, though volume is good, the company still needs to execute further in my opinion. Either way. It's a good day today but would like to put this on a 30 day time clock and see where things are, at that time.

QUOTE

"On Tuesday (1-14) the company reported that its Target Selector™ assays are now available to doctors. The goal is for these doctors to use the Target Selector™ to evaluate cerebrospinal fluid of patients and check for the presence of circulating tumor cells for patients with breast or lung cancer suspected of brain or nervous system metastases.According to the company, the presence of tumor cells in the central nervous system might indicate brain metastases that can happen when cancer has spread to these locations. Thanks to this update, shares of Biocept rallied."

QUOTE Source: Top Penny Stocks To Watch Right Now; 1 Up Over 100% Since November

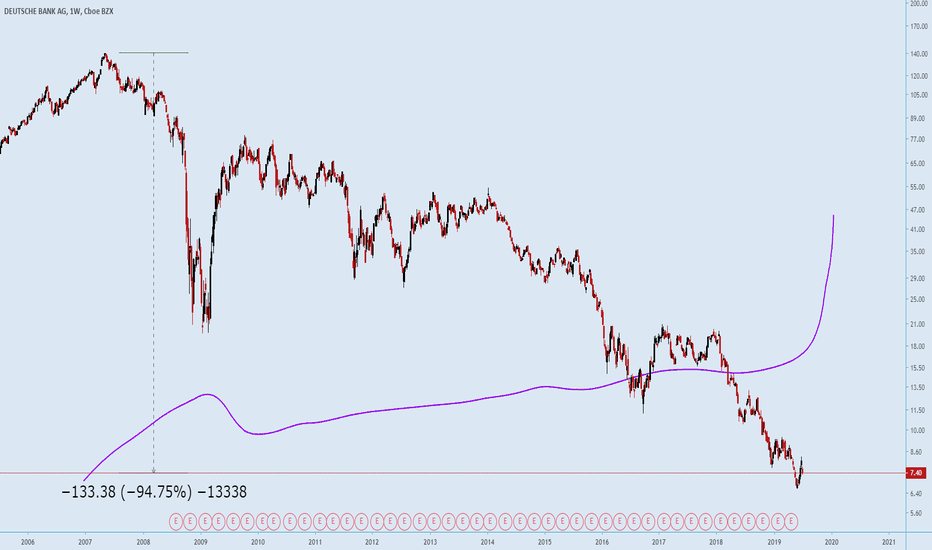

Interesting: Deutsche Bank Robinhood baghodlers went parabolicAnother fun story :D

By the way, the number of baghodlers on Tesla is down now that the price went up. Got their chance to break even on idiotic buys.

DB baggies spiked during the whole day of the 08 July. Did some guru tell his gullible paid group to buy the "bottom"? Or whale uses Baginhood?

DB baggies have been following the usual baggy path: exact opposite to what price does.

After being down 90% I guess baggies that lucked out and bought closest to the bottom, when it eventually goes back up, will get their shot at breaking even, and others will just ride it to zero.

Not making any speculation on this. Just watching and laughing.

Not even a good counter indicator as they just opposite-shadow the price just like alot of funds simply shadow the price.

Does not tell us anything we do not already know.

I have to finish my series...

Trading styles. Part 1/5. The 4 different kinds of bottoms.

Trading styles. Part 2/5. Buying pullbacks.

Trading styles. Part 3/5. Trend continuation breaks.

4/5 countertrend

5/5 other (ranging or exotic strats)

The count is wrong 1/5 is an intruder. I want to throw that and restart.

But I don't really know... I guess there are not that many type of strategies it's either pullbacks continuation countertrend or trading ranges?

With all the hate I got for shorting BTC as it was going up this makes zero sense. The peons all want to go against the trend.

The difference is they only go against the trend when it goes down I guess... "Buy cheap". How dumb. Just flip the chart then...

Noobs will buy absolutely anything when they see something down 95%. I bet there are some "educator" that teaches idiots to scan for poop and buy it.

Probably alot of those in penny stocks. Maybe they imagine other people than them are buying and they are not just scamming each other?

(With Tim making most of the dumping, on his followers).

Tim is a name I made up for the example. It is a totally made up character, let's call him Tim S. and he does not represent anyone existing in real life.

Short Options Trading: ENPH Buy Put $12.50 Exp: 8/16Understanding The trade:

As an options trader my goal is to identify trend change and utilize a breakout strategy to leverage profit off of major trend changes with minimal risk. Even though this contract does not expire till 8/16 I will be looking to take profit by late July as the rate of decay factor starts to come into play as the contract approaches expiry. This should correlate nicely with the Fib Retracement lvl .618. If you have any questions, please feel free to comment below and follow. Thank you and trade safe.

Reasons For Trade:

• Rejection off the ATH of $18.00 Back in Sep 14’

• RSI Broken upward channel (1D chart Jan 1st -July 2-tj)

• RSI Overbought > 70

Trade Parameters:

• Broker: Robinhood

• Cost For Entry: Free

• Contracts: 3

• Entry Price: .45

• Risk: $135

• Reward: $135

• ROI: 100%

• Risk/Reward Ratio: 1:1

LONG Options Trading: AMD Buy Call $32 Exp: 7/19Understanding The trade:

As an options trader my goal is to identify trend change and utilize a breakout strategy to leverage profit off of major trend changes with minimal risk. Even though this contract does not expire till 7/19 I will be looking to take profit by early July as the rate of decay factor starts to come into play as the contract approaches expiry. This should correlate nicely with the Fib Expansion lvl .618. If you have any questions, please feel free to comment below and follow. Thank you and trade safe.

Reasons For Trade:

• Continuation of the 4th leg for A B

• Support on Upward channel (1D chart Nov 17st - Current)

• Crypto at yearly high (More miners for AMD Graphics Card)

• Fib Expansion .618 correlation

Trade Parameters:

• Broker: Robinhood

• Cost For Entry: Free

• Contracts: 5

• Entry Price: .50

• Risk: $250

• Reward: $100

• ROI: 40%

• Risk/Reward Ratio: 5:2